Dave & Buster's SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dave & Buster's Bundle

Dave & Buster's boasts strong brand recognition and a unique entertainment-dining concept, but faces intense competition and evolving consumer preferences. Understanding these dynamics is crucial for strategic planning.

Want the full story behind Dave & Buster's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Dave & Buster's stands out with its hybrid entertainment and dining model, seamlessly blending a full-service restaurant with arcade games and a sports bar. This unique 'eatertainment' concept offers a comprehensive social experience that sets it apart from single-focus venues.

This integrated approach appeals to a wide range of customers seeking both quality food and engaging activities, fostering a strong value proposition. For example, in the first quarter of 2024, Dave & Buster's reported a 5.7% increase in total revenue compared to the previous year, demonstrating the continued appeal of its multifaceted offering.

Dave & Buster's enjoys broad customer appeal by effectively catering to both adults seeking entertainment and families looking for a fun outing. This dual focus allows the company to serve as a versatile venue for a wide range of events, from casual get-togethers to more formal corporate functions.

The company's ability to attract a diverse customer base, including affluent suburban families, is a significant strength. This broad appeal helps to create more stable revenue streams, as it's not overly reliant on a single demographic, providing resilience even when economic conditions are tough.

Dave & Buster's is making significant strides with its ongoing store remodel program, a key strength that's already yielding impressive results. Since 2023, the company has successfully upgraded 44 locations, with a clear target to have all stores refreshed by 2026. This strategic investment focuses on modernizing the customer experience through new game suites, interactive social bays, and improved sports viewing areas.

The impact of these renovations is undeniable, as remodeled stores have demonstrated superior performance. In fact, over the last three months, these upgraded locations have outperformed the overall system by more than 700 basis points. This data strongly suggests that the investment in store modernization is directly translating into enhanced revenue and customer engagement.

Strategic Expansion and Development

Dave & Buster's demonstrates a strong strategic expansion, consistently growing its physical presence. In fiscal year 2024, the company successfully opened 14 new locations.

Looking ahead, Dave & Buster's has ambitious plans for fiscal year 2025, targeting the opening of 10 to 12 additional stores. This growth is further bolstered by significant international franchising agreements, with plans for over 35 stores across five different countries.

These expansion efforts, which also include strategic store relocations, are designed to drive incremental revenue growth and deepen market penetration.

- New Store Openings: 14 opened in FY2024, with 10-12 planned for FY2025.

- International Growth: Over 35 franchise stores planned across five countries.

- Strategic Realocations: Enhancing market presence and driving growth.

Focus on Experiential Gaming Innovation

Dave & Buster's excels by consistently innovating its gaming and attraction portfolio, introducing unique experiences like the 'Human Crane' and 'UFC Challenge.' This focus on experiential gaming keeps the offerings fresh and compelling for customers.

The company's 'Store of the Future' concept, featuring advanced attractions such as high-tech darts and 'The Arena' immersive gaming, underscores this commitment. These novelties are designed to be exclusive, driving customer interest and encouraging repeat visits by offering entertainment not readily available elsewhere.

- Exclusive Gaming: Introduction of unique games like 'Human Crane' and 'UFC Challenge.'

- Future Formats: Development of 'Store of the Future' with high-tech darts and 'The Arena.'

- Customer Engagement: Innovation drives repeat visits and sustained interest in entertainment.

- Competitive Edge: Focus on groundbreaking experiences unavailable at competitor venues.

Dave & Buster's distinctive 'eatertainment' model, blending dining with arcade games and sports viewing, forms a core strength. This unique combination appeals broadly, as evidenced by a 5.7% revenue increase in Q1 2024. The company effectively captures both adult entertainment seekers and families, making it a versatile venue for various social gatherings and events. This broad demographic appeal, including affluent suburban families, contributes to more stable revenue streams, offering resilience against economic fluctuations.

The ongoing store remodel program is a significant driver of performance, with 44 locations upgraded since 2023 and a goal to refresh all stores by 2026. These modernized locations are outperforming the system by over 700 basis points in the last three months, directly linking investment to enhanced revenue and customer engagement. Furthermore, strategic expansion continues, with 14 new stores opened in fiscal year 2024 and plans for 10-12 more in fiscal year 2025. International growth is also robust, with over 35 franchise stores planned across five countries, enhancing market penetration.

Innovation in gaming and attractions, such as the 'Human Crane' and 'UFC Challenge,' keeps the entertainment fresh and compelling. The 'Store of the Future' concept, featuring advanced attractions like high-tech darts and immersive gaming, further solidifies this commitment. These exclusive experiences are designed to drive customer interest and encourage repeat visits, providing a competitive edge.

What is included in the product

Analyzes Dave & Buster's’s competitive position through key internal and external factors, highlighting its unique entertainment-dining model while considering market competition and evolving consumer preferences.

Offers a clear, actionable framework to identify and address Dave & Buster's competitive challenges and operational weaknesses.

Weaknesses

Dave & Buster's has been grappling with a persistent issue of declining comparable store sales. For the first quarter of fiscal year 2025, this metric saw an 8.3% drop, a continuation of the 7.2% decrease experienced in fiscal year 2024. This trend suggests a concerning pattern of reduced customer visits or lower spending at their established venues.

While there have been some positive signs of sequential improvement in these sales trends, the overall performance at existing locations continues to fall short of desired levels. This ongoing weakness in comparable store sales presents a significant hurdle for the company's revenue growth and overall profitability.

Dave & Buster's has faced challenges stemming from past strategic missteps. Previous leadership implemented changes across marketing, food and beverage, operations, remodels, and game investments that proved detrimental to the company's performance.

These ill-advised decisions led to a negative impact on the business, creating a need for significant course correction. The current management team is actively working to reverse these errors, focusing on a return to fundamental operational strengths.

This strategic pivot indicates a recovery phase, as the company aims to shed the legacy of past operational and strategic blunders. For instance, in fiscal year 2023, the company reported a revenue of $2.3 billion, an increase from previous years, suggesting progress in their turnaround efforts.

Dave & Buster's has faced profitability headwinds, with a notable decline in net income and adjusted EBITDA in fiscal 2024. This trend continued into the first quarter of fiscal 2025, signaling ongoing challenges in its financial performance.

A key indicator of these struggles was the adjusted earnings per share (EPS) of $0.76 in Q1 2025. This figure missed analyst expectations by a significant margin of 25%, even though the company managed to meet its revenue forecasts. This disconnect highlights difficulties in translating sales into bottom-line profit and suggests potential issues with cost management or operational efficiency.

Increased Operating Expenses

Dave & Buster's experienced a notable rise in operating expenses, with pre-opening costs alone jumping by $2.7 million in the first quarter of 2025. This increase stems from new store openings and relocations, coupled with higher spending on marketing and essential repair and maintenance (R&M). While these expenditures can fuel future expansion, they present a challenge to current profitability if not carefully controlled.

The company's financial strategy also involved significant upfront capital expenditures. This front-end loading of investment, while strategic for development, can place immediate pressure on operating margins. Effectively managing these increased costs is crucial for maintaining financial health amidst growth initiatives.

Key areas contributing to the higher operating expenses include:

- Pre-opening Expenses: A $2.7 million increase in Q1 2025 due to new store development and relocations.

- Marketing Costs: Elevated spending to support brand presence and customer acquisition.

- Repair and Maintenance (R&M): Increased investment in facility upkeep and operational readiness.

- Capital Expenditures: Significant front-end loading of investments for future growth projects.

Early Stages of Turnaround

Dave & Buster's turnaround is still in its nascent stages. While the 'back-to-basics' strategy has yielded encouraging early results, management itself acknowledges that the path to full recovery is a marathon, not a sprint. They've characterized their current position as being in the 'second or third inning of a basketball game,' highlighting that significant work remains.

This transitional phase means the full impact of strategic initiatives is yet to materialize. Sustained improvement hinges on the company's ability to consistently execute its plans, a process that requires ongoing diligence and adaptation. Investors and stakeholders should anticipate that the realization of the complete turnaround benefits will unfold over time.

- Transitional Phase: The company is actively implementing changes, but the complete positive effects are not yet fully reflected in financial performance.

- Execution Risk: Continued success depends on the management's ability to consistently execute their strategic plan.

- Long-Term Recovery: The stated 'second or third inning' analogy suggests that several more stages of development and improvement are expected.

Dave & Buster's faces a significant challenge with declining comparable store sales, which dropped 8.3% in Q1 fiscal 2025, following a 7.2% decrease in fiscal 2024. This indicates a persistent issue with customer traffic or spending at existing locations. Despite some sequential improvements, overall performance at established venues remains below expectations, impacting revenue growth and profitability.

The company is also dealing with profitability headwinds, as evidenced by a decline in net income and adjusted EBITDA in fiscal 2024, continuing into Q1 fiscal 2025. The adjusted EPS of $0.76 in Q1 2025 missed analyst expectations by 25%, suggesting difficulties in translating sales into profit, potentially due to cost management or operational efficiency issues.

Operating expenses have risen, with pre-opening costs alone increasing by $2.7 million in Q1 2025 due to new store openings and relocations, alongside higher marketing and repair/maintenance spending. This increased expenditure, while supporting growth, puts immediate pressure on operating margins.

Dave & Buster's turnaround is still in its early stages, with management describing it as being in the 'second or third inning.' This means the full benefits of strategic initiatives are yet to be realized, and sustained improvement relies on consistent execution, presenting execution risk.

| Weakness | Description | Impact |

| Declining Comparable Store Sales | 8.3% drop in Q1 FY2025, following 7.2% in FY2024 | Reduced revenue from established locations, impacting overall growth |

| Profitability Headwinds | Missed EPS expectations by 25% in Q1 FY2025 | Challenges in translating sales to bottom-line profit, potential cost inefficiencies |

| Rising Operating Expenses | $2.7M increase in pre-opening costs in Q1 FY2025 | Pressure on current operating margins despite growth investments |

| Early Turnaround Stage | Management estimates being in 'second or third inning' of recovery | Full impact of strategies not yet realized, execution risk remains |

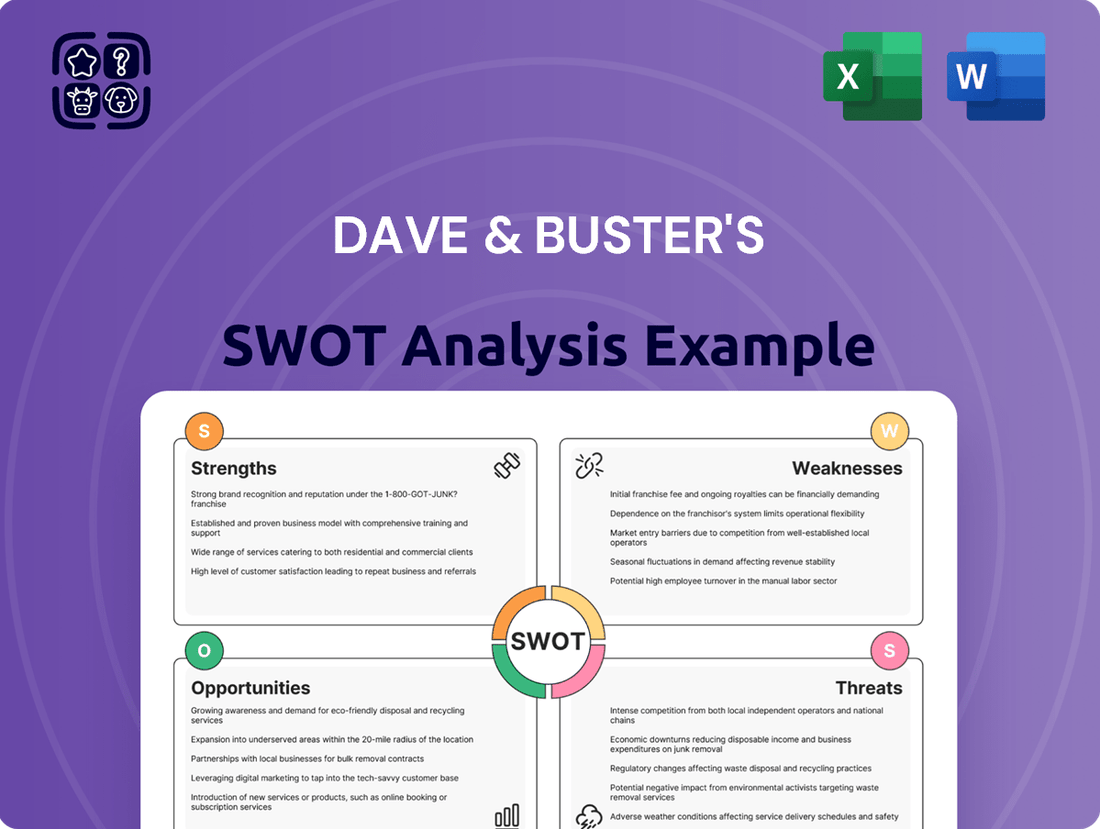

What You See Is What You Get

Dave & Buster's SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You're seeing a genuine snapshot of the comprehensive Dave & Buster's report, ready for your strategic planning.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing you with all the insights into Dave & Buster's Strengths, Weaknesses, Opportunities, and Threats.

Opportunities

Dave & Buster's is poised for significant international expansion through franchising, a strategy that minimizes capital outlay and operational risk. The company's entry into India in December 2024, with agreements for over 35 stores across five countries, highlights this burgeoning opportunity.

This accelerated franchising model allows Dave & Buster's to tap into new markets efficiently, leveraging existing brand recognition. The company's commitment to growth is further evidenced by its plan to open at least six more international franchise locations within the next year, signaling a strong focus on global reach.

Dave & Buster's is capitalizing on enhanced food and beverage offerings by reintroducing popular value promotions, such as the 'Eat & Play Combo,' which has demonstrably improved customer satisfaction and revenue. This strategic move, coupled with the introduction of the new Phase IV menu, signals a commitment to providing more appealing options for guests.

There's a clear opportunity to further refine menu items and pricing strategies to maximize sales and increase the rate at which customers purchase food and beverages alongside their gaming activities. By actively bringing back well-loved entrees and rectifying past pricing missteps, the company is laying the groundwork for sustained growth in this crucial segment.

Dave & Buster's is actively exploring technological advancements to enhance customer engagement. Their 'Store of the Future' concept, featuring interactive social bays and improved sports viewing, aims to create a more immersive experience. This focus on digital integration is crucial for attracting and retaining a modern customer base.

Expanding loyalty programs and digital platforms presents a significant opportunity for Dave & Buster's. By offering personalized promotions and driving repeat visits through these channels, the company can foster stronger customer relationships. The success of initiatives like the Summer Pass, which provided unlimited gameplay and discounts, highlights the potential of such digital strategies.

Growth in Special Events and Corporate Bookings

Dave & Buster's is actively pursuing growth in its special events sector, targeting corporate functions and private parties. This strategic focus aims to capitalize on a market segment that has demonstrated resilience and potential for increased revenue. By refining its event offerings and enhancing operational efficiency, the company is well-positioned to capture a larger share of this lucrative business.

The company's investment in an expanded sales team has already yielded positive results, driving an uptick in corporate bookings and special event revenue. This proactive approach signals a commitment to nurturing and growing this key revenue stream, which is crucial for diversified financial performance. For example, in the first quarter of 2024, Dave & Buster's reported a notable increase in its events and entertainment revenue, driven by these targeted efforts.

- Targeting Corporate Clients: Enhancing the special event menu and operating model specifically for corporate needs.

- Sales Team Expansion: A dedicated sales force focused on securing group and corporate bookings.

- Revenue Contribution: Special events and party revenue, a growing segment contributing to overall financial health.

- Market Potential: Tapping into the lucrative market for private parties, company outings, and celebrations.

Continued Remodel Program Benefits

Dave & Buster's ongoing remodel program, targeting full completion by 2026, offers a continuing chance to improve customer experiences and boost sales. This strategic investment is designed to modernize the brand and keep it fresh in the market.

The success seen in already remodeled locations highlights the program's effectiveness. These upgraded stores are consistently showing increased customer visits and higher revenue, demonstrating a clear return on investment for these facility enhancements.

By systematically upgrading its physical spaces, Dave & Buster's ensures it remains a competitive and appealing destination. This commitment to modernization is crucial for attracting and retaining customers in the entertainment and dining sector.

- Remodel Completion Target: 100% by 2026.

- Key Benefit: Enhanced customer experience and increased sales.

- Performance Indicator: Remodeled stores show higher traffic and revenue.

International expansion through franchising presents a significant avenue for growth, minimizing capital expenditure and risk. The company's entry into India in December 2024, with plans for over 35 stores across five countries, exemplifies this strategy. This approach allows for efficient market penetration, leveraging existing brand recognition and accelerating global reach, with at least six more international franchise locations planned within the next year.

Enhancing food and beverage offerings, including popular value promotions like the 'Eat & Play Combo,' drives customer satisfaction and revenue. The introduction of a new Phase IV menu further strengthens this commitment, focusing on appealing options and refining menu items and pricing to maximize sales alongside gaming activities. This strategic refresh aims to boost the rate at which customers purchase food and beverages.

Technological advancements offer opportunities to deepen customer engagement and create more immersive experiences. Concepts like the 'Store of the Future' with interactive social bays and improved sports viewing are key. Expanding loyalty programs and digital platforms, such as the successful Summer Pass, can foster stronger customer relationships through personalized promotions and driving repeat visits.

The special events sector, targeting corporate functions and private parties, represents a growing revenue stream. Investment in an expanded sales team has already boosted corporate bookings and event revenue, with Q1 2024 showing a notable increase in this segment. Refining event offerings and operational efficiency are crucial for capturing a larger share of this lucrative market.

The ongoing remodel program, targeting full completion by 2026, offers a continuous chance to enhance customer experiences and sales. Remodeled locations consistently demonstrate increased customer visits and higher revenue, confirming the effectiveness of these facility upgrades in keeping the brand competitive and appealing.

Threats

Economic headwinds, such as persistent inflation and a general slowdown in consumer discretionary spending, present a notable threat to Dave & Buster's. This is particularly true for lower-income demographics who may cut back on entertainment expenses first. For example, the U.S. Bureau of Labor Statistics reported a Consumer Price Index increase of 3.3% year-over-year in May 2024, indicating ongoing inflationary pressures that affect disposable income.

These challenging macroeconomic conditions can translate directly into reduced visit frequency and lower average spending per customer at Dave & Buster's locations. When consumers have less discretionary income, dining and entertainment activities are often among the first to be scaled back, impacting the company's top-line revenue and overall profitability. The company's reliance on entertainment and dining makes it inherently sensitive to shifts in both consumer and corporate spending patterns.

The 'eatertainment' sector where Dave & Buster's operates is incredibly crowded. Competitors aren't just other restaurants; they include everything from bowling alleys and VR arcades to specialized gaming centers, all vying for consumer leisure dollars. This means Dave & Buster's constantly needs to innovate to stand out.

This intense rivalry often forces price adjustments and significantly boosts marketing expenses as companies try to capture attention. For Dave & Buster's, this translates to pressure on their market share and profitability, making continuous differentiation a key survival strategy in 2024 and beyond.

Consumer tastes in dining and entertainment are notoriously fickle. For Dave & Buster's, this means a constant need to refresh its game library and menu. In 2024, the company reported that its entertainment segment, which includes arcade games, generated a significant portion of its revenue, highlighting the importance of keeping these offerings cutting-edge.

Failing to adapt to new trends, whether it's the rise of esports, virtual reality experiences, or evolving food preferences, poses a direct threat. If Dave & Buster's doesn't keep pace with what consumers want in terms of new games, unique food items, or engaging social atmospheres, it risks becoming outdated and losing customer interest. This agility is crucial for sustained relevance.

Operational Execution Risks

Dave & Buster's faces ongoing threats in the operational execution of its turnaround strategy. Even with a focus on core strengths, past challenges in implementing changes mean there's a persistent risk. For instance, if new marketing campaigns, menu updates, or efficiency drives don't land as planned, it could derail the recovery efforts.

The company’s ability to effectively roll out these operational improvements is critical. A stumble in executing these plans, whether it's a new loyalty program or updated staffing models, could directly impact financial performance. This was a concern noted in their Q1 2024 earnings call, where management emphasized the importance of consistent execution to achieve projected revenue growth.

- Risk of failed marketing campaigns: Past initiatives have shown varying success rates, creating uncertainty around new strategies.

- Challenges in menu and operational revamps: Implementing significant changes across a large chain can lead to inconsistencies and customer dissatisfaction.

- Impact of execution failures on financial targets: Any missteps in operational execution could prevent Dave & Buster's from meeting its stated financial goals for 2024 and beyond.

Maintaining Consistent Traffic Growth

Dave & Buster's faces a significant threat in maintaining consistent traffic growth, a challenge exacerbated by a history of declining comparable store sales. While recent performance indicates some recovery, the brand must overcome this legacy to ensure sustained customer engagement.

A key hurdle is boosting traffic during traditionally slower periods, such as weekday lunches and late-night hours. Success in these off-peak times is crucial for maximizing revenue and operational efficiency.

Failure to achieve steady traffic increases could unfortunately reignite questions about Dave & Buster's enduring appeal and its competitive standing in the entertainment and dining sector. For instance, in the first quarter of 2024, while overall revenue saw a boost, same-store sales experienced a more modest increase, highlighting the ongoing need to drive foot traffic consistently.

- Declining Comparable Store Sales History: Dave & Buster's has grappled with a prolonged period of negative comparable store sales, indicating a need to re-establish consistent customer draw.

- Off-Peak Traffic Challenges: A persistent threat is the difficulty in attracting customers during non-peak hours like lunch and late-night, impacting overall store utilization.

- Brand Appeal Concerns: Without sustained traffic growth, the brand risks facing renewed skepticism regarding its long-term relevance and market positioning.

Intense competition within the 'eatertainment' sector is a major threat, with Dave & Buster's vying for consumer dollars against a wide array of leisure options. This crowded market necessitates continuous innovation and can pressure pricing and marketing budgets.

Shifting consumer preferences pose a risk if Dave & Buster's fails to keep its game library and menu offerings fresh and aligned with emerging trends like esports or VR. The entertainment segment, a significant revenue driver, requires constant updates to maintain its appeal.

Operational execution challenges in implementing turnaround strategies, such as new marketing campaigns or menu revamps, could derail recovery efforts. Past inconsistencies in execution raise concerns about achieving projected financial targets for 2024 and beyond.

Sustaining consistent traffic growth remains a challenge, especially during off-peak hours. A history of declining comparable store sales underscores the need to re-engage customers and boost overall store utilization to maintain brand relevance.

SWOT Analysis Data Sources

This analysis is built upon a foundation of verified financial reports, comprehensive market research, and expert industry commentary to ensure a robust and accurate understanding of Dave & Buster's strategic position.