David Weekley Homes Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

David Weekley Homes Bundle

David Weekley Homes navigates a competitive landscape shaped by several key forces. Understanding the intensity of rivalry among existing homebuilders and the bargaining power of both buyers and suppliers is crucial for their strategic positioning. Furthermore, the threat of new entrants and the availability of substitute products or services significantly influence their market dynamics.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore David Weekley Homes’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

David Weekley Homes, like many in the homebuilding sector, faces a degree of supplier power stemming from the concentration of key material providers. For instance, the lumber market, crucial for framing, experienced significant price volatility in 2024, with futures contracts seeing fluctuations driven by supply chain disruptions and demand shifts. This limited pool of reliable lumber suppliers means they can exert more influence over pricing and availability.

Similarly, the availability and cost of specialized components, such as high-efficiency HVAC systems or premium appliance packages, are often dictated by a smaller number of manufacturers. In 2024, the demand for energy-efficient appliances remained robust, potentially strengthening the bargaining position of suppliers offering these sought-after products. If a particular supplier holds a patent or controls a unique production process for a critical component, their leverage increases substantially.

The availability of substitute materials for David Weekley Homes can significantly influence supplier bargaining power. While many standard building materials like lumber or drywall have readily available alternatives, specialized or high-performance components often do not. For example, if David Weekley Homes relies on a particular type of energy-efficient window or a unique structural steel, the number of suppliers offering comparable products might be limited, thereby strengthening those suppliers' positions.

Switching costs also play a crucial role. Even if substitute materials exist, the expense and time involved in re-engineering designs, retraining labor, or retooling manufacturing processes can make switching impractical. This inertia further empowers suppliers of specialized materials. In 2024, the construction industry continued to grapple with supply chain disruptions, making the availability and reliability of specific, high-quality materials a critical factor, potentially increasing the leverage of suppliers who can consistently deliver.

The quality and punctual delivery of construction materials are crucial for David Weekley Homes, directly influencing project timelines, the final build quality, and, consequently, overall costs. Any disruptions from suppliers, whether through delays or material defects, can significantly harm the company's reputation and its bottom line.

For instance, in 2024, the construction industry faced persistent supply chain challenges. Reports indicated that the average delay in residential construction projects due to material shortages or shipping issues reached as high as 30 days in some regions, directly impacting builders like David Weekley Homes by increasing labor costs and pushing back revenue recognition.

The cost of essential building materials, such as lumber and concrete, saw notable fluctuations throughout 2024. Lumber prices, after significant volatility in prior years, remained a key cost driver, with average prices for framing lumber fluctuating between $400 and $550 per thousand board feet, impacting the per-home cost structure for David Weekley Homes.

When suppliers have significant control over these essential inputs, their bargaining power increases. This allows them to potentially dictate terms, raise prices, or reduce quality, all of which directly affect David Weekley Homes' ability to control costs and maintain its brand promise of quality.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers, where they enter the homebuilding market, is a consideration for David Weekley Homes. While it's generally uncommon for broad material suppliers to undertake such a capital-intensive venture, specialized component manufacturers could present a more focused, albeit minor, threat. This would involve them directly competing with their customers in the construction space.

For instance, a company that manufactures advanced smart home technology might decide to offer pre-fabricated, integrated smart home packages directly to consumers or developers, bypassing traditional builders. While unlikely to be a widespread phenomenon impacting the entire industry, it's a potential disruption from niche suppliers.

- Specialized Component Manufacturers: These suppliers, offering unique or integrated building systems, hold a slightly higher potential for forward integration than basic material providers.

- Capital Intensity Barrier: The substantial capital required for land acquisition, development, and construction significantly deters most suppliers from entering the homebuilding sector directly.

- Niche Market Disruption: Forward integration is more probable in specific, high-value segments of the market where suppliers have deep expertise and proprietary technology.

- Limited Broad Impact: For a large homebuilder like David Weekley Homes, the threat from broad-based material suppliers attempting forward integration is generally low.

Supplier Switching Costs

Supplier switching costs represent a significant aspect of the bargaining power of suppliers. Establishing new relationships with suppliers involves considerable expenses, including the time and resources dedicated to vetting potential partners, negotiating new contract terms, and adapting existing supply chain logistics. These upfront investments can deter companies from seeking alternative suppliers, thus strengthening the position of incumbent suppliers.

For David Weekley Homes, the existence of its 'National Preferred Partner' program indicates a strategic effort to mitigate these switching costs and cultivate enduring, stable relationships with its suppliers. This program likely fosters loyalty and predictability, reducing the likelihood of frequent supplier changes. In 2024, the homebuilding industry, like many others, continued to navigate supply chain complexities, making these stable partnerships even more valuable. The average cost for a company to onboard a new supplier can range from a few hundred to several thousand dollars, depending on the complexity of the goods or services and the due diligence required.

- Reduced Risk: Long-term supplier relationships minimize the risk of supply disruptions, which is crucial in a dynamic market.

- Cost Efficiency: By avoiding repeated negotiation and onboarding processes, David Weekley Homes can achieve greater cost efficiency.

- Quality Control: Established partners often align with quality standards, ensuring consistent material and service quality.

- Program Benefits: Preferred partner programs can also unlock volume discounts and preferential service, further enhancing the value proposition.

The bargaining power of suppliers for David Weekley Homes is moderately high, particularly for specialized components and materials subject to supply chain volatility. In 2024, the lumber market, a key input, saw prices fluctuate, impacting builders due to a limited number of reliable suppliers. Similarly, advanced HVAC systems and premium appliances, often controlled by fewer manufacturers, can command higher prices, especially when demand for energy efficiency is strong, as observed in 2024.

Switching costs for David Weekley Homes are a significant factor, as re-engineering or retraining can be prohibitive. The industry's continued supply chain challenges in 2024 underscored the value of reliable suppliers, potentially increasing their leverage. The threat of forward integration by suppliers, while generally low for broad material providers, could be a niche concern for specialized technology providers.

David Weekley Homes' preferred partner programs aim to mitigate supplier power by fostering loyalty and reducing switching costs. These relationships are vital for minimizing supply disruption risks and ensuring cost efficiency, especially given the industry's ongoing supply chain complexities throughout 2024.

The cost of key materials like lumber significantly influences David Weekley Homes' per-home cost structure, with framing lumber prices ranging from $400 to $550 per thousand board feet in 2024, granting leverage to suppliers of these essential inputs.

| Factor | Impact on David Weekley Homes | 2024 Data/Trend |

| Supplier Concentration (Lumber) | Moderate to High | Price volatility due to supply chain issues and demand shifts. |

| Specialized Component Availability | Moderate to High | Strong demand for energy-efficient products increased supplier leverage. |

| Switching Costs | High | Significant expenses for re-engineering and retraining deter supplier changes. |

| Supply Chain Disruptions | High | Average project delays up to 30 days due to material shortages in some regions. |

| Key Material Costs (Lumber) | Significant | Prices fluctuated between $400-$550/thousand board feet for framing lumber. |

What is included in the product

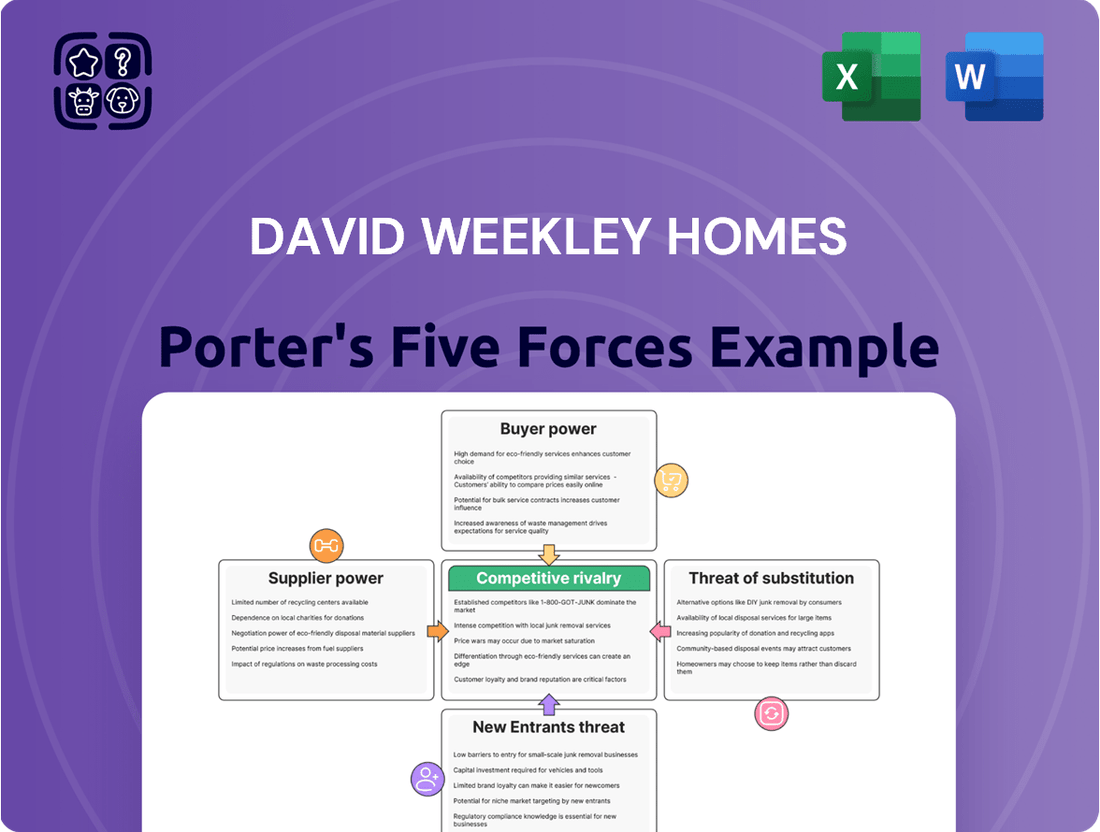

Uncovers key drivers of competition, customer influence, and market entry risks tailored to David Weekley Homes within the homebuilding industry.

Effortlessly assess competitive intensity by visualizing threats from substitutes and new entrants with a dynamic, interactive diagram.

Customers Bargaining Power

Homebuyers demonstrate significant price sensitivity, particularly as interest rates and economic conditions fluctuate. This sensitivity means David Weekley Homes must carefully calibrate its pricing strategies to remain competitive and attract a broad customer base, while still ensuring healthy profit margins.

To navigate this, the company often employs various incentives, such as reduced pricing on select inventory or contributions towards closing costs. These tactics are designed to alleviate affordability concerns for potential buyers in a dynamic market. For example, in early 2024, many homebuilders reported offering an average of 2% to 5% of the home’s price in incentives to attract buyers.

Customers considering a new home from David Weekley Homes face a wealth of alternatives, significantly impacting their bargaining power. These options range from pre-owned residences to new builds from a multitude of competing builders, and even the flexibility of renting. This broad availability empowers buyers to compare features, pricing, and locations across the market.

In 2024, the housing market saw varied inventory levels across different regions. For instance, while some areas experienced a tightening of supply, others saw an increase in available homes. This rise in inventory, particularly in competitive markets, directly translates to enhanced customer choice and a stronger negotiating position for potential David Weekley Homes buyers.

Customer information asymmetry for David Weekley Homes is moderate. While the company provides extensive details about its homes and building processes, homebuyers often supplement this with information from real estate agents and broad market data, which can level the playing field.

David Weekley Homes actively works to mitigate any information gap by emphasizing customer service and transparency. This approach builds buyer confidence and reduces the perceived risks associated with a significant purchase, such as a new home.

For instance, in 2024, the U.S. housing market saw continued demand, with median home prices fluctuating. This dynamic environment means buyers are actively seeking reliable information, making a builder's transparency a crucial differentiator.

By providing clear pricing, detailed specifications, and accessible customer support, David Weekley Homes empowers buyers, thereby diminishing their inherent information disadvantage and strengthening their bargaining position.

Switching Costs for Customers

For homebuyers, the perceived switching costs from one builder to another are relatively low in terms of direct financial outlay. While the emotional and time commitments to a new home build are substantial, the actual monetary cost to change builders mid-process or opt for an existing home is often minimal, which inherently strengthens the buyer's bargaining position.

This low barrier to switching directly empowers customers, giving them more leverage when negotiating terms and pricing with David Weekley Homes. In 2024, the housing market saw varying levels of demand, but the fundamental ease of exploring alternative options for buyers remained a constant factor influencing builder negotiations.

Consider these points regarding customer switching costs:

- Minimal Direct Financial Switching Costs: Buyers can often walk away from a new construction contract with limited financial penalties, especially in the early stages, compared to high switching costs in other industries.

- Emotional and Time Investment: While not strictly financial, the emotional energy and time already invested in a specific home design or builder relationship can act as a soft deterrent to switching.

- Availability of Alternatives: The presence of numerous competing home builders and a robust resale market for existing homes provides readily available alternatives, further reducing the perceived cost of switching.

- Impact on Bargaining Power: The ease with which customers can explore and move to other options directly translates to increased bargaining power, influencing pricing, customization options, and contract terms offered by David Weekley Homes.

Importance of the Purchase to the Customer

For David Weekley Homes, the sheer magnitude of purchasing a home grants customers significant bargaining power. Buying a house is arguably the largest financial commitment most individuals will ever make, often accompanied by deep emotional investment. This makes buyers highly discerning, scrutinizing every detail and expecting a high level of service and customization. They are not just buying a product; they are investing in their future and their family's well-being, which naturally leads them to demand the best and be less tolerant of shortcomings.

The importance of this purchase translates directly into customer leverage. Buyers will meticulously compare options, negotiate prices, and seek assurances regarding quality, design, and long-term value. They are willing to spend time and effort to ensure they secure a home that meets their specific needs and expectations. This meticulousness means David Weekley Homes must consistently deliver exceptional value and customer satisfaction to maintain its competitive edge.

- Significant Financial Commitment: A home purchase represents a substantial portion of a consumer's wealth, often exceeding 30% of their net worth.

- Emotional Investment: Beyond finances, buying a home is a deeply personal decision tied to lifestyle, family, and future aspirations.

- Information Availability: In 2024, buyers have unprecedented access to market data, competitor pricing, and customer reviews, empowering them to negotiate effectively.

- Demand for Customization: Many homebuyers seek personalized features and finishes, increasing their ability to bargain for specific inclusions.

The bargaining power of customers for David Weekley Homes is substantial, driven by price sensitivity, the availability of numerous alternatives, and the significant financial and emotional investment in a home purchase. In 2024, with fluctuating interest rates and varying inventory levels across regions, buyers were empowered to negotiate more effectively, seeking incentives and favorable terms. The ease of comparing options and the minimal direct financial switching costs further amplify this leverage.

Customers possess significant leverage due to the substantial financial and emotional commitment involved in buying a home. This makes them highly discerning, actively comparing options, negotiating prices, and demanding quality and customization. In 2024, access to market data and competitor reviews further bolstered their ability to bargain effectively.

| Factor | Description | Impact on David Weekley Homes |

|---|---|---|

| Price Sensitivity | Homebuyers are highly attuned to pricing, especially with changing economic conditions and interest rates. | Requires competitive pricing strategies and the use of incentives, such as reduced pricing or closing cost contributions, which averaged 2% to 5% of home price in early 2024 for many builders. |

| Availability of Alternatives | A wide array of options, including resale homes and new builds from numerous competitors, gives buyers many choices. | Increases buyer leverage, forcing David Weekley Homes to differentiate on features, quality, and service to attract and retain customers. |

| Switching Costs | Direct financial costs to switch builders are generally low, though emotional and time investments can be a factor. | Buyers can more easily explore and commit to other builders or existing homes, strengthening their negotiation position. |

| Purchase Magnitude | Buying a home is the largest financial and emotional decision for most individuals. | Buyers demand high value, customization, and excellent service, making them less tolerant of shortcomings and more inclined to negotiate. |

Preview the Actual Deliverable

David Weekley Homes Porter's Five Forces Analysis

This preview provides an exact replica of the David Weekley Homes Porter's Five Forces Analysis you will receive immediately upon purchase, ensuring transparency and no hidden surprises. You are looking at the actual, fully formatted document, ready for your immediate use. This comprehensive analysis will equip you with a deep understanding of the competitive landscape for David Weekley Homes. Once your purchase is complete, you'll gain instant access to this same, professionally written strategic assessment.

Rivalry Among Competitors

The homebuilding sector is notably fragmented, featuring a mix of colossal national builders such as D.R. Horton, Lennar, and PulteGroup, alongside a vast array of regional and local competitors. David Weekley Homes, as one of the largest privately held homebuilders in the United States, navigates this highly competitive landscape.

In 2023, D.R. Horton, a publicly traded competitor, reported revenues exceeding $35 billion, illustrating the scale of some market participants. Lennar also posted revenues in the vicinity of $30 billion for the same period, underscoring the significant financial heft of major players David Weekley Homes contends with.

This competitive intensity is further amplified by the presence of numerous smaller, agile builders who can often cater to more niche markets or specific geographic areas. These smaller entities contribute to the fragmentation, intensifying rivalry and placing pressure on pricing and market share for all participants, including David Weekley Homes.

The single-family housing construction sector, while showing some signs of life, operates within a broader housing market grappling with significant challenges. High interest rates, a persistent factor throughout 2024, continue to dampen buyer demand and strain affordability, creating a more competitive environment for builders like David Weekley Homes.

This affordability crunch, coupled with economic uncertainties, means that even modest industry growth can translate into intensified rivalry for every available customer. For instance, while new single-family home sales in the U.S. saw fluctuations in 2024, the underlying affordability metrics remained a key concern for many potential buyers.

David Weekley Homes stands out by offering highly customizable floor plans, allowing buyers to tailor their homes to specific needs and preferences. This commitment to personalization is a key differentiator in a market often characterized by standardized offerings.

Beyond customization, the company prioritizes quality construction, utilizing superior materials and building practices. This emphasis on craftsmanship not only enhances the product's appeal but also contributes to long-term customer satisfaction, further setting them apart from competitors focused purely on volume or lower price points.

A significant aspect of their differentiation strategy is the robust focus on the customer experience throughout the entire homebuying journey. From initial design consultations to post-move-in support, David Weekley Homes aims to build strong relationships, which helps to reduce direct price-based competition.

In 2023, David Weekley Homes was recognized as one of the nation's top builders, underscoring their commitment to quality and customer satisfaction. This strong reputation for a superior product and service experience directly combats the intense competitive rivalry, allowing them to command a premium in the market.

Exit Barriers

Homebuilders like David Weekley Homes face substantial exit barriers due to the significant capital tied up in land acquisition and work-in-progress inventory. For instance, the average cost of undeveloped land suitable for residential development can run into millions of dollars per acre, depending on location and zoning. This high upfront investment makes it financially difficult for companies to simply walk away from projects, even when market conditions deteriorate.

These high exit barriers mean that even during periods of reduced demand, such as a housing market downturn, companies are often compelled to remain operational and continue selling existing inventory at lower margins. This can exacerbate competitive rivalry as multiple builders vie for a smaller pool of buyers, leading to price pressures and a more intense struggle for market share.

- High Capital Investment: Significant funds are required for land purchase, development permits, and construction, creating a substantial financial commitment that discourages quick exits.

- Specialized Assets: Construction equipment, specialized labor, and established supply chains are not easily transferable or sold off, further locking companies into the industry.

- Inventory Holding Costs: Carrying costs for unsold homes, including property taxes, insurance, and maintenance, add to the financial burden of exiting, forcing builders to sell even at a loss.

- Market Stagnation: In 2024, some regional housing markets experienced slower sales growth compared to previous years, with inventory levels fluctuating, which can increase the difficulty and cost of exiting for builders with substantial unsold properties.

Market Concentration and Consolidation

The homebuilding sector is witnessing a noticeable trend of consolidation. Major players are actively acquiring smaller, regional builders, which naturally leads to a market with fewer, but more robust, competitors. For a company like David Weekley Homes, this means facing off against increasingly larger and more resource-rich rivals.

This ongoing consolidation can heighten the intensity of competition. As the market shrinks to fewer, larger entities, the battle for market share becomes more direct and aggressive. This dynamic puts pressure on all players, including David Weekley Homes, to innovate and maintain efficiency.

- Market Consolidation Trend: The U.S. homebuilding industry has seen a consistent trend of consolidation. For instance, in 2023, publicly traded homebuilders continued to acquire private builders, aiming to expand their geographic footprint and product offerings.

- Impact on Competition: This consolidation means that companies like David Weekley Homes must compete with fewer, but often larger and better-capitalized, rivals. This can lead to increased pricing pressures and a greater need for differentiation.

- Increased Operational Scale: Larger, consolidated entities often benefit from economies of scale in land acquisition, construction materials, and labor, potentially giving them a cost advantage over smaller or mid-sized builders.

The homebuilding industry is intensely competitive, characterized by numerous national, regional, and local players. David Weekley Homes, as a major private builder, faces formidable rivals like D.R. Horton and Lennar, which reported revenues of over $35 billion and $30 billion respectively in 2023. This fragmented landscape, coupled with high exit barriers due to substantial capital tied up in land and inventory, forces companies to remain competitive even in challenging markets, such as the one influenced by 2024's persistent high interest rates. Consolidation within the sector also means David Weekley Homes increasingly competes against larger, more resource-rich entities, intensifying the need for differentiation through customization and customer experience.

| Competitor | 2023 Revenue (approx.) | Market Position |

|---|---|---|

| D.R. Horton | $35 Billion+ | Largest Public Builder |

| Lennar | $30 Billion | Major Public Builder |

| PulteGroup | $14 Billion+ | Significant Public Builder |

SSubstitutes Threaten

The most significant substitute for a new David Weekley home is an existing resale home. A robust inventory of existing homes, particularly at lower price points or with desirable locations, can divert potential buyers from new construction. For instance, in 2023, the U.S. Census Bureau reported approximately 5.5 million existing homes sold, a figure that consistently represents a substantial market alternative to new builds.

For many, the rental market presents a significant substitute for homeownership, particularly for those not yet ready or able to commit to a purchase. This includes options like apartments, traditional rental houses, and the growing segment of build-to-rent communities. In 2024, with interest rates remaining a key factor for many buyers, these rental options become even more attractive.

The appeal of renting is amplified during periods of economic uncertainty, offering flexibility and lower upfront costs compared to buying. For instance, in many metropolitan areas, rental vacancy rates in late 2023 and early 2024 hovered around 5-7%, indicating ample availability for those seeking alternatives to ownership.

Buyers looking for more compact or lower-maintenance living arrangements might consider townhomes, condominiums, or even manufactured and modular homes. These alternatives can directly compete with single-family detached homes, especially for first-time buyers or those downsizing. In 2024, the demand for these more affordable or simpler housing solutions remained strong, particularly in urban and suburban areas where land costs are high.

Cost-Effectiveness of Substitutes

The cost-effectiveness of substitutes significantly shapes the threat to David Weekley Homes' new home sales. Factors such as fluctuating mortgage rates directly influence the affordability of purchasing a new home versus alternative housing options. For instance, if mortgage rates rise substantially, the overall cost of a new home becomes less attractive compared to renovating an existing property or renting. In May 2024, the average 30-year fixed mortgage rate hovered around 6.9% according to Freddie Mac, a level that can still make new home purchases a considerable financial undertaking for many buyers.

Renovation costs for existing homes present a tangible substitute. While the upfront cost of a fixer-upper might be lower, the expense and time involved in renovations can sometimes exceed the price of a new build, especially when factoring in labor and material costs. Rental prices also play a crucial role; a robust rental market with stable or declining rents can divert potential buyers away from homeownership altogether, thereby weakening the demand for new homes.

The interplay of these cost factors determines the competitive pressure from substitutes. When mortgage rates are high and renovation costs are escalating, the economic incentive to buy a new home diminishes. Conversely, when these costs are more manageable, the threat from substitutes lessens, allowing new home builders like David Weekley Homes to capture a larger market share.

- Mortgage Rates: As of May 2024, 30-year fixed mortgage rates were approximately 6.9%, impacting the affordability of new homes.

- Renovation Costs: The rising cost of construction materials and labor can make extensive renovations a less appealing substitute for new home purchases.

- Rental Market: Stable or decreasing rental prices can reduce the urgency for individuals to enter the homeownership market, thereby increasing the threat of renting as a substitute.

Customer Preferences for New vs. Existing

Customer preference between new and existing homes significantly shapes the threat of substitutes for David Weekley Homes. While new homes, like those built by David Weekley, offer the allure of customization and the latest architectural trends, existing homes can appeal to buyers prioritizing established communities, mature trees, and often a lower initial cost. This creates a direct substitute challenge. In 2023, the median sales price of existing homes sold in the U.S. was $389,800, while new homes sold for a median of $417,700, according to the National Association of Realtors. This price differential can sway many buyers. David Weekley Homes counters this by focusing on superior design, energy efficiency, and a premium buyer experience, aiming to justify the higher price point for those seeking new construction benefits.

- New Homes Appeal: Customization, modern amenities, energy efficiency.

- Existing Homes Appeal: Established neighborhoods, mature landscaping, potentially lower price points.

- Price Sensitivity: The median price difference between new and existing homes in 2023 was approximately $27,900, impacting buyer choices.

- David Weekley's Strategy: Emphasizing quality, design, and a premium experience to differentiate from existing home substitutes.

The most significant substitutes for a new David Weekley home are existing resale homes and the rental market. In 2023, the resale market saw approximately 5.5 million existing homes sold, highlighting its substantial presence. Rental options, including apartments and build-to-rent communities, also serve as a viable alternative, especially in 2024 with ongoing interest rate considerations influencing buying decisions.

Entrants Threaten

The homebuilding sector, as exemplified by David Weekley Homes, demands substantial upfront capital. New entrants must secure significant funds for land acquisition, which can cost millions depending on location and size. Furthermore, securing construction loans and developing necessary infrastructure like roads and utilities adds to the already considerable financial burden, effectively deterring many potential competitors.

Securing desirable land, especially in sought-after master-planned communities or prime individual lots, presents a significant barrier for new homebuilders. Established players like David Weekley Homes leverage their long-standing relationships and deep expertise in land acquisition, often securing prime locations before new entrants even identify opportunities.

In 2024, the competitive land market continues to be a critical hurdle. For instance, the median price for a single-family lot in many desirable suburban areas saw increases of 5-10% year-over-year, making upfront capital investment a substantial challenge for emerging builders lacking established financing networks.

David Weekley Homes’ pre-existing partnerships with developers and their proven track record in completing projects efficiently give them an advantage in negotiating land deals. This established access and reputation make it incredibly difficult for newcomers to compete for the most valuable parcels of land, thereby limiting the threat of new entrants.

David Weekley Homes, like other major homebuilders, benefits significantly from economies of scale. Large companies can negotiate lower prices for lumber, drywall, and other construction materials due to bulk purchasing power. In 2023, the average cost of residential construction materials saw fluctuations, but established players like David Weekley Homes were better positioned to absorb these costs or secure favorable long-term contracts compared to smaller, emerging builders.

This cost advantage extends to labor and marketing. Established builders often have dedicated construction crews and robust relationships with subcontractors, leading to more efficient project timelines and reduced labor overhead. Furthermore, their substantial marketing budgets allow for broader reach and brand recognition, which new entrants find difficult and expensive to replicate, thus posing a barrier to entry.

Government Policy and Regulations

Government policies and regulations significantly impact the threat of new entrants for homebuilders like David Weekley Homes. Strict zoning laws, stringent building codes, and comprehensive environmental regulations all act as substantial barriers. For instance, navigating the permitting process alone can involve multiple agencies and lengthy timelines, adding considerable cost and complexity for any new player trying to enter the market. In 2024, the average time to obtain building permits in major U.S. metropolitan areas could range from 60 to over 180 days, depending on the jurisdiction and project complexity.

These regulatory hurdles increase the capital and expertise required to start a homebuilding operation. New entrants must not only secure land but also invest heavily in understanding and complying with a patchwork of local, state, and federal rules. This includes adherence to energy efficiency standards, accessibility requirements, and land use restrictions, all of which can escalate construction costs and slow down project delivery. For example, updated building codes in 2024 often mandate higher insulation R-values and more efficient HVAC systems, directly increasing material and labor expenses for builders.

- Zoning Laws: Restrict where and what type of housing can be built, limiting available land for new competitors.

- Building Codes: Mandate specific construction standards, increasing initial investment and operational complexity.

- Environmental Regulations: Require assessments and mitigation efforts, adding time and cost to development projects.

- Permitting Processes: Can be lengthy and bureaucratic, creating significant delays and upfront expenses for new entrants.

Brand Loyalty and Differentiation

David Weekley Homes has cultivated a powerful brand reputation over many years, recognized for its commitment to quality construction and exceptional customer service. This deep-seated trust makes it difficult for new entrants to gain traction.

New homebuilders entering the market must invest heavily to replicate the brand loyalty David Weekley Homes enjoys. Potential buyers often gravitate towards builders with a proven history, making it a significant hurdle for newcomers to establish credibility and attract customers who prioritize reliability.

The challenge for new entrants is compounded by the need to differentiate themselves effectively in a market where David Weekley Homes already stands out through its distinctive home designs and customer-centric approach. Building a comparable level of brand recognition and customer preference requires substantial marketing and a consistent delivery of value.

- Brand Loyalty: David Weekley Homes has a decades-long history, fostering strong customer loyalty and trust.

- Customer Service Reputation: The company is known for its high standards of customer service, a difficult benchmark for new competitors to meet.

- Differentiation: Unique home designs and customer-centric processes set David Weekley Homes apart, creating a barrier for new entrants seeking to establish a distinct market position.

- Market Trust: New builders must overcome the inherent advantage of established players with proven track records and positive consumer perceptions.

The threat of new entrants in the homebuilding sector, as it pertains to David Weekley Homes, is significantly mitigated by high capital requirements and substantial economies of scale. New builders face immense upfront costs for land acquisition and construction, with lot prices in desirable areas continuing to rise, averaging 5-10% increases year-over-year in 2024. Established firms like David Weekley Homes leverage bulk purchasing power for materials and labor, securing cost advantages that are difficult for newcomers to match.

| Barrier Factor | Impact on New Entrants | Example for David Weekley Homes (2024 Context) |

|---|---|---|

| Capital Requirements | High upfront investment for land, loans, and infrastructure. | Median single-family lot prices increased 5-10% in 2024, demanding substantial capital. |

| Economies of Scale | Cost advantages in materials, labor, and marketing. | Bulk purchasing of lumber and drywall in 2023/2024 allowed for better cost absorption than smaller builders. |

| Land Acquisition Expertise | Difficulty securing prime locations due to established relationships. | David Weekley Homes' long-standing developer partnerships secure desirable parcels. |

| Brand Reputation & Trust | Need to build credibility against established, reputable builders. | Decades of quality service build loyalty, a difficult benchmark for new entrants. |

| Regulatory Hurdles | Complex zoning, building codes, and permitting processes. | Average permit times in 2024 ranged from 60-180+ days, increasing complexity and cost. |

Porter's Five Forces Analysis Data Sources

Our David Weekley Homes Porter's Five Forces analysis is built upon a foundation of proprietary market research, internal sales data, and direct customer feedback. This primary data is complemented by industry-wide housing market reports and economic trend analyses from reputable sources.