Dashang Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dashang Group Bundle

Unlock the critical external factors shaping Dashang Group's trajectory with our comprehensive PESTLE analysis. Understand how political stability, economic shifts, evolving social trends, technological advancements, environmental regulations, and legal frameworks are creating both opportunities and challenges. Equip yourself with actionable intelligence to refine your strategy and gain a competitive edge. Download the full PESTLE analysis now for immediate insights.

Political factors

The Chinese government is heavily invested in modernizing its retail sector, offering financial incentives for store upgrades, logistics improvements, and the adoption of energy-efficient technology. This push is designed to create a smarter, more convenient, and environmentally friendly retail landscape by 2029.

These policies directly benefit large retailers like Dashang Group by creating a supportive ecosystem for digital transformation and expansion. For instance, government subsidies for adopting advanced inventory management systems can significantly reduce operational costs.

China's government is actively stimulating consumer spending through various programs. For instance, trade-in initiatives for items like home appliances and vehicles are encouraging consumers to upgrade, directly boosting sales in these sectors.

A key driver of these consumption stimulus measures is the allocation of substantial funds from ultra-long-term special treasury bonds. In 2024, China announced plans to issue 1 trillion yuan ($138 billion) in ultra-long special treasury bonds, with a significant portion earmarked for boosting domestic demand and supporting key sectors.

These policies create a favorable environment for retailers like Dashang Group, which specializes in selling home appliances and automobiles. The increased consumer purchasing power and willingness to spend, fueled by these government initiatives, are expected to translate into higher sales volumes and revenue for the company.

Government initiatives to bolster rural infrastructure and public services are significantly enhancing the consumption landscape in these areas. In 2024, rural retail sales outpaced urban growth, reflecting this improved environment. This presents a clear avenue for Dashang Group to strategically expand its physical presence and tailor product assortments for lower-tier markets, tapping into this burgeoning consumer base.

'Dual Circulation' Strategy Impact

China's 'dual circulation' strategy, prioritizing domestic demand and technological self-reliance, directly impacts Dashang Group's retail operations. This policy encourages a shift towards higher-quality domestic goods and sustainable consumption, aligning with the group's potential for product diversification and innovation.

The emphasis on domestic consumption within the dual circulation framework suggests a growing middle class with increased disposable income, creating opportunities for Dashang Group to expand its premium and specialized product lines. For instance, by 2024, China's retail sales of consumer goods were projected to reach trillions of yuan, with a significant portion driven by domestic spending.

- Domestic Demand Focus: The strategy bolsters internal consumption, benefiting retailers like Dashang Group by fostering a more robust customer base.

- Technological Innovation: Encouragement of tech advancements can lead to improved supply chains and customer experiences for Dashang.

- Green Consumption: A growing preference for environmentally friendly products, supported by the strategy, presents an avenue for Dashang to enhance its product sustainability.

- Disposable Income Growth: Rising consumer spending power, a key outcome of dual circulation, directly translates to greater purchasing opportunities for Dashang's offerings.

Data Security and Consumer Protection Regulations

The Chinese government's commitment to enhancing data security and consumer protection is evident in its evolving regulatory landscape. The Personal Information Protection Law (PIPL) and the Data Security Law (DSL) are already in effect, setting stringent requirements for data handling. Furthermore, new Network Data Security Management Regulations are set to be implemented starting January 1, 2025, which will further shape how companies like Dashang Group manage sensitive information.

These regulations necessitate significant adjustments for Dashang Group in its operations. Compliance with PIPL and DSL requires robust systems for protecting personal information and managing data processing activities. The upcoming regulations will likely introduce even more specific guidelines, particularly concerning cross-border data transfers, which are crucial for businesses with international operations or supply chains.

The impact on Dashang Group includes the need for substantial investment in data governance infrastructure and cybersecurity measures. Companies must ensure their data collection, storage, processing, and sharing practices align with these legal mandates. Failure to comply could result in significant penalties, reputational damage, and operational disruptions.

- Increased compliance costs: Implementing new data protection protocols and technologies will require financial investment.

- Stricter data handling requirements: Dashang Group must ensure all personal information is collected with consent and handled securely.

- Cross-border data transfer limitations: Regulations may impose restrictions or require specific approvals for transferring data outside of China.

- Enhanced consumer trust: Proactive compliance can build confidence among customers regarding the security of their data.

Government initiatives are significantly shaping the retail landscape for Dashang Group. China's focus on modernizing retail through financial incentives for technology adoption and energy efficiency creates a supportive environment for growth. Furthermore, stimulus measures like trade-in programs, backed by substantial funding from ultra-long-term special treasury bonds, are directly boosting consumer spending, particularly in sectors where Dashang Group operates, such as home appliances and automobiles.

What is included in the product

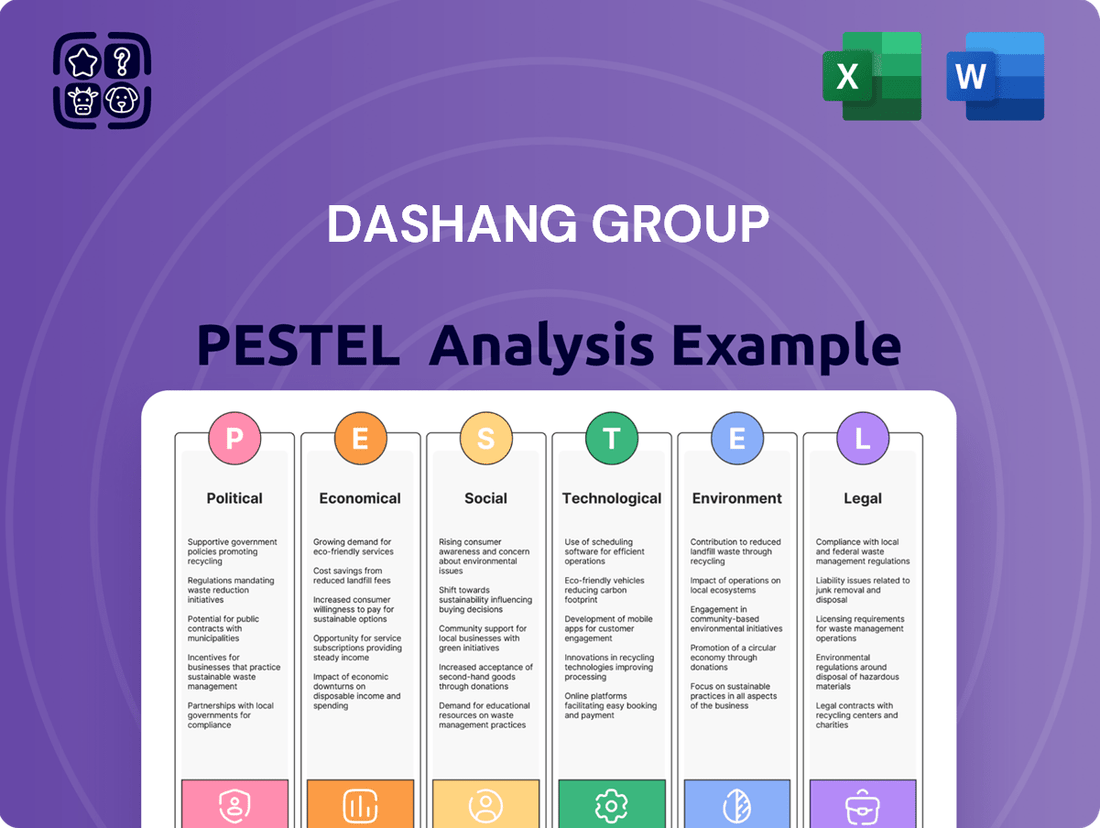

This PESTLE analysis of the Dashang Group critically examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting its operations and strategic direction.

This PESTLE analysis of the Dashang Group offers a concise, easily shareable summary format, ideal for quick alignment across teams and supporting discussions on external risks and market positioning during planning sessions.

Economic factors

China's retail spending growth is showing signs of a slowdown, with expectations that these softer conditions will continue into 2025. This deceleration is largely attributed to a sluggish macroeconomic environment, a struggling property market, and an uncertain economic outlook, all of which are dampening consumer confidence.

This trend could prompt consumers to focus more on value and potentially shift towards less expensive options, a dynamic known as 'trading down.' Such a shift might affect Dashang Group's sales performance, especially for its offerings in the premium or higher-end market segments.

Consumer confidence has seen a slow but steady climb since the latter half of 2024. However, persistent worries regarding the affordability of housing, education, and healthcare, alongside anxieties about securing a comfortable retirement, continue to weigh on consumers, particularly those in their middle years.

This cautious sentiment means Dashang Group must refine its approach, focusing on offerings that resonate with consumers prioritizing essential needs and demonstrable value. For instance, a recent survey in late 2024 indicated that 45% of consumers are actively seeking out deals and discounts, a figure up from 38% a year prior.

Online sales continue their upward trajectory, impacting traditional retail. For instance, global e-commerce sales were projected to reach $6.3 trillion in 2024, highlighting the persistent shift towards digital purchasing. This trend necessitates that offline retailers adapt by focusing on creating engaging in-store experiences and robust omnichannel strategies to remain competitive.

Dashang Group's strategy of blending digital and physical retail channels directly addresses this evolving market. By investing in offline locations that offer unique customer experiences, such as interactive displays or personalized services, the group aims to create a seamless journey for consumers. This approach recognizes that physical stores are increasingly becoming hubs for brand engagement rather than just transaction points, complementing their online presence.

Rising Disposable Income and Consumption Upgrade

Despite some recent economic headwinds, China's urbanization and rising income levels are poised to fuel consistent consumer spending growth over the coming years. This trend is particularly beneficial for companies like Dashang Group, which cater to evolving consumer preferences.

As consumer confidence rebounds and the ranks of upper-middle and high-income households expand, we anticipate a significant uptick in spending, especially on premium and diverse product offerings. This aligns perfectly with Dashang Group's strategic focus on enhancing its product quality and variety.

- Projected Growth: China's per capita disposable income is expected to continue its upward trajectory, with forecasts suggesting a compound annual growth rate (CAGR) of approximately 5-6% through 2025, according to various economic outlook reports.

- Household Spending: The number of households with annual incomes exceeding $30,000 USD, a key demographic for upgraded consumption, is projected to grow by over 15% by the end of 2025, driving demand for higher-value goods.

- Consumption Upgrade: Consumers are increasingly prioritizing quality, brand reputation, and unique experiences, leading to a shift away from basic necessities towards discretionary spending on fashion, electronics, and lifestyle products.

Inflationary Pressures and Price Stability

China's current economic climate presents a unique challenge with persistent deflationary pressures rather than rampant inflation. For Dashang Group, this means navigating an environment where consumer prices are barely ticking up, and producer prices have actually seen a decline. For instance, China's CPI growth was reported at a modest 0.3% year-on-year in April 2024, while the PPI contracted by 2.5% over the same period.

This situation directly impacts Dashang Group's operational and pricing strategies. The company must focus on maintaining profitability by meticulously controlling operational costs and implementing smart pricing to avoid being squeezed by stagnant or falling prices.

- Deflationary Trend: China's CPI growth slowed to 0.3% in April 2024, indicating weak consumer demand.

- Producer Price Decline: The PPI fell by 2.5% year-on-year in April 2024, signaling lower input costs but also reduced pricing power for manufacturers.

- Profitability Challenge: Dashang Group must manage expenses tightly and optimize pricing to sustain margins in this low-price environment.

China's economic landscape in 2024-2025 is characterized by a delicate balance between persistent deflationary pressures and the underlying growth drivers of urbanization and rising incomes. While consumer confidence is showing signs of recovery, it remains sensitive to economic uncertainties, leading to a greater emphasis on value. This environment necessitates strategic cost management and adaptable pricing for retailers like Dashang Group to maintain profitability.

The growth in disposable income and the expanding upper-middle class are key tailwinds, supporting an upgrade in consumer spending, particularly towards premium and experience-driven products. Dashang Group's omnichannel strategy, blending engaging physical retail with robust online presence, is well-positioned to capture this evolving consumer demand.

| Economic Indicator | Value (April 2024) | Projection/Trend (2024-2025) |

|---|---|---|

| China CPI Growth | 0.3% (YoY) | Modest growth, potential for slight increase but still low |

| China PPI Decline | -2.5% (YoY) | Continued pressure on producer prices, impacting margins |

| Per Capita Disposable Income CAGR | N/A (Historical data) | Projected 5-6% |

| Households > $30k USD Income | N/A (Historical data) | Projected >15% growth by end of 2025 |

What You See Is What You Get

Dashang Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of the Dashang Group delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations. Gain immediate access to this detailed strategic tool.

Sociological factors

Chinese consumers are increasingly seeking more than just products; they want value for money, high quality, and experiences that resonate emotionally. For Dashang Group, this translates to a need to innovate beyond competitive pricing, focusing on creating memorable and engaging shopping journeys that foster a deeper connection with customers. This shift reflects a broader trend where 70% of Chinese consumers surveyed in a 2024 report indicated that brand values and social responsibility are important factors in their purchasing decisions.

Consumers are increasingly prioritizing experiences and services over just tangible products. In 2024, global spending on services, particularly in areas like travel, entertainment, and personal care, saw a significant uptick, with some reports indicating service retail sales growth outstripping goods retail sales in key markets.

This shift presents a prime opportunity for Dashang Group. By transforming its commercial spaces into hubs offering a wider array of services and immersive experiential zones, the company can cater to this evolving consumer demand, thereby boosting foot traffic and engagement.

The increasing prevalence of digital natives, those born into a world of constant internet access, is reshaping consumer behavior. This generation, accustomed to instant gratification and seamless online interactions, expects brands to offer consistent experiences across all touchpoints, from mobile apps to physical stores. For instance, a 2024 report indicated that over 70% of Gen Z consumers prefer to shop with brands that offer a unified online and offline experience, highlighting the critical need for omnichannel strategies.

Dashang Group's strategic investment in its e-commerce platform and the simultaneous enhancement of its physical retail footprint directly addresses this sociological shift. By integrating digital channels with its extensive store network, the company is poised to meet the demand for convenience and accessibility that defines the modern consumer. This approach ensures that customers can browse online, pick up in-store, or return items easily, creating a fluid and user-friendly journey. In 2025, online retail sales in China are projected to exceed $3.5 trillion, underscoring the immense opportunity for businesses that can effectively bridge the digital and physical divide.

Growing Health and Wellness Consciousness

Chinese consumers are increasingly prioritizing health and wellness, driving a robust demand for related products and services. This trend signifies a significant cultural shift towards healthier living. For Dashang Group, this presents a prime opportunity to expand its retail portfolio by incorporating health-focused merchandise and potentially offering wellness services within its existing commercial properties. For instance, the health and wellness market in China was projected to reach over $1.5 trillion by 2025, indicating substantial growth potential.

This growing health consciousness directly impacts consumer purchasing decisions, influencing demand across various retail sectors. Dashang Group can strategically leverage this by:

- Expanding its range of organic and natural food products.

- Introducing fitness apparel and equipment.

- Partnering with wellness providers for in-store services like health check-ups or fitness classes.

- Developing private label health and beauty brands.

Sustainability and Green Consumption Trends

Societal shifts are increasingly prioritizing environmental responsibility, with a notable segment of Chinese consumers demonstrating a willingness to pay more for eco-friendly products. This trend directly impacts businesses like Dashang Group, as demand for carbon-neutral goods and sustainable operational practices continues to rise. For instance, a 2024 survey indicated that over 60% of urban Chinese consumers consider sustainability an important factor when making purchasing decisions.

Dashang Group can strategically leverage these evolving consumer preferences by integrating green initiatives throughout its operations. This includes sourcing eco-friendly materials, optimizing supply chains for reduced environmental impact, and transparently communicating these efforts to consumers. Such actions not only attract environmentally conscious customers but also bolster brand reputation in a market increasingly attuned to ethical consumption.

- Growing Consumer Demand: Over 60% of urban Chinese consumers prioritize sustainability in purchasing decisions (2024 data).

- Premium Willingness: A significant portion of consumers are willing to pay a premium for eco-friendly brands.

- Strategic Advantage: Adopting green initiatives can attract environmentally conscious customers and enhance brand image.

- Supply Chain Focus: Emphasis on eco-friendly materials and sustainable supply chains is crucial for market relevance.

Chinese consumers are increasingly focused on personal well-being, driving demand for health and wellness products and services. This cultural shift means Dashang Group can benefit from expanding its offerings in areas like organic foods, fitness apparel, and even in-store wellness services. The health and wellness market in China was projected to exceed $1.5 trillion by 2025, highlighting significant growth potential.

The rise of digital natives, who expect seamless online and offline experiences, is a key sociological factor. A 2024 report showed over 70% of Gen Z consumers prefer brands with unified digital and physical presences. Dashang Group's investment in e-commerce alongside its physical stores directly addresses this, aiming to capture the projected $3.5 trillion in Chinese online retail sales by 2025.

Environmental consciousness is also growing, with over 60% of urban Chinese consumers in 2024 considering sustainability important for purchases. This willingness to pay more for eco-friendly options presents Dashang Group with an opportunity to enhance its brand image by adopting green initiatives, from sourcing to operations.

| Sociological Factor | Consumer Trend | Impact on Dashang Group | Supporting Data (2024/2025) |

|---|---|---|---|

| Health & Wellness Focus | Increased demand for healthy living products and services | Opportunity to expand health-related retail and services | Health & Wellness Market in China projected >$1.5 trillion by 2025 |

| Digital Natives | Expectation of unified online/offline experiences | Need for integrated e-commerce and physical retail strategies | >70% of Gen Z prefer omnichannel brands (2024); China online retail sales projected >$3.5 trillion by 2025 |

| Environmental Consciousness | Preference for eco-friendly and sustainable products | Advantage in adopting green initiatives to attract customers | >60% of urban Chinese consumers consider sustainability important (2024) |

Technological factors

The Chinese retail landscape is rapidly embracing digital transformation, with artificial intelligence (AI) becoming a key driver for enhanced operational efficiency and cost management. Dashang Group can leverage AI-powered data analytics to gain deeper insights into consumer behavior, enabling more refined management practices and the development of highly targeted marketing campaigns. For instance, in 2024, the adoption of AI in retail analytics is projected to grow significantly, with companies reporting an average of 15% improvement in marketing ROI through personalized strategies.

Technological advancements are increasingly blurring the lines between online and offline retail, creating an omnichannel experience. Dashang Group's approach of bolstering its physical store presence while simultaneously enhancing its digital platforms reflects this critical trend, aiming to provide customers with a unified and convenient shopping journey.

This integration allows for services like click-and-collect, in-store returns for online purchases, and personalized recommendations based on both online browsing history and in-store interactions. For instance, in 2024, retailers globally saw a significant uptick in buy-online-pickup-in-store (BOPIS) options, with some reporting over 60% of online orders utilizing this fulfillment method, demonstrating the consumer demand for such integrated services.

Augmented Reality (AR) and Virtual Reality (VR) are rapidly reshaping China's retail landscape, offering innovative ways to boost customer interaction. Dashang Group can leverage these immersive technologies to create digital showrooms and virtual fitting rooms, providing more engaging and personalized shopping journeys.

By integrating AR/VR, Dashang Group can differentiate itself in a competitive market. For instance, the global AR/VR market was projected to reach over $100 billion by 2025, with China being a significant contributor, indicating substantial consumer interest and adoption potential for such advanced retail solutions.

Smart Stores and Automated Systems

The retail landscape in China is rapidly evolving with the widespread adoption of smart store technologies. Unmanned stores, powered by advanced systems, are becoming more common, offering a glimpse into the future of shopping. For instance, by the end of 2023, China's unmanned retail market was projected to reach significant growth, driven by these innovations.

Facial recognition payment systems and contactless transactions are streamlining the customer experience, making purchases quicker and more intuitive. Self-service payment options further empower consumers, reducing wait times and enhancing overall satisfaction. These technologies not only improve convenience but also provide retailers with invaluable data for operational improvements and personalized marketing.

Dashang Group can strategically leverage these technological advancements to its advantage. Integrating innovations like smart checkouts and data analytics platforms can significantly boost operational efficiency and customer engagement. This allows for better inventory management and a deeper understanding of consumer behavior, crucial for staying competitive.

- Smart Store Growth: China's unmanned retail market is experiencing a substantial expansion, with projections indicating continued upward momentum through 2024 and into 2025.

- Payment Innovation: Facial recognition and contactless payment systems are becoming standard, with a significant portion of Chinese consumers now comfortable using these methods for transactions.

- Operational Efficiency: Self-service kiosks and automated inventory management systems are being implemented to reduce labor costs and minimize errors in retail operations.

- Data-Driven Insights: The proliferation of smart technologies enables retailers to collect granular data on customer traffic, purchasing patterns, and product preferences, facilitating more targeted strategies.

Big Data Analytics for Consumer Insights

Retailers are increasingly using big data analytics to understand customer behavior, leading to more personalized shopping experiences and effective marketing campaigns. This allows them to anticipate trends and tailor product assortments. For instance, in 2024, many leading e-commerce platforms reported significant improvements in conversion rates after implementing advanced recommendation engines powered by big data.

Dashang Group can harness big data to gain a deeper understanding of its diverse customer segments. By analyzing purchase histories, online interactions, and demographic information, the group can identify emerging preferences and tailor its product offerings and services to meet specific needs. This data-driven approach can enhance customer loyalty and drive sales growth.

The application of big data analytics in retail is transforming customer engagement. Key benefits include:

- Enhanced Personalization: Delivering customized product recommendations and promotions.

- Improved Inventory Management: Predicting demand more accurately to optimize stock levels.

- Smarter Marketing Strategies: Creating targeted campaigns that resonate with specific customer groups.

- Identification of New Market Opportunities: Uncovering unmet customer needs and emerging trends.

Technological advancements are reshaping retail, with AI driving efficiency and personalized marketing. By 2024, retailers saw an average 15% ROI increase from AI-driven personalized campaigns. Omnichannel strategies, blending online and offline, are crucial, with 60% of online orders utilizing buy-online-pickup-in-store in 2024. AR/VR adoption is growing, with the global market projected to exceed $100 billion by 2025, signaling strong consumer interest in immersive retail experiences.

| Technology | Impact on Retail | 2024/2025 Data/Projections |

|---|---|---|

| Artificial Intelligence (AI) | Enhanced operational efficiency, personalized marketing, improved customer insights | 15% average improvement in marketing ROI from personalized strategies (2024 projection) |

| Omnichannel Integration | Unified customer journey, seamless online/offline experiences | Over 60% of online orders utilized BOPIS (Buy Online, Pickup In-Store) (2024) |

| Augmented/Virtual Reality (AR/VR) | Immersive shopping, digital showrooms, virtual fitting rooms | Global AR/VR market projected to exceed $100 billion by 2025 |

| Smart Store Technologies | Unmanned stores, facial recognition payments, contactless transactions | Significant growth in China's unmanned retail market (projected through 2024/2025) |

Legal factors

China's Personal Information Protection Law (PIPL), effective November 1, 2021, mandates explicit consent for collecting, processing, and transferring personal data. This means Dashang Group must obtain clear permission from customers before utilizing their information, impacting how loyalty programs and digital platforms operate.

PIPL also grants individuals significant rights, including the ability to access, correct, and delete their personal data. For Dashang Group, this necessitates robust data management systems to handle such requests efficiently and transparently, especially given the vast amounts of customer data collected through its extensive retail network and online presence.

Failure to comply with PIPL can result in substantial penalties, including fines of up to 50 million yuan or 5% of the previous year's annual turnover. Dashang Group's commitment to PIPL compliance is therefore crucial for maintaining customer trust and avoiding significant financial and reputational damage, particularly as digital engagement continues to grow.

China's Data Security Law (DSL), enacted in 2021, and the upcoming Network Data Security Management Regulations, effective January 1, 2025, introduce significant obligations for businesses. These laws mandate a tiered approach to data classification and require robust protection measures for different data categories. For Dashang Group, a large retail entity, compliance means carefully assessing its data handling practices, especially concerning customer personal information.

The regulations also place stringent controls on cross-border data transfers, necessitating careful review of any international data sharing or processing activities. Failure to comply could result in substantial penalties. For instance, the DSL allows for fines up to 50 million yuan or even suspension of business operations for serious violations, impacting Dashang Group's global reach and data-driven strategies.

China's new consumer protection regulations, effective July 1, 2024, specifically address online sales issues like misleading advertisements and unfair pricing. Dashang Group must ensure compliance with these rules to maintain consumer confidence in its operations.

These regulations aim to create a more equitable marketplace, impacting how Dashang Group handles online transactions, from product claims to return processes. Adherence is crucial for building and sustaining customer loyalty in the evolving retail landscape.

Anti-Monopoly and Fair Competition Regulations

China's commitment to fostering a competitive market environment means Dashang Group must navigate anti-monopoly and fair competition regulations. These rules are designed to prevent any single entity from dominating the retail sector, ensuring a level playing field for all businesses. For instance, the State Administration for Market Regulation (SAMR) actively monitors mergers and acquisitions to prevent the formation of monopolies, a trend that intensified with increased scrutiny on large tech platforms in recent years. Dashang's strategic growth, including potential acquisitions or partnerships, needs careful alignment with these legal frameworks to avoid penalties and maintain operational legitimacy.

The enforcement of these regulations aims to protect consumer interests and promote innovation within the retail industry. Dashang Group's business model, especially its expansion into new product categories or geographical markets, must be structured to avoid practices that could be deemed anti-competitive. This includes scrutinizing pricing strategies, distribution agreements, and any potential exclusionary conduct. As of late 2024, the regulatory focus remains on ensuring fair market access and preventing the abuse of dominant market positions, a principle that directly impacts large retail conglomerates like Dashang.

Key considerations for Dashang Group under these legal factors include:

- Compliance with merger control thresholds: Ensuring any future acquisitions or joint ventures meet reporting and approval requirements to avoid regulatory challenges.

- Fair pricing and promotional practices: Adhering to regulations that prevent predatory pricing or misleading promotional activities that could stifle smaller competitors.

- Open access to distribution channels: Maintaining fair and non-discriminatory access for suppliers and brands to Dashang's retail platforms.

- Data usage and privacy: Complying with evolving data protection laws, which can intersect with anti-monopoly concerns regarding market power derived from data.

Environmental Protection Laws and Green Policies

China's commitment to environmental protection is strengthening, with significant policy shifts toward green development. This includes ambitious targets for carbon reduction and the promotion of sustainable business practices across all sectors. For Dashang Group, this translates into a critical need to align its operations with these evolving environmental regulations.

Compliance with China's environmental protection laws is no longer optional. Dashang Group must actively integrate eco-friendly strategies throughout its value chain, from sourcing raw materials to manufacturing and product delivery. This proactive approach is essential for long-term operational viability and market acceptance.

- Carbon Emission Targets: China aims to peak carbon dioxide emissions before 2030 and achieve carbon neutrality before 2060, impacting energy-intensive industries.

- Green Finance Initiatives: The government is encouraging green bonds and sustainable investment, potentially offering incentives for environmentally conscious companies.

- Pollution Control Standards: Stricter regulations on air, water, and soil pollution will necessitate investments in advanced pollution abatement technologies for Dashang Group.

- Circular Economy Promotion: Policies supporting waste reduction, recycling, and resource efficiency will require Dashang Group to rethink its product design and waste management processes.

Dashang Group must navigate China's increasingly stringent data privacy and security laws, including the Personal Information Protection Law (PIPL) and the Data Security Law (DSL). These regulations impose strict requirements on data collection, processing, cross-border transfers, and grant individuals significant data rights, with non-compliance carrying substantial fines, potentially up to 5% of annual turnover.

Environmental factors

Consumers in China are increasingly prioritizing environmentally friendly products and sustainable practices, a trend that significantly impacts retail. For instance, a 2024 survey indicated that over 60% of Chinese urban consumers are willing to pay more for sustainable goods. This growing green consumption movement presents a clear opportunity for Dashang Group to align its offerings and operations with these evolving consumer preferences.

Dashang Group can leverage this shift by actively promoting its range of eco-conscious products, from organic textiles to energy-efficient electronics. Implementing sustainable initiatives within its physical stores and supply chain, such as reducing plastic packaging or optimizing energy usage, will further resonate with this environmentally aware customer base. By doing so, Dashang Group can enhance its brand image and capture a larger share of this expanding market segment.

China's ambitious goal of achieving carbon neutrality by 2060 significantly elevates the importance of sustainable supply chains. Initiatives like the Green Supply Chain Initiative are actively pushing for environmentally responsible practices across industries.

Dashang Group must proactively evaluate its existing supply chain operations to align with these growing sustainability mandates. This assessment will likely involve identifying areas for improvement to reduce its overall environmental impact, potentially leading to investments in greener logistics and sourcing.

China's commitment to sustainability is driving significant investment in eco-friendly materials. By 2025, the nation aims to increase the use of biodegradable plastics in packaging by 30%, according to the Ministry of Ecology and Environment. This trend presents a clear opportunity for Dashang Group to integrate these advanced materials into its product lines and packaging strategies, aligning with growing consumer demand for environmentally responsible options.

Renewable Energy Integration in Retail Operations

China is actively promoting the adoption of renewable energy across various sectors. By the end of 2023, the country's installed renewable energy capacity reached 1,450 gigawatts, a significant increase driven by solar and wind power. This national push creates a favorable environment for companies like Dashang Group to invest in green energy solutions for their retail infrastructure.

Dashang Group can leverage this trend by incorporating renewable energy, such as solar panels, into its physical store network. This move not only supports China's ambitious environmental goals, aiming for peak carbon emissions before 2030 and carbon neutrality before 2060, but also offers potential cost savings on energy expenses. For instance, solar-powered retail outlets can reduce reliance on the grid, mitigating fluctuating energy prices.

- Renewable Energy Growth: China's installed renewable energy capacity exceeded 1,450 GW by the end of 2023.

- Policy Alignment: Integrating renewables aligns Dashang Group with national green policies and carbon reduction targets.

- Cost Reduction Potential: Solar-powered stores can lower operational costs by decreasing reliance on traditional energy sources.

- Brand Enhancement: Demonstrating commitment to sustainability can improve brand image and attract environmentally conscious consumers.

Waste Reduction and Recycling Initiatives

The retail sector, including companies like Dashang Group, is seeing a significant push towards waste reduction and recycling. This trend is fueled by growing consumer awareness and stricter government regulations aimed at promoting sustainability. For example, by the end of 2024, many regions are expected to have implemented enhanced packaging waste directives, impacting retailers directly.

To stay competitive and responsible, Dashang Group needs to develop robust waste management strategies. This includes not only promoting recycling throughout its operations but also actively investigating circular economy principles. Such an approach could involve designing products for longevity, facilitating repair services, and establishing take-back programs for used items.

- Consumer Demand: A 2024 survey indicated that over 70% of consumers consider a company's environmental practices when making purchasing decisions.

- Regulatory Landscape: Evolving waste management laws, particularly concerning single-use plastics and packaging, are compelling retailers to adapt by mid-2025.

- Operational Efficiency: Implementing efficient recycling programs can lead to cost savings through reduced disposal fees and potential revenue from recycled materials.

- Circular Economy Exploration: Pilot programs in the fashion retail sector in 2024 demonstrated a 15% reduction in material waste by adopting resale and refurbishment models.

Environmental regulations in China are becoming more stringent, pushing businesses towards greener operations. By 2025, the government aims to increase the recycling rate of solid waste in major cities to 40%, a target that will influence retail practices significantly.

Dashang Group must adapt by enhancing its waste management and recycling initiatives, potentially investing in infrastructure for better sorting and processing. This proactive approach not only ensures compliance but also aligns with the growing consumer expectation for corporate environmental responsibility.

China's focus on reducing pollution is driving demand for eco-friendly packaging materials. The nation plans to reduce the use of non-biodegradable plastics by 50% in the e-commerce sector by the end of 2025, impacting how retailers like Dashang Group package and deliver goods.

Dashang Group should explore and adopt sustainable packaging solutions, such as compostable or recycled materials, to meet these evolving standards and consumer preferences. This strategic shift can also present opportunities for brand differentiation and cost savings through reduced material usage.

| Environmental Factor | China's Target/Trend | Impact on Dashang Group | Opportunity/Risk |

|---|---|---|---|

| Waste Reduction & Recycling | Increase city recycling rate to 40% by 2025 | Need for enhanced waste management systems | Opportunity for operational efficiency and brand image |

| Pollution Control | Reduce non-biodegradable plastic packaging by 50% (e-commerce) by 2025 | Shift to sustainable packaging materials | Risk of non-compliance; Opportunity for innovation and cost savings |

| Renewable Energy Adoption | Installed capacity exceeded 1,450 GW by end of 2023 | Potential to integrate green energy in retail operations | Cost savings on energy; Enhanced brand reputation |

| Green Consumption | Over 60% of urban consumers willing to pay more for sustainable goods (2024 survey) | Demand for eco-conscious products and practices | Market share growth; Brand loyalty |

PESTLE Analysis Data Sources

Our Dashang Group PESTLE Analysis is meticulously constructed using data from official government publications, reputable financial news outlets, and leading market research firms. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental landscape impacting the company.