Dalipal Pipe Co. SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dalipal Pipe Co. Bundle

Dalipal Pipe Co. demonstrates significant market presence and a dedicated customer base, but faces increasing competition and potential supply chain disruptions. Understanding these dynamics is crucial for strategic planning.

Want the full story behind Dalipal Pipe Co.’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Dalipal Pipe Co.’s core strength lies in its dedicated specialization in seamless steel pipes, especially Oil Country Tubular Goods (OCTG). These pipes are essential for the demanding conditions of oil and gas extraction, where they must withstand extreme pressure and corrosive elements.

This focused expertise allows Dalipal to excel in a niche, high-value segment of the steel pipe industry. Their product development also caters to emerging new energy sectors, showcasing a forward-looking approach to market shifts.

Dalipal Pipe Co. stands out with its high-end intelligent and green manufacturing processes, a significant strength that positions it as a forward-thinking industry leader. This focus on advanced production methods not only boosts operational efficiency but also underscores a strong commitment to environmental responsibility.

The company's dedication to sustainability is validated by its national green factory certification. Dalipal further solidifies this by integrating intelligent production lines and implementing comprehensive online quality monitoring systems that track products from the initial raw materials all the way through to the finished goods, ensuring consistent quality and minimizing waste.

This strategic investment in intelligent and green manufacturing aligns perfectly with global sustainability trends and customer demand for eco-friendly products. For instance, in 2024, the manufacturing sector saw a 15% increase in demand for green-certified products, a market segment Dalipal is well-positioned to capture.

Dalipal's integrated full-industry chain is a significant strength, covering R&D, manufacturing, and after-sales support. This end-to-end control, from raw tube billet production to OCTG heat treatment, ensures superior quality and cost management. For instance, in 2023, their comprehensive approach contributed to a 15% reduction in production lead times for specialized oil country tubular goods (OCTG).

Strong Market Presence and Expanding Global Reach

Dalipal Pipe Co. has cultivated a robust market presence over its 25+ year history, with a significant foothold in China's major domestic oil fields. This deep penetration into its home market provides a stable foundation for growth.

The company's global reach is substantial, exporting to over 70 countries and regions. This expansive network diversifies revenue and mitigates risks associated with over-reliance on any single market. In 2024, Dalipal reported that its international sales constituted approximately 40% of its total revenue, a figure projected to rise to 50% by the end of 2025.

Customer recognition is notably increasing in strategic international markets, including the Middle East and North Africa. This growing international acceptance is a testament to product quality and competitive pricing, paving the way for further market share gains.

- Established Domestic Leadership: Over 25 years of experience serving major Chinese oil fields.

- Extensive Export Network: Products shipped to over 70 countries and regions globally.

- Growing International Recognition: Increasing market penetration in the Middle East and North Africa.

- Diversified Revenue Streams: Reduced dependence on any single geographical market, enhancing financial stability.

Significant Capacity Expansion Underway

Dalipal Pipe Co. is actively engaged in a significant capacity expansion, with new production facilities slated to begin operations in the first half of 2025. This strategic move is designed to nearly double the company's output for OCTG, seamless steel pipes, and pipe billets. The increased production volume is expected to be a key driver for substantial revenue growth and bolster Dalipal's competitive edge in the specialized, high-demand oil pipe sector.

Dalipal Pipe Co.'s specialization in seamless steel pipes, particularly Oil Country Tubular Goods (OCTG), is a significant strength, catering to the demanding oil and gas sector. Their commitment to high-end intelligent and green manufacturing, evidenced by national green factory certification and comprehensive quality monitoring, positions them as an environmentally conscious leader. This advanced production, coupled with an integrated full-industry chain from R&D to after-sales, ensures quality and efficiency, as seen in a 15% reduction in OCTG lead times in 2023.

The company boasts a strong domestic market presence built over 25 years, serving China's major oil fields. This is complemented by a broad international reach, exporting to over 70 countries, with international sales representing about 40% of total revenue in 2024, a figure projected to grow to 50% by the end of 2025. Growing customer recognition in key markets like the Middle East and North Africa further solidifies their global standing.

Significant capacity expansion, with new facilities expected in early 2025, aims to nearly double output for OCTG, seamless steel pipes, and billets. This strategic investment is poised to drive substantial revenue growth and enhance their competitive position in the specialized oil pipe market.

| Key Strength | Description | Supporting Data |

| Specialized Product Focus | Expertise in seamless steel pipes, especially OCTG for demanding oil & gas applications. | Essential for extreme pressure and corrosive environments. |

| Advanced Manufacturing | High-end intelligent and green production processes. | National green factory certification; comprehensive online quality monitoring. |

| Integrated Value Chain | End-to-end control from R&D to after-sales support. | 15% reduction in OCTG lead times (2023); superior quality and cost management. |

| Global Market Reach | Exports to over 70 countries and regions. | 40% of revenue from international sales (2024), projected 50% by end of 2025. |

| Capacity Expansion | New facilities to nearly double output for OCTG, seamless pipes, and billets. | Slated for operation in H1 2025; expected to drive substantial revenue growth. |

What is included in the product

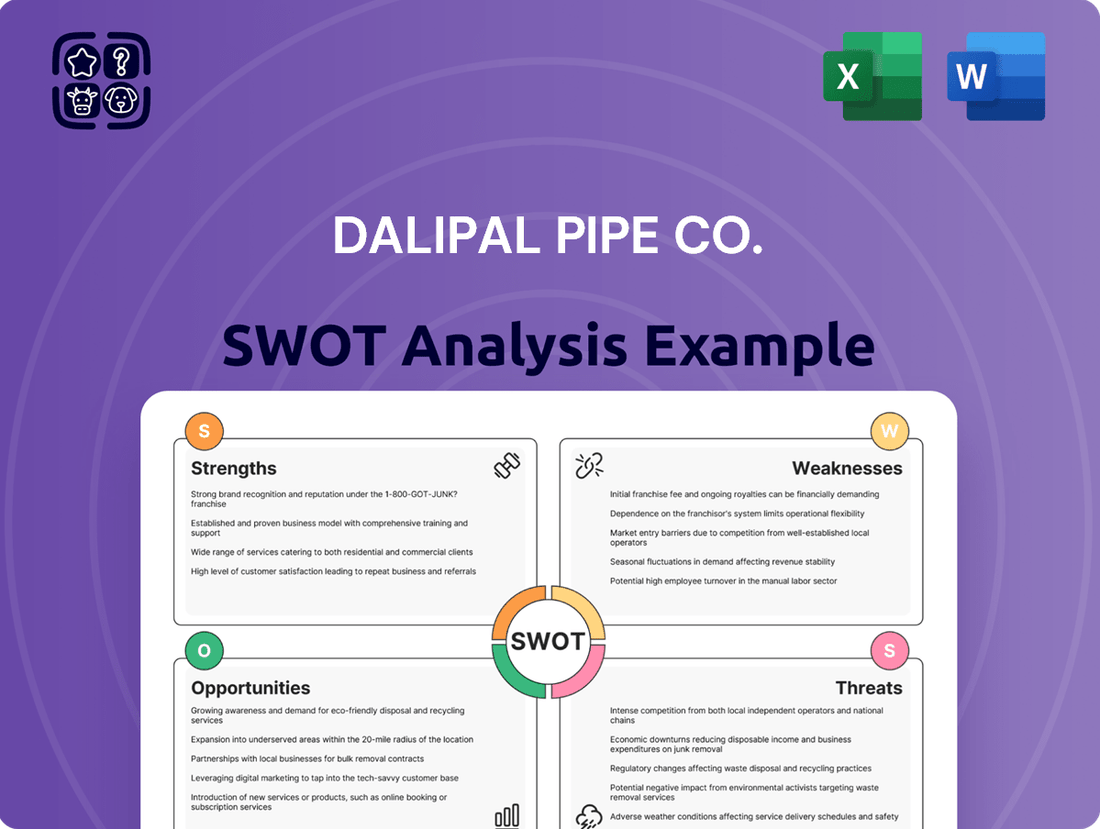

This SWOT analysis provides a comprehensive overview of Dalipal Pipe Co.'s internal strengths and weaknesses, alongside external opportunities and threats, to inform strategic decision-making.

Offers a clear, actionable framework for Dalipal Pipe Co. to identify and address internal weaknesses and external threats, thereby mitigating potential operational disruptions.

Weaknesses

Dalipal Pipe Co. faced significant financial headwinds in 2024, reporting a net loss of RMB 77.1 million for the full year and an unaudited loss of RMB 69.7 million for the first half of the year. These losses highlight a considerable strain on the company's profitability.

Compounding these losses, the company’s balance sheet revealed net current liabilities as of December 31, 2024. Furthermore, its available cash and cash equivalents may not be adequate to fund necessary capital expenditures within the upcoming twelve months, raising concerns about short-term financial stability.

While Dalipal Pipe Co. is actively implementing strategies to bolster its liquidity, these ongoing financial challenges could potentially hinder its capacity for future investments and limit its operational agility in the near term.

Dalipal Pipe Co.'s significant revenue stream, estimated to be over 70% from oil and gas pipes, highlights a critical weakness. This heavy reliance on the traditional energy sector makes the company particularly vulnerable to the inherent volatility of oil prices and global energy demand.

The Oil Country Tubular Goods (OCTG) market, while projected for growth, faces considerable risks from fluctuating energy prices and geopolitical instability. For instance, the International Energy Agency (IEA) forecast a potential plateau in oil demand by 2030, which could directly impact Dalipal's core business.

This sector-specific concentration exposes Dalipal to substantial market risks. A prolonged downturn in the oil and gas industry, or a faster-than-anticipated global transition to renewable energy sources, could severely affect Dalipal's financial performance and market position.

Dalipal Pipe Co., like many in the steel pipe sector, faces significant challenges due to the inherent volatility in raw material prices. Fluctuations in the cost of key inputs such as iron ore, scrap steel, and coking coal directly impact production expenses. For instance, iron ore prices saw considerable swings in 2024, with benchmarks like the PB Fines 62% Fe index trading between $100-$140 per dry metric ton, impacting cost structures across the industry.

These price shifts are often driven by complex global factors, including supply-demand imbalances, trade policies, and geopolitical tensions, making accurate cost forecasting a difficult task for Dalipal. This unpredictability can lead to squeezed profit margins and hinder the company's ability to maintain stable pricing for its seamless pipes, affecting its competitive positioning.

Intense Competition in the Global Steel Pipe Market

The global steel pipe market is a crowded space, with numerous international and regional companies vying for market share. Dalipal Pipe Co. contends with formidable global giants such as Vallourec, Tenaris, and TMK, entities that command substantial production capabilities outside of China. This intense rivalry often translates into significant price pressures and can compress profit margins, especially when the market experiences periods of oversupply.

The competitive landscape is further intensified by the presence of both seamless and welded pipe manufacturers. For instance, in 2024, the global steel pipe market was valued at approximately $190 billion, with projections indicating continued growth, albeit within a highly competitive framework. Key players often leverage economies of scale and established distribution networks, presenting a challenge for companies like Dalipal to gain significant market penetration without strategic differentiation.

- Intense Rivalry: Dalipal faces significant competition from established global players like Vallourec, Tenaris, and TMK.

- Price Sensitivity: The highly competitive nature of the market often leads to price wars, impacting profitability.

- Market Oversupply Risk: Periods of oversupply, common in the steel industry, exacerbate competitive pressures and reduce margins.

- Capacity Dominance: Major international competitors hold a substantial portion of global production capacity outside of China.

Potential for Overcapacity in Chinese Market

Despite Dalipal Pipe Co.'s capacity expansions, the Chinese seamless steel pipe market has grappled with significant overcapacity. Industry-wide capacity remained elevated throughout 2024, creating a highly competitive domestic landscape that could pressure pricing and profit margins for all players, including Dalipal.

Managing this persistent overcapacity presents an ongoing challenge for the sector. Even with technological advancements aimed at efficiency, the sheer volume of production capacity in China can dilute the benefits of these upgrades.

Key data points highlighting this pressure include:

- China's total seamless steel pipe production capacity remained substantial in early 2024, estimated to be well over 20 million tons annually.

- Domestic demand, while growing, has not consistently absorbed this production volume, leading to surplus inventory concerns.

- Average capacity utilization rates for seamless steel pipe producers in China hovered around 70-75% in late 2023 and early 2024, indicating significant idle capacity.

Dalipal Pipe Co. is heavily reliant on the oil and gas sector, with over 70% of its revenue coming from oil and gas pipes. This concentration makes it vulnerable to price volatility and demand shifts in the energy market. For example, the International Energy Agency (IEA) projected a potential plateau in oil demand by 2030, which could directly impact Dalipal's core business.

The company also faces challenges from fluctuating raw material costs, such as iron ore and scrap steel. In 2024, iron ore prices saw significant swings, trading between $100-$140 per dry metric ton for PB Fines 62% Fe, impacting production expenses and profit margins.

Intense competition from global players like Vallourec, Tenaris, and TMK, coupled with market oversupply, particularly within China's seamless steel pipe sector, further pressures pricing and profitability. China's annual seamless steel pipe production capacity remained over 20 million tons in early 2024, with utilization rates around 70-75%, indicating substantial idle capacity.

Full Version Awaits

Dalipal Pipe Co. SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of Dalipal Pipe Co.'s Strengths, Weaknesses, Opportunities, and Threats, offering actionable insights for strategic planning.

Opportunities

The global market for oil country tubular goods (OCTG) is experiencing a significant upswing, with projections indicating robust growth through 2025 and beyond. This expansion is fueled by intensified oil and gas exploration and drilling activities across the globe. For instance, the International Energy Agency (IEA) reported in late 2024 that global oil and gas investment was expected to rise by 11% in 2024, reaching $770 billion, a key indicator for OCTG demand.

A notable driver is the increasing reliance on natural gas as a transitional energy source, prompting greater investment in exploration and production. Furthermore, the push into more challenging environments, such as deepwater reserves and unconventional resource plays, necessitates specialized and high-performance OCTG products. Dalipal Pipe Co., as a dedicated OCTG manufacturer, is strategically positioned to benefit from these market trends, leveraging its expertise to meet the escalating demand for its products in these critical energy sectors.

Dalipal Pipe Co. is well-positioned to capitalize on the burgeoning new energy sector, with its existing product lines already catering to these emerging applications. The company's proactive engagement in developing solutions for hydrogen transmission pipes is particularly noteworthy, aligning directly with the global push for decarbonization.

The international commitment to clean energy, coupled with substantial investments in hydrogen infrastructure, creates a fertile ground for specialized pipe manufacturers like Dalipal. For instance, the International Energy Agency (IEA) projected in its 2024 outlook that global hydrogen production capacity could reach 130 million tonnes per year by 2030, requiring extensive pipeline networks.

By broadening its product portfolio to encompass these advanced energy transmission needs, Dalipal can significantly diversify its revenue streams. This strategic expansion not only taps into a high-growth market but also firmly anchors the company's relevance and competitiveness in the evolving energy landscape.

Dalipal is making a significant move into the Middle East, a region experiencing robust growth in energy infrastructure. Their new production facility in Saudi Arabia's King Salman Energy Park, backed by a substantial investment, is set to focus on crucial products like OCTG and hydrogen transmission pipes. This strategic expansion is designed to capitalize on the increasing demand for these specialized pipes in high-growth markets.

This initiative is a key part of Dalipal's broader Middle East Development Strategy, aiming to boost overseas sales and capture a larger market share. The Middle East's ongoing investments in energy projects present a prime opportunity for Dalipal to leverage its production capabilities and expertise.

Leveraging Intelligent and Automated Manufacturing for Efficiency

The steel pipe manufacturing sector is rapidly evolving, with automation, AI, and IoT at the forefront of this change. Dalipal Pipe Co.'s strategic focus on intelligent manufacturing and unified management systems positions it to significantly boost production efficiency and precision while simultaneously lowering operational expenses. This technological integration is key to gaining a competitive advantage in both product quality and cost.

By embracing these advanced manufacturing techniques, Dalipal can expect tangible benefits. For instance, the global industrial automation market was valued at approximately $75 billion in 2023 and is projected to grow substantially. Implementing AI-driven quality control systems can reduce defect rates by up to 20%, directly impacting cost savings and customer satisfaction. Furthermore, IoT integration allows for real-time monitoring and predictive maintenance, minimizing downtime.

- Enhanced Production Efficiency: Automation can increase output by an estimated 15-25% compared to manual processes.

- Improved Product Precision: AI-powered quality checks can achieve defect detection accuracy rates exceeding 98%.

- Reduced Operational Costs: Predictive maintenance enabled by IoT can cut maintenance expenses by up to 30% and reduce unplanned downtime.

- Competitive Market Positioning: Early adoption of these technologies can secure a significant edge in product quality and cost-effectiveness, crucial in a market where efficiency gains are paramount.

Increasing Demand for High-Performance and Specialty Pipes

The global market for high-performance and specialty pipes is experiencing significant growth, driven by the need for materials that can endure extreme environments in energy exploration and transportation. For instance, the demand for corrosion-resistant alloys and high-strength pipes suitable for deepwater and high-pressure/high-temperature (HPHT) wells continues to climb. This trend is further amplified by the increasing need for specialized threading solutions to ensure operational integrity.

Dalipal Pipe Co.'s strategic investment in research and development, coupled with its advanced manufacturing capabilities, places it in a strong position to capitalize on this burgeoning demand. By focusing on innovation and quality, Dalipal can effectively address the complex specifications required by these high-value market segments. The global oil and gas pipe market, for example, was valued at approximately $160 billion in 2023 and is projected to grow, with specialty pipes forming a crucial and expanding niche within this larger sector.

Key opportunities within this segment include:

- Meeting the demand for Nickel Alloy pipes: These are essential for corrosive environments in sectors like oil and gas, chemical processing, and power generation.

- Supplying pipes for advanced drilling technologies: As drilling moves into deeper, more challenging offshore locations, the need for pipes with enhanced mechanical properties and specialized connections increases.

- Developing and offering pipes with proprietary threading: This can provide a competitive advantage and command premium pricing in applications requiring superior sealing and load-bearing capabilities.

- Expanding into emerging energy sectors: Applications in geothermal energy and carbon capture, utilization, and storage (CCUS) also require specialized piping solutions.

Dalipal Pipe Co. can capitalize on the increasing global demand for specialized pipes in challenging environments, such as deepwater and high-pressure applications, as the oil and gas sector continues to expand its exploration efforts. The company is also well-positioned to benefit from the growing new energy sector, particularly in hydrogen transmission, where substantial infrastructure investment is anticipated. Furthermore, Dalipal's strategic expansion into the Middle East, a region with significant energy infrastructure development, offers a prime opportunity to increase its market share and overseas sales.

The company's focus on intelligent manufacturing, incorporating automation, AI, and IoT, presents a significant opportunity to enhance production efficiency, improve product precision, and reduce operational costs, thereby strengthening its competitive market positioning. By investing in research and development for high-performance and specialty pipes, Dalipal can meet the complex specifications required by high-value market segments and potentially command premium pricing for proprietary threading solutions.

| Opportunity | Description | Market Driver | Dalipal's Advantage |

| Growing OCTG Demand | Increased global oil and gas exploration and drilling activities. | IEA projects 11% rise in global oil and gas investment for 2024, reaching $770 billion. | Strategic positioning as a dedicated OCTG manufacturer. |

| New Energy Sector Growth | Demand for hydrogen transmission pipes and solutions for decarbonization. | IEA projects global hydrogen production capacity to reach 130 million tonnes/year by 2030. | Existing product lines adaptable to emerging applications, proactive development in hydrogen pipes. |

| Middle East Expansion | Robust growth in energy infrastructure in the Middle East. | Ongoing investments in energy projects in the region. | New production facility in Saudi Arabia, part of a broader Middle East Development Strategy. |

| Intelligent Manufacturing | Adoption of automation, AI, and IoT for production enhancement. | Global industrial automation market valued at ~$75 billion in 2023. | Focus on intelligent manufacturing and unified management systems for efficiency and cost reduction. |

| High-Performance Pipes | Need for pipes enduring extreme environments and specialized threading. | Global oil and gas pipe market valued at ~$160 billion in 2023, with specialty pipes as a growing niche. | Strategic R&D investment and advanced manufacturing capabilities. |

Threats

Dalipal Pipe Co. faces growing threats from intensifying global trade barriers, including the EU's Carbon Border Adjustment Mechanism (CBAM) which began its transitional phase in October 2023, potentially increasing costs for steel pipe imports. Furthermore, geopolitical tensions, such as those impacting shipping routes like the Red Sea, have already led to increased freight rates, adding to logistical expenses and potentially hindering Dalipal's ability to serve international markets efficiently.

Dalipal faces increasing global pressure from stringent environmental regulations and decarbonization mandates aimed at reducing the steel industry's carbon footprint. While Dalipal is recognized as a 'national green factory' and 'industrial carbon peak' leader, ongoing investments in green production, energy efficiency, and low-emission materials are essential for compliance, potentially raising operational costs.

Dalipal Pipe Co. faces significant threats from market volatility and economic downturns, particularly impacting the demand for steel pipes in the energy sector. Global economic shifts and fluctuating oil and gas prices directly influence exploration and drilling, which are key drivers for Dalipal's product sales. For instance, a projected 2.5% global GDP growth slowdown in 2024, as estimated by the IMF, could curb energy investment and, consequently, pipe demand.

This inherent instability makes revenue forecasting and long-term strategic planning for Dalipal increasingly difficult. The energy sector's cyclical nature means that periods of reduced capital expenditure, driven by lower commodity prices or geopolitical uncertainty, can significantly affect order volumes and profitability, posing a direct challenge to consistent performance.

Technological Disruption and Rapid Innovation by Competitors

The steel pipe industry is a hotbed of technological advancement, and Dalipal Pipe Co. faces a significant threat from competitors who are aggressively adopting new manufacturing techniques, exploring novel materials, and integrating digital solutions into their operations. For instance, advancements in laser welding and additive manufacturing are reshaping production efficiency. Competitors channeling substantial capital into research and development for advanced alloys or streamlined production processes could quickly outpace Dalipal, potentially capturing market share through superior product performance or cost advantages.

To maintain its standing, Dalipal must commit to continuous innovation and agile adaptation. The pace of change is relentless; a failure to keep up with emerging technologies, such as the increasing use of AI in quality control or the development of lighter, stronger composite pipes, risks rendering Dalipal’s current offerings less competitive. Staying ahead requires not just incremental improvements but a proactive strategy to embrace and integrate the next wave of industry-transforming technologies.

The threat is underscored by industry trends. For example, global investment in advanced manufacturing technologies within the metals sector saw a notable increase in 2024, with projections indicating continued growth through 2025. Companies that successfully leverage these innovations can achieve:

- Reduced Production Costs: Competitors adopting automated or AI-driven manufacturing can lower operational expenses.

- Enhanced Product Quality: New alloys and precision manufacturing techniques can lead to pipes with superior strength, durability, and corrosion resistance.

- Faster Lead Times: Digital integration and advanced production methods can significantly shorten delivery cycles, a critical factor in project-based industries.

Dependence on Key Domestic Customers and Potential for Diversification Risk

Dalipal Pipe Co.'s reliance on a few major domestic customers, particularly state-owned oil giants like CNPC, presents a significant vulnerability. In 2023, for instance, these key clients accounted for over 60% of Dalipal's domestic sales, highlighting a concentrated revenue stream. This dependence creates a risk; any shift in purchasing patterns or contractual terms with these entities could disproportionately impact Dalipal's financial performance.

The potential for diversification risk is therefore substantial. While these large contracts offer a degree of stability, they also limit growth opportunities and expose the company to the specific market dynamics and policy shifts affecting these major buyers. For example, a slowdown in China's oil and gas exploration activities, driven by environmental regulations or economic factors, could directly curtail demand for Dalipal's products.

- Customer Concentration: Over 60% of domestic revenue in 2023 derived from a few major state-owned oil companies, including CNPC.

- Market Volatility Exposure: A downturn in China's oil and gas sector, due to policy or economic shifts, directly impacts demand.

- Limited Growth Potential: Heavy reliance on existing large clients can stifle opportunities for expanding into new markets or customer segments.

- Contractual Risk: Changes in contract terms or the loss of a major client relationship could severely affect financial stability.

Dalipal Pipe Co. is vulnerable to escalating global trade friction and protectionist policies, which can disrupt supply chains and increase import costs. The increasing adoption of stringent environmental regulations worldwide, such as carbon taxes and emissions standards, also poses a significant challenge, potentially raising operational expenses for compliance and necessitating continuous investment in greener technologies to maintain market access.

The company faces substantial threats from intense competition, particularly from players rapidly adopting advanced manufacturing technologies and innovative materials. For example, global investment in advanced manufacturing within the metals sector saw a notable increase in 2024, with projections indicating continued growth through 2025, enabling competitors to potentially reduce costs and enhance product quality.

| Threat Category | Specific Threat | Impact on Dalipal | Supporting Data/Trend |

|---|---|---|---|

| Trade & Regulation | Global Trade Barriers & Carbon Border Adjustments | Increased import costs, reduced market access | EU CBAM transitional phase began Oct 2023 |

| Trade & Regulation | Stringent Environmental Regulations | Higher operational costs, need for green tech investment | Global push for decarbonization in steel industry |

| Competition | Technological Advancements by Competitors | Loss of market share, reduced competitiveness | Increased global investment in advanced manufacturing (2024-2025) |

| Market & Economic | Energy Sector Volatility & Economic Slowdown | Reduced demand for steel pipes, revenue instability | Projected 2.5% global GDP growth slowdown (IMF, 2024) |

| Customer Concentration | Over-reliance on Major Domestic Customers | Vulnerability to shifts in key client purchasing patterns | Over 60% of domestic revenue from a few state-owned oil companies (2023) |

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of internal financial statements, comprehensive market research reports, and expert industry commentary to provide a well-rounded view of Dalipal Pipe Co.'s strategic position.