Dave & Buster's Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dave & Buster's Bundle

Dave & Buster's faces a dynamic competitive landscape, with significant pressure from rivals and the constant threat of new entrants. Understanding the power of buyers and the availability of substitutes is crucial for navigating this market. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Dave & Buster's competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Dave & Buster's, like many in the casual dining sector, depends heavily on a steady flow of food and beverage supplies. The restaurant industry, particularly in 2024 and extending into 2025, is navigating increased operational expenses, with a notable potential for food price inflation. This environment can bolster the bargaining power of suppliers, especially those providing unique or sought-after ingredients, if Dave & Buster's lacks robust supplier diversification or binding long-term agreements. For instance, reports in early 2024 indicated ongoing volatility in commodity prices, impacting everything from beef to cooking oils, which could translate to stronger supplier leverage.

Dave & Buster's reliance on specialized arcade games and virtual reality attractions means manufacturers of these high-tech entertainment systems hold a degree of influence. The company's ability to offer unique and popular attractions, such as exclusive titles like 'Top Gun: Maverick' and 'UFC Challenge,' highlights the importance of these suppliers. In 2023, Dave & Buster's reported capital expenditures of $193.5 million, a significant portion of which would be allocated to acquiring and updating its extensive game inventory, underscoring the financial commitment tied to these supplier relationships.

As Dave & Buster's increasingly relies on technology for customer engagement, like mobile ordering and loyalty programs, software and IT infrastructure suppliers gain leverage. For instance, the gaming and entertainment technology sector, a key area for Dave & Buster's, saw significant investment and innovation leading up to 2024, with companies specializing in interactive displays and backend management systems becoming more crucial. The cost and availability of specialized software, such as point-of-sale systems and customer relationship management (CRM) platforms, directly impact Dave & Buster's operational efficiency and customer experience, giving these providers a degree of bargaining power.

Real Estate and Landlords

Landlords wield considerable influence over Dave & Buster's due to the company's reliance on numerous physical locations. This power is amplified in prime, high-traffic areas where demand for retail and entertainment space is robust. For instance, in 2023, Dave & Buster's operated approximately 224 locations, each requiring a lease agreement.

The company's use of sale-leaseback transactions underscores the critical nature of these real estate agreements. While these deals can unlock capital, they also mean that the terms of leases, including rent escalations and renewal options, are significant factors. The bargaining power of landlords directly impacts Dave & Buster's occupancy costs, a key component of its operating expenses.

- Location Dependence: Dave & Buster's extensive store footprint makes it susceptible to landlord power, particularly in sought-after markets.

- Lease Terms Impact: Rent, lease duration, and renewal clauses negotiated with landlords are crucial for financial planning.

- Sale-Leaseback Significance: These transactions highlight the financial leverage landlords can have in real estate negotiations.

Labor Market

The availability and cost of labor, especially for skilled positions in both dining and gaming, significantly impact the bargaining power of this 'supplier' group. A constrained labor market, where qualified staff are scarce, can drive up wages, directly increasing Dave & Buster's operational expenses. For instance, in early 2024, the US Bureau of Labor Statistics reported a median hourly wage for food preparation and serving workers that saw upward pressure due to ongoing labor shortages in the hospitality sector.

- Labor Availability: A shortage of skilled staff for both restaurant and arcade operations strengthens the bargaining position of potential employees.

- Wage Pressures: Rising minimum wage laws and competitive hiring practices in the service industry directly increase labor costs for Dave & Buster's.

- Skilled vs. Unskilled Labor: The demand for specialized roles, such as experienced chefs or technical staff for arcade maintenance, grants greater leverage to those individuals.

Suppliers of food and beverages hold moderate bargaining power for Dave & Buster's, as the company relies on a broad range of ingredients. However, this power can increase for suppliers of unique or specialty items, particularly if there are limited alternatives. For instance, in 2024, the casual dining sector continued to grapple with fluctuating commodity prices, impacting the cost of key inputs like beef and produce, which could give certain food suppliers more leverage.

The bargaining power of suppliers for Dave & Buster's arcade and entertainment equipment is significant. These are often specialized, high-cost items with few manufacturers, giving them considerable influence over pricing and terms. Dave & Buster's commitment to updating its attraction portfolio, as seen in its 2023 capital expenditures of $193.5 million, means these suppliers are critical partners whose terms can directly impact the company's investment strategy.

Technology and software providers also exert moderate to high bargaining power, especially those offering proprietary systems for operations, customer engagement, or game management. As Dave & Buster's integrates more digital solutions, the dependency on these specialized IT suppliers grows, potentially increasing their leverage in negotiations regarding upgrades, licensing, and support. The demand for innovative entertainment technology in 2024 further solidifies the position of key tech suppliers.

| Supplier Category | Bargaining Power Assessment | Key Considerations for Dave & Buster's |

|---|---|---|

| Food & Beverage | Moderate | Diversification of suppliers, long-term contracts, commodity price volatility |

| Arcade & Entertainment Equipment | High | Specialized nature of products, capital expenditure cycles, exclusivity of titles |

| Technology & Software | Moderate to High | Proprietary systems, integration costs, ongoing support and licensing |

What is included in the product

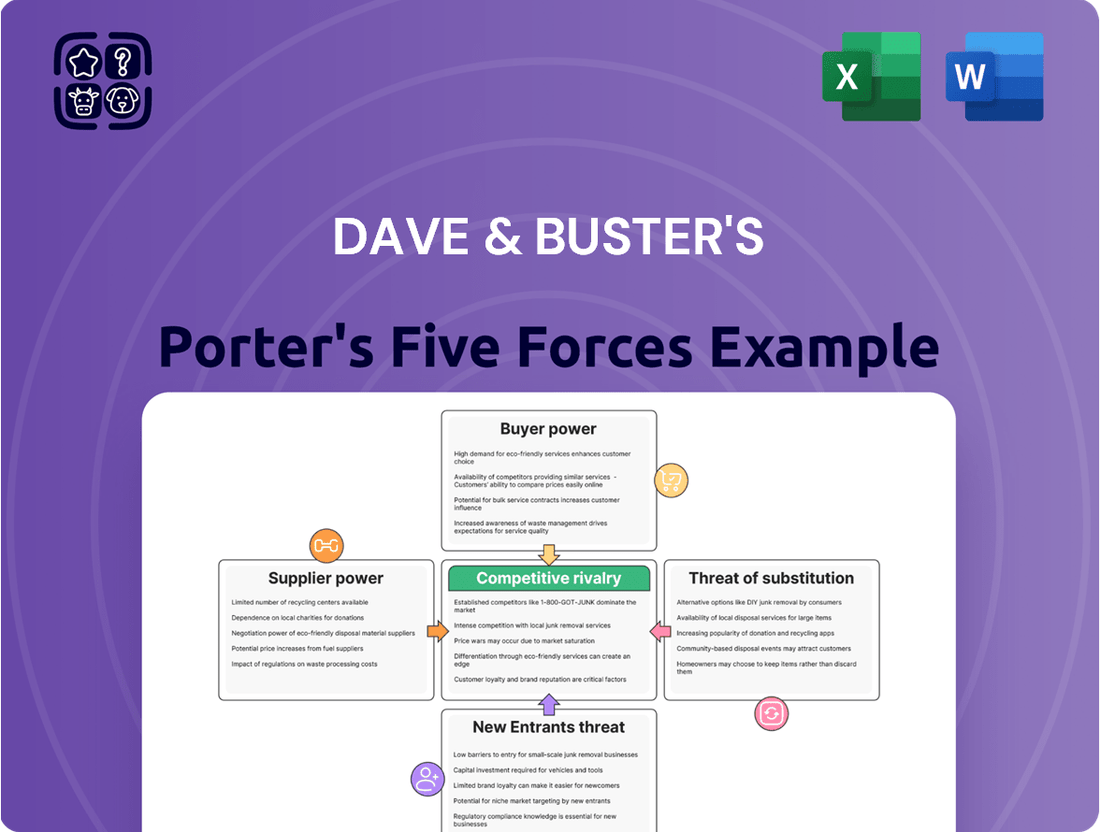

Analyzes the competitive landscape for Dave & Buster's, examining the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants, and the availability of substitutes.

Instantly understand the competitive landscape of Dave & Buster's with a clear, visual representation of Porter's Five Forces, simplifying complex market pressures.

Customers Bargaining Power

Customers' willingness to spend on out-of-home entertainment and dining is highly sensitive to economic conditions. When the economy tightens, discretionary spending on items like dining and entertainment often becomes one of the first areas consumers cut back on.

With rising costs impacting household budgets, a significant portion of U.S. adults are planning to reduce their spending on dining out and live entertainment in 2025. This trend directly increases customer price sensitivity, giving them more leverage and bargaining power when choosing where to spend their entertainment dollars.

The availability of alternatives significantly bolsters customer bargaining power for Dave & Buster's. Consumers can readily choose from a vast landscape of entertainment and dining, including casual restaurants, sports bars, arcades, movie theaters, and even at-home streaming services. This abundance of substitutes means customers aren't locked into a single provider.

For instance, in 2024, the U.S. casual dining sector alone comprises tens of thousands of establishments, each offering a unique value proposition. Furthermore, the growth of at-home entertainment, fueled by subscription services and advanced gaming technology, presents a compelling alternative that directly competes for leisure spending. This broad competitive set allows customers to easily shift their patronage if Dave & Buster's pricing or experience doesn't align with their perceived value.

In today's digital age, customers wield significant power thanks to readily available information. Online platforms allow patrons to effortlessly compare prices, read reviews, and scrutinize the offerings of numerous entertainment and dining venues. This transparency means Dave & Buster's faces constant pressure to deliver superior value and an engaging experience to stand out.

Group and Event Bookings

For group and event bookings, customers often wield significant bargaining power because they represent larger, more lucrative transactions. This can lead to negotiations for discounted pricing, customized event packages, or even preferential use of specific areas within Dave & Buster's venues. For instance, a large corporate event booking could potentially command better rates than individual walk-in customers.

This increased leverage allows these customers to push for concessions that directly impact Dave & Buster's revenue streams and profit margins for these specific events. The ability to negotiate can influence pricing strategies and the overall profitability of the group and event booking segment, especially when considering the potential for repeat business or positive word-of-mouth referrals.

- Volume Discounts: Large groups may negotiate per-person pricing reductions.

- Package Customization: Clients can request tailored food, beverage, and entertainment packages, influencing cost structures.

- Facility Exclusivity: For major events, customers might seek exclusive access to certain areas, potentially impacting operational flexibility and revenue from other customer segments.

- Negotiating Terms: Payment schedules, cancellation policies, and included amenities can all be points of negotiation for significant bookings.

Loyalty Programs and Promotions

Dave & Buster's loyalty program, the Power Card, allows customers to earn rewards and discounts, directly influencing their purchasing decisions. This program, while designed to foster loyalty, also highlights customer power by enabling them to leverage accumulated benefits. For instance, customers can redeem earned chips for free games or food, effectively dictating the value they expect for their continued business.

The effectiveness of these loyalty programs in 2024 can be seen in customer engagement metrics. Dave & Buster's reported a significant portion of its revenue coming from repeat customers, many of whom are enrolled in their rewards program. This demonstrates that customers, by actively participating and utilizing these benefits, wield considerable bargaining power, pushing the company to continuously enhance its offerings to maintain their patronage.

- Customer Leverage Customers can choose to spend their earned chips on desired items, influencing Dave & Buster's promotional strategies.

- Value Expectation The program’s existence signals that customers expect added value beyond the core entertainment and dining experience.

- Repeat Business Driver Successful loyalty programs like Dave & Buster's Power Card directly contribute to repeat business by incentivizing continued spending.

Customers' bargaining power is amplified by the widespread availability of entertainment and dining alternatives, as well as their ability to easily compare prices and reviews online. This makes them highly sensitive to value, pushing Dave & Buster's to offer competitive pricing and a compelling experience to retain their business.

The company's loyalty program, the Power Card, further empowers customers by allowing them to accumulate rewards and discounts, directly influencing their spending choices and signaling an expectation for ongoing value.

Large group bookings also grant customers significant leverage, enabling negotiations for customized packages and potential discounts, which can impact the profitability of event segments.

| Factor | Impact on Dave & Buster's | Supporting Data (2024/2025 Projections) |

|---|---|---|

| Availability of Substitutes | High Bargaining Power | U.S. casual dining sector: Tens of thousands of establishments; growth in at-home entertainment services. |

| Price Sensitivity | High Bargaining Power | Projected reduction in dining out/live entertainment spending by U.S. adults in 2025 due to economic pressures. |

| Information Availability | High Bargaining Power | Widespread online platforms for price comparison and reviews. |

| Group/Event Bookings | Moderate to High Bargaining Power | Potential for volume discounts, package customization, and negotiation of terms for large bookings. |

| Loyalty Programs | Moderate Bargaining Power | Customers leverage earned rewards, influencing company's promotional strategies and value proposition. |

What You See Is What You Get

Dave & Buster's Porter's Five Forces Analysis

This preview showcases the complete Dave & Buster's Porter's Five Forces analysis, offering a detailed examination of competitive rivalry, the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, and the threat of substitute products. The document you see here is precisely the same professionally formatted and ready-to-use analysis you will receive immediately after purchase, ensuring no surprises or missing content.

Rivalry Among Competitors

Dave & Buster's faces significant competitive rivalry from other eatertainment establishments that blend dining with amusement. For instance, Main Event, which Dave & Buster's also operates, directly competes by offering a similar experience, alongside other family entertainment centers that cater to the same demographic.

This intense rivalry means these venues are constantly vying for customer attention and spending. In 2024, the eatertainment sector, while recovering, still sees operators like Dave & Buster's and its competitors investing in new attractions and dining options to stand out and capture market share.

Traditional casual dining restaurants directly vie for the ‘eat’ portion of Dave & Buster’s customer base. These establishments, while lacking the entertainment aspect, can draw diners with competitive pricing and appealing menu variety. For instance, in 2023, the U.S. casual dining sector generated approximately $100 billion in sales, showcasing the significant market share these competitors hold.

Standalone entertainment venues like arcades, bowling alleys, sports bars, movie theaters, and VR centers directly vie for consumer leisure spending. These specialized venues can attract customers seeking a more concentrated or higher-quality experience in a specific activity. For instance, a dedicated esports arena might draw a younger demographic away from a general entertainment center.

In-Home Entertainment

The growing sophistication and affordability of in-home entertainment options present a substantial challenge to Dave & Buster's. Streaming services, advanced video game consoles, and immersive home theater setups offer consumers compelling alternatives for leisure time.

This trend is amplified by economic pressures. With consumer spending on discretionary items like out-of-home entertainment potentially slowing, individuals are increasingly evaluating the cost-effectiveness of their leisure choices. For instance, by mid-2024, many households reported prioritizing home-based entertainment due to inflation impacting disposable income.

- Streaming Service Growth: The global video streaming market was projected to reach over $200 billion by 2024, indicating a massive shift towards home-based content consumption.

- Gaming Industry Expansion: The video game industry continued its robust growth, with global revenues expected to exceed $200 billion in 2024, highlighting the appeal of interactive home entertainment.

- Home Theater Investment: Consumer spending on home entertainment systems, including soundbars and large-screen TVs, saw consistent year-over-year increases, making home viewing a more premium experience.

Promotional Activities and Innovation

Competitive rivalry at Dave & Buster's is intense, with rivals frequently launching new promotions, updating menus, and introducing fresh entertainment options. This constant push aims to capture and keep customer attention in a crowded entertainment and dining landscape.

To maintain its edge, Dave & Buster's actively invests in innovation. For instance, the company has been rolling out remodels and introducing new arcade games, reflecting a commitment to evolving its customer experience. This strategy is crucial for staying relevant and competitive in a market where novelty drives traffic.

- Promotional Campaigns: Competitors often run aggressive discount campaigns and loyalty programs to draw in customers.

- Menu Refresh: Regular updates to food and beverage menus, incorporating seasonal items and healthier options, are common tactics.

- Entertainment Innovation: The introduction of new virtual reality experiences, updated arcade cabinets, and unique event packages are key differentiators.

- Digital Engagement: Competitors leverage social media and mobile apps for targeted promotions and customer interaction.

Competitive rivalry for Dave & Buster's is fierce, with numerous players vying for consumer leisure dollars. This includes direct competitors like Main Event, as well as a broad range of entertainment and dining options. In 2024, the eatertainment sector continues to see operators innovate with new attractions and menu offerings to capture market share.

Casual dining restaurants also present a significant challenge, competing for the dining aspect of Dave & Buster's business. In 2023, the U.S. casual dining market generated roughly $100 billion, underscoring the strength of these traditional food establishments.

Furthermore, specialized entertainment venues and the growing appeal of in-home entertainment, fueled by streaming services and gaming, intensify this rivalry. The global video streaming market was projected to exceed $200 billion by 2024, illustrating a strong consumer shift towards home-based leisure.

| Competitor Type | Key Competitive Tactics | 2024 Market Context |

| Eatertainment Centers (e.g., Main Event) | New attractions, updated menus, promotions | Ongoing investment in customer experience to differentiate. |

| Casual Dining Restaurants | Competitive pricing, menu variety | Significant market share, estimated $100 billion U.S. sales in 2023. |

| Specialized Entertainment (Arcades, Bowling) | Niche experiences, focused activities | Attract specific demographics seeking concentrated entertainment. |

| In-Home Entertainment (Streaming, Gaming) | Convenience, affordability, advanced technology | Streaming market projected over $200 billion in 2024; gaming industry also exceeding $200 billion. |

SSubstitutes Threaten

The most significant substitute for Dave & Buster's offerings is entertainment enjoyed at home. This includes a wide array of options like video games, with the virtual reality (VR) market experiencing significant growth, and streaming services for movies and television shows. Even the simple act of preparing a home-cooked meal can be seen as a substitute for dining out.

This home-based entertainment segment poses a substantial threat, particularly as consumers navigate economic pressures. These at-home alternatives are often more cost-effective and undeniably more convenient, making them an attractive choice for many.

For instance, the global video game market was valued at approximately $200 billion in 2023 and is projected to continue its upward trajectory. Similarly, the streaming service market continues to expand, with major players reporting millions of new subscribers annually. These figures highlight the significant portion of entertainment budgets that consumers are allocating to home-based activities, directly competing with Dave & Buster's.

The threat of substitutes for Dave & Buster's is significant, as consumers have a wide array of alternative leisure activities available. These include everything from visiting local parks and engaging in outdoor sports to exploring museums or attending community festivals. For instance, the US Bureau of Labor Statistics reported that in 2023, Americans spent an average of $2,700 annually on recreation, a broad category that encompasses many of these substitute activities.

Traditional restaurants and bars present a significant threat of substitution for Dave & Buster's, particularly for customers seeking a primary dining or social experience. These establishments offer focused culinary offerings or dedicated bar atmospheres without the integrated entertainment, potentially appealing to consumers prioritizing specific aspects of their outing. For instance, a diner seeking a gourmet meal or a group looking for a quiet cocktail lounge might bypass Dave & Buster's for a more specialized venue.

Bowling Alleys and Standalone Arcades

While Dave & Buster's offers a comprehensive entertainment package, simpler establishments like bowling alleys and standalone arcades present a threat of substitutes by catering to specific entertainment needs. These venues may not replicate the full dining and bar experience, but they can attract customers seeking only the gaming or bowling aspect, especially at a lower price point.

- Focus on Specific Entertainment: Bowling alleys and arcades often concentrate on a single core activity, making them a more direct substitute for customers whose primary goal is arcade gaming or bowling, rather than a full-service dining and entertainment experience.

- Price Sensitivity: These substitutes can often operate with lower overheads, allowing them to offer more competitive pricing for their core offerings, which can be attractive to budget-conscious consumers.

- Accessibility and Location: The proliferation of local bowling alleys and arcades in various communities means they are readily accessible and can serve as convenient alternatives for quick entertainment outings.

- Evolving Entertainment Landscape: The rise of at-home gaming and other leisure activities further broadens the scope of substitutes, forcing Dave & Buster's to continually innovate its value proposition.

Live Sports and Concerts

Live sports and concerts present a significant threat of substitutes for Dave & Buster's. Consumers seeking a high-energy, social entertainment experience might opt for attending a professional basketball game or a popular music festival instead of visiting a Dave & Buster's location. This directly competes with Dave & Buster's core offerings of watching sports on large screens and engaging in arcade-style gaming.

Consumer spending on live entertainment is a substantial discretionary category, meaning consumers can easily shift their entertainment budgets. In 2023, the live events industry, including sports and concerts, saw robust recovery and growth, with many events selling out and ticket prices increasing, indicating strong consumer demand. For instance, the global live music industry was projected to reach over $10 billion in 2024, demonstrating the significant disposable income allocated to these experiences.

- Direct Competition: Live events offer a unique, often more immersive, entertainment experience than what Dave & Buster's can provide.

- Discretionary Spending: Entertainment budgets are flexible, and consumers can easily choose between a night at Dave & Buster's and a ticket to a live event.

- Market Size: The live entertainment sector is a multi-billion dollar industry, highlighting the substantial portion of consumer entertainment dollars it captures.

The threat of substitutes for Dave & Buster's is considerable, with consumers having numerous alternatives for leisure and dining. Home entertainment, including video games and streaming services, presents a cost-effective and convenient option, capturing a significant portion of entertainment budgets. In 2023, the global video game market alone was valued at roughly $200 billion, underscoring the scale of this substitute.

Other entertainment venues like bowling alleys, arcades, and even traditional restaurants and bars also serve as substitutes by catering to specific consumer preferences. These can be more budget-friendly or offer a more focused experience, drawing customers away from Dave & Buster's comprehensive offering. For example, the broad category of recreation saw Americans spending an average of $2,700 annually in 2023, indicating diverse leisure choices.

Live events, such as sports and concerts, represent another strong substitute, offering high-energy social experiences that compete for discretionary spending. The live music industry, projected to exceed $10 billion in 2024, highlights the substantial consumer allocation to these events, directly challenging Dave & Buster's market share.

| Substitute Category | Example Offerings | Key Competitive Factor | Market Size/Spending Data (2023/2024) |

|---|---|---|---|

| Home Entertainment | Video Games, Streaming Services | Cost-effectiveness, Convenience | Video Game Market: ~$200 Billion (2023) |

| Focused Entertainment Venues | Bowling Alleys, Arcades, Traditional Restaurants | Specialized Experience, Price Point | Recreation Spending: ~$2,700 per American (2023) |

| Live Events | Sports Games, Concerts | High-Energy Social Experience, Immersive Atmosphere | Live Music Industry: >$10 Billion Projected (2024) |

Entrants Threaten

The significant capital required to establish a Dave & Buster's competitor is a major deterrent. Building a new venue involves substantial costs for prime real estate acquisition or long-term leases, extensive construction and renovation, state-of-the-art kitchen and bar equipment, and the acquisition of a diverse and up-to-date selection of arcade games and immersive entertainment technologies.

Dave & Buster's has cultivated significant brand recognition and a loyal customer following, largely due to its distinctive Eat Drink Play Watch concept and effective loyalty programs. For instance, their Power Card system encourages repeat visits and builds a committed customer base. New competitors face a substantial hurdle in replicating this established trust and broad appeal, requiring significant investment in marketing and a considerable timeframe to achieve comparable brand equity.

The operational complexity of Dave & Buster's, which combines a restaurant, bar, and arcade, presents a significant barrier to new entrants. Managing diverse supply chains for both food and gaming equipment, alongside staffing for distinct service areas and maintaining a wide array of specialized machinery, creates intricate logistical challenges. This complexity makes it difficult for new businesses to achieve efficient operations and scale quickly, deterring potential competitors.

Permitting and Regulatory Hurdles

New entrants looking to compete with Dave & Buster's would encounter significant permitting and regulatory hurdles. These include obtaining licenses for food service, which involves health and safety compliance, and securing liquor licenses, a process that varies by state and can be lengthy and expensive. Additionally, regulations surrounding the operation of amusement devices, such as safety standards and inspection requirements, add another layer of complexity and cost.

Navigating these requirements can be a substantial barrier to entry.

- Food Service Permits: Varying state and local health codes require extensive documentation and inspections.

- Alcohol Sales Licenses: Obtaining and maintaining liquor licenses are complex and costly, often requiring background checks and adherence to strict regulations. For example, in 2024, the average cost to obtain a full liquor license in a major US city can range from $5,000 to over $20,000, plus annual renewal fees.

- Amusement Device Regulations: Compliance with safety standards and regular inspections for arcade games and other attractions adds operational overhead.

Access to Exclusive Content and Technology

Dave & Buster's often secures exclusive rights to new arcade games and virtual reality experiences, providing a unique selling proposition. In 2024, the company continued to invest in its entertainment offerings, aiming to maintain this competitive edge. New entrants might struggle to access similar high-demand, exclusive content, making it harder to differentiate their offerings and attract customers.

The threat of new entrants for Dave & Buster's is moderate, primarily due to the substantial capital investment required and the established brand loyalty. While the concept of combining dining and entertainment is appealing, replicating Dave & Buster's scale, operational complexity, and brand recognition presents significant challenges for newcomers. The regulatory landscape also adds a layer of difficulty, requiring extensive permits and licenses.

Porter's Five Forces Analysis Data Sources

Our Dave & Buster's Porter's Five Forces analysis is built upon a foundation of publicly available financial reports, industry-specific market research from firms like IBISWorld, and consumer trend data from reputable sources to capture competitive dynamics.