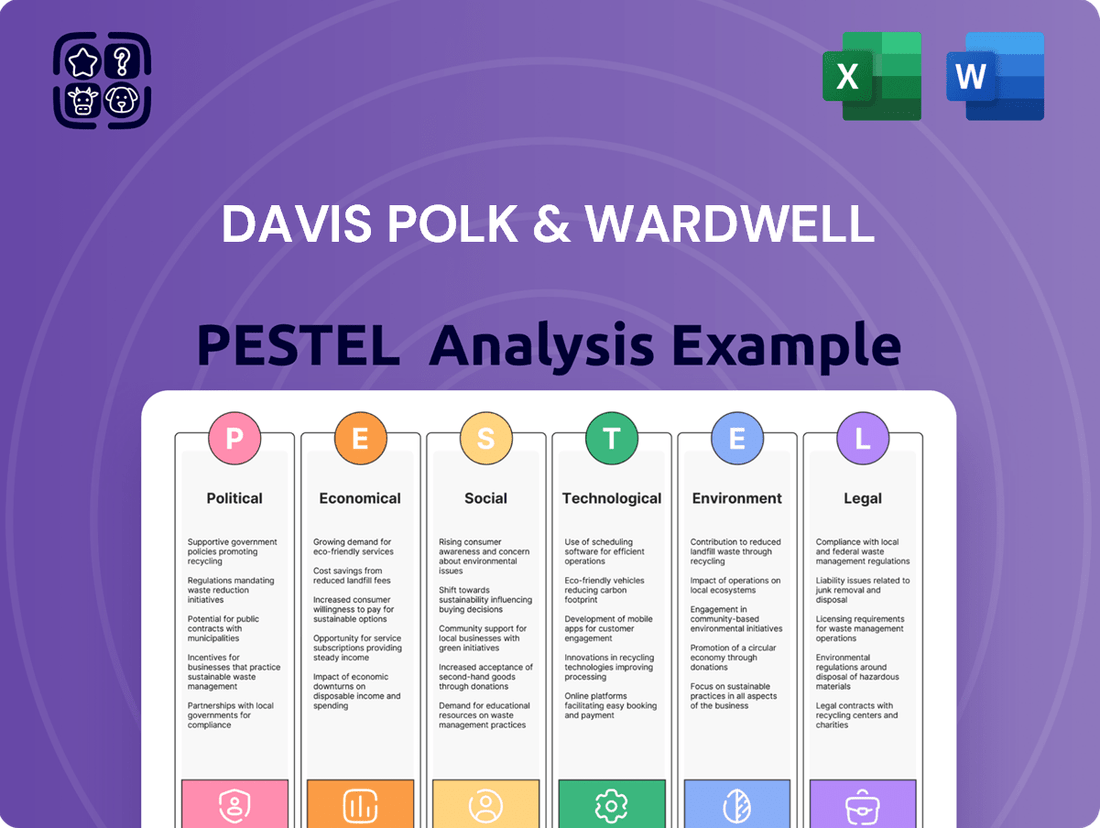

Davis Polk & Wardwell PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Davis Polk & Wardwell Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors impacting Davis Polk & Wardwell's operations. Our meticulously researched PESTLE analysis provides the essential external intelligence you need to understand their strategic landscape. Gain a competitive advantage and make informed decisions by downloading the full, actionable report today.

Political factors

Government regulatory shifts are a constant factor for Davis Polk & Wardwell. For instance, the U.S. Securities and Exchange Commission (SEC) has been actively updating rules around digital assets and cybersecurity, impacting financial services clients and requiring specialized legal counsel. Similarly, the European Union's Digital Markets Act (DMA) and Digital Services Act (DSA) are reshaping how tech companies operate, creating new avenues for antitrust and regulatory advisory work.

Global geopolitical instability, including ongoing conflicts and trade tensions, directly impacts Davis Polk's international practice areas. For instance, the escalating geopolitical risks in Eastern Europe and the Middle East in 2024 led to increased client inquiries regarding sanctions compliance and supply chain resilience, boosting demand for specialized legal counsel.

The firm's cross-border transactional and litigation work is particularly sensitive to shifts in international relations. As of early 2025, the ongoing trade disputes between major economic blocs are creating complex legal challenges for multinational corporations, requiring Davis Polk to provide sophisticated advice on navigating these evolving regulatory landscapes.

Governments worldwide are intensifying their focus on antitrust and competition enforcement. This means stricter reviews for mergers, more investigations, and increased litigation, directly affecting Davis Polk's work in corporate deals and legal disputes. For instance, the US Federal Trade Commission (FTC) has been particularly active, with Commissioner Lina Khan pushing for more aggressive enforcement against perceived anti-competitive practices, impacting large tech mergers.

Davis Polk needs to keep a close eye on how antitrust rules are changing in major markets. Understanding these shifts is crucial for helping clients navigate approvals for mergers and acquisitions, especially when competition concerns arise. The European Union's Digital Markets Act, implemented in 2023, exemplifies this trend, imposing new obligations on large digital platforms and signaling a tougher stance on market dominance.

This heightened regulatory environment presents both hurdles and potential business for the firm. While navigating complex approvals can be challenging, the increased need for expert legal counsel in antitrust matters creates significant opportunities for Davis Polk's specialized practices.

Tax Policy Changes

Changes in national and international tax policies, such as adjustments to corporate tax rates or the implementation of digital services taxes, significantly impact how clients structure their finances and plan transactions. Davis Polk's tax practice is heavily influenced by these shifts, requiring constant adaptation to guide clients through compliance, restructuring, and tax optimization strategies.

For instance, the OECD's Pillar One and Pillar Two initiatives, aiming to reallocate taxing rights and establish a global minimum corporate tax rate of 15%, are fundamentally altering the international tax landscape. These reforms, with significant implications for multinational corporations, drive demand for expert legal counsel on navigating new compliance obligations and optimizing global tax structures.

The potential for further tax policy changes, including those related to environmental, social, and governance (ESG) initiatives or evolving digital economy taxation, presents ongoing challenges and opportunities. Businesses must remain vigilant and seek specialized advice to manage the financial and strategic ramifications of these dynamic regulatory environments.

- Global Minimum Tax: The OECD's Pillar Two aims for a 15% global minimum corporate tax rate, impacting multinational enterprises.

- Digital Services Taxes: Several countries have introduced or are considering digital services taxes, affecting tech companies and their revenue.

- Corporate Tax Rate Fluctuations: National corporate tax rates can change, influencing investment decisions and profitability for businesses operating across jurisdictions.

- Tax Treaty Updates: Revisions to tax treaties between nations can alter withholding tax rates and the application of double taxation avoidance measures.

Judicial Appointments and Legal Reforms

The political environment significantly impacts judicial appointments and legal reforms, directly affecting how laws are interpreted and the future trajectory of legal thought. For Davis Polk & Wardwell, shifts in judicial philosophy or substantial legislative changes can alter litigation outcomes, contract enforceability, and the overall legal risk profile for their clientele.

Monitoring these political developments is crucial for anticipating changes in legal precedent and providing timely, informed advice to clients. For instance, the U.S. Supreme Court's docket for the 2024-2025 term, which began in October 2024, includes cases that could redefine areas of corporate law and regulatory enforcement, directly impacting business operations and legal strategies.

- Judicial Philosophy Shifts: Changes in the ideological leanings of appointed judges can lead to new interpretations of existing statutes and constitutional principles.

- Legislative Reform Impact: Major legislative overhauls, such as potential changes to antitrust laws or financial regulations debated in late 2024 and early 2025, can fundamentally alter the legal landscape for businesses.

- Litigation Outcome Variability: Evolving judicial interpretations can increase uncertainty in the outcomes of complex commercial disputes, necessitating proactive risk management.

- Contractual Certainty: Reforms in areas like contract law or intellectual property can affect the enforceability and interpretation of agreements, requiring careful drafting and review.

Governmental regulatory shifts are a constant factor for Davis Polk & Wardwell, impacting financial services clients and requiring specialized legal counsel. For instance, the U.S. Securities and Exchange Commission (SEC) has been actively updating rules around digital assets and cybersecurity, while the EU's Digital Markets Act (DMA) and Digital Services Act (DSA) are reshaping tech operations.

Global geopolitical instability, including conflicts and trade tensions, directly impacts the firm's international practice areas. Escalating risks in Eastern Europe and the Middle East in 2024 led to increased client inquiries regarding sanctions compliance and supply chain resilience.

The firm's cross-border transactional and litigation work is sensitive to shifts in international relations, with ongoing trade disputes creating complex legal challenges for multinational corporations as of early 2025.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Davis Polk & Wardwell, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers forward-looking insights and data-backed trends to help identify strategic opportunities and threats for the firm.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear overview of external factors impacting Davis Polk & Wardwell.

Economic factors

Global economic growth is projected to be a modest 2.7% in 2024, according to the IMF, a slight uptick from 2023. This generally healthy, albeit not booming, economic environment supports continued activity in corporate transactions. However, the IMF also forecasts a slowdown in advanced economies to 1.6% in 2024, which could temper the volume of large-scale capital markets and M&A deals for firms like Davis Polk.

Interest rate changes by central banks significantly affect how much it costs companies to borrow money. This directly influences whether they issue new debt, refinance existing loans, or decide to invest in new projects. For Davis Polk & Wardwell, this means their work in capital markets and corporate finance is closely tied to these rate movements, as it shapes client decisions on borrowing, lending, and investment planning.

When interest rates rise, it generally makes borrowing more expensive, which can lead to a slowdown in deal activity and investment. Conversely, lower interest rates tend to encourage more borrowing and investment, potentially boosting deal flow. For instance, the Federal Reserve's hawkish stance in 2022 and 2023, with multiple rate hikes to combat inflation, saw the federal funds rate target range increase from near zero to 5.25%-5.50%. This environment likely impacted the volume and nature of financing transactions advised upon by firms like Davis Polk.

Rising inflation in 2024 and 2025 directly impacts Davis Polk & Wardwell's operational expenditures. We've observed significant increases in overheads, with salary expectations for top legal talent climbing by an estimated 5-7% annually due to cost-of-living adjustments and competitive market pressures. Technology investments and general office expenses are also seeing upward trends, contributing to higher operating costs.

Client demand for legal services can fluctuate with inflationary periods. Some clients, particularly those in sectors sensitive to economic downturns, may reduce their legal budgets or postpone discretionary matters. For instance, a 2024 survey indicated that 30% of corporate legal departments were reviewing outside counsel spending due to economic uncertainty, potentially impacting Davis Polk's revenue streams.

Effectively managing its cost structure while maintaining service quality is paramount for Davis Polk. The firm needs to balance increased operational expenses with the need to retain its competitive edge and deliver high-value legal advice. This involves strategic resource allocation and potentially exploring efficiencies in service delivery to mitigate the impact of inflation on profitability.

Capital Markets Activity

The health of global capital markets is a direct driver for Davis Polk's corporate finance and securities practices. A robust market environment, characterized by active equity and debt offerings, fuels demand for the firm's expertise in capital raising, initial public offerings (IPOs), and intricate financial transactions. For instance, the global IPO market saw a significant rebound in early 2024, with proceeds reaching approximately $100 billion by mid-year, a substantial increase from the previous year, directly benefiting firms like Davis Polk.

Conversely, periods of market volatility or economic downturns can temper deal activity, leading to a reduction in transaction volumes. In such scenarios, Davis Polk's focus might shift towards advisory services related to regulatory compliance, restructuring, or potential litigation arising from distressed market conditions. For example, during periods of high interest rates, such as those experienced in late 2023 and into 2024, the volume of new debt issuances can fluctuate, impacting the demand for related legal services.

- Global Equity Offerings: In the first half of 2024, global equity capital markets activity reached approximately $350 billion, up from around $200 billion in the same period of 2023, indicating increased opportunities for corporate finance legal work.

- Debt Capital Markets: The corporate bond market, a key area for Davis Polk, saw issuance volumes remain strong in early 2024, with investment-grade corporate debt issuance exceeding $700 billion in the first half of the year.

- IPO Activity: The US IPO market showed particular strength in Q1 and Q2 2024, with a notable increase in the number and value of listings compared to the subdued activity in 2023.

- Market Volatility Impact: Increased market uncertainty, as measured by indices like the VIX, can lead to a slowdown in M&A and capital raising, potentially increasing demand for restructuring and distressed M&A advisory services.

Currency Exchange Rate Volatility

Currency exchange rate volatility presents a significant challenge for international law firms like Davis Polk. Fluctuations directly affect the profitability of their global operations and the financial health of cross-border deals for clients. For instance, a strengthening US dollar against the Euro could reduce the dollar-denominated value of fees earned in Europe, impacting overall revenue.

These shifts also influence strategic decisions for clients, including investment choices, the structuring of mergers and acquisitions, and the valuation of assets held in various countries. For example, a sudden devaluation of a target company's local currency could drastically alter the perceived value of an M&A transaction.

Davis Polk actively advises clients on mitigating these risks. Strategies often involve sophisticated hedging techniques and careful deal structuring to insulate against adverse currency movements.

- Impact on Revenue: A 10% depreciation of the Euro against the US dollar in late 2024 could reduce the dollar value of European-based revenue for Davis Polk by a similar percentage, affecting profitability.

- M&A Valuation: If a target company's primary revenue is in Japanese Yen, and the Yen depreciates significantly against the dollar, the acquisition price in dollar terms would effectively decrease, requiring careful revaluation.

- Hedging Costs: Implementing currency hedging strategies, such as forward contracts, incurs costs that need to be factored into transaction planning, potentially adding 0.1% to 0.5% to deal expenses depending on market conditions.

- Investment Decisions: For clients considering direct foreign investment, a volatile exchange rate environment can increase the perceived risk, potentially leading to a higher required rate of return or a pause in investment activity until stability returns.

Economic factors significantly influence the legal services landscape for Davis Polk & Wardwell. Modest global growth projected for 2024, around 2.7%, provides a stable backdrop, but a slowdown in advanced economies to 1.6% could temper large-scale deal volumes.

Interest rate policy remains a critical determinant; the Federal Reserve's target range of 5.25%-5.50% in 2024 makes borrowing more expensive, potentially impacting corporate finance transactions. Inflationary pressures are also increasing operational costs, with salary expectations for legal talent rising by an estimated 5-7% annually, and client legal budgets may contract due to economic uncertainty.

Capital markets activity is a key driver, with global equity offerings reaching approximately $350 billion in the first half of 2024, a substantial increase from 2023, signaling robust opportunities for corporate finance legal work.

Currency exchange rate volatility also presents challenges, impacting the dollar-denominated value of international revenue and requiring sophisticated hedging strategies for clients and the firm.

| Economic Indicator | 2023 (Estimate) | 2024 (Projection) | Impact on Davis Polk |

|---|---|---|---|

| Global GDP Growth | 2.6% | 2.7% | Supports general transaction activity |

| Advanced Economies GDP Growth | 1.5% | 1.6% | Potential slowdown in large-scale deals |

| Federal Funds Rate (End of Period) | 5.25%-5.50% | 5.25%-5.50% | Increased cost of borrowing, impacts deal financing |

| US CPI Inflation (Annual) | 3.4% | 3.0% | Increases operational costs, impacts client spending |

| Global IPO Proceeds (H1) | ~$50 billion | ~$100 billion | Increased demand for capital markets legal services |

Preview Before You Purchase

Davis Polk & Wardwell PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Davis Polk & Wardwell covers all key external factors. You'll gain immediate access to this detailed report upon completing your purchase.

Sociological factors

Societal expectations are increasingly pushing companies towards Environmental, Social, and Governance (ESG) principles. This shift directly translates into a higher demand for legal counsel specializing in sustainable finance, climate-related disclosures, and corporate social responsibility initiatives. For instance, the global sustainable investment market reached an estimated $35.3 trillion in early 2024, showcasing the significant financial weight behind ESG considerations.

Davis Polk needs to bolster its capabilities in these ESG domains to effectively guide clients. This involves assisting them in navigating the complex and evolving regulatory landscapes, mitigating potential reputational damage, and embedding sustainable practices into their core business operations. This growing emphasis on responsible business conduct is a clear indicator of a fundamental societal reorientation.

The legal sector's fierce competition for skilled professionals is heavily shaped by evolving societal values. Lawyers increasingly prioritize work-life balance, with surveys indicating a significant portion of associates seeking more predictable hours. Davis Polk's ability to attract and retain top talent hinges on its capacity to foster a culture that respects these demands, alongside a demonstrable commitment to diversity, equity, and inclusion (DEI).

In 2024, firms that actively promote DEI initiatives and offer flexible work arrangements are seeing higher retention rates. For instance, reports from late 2023 showed a marked preference among law school graduates for firms with robust mentorship programs and clear pathways for advancement, particularly for underrepresented groups.

Societal pressure for Diversity, Equity, and Inclusion (DEI) significantly impacts law firms like Davis Polk. These movements drive the implementation of comprehensive internal DEI programs, aiming to cultivate an inclusive environment and promote diverse leadership. For instance, many firms are setting public diversity targets for their workforce and partnership ranks, with some reporting progress in their 2024 diversity reports.

Davis Polk's commitment to DEI is crucial for its reputation and talent acquisition. A strong DEI record helps attract a wider pool of candidates and enhances the firm's appeal to clients who increasingly prioritize working with organizations that align with their own diversity values. This can also influence client selection, as firms may choose to partner with businesses that demonstrate a similar commitment to equity.

Changing Client Demographics

The legal industry, including firms like Davis Polk, must adapt to evolving client demographics. A younger generation of business leaders and owners is entering positions of influence, bringing with them distinct priorities and communication preferences. This shift necessitates a re-evaluation of how legal services are procured and delivered.

Understanding these generational changes is crucial for Davis Polk to effectively tailor its service offerings. This includes embracing digital communication channels and prioritizing efficiency, reflecting the expectations of emerging client cohorts who value responsiveness and streamlined interactions.

- Millennial and Gen Z Leadership: By 2025, millennials are projected to represent a significant portion of the global workforce, influencing business ownership and leadership roles.

- Digital Natives: Younger clients are accustomed to immediate digital communication and expect legal service providers to be accessible and responsive through various online platforms.

- Value-Driven Expectations: New client generations often prioritize value and transparency, seeking legal counsel that demonstrates efficiency and clear communication regarding costs and outcomes.

Pro Bono and Social Responsibility

Societal expectations for corporate social responsibility are increasingly influencing law firms like Davis Polk. This trend is driving an enhanced focus on pro bono services and community engagement, reflecting a growing societal value placed on businesses contributing positively beyond their core operations.

Davis Polk's dedication to pro bono work serves a dual purpose: fulfilling a societal obligation and bolstering its brand. This commitment also plays a crucial role in attracting talent that prioritizes social impact and in deepening the firm's connections within the communities it serves.

- Pro Bono Hours: In 2023, major law firms reported an average of 40-50 pro bono hours per attorney, with some firms significantly exceeding this.

- Community Investment: Many large firms contribute millions annually to community organizations and legal aid societies.

- Talent Attraction: Surveys consistently show that a strong pro bono program is a significant factor for associates when choosing an employer.

- Reputation Enhancement: Positive media coverage and recognition for pro bono achievements directly contribute to a firm's public image and client perception.

Societal expectations are increasingly pushing companies towards Environmental, Social, and Governance (ESG) principles, creating a demand for legal expertise in sustainable finance and climate disclosures. The global sustainable investment market reached an estimated $35.3 trillion in early 2024, highlighting the financial significance of these trends.

Davis Polk must enhance its ESG capabilities to advise clients on navigating evolving regulations and embedding sustainable practices, responding to a fundamental societal reorientation towards responsible business conduct.

Evolving societal values, including a greater emphasis on work-life balance and diversity, equity, and inclusion (DEI), are shaping the legal talent landscape. Firms promoting DEI and flexible work arrangements are seeing higher retention rates, with recent graduate preferences leaning towards robust mentorship and clear advancement paths.

Societal pressure for DEI significantly impacts law firms, driving the implementation of internal programs and public diversity targets. A strong DEI record is crucial for talent acquisition and client selection, as businesses increasingly partner with organizations that share their commitment to equity.

The legal industry must adapt to evolving client demographics, particularly the priorities and communication preferences of younger leaders. Embracing digital channels and prioritizing efficiency are key to meeting the expectations of emerging client cohorts.

| Societal Factor | Impact on Legal Services | 2024/2025 Data/Trend |

|---|---|---|

| ESG & Sustainability | Demand for expertise in sustainable finance, climate disclosures, CSR. | Global sustainable investment market ~$35.3 trillion (early 2024). |

| Work-Life Balance & DEI | Attracting and retaining talent, fostering inclusive culture. | Higher retention at firms with DEI initiatives and flexible work (late 2023 reports). |

| Evolving Client Demographics | Tailoring service delivery, embracing digital communication. | Millennials projected to be significant workforce portion by 2025; digital-native expectations. |

| Corporate Social Responsibility | Increased focus on pro bono and community engagement. | Major firms averaged 40-50 pro bono hours/attorney in 2023; significant community investment. |

Technological factors

The legal sector is experiencing a significant transformation due to artificial intelligence and automation. These technologies are revolutionizing how legal services are delivered, particularly in areas like document review, e-discovery, and contract analysis, leading to enhanced efficiency. For instance, AI-powered contract review platforms can analyze thousands of documents in minutes, a task that would take legal professionals hours, potentially reducing review costs by up to 30% according to some industry estimates.

Davis Polk must strategically integrate these advanced tools to boost productivity and lower operational expenses. This adoption is crucial for maintaining a competitive edge and offering clients more cost-effective and innovative legal solutions. However, this transition necessitates substantial investment in technology and comprehensive training programs for legal staff to ensure effective utilization and address the critical need for human oversight and ethical considerations in AI-driven legal processes.

Cybersecurity and data privacy are paramount for a firm like Davis Polk & Wardwell, given the sensitive nature of client information. The escalating sophistication of cyber threats, including ransomware and data breaches, necessitates continuous investment in advanced security infrastructure. The global regulatory landscape, exemplified by GDPR and the California Consumer Privacy Act (CCPA), imposes strict compliance requirements, with significant penalties for violations. For instance, the average cost of a data breach in 2024 reached $4.73 million, highlighting the financial implications of inadequate security.

The legal technology landscape is expanding quickly, with new tools for managing cases, working with clients, and analyzing data emerging constantly. For a firm like Davis Polk, effectively using these technologies can significantly improve how they serve clients and manage their own work, offering a distinct edge over competitors.

Data from 2024 indicates that firms investing in legal tech are seeing tangible benefits. For instance, a significant percentage of law firms reported increased efficiency and reduced costs after implementing practice management software. Davis Polk's strategic integration of these advancements, such as AI-powered contract review or advanced e-discovery platforms, is crucial for maintaining its leadership position.

The firm's commitment to staying ahead means regularly assessing new legal tech solutions. This proactive approach ensures Davis Polk can leverage innovations that enhance client outcomes and operational effectiveness, solidifying its competitive standing in the evolving legal market.

Digital Transformation of Clients

Clients are increasingly embracing digital transformation, demanding legal expertise in areas such as artificial intelligence, cybersecurity, and data privacy. This shift necessitates that Davis Polk cultivate deep knowledge in emerging technologies like blockchain and cloud infrastructure to effectively advise businesses navigating these complex landscapes. For instance, the global legal tech market was valued at approximately $20 billion in 2023 and is projected to grow significantly, highlighting the demand for specialized legal services in technology-driven fields.

This evolving client demand directly impacts legal service providers. Davis Polk's ability to offer counsel on new business models enabled by technology, such as platform economies and subscription services, is crucial. The firm's proactive development of specialized practices in fintech and data governance, for example, positions it to capture a larger share of this growing market. By staying ahead of these technological trends, Davis Polk can better serve its clients' evolving needs.

- Increased demand for expertise in AI and data privacy law.

- Growth in the legal tech market, reaching an estimated $20 billion in 2023.

- Necessity for law firms to advise on new tech-enabled business models.

- Focus on specialized areas like fintech and blockchain solutions.

Remote Work Technologies

The shift towards remote and hybrid work has driven substantial investment in collaboration technologies. Davis Polk leverages these tools for secure internal communication, global client engagement, and uninterrupted operations. For instance, by mid-2024, a significant percentage of legal professionals reported using cloud-based collaboration platforms for daily tasks, a trend that accelerated post-2020.

The efficiency of these technological solutions directly influences the firm's overall productivity and its capacity to support clients across different time zones and locations. In 2024, surveys indicated that firms with robust remote work technology stacks saw a notable increase in project completion rates compared to those with less advanced systems.

- Increased reliance on secure cloud-based platforms for document sharing and communication.

- Investment in advanced video conferencing and virtual meeting software for client and internal collaboration.

- Focus on cybersecurity measures to protect sensitive client data accessed remotely.

- Adoption of project management and workflow automation tools to streamline remote team operations.

Technological advancements are reshaping legal practice, with AI and automation driving efficiency in tasks like document review and e-discovery. Firms adopting these tools, such as AI contract analysis, can see cost reductions of up to 30%. Davis Polk's strategic integration of these technologies is vital for competitiveness and offering clients innovative, cost-effective solutions.

Legal factors

The regulatory environment for financial services, particularly concerning data privacy and environmental, social, and governance (ESG) standards, continues to grow in complexity. For instance, the European Union's Digital Services Act and Digital Markets Act, fully in effect by early 2024, impose significant new compliance burdens on digital platforms, impacting how data is handled and services are offered.

Davis Polk's expertise is crucial in navigating these evolving rules, helping clients manage risks associated with non-compliance, which can lead to substantial fines. In 2023, financial penalties for data breaches alone exceeded billions globally, underscoring the financial imperative of robust compliance strategies.

Staying ahead of these changes, such as the ongoing development of AI regulations and updated anti-money laundering (AML) frameworks, requires constant vigilance and strategic adaptation to ensure adherence to both national and international legal standards.

Davis Polk & Wardwell, as a global law firm, must meticulously navigate a complex tapestry of international legal frameworks. This includes understanding diverse treaties, cross-border agreements, and the varying legal systems of the numerous countries in which it operates. For instance, the firm's involvement in cross-border M&A deals, like the reported record-breaking M&A activity in 2024 which saw global volumes exceeding $3 trillion by mid-year, necessitates deep expertise in private international law to ensure compliance and successful execution across jurisdictions.

Corporate governance reforms are continuously shaping the landscape of legal advice. For instance, the push for greater board diversity, with some jurisdictions implementing quotas or targets, directly influences how Davis Polk advises clients on board composition and recruitment. Similarly, evolving regulations around executive compensation, including pay-ratio disclosures and clawback provisions, necessitate careful guidance to ensure compliance and mitigate risk.

Shareholder activism remains a significant driver of governance changes. In 2024, we've seen a notable increase in shareholder proposals related to environmental, social, and governance (ESG) factors, prompting companies to strengthen their disclosure and engagement strategies. Davis Polk assists clients in navigating these demands, developing proactive governance frameworks that meet both legal requirements and evolving stakeholder expectations, thereby safeguarding their reputation and long-term value.

Litigation and Dispute Resolution Trends

Changes in litigation trends, such as the increasing frequency of class-action lawsuits and heightened regulatory enforcement, directly impact Davis Polk's litigation practice. For instance, in 2023, the U.S. saw a significant rise in securities class actions, with filings up by 15% compared to 2022, according to data from Cornerstone Research. This necessitates continuous adaptation of the firm's strategies and expertise to effectively represent clients in this evolving dispute landscape.

The firm must remain adept at navigating both traditional court proceedings and alternative dispute resolution (ADR) mechanisms like arbitration. The adoption of ADR is a growing trend; in 2024, it's projected that over 60% of commercial disputes will utilize some form of ADR, reflecting a desire for efficiency and cost-effectiveness. Davis Polk's ability to excel in these varied arenas, while staying abreast of judicial precedents and procedural rule changes, is crucial for client success.

- Increased Class Action Filings: U.S. securities class action filings saw a 15% increase in 2023.

- Regulatory Enforcement Focus: Agencies like the SEC and FTC continue robust enforcement actions, impacting corporate clients.

- Shift to ADR: Projections for 2024 indicate over 60% of commercial disputes may involve alternative dispute resolution.

- Adaptation to Precedents: Staying current on judicial decisions and procedural rules is paramount for effective representation.

Emerging Areas of Law

Emerging legal domains are reshaping the practice of law, demanding specialized knowledge. Fields like space law, AI ethics, cryptocurrency regulation, and climate change litigation are rapidly developing, creating new challenges and opportunities for legal professionals. Davis Polk must cultivate expertise in these nascent areas to effectively serve clients navigating these complex, evolving landscapes.

The growth of these new sectors is directly tied to technological advancement and global societal shifts. For instance, the global AI market was valued at approximately $150 billion in 2023 and is projected to grow significantly, necessitating clear legal frameworks around data privacy, algorithmic bias, and intellectual property. Similarly, the cryptocurrency market, despite its volatility, saw a market capitalization that fluctuated but remained in the trillions of dollars at various points in 2024, underscoring the need for robust regulatory guidance.

- Space Law: As commercial space activities increase, including satellite constellations and potential resource extraction, new legal questions arise regarding jurisdiction, liability, and property rights.

- AI Ethics and Regulation: The widespread adoption of artificial intelligence across industries creates a demand for legal counsel on issues such as bias, transparency, and accountability in AI systems.

- Cryptocurrency and Digital Assets: Evolving regulations surrounding digital currencies and decentralized finance (DeFi) require firms to stay abreast of compliance, security, and transactional law.

- Climate Change Litigation: Growing efforts to hold corporations and governments accountable for climate-related damages are leading to an increase in environmental litigation, demanding expertise in this area.

The legal landscape is increasingly shaped by evolving regulatory frameworks, particularly in data privacy and ESG, with significant implications for compliance. For example, the EU's Digital Services Act and Digital Markets Act, fully operational by early 2024, impose substantial new requirements on digital platforms, affecting data handling and service provision.

Davis Polk's role in navigating these complex rules is vital for clients to manage non-compliance risks, which carry substantial financial penalties; global fines for data breaches alone surpassed billions in 2023, highlighting the financial imperative of strong compliance. Staying ahead of new AI regulations and updated anti-money laundering (AML) frameworks demands continuous adaptation to national and international legal standards.

Corporate governance reforms, including diversity mandates and executive compensation regulations, are continuously altering advice paradigms. Shareholder activism in 2024, with a notable rise in ESG-related proposals, prompts companies to enhance disclosure and engagement, areas where Davis Polk guides clients to align with legal requirements and stakeholder expectations.

Litigation trends, marked by increased class-action filings and regulatory enforcement, directly influence legal practices. U.S. securities class action filings rose 15% in 2023, and over 60% of commercial disputes in 2024 are projected to use alternative dispute resolution (ADR), necessitating firms like Davis Polk to adapt their strategies and expertise across diverse dispute resolution methods.

Environmental factors

The intensifying global concern over climate change is driving a surge in environmental regulations, carbon pricing, and mandatory disclosures across industries. Davis Polk helps clients navigate these evolving rules, focusing on areas like emissions trading and climate risk reporting to ensure compliance and unlock sustainable growth.

This regulatory landscape is dynamic, with significant implications for business operations and investment strategies. For instance, the European Union's Carbon Border Adjustment Mechanism (CBAM), fully phased in for reporting in 2024, is already impacting trade flows and incentivizing decarbonization efforts for companies exporting to the EU.

The increasing focus on Environmental, Social, and Governance (ESG) factors is reshaping investment strategies, pushing companies to adopt more sustainable practices and driving demand for legal expertise in areas like green bonds and ethical supply chains. Davis Polk is actively guiding clients through this landscape, helping them align with investor demands and navigate new ESG disclosure requirements, which are now essential for securing funding and maintaining trust.

Companies are increasingly exposed to environmental litigation, facing lawsuits over pollution incidents, the impacts of climate change, and breaches of environmental regulations. For instance, in 2024, litigation surrounding PFAS contamination continued to escalate, with numerous class-action lawsuits filed against manufacturers, seeking billions in damages.

Davis Polk & Wardwell assists clients in navigating these complex legal landscapes, offering defense against environmental claims and guidance on maintaining compliance with evolving environmental protection standards. This proactive approach is vital for minimizing substantial financial penalties and safeguarding corporate reputation.

The firm's deep knowledge of environmental law is instrumental in mitigating significant financial and reputational damage. In 2024, environmental litigation settlements often ran into hundreds of millions of dollars, underscoring the financial stakes involved.

Resource Scarcity and Sustainability

Global concerns about running out of essential resources and the growing need for eco-friendly practices are pushing companies to re-evaluate how they operate and where they get their materials. This shift is driven by increasing awareness and regulatory pressure, impacting everything from manufacturing to consumer goods. For instance, the UN estimates that by 2050, the world will need 50% more food, 40% more water, and 30% more energy, highlighting the urgency of resource management.

Davis Polk offers legal guidance on critical environmental issues, including navigating complex water rights regulations, managing waste disposal legally, and structuring deals for circular economy initiatives. They help clients adjust to tighter resource availability and improve their environmental footprint. This advisory includes ensuring that raw materials are sourced responsibly and production methods are as sustainable as possible, aligning with evolving market expectations and legal frameworks.

- Water Scarcity: By 2040, the World Resources Institute projects that over 5 billion people could face water shortages.

- Circular Economy Growth: The Ellen MacArthur Foundation estimates the circular economy could generate $4.5 trillion in economic benefits by 2030.

- Sustainable Sourcing: Over 70% of consumers in a 2024 survey indicated they are willing to pay more for sustainable products, reflecting a strong market push for ethical supply chains.

Corporate Environmental Responsibility

Beyond simply following environmental laws, there's a rising societal pressure for companies to actively take care of the planet. Davis Polk & Wardwell assists clients in creating and putting into action strong environmental plans, checking their own practices, and openly sharing their sustainability work with everyone involved. This forward-thinking strategy boosts brand worth, reduces the risk of damaging their reputation, and satisfies the expectations of consumers and investors who care about the environment.

The push for corporate environmental responsibility is significantly impacting business operations and investor relations. For instance, in 2024, the global sustainable investing market reached an estimated $150 trillion, reflecting a strong demand for companies with robust environmental, social, and governance (ESG) practices. Companies are increasingly expected to go beyond mere compliance.

Davis Polk's role in this area includes:

- Developing and implementing comprehensive environmental policies tailored to client needs.

- Conducting thorough internal audits to ensure adherence to environmental standards and identify areas for improvement.

- Advising on transparent communication strategies for sustainability initiatives to build trust with stakeholders.

- Helping clients navigate evolving environmental regulations and stakeholder expectations to mitigate reputational and financial risks.

Environmental factors continue to shape business strategy, driven by climate change concerns and resource scarcity. By 2050, global demand for food, water, and energy is projected to increase significantly, creating pressure for sustainable practices. Davis Polk advises clients on navigating these challenges, focusing on compliance and opportunities in areas like the circular economy, which is expected to generate substantial economic benefits by 2030.

| Environmental Factor | Impact on Businesses | Davis Polk's Role | Relevant Data/Projections |

|---|---|---|---|

| Climate Change & Regulations | Increased compliance costs, operational changes, risk of litigation | Guidance on emissions trading, climate risk reporting, navigating new regulations | EU's CBAM impacting trade flows (2024); Escalating PFAS litigation in 2024 |

| Resource Scarcity | Supply chain disruptions, increased raw material costs, need for efficiency | Advising on water rights, waste management, circular economy initiatives | 5 billion people facing water shortages by 2040; Circular economy potential of $4.5 trillion by 2030 |

| ESG Demands & Consumer Pressure | Shifting investment strategies, demand for transparency, reputational risk/reward | Developing ESG policies, conducting audits, advising on sustainability communications | Global sustainable investing market reached $150 trillion in 2024; 70% of consumers willing to pay more for sustainable products |

PESTLE Analysis Data Sources

Our PESTLE Analysis draws from a comprehensive blend of official government publications, reputable financial institutions, and leading industry-specific research. This ensures each political, economic, social, technological, legal, and environmental insight is grounded in credible, current data.