Daou Technology Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Daou Technology Bundle

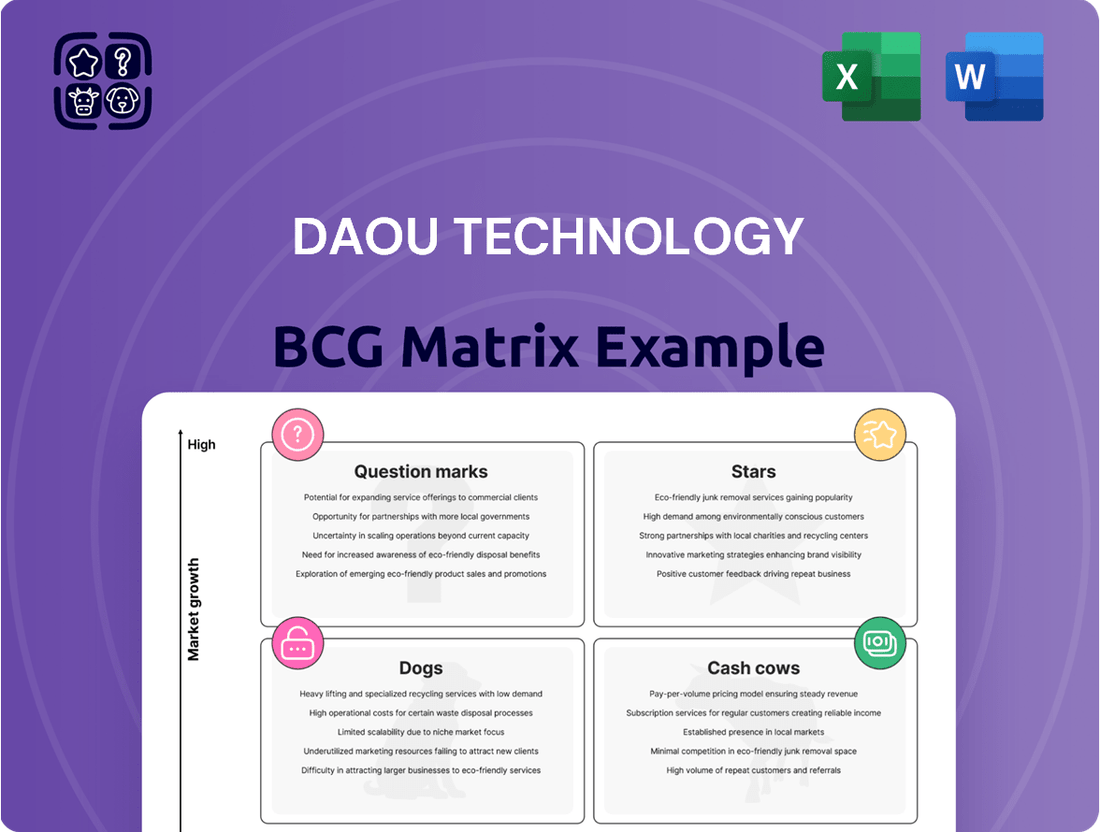

Curious about Daou Technology's market performance? This glimpse into their BCG Matrix reveals key product categories, but the real strategic advantage lies in understanding the full picture.

Unlock the complete BCG Matrix for Daou Technology to pinpoint their Stars, Cash Cows, Dogs, and Question Marks. Purchase the full report for actionable insights and a clear roadmap to optimize their product portfolio and drive future growth.

Stars

Daou Technology's cloud computing solutions, encompassing Daou Cloud and Daou IDC, are strong contenders in the rapidly expanding IT services landscape. The South Korean IT services market is anticipated to hit USD 43.9 billion by 2033, growing at a compound annual growth rate of 6.6% between 2025 and 2033, highlighting a robust domestic demand.

Globally, the cloud market is set to surpass $1 trillion in 2025, fueled by the increasing need for advanced computing power and artificial intelligence. Daou Technology's strategic investments in hyperscale data centers position them to capitalize on this trend, suggesting a significant market share and promising future growth prospects.

Cybersecurity solutions represent a star in Daou Technology's BCG portfolio, driven by South Korea's rapidly expanding digitalization and escalating cyber threats. The global market for DDoS cyber-attack solutions, for instance, is anticipated to hit $5.13 billion by 2025, showcasing a robust 14.3% compound annual growth rate.

Daou Technology's security offerings are strategically positioned to capitalize on this surging demand, pointing to a high-growth market segment. While precise market share figures for Daou's individual security products remain undisclosed, the prevailing market trends suggest these solutions are strong contenders, likely requiring ongoing investment to sustain development and expand market presence.

AI and Big Data Solutions represent a significant growth area within Daou Technology's portfolio. The global cloud AI market is anticipated to surge from $102.09 billion in 2025 to an impressive $589.22 billion by 2032, demonstrating a compound annual growth rate of 28.5%.

Big data solutions, particularly when enhanced with AI capabilities, are instrumental in boosting operational efficiency and analytical precision. The emphasis is increasingly on real-time data processing and sophisticated analytical techniques to derive actionable insights.

Daou Technology's strategic focus on these burgeoning fields, leveraging its expertise in AI and big data, aligns with the sector's robust growth trajectory, positioning the company for substantial expansion and market leadership.

System Integration Services

System Integration Services, as a segment of Daou Technology, likely falls into the Stars category of the BCG Matrix. The South Korean IT services market, which encompasses system integration, is projected to grow significantly, with an estimated compound annual growth rate (CAGR) of 11.5% between 2025 and 2030. This robust expansion suggests a dynamic and expanding market.

Daou Technology's offerings in system integration are well-positioned to capitalize on the ongoing digital transformation trend across various industries. Businesses are increasingly relying on integrated IT systems to enhance efficiency and competitiveness, driving substantial demand for these services.

- Strong Market Growth: The South Korean IT services market, including system integration, is expected to see a 11.5% CAGR from 2025 to 2030.

- Digitalization Driver: Daou Technology's system integration services directly address the growing need for business digitalization.

- High Demand Potential: The increasing adoption of integrated IT solutions by businesses signifies a strong demand for Daou Technology's expertise.

- Market Leadership Opportunity: The combination of market growth and service relevance positions Daou Technology for potential leadership in this segment.

Enterprise Solutions (e.g., Terrace Mail, Unicro, Daou Office)

Daou Technology provides core enterprise solutions such as Terrace Mail, Unicro, and Daou Office, vital for modern business operations and productivity.

These solutions cater to the growing demand for integrated digital workflows. While specific market share data for these Daou products isn't publicly segmented, the broader South Korean market for enterprise resource planning (ERP) and collaboration software experienced significant growth. For instance, the South Korean software market was projected to reach approximately $11.5 billion in 2024, with enterprise software being a substantial contributor.

Daou Technology's established presence and continuous development in these areas indicate a strong foothold. The increasing reliance on cloud-based services and digital collaboration tools by South Korean businesses, including SMEs and large enterprises, fuels the demand for such solutions. Daou's offerings are positioned to benefit from this ongoing digital transformation trend.

- Enterprise Solutions: Terrace Mail, Unicro, Daou Office are key productivity tools.

- Market Trend: Digital transformation and collaboration tools are in high demand in South Korea.

- Market Growth: The South Korean software market, including enterprise solutions, shows robust growth.

- Daou's Position: Long-standing development suggests a strong market position for these offerings.

Daou Technology's AI and Big Data solutions are clearly Stars, given the explosive growth in the global cloud AI market, projected to reach $589.22 billion by 2032 with a 28.5% CAGR. These offerings are crucial for businesses seeking enhanced operational efficiency and analytical insights. The company's focus on these advanced fields positions it for significant expansion and market leadership.

| Daou Technology Segment | BCG Category | Market Growth | Daou's Position |

|---|---|---|---|

| AI and Big Data Solutions | Star | Global cloud AI market to reach $589.22B by 2032 (28.5% CAGR) | Strong alignment with high-growth sector, potential for market leadership |

| Cybersecurity Solutions | Star | Global DDoS attack solutions market to reach $5.13B by 2025 (14.3% CAGR) | Well-positioned to capitalize on surging demand for security offerings |

| System Integration Services | Star | South Korean IT services market (incl. SI) to grow at 11.5% CAGR (2025-2030) | Addresses digital transformation needs, strong demand potential |

What is included in the product

Strategic overview of Daou Technology's product portfolio using the BCG Matrix.

The Daou Technology BCG Matrix provides a clear, one-page overview, instantly relieving the pain of complex portfolio analysis.

Cash Cows

Daou Technology's traditional IT consulting services are firmly positioned as a Cash Cow. With roots tracing back to 1986, the company is a pioneer in South Korea's IT sector, boasting a deep well of experience and a loyal client roster. This maturity translates into predictable, high cash flow generation, a hallmark of Cash Cow businesses.

While the broader IT services market continues its upward trajectory, core consulting offerings represent a more mature, stable segment. Daou Technology's long-standing presence and established market share in these areas allow it to command consistent revenue streams with relatively low investment needs, further solidifying its Cash Cow status.

Products like Ppurio and Enfax represent Daou Technology's established marketing communication solutions, suggesting they are well into their mature product lifecycle. These offerings likely command a solid market share in their respective niches, contributing consistent revenue streams with minimal need for aggressive marketing spend given their long-standing presence.

Daou Technology's established IT infrastructure and outsourcing services, including Daou IDC and Daou Cloud, have been a consistent revenue generator since 2013. These mature offerings, characterized by long-term contracts and high operational efficiency, typically represent Cash Cows within the BCG Matrix. Their stability provides a reliable income stream, fueling investments in other business areas.

Financial IT Solutions via Subsidiaries (e.g., Kiwoom Securities)

Daou Technology's substantial investment in Kiwoom Securities positions this subsidiary firmly within the Cash Cows quadrant of the BCG Matrix. Kiwoom Securities, a dominant player in South Korea's online brokerage sector, benefits from a mature market and a strong, established brand presence.

As a result, Kiwoom Securities is expected to be a consistent and significant generator of profits for Daou Technology. Its operations likely contribute substantial, stable cash flows, underscoring its role as a key cash cow for the broader Daou Technology group.

- Kiwoom Securities' Market Dominance: As of the first quarter of 2024, Kiwoom Securities reported total assets of approximately ₩68.5 trillion (around $50 billion USD), highlighting its significant scale within the South Korean financial landscape.

- Consistent Profitability: For the full year 2023, Kiwoom Securities announced a net profit attributable to equity holders of ₩457.5 billion (approximately $330 million USD), demonstrating its robust and steady earnings power.

- Contribution to Daou Technology: Daou Technology's stake in Kiwoom Securities is a primary driver of its consolidated financial performance, providing a reliable stream of dividends and capital appreciation that fuels other ventures.

Online Commerce Inventory Management (Sabangnet)

Sabangnet, launched by Daou Technology in 2018, is a prime example of a Cash Cow within their portfolio. Holding a substantial 45% market share in the domestic multi-channel management sector, it signifies a mature product that consistently generates significant cash flow.

This strong market position, coupled with the maturity of the multi-channel management market, suggests that Sabangnet is likely to experience slower growth. However, its established dominance ensures a steady and reliable stream of revenue for Daou Technology.

- Market Share: 45% in the domestic multi-channel management market.

- Launch Year: 2018.

- Revenue Generation: High, consistent cash flow due to market maturity and strong competitive advantage.

- Growth Potential: Limited due to market saturation.

Daou Technology's established IT infrastructure and outsourcing services, including Daou IDC and Daou Cloud, have been consistent revenue generators. These mature offerings, characterized by long-term contracts and high operational efficiency, represent stable income streams.

Kiwoom Securities, a dominant player in South Korea's online brokerage sector, benefits from a mature market and a strong brand. As of Q1 2024, its total assets were approximately ₩68.5 trillion, and it reported a 2023 net profit of ₩457.5 billion, underscoring its role as a key cash cow.

Sabangnet, launched in 2018, holds a substantial 45% market share in the domestic multi-channel management sector. This mature product consistently generates significant cash flow, though its growth potential is limited by market saturation.

| Business Unit | BCG Quadrant | Key Financial Indicator (2023/Q1 2024) | Market Position |

| IT Consulting | Cash Cow | Stable, high cash flow generation | Pioneer, loyal client base |

| Ppurio & Enfax | Cash Cow | Consistent revenue streams | Mature product lifecycle, solid market share |

| Daou IDC & Daou Cloud | Cash Cow | Reliable income stream | Established IT infrastructure, long-term contracts |

| Kiwoom Securities | Cash Cow | 2023 Net Profit: ₩457.5 billion | Dominant online brokerage |

| Sabangnet | Cash Cow | High, consistent cash flow | 45% domestic multi-channel management market share |

What You’re Viewing Is Included

Daou Technology BCG Matrix

The Daou Technology BCG Matrix preview you are viewing is the identical, fully formatted document you will receive upon purchase. This means no watermarks, no demo content, and no surprises – just the complete, analysis-ready strategic tool for evaluating Daou Technology's product portfolio. You can confidently use this preview as a direct representation of the high-quality, professionally designed BCG Matrix that will be immediately downloadable for your business planning needs.

Dogs

Legacy hardware sales for Daou Technology likely represent a 'Dog' in the BCG matrix. Historically, the company transitioned away from hardware due to declining profit margins, indicating that any residual sales are probably in a low-growth sector with a small market footprint and negligible profitability.

Daou Technology's older, unmaintained proprietary software versions, such as legacy groupware or enterprise solutions, would likely be classified as Dogs in a BCG Matrix. These products probably hold a minimal market share because more modern and feature-rich alternatives have emerged.

The growth potential for these outdated software versions is also very limited. For instance, if Daou Technology's initial groupware solution, developed perhaps in the early 2000s, hasn't seen significant updates, its adoption rate would naturally decline as businesses seek cloud-based, AI-integrated collaboration tools.

Niche or Specialized Services with Limited Market Demand, within Daou Technology's BCG Matrix, would encompass highly specialized IT services experiencing a downturn in demand or possessing a very narrow customer base. Without substantial innovation or adaptation, these offerings would find it challenging to grow their market share in a low-growth sector.

Underperforming International Ventures

Underperforming international ventures for Daou Technology, despite its presence in markets like Japan, China, Indonesia, and France, would be classified as Dogs. These are ventures with a low market share in industries experiencing slow growth. For instance, a specific localized software product launched in France that failed to capture significant user adoption, resulting in minimal revenue and a negligible market position within the French tech sector, would exemplify a Dog.

These ventures typically consume resources without generating substantial returns, hindering overall portfolio efficiency. Imagine a Daou Technology subsidiary in Indonesia that invested heavily in a niche hardware component, but due to intense competition and limited demand, it only managed to secure a 1.5% market share in a market projected to grow at a modest 3% annually. This scenario highlights the characteristics of a Dog.

- Low Market Share: Ventures holding a small percentage of their respective foreign markets.

- Slow Market Growth: Operating in industries or regions with limited expansion potential.

- Resource Drain: Consuming capital and management attention without commensurate returns.

- Example: A Daou Technology subsidiary in Japan focused on a legacy software solution that saw its market shrink by 2% year-over-year, with the company holding only a 2% market share.

Services with High Maintenance Costs and Low Scalability

Services with high maintenance costs and low scalability are classified as Dogs in the Daou Technology BCG Matrix. These are offerings that demand significant resources for upkeep or operations but struggle to expand their reach or revenue streams. For instance, a highly specialized legacy software maintenance service that requires dedicated, skilled personnel for each client, with limited ability to onboard new customers efficiently, would fall into this category. Such services can become a drain on financial and human capital, hindering overall company growth.

These offerings often represent a challenge for Daou Technology, as they consume operational budgets without contributing proportionally to market share or future growth potential. Consider a scenario where a bespoke IT support service for a niche industry requires constant updates and on-site intervention for a small, declining client base. In 2024, such a service might represent only 2% of Daou Technology's total revenue but consume 8% of its operational expenditure, illustrating the resource imbalance.

- Legacy System Support: Offering maintenance for outdated enterprise software that requires specialized, expensive expertise and cannot be easily replicated for new clients.

- Highly Customized Hardware Solutions: Providing unique, hardware-dependent services that are costly to maintain and adapt for a broad market.

- Niche Consulting with High Overhead: Specialized advisory services that necessitate significant on-site presence or unique infrastructure for each engagement, limiting scalability.

Daou Technology's legacy hardware sales are likely Dogs, characterized by low market share and slow growth, as the company shifted focus due to declining margins. Older, unmaintained proprietary software versions also fall into this category, facing competition from modern alternatives and experiencing limited adoption.

Niche or specialized IT services with dwindling demand or a very narrow customer base, without innovation, struggle to grow market share in low-growth sectors. Underperforming international ventures, such as a localized software product in France with minimal adoption, also represent Dogs due to low market share in slow-growing industries.

These ventures consume resources without significant returns, impacting portfolio efficiency. For instance, a Daou Technology subsidiary in Indonesia focused on niche hardware might hold only a 1.5% market share in a market projected for 3% annual growth, exemplifying a Dog.

Services with high maintenance costs and low scalability, like legacy software support, are classified as Dogs. These offerings drain capital and human resources, hindering overall company growth, as seen in bespoke IT support services consuming 8% of operational expenditure for only 2% of revenue in 2024.

| BCG Category | Daou Technology Examples | Market Characteristics | Financial Implications |

|---|---|---|---|

| Dogs | Legacy Hardware | Low Market Share, Slow Growth | Negligible Profitability, Resource Drain |

| Dogs | Outdated Proprietary Software | Minimal Market Share, Declining Adoption | Low Revenue Contribution, High Obsolescence Risk |

| Dogs | Niche IT Services with Limited Demand | Narrow Customer Base, Stagnant Growth | Low Scalability, High Operational Overhead |

| Dogs | Underperforming International Ventures | Small Market Share in Slow-Growing Regions | Resource Consumption Without Commensurate Returns |

Question Marks

Emerging AI-powered services, distinct from core big data solutions, represent Daou Technology's potential Stars in the BCG Matrix. These are innovative offerings, perhaps in areas like advanced AI-driven cybersecurity or personalized AI educational platforms, that are currently in early adoption phases. Daou Technology is actively cultivating market share in these nascent but high-growth segments of the AI landscape.

These services exhibit high growth potential due to the booming AI market, but Daou Technology's current market share is relatively low. Significant investment is necessary to nurture these ventures, positioning them for future dominance. For instance, Daou Technology's recent investment in AI-powered medical diagnostics, a field projected to grow by 30% annually through 2028, exemplifies this strategy.

Daou Technology's new cloud-native security offerings are positioned as Stars within the BCG matrix. The cloud security market, projected to reach $137.5 billion by 2027 according to Mordor Intelligence, is a high-growth area. Daou's innovative solutions, designed for the dynamic cloud environment, aim to capture significant market share by addressing emerging threats and leveraging new technologies.

Daou Technology's advanced big data analytics platforms, focusing on next-generation AI and machine learning integration, are positioned as question marks. These platforms tap into a rapidly expanding market, with global big data analytics market size projected to reach $358.6 billion by 2027, indicating strong growth potential.

Despite this market's upward trajectory, these platforms demand significant capital for research, development, and market penetration to secure a substantial market share. Daou Technology's commitment to these areas reflects a strategic bet on future data utilization trends.

IoT Integration Services

Daou Technology's IoT integration services likely fall into the question mark category of the BCG matrix. The South Korean ICT market is experiencing robust growth in IoT services, with projections indicating continued expansion. For instance, the Korean government has been actively promoting smart city initiatives and industrial IoT adoption, creating a fertile ground for such services.

If Daou Technology is significantly expanding its offerings in comprehensive IoT integration, this positions them within a high-growth market. However, establishing a strong market presence requires substantial investment to compete effectively against established players and emerging technologies. This strategic move, while promising, demands careful resource allocation and a clear path to market leadership.

- Market Growth: South Korea's IoT market is projected to reach over $30 billion by 2025, driven by smart factories and connected vehicles.

- Investment Needs: Significant capital expenditure is required for R&D, talent acquisition, and marketing to build a competitive IoT integration offering.

- Competitive Landscape: Daou Technology faces competition from both global tech giants and specialized local ICT firms already entrenched in the IoT space.

- Strategic Focus: Success hinges on differentiating Daou's services and securing key partnerships to capture market share in this dynamic sector.

Specific Niche AI/Cloud Partnerships or Joint Ventures

Daou Technology's strategic focus on niche AI/cloud partnerships and joint ventures places them in the question mark category of the BCG matrix. These ventures target high-growth, specialized areas like AI-driven cybersecurity or quantum computing cloud solutions.

For instance, a potential joint venture in early 2024 with a leading AI research firm to develop predictive maintenance solutions for the industrial sector would exemplify this. While the market for AI in industrial IoT is projected to grow significantly, Daou's initial market share in this specific niche would be minimal, making the venture's success uncertain but offering high potential returns.

- Targeting Emerging AI Niches: Partnerships in areas like AI-powered drug discovery or specialized cloud infrastructure for autonomous vehicles represent question marks due to their nascent market development and unproven commercial viability.

- Strategic Investment for Future Growth: Ventures in these specialized domains, such as a 2024 collaboration to build a federated learning platform for healthcare data, require substantial upfront investment with uncertain future market share but the potential to capture a dominant position in a rapidly evolving field.

- High Risk, High Reward Potential: The success of these joint ventures hinges on technological breakthroughs and market adoption, positioning them as high-risk, high-reward opportunities that demand careful strategic evaluation and resource allocation.

Daou Technology's advanced big data analytics platforms, particularly those integrating next-generation AI and machine learning, are classified as question marks. The global big data analytics market is experiencing robust expansion, projected to reach $358.6 billion by 2027.

These platforms require substantial investment in research, development, and market penetration to gain significant market share, despite the market's strong growth trajectory. Daou Technology's strategic investment in these areas reflects a forward-looking approach to data utilization.

Daou Technology's IoT integration services are also categorized as question marks. The South Korean ICT market shows significant growth in IoT, with government initiatives like smart cities providing a boost. Capturing market share in this competitive landscape demands considerable investment.

Daou's niche AI/cloud partnerships and joint ventures, targeting areas like AI-driven cybersecurity, are question marks. For example, a 2024 venture to develop predictive maintenance solutions for industry, while targeting a growing market, would start with minimal market share, making its success uncertain but potentially highly rewarding.

| Business Unit | Market Growth | Relative Market Share | BCG Category | Strategic Implication |

|---|---|---|---|---|

| Advanced Big Data Analytics (AI/ML Integrated) | High (Projected $358.6B by 2027) | Low | Question Mark | Requires significant investment for market share gain. |

| IoT Integration Services (South Korea) | High (Driven by smart city initiatives) | Low | Question Mark | Needs substantial capital for R&D and market entry. |

| Niche AI/Cloud Partnerships (e.g., Predictive Maintenance) | High (Specific AI niches) | Very Low (Nascent) | Question Mark | High risk, high reward; dependent on technological breakthroughs. |

BCG Matrix Data Sources

Our Daou Technology BCG Matrix leverages comprehensive financial reports, industry-specific market research, and publicly available business intelligence to provide a clear strategic overview.