Datalogic Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Datalogic Bundle

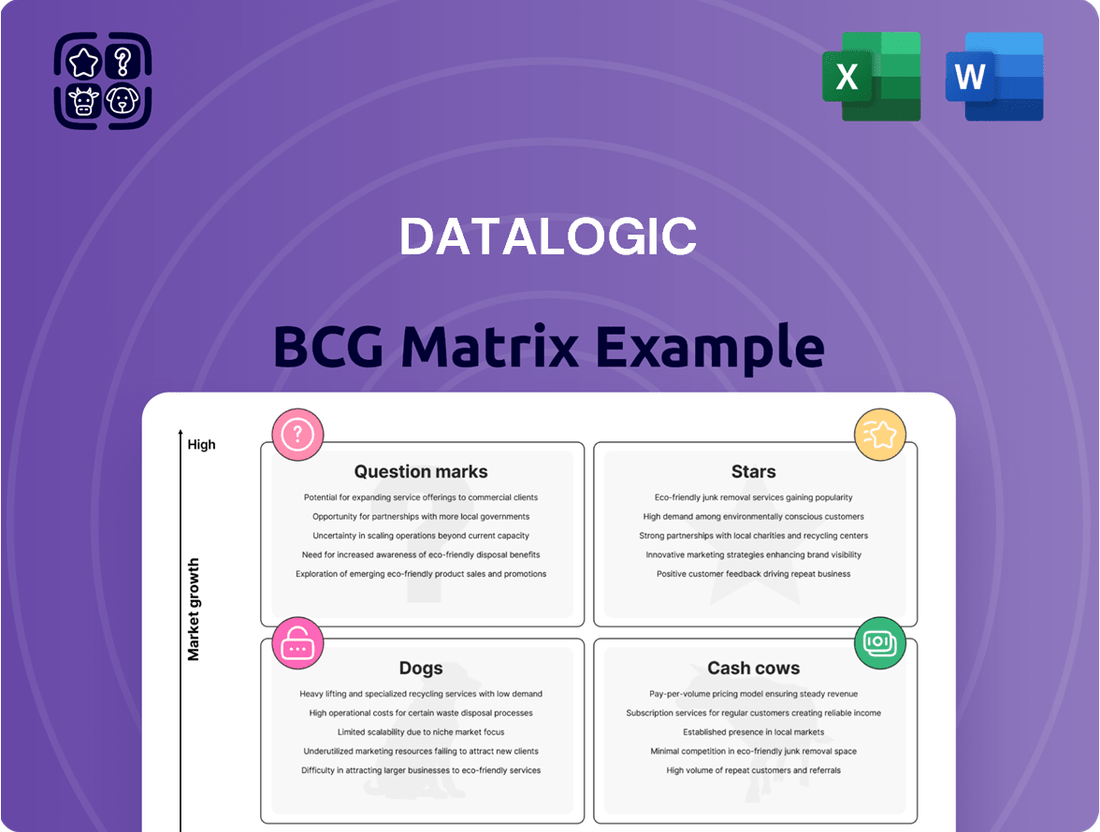

Unlock the strategic potential of Datalogic's product portfolio with a glimpse into its BCG Matrix. See how its offerings stack up as Stars, Cash Cows, Dogs, or Question Marks, and understand the implications for future growth and resource allocation.

Ready to transform this initial insight into actionable strategy? Purchase the complete Datalogic BCG Matrix report to gain a comprehensive quadrant-by-quadrant analysis, detailed market share data, and expert recommendations tailored for maximizing profitability and market leadership.

Stars

Datalogic's Advanced AI-Powered Retail Solutions, particularly its new AI Loss Prevention Suite, are positioned as a Star in the BCG Matrix. This suite, integrated into devices like Magellan™ multi-plane scanners and mobile computers, aims to significantly reduce retail shrinkage and detect fraud. The market for AI in retail is rapidly expanding, with projections indicating substantial growth through 2025 and beyond.

The suite's features, such as Produce Recognition and Ticket Switching Detection, address key pain points for retailers, offering real-time operational insights. With a planned 2025 launch, these advanced capabilities tap into a high-growth segment of the retail technology market, where efficiency and loss reduction are paramount.

The unveiling of Datalogic's Memor 12/17 family at NRF 2025 marks a significant leap in mobile computing, showcasing their dedication to cutting-edge solutions. These devices are engineered for retail and logistics, integrating advanced scanning, payment features, and modern mobile tech to capture a growing market.

The launch of Datalogic's CODiScan Series, a Bluetooth wearable barcode scanner, directly taps into the surging demand for hands-free data capture solutions. This innovation is particularly impactful in industries like transportation and logistics, where efficiency is paramount.

The broader barcode scanner market is experiencing robust growth, with wearable scanners identified as a significant trend. Projections indicate the global barcode scanner market could reach over $15 billion by 2027, with wearable segments showing particularly strong upward momentum, positioning the CODiScan Series as a high-potential, high-growth product line for Datalogic.

Solutions for E-commerce Fulfillment and Logistics Automation

Datalogic's automated solutions are a strong contender in the booming e-commerce fulfillment and logistics sector, a market experiencing significant expansion. Their focus on high-speed conveyor scanning, pallet identification, and enhancing order fulfillment efficiency directly addresses the escalating demand for speed and precision in supply chains.

The company's advanced data capture technology, including sophisticated scanners and mobile computers, is well-positioned to capitalize on this growth. The global e-commerce market was valued at approximately $6.3 trillion in 2023 and is projected to reach over $13 trillion by 2028, highlighting the substantial opportunity for logistics automation providers like Datalogic.

- High-Growth Market: The e-commerce logistics sector is expanding rapidly, driven by consumer demand for faster delivery and greater accuracy.

- Key Technologies: Datalogic offers solutions for high-speed conveyor scanning, pallet identification, and order fulfillment automation.

- Market Value: The global e-commerce market's substantial growth underscores the demand for efficient logistics and fulfillment technologies.

- Industry Needs: Datalogic's data capture and mobile computing offerings are designed to meet critical operational requirements in warehousing and distribution.

AI-Enhanced Industrial 2D Barcode Readers

Datalogic's forthcoming AI-enhanced industrial 2D barcode reader signifies a strong move into a rapidly expanding market segment. This innovation is poised to solidify their leadership position.

The 2D barcode reader market is experiencing robust growth, fueled by increased adoption across various sectors, notably retail and e-commerce. For instance, the global 2D barcode scanner market was valued at approximately USD 2.5 billion in 2023 and is projected to grow at a CAGR of over 7% through 2030, according to market research reports available up to mid-2025.

The integration of Artificial Intelligence into these readers offers a significant competitive advantage. AI capabilities can improve read rates, handle damaged or poorly printed barcodes, and provide real-time data analysis, thereby increasing operational efficiency for businesses.

- Market Growth Driver: Rising adoption in retail and e-commerce, coupled with increasing demand for automation in manufacturing and logistics.

- AI Integration: Enhanced read accuracy, improved performance with challenging barcodes, and advanced data analytics capabilities.

- Competitive Edge: Datalogic's AI-powered readers are positioned to capture market share in a segment driven by technological advancement and efficiency gains.

- Financial Outlook: The company's investment in AI technology aligns with market trends, suggesting potential for increased revenue and market leadership.

Datalogic's AI Loss Prevention Suite, integrated into devices like Magellan scanners, addresses the growing need for fraud detection in retail. The market for AI in retail technology is expanding rapidly, with significant growth projected through 2025 and beyond, positioning this suite as a high-potential Star.

The Memor 15 family, launched in 2024, represents Datalogic's commitment to advanced mobile computing for retail and logistics. These devices, featuring enhanced scanning and payment capabilities, are designed to capture market share in a segment driven by the demand for integrated, modern mobile solutions.

Datalogic's CODiScan Series, a wearable barcode scanner, capitalizes on the increasing demand for hands-free data capture. The wearable scanner segment within the broader barcode scanner market is experiencing strong upward momentum, with the global market expected to exceed $15 billion by 2027.

Datalogic's automated solutions are well-suited for the booming e-commerce fulfillment sector. Their focus on high-speed scanning and order fulfillment automation aligns with the global e-commerce market, which was valued at approximately $6.3 trillion in 2023 and is projected to surpass $13 trillion by 2028.

The company's AI-enhanced industrial 2D barcode reader taps into a rapidly growing market. The global 2D barcode scanner market was valued at around $2.5 billion in 2023 and is expected to grow at a CAGR of over 7% through 2030, with AI integration providing a key competitive advantage.

| Product/Solution | BCG Category | Market Growth | Datalogic's Position | Key Differentiator |

| AI Loss Prevention Suite | Star | High (AI in Retail) | Strong | Real-time fraud detection, shrinkage reduction |

| Memor 15 Family | Star | High (Mobile Computing in Retail/Logistics) | Strong | Integrated scanning, payment, modern mobile tech |

| CODiScan Series | Star | High (Wearable Barcode Scanners) | Emerging | Hands-free data capture efficiency |

| E-commerce Fulfillment Automation | Star | Very High (E-commerce Logistics) | Strong | High-speed scanning, order fulfillment optimization |

| AI-Enhanced Industrial 2D Barcode Reader | Star | High (2D Barcode Scanners with AI) | Emerging Leader | Improved read rates, AI-driven analytics |

What is included in the product

The Datalogic BCG Matrix provides strategic insights by categorizing product lines into Stars, Cash Cows, Question Marks, and Dogs.

Clear visualization of Datalogic's product portfolio, simplifying strategic decisions.

Cash Cows

Datalogic's traditional barcode readers, encompassing both fixed and handheld models, are firmly established as Cash Cows in their Boston Consulting Group (BCG) matrix. The company boasts a robust, long-standing leadership in these essential identification markets. For instance, in 2024, Datalogic continued to see strong demand for its fixed retail scanners (FRS) and handheld scanners (HHS), which are critical for efficient data capture in retail environments.

These products operate within a mature market, a testament to their foundational role in retail operations. Datalogic's significant market share in this segment ensures a consistent and reliable generation of cash flow, a hallmark of a Cash Cow. This steady revenue stream supports investment in other areas of the business.

Datalogic's stationary industrial scanners are a cornerstone of their business, deeply entrenched in the manufacturing and logistics sectors. These devices are vital for ensuring accuracy and efficiency in industrial operations, contributing a consistent and reliable revenue stream. The market for these scanners, while mature, remains essential, underpinning a significant portion of Datalogic's established income.

Datalogic's proficiency in sensors for detection, measurement, and safety represents a well-established segment within their portfolio, commanding a significant market share, especially in factory automation. This mature product category consistently contributes to the company's revenue stream.

Despite some fluctuations in broader factory automation demand, the need for robust control and safety systems continues to be a reliable growth engine. In 2024, the global industrial automation market, which heavily relies on such sensor technologies, was projected to reach over $200 billion, indicating the sustained importance of Datalogic's offerings in this space.

Laser Marking Systems

Datalogic's laser marking systems are a cornerstone of its business, operating within a mature yet consistently in-demand market. These systems are vital for industries like automotive and electronics, providing precise and durable marking solutions. The company's established position in this segment means it reliably generates substantial cash flow, acting as a significant cash cow for Datalogic.

While the laser marking market may not exhibit the explosive growth of newer technologies, its stability and Datalogic's strong market share ensure consistent revenue. This segment is crucial for funding research and development into more innovative product lines. For instance, Datalogic's laser marking solutions are integral to traceability requirements in many manufacturing processes, a demand that continues to grow steadily.

- Market Maturity: The laser marking sector is well-established, offering predictable demand.

- Datalogic's Position: The company holds a significant share in this market, ensuring consistent revenue generation.

- Cash Generation: This segment reliably contributes to Datalogic's overall cash flow, funding other business areas.

- Industry Importance: Laser marking is essential for traceability and quality control across various manufacturing sectors.

RFID Solutions

Datalogic's RFID readers and solutions represent a mature segment within their automatic data capture offerings. These technologies, while having potential in emerging areas like retail loss prevention, are already well-established in core applications such as warehouse management and inventory control.

Their consistent performance in these established markets, particularly in mature economies, generates a reliable and steady stream of cash flow for the company. For instance, in 2024, the global RFID market was valued at approximately $13.2 billion, with a significant portion of this driven by industrial and supply chain applications where Datalogic holds a strong presence.

- Established Market Presence: Datalogic's RFID solutions are a cornerstone in traditional automatic data capture, particularly in warehouse and inventory management.

- Steady Cash Flow Generation: Their utility in mature markets ensures consistent revenue, contributing significantly to Datalogic's cash flow.

- Growth Potential: Emerging applications like retail loss prevention offer avenues for future expansion and increased market share.

- Market Context: The broader RFID market's continued growth, projected to reach over $30 billion by 2030, highlights the underlying strength of Datalogic's RFID segment.

Datalogic's established barcode readers, including fixed and handheld models, are strong Cash Cows, dominating mature identification markets. In 2024, demand for their retail scanners remained robust, ensuring consistent cash flow. This steady revenue underpins investment in other business areas, showcasing their foundational strength.

Their stationary industrial scanners are vital for manufacturing and logistics, providing a reliable revenue stream in a mature but essential market. Datalogic's significant market share here guarantees consistent income, supporting broader company initiatives.

Datalogic's sensors for detection, measurement, and safety are a mature, high-share segment, especially in factory automation. Despite market fluctuations, the need for robust control systems in 2024 continued to drive demand, with the industrial automation market exceeding $200 billion.

Laser marking systems are another key Cash Cow, essential for automotive and electronics with predictable demand. Datalogic's strong market position ensures substantial, consistent cash flow, funding innovation in other product lines.

RFID readers and solutions also function as Cash Cows, well-established in warehouse and inventory management. The global RFID market, valued at $13.2 billion in 2024, with significant industrial contributions, highlights the ongoing financial contribution of this segment.

| Product Segment | BCG Category | Market Maturity | Datalogic's Share | Cash Flow Contribution |

|---|---|---|---|---|

| Barcode Readers (Fixed & Handheld) | Cash Cow | Mature | High | Strong & Consistent |

| Stationary Industrial Scanners | Cash Cow | Mature | High | Reliable |

| Sensors (Detection, Measurement, Safety) | Cash Cow | Mature | High | Consistent |

| Laser Marking Systems | Cash Cow | Mature | High | Substantial |

| RFID Readers & Solutions | Cash Cow | Mature | High | Steady |

Full Transparency, Always

Datalogic BCG Matrix

The Datalogic BCG Matrix preview you are currently viewing is the exact, unwatermarked, and fully formatted document you will receive immediately after purchase. This comprehensive report has been meticulously designed by strategy experts to provide actionable insights into Datalogic's product portfolio, enabling clear strategic decision-making. You can confidently anticipate receiving this analysis-ready file, perfect for immediate integration into your business planning, presentations, or competitive strategy development.

Dogs

Legacy or niche product lines with limited innovation, often found in Datalogic's portfolio, can be categorized as Dogs within the BCG Matrix. These are typically older barcode scanners or sensors that haven't received substantial upgrades and operate in markets with little growth and intense price competition, lacking unique features to stand out. For instance, if a specific model of a 2D imager launched in 2018, and the market has since shifted to faster, more integrated solutions, it might fall into this category if it hasn't been refreshed.

Products in stagnant or declining market segments, like certain areas of logistics automation experiencing subdued demand in 2024, can become Datalogic's Dogs. If a significant portion of Datalogic's product portfolio is concentrated in these low-growth sectors, without a clear strategy for revitalization or diversification, these offerings may struggle to generate substantial returns.

Products that require a disproportionately high amount of support, maintenance, or customization for a relatively small revenue contribution could be considered Dogs. For instance, a legacy software product that necessitates extensive client-specific coding for each new implementation, while only generating 1% of a company's total revenue, would fit this description. Such offerings drain valuable engineering and support resources that could be better allocated to more profitable ventures.

Geographical Market Segments with Persistent Low Performance

Geographical market segments that consistently exhibit low market share and minimal growth for specific Datalogic product categories can be identified as Dogs within the BCG Matrix framework. This signifies a challenging position where the product is underperforming in a stagnant or declining market. For example, if Datalogic's industrial barcode scanners face persistent low adoption rates in a particular region with limited economic expansion, that specific regional product offering would be classified as a Dog.

These underperforming segments require careful strategic consideration. Datalogic might analyze the root causes of this low performance, which could include intense local competition, unsuitable product features for the regional market, or ineffective marketing strategies. In 2024, Datalogic continued to navigate diverse global markets, and identifying these "Dog" segments is crucial for resource allocation and strategic planning.

- Underperforming Regions: Identification of geographical areas where specific product lines consistently fail to capture significant market share.

- Low Market Growth: Segments characterized by stagnant or declining market expansion, offering little potential for future revenue growth for certain products.

- Strategic Review: Necessity for Datalogic to evaluate divestment, turnaround strategies, or product adaptation for these identified Dog segments.

Solutions Facing Intense Commoditization Without Differentiation

In the intensely competitive hardware landscape, products that fail to stand out through unique features or robust brand identity can find themselves in a precarious position. If Datalogic possesses offerings that are readily imitated by rivals and are not central to their innovation strategy, these products risk becoming what are often termed Dogs in the BCG Matrix.

These "Dog" products typically operate in mature, low-growth markets where competition is fierce and price is the primary differentiator. For instance, in the barcode scanner market, a segment Datalogic operates within, many entry-level scanners offer similar basic functionality. Without ongoing investment in advanced features like enhanced durability, superior scanning speed in challenging conditions, or seamless integration with diverse software platforms, these products can quickly lose ground.

- Stagnant Market Share: Products lacking differentiation often see their market share plateau or decline as competitors introduce slightly improved or lower-priced alternatives.

- Low Profitability: Intense price competition in commoditized markets erodes profit margins, making these products less attractive contributors to overall revenue.

- Resource Drain: Continued investment in "Dogs" can divert resources from more promising growth areas, hindering the company's overall strategic advancement.

- Brand Dilution: Offering undifferentiated products can inadvertently dilute the perception of innovation and quality associated with the Datalogic brand.

Products classified as Dogs within Datalogic's portfolio represent offerings with low market share in low-growth markets. These are often legacy products or those in mature, highly competitive segments where differentiation is minimal. For example, a specific line of older industrial scanners facing intense price pressure in a market segment projected for only 2% annual growth through 2026 would likely be a Dog. Such products typically generate modest revenue and can consume resources without significant future potential.

| Product Category Example | Market Growth (2024-2026 est.) | Datalogic Market Share (est.) | Strategic Implication |

|---|---|---|---|

| Entry-level Wired Barcode Scanners | 1.5% | 5% | Low profitability, potential divestment or niche focus |

| Older Generation RFID Readers | 2.0% | 3% | High support costs, limited innovation, consider phasing out |

| Specific Legacy Fixed-Position Scanners | 0.8% | 4% | Niche market, low investment, focus on existing customer base |

Question Marks

Datalogic's Shopevolution™ 8, featuring AI Audit Rules for self-shopping, is a significant advancement in retail loss prevention. This technology aims to curb shrinkage, which cost U.S. retailers an estimated $112 billion in 2023 alone, according to the National Retail Federation.

The success of Shopevolution™ 8 as a potential 'Star' in the BCG matrix hinges on its market penetration against competitors offering similar AI-driven solutions. The global AI in retail market is projected to reach $25.1 billion by 2027, indicating robust growth but also intense competition.

The Datalogic Memor 12/17 mobile computing families, while projected to be Stars, initially operate as Question Marks in the BCG Matrix. This classification stems from their status as new product rollouts requiring substantial investment for market establishment. For instance, in 2024, the rugged mobile computer market, where these devices compete, saw significant growth, with projections indicating a compound annual growth rate of over 6% through 2028, highlighting the competitive landscape.

Datalogic must channel significant resources into marketing, sales efforts, and distribution channels to drive adoption and capture market share for the Memor 12/17. Without this strategic investment, these promising new products risk failing to gain traction against established competitors, potentially hindering their transition to a Star status.

Datalogic is pushing the boundaries by embedding AI and machine vision into novel applications. Think beyond just scanning; they're developing systems for sophisticated tasks like advanced produce recognition in grocery stores, a significant leap from traditional barcode reading. This move positions them in exciting, rapidly expanding markets.

These innovative integrations, while promising, are situated in high-growth sectors where their long-term market dominance and profitability are still taking shape. For instance, the global AI in retail market, which includes applications like produce recognition, was projected to reach over $10 billion by 2024, highlighting the potential but also the nascent stage of some of these Datalogic applications within this broader trend.

Strategic Alliances and Emerging Technology Partnerships

Datalogic's strategic alliances, like its adoption of B&R Automation PC 910 systems for new vision processors, signal a strong push into high-growth sectors such as advanced industrial automation. This move positions Datalogic to leverage emerging technologies and expand its market reach in these dynamic areas.

The effectiveness and market penetration of these integrated solutions, born from collaborations, are still unfolding. Therefore, Datalogic's strategic alliances and emerging technology partnerships are best categorized as Stars within the BCG Matrix, representing significant investment potential in rapidly developing markets.

- Star: High market growth, high relative market share.

- Strategic Alliances: Partnerships like the one with B&R Automation for PC 910 systems.

- Emerging Technology: Focus on advanced industrial automation and vision processors.

- Market Penetration: Still in development, indicating future growth potential.

Solutions Targeting New Industry Verticals or Niche Segments

Solutions targeting new industry verticals or niche segments, where Datalogic currently holds a low market share but the market itself is experiencing growth, would be classified as Question Marks within the Datalogic BCG Matrix. These are essentially emerging opportunities that require strategic investment to build market presence and capitalize on future potential.

For instance, if Datalogic is developing specialized scanning solutions for the burgeoning drone delivery sector or advanced identification technologies for the rapidly expanding personalized medicine market, these would likely fall into the Question Mark category. The company would need to allocate resources for research and development, targeted marketing, and sales force expansion to gain traction in these nascent areas. A key consideration here is the market growth rate; if these new verticals are projected to grow at a significant CAGR, the investment in them becomes more compelling.

- Emerging Markets: Datalogic's expansion into new, specialized industry verticals represents entry into markets with high growth potential but currently low penetration for the company.

- Investment Required: Significant investment in R&D, marketing, and sales is necessary to establish a strong foothold and capture market share in these developing segments.

- Strategic Importance: These Question Mark offerings are crucial for Datalogic's long-term growth strategy, aiming to transform into future Stars as these niche markets mature and Datalogic gains prominence.

- Risk vs. Reward: While carrying higher risk due to market uncertainty, successful penetration of these new verticals offers substantial reward potential, driving future revenue streams.

Question Marks in Datalogic's BCG Matrix represent products or business units with low relative market share in high-growth markets. These are often new ventures or products entering rapidly expanding sectors where Datalogic's current market presence is minimal.

Significant investment is required to nurture these Question Marks, aiming to increase market share and eventually transition them into Stars. Failure to invest adequately could see them stagnate or decline, becoming Dogs.

For example, Datalogic's exploration into AI-powered solutions for niche industrial automation, while in a high-growth sector, might currently represent a Question Mark if their market share is nascent.

BCG Matrix Data Sources

Our BCG Matrix leverages robust market data, including financial reports, industry growth rates, and competitive analysis, to accurately position products and inform strategic decisions.