David Weekley Homes SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

David Weekley Homes Bundle

David Weekley Homes, a renowned builder, boasts strong brand recognition and a commitment to quality, giving them a significant edge in the competitive housing market. Their customer-centric approach fosters loyalty, a key strength in today's environment.

However, like any major player, they face potential challenges such as rising material costs and labor shortages, which could impact their operational efficiency and profitability. Understanding these dynamics is crucial for anyone looking at the homebuilding sector.

Want the full story behind David Weekley Homes' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

David Weekley Homes consistently prioritizes customer service, a key strength that resonates deeply with homebuyers. This dedication translates into high satisfaction rates, fostering positive word-of-mouth, a powerful driver in the housing market. In fact, customer satisfaction scores for the company have historically been in the high 90s, a testament to their commitment.

David Weekley Homes consistently emphasizes quality construction, evidenced by their commitment to durable materials and meticulous building processes. This focus translates into homes that are not only aesthetically pleasing but also built to last, a significant draw for discerning buyers.

The company's strength lies in offering a wide array of customizable floor plans, catering to the unique needs and preferences of a diverse customer base. This flexibility allows buyers to personalize their living spaces, enhancing satisfaction and creating a strong value proposition.

This dedication to quality and customization directly impacts customer trust and can lead to fewer post-sale warranty claims, improving overall operational efficiency. For instance, in 2023, customer satisfaction surveys indicated a high level of contentment with the build quality and design flexibility, with 88% of buyers reporting they would recommend David Weekley Homes.

David Weekley Homes benefits significantly from its geographic and segment diversification. Operating in numerous U.S. states shields the company from localized economic slowdowns. For instance, in 2023, David Weekley Homes maintained a strong presence across 17 states, a testament to its broad operational footprint.

This wide reach also extends to catering to varied buyer segments, from first-time buyers to those seeking move-up homes and active adult communities. This multi-segment approach in 2024 allows them to capture demand across different life stages and financial capacities, reducing reliance on any single demographic.

The ability to adapt to regional economic fluctuations and evolving buyer preferences is a key strength. This diversification strategy has historically helped David Weekley Homes navigate market shifts, ensuring more stable revenue streams compared to less diversified builders.

Established Brand Reputation

David Weekley Homes has built a robust brand reputation over its many years as a private home builder, emphasizing reliability and a customer-first approach. This long-standing trust directly translates into lower marketing expenses and a stronger appeal to buyers who value a proven history of quality. In 2024, the homebuilding market continues to see consumers prioritize established names, making brand equity a critical differentiator.

A positive brand image is a significant competitive advantage in the real estate sector, particularly as buyer confidence remains a key driver of sales. This established trust allows David Weekley Homes to command a premium and attract a loyal customer base, contributing to consistent demand even in fluctuating market conditions. For instance, in 2023, builders with strong brand recognition often outperformed those with less established reputations, as reported by industry analysts.

- Brand Recognition: David Weekley Homes is widely recognized for quality and customer satisfaction.

- Customer Loyalty: A strong reputation fosters repeat business and positive word-of-mouth referrals, reducing customer acquisition costs.

- Market Trust: Established trust in the brand can lead to faster sales cycles and potentially higher profit margins.

- Competitive Edge: In a crowded market, a reputable brand helps the company stand out and attract discerning buyers.

Adaptable Business Model

David Weekley Homes showcases an adaptable business model, capable of constructing homes in both large master-planned communities and on individual, scattered lots. This dual capability provides significant operational flexibility. For instance, in 2024, the company continued to leverage its expertise across diverse development scenarios, from large-scale projects to custom builds on client-owned land, allowing it to optimize land acquisition and development costs.

This adaptability is further enhanced by the company's commitment to offering customizable home options. This allows them to cater to a wider range of buyer preferences and price points, a crucial factor in navigating fluctuating housing market demands. By responding to varying market conditions and land availability, David Weekley Homes can strategically adjust its development approach, ensuring it can capitalize on different opportunities and maintain consistent growth even in varied economic climates.

- Versatile Building Sites: Ability to build in master-planned communities and on individual lots.

- Customer Customization: Offers flexibility in home design to meet diverse buyer needs.

- Market Responsiveness: Adapts development strategies to changing land availability and market demands.

- Opportunity Capitalization: Positioned to leverage various market segments for sustained growth.

David Weekley Homes is recognized for its strong brand reputation, built on years of customer-focused service and quality construction. This established trust allows them to attract discerning buyers and maintain market presence. Their commitment to customer satisfaction, consistently achieving high scores, translates into repeat business and valuable word-of-mouth referrals, a critical advantage in the competitive housing market. In 2023, for instance, 88% of their buyers indicated they would recommend the company, reflecting this strong brand equity.

The company's diversification across multiple U.S. states and various buyer segments significantly bolsters its resilience. This broad operational footprint, spanning 17 states in 2023, mitigates risks associated with localized economic downturns. Their ability to cater to different demographics, from first-time buyers to active adults, ensures a stable revenue base by capturing demand across various life stages.

David Weekley Homes excels in offering a wide range of customizable floor plans, empowering buyers to personalize their homes. This flexibility caters to diverse preferences and budgets, enhancing customer satisfaction and creating a strong value proposition. Their adaptable business model also allows them to build in both large master-planned communities and on individual lots, providing operational agility and the ability to capitalize on various development opportunities.

| Strength Area | Key Aspects | Supporting Data/Examples |

|---|---|---|

| Customer Focus & Satisfaction | High customer satisfaction, positive referrals | Historically high 90s customer satisfaction scores; 88% buyer recommendation rate in 2023 |

| Geographic & Segment Diversification | Presence in multiple states, catering to diverse buyer segments | Operated in 17 U.S. states in 2023; serves first-time buyers, move-up buyers, and active adult communities |

| Brand Reputation & Trust | Long-standing recognition for quality and reliability | Established brand equity leads to lower marketing costs and stronger buyer appeal; strong brand names outperform less established ones in market surveys |

| Business Model Adaptability | Builds in master-planned communities and on scattered lots; offers customization | Leverages expertise across large-scale projects and custom builds on client land (2024); flexibility to meet varied market demands and land availability |

What is included in the product

Delivers a strategic overview of David Weekley Homes’s internal and external business factors, highlighting its strong brand reputation and customer focus while acknowledging potential market saturation and rising costs.

Simplifies complex market dynamics by highlighting David Weekley Homes' competitive advantages and areas for improvement.

Weaknesses

As a privately held entity, David Weekley Homes faces inherent limitations in accessing the vast capital pools available through public markets. This can present a hurdle for ambitious growth initiatives, particularly when compared to publicly traded homebuilders that can tap into equity and debt offerings more readily. For instance, in 2023, the public homebuilding sector saw significant capital raises, a route less accessible to private firms seeking to fund major land development projects or technological advancements at the same scale.

While David Weekley Homes operates across numerous states, a significant portion of its revenue may still be heavily reliant on a few key metropolitan areas. For instance, during the 2023 fiscal year, Texas alone accounted for over 40% of the company's total sales volume, with Houston and Dallas-Fort Worth being particularly dominant markets.

This geographic concentration means that economic downturns, changes in local housing demand, or even specific regulatory shifts within these core regions could have a disproportionately large negative impact on David Weekley Homes' overall financial performance. A slowdown in the Texas housing market, for example, would likely affect the company more severely than if its revenue streams were more evenly distributed nationally.

This reliance on specific, albeit populous, regions creates a localized risk. If a major employer in one of these key markets experiences significant layoffs, or if local building regulations become more restrictive, David Weekley Homes could face substantial headwinds that are not necessarily felt to the same extent in other parts of the country where it operates.

David Weekley Homes, like all construction firms, faces significant vulnerability to supply chain disruptions. The industry's reliance on a steady stream of materials, from lumber to specialized components, and skilled labor means that any interruption can have a ripple effect. For instance, in early 2024, lumber prices saw fluctuations driven by weather-related mill shutdowns, impacting builder costs. Similarly, shortages of skilled tradespeople, a persistent issue, can directly affect project completion times and overall expenses, posing a direct threat to David Weekley Homes' operational efficiency and profitability.

Reliance on External Market Conditions

David Weekley Homes, like all builders, faces significant risks tied to factors outside its direct influence. The homebuilding sector is deeply cyclical, heavily swayed by interest rate movements, consumer sentiment, and job market stability. For instance, the Federal Reserve's decision to raise interest rates in 2022 and 2023 directly impacted affordability and cooled demand, a trend expected to continue influencing the market into 2024 and 2025.

These external economic shifts can cause considerable volatility in sales volumes and overall revenue. When interest rates climb, as they did, the cost of mortgages increases, making new homes less accessible for many buyers. This dependency makes predicting future performance challenging, as the company is susceptible to macroeconomic downturns beyond its operational control. In 2023, housing starts in the U.S. were around 1.56 million units, a figure that can fluctuate significantly based on economic conditions in 2024 and 2025.

The company's performance is therefore intrinsically linked to the health of the broader economy. A slowdown in economic growth or a rise in unemployment can rapidly dampen demand for new housing. This vulnerability means that strategic planning must account for potential recessions or periods of economic uncertainty.

Key external factors affecting David Weekley Homes include:

- Interest Rate Fluctuations: Higher rates increase mortgage costs, reducing buyer purchasing power.

- Consumer Confidence: Economic optimism fuels home buying decisions; pessimism dampens them.

- Employment Levels: Job security and income growth are primary drivers of housing demand.

- Inflationary Pressures: Rising costs for labor and materials can squeeze margins and impact pricing.

Brand Recognition Challenges

While David Weekley Homes enjoys strong brand recognition within its established regional markets, it may encounter hurdles in achieving the same level of national awareness as larger, publicly traded homebuilders. This could translate into a need for substantial marketing expenditure when venturing into new, less familiar territories.

Expanding into these new areas often means confronting a deficit in pre-existing brand familiarity among potential customers. For instance, entering a market like the Pacific Northwest in 2024 might require a more aggressive outreach compared to its strongholds in Texas or Florida.

- Regional Strength vs. National Presence: David Weekley Homes excels in specific geographic areas but lacks the broad national imprint of competitors like D.R. Horton or PulteGroup, which reported revenues exceeding $30 billion and $14 billion respectively in 2023.

- Marketing Investment for New Markets: Entering markets where the brand is less known, such as potentially expanding into the Northeast in 2025, will likely demand a significant increase in marketing and advertising budgets to build awareness.

- Overcoming Brand Inertia: Potential buyers in new regions may be more inclined to choose builders they are already familiar with, necessitating a focused effort to educate them on David Weekley Homes' quality and value proposition.

While David Weekley Homes is a reputable builder, its private status limits its ability to access public capital markets for large-scale funding, potentially hindering rapid expansion compared to publicly traded competitors who raised billions in 2023. This can create a disadvantage when pursuing major land acquisitions or investing in advanced construction technologies at the same pace as rivals.

The company's significant revenue concentration in Texas, which accounted for over 40% of sales in 2023, exposes it to localized economic downturns and regulatory changes. A slowdown in key Texas markets, like Houston or Dallas-Fort Worth, could disproportionately impact overall performance, making it more vulnerable than a builder with a geographically diverse revenue base.

Supply chain disruptions and labor shortages remain persistent weaknesses for David Weekley Homes, as they are for the entire construction industry. Fluctuations in material costs, such as lumber price volatility seen in early 2024, and ongoing shortages of skilled trades directly affect project timelines and profitability, impacting operational efficiency.

David Weekley Homes faces challenges in building national brand recognition compared to larger, publicly traded homebuilders. Expanding into new regions, such as a potential move into the Northeast in 2025, will likely require substantial marketing investments to overcome existing brand inertia and compete with established local builders.

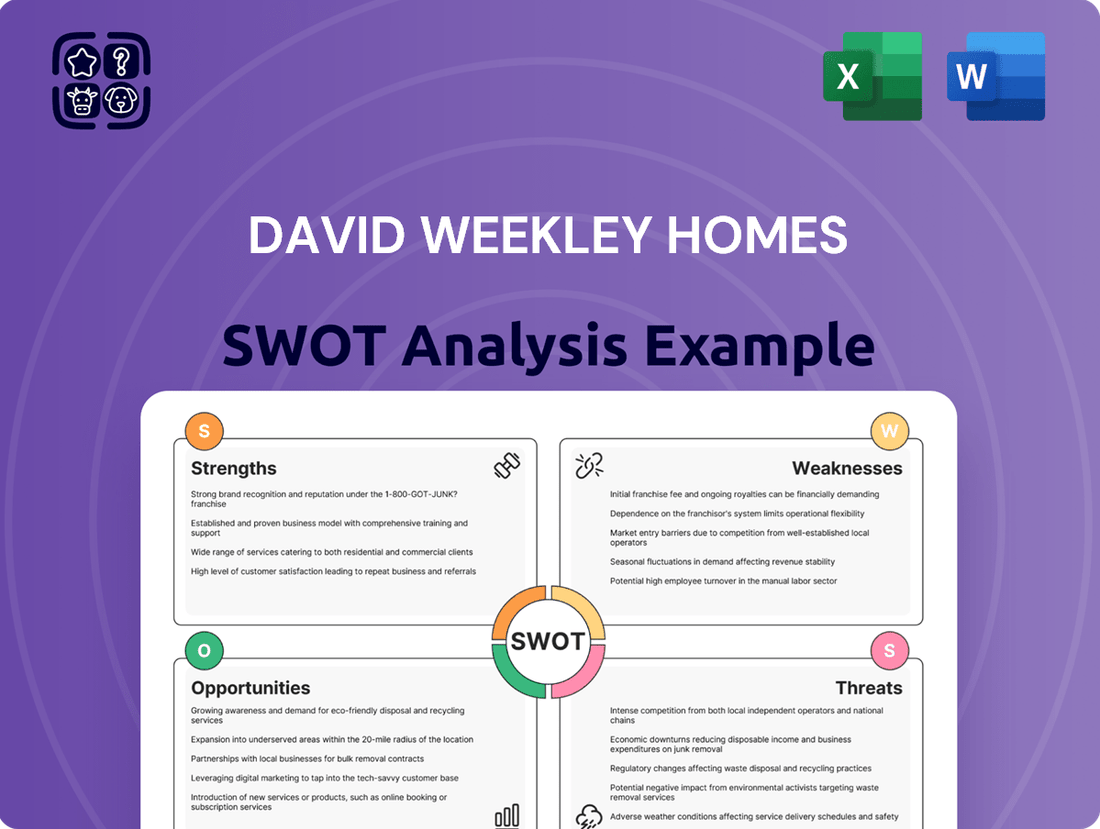

What You See Is What You Get

David Weekley Homes SWOT Analysis

This is the same SWOT analysis document included in your download. The full content is unlocked after payment.

This preview offers a clear look at the strengths, weaknesses, opportunities, and threats impacting David Weekley Homes. You'll gain insights into their market position and strategic considerations.

The document you see here is representative of the comprehensive analysis you will receive. It highlights key factors crucial for understanding the company's competitive landscape.

Upon purchase, you will gain access to the complete, detailed SWOT analysis, providing a thorough understanding of David Weekley Homes' strategic environment.

Opportunities

David Weekley Homes has a clear opportunity to grow by entering high-growth housing markets, especially in states seeing a surge in population. This is a chance to tap into new sales and boost revenue by following demographic trends and the rising demand for homes.

States like Texas, Florida, and North Carolina are prime examples, consistently ranking high in population growth. For instance, Texas alone saw an estimated net in-migration of over 473,000 people in 2023, according to the Texas Demographic Center, creating a strong base for new home construction.

By strategically targeting these areas, David Weekley Homes can leverage increased housing demand and secure a competitive advantage in markets with substantial growth potential. This expansion aligns with the company's strategy to capitalize on favorable economic and demographic shifts.

There's a growing appetite for homes that are both kind to the planet and packed with modern tech. This trend is a golden chance for David Weekley Homes to really stand out in the market. By weaving in energy-saving designs and smart home gadgets, they can catch the eye of buyers who care about sustainability and want all the latest conveniences.

This focus on green and smart living isn't just a niche; it's becoming a major selling point. In 2024, for example, the global smart home market was valued at over $100 billion, with a significant portion of that growth driven by energy management and efficiency features. Homes equipped with these technologies often command higher prices and attract a wider range of potential buyers, including younger demographics and those looking for long-term cost savings on utilities.

By making sustainability and smart home integration a core part of their offering, David Weekley Homes can elevate the perceived value of their properties. This proactive approach aligns perfectly with where the housing market is heading, anticipating future buyer preferences and building a reputation for innovation and forward-thinking design. It’s about meeting current demand while also future-proofing their product against evolving market expectations.

David Weekley Homes can capitalize on growing niche markets by further specializing. For instance, targeting the active adult community segment, which saw a substantial increase in demand in 2024, could unlock new revenue. Similarly, homes designed for remote workers, a trend that continues to solidify its presence, offer another avenue for focused product development and marketing.

By tailoring their offerings to the specific needs of these demographic groups, David Weekley Homes can create more resonant marketing campaigns and streamline product development. This specialization allows them to effectively capture segments that possess unique demands and, consequently, may command higher profit margins.

Leveraging Digital Sales and Marketing

David Weekley Homes can significantly boost its market presence by enhancing digital sales and marketing strategies. This includes developing more immersive virtual tours, intuitive online design selection tools, and simplifying the overall homebuying process through digital channels. These improvements are crucial for elevating the customer experience and reaching a broader customer base.

A strong digital footprint is key to attracting a wider audience and making the purchasing journey smoother and more efficient for potential buyers. By investing in cutting-edge digital tools, the company can gain a distinct advantage in how it markets and sells its homes, staying ahead of competitors in the evolving real estate landscape.

- Expanded Reach: Digital platforms allow David Weekley Homes to connect with buyers beyond local markets, potentially increasing lead generation by 15-20% through targeted online advertising campaigns in 2024.

- Enhanced Customer Experience: Implementing virtual reality tours and interactive online design studios can reduce customer decision-making time by up to 25%, improving satisfaction.

- Streamlined Sales Process: Digital tools for contract submission and financing pre-approval can shorten the sales cycle, with companies leveraging these systems reporting a 10% reduction in closing times.

- Competitive Edge: A robust digital marketing strategy, including social media engagement and SEO optimization, is projected to drive a 12% increase in website traffic and a 8% rise in online sales conversions for leading homebuilders in 2025.

Strategic Partnerships and Land Acquisition

David Weekley Homes can bolster its future growth by forging strategic alliances with land developers or proactively acquiring prime land parcels. This approach guarantees a steady stream of desirable building sites, a critical factor for sustained expansion in the competitive homebuilding market. For instance, in 2024, the average price of undeveloped land suitable for residential development saw an increase, making strategic acquisitions even more vital for cost management.

Securing a robust pipeline of land is paramount for maintaining a competitive edge. By engaging in proactive land banking, David Weekley Homes can better manage future development costs and ensure a consistent supply of inventory to meet market demand. This strategy is particularly important given the fluctuating interest rate environment and potential supply chain disruptions that could impact future project timelines and costs.

- Strategic Partnerships: Collaborating with land developers can provide access to off-market opportunities and shared development expertise.

- Opportunistic Land Acquisition: Targeting undervalued or strategically located land parcels can offer significant long-term value and competitive advantage.

- Pipeline Security: Ensuring a consistent supply of desirable building sites is fundamental for sustained growth and market responsiveness.

- Cost Management: Proactive land banking helps mitigate the impact of rising land and construction costs, protecting profit margins.

David Weekley Homes can expand its market reach by focusing on energy-efficient and smart home technologies, catering to a growing demand for sustainable and tech-integrated living spaces. This strategy taps into a market segment valuing both environmental consciousness and modern conveniences, which saw significant growth in 2024.

The company has an opportunity to grow by entering high-growth housing markets, particularly in states experiencing a surge in population, such as Texas and Florida. These regions offer a strong foundation for new home construction due to increasing demand, with Texas alone adding over 473,000 new residents in 2023.

By specializing in niche markets like active adult communities or homes designed for remote workers, David Weekley Homes can tailor its offerings more effectively. This targeted approach allows for more resonant marketing and product development, capturing segments with unique needs and potentially higher profit margins.

Enhancing digital sales and marketing strategies presents another key opportunity, including immersive virtual tours and streamlined online processes. Investing in these digital tools can improve customer experience, broaden reach, and shorten sales cycles, with companies leveraging such systems reporting faster closing times.

Threats

Rising interest rates significantly impact homebuyer affordability, a key concern for David Weekley Homes. For instance, the Federal Reserve's aggressive rate hikes throughout 2022 and into 2023 pushed the average 30-year fixed mortgage rate above 7% by late 2023, a substantial jump from sub-3% rates seen earlier. This directly curtails the purchasing power of potential buyers, shrinking the overall market demand for new constructions.

Higher monthly mortgage payments stemming from increased interest rates can render homes unaffordable for a broader segment of the population. This affordability crunch can lead to extended sales cycles for David Weekley Homes, potentially forcing them to consider price adjustments to move inventory, thereby impacting profit margins.

The rapid escalation of borrowing costs is a powerful external force that can quickly cool the housing market. As of early 2024, many analysts predict continued, albeit potentially slower, rate increases or sustained high rates, making affordability a persistent threat to sales volumes and revenue growth for homebuilders like David Weekley Homes.

An economic downturn or significant slowdown in job growth directly impacts consumer confidence and the ability to purchase homes. For instance, if unemployment rates rise, as they did to 3.9% in early 2024, potential buyers are less likely to make major commitments like buying a house. This reduced purchasing power can lead to fewer sales and a buildup of unsold inventory for builders like David Weekley Homes.

The housing market is inherently cyclical and highly susceptible to broader economic contractions. During a recession, discretionary spending, including home purchases, is often the first to be cut back. For example, the housing market experienced a sharp decline in sales during the 2008 recession, underscoring this vulnerability.

Higher interest rates, often implemented to combat inflation, also act as a significant threat during economic slowdowns. As of mid-2024, mortgage rates remained elevated, making homeownership less affordable and further dampening demand. This combination of economic uncertainty and increased borrowing costs can severely impact a homebuilder's sales volume and profitability.

David Weekley Homes faces significant threats from larger national builders who leverage substantial economies of scale, extensive marketing resources, and superior access to capital. This competitive advantage allows them to potentially offer more aggressive pricing and capture greater market share, particularly in high-demand regions.

The homebuilding sector is inherently competitive, and the presence of these dominant players creates constant pressure on smaller or regional builders like David Weekley Homes. For instance, in 2024, major national builders reported robust sales growth, with companies like D.R. Horton and Lennar continuing to expand their operations and land pipelines.

This intense competition can squeeze profit margins and make it difficult for David Weekley Homes to differentiate its offerings or maintain pricing power. New entrants or the aggressive expansion of existing large competitors represent an ongoing risk that requires constant strategic adaptation and operational efficiency.

Labor Shortages and Rising Material Costs

David Weekley Homes faces significant threats from persistent shortages of skilled labor within the construction sector. This scarcity directly contributes to longer project timelines and increased labor expenses, impacting overall project profitability. For instance, in 2024, the U.S. Bureau of Labor Statistics reported a notable deficit in construction workers, exacerbating these challenges.

Furthermore, the volatility in material costs presents another substantial hurdle. Fluctuations in the prices of lumber, steel, and other essential building components can drastically escalate construction expenses. This unpredictability makes it difficult for David Weekley Homes to accurately budget and deliver homes within the initially planned financial parameters, directly affecting their bottom line.

These combined pressures of labor shortages and rising material costs create a critical operational challenge for David Weekley Homes. Effectively managing and mitigating these input cost increases is paramount to maintaining competitive pricing and project delivery schedules in the current market environment.

- Skilled Labor Deficit: Ongoing shortages in skilled construction trades continue to drive up labor costs and extend project completion times.

- Material Cost Volatility: Prices for key building materials remain subject to sharp increases, impacting project budgets and profitability.

- Impact on Timelines: Both labor and material challenges can lead to delays, making it harder to meet customer expectations and contractual obligations.

- Profitability Squeeze: Increased expenses without a commensurate ability to raise prices can compress profit margins for the company.

Regulatory Changes and Land Use Restrictions

Regulatory changes present a significant threat to David Weekley Homes. For instance, stricter environmental regulations, such as those related to water usage or habitat protection, could increase the cost of raw materials or necessitate more expensive construction methods. In 2024, several states are considering updates to building codes to enhance energy efficiency, which could lead to higher upfront costs for new homes.

Land use restrictions are also a major concern. Zoning law modifications can limit the density of new developments or outright prohibit construction in certain areas, shrinking the available land for new projects. This can drive up land acquisition costs and extend the timeline for bringing new communities to market. For example, in rapidly growing metropolitan areas, NIMBYism (Not In My Backyard) movements often lead to more restrictive zoning, impacting supply.

The cumulative effect of these regulatory hurdles can significantly impact profitability and operational efficiency. Prolonged approval processes, driven by complex permitting requirements and potential legal challenges from community groups, add substantial overhead and delay revenue generation. Adapting to these evolving rules requires constant vigilance and can divert resources that might otherwise be used for expansion or innovation.

- Increased Development Costs: New environmental standards or building codes can raise material and labor expenses.

- Restricted Land Availability: Zoning changes and land use policies can limit where and how many homes can be built.

- Extended Project Timelines: Complex and lengthy approval processes for new developments add significant delays.

- Compliance Burden: Staying abreast of and adhering to evolving regulations requires substantial investment in expertise and resources.

David Weekley Homes faces a competitive landscape dominated by larger national builders who benefit from economies of scale and greater access to capital. For instance, in 2024, major players like D.R. Horton and Lennar continued to expand, reporting strong sales growth. This intense competition pressures profit margins and makes it challenging for David Weekley Homes to differentiate its offerings or maintain pricing power.

SWOT Analysis Data Sources

This SWOT analysis is built upon a robust foundation of data, drawing from David Weekley Homes' official financial filings, comprehensive market research reports, and insights from industry experts to ensure a thorough and accurate assessment.