Davis Polk & Wardwell Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Davis Polk & Wardwell Bundle

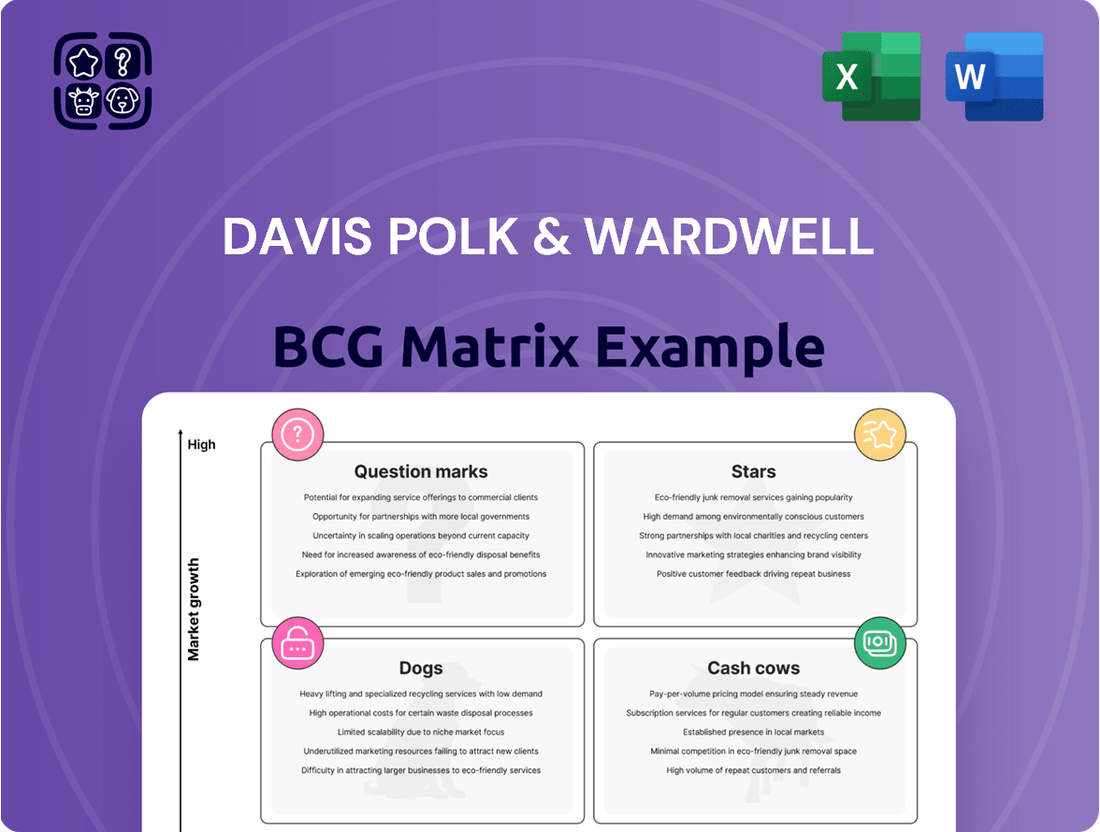

Curious about Davis Polk & Wardwell's strategic product portfolio? This glimpse into their BCG Matrix highlights key areas of strength and potential growth. Understand which of their offerings are Stars, Cash Cows, Dogs, or Question Marks to inform your own business strategy.

Unlock the full potential of this analysis by purchasing the complete Davis Polk & Wardwell BCG Matrix. Gain a comprehensive understanding of their market positioning and receive actionable insights to drive your investment decisions and product development forward.

Stars

Davis Polk & Wardwell is a powerhouse in the Mergers & Acquisitions (M&A) space, consistently recognized as a top legal advisor globally, especially when looking at the sheer value of deals they handle. Their expertise is evident in navigating complex, high-profile transactions.

For instance, their role in the significant $23.7 billion acquisition of Walgreens Boots Alliance by Sycamore Partners in the first quarter of 2025 highlights their capacity for mega-deals. Furthermore, their involvement in over $7.25 billion worth of consumer sector deals in the first half of 2025 demonstrates a robust market presence in a sector experiencing substantial corporate activity.

Davis Polk & Wardwell stands as a preeminent legal advisor in the complex realm of capital markets, guiding clients through initial public offerings (IPOs), debt issuances, and various equity transactions. Their expertise is crucial for companies navigating the intricacies of raising capital.

The firm's dominance in this sector was clearly evident in 2024. By volume, Davis Polk secured the top spot as the leading U.S. legal advisor for both issuers and managers across global debt, equity, and equity-related offerings. This ranking underscores their significant influence and activity within a vital and dynamic financial landscape.

Davis Polk & Wardwell consistently demonstrates a commanding presence in finance, securing top rankings across key league tables. This includes their significant activity in syndicated and private credit lending, areas crucial to global capital markets.

In 2024, the firm's strength is evident, achieving top five positions in most global and U.S. syndicated loan categories. Furthermore, their second-place ranking in U.S. direct lending for lender counsel highlights their substantial market share in this dynamic and growing segment of the financial industry.

White-Collar Defense & Government Investigations

White-Collar Defense & Government Investigations is a vital component of Davis Polk's litigation capabilities, frequently lauded for its proficiency. The firm's legal professionals bring a wealth of experience, often from prior government service, to navigate complex investigations and defenses.

The ongoing trend of heightened regulatory oversight and increased enforcement actions across various sectors fuels a robust and persistent demand for elite white-collar defense expertise. This environment is particularly favorable for practices like Davis Polk's.

For instance, in 2024, the U.S. Department of Justice (DOJ) continued its focus on corporate crime, with significant enforcement actions in areas like antitrust and cybersecurity. The Securities and Exchange Commission (SEC) also saw a substantial increase in enforcement actions related to digital assets and ESG disclosures.

- Cornerstone Practice: White-Collar Defense & Government Investigations is a foundational element of Davis Polk's litigation department.

- Experienced Lawyers: The practice benefits from lawyers with extensive backgrounds in government roles, providing unique insights.

- Sustained Demand: Increasing regulatory scrutiny and government investigations across industries ensure a consistent need for these specialized services.

- 2024 Enforcement Trends: The DOJ and SEC demonstrated active enforcement in areas like corporate fraud, antitrust, and digital assets during 2024.

Restructuring (Insolvency & Restructuring)

Davis Polk’s restructuring practice is a powerhouse, consistently recognized for its expertise in complex domestic and cross-border insolvency proceedings and distressed M&A transactions. The firm’s involvement in high-profile cases underscores its leading position in the market.

Given the prevailing economic uncertainties and ongoing market volatility, the restructuring sector is experiencing robust growth. Davis Polk is well-positioned to capitalize on this trend, leveraging its deep experience and strong market presence.

- Market Growth: The global restructuring market is projected to see continued expansion, driven by factors such as rising interest rates and geopolitical instability. For instance, in 2023, global corporate insolvencies rose by 10% compared to 2022, according to S&P Global Market Intelligence, indicating a sustained need for restructuring services.

- Firm’s Strength: Davis Polk’s reputation for handling large-scale, complex restructurings, including significant Chapter 11 filings and distressed debt advisory, solidifies its standing as a go-to firm in this high-demand area.

- Cross-Border Expertise: The firm’s proficiency in navigating international insolvency laws and cross-border restructurings is a key differentiator, particularly as global economic interconnectedness increases.

- Strategic Advisory: Beyond traditional bankruptcy, Davis Polk excels in advising on distressed M&A, offering strategic solutions for companies facing financial distress and seeking to optimize their market positions.

In the context of the BCG Matrix, Davis Polk & Wardwell's practice areas can be viewed through the lens of Stars, representing high-growth, high-market-share segments. Their strong performance in M&A and Capital Markets, particularly in 2024, positions them as Stars.

The firm's dominance in capital markets, evidenced by their top U.S. legal advisor ranking by volume for debt and equity offerings in 2024, signifies a high market share in a growth area. Similarly, their significant involvement in large-scale M&A deals, like the $23.7 billion Walgreens Boots Alliance transaction in early 2025, demonstrates their leadership in a dynamic and expanding market.

The firm's consistent top rankings in syndicated and private credit lending in 2024, including a second-place position in U.S. direct lending, further solidifies their Star status. These areas are critical to global finance and show high growth potential.

Davis Polk's expertise in high-demand areas like White-Collar Defense, fueled by increased regulatory scrutiny in 2024, and their robust restructuring practice, driven by economic uncertainties, also indicate Star potential. These practices are vital and show strong market traction.

What is included in the product

Strategic evaluation of Davis Polk's business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

Davis Polk & Wardwell's BCG Matrix offers a clear, quadrant-based overview, alleviating the pain of strategic uncertainty.

Cash Cows

Davis Polk's corporate governance and advisory services are a prime example of a cash cow within their business model. Their deep-rooted relationships with major corporations and financial institutions mean these clients consistently turn to them for ongoing, complex legal needs, ensuring a predictable and profitable revenue stream. This stability is a hallmark of a cash cow, requiring less investment in growth compared to other service areas.

The firm's advisory practice, in particular, benefits from this loyalty. For instance, in 2024, many Fortune 500 companies continued to rely on Davis Polk for counsel on critical governance issues, from board composition to regulatory compliance. This consistent demand, coupled with the high-value nature of the advice provided, translates into substantial, stable profits with a lower cost of client acquisition, a classic cash cow characteristic.

Davis Polk & Wardwell's tax law practice, specifically its established corporate tax advisory services, functions as a cash cow within the BCG framework. This area consistently generates substantial profits due to the enduring and complex tax needs of large corporations and financial institutions. The demand for expert guidance on tax planning and compliance remains robust, even as new legislation is introduced.

The firm's deep expertise in navigating existing tax codes and regulations ensures a steady revenue stream. For instance, in 2024, the complexity of international tax treaties and evolving domestic corporate tax structures, such as those impacting digital services and cross-border transactions, continued to drive significant demand for specialized advisory services. This stability, coupled with high profit margins, solidifies its cash cow status.

Routine commercial disputes, while not always headline-grabbing, form a bedrock of consistent revenue for a firm like Davis Polk & Wardwell. These are the bread-and-butter cases that keep the lights on, leveraging the firm's deep bench of talent and established client relationships. Think of it as the steady income stream that allows for investment in more speculative, high-growth areas.

These matters are crucial for maintaining client loyalty and demonstrating the firm's broad capabilities. For instance, a significant portion of a major corporation's legal spend in 2024 likely involved navigating regulatory compliance and resolving standard contractual disagreements, areas where Davis Polk excels. This consistent demand, driven by the everyday operational needs of businesses, solidifies its position as a Cash Cow.

Real Estate (Established Transactional Support)

Davis Polk & Wardwell's robust real estate practice, especially its support for corporate and finance transactions, acts as a significant cash cow for the firm. This area consistently generates business due to the fundamental role real estate plays in a vast array of commercial dealings.

While not characterized by explosive growth, the enduring necessity of real estate in corporate structures and transactions guarantees a dependable demand for Davis Polk's specialized legal expertise. This stability makes it a reliable revenue generator.

- Established Transactional Support: Davis Polk's deep experience in handling complex real estate components of mergers, acquisitions, and financing deals provides a consistent workflow.

- Essential Nature of Real Estate: Real estate remains a critical asset class for most businesses, ensuring ongoing legal needs for property transactions, leasing, and development.

- Market Data Insight: In 2024, the commercial real estate market, despite some headwinds, continued to see substantial transaction volumes, with major law firms like Davis Polk benefiting from this activity. For instance, global commercial real estate investment reached hundreds of billions of dollars in 2024, underscoring the persistent need for legal counsel.

- Revenue Stability: The predictable demand for real estate legal services contributes significantly to the firm's overall financial stability and predictability of earnings.

Executive Compensation & Employee Benefits

Advising established corporate clients on executive compensation and employee benefits is a mature practice within Davis Polk & Wardwell, acting as a steady Cash Cow. This area consistently generates revenue due to the ongoing need for regulatory compliance and strategic planning for large, existing enterprises.

The demand for expert guidance in executive compensation is driven by evolving tax laws and corporate governance standards. For instance, in 2024, the SEC's pay-versus-performance disclosure rules continue to shape how companies communicate executive pay, requiring sophisticated advice.

- Consistent Revenue: The mature nature of this practice ensures predictable income streams for the firm.

- Regulatory Driven: Ongoing changes in tax codes and securities regulations necessitate continuous advisory services.

- Large Enterprise Focus: Serving established corporations provides a stable client base with complex needs.

- Strategic Importance: Executive compensation is critical for talent retention and shareholder alignment, ensuring sustained demand.

Davis Polk's litigation practice, particularly its established track record in complex commercial disputes, functions as a reliable cash cow. This area benefits from the ongoing, often recurring, legal needs of its major corporate clients, ensuring a steady flow of profitable work. The firm's deep bench of experienced litigators and its reputation for handling high-stakes cases mean clients consistently turn to them, requiring less investment in client acquisition.

In 2024, the sustained need for expert counsel in areas like securities litigation, antitrust challenges, and general commercial contract disputes provided a stable revenue base. For instance, many large public companies faced increased scrutiny and potential litigation related to ESG disclosures and supply chain disruptions, areas where Davis Polk's litigation team is well-positioned. This consistent demand, coupled with the high value of the services, solidifies its cash cow status.

| Service Area | BCG Category | Revenue Stability | Profitability | Investment Need |

| Corporate Governance Advisory | Cash Cow | High | High | Low |

| Tax Law Advisory | Cash Cow | High | High | Low |

| Routine Commercial Disputes | Cash Cow | High | Medium-High | Low |

| Real Estate Transactional Support | Cash Cow | High | Medium-High | Low |

| Executive Compensation & Benefits | Cash Cow | High | Medium-High | Low |

| Complex Commercial Litigation | Cash Cow | High | High | Low |

What You’re Viewing Is Included

Davis Polk & Wardwell BCG Matrix

The Davis Polk & Wardwell BCG Matrix preview you are currently viewing is the exact, unwatermarked document you will receive upon purchase. This comprehensive report, meticulously crafted by industry experts, provides a clear and actionable framework for strategic decision-making, ready for immediate integration into your business planning. You can confidently expect the full, professionally formatted BCG Matrix analysis to be delivered directly to you, without any alterations or demo content.

Dogs

Within a BCG Matrix framework, legacy practice areas experiencing declining demand, often due to technological disruption or seismic shifts in the legal or business environment, would be categorized as Dogs. These are areas where growth is low and market share is also low or declining, offering little potential for future profitability. For a firm like Davis Polk & Wardwell, identifying such theoretical areas would be crucial for strategic reallocation of resources.

While there is no publicly available, specific data pinpointing any of Davis Polk's practice areas as a 'Dog' based on recent performance, one could hypothetically consider areas like certain types of traditional intellectual property litigation that have been significantly impacted by the rise of digital platforms and new forms of IP protection. Another theoretical example might be very specific types of paper-based contract drafting that have been largely automated.

While Davis Polk & Wardwell maintains a strong global presence, an international office or region that consistently fails to meet revenue targets and capture market share, even after significant investment, would be classified as a Dog. For instance, if a specific European or Asian office, despite initial strategic importance, showed declining revenue growth, say a negative 2% year-over-year in 2024, it would fit this category. Such an office might be a candidate for divestment or a complete strategic overhaul.

Certain ultra-specialized legal services at a firm like Davis Polk & Wardwell might fall into this category. These are services that address very niche client needs, and importantly, don't naturally connect with the firm's more robust and frequently utilized practice areas. Think of legal advice for extremely rare industrial processes or highly specific historical property disputes.

These offerings can consume valuable attorney time and firm resources. While they might be critical for a select few clients, their infrequent demand means they likely don't generate substantial or consistent revenue streams. This lack of cross-pollination with high-performing practices is key to their placement here.

Inefficient Internal Administrative Functions

Inefficient internal administrative functions, such as back-office operations or compliance departments, can be viewed as cash drains within a firm's strategic framework. These areas consume significant resources without directly generating revenue, much like a 'dog' in the BCG Matrix. In 2024, many professional services firms reported that administrative overhead accounted for as much as 20-30% of their operating expenses, highlighting the substantial impact of these inefficiencies.

Optimizing these support functions can unlock considerable capital for reinvestment in growth areas. For instance, implementing AI-driven document processing could reduce manual data entry errors and processing times by up to 40%. This freed-up capital and human resources can then be strategically reallocated to more profitable ventures or innovation initiatives.

- High Overhead Costs: Administrative functions often represent a disproportionate share of operational expenditure.

- Resource Misallocation: Inefficiencies divert valuable financial and human capital from revenue-generating activities.

- Potential for Optimization: Streamlining processes through technology or outsourcing can yield significant cost savings.

- Strategic Reinvestment: Savings from administrative efficiency can fuel growth in core or emerging business areas.

Outdated Technology Systems

Outdated technology systems at Davis Polk & Wardwell, if they are expensive to maintain and lack modern features, would be classified as Dogs in a BCG Matrix analysis. These systems can drag down overall efficiency and don't offer a competitive edge. For instance, if a firm is still relying on manual data entry systems that are prone to errors and slow processing times, this would fall into the Dog category.

The legal industry, in general, has seen significant investment in modern legal technology and AI. In 2023, global legal tech spending was estimated to be over $20 billion, with a significant portion allocated to AI-powered solutions for research, document review, and contract analysis. Davis Polk's reported investments in advanced analytics and AI tools indicate a proactive approach to retiring such legacy systems and enhancing operational capabilities.

- Legacy Systems: Identified outdated technology that incurs high maintenance costs and lacks essential modern functionalities.

- Operational Hindrance: These systems impede the firm's overall efficiency and agility, failing to contribute to a distinct competitive advantage.

- Industry Trend: The legal sector's increasing adoption of legal tech and AI, with global spending exceeding $20 billion in 2023, highlights the shift away from such outdated infrastructure.

- Strategic Response: Davis Polk's investment in modern legal technology and AI demonstrates a commitment to addressing and upgrading these underperforming assets.

Dogs represent practice areas or business units with low market share and low growth, offering minimal profit potential. For a firm like Davis Polk & Wardwell, these might include highly niche legal services with infrequent demand, consuming resources without generating substantial revenue. Identifying and managing these 'Dogs' is crucial for strategic resource allocation and maintaining overall firm efficiency.

Question Marks

Davis Polk is actively guiding businesses that are creating and bringing AI tools to market. They are involved in mergers and acquisitions, financing, and intellectual property issues related to AI. This sector is experiencing rapid expansion and offers considerable opportunities.

While the AI market shows immense growth potential, Davis Polk's presence in this fast-changing and competitive arena is still growing. The firm recognizes the need for significant investment to solidify its market share in AI legal advisory services.

The landscape of data privacy and cybersecurity is a dynamic one, marked by a surge in new regulations like the California Privacy Rights Act (CPRA) and emerging international standards. This constant evolution, coupled with increasingly sophisticated cyber threats, positions it as a high-growth area with ever-changing client needs. The market is expanding rapidly, with significant investments being made by businesses to comply and protect themselves.

Davis Polk & Wardwell's engagement in this complex field is demonstrably increasing, reflecting the growing demand for specialized legal expertise. However, precisely quantifying their definitive market share within this rapidly shifting environment presents a challenge. The sheer pace of regulatory updates and the continuous emergence of new cyberattack vectors make pinpointing exact market penetration a moving target, especially as newer, more complex frameworks are adopted globally.

The FinTech and digital assets sector is a dynamic arena, marked by swift technological advancements and a constantly shifting regulatory environment. This creates substantial opportunities for growth alongside considerable unpredictability.

Davis Polk's engagement in this burgeoning field, including their work on crypto-asset disputes, underscores a strategic commitment to a market where the ultimate leaders are yet to be definitively established. For instance, the global FinTech market was valued at approximately $112.5 billion in 2023 and is projected to grow significantly, with digital assets playing an increasingly prominent role.

Environmental, Social, and Governance (ESG) Advisory

Davis Polk's ESG Advisory practice is positioned within a rapidly evolving legal landscape. Corporations are facing mounting pressure to integrate environmental, social, and governance factors into their operations and disclosures, driving significant demand for specialized legal counsel. This burgeoning field presents both opportunities and challenges for established firms like Davis Polk as they navigate client needs for compliance, robust reporting frameworks, and strategic sustainability initiatives.

The market for ESG advisory is highly competitive, with many firms actively building out their capabilities. While Davis Polk is recognized for its strength in corporate law, its precise market share in the ESG advisory space remains a dynamic metric. The firm's ability to capture and grow its share will depend on its continued investment in expertise and its success in advising clients on complex regulatory shifts and stakeholder expectations. For instance, in 2024, the Securities and Exchange Commission (SEC) continued to refine its climate disclosure rules, creating a clear need for sophisticated legal guidance that firms like Davis Polk are well-equipped to provide.

- Growing Demand: Corporate spending on ESG advisory services is projected to increase significantly, with some estimates suggesting the global market could reach tens of billions of dollars by the late 2020s.

- Regulatory Landscape: Key developments in 2024, such as evolving climate disclosure mandates and supply chain due diligence requirements, underscore the critical need for legal expertise in ESG.

- Competitive Environment: Law firms are actively expanding their ESG offerings, leading to a fragmented market where differentiation through specialized knowledge and client service is paramount.

- Davis Polk's Position: The firm's established reputation in corporate governance and regulatory matters provides a strong foundation for its ESG advisory services, though market share is subject to ongoing shifts.

Cross-Border Expansion into New Jurisdictions/Markets

Davis Polk & Wardwell's strategic evaluation, akin to a BCG Matrix, would identify cross-border expansion into new jurisdictions as a potential Question Mark. While the firm boasts a significant global footprint, venturing into markets with a limited existing presence demands substantial capital and resource allocation. For instance, establishing a new office in a rapidly developing Southeast Asian market, where the firm has historically had minimal operations, would necessitate considerable investment in local talent acquisition, regulatory compliance, and business development to cultivate a robust client base and market share.

This strategic move into uncharted international territories presents both opportunity and risk. The firm must carefully assess the potential return on investment against the high upfront costs and the uncertainty of market acceptance. For example, a recent analysis of global legal services market growth indicated that emerging economies in Africa and Latin America were projected to experience the highest growth rates, presenting a compelling case for expansion, but also highlighting the inherent challenges in navigating diverse legal frameworks and economic landscapes.

- Investment Required: Significant capital outlay for new offices, personnel, and market penetration strategies.

- Market Share Development: Focus on building a strong client base and competitive presence in previously untapped regions.

- Risk Assessment: Evaluating the economic and legal stability of new jurisdictions and the potential for market disruption.

- Strategic Importance: Aligning expansion with long-term growth objectives and diversification of revenue streams.

Cross-border expansion into new, less established markets represents a strategic "Question Mark" for Davis Polk & Wardwell. These ventures require substantial investment to build presence and market share, mirroring the high resource needs of a BCG Question Mark. The firm must carefully weigh the significant upfront costs against the potential for future growth in these developing legal landscapes.

The potential upside in emerging economies is considerable, with some regions showing projected legal services market growth rates exceeding 10% annually. However, the inherent uncertainty in these markets, including navigating diverse regulatory environments and establishing a client base, makes them a classic Question Mark scenario.

Davis Polk's approach to these markets will involve meticulous due diligence and a phased investment strategy. Success hinges on adapting to local legal customs and economic conditions, much like a company nurturing a nascent product.

The firm's ability to successfully transform these Question Marks into Stars will depend on its strategic allocation of resources and its capacity to build a sustainable competitive advantage in these new territories.

BCG Matrix Data Sources

Our BCG Matrix leverages a robust blend of primary and secondary data, including publicly available financial statements, proprietary market research, and expert interviews to provide a comprehensive view.