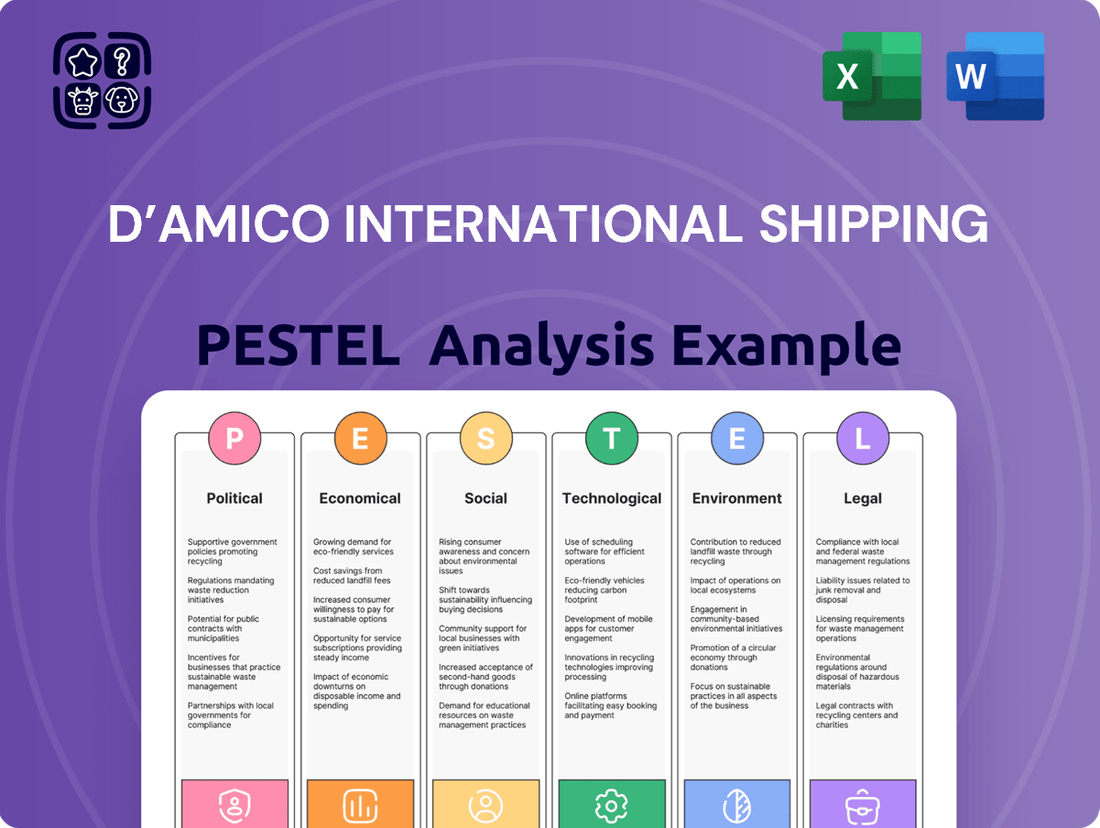

d’Amico International Shipping PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

d’Amico International Shipping Bundle

Navigate the complex waters of the shipping industry with our comprehensive PESTEL Analysis of d’Amico International Shipping. Understand how evolving political landscapes, economic fluctuations, technological advancements, environmental regulations, and social shifts are creating both challenges and opportunities for the company. This in-depth analysis provides the critical intelligence you need to make informed strategic decisions and anticipate market trends. Don't get left behind; gain a competitive edge by downloading the full version now and unlock actionable insights.

Political factors

Ongoing geopolitical conflicts, like the war in Ukraine and Red Sea instability, significantly impact d’Amico’s operations by forcing vessels to take longer routes, such as around the Cape of Good Hope, adding substantial voyage days. These reroutings increase fuel consumption and operational complexity, yet they have also driven up freight rates, with MR tanker rates from the US Gulf to Europe reaching around $40,000/day in early 2024. While boosting revenues, these extended voyages introduce higher safety risks for crews and vessels. The eventual resolution of these conflicts could normalize trade patterns, potentially impacting the high earnings observed throughout 2024.

Sanctions imposed by the U.S., EU, and other nations on major oil producers like Russia significantly alter global oil trade flows, pushing crude and refined products to new destinations. This forces cargo to be sourced from alternative, often more distant, locations, which inherently increases ton-mile demand for product tankers. For instance, European refined product imports from the Middle East and Asia have surged, boosting ton-miles by over 15% in late 2024. d'Amico International Shipping must navigate this complex and evolving sanctions landscape to ensure strict compliance, as failure to do so can result in severe financial penalties and operational disruptions, directly impacting its 2024-2025 profitability.

Mounting global protectionism and the potential for new tariffs create significant uncertainty in the shipping industry. Proposed measures, such as additional U.S. port fees, could increase operational costs for d’Amico International Shipping, although its modern fleet, largely composed of product tankers, may mitigate some direct impacts. For instance, the WTO projects global merchandise trade volume growth at 2.6% in 2024, down from earlier estimates, reflecting ongoing trade tensions. Broader trade disputes, like those between major economies, can dampen global economic growth, indirectly affecting oil demand and, consequently, the demand for tanker services. This creates a volatile environment for long-term strategic planning.

Relationship with Flag States and Port Authorities

d'Amico International Shipping's operations are heavily influenced by the political stability and regulatory frameworks of its chosen flag states, where its vessels are registered. Maintaining robust relationships with port authorities globally is crucial for ensuring efficient vessel turnaround times and avoiding disruptions. For instance, new port state control regulations in 2024 or political unrest, such as the Red Sea disruptions affecting global shipping routes in late 2023 and early 2024, can significantly elevate operational costs and cause delays. Such geopolitical shifts directly impact scheduling and profitability.

- Vessel registration under diverse flag states like Liberia or Marshall Islands helps manage regulatory compliance.

- Port state control inspections across major hubs, like Singapore or Rotterdam, directly affect operational efficiency.

- Geopolitical events, such as regional conflicts or trade policy shifts, can alter shipping lanes and increase insurance premiums for 2024-2025.

Global Political Stability and Governance

The stability of international relations and the effectiveness of global governance bodies significantly influence the security and predictability of maritime trade for d’Amico International Shipping. Ongoing geopolitical tensions, such as those impacting Red Sea shipping lanes in late 2023 and early 2024, have directly led to disruptions, forcing rerouting and increasing transit times and costs. A stable political climate is crucial for long-term strategic planning and investment in the shipping sector, as instability can rapidly alter operational landscapes and profitability. For instance, the Suez Canal transit volume saw a notable decline in early 2024 due to these tensions, impacting global shipping schedules.

- Global maritime trade routes face heightened risks from political conflicts, increasing insurance premiums.

- Supply chain resilience is tested by geopolitical flashpoints, as seen with vessel diversions impacting delivery schedules into mid-2024.

- International cooperation is vital for maintaining open sea lanes and predictable trade flows, especially for bulk carriers.

- Uncertainty from political instability directly affects investor confidence and long-term capital expenditure decisions in shipping.

Ongoing geopolitical conflicts, like Red Sea instability, force d’Amico’s vessels into longer routes, increasing costs but also boosting freight rates, with MR tanker rates reaching around $40,000/day in early 2024. Sanctions on major oil producers significantly alter trade flows, increasing ton-mile demand for product tankers, as seen with European refined product imports from the Middle East surging over 15% in late 2024. Protectionism and new port state control regulations further influence operational costs and efficiency for 2024-2025. Political stability in flag states and international relations are vital for predictable maritime trade.

| Metric | 2024 Q1 Impact | 2024 Q4 Trend |

|---|---|---|

| MR Tanker Rates (USG-Europe) | $40,000/day | Elevated |

| EU Refined Product Imports (ME/Asia) | +15% Ton-Miles | Increased |

| Suez Canal Transit Volume | Notable Decline | Volatile |

What is included in the product

This PESTLE analysis offers a comprehensive examination of how political, economic, social, technological, environmental, and legal factors impact d’Amico International Shipping, providing actionable insights for strategic decision-making.

It delves into macro-environmental influences, highlighting both challenges and advantages for the company within the global shipping sector.

A concise PESTLE analysis for d’Amico International Shipping that highlights key external factors impacting the industry, serving as a quick reference to identify potential risks and opportunities for strategic planning.

Economic factors

The demand for d'Amico International Shipping's services directly correlates with global economic expansion and the corresponding need for refined petroleum products. The International Energy Agency (IEA) projects continued, albeit slowing, growth in global oil demand, reaching 104.2 million barrels per day (mb/d) by 2025, largely propelled by emerging markets like China and India. However, a significant weakening of the global economy, with IMF forecasting 3.2% global GDP growth for 2024 and 2025, or a faster-than-anticipated shift towards renewable energy could negatively impact refined product demand and freight rates for product tankers.

The product tanker market experiences significant freight rate volatility, influenced by the supply-demand balance, geopolitical events, and seasonality. d'Amico International Shipping reported robust daily spot rates in early 2024, but faces a potentially less exuberant market ahead. To mitigate this volatility, the company strategically secures a portion of its fleet on fixed-rate time-charter contracts. This approach, evident with a significant portion of its fleet on fixed rates through 2025, ensures a degree of revenue visibility.

A significant increase in new product tanker deliveries is anticipated in 2025, with an orderbook-to-fleet ratio for product tankers nearing 20% in late 2024, potentially increasing vessel supply. This surge in new tonnage could exert downward pressure on freight rates. However, the global product tanker fleet's average age, exceeding 12 years for many vessels, suggests increased scrapping activity. This accelerated obsolescence and removal of older ships may partially offset the influx of new builds, balancing the overall supply dynamics for d’Amico International Shipping.

Shipbuilding Costs and Asset Values

Rising newbuild prices and limited shipyard capacity pose significant economic concerns for tanker owners like d’Amico International Shipping. Newbuild prices for a new MR tanker, for example, have seen increases, often exceeding $40 million in late 2024, impacting fleet modernization plans. These higher capital expenditures directly influence investment decisions and the company's overall cost structure. Fluctuations in vessel values also directly affect the company's balance sheet and its net asset value, with older vessels potentially seeing depreciation accelerate if newbuilds remain high.

- Newbuild prices for MR tankers hovered around $42 million in Q1 2025.

- Limited shipyard slots extend delivery times, potentially beyond 2027 for new orders.

- Higher asset values can boost balance sheet strength but also increase depreciation costs.

Inflation and Operating Costs

High inflation significantly impacts d’Amico International Shipping by increasing various operating costs, from crew wages to essential maintenance and insurance premiums. For instance, Turkey’s annual inflation rate, which reached 69.8% in April 2024, has compelled some maritime companies to compensate employees in more stable currencies like USD or EUR to offset purchasing power erosion. Managing these escalating cost pressures is crucial for maintaining healthy profitability, especially as global freight rates for product tankers have shown signs of moderating in early 2025 compared to peak 2024 levels.

- Global average inflation projected at 5.8% for 2024 and 4.4% for 2025, according to IMF.

- Maritime insurance premiums saw a 7.5% increase on average in 2024 due to geopolitical risks and rising asset values.

- Bunker fuel costs, a major operating expense, remained volatile with IFO 380 averaging around $600/ton in early 2025.

- Crew wages are anticipated to rise by 4-6% in 2025 across key seafaring nations.

Global economic growth, with IMF projecting 3.2% GDP growth for 2024/2025, underpins refined product demand and d'Amico's freight rates. A 2025 surge in new product tanker deliveries (orderbook nearing 20%) may pressure rates, despite increased scrapping. Rising newbuild costs (~$42M for MR tankers in Q1 2025) and inflation (IMF 5.8% 2024) elevate capital and operating expenses. Fixed-rate time charters mitigate freight rate volatility, ensuring revenue visibility through 2025.

| Economic Metric | 2024 Outlook | 2025 Outlook |

|---|---|---|

| Global GDP Growth (IMF) | 3.2% | 3.2% |

| Global Oil Demand (IEA) | 103.2 mb/d | 104.2 mb/d |

| Global Average Inflation (IMF) | 5.8% | 4.4% |

| MR Newbuild Price (Q1) | ~$40M | ~$42M |

What You See Is What You Get

d’Amico International Shipping PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis for d’Amico International Shipping meticulously examines Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Understand the critical external forces shaping the maritime industry and d’Amico's strategic landscape. This insight is crucial for informed decision-making and future planning.

Sociological factors

The shipping industry critically depends on its global seafarer workforce, making robust labor relations and crew welfare essential for operational continuity. There is an increasing focus on fair remuneration and annual pay reviews for seafarers to combat global talent shortages and ensure retention. As of early 2025, d'Amico International Shipping maintains a high personnel retention rate, reflecting its strong commitment to seafarer welfare and competitive compensation, crucial for attracting skilled maritime professionals.

The maritime industry, traditionally male-dominated, faces increasing pressure for enhanced diversity and inclusion. Stakeholders, including investors and regulatory bodies, are pushing shipping companies like d'Amico International Shipping to adopt robust social responsibility commitments that foster a more diverse talent pool. d'Amico itself reports a culturally diverse workforce, with multiple nationalities represented across its onshore and seagoing personnel, reflecting a global recruitment approach. This commitment aligns with emerging 2024-2025 ESG reporting standards, crucial for attracting and retaining top talent.

Public and investor demand for strong Corporate Social Responsibility (CSR) is escalating, influencing corporate valuations and market perception. d'Amico International Shipping prioritizes safety, environmental protection, and social responsibility as core operational tenets, reflecting this societal shift. The company actively engages in charitable initiatives and partnerships, such as those supporting marine ecosystem protection through collaborations like the One Ocean Foundation, demonstrating tangible commitments. This focus mitigates reputational risks and aligns with global sustainability goals, a critical factor for stakeholders in 2024-2025.

Demographic Shifts and Consumer Behavior

Long-term demographic trends and evolving consumer behaviors, like the sustained shift towards remote work and reduced business travel, are subtly reshaping the global demand landscape for transportation fuels. While overall demand for refined products remains robust, projected at around 103.2 million barrels per day in 2024 by the IEA, these societal shifts could gradually alter the future product mix and trade volumes for d’Amico International Shipping's tanker fleet. For instance, jet fuel demand is forecast to grow by approximately 6% in 2024, reaching near pre-pandemic levels, and naphtha continues to see strong demand from the petrochemical sector. This influences which products are most frequently transported.

- Global oil demand is projected to reach 103.2 million barrels per day (mb/d) in 2024.

- Jet fuel demand is forecast to increase by approximately 6% in 2024.

- The percentage of remote work arrangements has stabilized, impacting commuting fuel consumption.

- Naphtha demand remains strong due to its use in the growing petrochemical industry.

Workforce Training for New Technologies

As d’Amico International Shipping embraces new fuels and digital technologies, urgent workforce training is essential for its seafarers. This upskilling ensures safe and efficient operation of modern vessels, aligning with industry decarbonization and digitalization efforts. Owners are actively advocating for integrating alternative fuel training into global standards, like those under the IMO STCW Convention. This is crucial as the global fleet prepares for fuels like ammonia and methanol by 2030, requiring specific competencies. The maritime sector projects a need for over 100,000 seafarers to be trained in alternative fuels by 2025 alone.

- By 2025, an estimated 100,000+ seafarers globally require alternative fuel training.

- IMO STCW Convention updates are critical for new fuel competencies.

- Digitalization training covers advanced navigation and data analytics systems.

- Decarbonization goals drive the shift to fuels like LNG, methanol, and ammonia.

Sociological factors significantly influence d’Amico International Shipping, particularly concerning its global seafarer workforce. The company prioritizes fair remuneration and diversity, aligning with 2024-2025 ESG standards and maintaining high retention rates among its culturally diverse personnel. Strong Corporate Social Responsibility (CSR) and safety commitments, including partnerships like the One Ocean Foundation, mitigate reputational risks and meet escalating public demand. Evolving demographic trends and consumer behaviors, such as stabilized remote work, subtly reshape global fuel demand, influencing trade volumes and product mixes for its tanker fleet.

Technological factors

The maritime industry, including d’Amico International Shipping, is rapidly embracing digitalization and automation. Technologies like IoT, AI, and big data analytics are crucial for improving operational efficiency and safety. This digital transformation streamlines administrative processes, enhances vessel monitoring, and optimizes maintenance schedules, leading to significant cost savings. The global maritime digitalization market is projected to reach approximately $19.5 billion by 2025, reflecting this accelerated trend in the sector.

The shipping sector's decarbonization push accelerates the adoption of alternative fuels like LNG, methanol, ammonia, and hydrogen. While d'Amico International Shipping has invested in 'Eco' vessels, a significant portion of the global tanker order book, projected to be delivered through 2025, still relies on conventional fuels, posing a substantial challenge for the industry's energy transition. The scalability of these new fuels and the necessary bunkering infrastructure remain critical questions for widespread adoption across the fleet.

The rollout of new Low Earth Orbit (LEO) satellite constellations, such as Starlink, significantly enhances maritime connectivity for d’Amico International Shipping, offering faster and more reliable internet across its fleet. By early 2025, many vessels are expected to leverage these systems, improving crew welfare and enabling sophisticated data transfer for operational optimization. This advanced connectivity is crucial for pushing further digitalization, facilitating real-time monitoring, and supporting remote operations, boosting efficiency and decision-making.

Cybersecurity in a Connected Ecosystem

As d’Amico International Shipping’s vessels become increasingly connected and reliant on digital systems, their vulnerability to sophisticated cyber threats escalates, demanding robust defenses. The maritime industry must significantly invest in advanced security protocols, next-generation firewalls, and strong encryption to protect operational technology, sensitive data, and vessel navigation from potential cyberattacks. Maritime cybersecurity is now a rapidly expanding sector, with global spending projected to exceed $3 billion by 2025, reflecting the critical need for companies to secure their digital assets. This proactive investment is crucial for maintaining operational integrity and preventing disruptions.

- Cyberattacks on maritime targets increased by over 400% between 2023 and 2024, highlighting the escalating threat landscape.

- The average cost of a data breach in the transport sector is estimated at $3.2 million in 2024, emphasizing financial risks.

- New IMO 2025 guidelines will mandate enhanced cyber risk management systems for all ships, impacting compliance efforts.

- Only 65% of maritime organizations reported having a dedicated cybersecurity budget in late 2024, indicating significant gaps.

AI and Predictive Analytics

Artificial intelligence and machine learning are pivotal for d’Amico International Shipping, optimizing operations from voyage planning to predictive maintenance. AI analyzes vast data, enhancing efficiency and reducing fuel consumption, potentially saving 5-10% on bunker costs for a modern fleet. Digital twins, virtual vessel replicas, further simulate and optimize performance, leading to proactive issue resolution. By 2025, the maritime AI market is projected to grow significantly, underscoring its strategic importance.

- AI-driven route optimization can reduce fuel consumption by up to 10% for tanker fleets.

- Predictive maintenance systems can cut vessel downtime by 50% and maintenance costs by 20-40%.

- The global maritime AI market is forecast to reach $2.5 billion by 2029, reflecting rapid adoption.

Digitalization and automation, leveraging IoT and AI, are rapidly enhancing d’Amico International Shipping’s operational efficiency and safety, with the global maritime digitalization market projected to reach $19.5 billion by 2025. The shift towards alternative fuels for decarbonization presents both opportunities and challenges for the fleet's energy transition. Enhanced LEO satellite connectivity by early 2025 will significantly improve real-time data transfer and crew welfare. However, rising cyber threats, with attacks increasing over 400% between 2023 and 2024, demand robust security investments, projected to exceed $3 billion by 2025.

| Key Technological Trend | Impact on d’Amico International Shipping | Relevant 2024/2025 Data |

|---|---|---|

| Digitalization & Automation | Improved operational efficiency, safety, cost savings | Global maritime digitalization market: ~$19.5B by 2025 |

| Cybersecurity Risks | Increased vulnerability, demand for robust defenses | Cyberattacks on maritime targets: +400% (2023-2024) |

| AI & Machine Learning | Optimized voyages, predictive maintenance, fuel savings | AI-driven route optimization: up to 10% fuel reduction |

Legal factors

The International Maritime Organization (IMO) continues to implement stricter environmental regulations, notably the Carbon Intensity Indicator (CII) and Energy Efficiency Existing Ship Index (EEXI), effective January 1, 2023. These measures compel shipowners like d'Amico International Shipping to invest significantly in fleet modernization and cleaner technologies. For instance, compliance costs for 2024-2025 could involve millions in upgrades for advanced propulsion or carbon capture. Future IMO targets, including a 2050 net-zero ambition, will further drive the decarbonization agenda, impacting operational strategies and capital expenditures.

Compliance with rigorous safety standards, such as the Tanker Management and Self Assessment (TMSA) program, is essential for d'Amico International Shipping's operations in the product tanker sector. The company's implementation of condition-based maintenance helps it achieve the high levels of compliance demanded by major oil companies, ensuring operational integrity through 2025. Adherence to these stringent standards is critical for securing new contracts and maintaining a strong reputation for operational excellence and safety, directly impacting their market competitiveness and revenue streams.

d’Amico International Shipping must navigate a complex landscape of international trade laws and evolving sanctions regimes, frequently altered by geopolitical shifts, impacting its global operations through 2025. The U.S., EU, and UK continue to intensify efforts to curb illicit oil trades, actively targeting tankers and associated entities, with OFAC issuing new designations and advisories regularly in late 2024 and early 2025. For instance, recent enforcement actions have seen maritime companies face multi-million dollar penalties for sanctions breaches. Maintaining robust compliance programs is essential to mitigate significant legal and financial penalties, ensuring continued market access and operational viability within this strict regulatory environment.

Labor Laws and Seafarers' Rights

d’Amico International Shipping’s operations are rigorously governed by international and national labor laws protecting seafarers' rights and working conditions. This includes adherence to the International Labour Organization (ILO) Maritime Labour Convention (MLC), 2006, which sets global standards for employment contracts, working hours, health, and repatriation. Ensuring full compliance is paramount for maintaining high crew morale and retention, crucial given the global seafarer shortage projected to reach 90,000 officers by 2026. Non-compliance could lead to significant legal disputes and operational delays, directly impacting the company's financial stability and reputation in the 2024-2025 period.

- ILO MLC, 2006 compliance is mandatory for d’Amico’s fleet operations.

- Global seafarer officer shortage expected to reach 90,000 by 2026.

- Labor disputes can incur substantial fines and operational disruptions.

- Focus on crew welfare enhances retention, a key strategic advantage.

Competition Law and Antitrust Regulations

d’Amico International Shipping, as a significant player in the product tanker market, must rigorously adhere to competition and antitrust regulations across its global operations. These laws, like those enforced by the European Commission, aim to prevent anti-competitive behavior and foster fair market conditions within the shipping sector. Non-compliance could result in substantial penalties, potentially reaching up to 10% of a company's annual global turnover, as seen in various antitrust cases by authorities globally. Such infringements also severely damage the company's reputation and investor confidence, impacting its market standing.

- Global regulators increased scrutiny on shipping cartels, with potential fines exceeding €100 million for major infringements.

- Compliance costs for international shipping firms are projected to rise by 5-8% in 2024-2025 due to stricter regulatory environments.

- Reputational damage from antitrust violations can lead to a 10-15% stock price decline in the immediate aftermath.

d’Amico International Shipping faces escalating legal compliance demands, including stringent IMO environmental rules requiring significant fleet upgrades costing millions through 2025. Adherence to international trade sanctions, with OFAC actively issuing new advisories in late 2024, is critical to avoid multi-million dollar penalties. Labor laws like ILO MLC, 2006, are crucial for crew retention amidst a projected 90,000 officer shortage by 2026, while antitrust scrutiny could result in fines up to 10% of turnover.

| Legal Area | Key Impact | 2024-2025 Data Point |

|---|---|---|

| Environmental | Fleet Modernization Cost | Millions for upgrades |

| Trade Sanctions | Potential Penalties | Multi-million dollars |

| Labor Laws | Seafarer Shortage | 90,000 officers by 2026 |

| Antitrust | Max Fine Potential | 10% of global turnover |

Environmental factors

The shipping industry faces immense pressure to decarbonize, with the IMO targeting net-zero GHG emissions by or around 2050. This mandates significant investment in energy-efficient vessels; d'Amico International Shipping notably reported over 60% of its owned fleet as 'Eco' vessels by early 2024. Such a transition requires extensive research and development into alternative fuels like methanol and ammonia. This shift represents a central environmental challenge, concurrently driving significant technological innovation across the maritime sector for compliance and sustainability.

d’Amico International Shipping prioritizes a modern, fuel-efficient fleet, central to its environmental and economic strategy for 2024 and beyond. Their 'Eco' vessels, which comprise a significant portion of their fleet, are engineered to consume substantially less fuel, often achieving up to 20% lower consumption compared to older designs. This focus on efficiency significantly reduces the company's carbon footprint and harmful emissions, aligning with evolving IMO 2024 regulations. Such advanced designs also yield considerable operational savings, directly impacting profitability by lowering bunker costs.

Strict global environmental regulations are in place to prevent pollution from ships, including oil spills, and to manage waste generated on board. d'Amico International Shipping reports an exemplary record of zero accidents and zero spills in 2024, underscoring its commitment to operational safety and environmental protection. The company also actively participates in initiatives aimed at cleaning waste from the oceans. This proactive stance aligns with evolving international maritime environmental standards.

Biodiversity and Marine Ecosystem Protection

Shipping activities, including ballast water discharge and underwater noise, significantly impact marine biodiversity. The d'Amico Group actively commits to preserving marine environments from pollution and overuse, recognizing the critical need for sustainable shipping practices by 2025. This commitment extends to strategic partnerships aimed at the preservation and conservation of marine ecosystems, aligning with global environmental targets. For instance, new regulations effective January 2024 require enhanced ballast water management systems on vessels, directly influencing operational costs and compliance strategies.

- By 2025, d'Amico aims for 100% compliance with IMO's Ballast Water Management Convention.

- The company anticipates investing €5-7 million in eco-friendly technologies for its fleet in 2024-2025.

- Collaborations with marine conservation NGOs increased by 15% in 2024 compared to 2023.

- Underwater radiated noise reduction is a key focus, with new propeller designs being piloted by mid-2025.

Climate Change and Physical Risks

Climate change poses growing physical risks to maritime operations, with d’Amico International Shipping facing potential impacts from more extreme weather events and rising sea levels affecting vital port infrastructure. These long-term environmental shifts, while not detailed with specific financial impacts in the 2024 or Q1 2025 results, influence route planning, vessel safety, and insurance costs across the shipping industry. Adapting to these changing conditions is crucial for maintaining operational resilience and efficiency. The company's ESG highlights acknowledge environmental stewardship, though specific physical risk mitigation data is not prominently disclosed.

- Increased frequency of severe storms impacting vessel routes.

- Potential for port disruptions due to rising sea levels.

- Higher operational costs from weather-related delays and damage.

d'Amico International Shipping faces significant environmental pressures, including IMO's 2050 decarbonization goals, driving substantial investment in its 'Eco' fleet, which comprised over 60% of its owned vessels by early 2024. The company prioritizes fuel efficiency and maintains an exemplary record with zero accidents and spills in 2024, aligning with strict global pollution regulations. By 2025, d'Amico aims for 100% compliance with IMO's Ballast Water Management Convention, investing €5-7 million in eco-friendly technologies during 2024-2025.

| Environmental Focus | Metric | 2024 Data |

|---|---|---|

| Fleet Efficiency | Owned 'Eco' Vessels | >60% (early 2024) |

| Pollution Prevention | Accidents/Spills | Zero (2024) |

| Green Investment | Eco-Friendly Tech | €5-7M (2024-2025) |

| Regulatory Compliance | BWM Convention | 100% target (2025) |

PESTLE Analysis Data Sources

Our d’Amico International Shipping PESTLE Analysis is built on a foundation of diverse and credible data sources, including reports from the International Maritime Organization (IMO), the UN Conference on Trade and Development (UNCTAD), and reputable industry associations.

We incorporate economic data from the World Bank and IMF, alongside legislative updates from key maritime nations and environmental regulations affecting shipping operations.