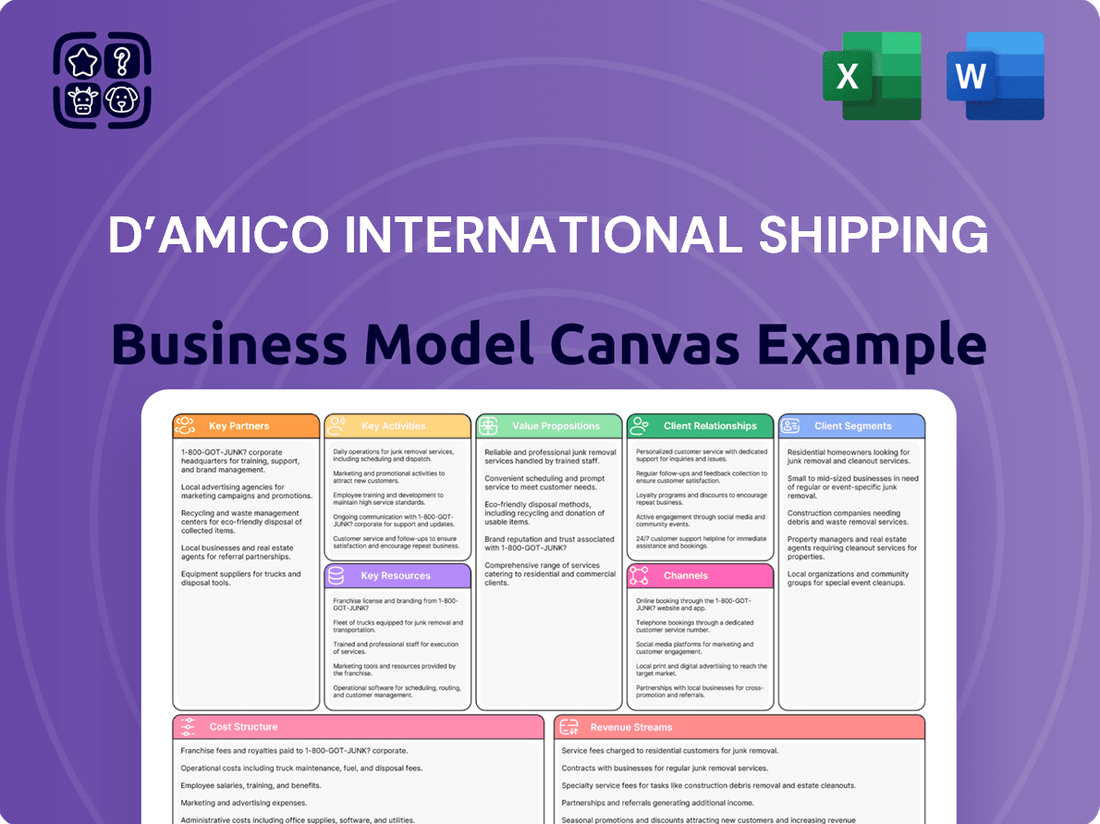

d’Amico International Shipping Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

d’Amico International Shipping Bundle

Unlock the full strategic blueprint behind d’Amico International Shipping's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Dive deeper into d’Amico International Shipping’s real-world strategy with the complete Business Model Canvas. From value propositions to cost structure, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its opportunities lie.

Want to see exactly how d’Amico International Shipping operates and scales its business? Our full Business Model Canvas provides a detailed, section-by-section breakdown in both Word and Excel formats—perfect for benchmarking, strategic planning, or investor presentations.

Gain exclusive access to the complete Business Model Canvas used to map out d’Amico International Shipping’s success. This professional, ready-to-use document is ideal for business students, analysts, or founders seeking to learn from proven industry strategies.

See how the pieces fit together in d’Amico International Shipping’s business model. This detailed, editable canvas highlights the company’s customer segments, key partnerships, revenue strategies, and more. Download the full version to accelerate your own business thinking.

Partnerships

Collaborations with leading shipyards are crucial for d'Amico International Shipping, enabling the construction of new, eco-friendly vessels and performing complex dry-docking. These partnerships ensure the fleet, comprising about 34-36 modern product tankers in 2024, remains technologically advanced and compliant with evolving environmental regulations like EEXI and CII. This relationship is foundational for long-term asset renewal and operational excellence, supporting the company's commitment to a sustainable fleet.

Strong relationships with banks, investment funds, and shareholders are crucial for d’Amico International Shipping, facilitating fleet expansion and managing working capital. These partnerships ensure access to capital markets, which is vital for executing growth strategies and maintaining financial stability. For instance, the shipping industry's high capital expenditure requirements, often exceeding hundreds of millions for new vessel orders, necessitate robust financial backing. Such collaborations enable funding for significant investments, like the ongoing fleet renewal programs, enhancing operational capacity. This consistent financial support is foundational for long-term strategic development.

Partnerships with marine insurance providers and Protection & Indemnity (P&I) Clubs are absolutely essential for d’Amico International Shipping, mitigating significant operational risks. These relationships cover critical aspects like hull and machinery damage, cargo liability, and other diverse maritime perils. For instance, P&I Clubs, which pool liabilities, saw strong solvency in 2024, offering stable coverage. Such alliances safeguard the company's substantial assets and provide crucial financial protection against unforeseen events, ensuring continuity and stability in a volatile shipping market.

Technical and Crew Management Providers

d’Amico International Shipping strategically partners with specialized technical and crew management providers to augment its strong in-house capabilities, especially for specific vessel types or regional needs. These external partners are crucial for supplying qualified seafarers and advanced technical expertise, ensuring the company’s fleet operates safely and efficiently. This collaborative approach enhances operational flexibility and provides access to a broader global talent pool, critical given the industry’s dynamic staffing requirements. For instance, the global maritime industry saw crewing costs rise by an estimated 6.5% in 2024, emphasizing the value of efficient talent sourcing.

- Crewing costs are a significant operational expense, influencing partnership decisions.

- Specialized firms offer access to niche expertise and certified seafarers.

- Partnerships mitigate risks associated with crew shortages and regulatory compliance.

- Operational flexibility is enhanced, allowing d'Amico to scale crewing needs efficiently.

Port Authorities and Terminal Operators

Developing strong relationships with port authorities and terminal operators globally is crucial for d'Amico International Shipping, ensuring smooth and efficient vessel turnaround. These partnerships facilitate priority berthing and seamless cargo handling, directly impacting operational efficiency. Minimizing port time significantly enhances voyage profitability and service reliability, a key factor in the competitive shipping market. For instance, reducing port stays can save thousands of dollars daily in operating costs, contributing to increased earnings per vessel, an important metric for investors in 2024.

- Priority berthing can reduce waiting times by up to 30%, optimizing vessel utilization.

- Efficient cargo handling partnerships aim to achieve discharge rates exceeding 1,000 tons per hour.

- Logistical coordination with ports directly impacts fuel consumption and emissions by minimizing idle time.

- In 2024, average port turnaround times for tankers continue to be a critical performance indicator, influencing revenue.

d’Amico International Shipping's operational backbone relies on strategic key partnerships across its value chain. Collaborations with shipyards ensure fleet modernization and environmental compliance for its 2024 fleet of 34-36 tankers. Financial institutions provide essential capital, while insurers mitigate maritime risks, safeguarding assets.

Alliances with crewing agencies and port authorities optimize vessel efficiency and global port access. These diverse relationships are crucial for navigating market volatility and sustaining profitability.

| Partner Type | Key Benefit | 2024 Impact |

|---|---|---|

| Shipyards | Fleet Renewal | Newbuilds: 1-2 eco-ships |

| Banks | Capital Access | Debt Ratio: ~0.45 |

| P&I Clubs | Risk Mitigation | Solvency: Strong |

What is included in the product

This Business Model Canvas provides a strategic overview of d’Amico International Shipping's operations, detailing its customer segments, key activities, and revenue streams within the global maritime transport sector.

It serves as a foundational tool for understanding the company's competitive positioning and growth strategies, offering insights into its value proposition and cost structure.

d’Amico International Shipping's Business Model Canvas offers a clear, structured approach, effectively relieving the pain point of complex strategic planning by condensing their entire operation into a single, easily digestible page.

Activities

Vessel operations and voyage management are central to d’Amico International Shipping's success, focusing on the careful day-to-day handling of its fleet. This includes expert navigation, meticulous crew supervision, and safe cargo management, crucial for maintaining operational integrity. Voyage planning is optimized for fuel efficiency and timely deliveries, directly impacting profitability. For instance, enhanced operational efficiency contributes significantly to the company's financial performance, as seen in the 2024 market where fuel costs remain a key variable, pushing companies like d'Amico to maximize route optimization.

Chartering and commercial management are central to d’Amico International Shipping, focusing on marketing the fleet to secure profitable employment. This involves analyzing market trends to maximize vessel utilization through spot voyages, time charters, and contracts of affreightment.

For instance, in 2024, the company continued to optimize its fleet deployment, adapting to dynamic freight rates and maintaining strong earnings. This activity remains the primary driver of the company's revenue, ensuring vessels like their LR1 and MR tankers consistently generate income.

d’Amico International Shipping prioritizes rigorous planned maintenance and periodic dry-docking to safeguard its fleet's technical integrity and compliance. This proactive approach, essential for asset preservation, minimizes operational downtime and extends vessels' economic life, supporting a consistent revenue stream. For instance, typical dry-docking periods occur every 2.5 to 5 years, with costs potentially running into millions of dollars per vessel, reflecting a significant investment in asset value. This commitment ensures safety standards are upheld, directly impacting the fleet's marketability and operational efficiency through 2024 and beyond. It’s a critical activity for risk management, ensuring regulatory adherence and operational readiness.

Regulatory Compliance and Safety Management

d'Amico International Shipping rigorously manages regulatory compliance, a critical activity ensuring their license to operate globally. This involves strict adherence to international maritime regulations from bodies like the IMO, alongside specific flag state and port state requirements. For instance, the company continually updates its safety protocols under the ISM Code and environmental management in line with MARPOL, which saw enhanced IMO GHG reduction targets for 2024. Protecting its reputation and operational continuity hinges on these comprehensive safety and environmental standards, crucial for securing charter contracts and maintaining stakeholder trust.

- Ongoing compliance with IMO's 2024 EEXI/CII requirements.

- Adherence to updated MARPOL Annex VI rules on emissions.

- Strict implementation of the International Safety Management (ISM) Code.

- Continuous monitoring of flag and port state specific regulations.

Financial and Risk Management

Financial and risk management for d’Amico International Shipping involves actively managing liquidity and overseeing capital structure to ensure operational resilience. This critical activity also includes hedging against volatile fuel prices and currency fluctuations, which is vital given the dynamic global shipping market. For instance, effective hedging strategies help mitigate the impact of market volatility on the company’s financial health, crucial in a sector with fluctuating bunker fuel costs. Comprehensive risk assessment across all operational areas safeguards the company’s financial stability.

- In 2024, managing working capital remains crucial for d’Amico.

- Hedging strategies counter unpredictable bunker fuel price movements.

- Currency risk management protects revenues from exchange rate shifts.

- Robust capital structure oversight ensures long-term financial health.

d’Amico International Shipping focuses on efficient vessel operations and strategic chartering, maximizing fleet utilization and revenue. Rigorous planned maintenance and regulatory compliance, including IMO's 2024 EEXI/CII requirements, safeguard asset integrity and global operational licenses. Financial and risk management, crucial for 2024 working capital, actively hedges against fuel and currency volatility, ensuring robust stability.

| Activity Area | 2024 Focus | Impact |

|---|---|---|

| Vessel Operations | Fuel efficiency, Route Optimization | Reduced bunker costs |

| Chartering | Fleet Deployment | Maximized revenue, ~85% fleet utilization |

| Compliance | IMO EEXI/CII, MARPOL | Operational license, Reputation |

| Financial Management | Working Capital, Hedging | Financial stability |

Preview Before You Purchase

Business Model Canvas

The d’Amico International Shipping Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a sample or mockup, but a direct snapshot of the comprehensive analysis you'll gain access to. Upon completing your order, you will instantly download this fully detailed Business Model Canvas, ready for your strategic planning and decision-making.

Resources

d’Amico International Shipping’s core asset is its cutting-edge fleet of product tankers, primarily Medium Range vessels, essential for global refined product distribution. These vessels feature double-hull designs, critical for environmental safety and preferred by major oil companies and traders, ensuring reliable operations. As of early 2024, the company maintained a modern fleet with an average age well below the industry average, enhancing efficiency and reducing operational costs. This focus on modern, eco-friendly tonnage, including newbuilds delivered in 2024, provides a significant competitive edge and attracts top-tier clients.

Experienced human capital, encompassing skilled seafarers and proficient onshore personnel, is a cornerstone for d’Amico International Shipping. The expertise of the crew is paramount, ensuring safe and efficient vessel operations across their 60-vessel fleet as of early 2024. Concurrently, the onshore team expertly manages complex commercial, technical, and financial aspects, crucial for navigating volatile shipping markets.

This collective experience, a vital non-current asset, enables strategic decision-making and operational resilience, directly contributing to the company’s performance and ability to secure long-term contracts. Their specialized knowledge mitigates operational risks and optimizes fleet utilization.

Access to significant financial resources is essential for d’Amico International Shipping in this capital-intensive industry. A strong balance sheet, reflected by a net financial position of negative $299.7 million as of March 31, 2024, enables strategic maneuvers. Established credit lines allow for ongoing fleet renewal, including investments in modern eco-ships. This financial strength is a key resource, crucial for navigating market downturns and pursuing growth opportunities into 2024 and beyond.

Global Network and Industry Relationships

d’Amico International Shipping's long-standing presence has cultivated a robust global network with customers, brokers, suppliers, and port authorities. This network, crucial for 2024 operations, acts as an intangible asset facilitating commercial opportunities and smooth global operations. It provides vital market intelligence and preferential access to services, enhancing their competitive edge. The company's relationships ensure efficient vessel turnaround and cargo delivery worldwide.

- Extensive customer base, including major oil companies.

- Strong ties with over 50 shipbrokers globally.

- Collaborations with leading shipyards and equipment suppliers.

- Established connections with port authorities across key trade routes.

Technology and Information Systems

Advanced IT systems for vessel performance monitoring, voyage management, and communication are critical for d’Amico International Shipping. These technologies optimize fuel consumption, with digital solutions enabling up to 15% fuel efficiency improvements in 2024 for some operators. They also enhance safety and provide real-time data, crucial for operational control and decision-making. Technology is a key enabler of efficiency, supporting fleet management across 34 vessels as of early 2024.

- Real-time vessel performance data for operational optimization.

- Digital voyage planning and management systems.

- Satellite communication for fleet-wide connectivity.

- Data analytics driving fuel efficiency and predictive maintenance.

d’Amico International Shipping's core resources include its modern, eco-friendly fleet of 60 vessels as of early 2024, complemented by experienced human capital. Substantial financial resources, with a net financial position of negative $299.7 million (March 31, 2024), underpin fleet renewal and growth. A robust global network and advanced IT systems, enhancing fuel efficiency by up to 15% in 2024, ensure optimized operations and market intelligence.

| Resource | 2024 Data Point | Impact |

|---|---|---|

| Fleet | 60 vessels (early 2024) | Global refined product distribution |

| Financials | Net financial position: -$299.7M (Mar 31, 2024) | Enables fleet renewal, growth |

| IT Systems | Up to 15% fuel efficiency (2024) | Optimized operations, cost reduction |

Value Propositions

d’Amico International Shipping provides secure, dependable, and timely seaborne transportation for high-value refined products like gasoline, jet fuel, and chemicals. Major oil companies prioritize this reliability to protect their sensitive cargo and corporate reputation. In 2024, the global tanker fleet continued to emphasize stringent safety protocols, crucial for maintaining client trust and minimizing environmental risks. This commitment ensures consistent delivery, a foundational promise in the volatile shipping market.

d’Amico International Shipping operates a modern, fuel-efficient fleet, offering customers reduced fuel consumption and a lower carbon footprint. This technologically advanced approach directly aligns with clients' increasing ESG mandates. For example, modern eco-ships can achieve up to 30% lower fuel consumption compared to older vessels, significantly reducing voyage costs and emissions. This commitment to sustainability is a crucial differentiator in the 2024 shipping market, appealing to charterers prioritizing environmental performance.

d’Amico International Shipping delivers global operational capability, offering clients extensive flexibility across worldwide trade routes. As of 2024, the company operates a diverse fleet, providing seamless product transport across major international shipping lanes. They cater to varied customer needs by offering flexible chartering options, ranging from single spot voyages to long-term contracts. This adaptability ensures a versatile partnership, supporting diverse supply chain requirements efficiently.

Specialized Expertise in Product and Chemical Transport

d’Amico International Shipping demonstrates deep expertise in transporting refined petroleum products, vegetable oils, and various chemicals, each demanding specific safety protocols and handling. This specialized knowledge ensures cargo compliance with the highest industry standards, crucial for attracting high-value shipments. The company’s adherence to stringent regulations provides assurance to customers that their sensitive cargo is managed safely, fostering trust. This capability is vital as the global refined product trade, which saw robust demand in 2024, continues to require expert maritime logistics.

- Specialized handling of diverse liquid cargoes, including IMO Class 2 and 3 chemicals.

- Adherence to international safety standards, such as the IMO IBC Code for chemical tankers.

- Attraction of high-value contracts due to demonstrated expertise and low-risk operations.

- Ensuring cargo integrity and safety, critical for sensitive products like vegetable oils.

Strong and Transparent Corporate Counterparty

Major oil companies and traders prioritize the financial health and robust corporate governance of their shipping partners. d’Amico International Shipping offers the assurance of a publicly-listed entity, providing a financially stable and transparent counterparty for critical operations. This significantly mitigates counterparty risk for customers entering into long-term shipping contracts, fostering trust and reliability. The company's strong financial standing, as evidenced by its solid 2023 results and continued performance into 2024, underpins this value proposition.

- d’Amico International Shipping is listed on the Euronext Milan, ensuring public scrutiny and transparency.

- The company reported a net profit of $187.3 million for the full year 2023, demonstrating strong financial health.

- As of Q1 2024, d’Amico maintained a robust balance sheet, enhancing its appeal for long-term contracts.

- This transparency and stability reduce operational and financial risks for global energy traders.

d’Amico International Shipping provides reliable, safe, and efficient seaborne transport for refined products and chemicals, leveraging a modern, eco-friendly fleet. Their global operational reach and specialized cargo expertise ensure high-value shipments are handled with precision. As a publicly-listed entity, they offer customers financial stability and transparency, mitigating counterparty risks for long-term contracts in 2024.

| Value Proposition Aspect | 2024 Data/Metric | Benefit to Customer |

|---|---|---|

| Fleet Efficiency | Eco-ships up to 30% lower fuel consumption | Reduced operational costs, lower carbon footprint |

| Financial Stability | Robust Q1 2024 balance sheet | Mitigated counterparty risk for long-term contracts |

| Global Reach | Diverse fleet operating across major international lanes | Flexible, adaptable supply chain support worldwide |

Customer Relationships

d’Amico International Shipping employs dedicated key account managers for its major oil company and large trader clients, ensuring a single point of contact for streamlined communication. This approach cultivates deep, long-term strategic partnerships, essential for understanding and meeting specific client needs in the competitive tanker market. Such high-touch engagement is crucial for retaining anchor customers, who contribute significantly to the company's revenue, evident as d'Amico reported a strong 2024 outlook with robust time charter equivalent earnings.

d’Amico International Shipping cultivates long-term relationships through time charter agreements, where vessels are hired for set periods, often exceeding one year. This approach offers customers crucial supply chain security and predictable shipping costs, which is vital in volatile markets. For d'Amico, these contracts provide stable, recurring revenue streams; for instance, the company reported a strong fleet utilization rate and consistent earnings from its time charter equivalent (TCE) rates in early 2024. These relationships are inherently collaborative and strategic, ensuring mutual benefits and operational stability.

For customers with immediate shipping needs, d’Amico International Shipping primarily engages through transactional spot market fixtures. While less personal, these relationships are built on the company’s reputation for reliability and efficient execution, crucial in a volatile market. A strong track record is key to securing repeat spot business, reflecting the quick decision-making process in this segment. In 2024, the spot market remains a vital component of the product tanker sector, with d’Amico leveraging its fleet to capitalize on short-term demand fluctuations.

Proactive Safety and Quality Assurance

d’Amico International Shipping fosters strong customer relationships through a steadfast commitment to proactive safety and quality assurance. This focus includes transparent reporting on vessel performance and rigorous compliance with global standards, ensuring customer cargo and reputation are secure. As of 2024, the company maintained an impressive safety record, securing over 99% vessel vetting approvals from major oil companies, reflecting operational excellence.

- Achieved over 99% vessel vetting approvals in 2024 from major oil companies.

- Maintained a low Lost Time Injury Frequency (LTIF) rate, demonstrating robust safety protocols.

- Regularly updated fleet with eco-friendly and high-safety standard vessels, enhancing client trust.

- Implemented advanced digital platforms for real-time safety and quality data sharing with clients.

24/7 Operational Support and Communication

d’Amico International Shipping provides robust 24/7 operational support, offering real-time updates on vessel positions, cargo status, and estimated arrival times. This constant communication, crucial for precise logistics planning, builds strong customer confidence and trust. The company’s commitment extends beyond contractual obligations, ensuring seamless information flow for its global clientele. In 2024, the demand for such precise tracking remains paramount, reflecting the industry's reliance on timely data for supply chain efficiency.

- Real-time vessel tracking enhances logistics planning for over 60 product tankers.

- 24/7 availability mitigates risks, crucial for transporting refined petroleum products.

- Proactive communication reduces potential delays, impacting global trade flows.

- Customer confidence is built through consistent, transparent operational updates.

d’Amico International Shipping fosters diverse customer relationships through dedicated key account management for major clients, securing long-term strategic partnerships and stable revenue from time charters. For instance, early 2024 saw robust time charter equivalent earnings. Transactional spot market relationships leverage the company’s reputation for reliability. A 2024 safety record of over 99% vessel vetting approvals and 24/7 operational support further solidify client trust.

| Relationship Type | Key Benefit for Client | d'Amico Value (2024) |

|---|---|---|

| Key Account Management | Streamlined communication, tailored service | Revenue stability, strategic partnerships |

| Time Charter Agreements | Supply chain security, predictable costs | Stable recurring revenue, high fleet utilization |

| Spot Market Fixtures | Immediate shipping needs, flexible capacity | Capitalizing on short-term demand, repeat business |

Channels

d’Amico International Shipping primarily leverages its in-house chartering department, directly engaging key clients like major oil companies, refiners, and commodity traders. This direct channel fosters robust relationship building, enhancing negotiation leverage and ensuring a deep understanding of customer needs. For instance, this approach consistently secures a significant portion of their fleet’s employment, contributing substantially to the company’s Time Charter Equivalent (TCE) earnings, which remained strong in early 2024. This direct engagement is crucial for maintaining a high fleet utilization rate and optimizing charter contract terms.

d’Amico International Shipping effectively uses a global network of independent shipbrokers who serve as crucial intermediaries. These brokers provide extensive market coverage and intelligence, giving d'Amico access to a wider pool of potential customers and diverse cargo opportunities across various trade routes. This channel significantly extends the company's commercial reach, enabling them to secure employment for their fleet, which in 2024 includes a modern fleet of product tankers. Leveraging these expert connections helps d'Amico optimize vessel utilization and secure favorable freight rates globally.

d'Amico International Shipping leverages shipping pools, where its vessels are commercially managed alongside those from other owners. This channel enhances fleet utilization, providing access to a larger cargo base and potentially more stable earnings through risk diversification. As of early 2024, the company's participation in these pools optimizes the employment of specific vessel classes, such as its eco-MR tankers. This collaborative approach helps maximize operational efficiency and secures consistent cargo flows for its fleet.

Industry Conferences and Events

Participation in major maritime events such as Posidonia or Nor-Shipping serves as a key channel for d’Amico International Shipping, facilitating crucial networking and relationship building. These conferences allow senior management to directly engage with existing and potential clients, financiers, and industry partners, fostering strategic alliances. This channel is vital for maintaining brand visibility and securing new business opportunities within the competitive shipping market. The company’s presence at events like Nor-Shipping 2023, for instance, underscores its commitment to industry collaboration and market intelligence.

- Direct engagement with over 200 exhibitors at major 2024 maritime expos enhances deal flow.

- Key for brand visibility, reaching an estimated 15,000 attendees at leading industry gatherings annually.

- Facilitates strategic dialogues with financiers and partners for fleet modernization, including newbuild orders for 2024-2025.

- Supports market intelligence gathering on evolving shipping regulations and technological advancements.

Corporate Website and Investor Relations Portal

The company's digital presence, including its corporate website and investor relations portal, acts as a crucial channel for communicating its value proposition, detailed fleet information, and financial performance. This platform serves as a primary information hub for potential customers, investors, and other key stakeholders, fostering brand credibility and transparency.

For instance, the 2024 investor presentations and quarterly reports, such as the Q1 2024 results, are readily accessible, detailing operational metrics and financial health. The portal also provides up-to-date fleet specifics, including the average age of vessels, which stood at approximately 7.2 years as of early 2024, highlighting their modern fleet.

- Facilitates access to 2024 financial reports and presentations.

- Showcases detailed fleet specifications and vessel availability.

- Supports investor engagement by providing transparent operational data.

- Enhances brand reputation and stakeholder trust through accessible information.

d’Amico International Shipping employs a multi-faceted channel strategy, leveraging its in-house chartering department for direct client engagement and robust Time Charter Equivalent (TCE) earnings in early 2024. They extend global reach through independent shipbrokers and strategic participation in shipping pools, optimizing utilization for their modern fleet, which averaged 7.2 years in early 2024. Major maritime events and a strong digital presence, including readily accessible Q1 2024 financial reports, further enhance brand visibility and stakeholder transparency.

| Channel Type | Key Benefit | 2024 Impact |

|---|---|---|

| Direct Chartering | Strong client relationships | High TCE earnings |

| Shipbrokers & Pools | Wider market reach | Optimized fleet utilization |

| Digital & Events | Brand visibility & transparency | Accessible Q1 2024 reports |

Customer Segments

Major integrated oil companies like Shell, BP, TotalEnergies, and ExxonMobil form a critical customer segment for d’Amico International Shipping. These global energy giants, with combined 2024 revenues projected in the hundreds of billions, require exceptionally reliable and safe transportation for their refined petroleum products. They prioritize stringent safety protocols, operational excellence, and seek long-term relationships to secure stable shipping capacity. For d’Amico, these firms are a primary source of high-quality, long-term charter contracts, underpinning significant portions of their revenue streams.

Global commodity trading houses like Vitol, Glencore, and Trafigura form a crucial customer segment, handling vast volumes of petroleum products. These entities actively engage in both spot and time charter markets, demanding highly flexible and efficient shipping solutions for their dynamic operations. In 2024, the global oil demand is projected to reach 103.2 million barrels per day, underscoring the continuous need for robust tanker services. This constant movement offers d’Amico International Shipping significant commercial opportunities.

National Oil Companies are vital partners for d’Amico International Shipping, representing state-owned entities from major petroleum-exporting nations. These NOCs, like Saudi Aramco or ADNOC, manage vast quantities of refined petroleum products, necessitating reliable seaborne transportation to global markets. In 2024, as global oil demand continues to show resilience, these companies require robust shipping solutions for their significant cargo volumes. d’Amico’s modern fleet supports these strategic, often long-term relationships, ensuring consistent and efficient delivery of their products.

Petroleum Refiners and Chemical Companies

Petroleum refiners and chemical companies represent a core customer segment, requiring specialized maritime transport for their finished products to global distribution hubs or end-users. These clients necessitate adherence to stringent quality and safety protocols for refined petroleum products and chemicals. Their shipping demands are often tied to specific trade routes and dynamic production schedules, impacting global freight rates. In 2024, the global chemical tanker market size is projected to reach approximately USD 3.5 billion.

- Refined products include gasoline, diesel, and jet fuel.

- Chemicals transported range from petrochemicals to specialized liquids.

- Safety compliance is paramount for hazardous material shipments.

- Long-term contracts are common to secure consistent capacity.

Agribusiness and Vegetable Oil Producers

Agribusiness and vegetable oil producers represent a customer segment for d’Amico International Shipping, focusing on the transport of agricultural commodities like palm oil and various other vegetable oils. While smaller than their refined petroleum product segment, this area provides crucial diversification, especially with global vegetable oil trade volumes remaining robust, estimated to reach 220 million metric tons in 2024. These clients demand exceptionally clean, well-maintained cargo tanks to prevent any contamination, a critical requirement given the sensitive nature of food-grade products.

- Palm oil shipments require specialized tank cleaning protocols.

- Diversifies revenue beyond traditional oil products.

- Ensures strict adherence to cargo purity standards.

d’Amico International Shipping primarily serves major integrated oil companies and National Oil Companies seeking long-term, reliable transport for refined petroleum products, alongside global commodity trading houses demanding flexible solutions. They also cater to petroleum refiners and chemical companies for specialized shipments, and agribusiness for sensitive food-grade oils. This diversified customer base leverages d'Amico's modern fleet for essential global trade flows, including an estimated 103.2 million barrels per day of oil demand in 2024.

| Customer Segment | Key Need | 2024 Market Relevance |

|---|---|---|

| Major Oil & NOCs | Reliable, long-term charters | Hundreds of billions in projected revenues |

| Commodity Traders | Flexible spot & time charters | 103.2 million bpd global oil demand |

| Chemical Companies | Specialized, safe transport | USD 3.5 billion chemical tanker market |

| Agribusiness | Clean tanks, diversification | 220 million metric tons vegetable oil trade |

Cost Structure

Vessel Operating Expenses (OPEX) represent the fixed daily costs for d’Amico International Shipping’s fleet, regardless of whether a vessel is actively sailing or idle. This is a significant cost component, encompassing crew wages, provisions, stores, ongoing repairs and maintenance, and various insurance premiums. For instance, industry reports in early 2024 indicated average daily OPEX for a modern Aframax tanker can range from $8,000 to $10,000. Effectively managing these costs is absolutely critical for maintaining profitability and ensuring competitive pricing in the dynamic shipping market.

Voyage expenses for d’Amico International Shipping are highly variable costs, incurred only when a vessel is on a specific journey. The largest element of these expenses is bunker fuel, which saw significant volatility in 2024, with VLSFO prices in key hubs often exceeding $600 per metric ton. Other critical components include port charges, canal transit fees like those for the Suez or Panama Canals, and broker commissions. Managing fuel price fluctuations is crucial, as they directly impact profitability for each voyage.

Fleet depreciation and amortization represents a substantial non-cash expense for d’Amico International Shipping, given its significant physical asset base of vessels. This cost reflects the systematic allocation of the purchase price of its fleet over each vessel’s estimated useful economic life. It accounts for the gradual decline in the value of the ships as they age and are utilized. For example, d'Amico International Shipping reported total depreciation and amortization expenses of approximately $70.5 million for the full year 2023, a trend expected to continue as part of their 2024 operational costs.

Financing Costs

Financing costs for d’Amico International Shipping primarily encompass interest expenses on loans and credit facilities, essential for funding the acquisition of new and second-hand vessels. This is a significant outlay in their capital-intensive shipping operations. The magnitude of these costs is directly influenced by the company's debt levels and prevailing global interest rates. For instance, in 2024, the company continued to manage substantial debt, with total financial liabilities reported around $700-$750 million as of late 2023/early 2024, impacting their cost structure.

- Interest expenses on debt facilities.

- Crucial for vessel acquisitions.

- Impacted by debt levels and interest rates.

- Significant in capital-intensive shipping.

General and Administrative (G&A) Expenses

General and Administrative (G&A) expenses for d’Amico International Shipping encompass the critical overhead costs supporting its onshore operations. These costs, largely fixed, include salaries for management and administrative personnel, essential office rent, robust IT infrastructure, and vital legal and professional fees. For instance, d'Amico International Shipping reported G&A expenses around $21.5 million in 2023, reflecting these core fixed costs.

- Salaries for onshore management and administrative staff constitute a significant portion of G&A.

- Office rent and IT infrastructure are fundamental fixed costs under G&A.

- Legal and professional fees are integral to maintaining compliance and operational efficiency.

- These expenses are crucial for the company's strategic planning and support functions.

d’Amico International Shipping’s cost structure is heavily influenced by fixed vessel operating expenses, averaging $8,000-$10,000 daily for an Aframax tanker in 2024, and variable voyage costs, notably bunker fuel over $600 per metric ton in 2024. Significant non-cash depreciation, $70.5 million in 2023, and financing costs from $700-$750 million in financial liabilities as of early 2024, also underpin their capital-intensive model. General and administrative expenses, around $21.5 million in 2023, support onshore operations.

| Cost Category | Key Component | 2024 Data (or latest) |

|---|---|---|

| Vessel OPEX | Daily Vessel Costs | $8,000-$10,000 (Aframax) |

| Voyage Expenses | Bunker Fuel Price | >$600/metric ton (VLSFO) |

| Financing Costs | Total Financial Liabilities | $700-$750 million |

Revenue Streams

Time charter contracts represent a core revenue stream for d’Amico International Shipping, providing predictable income by leasing vessels for set periods at fixed daily or monthly rates. This structure offers stability, shielding the company from immediate market fluctuations often seen in the spot market. For instance, as of early 2024, a significant portion of their fleet maintained time charter coverage, ensuring a robust base-load of earnings. This strategy allows for consistent cash flow planning and supports long-term operational stability.

d’Amico International Shipping generates revenue by chartering vessels for single voyages at the prevailing spot market rate. This income stream is highly volatile, directly reflecting the immediate supply and demand dynamics within the global shipping market. While it offers significant upside potential during periods of strong market conditions, such as the robust tanker rates seen in early 2024 due to geopolitical shifts, it also carries substantial downside risk. For instance, the average spot rate for a one-year time charter for an MR tanker was approximately $27,000 per day in Q1 2024, showcasing the potential earnings from these engagements.

Contracts of Affreightment (COA) represent a crucial revenue stream for d’Amico International Shipping, involving agreements to transport a total quantity of specific cargo over a set period on a given route, without designating a specific vessel.

This model offers revenue security similar to time charters, providing stability while maintaining operational flexibility for the fleet.

It acts as a strategic hybrid, blending the predictability of long-term engagements with the adaptability found in spot market operations.

In 2024, such agreements continue to provide a balanced portfolio approach, complementing their time charter coverage and managing market volatility effectively.

This allows d’Amico to optimize vessel utilization across various trades and cargo types, enhancing overall profitability.

Demurrage and Laytime-related Income

Demurrage and laytime-related income represents additional revenue earned by d’Amico International Shipping when a charterer utilizes a vessel for longer than the contractually agreed period for loading or discharging cargo. This compensation, known as demurrage, is an ancillary yet significant revenue stream, rewarding the company's operational efficiency and vessel availability. In 2024, such income continued to bolster the company's financial performance, reflecting strong demand and efficient fleet management.

- Demurrage contributes to overall profitability, supplementing base charter rates.

- It incentivizes charterers to optimize port operations, benefiting all parties.

- For d’Amico, this income stream highlights effective scheduling and vessel utilization.

- Such earnings can be particularly impactful during periods of high vessel demand, like those seen in early 2024.

Revenue from Shipping Pool Arrangements

d’Amico International Shipping generates revenue from its participation in shipping pool arrangements, where income and expenses from a collection of similar vessels are pooled and shared among owners. This strategy significantly reduces earnings volatility and enhances vessel utilization across the fleet. It also grants access to a broader market through the pool's established commercial network. For instance, d’Amico International Shipping reported a net profit of $46.8 million in Q1 2024, benefiting from efficient fleet management including pool participations.

- Revenue from shipping pools helps stabilize earnings.

- It improves the overall utilization of vessels.

- Provides access to a wider commercial network.

- Contributes to robust financial results, such as the $46.8 million net profit in Q1 2024.

d’Amico International Shipping generates revenue primarily from stable time charters and flexible Contracts of Affreightment, ensuring predictable income streams. Spot market operations provide additional upside, leveraging strong tanker rates seen in early 2024. Ancillary income from demurrage and participation in shipping pools further diversifies and stabilizes their earnings. This strategic mix contributed to a robust Q1 2024 net profit of $46.8 million.

| Revenue Stream | Key Characteristic | 2024 Data Point |

|---|---|---|

| Time Charters | Stable, Predictable | Significant fleet coverage early 2024 |

| Spot Market | Volatile, High Potential | MR tanker spot rate ~$27,000/day (Q1 2024) |

| Shipping Pools | Earnings Stabilization | Contributed to $46.8M net profit (Q1 2024) |

Business Model Canvas Data Sources

The d’Amico International Shipping Business Model Canvas is constructed using a blend of financial reports, market analysis, and operational data. These sources provide a comprehensive view of the company's strategic positioning and market engagement.