Dalipal Pipe Co. Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dalipal Pipe Co. Bundle

Dalipal Pipe Co. faces moderate buyer power due to a fragmented customer base, yet intense rivalry from established competitors significantly impacts pricing strategies. The threat of new entrants is somewhat limited by capital requirements, but the availability of substitute materials presents a growing concern.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Dalipal Pipe Co.’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The bargaining power of suppliers for Dalipal Pipe Co. is significantly influenced by the concentration of raw material suppliers. The seamless steel pipe sector, especially for demanding applications like Oil Country Tubular Goods (OCTG) and new energy projects, depends on a select group of steel producers. These producers are crucial for supplying specialized steel alloys and grades that meet stringent industry standards.

A limited number of global steel mills possess the capability to manufacture these specific, high-quality materials. This scarcity grants these few suppliers considerable leverage over buyers like Dalipal Pipe Co. For instance, in 2024, the global production of certain high-strength alloy steels, critical for OCTG, is dominated by a handful of major integrated steel producers, potentially limiting Dalipal's options and driving up input costs.

This concentrated supplier base can translate into higher raw material prices or less favorable contract terms for Dalipal. When fewer suppliers can meet the technical specifications, they are in a stronger position to dictate pricing and conditions, impacting Dalipal's profitability and competitive edge in the market.

Dalipal Pipe Co.'s commitment to high-end intelligent and green manufacturing necessitates specialized raw materials and advanced machinery. If these critical inputs are proprietary or sourced from a limited number of suppliers, those suppliers hold considerable leverage.

The stringent specifications required for pipes used in demanding energy sectors, such as oil and gas, further restrict the availability of suitable raw materials, thereby increasing supplier bargaining power. For instance, the need for specific alloys with precise tensile strength and corrosion resistance means fewer suppliers can meet Dalipal's exacting standards.

Switching suppliers for critical raw materials or manufacturing equipment presents significant hurdles for Dalipal Pipe Co. These switching costs can encompass retooling production lines, obtaining new certifications, and managing potential disruptions to ongoing operations. For instance, if a key supplier provides specialized polymers essential for high-pressure pipes, the effort and expense to qualify a new supplier could run into hundreds of thousands of dollars.

These substantial switching costs directly empower Dalipal's existing suppliers. When it's costly and time-consuming to find and integrate an alternative, suppliers can leverage this to negotiate more favorable terms. This is particularly true if Dalipal relies on proprietary technology or unique material specifications that only a few suppliers can meet.

Furthermore, long-term supply contracts or deep technical integration with current providers can further escalate these switching costs. If Dalipal's manufacturing processes are intricately linked to a specific supplier's equipment or material properties, the inertia to change becomes even greater, solidifying the supplier's bargaining power.

Threat of Forward Integration by Suppliers

Major steel producers, the primary suppliers for Dalipal Pipe Co., possess the potential to integrate forward into the seamless pipe manufacturing sector. This means they could start producing pipes themselves, directly competing with their existing customers.

While this forward integration is less frequently observed in highly specialized markets like Oil Country Tubular Goods (OCTG), the possibility remains, particularly if the profit margins within pipe manufacturing become exceptionally attractive. For instance, in 2024, the global seamless pipe market was valued at approximately $50 billion, with growth projected due to increased energy exploration and infrastructure development.

The mere existence of this potential threat grants significant bargaining power to these steel suppliers. They can leverage this capability to influence pricing and contract terms with Dalipal, as Dalipal would face increased competition and potential supply disruptions if a major supplier decided to enter the market.

- Potential for Forward Integration: Major steel producers could enter seamless pipe manufacturing.

- Market Context: The global seamless pipe market was valued around $50 billion in 2024.

- Supplier Leverage: This threat enhances supplier bargaining power in negotiations with Dalipal.

Supplier's Contribution to Dalipal's Quality and Cost

The quality and consistency of raw materials are paramount to Dalipal's seamless steel pipe production, directly affecting the integrity and performance crucial for the energy sector. Suppliers who consistently deliver superior materials that minimize Dalipal's processing costs or boost final product performance wield considerable influence.

This supplier power significantly impacts Dalipal's overall cost structure and the competitiveness of its end products. For instance, in 2024, the global average price for high-grade iron ore, a key input for steel pipes, saw fluctuations, with some periods experiencing increases of up to 15% due to supply chain disruptions and increased demand from infrastructure projects.

- Raw Material Quality: Suppliers of premium steel billets with tight metallurgical controls can reduce Dalipal's scrap rates and enhance pipe strength.

- Supplier Concentration: A limited number of high-quality raw material providers for specialized alloys can increase their bargaining leverage.

- Input Cost Impact: Fluctuations in global commodity prices, such as nickel and chromium for stainless steel pipes, directly affect Dalipal's cost of goods sold.

- Switching Costs: The effort and time required for Dalipal to qualify and integrate new raw material suppliers can be substantial, reinforcing the power of established, reliable suppliers.

Dalipal Pipe Co. faces significant bargaining power from its suppliers due to the concentrated nature of specialized steel producers. These suppliers hold leverage because of the high switching costs associated with retooling and qualifying new sources for critical alloys. In 2024, the global seamless pipe market, valued at approximately $50 billion, saw demand increase from energy projects, further strengthening the position of key raw material providers.

The limited number of suppliers capable of meeting Dalipal's stringent quality and technical specifications for demanding sectors like Oil Country Tubular Goods (OCTG) allows them to dictate terms. This scarcity, coupled with the potential for these suppliers to integrate forward into pipe manufacturing, amplifies their influence over pricing and contract negotiations.

Suppliers who consistently deliver superior raw materials, reducing Dalipal's processing costs and enhancing product performance, possess considerable sway. For instance, in 2024, fluctuations in the price of key inputs like iron ore, which saw increases of up to 15% at times, directly impacted Dalipal's cost of goods sold and overall competitiveness.

| Factor | Impact on Dalipal | 2024 Context |

|---|---|---|

| Supplier Concentration | Limited options increase supplier leverage. | Domination of specialized alloy production by a few global mills. |

| Switching Costs | High costs for retooling and qualification empower existing suppliers. | Hundreds of thousands of dollars potentially required to qualify new suppliers for proprietary materials. |

| Forward Integration Threat | Potential competition from steel producers limits Dalipal's negotiation power. | Global seamless pipe market valued at $50 billion, attractive for potential market entry. |

| Raw Material Quality & Consistency | Superior materials reduce Dalipal's costs and boost product performance. | Up to 15% price increases for high-grade iron ore in 2024 due to supply chain issues. |

What is included in the product

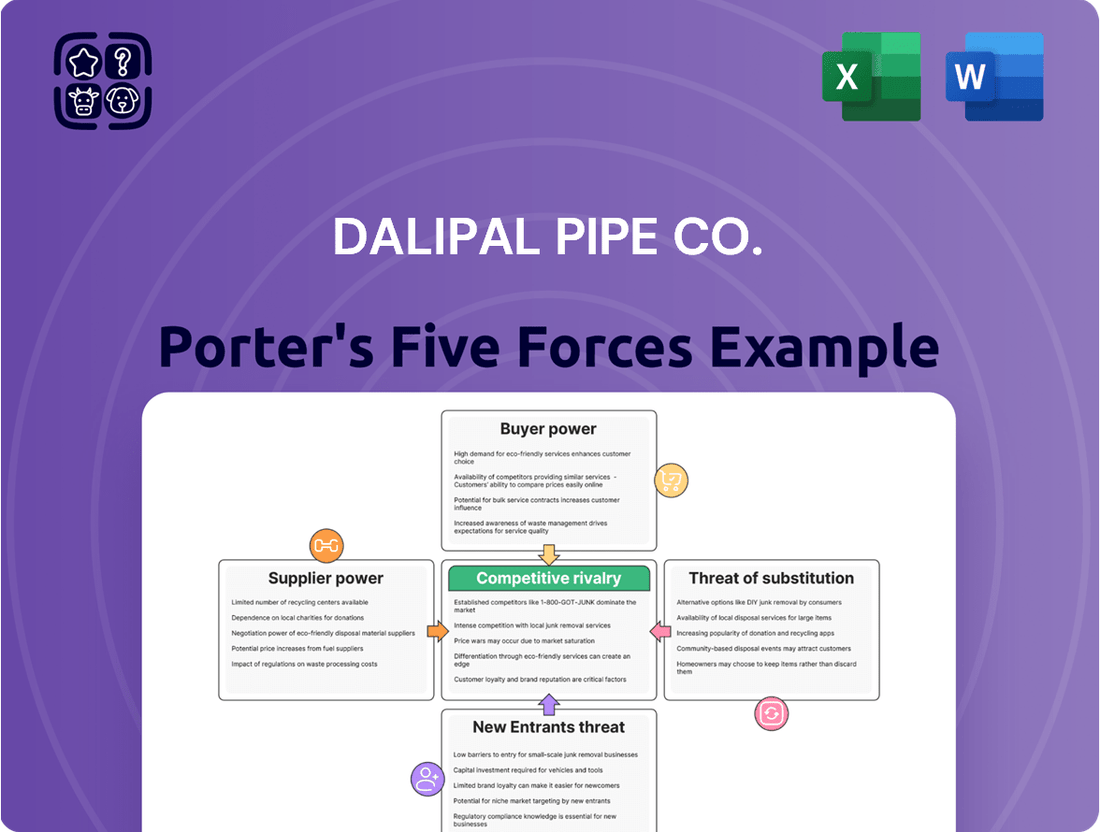

This Porter's Five Forces analysis provides a comprehensive evaluation of the competitive landscape for Dalipal Pipe Co., detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces for Dalipal Pipe Co.

Gain actionable insights into customer bargaining power, supplier leverage, and the threat of substitutes, enabling strategic adjustments for Dalipal Pipe Co.

Customers Bargaining Power

Dalipal Pipe Co.'s customer base is heavily concentrated within large oil and gas corporations, emerging new energy ventures, and major industrial enterprises. These clients typically engage in substantial, high-volume purchases, giving them significant leverage.

The substantial purchase volumes by a few key customers grant them considerable bargaining power. This means they can often dictate pricing, negotiate favorable terms, and influence product specifications, directly impacting Dalipal's profitability and operational flexibility.

This concentration presents a notable risk; the potential loss of even one major client due to competitive bidding or shifts in demand could lead to a significant and immediate downturn in Dalipal's overall revenue stream.

The bargaining power of customers in the seamless steel pipe market for Dalipal Pipe Co. is influenced by product standardization versus customization. While the energy sector often demands standard specifications for seamless steel pipes, Dalipal focuses on higher-end, specialized products and offers integrated services, which inherently involves a degree of customization.

For highly customized solutions, where Dalipal invests in unique research and development and provides extensive support, customer bargaining power is significantly reduced. This is because these specialized offerings are not easily replicated by competitors. For instance, if a client requires a pipe with specific material properties or dimensions for a unique application, their ability to switch suppliers is limited.

Conversely, for more standardized Oil Country Tubular Goods (OCTG) products, customers possess greater bargaining power. In 2024, the global OCTG market saw increased competition, with several major players expanding production capacity. This increased supply for standard products gives buyers more options, allowing them to negotiate on price and terms more effectively, potentially impacting Dalipal's margins on these less differentiated products.

Customers' switching costs when changing pipe suppliers in the energy sector are substantial. These can include the expense and time associated with re-qualifying new suppliers, managing new logistics, and the risk of project delays, which can cost millions. For instance, a major oil and gas project might face a 10-15% cost increase due to supplier changes.

Dalipal Pipe Co. actively works to increase these switching costs by offering integrated services. This means they handle everything from research and development to manufacturing and ongoing support. This comprehensive approach makes it more difficult and costly for clients to move to a competitor, as they would need to find multiple specialized providers to replicate Dalipal's offering.

This increased stickiness of their customer base directly strengthens Dalipal's bargaining power. When customers face high costs to switch, they are less likely to demand lower prices or more favorable terms, as the potential disruption and expense outweigh the benefits. This positions Dalipal favorably in negotiations.

Price Sensitivity of Customers

Customers in the energy sector, especially when commodity prices are low, are very focused on price and actively look for ways to cut costs. This means they will likely push Dalipal to lower its prices, which can impact the company's profitability.

For instance, in 2024, the volatility in oil prices, with Brent crude averaging around $80 per barrel for much of the year, directly translates to increased price scrutiny from energy companies. This heightened sensitivity forces suppliers like Dalipal to justify their pricing more rigorously.

Dalipal can counter this by highlighting its product quality, dependable performance, or specialized technical features. Offering value beyond just the price point is crucial.

For example, if Dalipal can demonstrate that its pipes offer longer lifespan or require less maintenance compared to competitors, it can justify a higher price. This is especially true if these benefits lead to lower total cost of ownership for the customer, a key consideration in capital-intensive industries like energy.

- Price Sensitivity: Energy sector customers are highly sensitive to price, particularly during periods of low commodity prices, seeking cost efficiencies.

- Downward Pressure: This sensitivity exerts downward pressure on Dalipal's pipe pricing strategies.

- Mitigation Strategies: Dalipal can mitigate this pressure by offering superior quality, reliability, or unique technical solutions.

- Value Proposition: Demonstrating a lower total cost of ownership through enhanced product features can justify premium pricing.

Threat of Backward Integration by Customers

Large energy companies, particularly those with significant operational footprints, may contemplate backward integration into manufacturing specific pipe components. However, the production of highly specialized seamless steel pipes demands substantial capital investment and technical expertise, making this a formidable undertaking.

While the direct threat of customers manufacturing their own pipes for Dalipal's high-end, intelligent products is low, it still provides a degree of negotiation leverage. For instance, in 2024, the global oil and gas industry saw continued investment in infrastructure, but the specialized nature of advanced pipe manufacturing remains a barrier to entry for most end-users.

- Capital Intensity: The high cost of establishing seamless steel pipe production facilities deters most customers from backward integration.

- Technical Expertise: Manufacturing advanced pipes requires specialized knowledge and technology, which customers typically lack.

- Negotiation Leverage: The mere possibility of backward integration, however remote, can influence pricing and contract terms.

- Dalipal's Niche: Dalipal's focus on intelligent, high-end manufacturing further insulates it from this threat.

Dalipal Pipe Co. faces significant customer bargaining power due to its concentrated client base in the oil, gas, and industrial sectors, where large-volume purchases are common. This concentration means key clients can negotiate favorable pricing and terms, directly impacting Dalipal's profitability. The threat is amplified when customers, particularly in the standard OCTG market, have numerous supplier options, as seen with increased competition in 2024.

The bargaining power of customers is somewhat tempered by Dalipal's focus on specialized, customized pipe solutions and integrated services, which increase switching costs for clients. However, for more standardized products, customers' price sensitivity, especially during periods of volatile oil prices like those seen in 2024, remains a key factor. Despite the potential for backward integration by large clients, the substantial capital and technical expertise required for advanced pipe manufacturing limit this threat.

| Factor | Impact on Dalipal | Mitigation/Observation |

|---|---|---|

| Customer Concentration | High bargaining power for large clients | Focus on specialized products reduces leverage for standard items. |

| Product Standardization vs. Customization | Higher power for standard products, lower for custom | Dalipal's investment in R&D for specialized pipes strengthens its position. |

| Switching Costs | Low for standard, high for integrated services | Integrated services increase customer stickiness and reduce price pressure. |

| Price Sensitivity | High, especially with commodity price volatility | Emphasis on quality, performance, and total cost of ownership is crucial. |

| Threat of Backward Integration | Low for specialized products, moderate for standard | High capital and technical barriers deter most customers from in-house production. |

Full Version Awaits

Dalipal Pipe Co. Porter's Five Forces Analysis

This preview displays the complete Porter's Five Forces Analysis for Dalipal Pipe Co., offering a thorough examination of industry competitiveness. You are looking at the actual document. Once you complete your purchase, you’ll get instant access to this exact file, providing actionable insights into competitive pressures and strategic positioning.

Rivalry Among Competitors

The global seamless steel pipe market, particularly for demanding energy sector applications, features a mix of significant international corporations and numerous domestic Chinese manufacturers. Dalipal operates within this competitive arena, facing established giants who possess considerable market share and resources.

The intensity of competition is directly influenced by the scale, market penetration, and strategic ambitions of these rivals. For instance, in 2023, the global seamless steel pipe market was valued at approximately USD 85 billion, with key players like Tenaris, Vallourec, and TMK Group holding substantial portions of the high-end segment.

The energy sector's growth rate is a critical driver for Dalipal Pipe Co. As of early 2024, global energy demand is projected to increase, with significant investment flowing into both traditional oil and gas exploration and the burgeoning new energy infrastructure, such as renewable energy projects and hydrogen transport. This expansion directly translates to a higher demand for the specialized pipes Dalipal manufactures.

In mature segments of the energy market, where growth is slower, competitive rivalry tends to be more intense. Companies often fight harder for existing market share, which can put pressure on pricing and margins for Dalipal. For instance, established pipelines for conventional oil and gas may see fewer new projects, leading to increased competition among suppliers for replacement or upgrade contracts.

Conversely, the rapid expansion of new energy applications, such as the development of extensive electric vehicle charging networks or the infrastructure for carbon capture and storage, presents opportunities that can temper rivalry. If Dalipal can effectively position itself to supply these growing, less saturated markets, the intense competition seen in mature sectors might be mitigated by the sheer availability of new business.

Dalipal Pipe Co. distinguishes itself through advanced intelligent and green manufacturing, alongside specialized offerings such as Oil Country Tubular Goods (OCTG) and pipes for the new energy sector. This focus on high-end, differentiated products, supported by integrated services, enables Dalipal to achieve premium pricing and sidestep intense price-based competition.

For instance, in 2024, Dalipal's investment in smart factory technology contributed to a 5% increase in production efficiency, allowing for tighter quality control on its specialized OCTG products. This differentiation strategy directly impacts competitive rivalry by making direct price comparisons less relevant for customers seeking specific performance attributes.

However, the intensity of rivalry could escalate if competitors successfully develop and market comparable intelligent manufacturing capabilities or specialized product lines. Should rivals such as Baosteel or Tianjin Pipe Corporation invest heavily in similar green technologies and niche product development, the pressure on Dalipal's market share and pricing power would intensify.

High Fixed Costs and Exit Barriers

The seamless steel pipe manufacturing sector, where Dalipal Pipe Co. operates, is defined by substantial fixed costs. These stem from the immense capital required for advanced machinery, ongoing research and development, and the foundational infrastructure of manufacturing facilities. For instance, a modern seamless pipe mill can easily cost hundreds of millions of dollars to construct and equip.

These high fixed costs, combined with the specialized nature of the production assets, erect significant barriers to exiting the industry. Companies find it difficult and financially punishing to divest or repurpose such highly specific equipment and facilities. This often compels them to continue operating and competing vigorously, even when market demand softens or profitability declines, thereby intensifying the competitive rivalry among existing players.

- High Capital Investment: The seamless steel pipe industry demands significant upfront investment in specialized manufacturing equipment and infrastructure, often running into hundreds of millions of dollars for a single facility.

- Specialized Assets: Production machinery and facilities are highly specific to seamless pipe manufacturing, making them difficult to repurpose or sell in other industries, thus increasing exit barriers.

- Intensified Rivalry: Due to high exit barriers, companies are incentivized to stay in the market and compete aggressively, even during economic downturns, leading to sustained pressure on pricing and margins.

Strategic Objectives of Competitors

Competitors in the pipe manufacturing sector, including those vying with Dalipal Pipe Co., often pursue divergent strategic goals. These can range from aggressively expanding market share through price competition to prioritizing long-term profitability by focusing on higher-margin products or operational efficiencies.

For instance, some rivals might adopt a strategy of deep discounting to capture a larger portion of the market, potentially impacting Dalipal's pricing power. Others may concentrate on specialized product segments, such as high-performance industrial pipes or sustainable material solutions, aiming for technological leadership and premium pricing.

Understanding these varied objectives is key to gauging the intensity of competition Dalipal faces. For example, in 2024, the global pipes and tubes market experienced growth, with companies like Tenaris reporting robust demand, indicating a dynamic competitive landscape where strategic positioning plays a vital role.

- Market Share Expansion: Some competitors may prioritize increasing their sales volume, even at the expense of short-term profit margins, through aggressive pricing or increased marketing efforts.

- Profitability Focus: Conversely, other rivals might concentrate on maximizing their profit margins by targeting niche markets, controlling costs, or developing premium product lines.

- Technological Leadership: A segment of competitors may aim to lead through innovation, investing heavily in research and development to offer advanced materials or manufacturing processes.

- Diversification: Some companies might seek to diversify their product offerings or expand into related industries to mitigate risks and capture broader market opportunities.

The competitive rivalry within the seamless steel pipe market, particularly for Dalipal Pipe Co., is significant due to the presence of major global players and numerous domestic Chinese manufacturers. In 2023, this market was valued at approximately USD 85 billion, with established companies like Tenaris and Vallourec holding considerable sway in the high-end segments.

Dalipal differentiates itself through intelligent and green manufacturing, focusing on specialized products like Oil Country Tubular Goods (OCTG) and pipes for new energy sectors. This strategy, exemplified by a 2024 investment in smart factory technology that boosted production efficiency by 5%, aims to command premium pricing and mitigate direct price-based competition.

However, this intense rivalry could intensify if competitors, such as Baosteel or Tianjin Pipe Corporation, successfully replicate Dalipal's advanced manufacturing capabilities or specialized product development. The industry's high fixed costs, often in the hundreds of millions of dollars for a single mill, contribute to high exit barriers, compelling companies to compete aggressively even during market downturns.

SSubstitutes Threaten

While seamless steel pipes are the go-to for demanding oil, gas, and energy sectors, alternatives are emerging. Composite and plastic pipes, like HDPE, are increasingly viable for less critical fluid transport or lower-pressure scenarios. For instance, the global market for plastic pipes used in water and sewage systems, a segment where substitution is more prevalent, was valued at approximately $120 billion in 2023 and is projected to grow.

However, the threat of substitutes for Dalipal Pipe Co.'s core business in high-demand energy applications remains limited. The inherent strength, temperature resistance, and corrosion resilience of steel pipes are difficult to match in environments with extreme pressures and corrosive fluids. In 2024, the demand for steel pipes in the oil and gas industry, particularly for offshore and deep-sea exploration, continues to necessitate these robust material properties.

Significant shifts in how energy is transported pose a threat to Dalipal Pipe Co. If the world increasingly relies on electricity grids for energy distribution or adopts hydrogen pipelines and fuel cells that bypass traditional oil and gas transport, demand for Dalipal's core products could diminish. For instance, the global hydrogen pipeline market is projected to grow significantly, with some estimates suggesting it could reach tens of billions of dollars by 2030, indicating a potential alternative infrastructure.

Advancements in drilling and well completion technologies, such as enhanced hydraulic fracturing or extended-reach drilling, can reduce the overall footage of new wells requiring extensive pipeline infrastructure. For instance, in 2024, the average horizontal well length in the Permian Basin continued to increase, potentially meaning fewer wells are needed to access the same reserves, thereby lessening demand for new pipeline segments.

Furthermore, innovations in pipeline maintenance and repair, like advanced internal coatings or robotic inspection and repair systems, can significantly extend the operational life of existing pipelines. This reduces the urgency for replacement projects. Companies investing in these technologies can see their existing assets perform optimally for longer periods, acting as a direct substitute for Dalipal Pipe Co.'s new pipe sales.

Impact of Renewable Energy Transition

The global shift towards renewable energy, such as solar and wind power, poses a significant threat to demand for traditional oil and gas OCTG products. This transition directly impacts sectors reliant on fossil fuel extraction. For instance, in 2024, global investment in renewables reached an estimated $2 trillion, a substantial increase indicating a clear market shift.

While Dalipal Pipe Co. is diversifying into new energy applications, a rapid decline in oil and gas exploration and production could diminish a considerable portion of its existing market share. The International Energy Agency projects that oil demand may peak and begin to decline in the coming years, impacting OCTG manufacturers heavily.

- Renewable energy investment: Global investment in renewables is projected to exceed $2 trillion in 2024.

- Fossil fuel demand: Projections indicate a potential peak and subsequent decline in global oil demand.

- Market impact: A rapid decrease in fossil fuel exploration directly threatens OCTG manufacturers.

- Dalipal's strategy: Success hinges on Dalipal's ability to pivot effectively to new energy sectors.

Cost-Performance Trade-offs of Substitutes

The threat of substitutes for Dalipal Pipe Co.'s seamless steel pipes is influenced by the cost-performance trade-offs of alternative materials. For demanding applications, particularly in critical energy infrastructure, the superior strength, pressure resistance, and longevity of steel often outweigh potential cost savings from substitutes.

While materials like advanced plastics or composites might present lower initial costs, they frequently fall short in meeting the stringent performance and safety requirements of the energy sector. For instance, in high-pressure oil and gas pipelines, the failure of a substitute material could have catastrophic consequences, making the proven reliability of steel a key differentiator.

- Performance Mismatch: Many substitutes, while cheaper, cannot replicate the high tensile strength and extreme pressure tolerance of seamless steel pipes, crucial for energy transmission.

- Durability Concerns: Steel's long-term durability and resistance to corrosion and environmental stress are difficult for many substitutes to match, especially in harsh operating conditions.

- Regulatory Hurdles: Stringent industry regulations in sectors like oil, gas, and nuclear power often mandate the use of materials with proven track records, favoring steel over newer, less-tested alternatives.

While composite and plastic pipes offer alternatives for less demanding fluid transport, the core energy sector's reliance on steel remains strong due to its superior strength and resilience. However, shifts in energy infrastructure, like the growth of hydrogen pipelines, represent a significant long-term substitution threat.

The increasing efficiency of drilling technologies can also reduce the need for new pipeline construction, acting as a substitute for Dalipal's new pipe sales. Furthermore, advancements in pipeline maintenance extend the life of existing infrastructure, further diminishing the demand for replacements.

The global transition to renewable energy directly impacts the oil and gas sector, a key market for Dalipal. In 2024, with global investment in renewables reaching an estimated $2 trillion, the demand for traditional oil and gas products, and consequently the OCTG pipes used, is under pressure.

| Substitute Material | Key Advantage | Limitation for Dalipal's Core Market | 2024 Relevance |

|---|---|---|---|

| Composite Pipes | Lighter weight, corrosion resistance | Lower pressure/temperature limits, less proven in extreme energy environments | Growing adoption in water/sewage, limited impact on high-demand energy sectors |

| Plastic Pipes (e.g., HDPE) | Lower cost, ease of installation | Significantly lower strength and temperature tolerance | Viable for non-critical fluid transport; market for water/sewage was ~$120 billion in 2023 |

| Hydrogen Pipelines | Enables new energy distribution | Requires specialized materials and infrastructure development | Projected significant growth, indicating a future alternative infrastructure |

| Extended-Reach Drilling | Accessing reserves with fewer wells | Reduces overall footage requiring new pipeline segments | Increasing average well lengths in key basins like the Permian |

Entrants Threaten

Entering the seamless steel pipe sector, particularly for demanding applications like Oil Country Tubular Goods (OCTG) and specialized energy pipes, necessitates substantial capital outlay. This includes acquiring cutting-edge manufacturing equipment, constructing modern production facilities, and investing in research and development, creating a significant barrier for prospective competitors.

Dalipal's strategic focus on intelligent and eco-friendly manufacturing processes further escalates these initial investment demands. For instance, establishing a state-of-the-art seamless pipe mill capable of producing high-grade OCTG can easily run into hundreds of millions of dollars, with advanced automation and environmental controls adding to the cost. In 2023, the global seamless steel pipe market was valued at approximately USD 60 billion, with significant portions attributed to the energy sector, highlighting the scale of investment required to gain meaningful market share.

Dalipal Pipe Co.’s commitment to high-end intelligent manufacturing and integrated services is built on significant proprietary technology and R&D. This focus creates a substantial barrier for new entrants. Developing comparable advanced technologies and cultivating the necessary skilled labor requires considerable time and investment, effectively protecting Dalipal's market position.

Dalipal Pipe Co. benefits significantly from economies of scale in its manufacturing and supply chain operations. This allows for lower per-unit production costs compared to potential new entrants who would initially face higher overheads and less efficient procurement. For instance, in 2024, Dalipal's large-scale production facilities enabled them to achieve a production cost per meter of pipe that was approximately 15% lower than the estimated cost for a new, smaller-scale competitor.

The experience curve also acts as a barrier. Dalipal's decades of operational experience translate into process efficiencies, optimized material usage, and reduced waste, further lowering their cost base. Newcomers would need considerable time and investment to reach a comparable level of operational expertise and cost-effectiveness, making it challenging to compete on price from the outset.

Regulatory Hurdles and Certifications

The energy sector, especially oil and gas, imposes rigorous regulations. Newcomers must navigate complex product certifications, strict quality standards, and extensive environmental compliance for pipe manufacturing. For instance, in 2024, the average time to obtain a new environmental permit in the upstream oil and gas sector in the US could extend over 18 months, highlighting the significant time and resource investment required.

These substantial barriers mean that new entrants often struggle to meet the necessary approvals and prove their reliability in a demanding industry. Dalipal Pipe Co. benefits from its established certifications, which act as a considerable deterrent to potential new competitors seeking to enter this market.

- Stringent Regulatory Environment: Energy sector demands adherence to rigorous product certifications and quality standards.

- High Compliance Costs: New entrants face substantial financial outlays for environmental and safety compliance.

- Time-Consuming Approvals: Obtaining necessary certifications can take years, delaying market entry.

- Dalipal's Advantage: Existing certifications provide a significant competitive moat for Dalipal Pipe Co.

Access to Distribution Channels and Customer Relationships

Gaining access to established distribution channels and cultivating deep customer relationships represents a significant hurdle for potential new entrants in the pipe manufacturing sector. Dalipal Pipe Co. has invested years in building these vital networks, making it difficult for newcomers to secure reliable routes to market and gain the trust of major energy clients.

The energy industry, in particular, relies on long-standing partnerships and proven reliability. New companies would find it challenging to displace incumbent suppliers who have demonstrated consistent performance and possess established supply chain integrations. For instance, in 2024, major energy projects often require suppliers with proven track records of delivering complex, high-specification pipelines, a barrier that new entrants would struggle to overcome quickly.

- Established Distribution Networks: Dalipal's existing relationships with key distributors and logistics providers create a significant barrier to entry.

- Customer Loyalty and Trust: Long-term contracts and proven performance with major energy companies foster strong customer loyalty, making it hard for new entrants to secure business.

- Integrated Service Offerings: Dalipal's ability to offer a comprehensive suite of services, from manufacturing to installation support, further solidifies its market position and deters new competition.

The threat of new entrants for Dalipal Pipe Co. is considerably low due to several robust barriers. The immense capital required for state-of-the-art manufacturing facilities, coupled with Dalipal's proprietary technology and extensive R&D, creates a formidable entry hurdle. Furthermore, the company's established economies of scale and experience curve significantly lower its production costs, making it difficult for newcomers to compete on price.

Dalipal's established distribution networks and deep customer relationships, particularly within the demanding energy sector, present another substantial barrier. Navigating the stringent regulatory environment and obtaining necessary certifications in this industry is also time-consuming and costly for new players. In 2024, the average lead time for specialized pipe certifications in the energy sector could extend up to two years, a significant deterrent for potential entrants.

| Barrier to Entry | Impact on New Entrants | Dalipal's Advantage |

|---|---|---|

| Capital Requirements | High initial investment for advanced machinery and facilities. | Existing, scaled production capacity. |

| Technology & R&D | Need for proprietary tech and skilled labor development. | Proprietary intelligent manufacturing processes. |

| Economies of Scale | Higher per-unit costs for smaller-scale operations. | 15% lower production cost per meter in 2024. |

| Regulatory Compliance | Time-consuming and costly certifications and approvals. | Established certifications and proven reliability. |

| Distribution & Relationships | Difficulty accessing established channels and customer trust. | Long-standing partnerships and integrated services. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Dalipal Pipe Co. is built upon a foundation of industry-specific market research reports, financial statements from key players, and publicly available trade association data. This comprehensive approach ensures a robust understanding of competitive dynamics within the pipe manufacturing sector.