Datalogic Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Datalogic Bundle

Datalogic navigates a complex market landscape, influenced by intense rivalry, evolving buyer power, and the constant threat of substitutes. Understanding these forces is crucial for any stakeholder seeking to grasp Datalogic's strategic positioning.

The complete report reveals the real forces shaping Datalogic’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Datalogic's supplier bargaining power is significantly shaped by the concentration of providers in niche technology sectors. For components like advanced sensors, specialized chipsets for mobile computers, and high-performance lasers, a limited number of dominant suppliers can exert considerable influence on pricing and supply chain reliability. For example, in the industrial sensor market, key players such as Rockwell Automation, Honeywell, and Siemens demonstrate a degree of market concentration for specific sensor technologies, potentially increasing their leverage.

The ease and cost for Datalogic to switch between suppliers for essential components significantly impact supplier power. High switching costs, potentially involving re-engineering product designs or re-qualifying new vendors, would empower existing suppliers. This is especially true for proprietary components crucial to Datalogic's barcode readers and mobile computers.

Suppliers wield significant bargaining power when they offer inputs that are highly unique or differentiated, especially if those inputs are critical to Datalogic's advanced automatic data capture and factory automation solutions. When few substitutes exist for these specialized components, suppliers can command higher prices or more favorable terms. For instance, if Datalogic relies on patented sensor technology or proprietary software modules from a specific vendor, that vendor's leverage increases substantially.

Threat of Forward Integration by Suppliers

The risk of suppliers moving into Datalogic's business space and becoming direct rivals is typically minimal across most component providers. However, for those supplying highly specialized technology, there's a theoretical possibility they could develop their own finished goods, should they have both the capacity and the strategic ambition. This potential capability enhances their leverage as current suppliers.

For instance, a key supplier of advanced image sensors, if they also developed the software and integration capabilities to create a complete scanning solution, could directly compete with Datalogic's product offerings. This would shift the power dynamic significantly, as they would no longer just be a component vendor but a potential market competitor.

- Low Threat for Most Component Suppliers: The majority of Datalogic's suppliers are unlikely to possess the resources or strategic focus to enter the complex market of automated data capture solutions.

- Potential for Specialized Tech Providers: Suppliers of highly proprietary or advanced components, such as specialized optical sensors or processing units, might have the technical know-how to integrate these into finished products.

- Increased Bargaining Power: If a supplier demonstrates the capability or intent for forward integration, their bargaining power over Datalogic would increase, as they could potentially capture more value in the supply chain.

- Strategic Consideration for Datalogic: Datalogic must monitor key technology suppliers for any signs of developing end-to-end solutions, which could necessitate strategic adjustments in sourcing or partnership strategies.

Importance of Datalogic to Supplier Revenue

The bargaining power of suppliers is significantly influenced by how crucial Datalogic's business is to their overall revenue. If Datalogic constitutes a large percentage of a supplier's sales, that supplier is more likely to negotiate favorable terms and pricing to retain such a valuable customer. This dependence reduces the supplier's leverage.

Conversely, if Datalogic represents only a small fraction of a supplier's total income, the supplier has less motivation to compromise on price or terms. In such scenarios, the supplier holds greater power, as losing Datalogic as a customer would not substantially impact their financial performance. This dynamic can lead to less favorable purchasing conditions for Datalogic.

- Supplier Dependence: If Datalogic is a major client for a supplier, that supplier's revenue is heavily reliant on Datalogic's orders.

- Favorable Terms: High dependence often translates into suppliers offering better pricing, extended payment terms, or preferential delivery schedules to maintain the relationship.

- Limited Supplier Power: When Datalogic accounts for a significant portion of a supplier's business, the supplier's ability to dictate terms is diminished.

- Supplier Incentive: Suppliers are motivated to keep large customers like Datalogic satisfied, often by accommodating their needs and demands.

Datalogic's bargaining power with suppliers is generally moderate, influenced by the specialized nature of many components and the relatively fragmented supplier base for some standard parts. However, for highly proprietary or advanced technologies, such as specific optical sensors or custom-designed chipsets, a few key suppliers can hold significant sway, potentially impacting pricing and availability. For instance, in 2024, the global market for industrial automation components saw price increases for certain advanced sensors, driven by supply chain constraints and demand surges, which would have directly affected Datalogic's procurement costs for those items.

| Factor | Impact on Datalogic | Example/Data (2024) |

|---|---|---|

| Supplier Concentration | Moderate to High for specialized tech | Limited suppliers for advanced image sensors |

| Switching Costs | Moderate to High for integrated systems | Re-qualification of embedded software can take months |

| Uniqueness of Input | High for proprietary components | Patented laser scanner technology |

| Supplier Forward Integration Risk | Low for most, potential for tech leaders | N/A for standard component providers |

| Supplier Dependence on Datalogic | Varies; Datalogic is a significant customer for some | Datalogic's revenue contribution to key sensor suppliers can be substantial |

What is included in the product

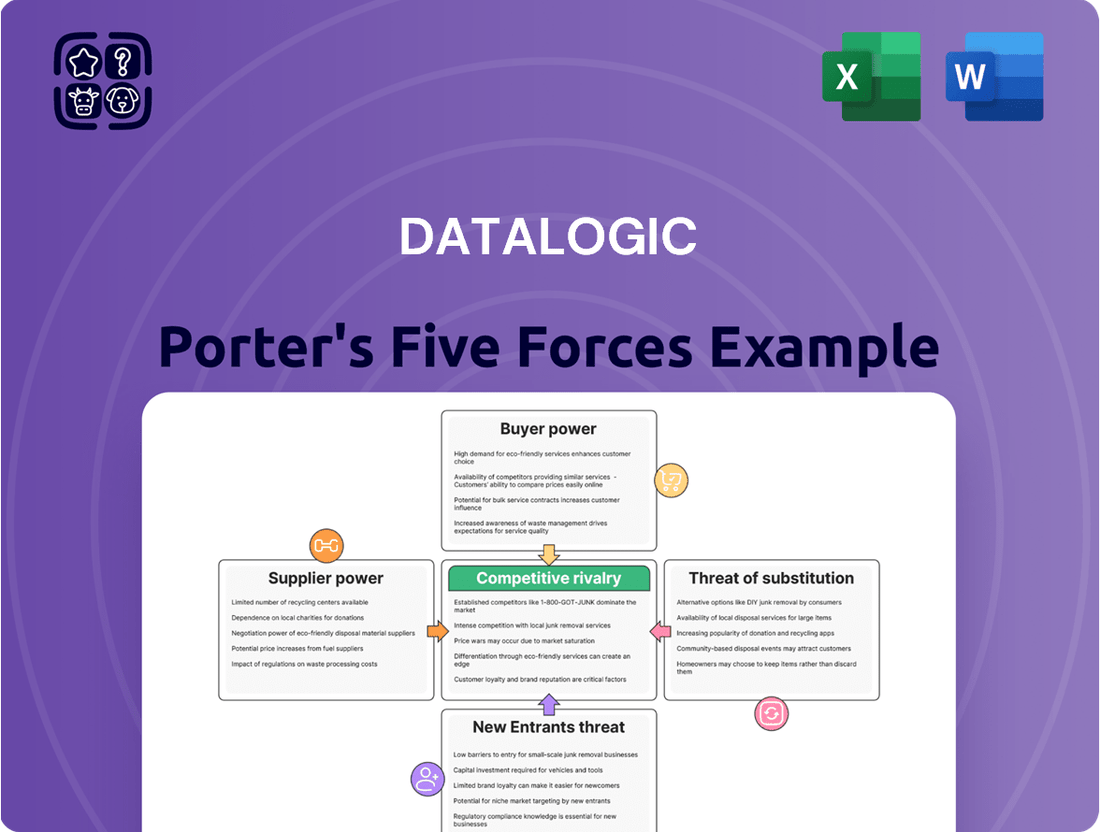

Datalogic's Porter's Five Forces analysis dissects the competitive intensity and profitability potential within the automated data capture industry, examining threats from new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the rivalry among existing competitors.

Visualize competitive intensity at a glance with a dynamic, interactive dashboard that highlights key pressures.

Customers Bargaining Power

Datalogic's customer base spans retail, manufacturing, transportation, and healthcare, presenting a mix of fragmented and concentrated segments. Where a few major clients, like large retail chains or global manufacturers, represent a substantial portion of Datalogic's revenue, their significant purchasing volume translates into considerable bargaining power. These key accounts can leverage their scale to negotiate preferential pricing, tailored product configurations, and advantageous contract terms, directly impacting Datalogic's profitability.

The ease and cost for Datalogic's customers to switch to a competitor's products directly influence their bargaining power. If the cost of replacing Datalogic's barcode readers, mobile computers, or vision systems, encompassing integration, training, and potential disruption, is low, customers gain more leverage.

Datalogic's solutions are frequently integrated into intricate industrial processes. This integration can lead to substantial switching costs for customers with established systems, thereby reducing their bargaining power.

If Datalogic's products were highly standardized and easily comparable to competitors, customers would have more leverage to demand lower prices. For example, if a barcode scanner from Datalogic had identical features and performance to a competitor's offering, a large retail chain could easily switch suppliers to secure a better deal.

However, Datalogic actively works to differentiate its products through continuous innovation and a focus on high-quality, cutting-edge solutions. This strategy aims to reduce direct price comparisons by offering unique value propositions, thereby lessening the bargaining power of customers who are less sensitive to price and more focused on performance and reliability.

Customer Price Sensitivity

Customers in industries where cost efficiency is paramount, such as large-scale manufacturing and transportation, exhibit high price sensitivity. This makes them powerful negotiators, as they will diligently search for the most economical automatic data capture and factory automation solutions. The increasing emphasis on operational cost reduction across these sectors, a trend evident throughout 2024, amplifies this customer leverage.

- High Price Sensitivity: Industries like automotive manufacturing and global logistics prioritize cost optimization, making them highly responsive to price changes for data capture technology.

- Seeking Cost-Effective Solutions: These customers actively compare vendors and negotiate aggressively to secure the lowest possible prices for barcode scanners, RFID readers, and related automation software.

- Growing Demand for Efficiency: The ongoing push for greater productivity and reduced operational expenses in 2024 across these sectors directly translates to increased bargaining power for their purchasing departments.

- Impact on Datalogic: For Datalogic, catering to these price-sensitive segments requires a strong focus on competitive pricing strategies and demonstrating clear value propositions beyond just the initial purchase cost.

Threat of Backward Integration by Customers

While not a frequent occurrence, exceptionally large clients might evaluate building their own data capture or automation systems, particularly if their requirements are highly specialized. This theoretical possibility of backward integration, though often challenging due to the significant investment in research, development, and manufacturing, can indeed bolster a major customer's leverage in negotiations with Datalogic.

For instance, a global logistics firm with substantial internal IT resources might explore developing proprietary scanning solutions for unique inventory tracking challenges. This capability, even if not fully realized, can influence pricing and service level agreements.

- Customer Capability: Large customers may possess the financial and technical resources to develop in-house data capture solutions.

- Cost of Integration: The high cost and complexity of R&D and manufacturing for specialized data capture technology often make backward integration impractical.

- Negotiating Leverage: The mere threat of backward integration can empower major customers to demand better terms from Datalogic.

- Industry Examples: While specific 2024 data on customer backward integration against data capture companies like Datalogic is not publicly detailed, the principle applies across industries where large buyers consider vertical integration for critical components or services.

Datalogic's bargaining power with its customers is influenced by several factors. Large customers, particularly in sectors like retail and manufacturing, can exert significant pressure due to their purchasing volume, enabling them to negotiate better pricing and customized solutions. The ease with which customers can switch to competitors also plays a crucial role; lower switching costs empower customers to demand more favorable terms.

The integration of Datalogic's solutions into customer operations can create high switching costs, thereby reducing customer leverage. However, if Datalogic's products are highly standardized, customers gain more power to negotiate lower prices by easily comparing offerings. Datalogic counters this by focusing on product differentiation through innovation, aiming to reduce price sensitivity.

Industries with a strong emphasis on cost efficiency, such as logistics and manufacturing, exhibit higher price sensitivity in 2024, amplifying customer negotiation power. The potential for large customers to develop in-house solutions, though often impractical, can still serve as a negotiating tactic.

| Factor | Impact on Customer Bargaining Power | Datalogic's Response/Mitigation |

|---|---|---|

| Customer Concentration | High for major clients due to volume | Focus on value-added services and long-term partnerships |

| Switching Costs | Low when integration is minimal | Enhance product integration and ecosystem support |

| Product Differentiation | Low for standardized products | Invest in R&D for unique features and performance |

| Price Sensitivity | High in cost-driven industries | Offer competitive pricing and demonstrate ROI |

| Threat of Backward Integration | Potential leverage for large, capable clients | Maintain technological leadership and superior service |

Preview the Actual Deliverable

Datalogic Porter's Five Forces Analysis

This preview showcases the complete Datalogic Porter's Five Forces Analysis, offering a thorough examination of the competitive landscape. The document you see here is precisely what you'll receive immediately after purchase, ensuring full transparency and immediate utility for your strategic planning. This professionally crafted analysis is ready for immediate download and application, providing actionable insights into Datalogic's market environment.

Rivalry Among Competitors

Datalogic operates in automatic data capture and factory automation markets populated by a significant number of global and regional competitors. These include companies specializing in barcode readers, mobile computers, sensors, vision systems, and laser marking. For example, in the barcode scanner market alone, key players like Honeywell, Zebra Technologies, and Cognex compete fiercely with Datalogic.

The automatic identification and data capture (AIDC) market is booming, with substantial growth anticipated from 2024 through 2029. This rapid expansion, coupled with an 8.1% CAGR for factory automation between 2024 and 2025, signals a dynamic environment. While such growth can support multiple competitors, it also intensifies the race for market share and innovation.

Datalogic thrives on product differentiation, with a strong emphasis on continuous innovation. In 2023, new product introductions represented a substantial percentage of their revenue, underscoring their commitment to staying ahead. This focus on high-quality, advanced solutions allows them to carve out a distinct market position.

However, the landscape is intensely competitive. Rivals are also heavily invested in research and development, frequently releasing similar or even superior technologies. This rapid pace of innovation means that perceived differentiation can be fleeting, intensifying the rivalry as companies vie to capture market share through technological advancements.

Switching Costs for Customers

Low switching costs for customers can significantly fuel competitive rivalry. When it's easy and inexpensive for clients to switch from one provider to another, they are more likely to do so for even small price differences or minor feature upgrades. This dynamic puts constant pressure on companies to maintain competitive pricing and continuously innovate.

While Datalogic's offerings, particularly its integrated solutions, may create some level of switching costs for its customers, the broader market is increasingly leaning towards interoperability and open standards. This trend can lower the barriers to entry and make it simpler for competitors to attract Datalogic’s customers. For instance, the rise of cloud-based platforms and standardized data protocols in the industrial automation sector, a key market for Datalogic, means that integrating new hardware or software might become less of a hurdle.

The ease with which customers can switch providers directly impacts the intensity of competition. In markets where switching is frictionless, companies must work harder to retain their customer base, often through superior service, loyalty programs, or by offering unique value propositions that go beyond mere price. Datalogic's strategy, therefore, needs to consider how to build customer loyalty in an environment where switching is a readily available option.

- Low Switching Costs: Customers can easily switch to competitors if they find better pricing or marginal feature improvements, increasing rivalry.

- Datalogic's Integrated Solutions: While these may create some switching barriers, the market trend towards interoperability could lessen their impact.

- Market Trend: The increasing adoption of open standards and interoperable systems in sectors like industrial automation reduces the cost and complexity of switching providers.

- Competitive Pressure: This environment necessitates continuous innovation and strong customer retention strategies from companies like Datalogic.

Strategic Stakes and Exit Barriers

The automatic data capture and factory automation sectors are strategically vital, fueled by Industry 4.0 and digital transformation initiatives. This deep commitment means companies like Datalogic and its rivals have significant investments, making them reluctant to exit.

Exit barriers are substantial, including highly specialized equipment, lengthy customer agreements, and the critical need to maintain brand reputation. These factors lock companies into the market, intensifying competition even when economic conditions are unfavorable.

- High Strategic Importance: Industry 4.0 adoption is accelerating, with the global industrial automation market projected to reach $310.5 billion by 2027, according to Mordor Intelligence.

- Significant Investments: Companies are investing heavily in R&D and manufacturing capabilities for advanced scanning and automation solutions.

- Exit Barriers: Specialized assets, such as proprietary scanning technology and automated production lines, represent significant sunk costs.

- Long-Term Commitments: Contracts with large industrial clients often span multiple years, creating a strong incentive to remain operational and supportive.

The competitive rivalry within Datalogic's markets is intense, driven by numerous global and regional players specializing in automatic data capture and factory automation. Companies like Honeywell and Zebra Technologies are major rivals, constantly pushing innovation in areas such as barcode scanners and mobile computers. This fierce competition is further fueled by low switching costs for customers, who can easily move to competitors offering slightly better pricing or features, necessitating continuous innovation and strong customer retention strategies from Datalogic.

The market's rapid growth, with factory automation expected to grow at an 8.1% CAGR between 2024 and 2025, attracts and sustains many competitors. While this expansion offers opportunities, it also intensifies the battle for market share. Datalogic's reliance on product differentiation and innovation, which contributed a substantial percentage of revenue in 2023 through new product introductions, is crucial for maintaining its position against rivals who are also heavily invested in R&D.

The trend towards interoperability and open standards in sectors like industrial automation, a key market for Datalogic, can potentially lower barriers to entry and make it simpler for competitors to attract Datalogic’s customers. This environment places constant pressure on companies to offer superior service and unique value propositions beyond just price, as customers have readily available alternatives.

| Competitor | Key Product Areas | 2023 Revenue (Approx. USD Billions) | Market Focus |

|---|---|---|---|

| Honeywell | Scanning & Mobility, Warehouse Automation | ~12.4 | Broad industrial and commercial applications |

| Zebra Technologies | Mobile Computers, Barcode Scanners, Printers | ~5.7 | Retail, Logistics, Healthcare, Manufacturing |

| Cognex | Machine Vision, Barcode Readers | ~1.1 | Factory Automation, Quality Control |

SSubstitutes Threaten

The threat of substitutes for Datalogic's automatic data capture (AIDC) solutions, like barcode scanners and mobile computers, is significant and evolving. General-purpose devices, particularly smartphones, are increasingly capable of performing similar data capture functions. These devices leverage advanced image recognition and AI-powered computer vision, offering a viable alternative for many tasks.

The growing sophistication of smartphone technology presents a cost-effective substitute for dedicated AIDC hardware in various operational contexts. For instance, by mid-2024, a significant portion of the global workforce already utilizes smartphones for business-related tasks, indicating a ready infrastructure for alternative data capture. This trend is expected to accelerate as mobile device capabilities continue to expand, potentially eroding market share for specialized AIDC equipment in less demanding applications.

In certain niche operations or smaller businesses, manual data entry and older, less efficient data collection methods can act as substitutes for Datalogic's advanced solutions. These manual processes, while offering a lower barrier to entry, come with significantly reduced efficiency and a higher propensity for errors, impacting overall data accuracy and operational speed.

Despite the push towards automation, some companies may delay adopting sophisticated Datalogic technologies due to the initial investment costs or the perceived complexity of implementation. This hesitation can lead them to continue relying on existing legacy systems or manual workflows, representing a soft threat of substitution.

Advancements in artificial intelligence (AI) and machine vision, independent of Datalogic's hardware, represent a growing threat of substitutes. These technologies offer alternative methods for sensing and data capture, potentially reducing reliance on traditional barcode scanners or specialized sensors. For instance, AI-powered computer vision systems are increasingly capable of identifying objects and extracting data in ways previously requiring dedicated hardware.

The increasing sophistication of machine vision, fueled by AI, allows for more versatile applications in areas like automated inspection and data collection. This means that solutions not directly involving Datalogic's core product lines could fulfill similar operational needs. By 2024, the global machine vision market was projected to reach over $10 billion, indicating significant investment and rapid development in this substitutable technology space.

Cloud-Based Software Solutions

Advanced cloud-based software solutions present a significant threat of substitution for Datalogic's offerings, particularly in data processing and management. These platforms can deliver sophisticated analytical capabilities and operational insights, often by integrating with simpler hardware or leveraging existing IT infrastructure, thereby bypassing the need for Datalogic's more complex, dedicated hardware systems.

For instance, the global cloud computing market was projected to reach over $1.3 trillion by 2024, indicating a substantial and growing availability of powerful software substitutes. Companies are increasingly adopting Software-as-a-Service (SaaS) models that offer flexibility and scalability, potentially reducing the perceived necessity of Datalogic's traditional hardware-centric solutions.

- Cloud analytics platforms can offer comparable data processing power to on-premise systems.

- SaaS solutions provide access to advanced features without significant upfront hardware investment.

- The growing adoption of **AI-driven analytics in the cloud** offers an alternative to specialized data capture hardware.

- Many businesses are migrating **data management to cloud services**, seeking cost efficiencies and enhanced accessibility.

Integrated Solutions from Broader IT Providers

Large IT solution providers and industrial automation giants pose a significant threat of substitutes. These companies often bundle data capture and automation capabilities into their extensive platforms, offering a one-stop shop for businesses. For instance, Siemens' extensive portfolio in industrial automation, including its Digital Industries segment, provides integrated solutions that can encompass data collection and analysis, potentially drawing customers away from specialized providers like Datalogic. This broad offering can be particularly attractive to customers prioritizing a single vendor relationship.

The appeal of integrated solutions lies in their potential for seamless interoperability and simplified management. Companies like Honeywell, with its integrated building and industrial automation systems, also represent a substitute threat. Their ability to offer a cohesive ecosystem, from sensors to enterprise software, can be a compelling alternative for organizations looking to streamline their technology infrastructure. This consolidation of IT and operational technology functions by larger players can dilute the market share for more focused companies.

In 2024, the trend towards digital transformation and Industry 4.0 further amplifies this threat. Businesses are increasingly seeking holistic solutions that address multiple operational needs.

- Integrated Offerings: Major IT and automation firms provide bundled solutions that cover data capture and broader operational needs.

- Single-Vendor Appeal: Customers may prefer the convenience and potential cost savings of a single, comprehensive vendor.

- Industry 4.0 Impact: The push for smart factories and digital transformation favors integrated, end-to-end solutions.

- Competitive Landscape: Companies like Siemens and Honeywell offer extensive automation portfolios that can act as substitutes for specialized offerings.

The threat of substitutes for Datalogic's specialized automatic data capture (AIDC) solutions is growing, particularly from general-purpose devices like smartphones. By mid-2024, the widespread adoption of smartphones for business tasks means many companies can leverage existing devices for simpler data capture needs, reducing the necessity for dedicated AIDC hardware. This trend is amplified by advancements in AI and machine vision, which offer alternative data extraction methods, potentially bypassing traditional barcode scanning.

Cloud-based software solutions also present a significant substitute threat, offering advanced data processing and analytics without requiring Datalogic's specialized hardware. The massive growth of the cloud computing market, projected to exceed $1.3 trillion by 2024, underscores the availability of powerful software alternatives. Furthermore, large IT and industrial automation providers are increasingly bundling data capture capabilities into their broader, integrated platforms, appealing to businesses seeking single-vendor solutions for digital transformation initiatives.

| Substitute Type | Key Characteristics | Impact on Datalogic | Examples |

|---|---|---|---|

| General-Purpose Devices | Cost-effective, widely available, leveraging AI/computer vision | Erodes market share for less demanding applications | Smartphones, tablets |

| Advanced Software | Scalable, flexible, cloud-based analytics | Reduces reliance on dedicated hardware for data processing | SaaS analytics platforms, AI-driven data management |

| Integrated Solutions | Bundled capabilities, single-vendor appeal, seamless interoperability | Attracts customers seeking holistic automation | Siemens' Digital Industries, Honeywell's automation systems |

Entrants Threaten

The automatic data capture and factory automation sectors, where Datalogic operates, demand significant upfront capital. Developing and manufacturing specialized products like barcode scanners, mobile computers, and vision systems necessitates heavy investment in research and development, state-of-the-art manufacturing plants, and robust global distribution channels.

For instance, establishing a competitive presence in advanced robotics and AI-driven automation solutions in 2024 could easily require hundreds of millions of dollars. This substantial financial commitment acts as a formidable barrier, effectively discouraging many potential new players from entering these capital-intensive markets.

Established players like Datalogic leverage significant economies of scale in manufacturing and global supply chains, a critical barrier for newcomers. For instance, in 2024, the industrial automation market, where Datalogic operates, saw continued consolidation, with larger firms absorbing smaller competitors precisely due to these scale advantages.

The experience curve also plays a crucial role; Datalogic's decades of expertise in developing advanced scanning and automation technologies translate into optimized production processes and product reliability. This accumulated knowledge, difficult to replicate quickly, allows them to offer competitive pricing and superior performance, making it challenging for new entrants to match their cost-efficiency without substantial upfront investment and a high risk of initial losses.

Datalogic's strong product differentiation and over 50 years of continuous innovation create a formidable barrier against new entrants. Their reputation for high-quality solutions, particularly in demanding sectors like retail and manufacturing, fosters significant brand loyalty. For instance, in 2023, Datalogic reported revenues of €662.6 million, underscoring their established market presence and the substantial investment required for newcomers to even approach this level of recognition and trust.

Access to Distribution Channels and Customer Relationships

New players face significant hurdles in securing access to established distribution channels, a critical factor for reaching customers. Datalogic's extensive network, built over years, provides a substantial advantage, making it tough for newcomers to compete on reach and efficiency. For instance, in 2024, Datalogic reported a strong presence across various sectors, including retail and logistics, where established relationships are key to market penetration.

Building and maintaining robust relationships with diverse customer segments, from retailers to healthcare institutions, is another formidable barrier. These entrenched connections are not easily replicated by new entrants. Datalogic's long-standing partnerships are a testament to its ability to foster loyalty and trust within these crucial markets.

The difficulty in penetrating Datalogic's well-developed channels means new companies struggle to gain immediate market traction. This can lead to longer sales cycles and higher initial marketing costs for those attempting to enter. Datalogic's strategic investments in channel development throughout 2023 and into 2024 have further solidified its position.

- Distribution Channel Barriers: New entrants struggle to gain shelf space or access to established sales networks that Datalogic already commands.

- Customer Loyalty: Datalogic's existing customer relationships, cultivated over years, create a significant hurdle for new companies seeking to acquire a customer base.

- Market Penetration Costs: The expense and time required to build comparable distribution and customer engagement infrastructure are substantial for new entrants in 2024.

Proprietary Technology and Intellectual Property

Datalogic's substantial investment in research and development, evidenced by its extensive portfolio of patents and proprietary technologies in automatic data capture and factory automation, creates a significant hurdle for potential new entrants. Developing comparable, innovative solutions from scratch is a resource-intensive endeavor, demanding considerable time and capital. For instance, in 2023, Datalogic reported R&D expenses of €108.3 million, underscoring their commitment to technological leadership.

New players entering the market would face the daunting task of either replicating Datalogic's established technological advantages or incurring substantial licensing fees for existing intellectual property. These licensing agreements often come with restrictive terms, further limiting a new entrant's operational flexibility and competitive positioning. The sheer volume and strategic importance of Datalogic's patents, covering areas like advanced scanning algorithms and industrial IoT connectivity, make direct technological competition exceptionally challenging.

- Proprietary Technology: Datalogic holds thousands of patents globally, protecting its innovations in areas like image processing and data transmission.

- R&D Investment: The company consistently allocates a significant portion of its revenue to R&D, aiming to maintain its technological edge.

- Licensing Costs: Acquiring licenses for advanced, patented technologies can be prohibitively expensive for new market entrants.

- Time to Market: Developing equivalent technologies would require years of dedicated research and development, delaying market entry.

The threat of new entrants in Datalogic's market is significantly mitigated by substantial capital requirements for research, development, and manufacturing. For example, establishing a cutting-edge facility for automated data capture in 2024 could easily cost hundreds of millions of dollars, a massive hurdle for most aspiring competitors. This high entry cost effectively shields established players like Datalogic.

Datalogic's deep-rooted customer relationships and extensive, well-established distribution networks present formidable barriers. Building comparable trust and reach takes years and significant investment, making it difficult for newcomers to gain immediate traction. In 2024, Datalogic's continued expansion into key sectors like logistics underscores the strength of these entrenched relationships.

The company's significant investment in proprietary technology and a robust patent portfolio, including €108.3 million spent on R&D in 2023, creates a strong technological moat. New entrants would face immense challenges in replicating these innovations or incurring substantial licensing fees, thereby limiting their competitive edge.

| Barrier Type | Description | Example Impact (2024) |

| Capital Requirements | High upfront investment in R&D and manufacturing | Hundreds of millions for advanced automation facilities |

| Distribution & Customer Relationships | Entrenched sales networks and customer loyalty | Difficulty for newcomers to gain market access and trust |

| Proprietary Technology & Patents | Datalogic's innovation and IP protection | High licensing costs or lengthy development cycles for competitors |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Datalogic is built upon a foundation of comprehensive data, including Datalogic's official investor relations materials, annual reports, and SEC filings. We also incorporate insights from leading industry analyst reports, market research databases specializing in automatic data capture and industrial automation, and competitor financial disclosures.