Daou Technology Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Daou Technology Bundle

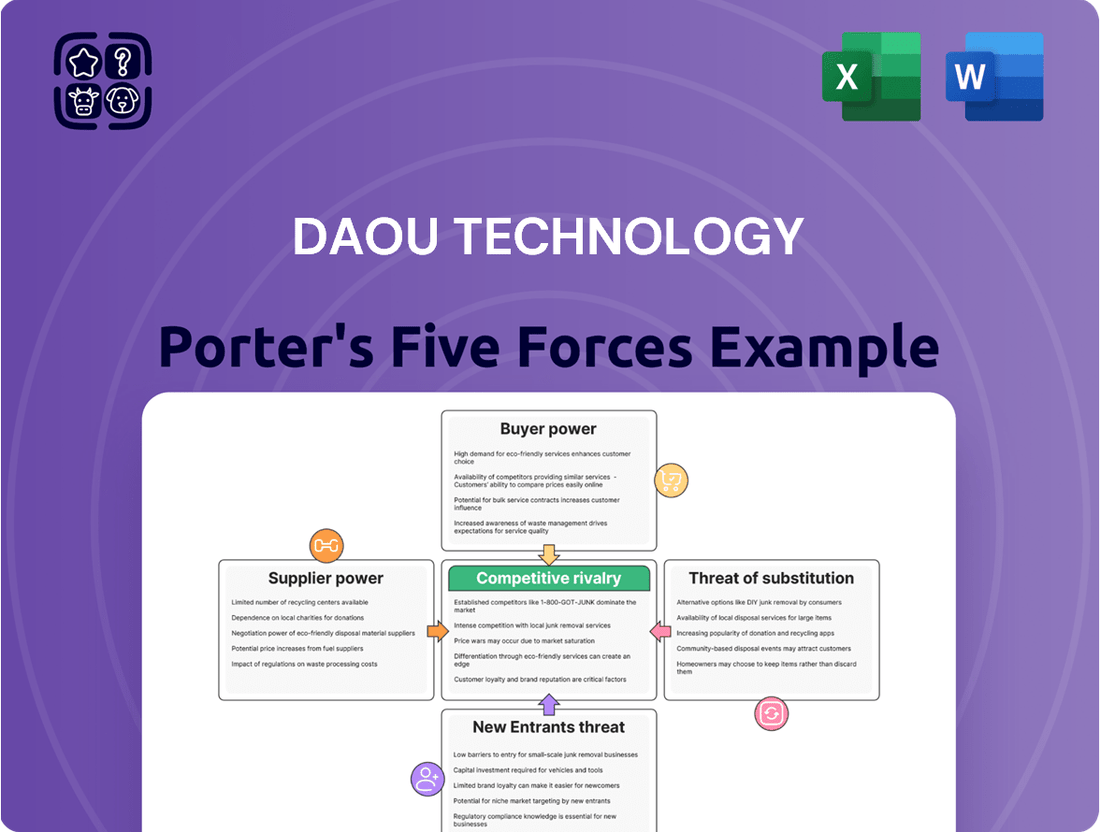

Daou Technology navigates a dynamic market, facing pressures from rivals and the ever-present threat of new entrants. Understanding the subtle influence of suppliers and the power of buyers is crucial for strategic advantage. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Daou Technology’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The bargaining power of technology component suppliers for Daou Technology leans towards moderate to high. This is primarily due to Daou's reliance on essential technologies such as operating systems, database management systems, and specific software licenses. These foundational elements are often controlled by a limited number of powerful vendors.

Daou Technology's strategic partnerships with major global software providers like IBM, VMware, Citrix, and RedHat highlight its dependence on particular vendor technologies. This reliance on specialized and often proprietary solutions grants these suppliers a degree of leverage in negotiations, impacting pricing and terms for Daou.

The availability of highly skilled IT professionals, especially in fields like AI, cloud computing, and cybersecurity, significantly influences supplier power. South Korea has a strong STEM talent pool, but the intense demand for specialized skills in cybersecurity and AI means that suppliers of this human capital can wield considerable bargaining power.

For Daou Technology, the bargaining power of suppliers in hardware and data center infrastructure is a key consideration. While generic components might face intense competition among suppliers, limiting their power, specialized or high-performance equipment critical for advanced computing, such as AI and big data, can significantly elevate supplier leverage. This means suppliers of cutting-edge processors or specialized networking gear could command higher prices and dictate terms.

In 2024, the demand for advanced semiconductor components, essential for AI workloads that Daou Technology likely supports, has remained robust. For instance, the global semiconductor market was projected to reach approximately $689 billion in 2024, according to some industry forecasts, indicating strong demand but also potential supply chain constraints for leading-edge chips. This environment could empower suppliers of these critical, high-demand components.

Supplier Power 4

Cloud infrastructure providers like AWS, Google Cloud, and Microsoft Azure are essential suppliers for Daou Technology's cloud services. Their substantial market share, both globally and within South Korea, grants them considerable leverage. This means they can influence the pricing and the technological capabilities Daou Technology can integrate into its client offerings.

The concentrated nature of the cloud infrastructure market, with a few dominant players, amplifies supplier power. For instance, as of early 2024, AWS, Azure, and Google Cloud collectively held over 60% of the global cloud infrastructure market share. This concentration limits Daou Technology's options for alternative suppliers, forcing reliance on these major providers and their terms.

- Dominant Market Share: Major cloud providers control a significant portion of the market, reducing Daou Technology's negotiation leverage.

- High Switching Costs: Migrating complex cloud infrastructure can be costly and time-consuming, locking Daou Technology into existing provider relationships.

- Limited Alternatives: The scarcity of comparable, large-scale cloud infrastructure providers in South Korea further strengthens the bargaining power of existing suppliers.

- Impact on Pricing: Supplier pricing directly affects Daou Technology's cost structure and its ability to offer competitive pricing to its own customers.

Supplier Power 5

Suppliers of foundational security solutions and advanced analytics platforms hold significant sway over Daou Technology. As cyber threats evolve and the need for real-time business intelligence intensifies, Daou Technology depends on these providers for critical, cutting-edge tools. This reliance can translate into increased costs or less adaptable contract terms, particularly if viable alternative suppliers are scarce.

The bargaining power of these suppliers is amplified by the specialized nature of their offerings and the high switching costs associated with integrating new systems. For instance, a significant portion of Daou Technology's operational efficiency in cybersecurity and data analytics relies on the seamless integration of third-party software. In 2024, the global cybersecurity market was valued at approximately $232 billion, highlighting the substantial investment in these solutions, and the advanced analytics market reached an estimated $35 billion, underscoring the critical role of these platforms.

- Specialized Offerings: Suppliers provide niche technologies essential for Daou Technology's core operations, limiting readily available substitutes.

- High Switching Costs: Integrating new security or analytics platforms involves substantial time, resources, and potential operational disruption, deterring Daou Technology from frequent vendor changes.

- Market Growth: The expanding markets for cybersecurity and advanced analytics in 2024 indicate strong demand, potentially allowing suppliers to command higher prices and more favorable terms.

- Dependency on Innovation: Daou Technology's need to stay ahead of sophisticated cyber threats and leverage advanced data insights makes it dependent on suppliers' continuous innovation, further strengthening supplier leverage.

The bargaining power of suppliers for Daou Technology is generally moderate to high, particularly for specialized technology components and cloud infrastructure. This is driven by the concentration of key vendors, high switching costs, and the critical nature of these inputs for Daou's operations, especially in areas like AI and cybersecurity.

In 2024, the demand for advanced semiconductors, crucial for AI, remained strong, with the global market projected to exceed $689 billion. This robust demand, coupled with potential supply constraints for leading-edge chips, empowers suppliers of these critical components.

Major cloud providers like AWS, Azure, and Google Cloud, which held over 60% of the global market share in early 2024, exert significant influence due to high switching costs and limited alternatives, directly impacting Daou Technology's operational expenses.

| Supplier Category | Key Dependencies for Daou Technology | Estimated 2024 Market Value (USD) | Supplier Bargaining Power |

| Cloud Infrastructure | AWS, Azure, Google Cloud | Global Market: ~$200 billion+ (IaaS) | High |

| Semiconductors (AI/High-Performance) | Advanced Processors, GPUs | Global Market: ~$689 billion (Total Semiconductor) | Moderate to High |

| Cybersecurity Solutions | Advanced Threat Detection, Data Protection | Global Market: ~$232 billion | Moderate to High |

| Advanced Analytics Platforms | Data Processing, BI Tools | Global Market: ~$35 billion | Moderate |

What is included in the product

This analysis unpacks the competitive forces shaping Daou Technology's market, evaluating supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry.

Effortlessly navigate competitive landscapes with Daou Technology's Porter's Five Forces analysis, offering a clear, actionable roadmap to mitigate strategic threats and capitalize on opportunities.

Customers Bargaining Power

Customers in South Korea's IT services sector, a market expected to see substantial growth, often demand solutions that are not only comprehensive and scalable but also budget-friendly. Major clients, including large corporations and government agencies, wield considerable influence due to the sheer volume and critical nature of the IT services, system integration, and consulting they procure.

The increasing digitalization across sectors like BFSI, healthcare, manufacturing, and government has made customers highly dependent on IT services for their fundamental operations. This reliance, coupled with a broad choice of IT service providers, significantly enhances customers' bargaining power.

Customers can leverage this position to negotiate more favorable terms, competitive pricing, and robust service level agreements. For instance, in 2024, IT outsourcing deals often included clauses for performance-based incentives, reflecting this customer leverage.

Customers in cloud computing and cybersecurity are highly attuned to data privacy and security. This makes them powerful negotiators, pushing providers like Daou Technology for strong security measures, adaptable deployment options, and clear contract terms. For instance, a 2024 survey indicated that over 70% of enterprise cloud users prioritize data security over cost savings, giving them significant leverage.

4

The bargaining power of customers for Daou Technology is significantly influenced by government procurement. South Korea's commitment to digital transformation, exemplified by initiatives like the 'Digital New Deal,' consolidates IT infrastructure projects, creating substantial purchasing blocs. This government focus allows it to act as a dominant customer, capable of dictating terms and pricing for IT services and solutions.

The government's role as a major IT procurer can lead to intense price competition among suppliers. For instance, in 2023, government IT spending in South Korea was projected to reach approximately 18.1 trillion Korean won, underscoring the scale of these opportunities and the leverage held by the government.

Key aspects influencing customer bargaining power include:

- Consolidated Procurement: Government-led digital transformation projects often involve large-scale, unified procurements, concentrating purchasing power.

- Influence on Standards: Government specifications and requirements can set de facto industry standards, limiting customer choice but increasing their influence on product development.

- Price Sensitivity: Large public sector contracts often prioritize cost-effectiveness, making price a critical negotiation point for customers.

- Market Shaping: Government investments in areas like cloud computing and AI can shape market demand and supplier offerings, giving the government considerable sway.

5

The bargaining power of customers in the IT services sector, particularly for companies like Daou Technology, is influenced by the growing adoption of IT, cloud, and AI solutions by Small and Medium-sized Enterprises (SMEs). These businesses, often spurred by government incentives and a focus on efficiency, represent a substantial and expanding market. While individual SMEs may not wield significant power, their collective demand for affordable and effective solutions can shape market offerings.

The increasing digital transformation among SMEs, a trend amplified in 2024, means that IT service providers must remain competitive on price and value. For instance, the global cloud computing market, a key area for IT service providers, was projected to reach over $1.3 trillion in 2024, indicating a highly competitive landscape where customer price sensitivity is a major factor.

- Growing SME Digitalization: SMEs are increasingly investing in IT, cloud, and AI, creating a larger customer base.

- Cost Sensitivity: Government subsidies and the need for cost optimization make SMEs price-conscious.

- Collective Influence: The sheer number of SMEs adopting these technologies gives them a combined bargaining advantage.

- Demand for Value: Customers expect accessible and cost-effective solutions that deliver tangible benefits.

Customers in South Korea's IT sector, especially large enterprises and government bodies, possess significant bargaining power due to their substantial purchasing volume and the critical nature of IT services. This leverage allows them to negotiate favorable pricing and service terms, a trend evident in 2024 IT outsourcing deals incorporating performance-based incentives.

The increasing reliance on IT for core operations across industries like finance, healthcare, and manufacturing, coupled with a wide array of service providers, amplifies customer influence. This is particularly true in specialized areas like cloud computing and cybersecurity, where customers prioritize data security, granting them considerable negotiation leverage, as over 70% of enterprise cloud users in a 2024 survey indicated security as a higher priority than cost.

| Factor | Description | Impact on Bargaining Power |

| Customer Concentration | Large corporations and government agencies are major IT service procurers. | High |

| Switching Costs | While IT integration can involve switching costs, the availability of multiple providers mitigates this. | Moderate |

| Information Availability | Customers are increasingly informed about IT solutions and pricing. | High |

| Price Sensitivity | Government procurement and SME cost-consciousness drive price negotiations. | High |

Preview the Actual Deliverable

Daou Technology Porter's Five Forces Analysis

This preview showcases the complete Daou Technology Porter's Five Forces Analysis, offering a detailed examination of competitive forces within its industry. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, ensuring no surprises. You're looking at the actual, ready-to-use document, providing you with instant access to valuable strategic insights the moment you buy.

Rivalry Among Competitors

The South Korean IT services sector is a crowded arena, with many domestic and international companies fiercely competing for business. This intense competition is further fueled by the market's strong growth trajectory, which continues to draw in new entrants and heighten the rivalry for established players like Daou Technology.

Daou Technology faces intense competition across its varied business segments. In the cloud computing arena, it contends with global behemoths like Amazon Web Services (AWS), Google Cloud, and Microsoft Azure, alongside formidable domestic rivals such as Naver Cloud and Kakao Enterprise. This intense rivalry necessitates continuous innovation and competitive pricing to maintain market share.

Daou Technology operates within South Korea's highly competitive IT consulting and system integration landscape. Numerous companies offer similar broad service portfolios, intensifying the need for differentiation. This often translates into a strategic emphasis on cultivating deep client relationships and developing specialized expertise within particular industries.

4

The IT services industry, where Daou Technology operates, is characterized by intense rivalry. Rapid technological advancements, especially in areas like artificial intelligence and cybersecurity, demand constant innovation and significant investment from all players. This relentless pace means companies must continuously update their offerings to stay relevant and competitive.

This drive for cutting-edge solutions intensifies the competition. Companies are constantly pushing to be the first to market with new technologies, creating a dynamic environment where market share can shift quickly. For instance, the global IT services market was valued at approximately $1.2 trillion in 2023 and is projected to grow, highlighting the scale of competition.

- High R&D Spending: Companies like Daou Technology must allocate substantial resources to research and development to keep pace with technological shifts.

- Talent Wars: Competition for skilled IT professionals, particularly in AI and cybersecurity, is fierce, driving up labor costs.

- Price Sensitivity: While innovation is key, price remains a significant factor for many clients, leading to pressure on margins.

- Mergers and Acquisitions: Consolidation is common as larger players acquire smaller, innovative firms to gain market share and technological capabilities.

5

Government initiatives promoting digital transformation and investing heavily in the IT sector, while creating opportunities, also intensify competition as companies vie for these lucrative projects. The strong government support encourages both established players and new entrants to expand their offerings.

In 2024, South Korea's government continued its robust investment in the digital economy. For instance, the Ministry of Science and ICT announced plans to allocate over ₩5 trillion (approximately $3.7 billion USD) towards AI and Big Data infrastructure development, directly fueling competition for related IT service contracts.

- Increased Project Bidding: Government funding for digital transformation projects, such as smart city initiatives and public sector cloud adoption, leads to a higher volume of competitive bids.

- New Entrant Activity: The attractive market, bolstered by government incentives, encourages new technology firms to enter, increasing the number of players competing for market share.

- Established Player Expansion: Existing IT service providers, including Daou Technology, are compelled to innovate and expand their service portfolios to secure a larger share of government-backed digital transformation projects.

- Price Sensitivity: The competitive landscape often leads to increased price pressure on IT services, as companies aim to win bids in a market where multiple providers are vying for government contracts.

The competitive rivalry for Daou Technology is fierce, stemming from a crowded South Korean IT services market. This intensity is amplified by rapid technological advancements, particularly in AI and cybersecurity, necessitating substantial R&D investment and a constant pursuit of innovation. The global IT services market, valued at approximately $1.2 trillion in 2023, underscores the scale of this competition.

Daou Technology faces direct competition from global cloud leaders like AWS, Google Cloud, and Microsoft Azure, as well as domestic giants such as Naver Cloud and Kakao Enterprise. In IT consulting and system integration, numerous firms offer similar services, forcing Daou to focus on client relationships and specialized expertise to stand out.

Government initiatives, like South Korea's 2024 plan to invest over ₩5 trillion (approx. $3.7 billion USD) in AI and Big Data infrastructure, further intensify competition. This funding attracts new entrants and encourages existing players to expand their offerings, often leading to increased price sensitivity on IT services as companies vie for lucrative government contracts.

| Competitor Type | Key Players | Competitive Pressure |

|---|---|---|

| Cloud Services | AWS, Google Cloud, Microsoft Azure, Naver Cloud, Kakao Enterprise | High (requires continuous innovation and competitive pricing) |

| IT Consulting & System Integration | Numerous domestic and international firms | High (necessitates differentiation through client relationships and specialization) |

| Emerging Technologies (AI, Cybersecurity) | Global tech giants, specialized startups | Very High (demands significant R&D and rapid adaptation) |

SSubstitutes Threaten

The threat of substitutes for Daou Technology's IT services primarily stems from clients choosing to build and manage their own in-house IT departments. This is particularly relevant for large enterprises that may prefer to keep core IT functions, especially those involving sensitive data or proprietary systems, under direct internal control.

For example, many large corporations in 2024 continue to invest heavily in their internal IT infrastructure and personnel, aiming for greater control and customization. This trend can reduce the demand for external IT service providers like Daou Technology for certain critical operations, thereby posing a significant substitution threat.

Generic, off-the-shelf software, especially for routine business tasks, poses a significant threat to Daou Technology's specialized groupware and enterprise solutions. Companies often opt for these readily available, more affordable options instead of investing in custom system integration services. For instance, the global market for enterprise resource planning (ERP) software, a common area for groupware, was projected to reach over $50 billion in 2024, highlighting the vast availability of substitute solutions.

The rise of robust open-source alternatives across cloud infrastructure, big data analytics, and security tools presents a significant threat of substitution for Daou Technology's offerings. While Daou Technology leverages partnerships with key open-source players like Red Hat, clients may opt to directly implement and manage these solutions themselves. This independent adoption can stem from a desire to reduce vendor lock-in and achieve cost savings, potentially bypassing Daou Technology's value-added services.

4

The threat of substitutes for IT consulting services is moderate. Clients can opt for internal IT departments or individual freelance consultants as alternatives to full-service IT consulting firms. This is particularly true for well-defined, smaller-scale projects where specialized skills can be sourced externally without engaging a larger firm.

In 2024, the IT consulting market continued to see a rise in specialized freelance platforms, making it easier for businesses to find independent experts for specific tasks. For instance, while large IT consulting projects might still favor established firms, smaller digital transformation initiatives or cloud migration tasks could be more cost-effectively handled by individual specialists.

- Internal Expertise: Companies increasingly invest in upskilling their internal IT teams, reducing reliance on external consultants for routine tasks or knowledge management.

- Freelance Consultants: The gig economy has empowered independent IT professionals, offering flexible and often more affordable solutions for project-based needs.

- Off-the-Shelf Software: For certain business process needs, readily available software solutions can sometimes eliminate the requirement for custom IT consulting.

5

The threat of substitutes for Daou Technology's services is a significant consideration. Emerging technologies, particularly low-code and no-code development platforms, present a viable alternative for some clients. These platforms allow businesses to create basic applications and automate processes with less reliance on traditional IT service providers.

This trend could directly impact Daou Technology by reducing the demand for certain custom development and integration services. For instance, companies might opt to build internal tools or simple customer-facing applications using these accessible platforms rather than engaging a third-party developer for every need. This shift could affect revenue streams for services that can be replicated by these substitute technologies.

Consider the growth in the low-code market. By mid-2024, it's projected that the global low-code development platform market size will reach approximately $21.2 billion, with continued strong growth expected. This indicates a substantial and expanding market for these substitute solutions.

- Low-Code/No-Code Platforms: Offer clients the ability to build applications and automate processes internally, reducing the need for external IT service providers.

- Impact on Demand: Potential decrease in demand for Daou Technology's custom development and integration services as clients adopt self-service solutions.

- Market Growth: The global low-code development platform market is expanding rapidly, projected to reach around $21.2 billion by mid-2024, highlighting the increasing viability of substitutes.

- Strategic Response: Daou Technology may need to adapt its service offerings to focus on more complex, specialized, or strategic IT needs that low-code platforms cannot easily address.

The threat of substitutes for Daou Technology's IT services is multifaceted, encompassing internal capabilities, readily available software, and emerging development platforms.

Clients can choose to build in-house IT departments, leverage freelance consultants for specific tasks, or opt for off-the-shelf software, particularly for routine business needs. For example, the global market for enterprise resource planning software, a common area for groupware, was projected to exceed $50 billion in 2024.

Furthermore, the rapid growth of low-code/no-code platforms, with the market projected to reach approximately $21.2 billion by mid-2024, offers clients a way to develop applications internally, potentially reducing demand for Daou Technology's custom development services.

| Substitute Type | Description | 2024 Market Indicator |

| Internal IT Departments | Companies developing and managing IT functions in-house. | Continued significant investment by large enterprises in internal infrastructure and personnel. |

| Off-the-Shelf Software | Generic, readily available software for common business tasks. | Global ERP software market projected over $50 billion. |

| Freelance Consultants | Independent IT professionals for project-based needs. | Rise in specialized freelance platforms making expert sourcing easier. |

| Low-Code/No-Code Platforms | Platforms enabling internal application development with less coding. | Global market projected around $21.2 billion by mid-2024. |

Entrants Threaten

The South Korean IT services, cloud computing, AI, and cybersecurity markets are experiencing robust growth, with many segments projected to see double-digit compound annual growth rates (CAGRs) through 2027. This rapid expansion, fueled by digital transformation initiatives and increasing demand for advanced technological solutions, presents a significant draw for new companies looking to establish a foothold.

The allure of these high-growth sectors makes the threat of new entrants a considerable factor for established players like Daou Technology. For instance, the South Korean cloud market alone was valued at approximately $2.5 billion in 2023 and is expected to grow substantially. This lucrative environment can attract both domestic startups and international firms, potentially disrupting market dynamics and intensifying competition.

The threat of new entrants for Daou Technology, particularly within South Korea's dynamic tech landscape, is moderately low due to significant capital requirements for advanced R&D and infrastructure. However, government initiatives like the Korea New Deal, launched in 2020 with substantial investment, actively foster digital transformation and support startups, potentially lowering some entry barriers for agile, well-funded newcomers.

While specialized knowledge is crucial in Daou Technology's sector, South Korea's robust education system, with its emphasis on science, technology, engineering, and mathematics (STEM), is consistently producing a capable workforce. This readily available talent pool, particularly in emerging areas like artificial intelligence and big data, can lower the barrier to entry for new competitors.

4

The threat of new entrants in the IT infrastructure and services sector, relevant to companies like Daou Technology, is moderate. While building massive data centers requires substantial capital, the rise of public cloud providers like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud significantly lowers this barrier. New companies can leverage these existing infrastructures, reducing the upfront investment needed to offer competitive services.

For instance, in 2024, the global cloud computing market was projected to reach over $1 trillion, demonstrating the accessibility and scalability offered by these platforms. This accessibility means a startup doesn't necessarily need to own physical servers to compete in areas like cloud hosting or managed IT services.

- Capital Investment: Historically high for data centers, but mitigated by cloud adoption.

- Cloud Services: Public cloud platforms reduce the need for new entrants to build their own IT infrastructure.

- Market Accessibility: Lowered infrastructure costs make it easier for new players to enter specialized IT service niches.

- Competitive Landscape: While barriers are lower, established players still benefit from economies of scale and brand recognition.

5

The threat of new entrants in the technology sector, particularly for companies like Daou Technology, is moderately high, but incumbent advantages do create barriers. Established relationships and the strong reputation of firms like Daou Technology are significant hurdles for newcomers. Building the trust necessary to secure major contracts, especially with large enterprises and government clients, demands a proven track record and substantial industry experience, which new players often lack.

New entrants face considerable challenges in replicating the deep-seated trust and established networks that Daou Technology has cultivated over years of operation. For instance, in the South Korean IT services market, where Daou Technology is prominent, securing government IT contracts often involves stringent pre-qualification processes that favor vendors with a history of successful project delivery and robust security clearances. In 2023, the South Korean government's IT spending was projected to reach over 20 trillion KRW, representing a significant but highly competitive market where established players have a distinct advantage.

- Established Relationships: Daou Technology benefits from long-standing partnerships with key clients, making it difficult for new entrants to gain initial traction.

- Reputation and Trust: A proven track record and strong industry reputation, essential for winning large contracts, are hard-earned and difficult for new companies to replicate quickly.

- Capital Requirements: Significant upfront investment in infrastructure, talent, and regulatory compliance can deter new entrants.

- Switching Costs: For clients, the cost and complexity of switching from an established provider like Daou Technology to a new one can be a substantial barrier.

The threat of new entrants for Daou Technology is moderate. While high capital requirements for infrastructure and R&D exist, the widespread adoption of public cloud services like AWS, Azure, and Google Cloud significantly lowers entry barriers for specialized IT services. For example, the global cloud market exceeded $1 trillion in 2024, highlighting the accessibility of scalable infrastructure for new players.

| Factor | Impact on New Entrants | Daou Technology's Position |

| Capital Investment | High for core infrastructure, but reduced by cloud platforms | Established infrastructure, but also leverages cloud |

| Technological Expertise | Requires specialized skills, but talent is available | Deep expertise and experienced workforce |

| Market Access & Relationships | Difficult to establish trust and secure large contracts | Strong, long-standing client relationships and reputation |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Daou Technology is built upon a foundation of publicly available financial statements, investor relations materials, and industry-specific market research reports. We also incorporate insights from reputable tech news outlets and competitor announcements to capture the dynamic competitive landscape.