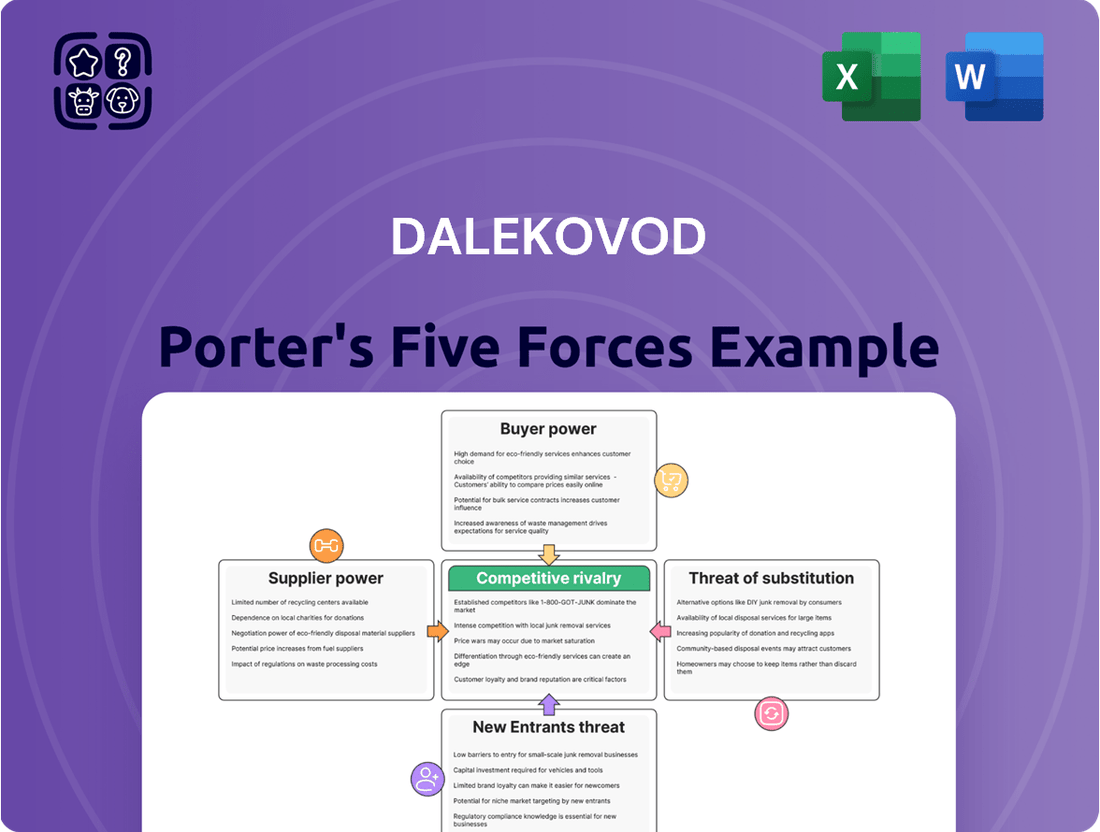

Dalekovod Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dalekovod Bundle

Dalekovod's competitive landscape is shaped by significant supplier power and the ever-present threat of new entrants, impacting their pricing and market share. Understanding these forces is crucial for any stakeholder looking to navigate this complex industry.

The complete report reveals the real forces shaping Dalekovod’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Dalekovod's reliance on a concentrated group of global manufacturers for specialized, high-voltage components like transformers and insulators significantly impacts supplier bargaining power. These suppliers often hold proprietary technology and essential certifications, narrowing Dalekovod's choices and strengthening the suppliers' negotiating position on pricing and contract terms.

Once Dalekovod integrates a specific supplier's components into its designs and construction, switching to another can be very expensive. This involves costs for re-engineering, getting new certifications, and potential delays, which can be substantial in the infrastructure sector. For instance, in 2024, the average cost for re-certifying specialized electrical components in large-scale projects could range from 5% to 15% of the component's initial value, impacting project timelines significantly.

This dependency gives suppliers a stronger hand, especially in long-term contracts or for ongoing maintenance needs. The intricate nature and stringent safety requirements for high-voltage infrastructure, a core area for Dalekovod, amplify these switching costs. For example, a single project might require components that meet specific international safety standards, making it difficult and costly to find comparable alternatives quickly.

The global power industry is currently grappling with significant shortages of essential components, including transformers. This scarcity directly impacts companies like Dalekovod, affecting their ability to secure necessary equipment for projects.

These widespread material and equipment shortages empower the few suppliers who can still provide these critical items. This situation translates into higher prices and extended delivery times, granting these suppliers considerable bargaining leverage over their customers.

For Dalekovod, these market dynamics pose a direct challenge to project execution and financial performance. For instance, reports from early 2024 indicated lead times for high-voltage transformers extending to 18-24 months, a substantial increase from pre-shortage periods, directly impacting project planning and cost estimations.

Supplier's Forward Integration Potential

Some major global suppliers of power transmission components and equipment are increasingly offering Engineering, Procurement, and Construction (EPC) services. This forward integration means these suppliers could directly compete with Dalekovod on projects, potentially squeezing market share and intensifying competition from vertically integrated players.

For instance, in 2024, several large international manufacturers in the power sector announced expansions into EPC services, aiming to capture a larger portion of project value chains. This trend highlights how suppliers are leveraging their manufacturing capabilities to move downstream.

- Forward Integration Threat: Key suppliers can become direct competitors by offering EPC services, eroding Dalekovod's project opportunities.

- Increased Competition: Vertically integrated suppliers can offer bundled solutions, potentially at more competitive prices.

- Dalekovod's Counterbalance: Dalekovod's deep-seated expertise in construction and maintenance provides a significant advantage in project execution and client relationships.

Impact of Raw Material Price Fluctuations

The bargaining power of suppliers is a significant factor for Dalekovod, particularly concerning raw materials like steel. Suppliers of steel structures and metallic components, essential for Dalekovod's manufacturing operations, are exposed to considerable volatility in raw material prices. For instance, global steel prices saw fluctuations throughout 2024, influenced by factors such as geopolitical events and energy costs, directly impacting the cost base for these suppliers.

When these suppliers experience substantial cost increases, they often pass these higher expenses onto their customers, including Dalekovod. This can directly affect Dalekovod's profitability and project margins. The company's stated focus on an efficient procurement process in its recent reports is a clear indicator of its strategy to actively manage and mitigate this supplier power.

- Steel Price Volatility: Global steel prices, a key input for Dalekovod, experienced notable price swings in 2024, impacting supplier costs.

- Cost Pass-Through: Suppliers with strong market positions can pass increased raw material costs directly to Dalekovod.

- Procurement Strategy: Dalekovod's emphasis on an efficient procurement process aims to reduce the impact of supplier bargaining power.

Dalekovod faces significant supplier bargaining power due to its reliance on a limited number of global manufacturers for specialized high-voltage components. These suppliers often possess proprietary technology and essential certifications, limiting Dalekovod's options and strengthening their negotiating position on pricing and terms.

Switching costs are substantial for Dalekovod, as re-engineering and recertification for specialized components can be costly, potentially ranging from 5% to 15% of component value in 2024. This dependency grants suppliers considerable leverage, especially for ongoing maintenance or long-term contracts where specific safety standards are paramount.

Current global shortages of critical components, like transformers, further empower suppliers who can still deliver. This scarcity translates into higher prices and extended lead times, with transformer delivery times in early 2024 reaching 18-24 months, impacting project planning and costs for Dalekovod.

Some suppliers are also moving into EPC services, directly competing with Dalekovod and potentially capturing market share. This forward integration, observed with several international manufacturers expanding their offerings in 2024, intensifies competition from vertically integrated players.

| Factor | Impact on Dalekovod | 2024 Data/Trend |

|---|---|---|

| Component Specialization | Limited supplier options, higher prices | Proprietary technology, essential certifications |

| Switching Costs | High costs for re-engineering/recertification | 5-15% of component value for recertification |

| Component Shortages | Increased prices, extended lead times | Transformer lead times: 18-24 months |

| Supplier Forward Integration | Increased competition from EPC services | Expansion of EPC services by key manufacturers |

What is included in the product

This analysis dissects the competitive forces impacting Dalekovod, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the energy infrastructure sector.

Effortlessly identify and mitigate competitive threats with a visual breakdown of industry forces, enabling proactive strategic adjustments.

Customers Bargaining Power

Dalekovod's primary customers are national grid operators (TSOs), state-owned utilities, and large government entities. These sophisticated buyers, involved in massive energy infrastructure projects, often participate in competitive tenders. This allows them to exert significant pressure on pricing and contract terms, leveraging their strategic importance in national energy security.

The bargaining power of customers is influenced by the high value and long-term nature of infrastructure projects. While individual project bids are highly competitive, Dalekovod's sustained engagement with clients like HOPS in Croatia and securing substantial contracts with TenneT in Germany indicates a degree of customer loyalty and a recognition of established partnerships.

Customers are increasingly looking for complete Engineering, Procurement, and Construction (EPC) services, like those Dalekovod provides, which handle everything from design to installation. This shift means clients prefer a single, expert point of contact, simplifying their project management but also raising expectations for a provider's capabilities and reliability.

Furthermore, there's a growing customer preference for sustainable options and products that minimize environmental impact. For instance, by 2024, global investment in renewable energy projects, a key area for EPC services, reached over $500 billion, indicating a strong market pull for eco-conscious solutions.

Regulatory and Public Scrutiny on Projects

The bargaining power of customers for Dalekovod is significantly influenced by regulatory and public scrutiny on power infrastructure projects. Given the essential and often strategic nature of these projects, customers, frequently government-backed entities, are subject to stringent oversight concerning project expenses, delivery schedules, and environmental considerations.

This intense focus translates into considerable pressure on contractors like Dalekovod to maintain strict adherence to budgets, timelines, and sustainability mandates. For instance, the European Union's ambitious Green Deal, aiming for climate neutrality by 2050, necessitates massive investments in grid modernization and renewable energy integration. By 2024, the EU projected needing over €350 billion annually for energy infrastructure upgrades to meet its climate targets.

- Government-backed customers demand strict cost control due to public accountability.

- Project delays and environmental non-compliance face significant public and regulatory penalties.

- The push for renewable energy integration across Europe, with billions invested annually, heightens customer expectations for efficient and sustainable project execution.

Availability of Alternative Contractors

While the high-voltage power infrastructure market is quite specialized, customers often find they have a selection of qualified international and regional contractors for significant projects. This competitive landscape among service providers grants customers considerable leverage when negotiating favorable terms, particularly for projects that are less intricate or more standardized.

Major global entities actively compete within this segment, further intensifying customer bargaining power. For instance, in 2024, several large-scale transmission line projects saw bids from multiple international consortia, allowing clients to secure more competitive pricing and contract conditions.

- Limited but Present Choice: Customers in the high-voltage power infrastructure sector, while facing a specialized market, still have a choice of several qualified international and regional contractors for major undertakings.

- Negotiating Leverage: The presence of multiple competing service providers empowers customers to negotiate better terms, especially for projects that are less complex or more standardized.

- Global Competition: Major international players are active participants in this market, contributing to a competitive environment that benefits customers.

- 2024 Market Dynamics: In 2024, significant transmission line projects demonstrated this trend, with multiple international bids leading to more favorable client outcomes in pricing and contract terms.

Dalekovod's customers, primarily national grid operators and state-owned utilities, wield considerable bargaining power due to the strategic importance and large scale of energy infrastructure projects. These sophisticated buyers, often government-backed, participate in competitive tenders, driving down prices and influencing contract terms. The increasing demand for comprehensive EPC services and a growing preference for sustainable solutions further amplify customer leverage, as they seek reliable, end-to-end project management and environmentally conscious execution.

The competitive landscape, featuring both international and regional contractors, grants customers significant negotiating power. For example, in 2024, several major transmission line projects saw multiple international consortia bidding, allowing clients to secure more favorable pricing and contract conditions. This dynamic is further underscored by the substantial investments in renewable energy integration across Europe, projected to exceed €350 billion annually by 2024 to meet climate targets, pushing customers to demand efficient and sustainable project delivery.

| Customer Type | Bargaining Power Drivers | Key Customer Expectations | 2024 Market Insight |

|---|---|---|---|

| National Grid Operators & State Utilities | Strategic importance, large project scale, competitive tenders | Competitive pricing, favorable contract terms, adherence to budgets and timelines | Multiple international bids for transmission projects led to better client outcomes. |

| Government Entities | Public accountability, regulatory oversight | Strict cost control, environmental compliance, project efficiency | EU's Green Deal drives demand for grid upgrades, requiring significant annual investment. |

| Clients seeking EPC Services | Demand for integrated solutions, preference for sustainability | End-to-end project management, reliable execution, eco-conscious solutions | Global investment in renewables surpassed $500 billion in 2024, indicating a strong market for sustainable infrastructure. |

Full Version Awaits

Dalekovod Porter's Five Forces Analysis

This preview showcases the complete Dalekovod Porter's Five Forces Analysis, offering a detailed examination of competitive forces within its industry. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, ensuring no surprises or placeholder content. You can confidently expect instant access to this comprehensive report, ready for immediate use and strategic application.

Rivalry Among Competitors

Dalekovod faces intense rivalry from global giants like Siemens and Hitachi Energy, alongside formidable regional specialists in power transmission. This competitive landscape is further heated by substantial investments in global energy demand and grid modernization, creating a fierce battle for lucrative projects across Europe and internationally.

The power transmission and distribution sector, where Dalekovod operates, is inherently burdened by substantial fixed costs. These include significant investments in specialized machinery, advanced engineering talent, and robust infrastructure, all of which are essential for project execution.

These high fixed costs create a powerful incentive for companies like Dalekovod to secure a steady stream of projects. To achieve optimal capacity utilization and spread these overheads, firms often engage in aggressive bidding, which naturally intensifies price competition within the industry.

Dalekovod's 2024 financial disclosures indicate a positive trend, with improved capacity utilization directly correlating with enhanced profitability, underscoring the critical link between project acquisition and financial health in this capital-intensive environment.

In the power industry, a company's reputation and track record are paramount. Success hinges on demonstrating unwavering safety standards and consistently delivering reliable projects, especially given the critical nature of energy infrastructure. Dalekovod's extensive experience, both within Croatia and on international stages, including a recent €30 million contract secured in Germany, underscores its significant competitive advantage in this regard.

Market Growth Driven by Energy Transition

The global push for an energy transition, driven by climate concerns and technological advancements, is significantly expanding the power transmission and distribution sector. This market is anticipated to surpass USD 400 billion by 2033, creating a fertile ground for growth.

This burgeoning market presents a dual-edged sword for Dalekovod. While the expansion offers substantial opportunities for new projects and revenue streams, it simultaneously intensifies competitive rivalry. Established players and new entrants are all eager to capture a portion of this lucrative and growing market.

- Market Expansion: The global power transmission and distribution market is projected to exceed USD 400 billion by 2033, driven by the energy transition.

- Increased Competition: This significant growth attracts numerous companies, leading to heightened competition for market share.

- Opportunities for Dalekovod: The expanding market provides Dalekovod with opportunities for new projects, particularly in grid modernization and renewable energy integration.

- Rivalry Dynamics: Dalekovod must navigate a landscape with both established competitors and emerging players vying for contracts in this dynamic sector.

Differentiated Services and Niche Specialization

Companies can significantly reduce competitive rivalry by offering specialized services. Dalekovod, for instance, differentiates itself through its integrated Engineering, Procurement, and Construction (EPC) capabilities, alongside its manufacturing of critical components like steel structures. This dual focus allows it to tackle complex projects, including those in challenging terrains, thereby carving out a unique market position.

This specialization can lessen direct competition. By providing end-to-end solutions, Dalekovod might face fewer rivals who can match its comprehensive service offering. For example, in 2024, the global EPC market for energy infrastructure was valued at approximately $300 billion, with specialized players often commanding higher margins due to their unique expertise.

- Niche Focus: Specialization in areas like high-voltage transmission lines or renewable energy infrastructure projects.

- Integrated Solutions: Offering both design/engineering and manufacturing of key components.

- Technical Expertise: Demonstrating advanced capabilities in complex project execution and challenging environments.

Dalekovod faces intense competition from global players like Siemens and Hitachi Energy, as well as strong regional specialists. This rivalry is fueled by significant investments in global energy demand and grid modernization, leading to a fierce battle for projects. The sector's high fixed costs, including machinery and talent, push companies towards aggressive bidding to ensure capacity utilization and spread overheads, intensifying price competition.

Dalekovod's 2024 performance shows that better capacity utilization directly impacts profitability, highlighting the crucial link between securing projects and financial health in this capital-intensive industry. The global power transmission and distribution market is expected to exceed USD 400 billion by 2033, a growth that attracts both established firms and new entrants, thus heightening rivalry.

By offering integrated Engineering, Procurement, and Construction (EPC) services and manufacturing critical components like steel structures, Dalekovod differentiates itself. This specialization, particularly in complex projects or challenging terrains, can reduce direct competition, as fewer rivals can match its comprehensive offering. The global EPC market for energy infrastructure was valued at approximately $300 billion in 2024, with specialized firms often achieving higher margins.

| Company | Key Competitors | Market Share (Estimate) | 2024 Revenue (Approx.) | Key Differentiators |

|---|---|---|---|---|

| Dalekovod | Siemens, Hitachi Energy, ABB | N/A (Specific data not publicly available for all competitors) | N/A (Specific data not publicly available for all competitors) | Integrated EPC, component manufacturing |

| Siemens Energy | General Electric, Mitsubishi Heavy Industries | Significant global player | €33.3 billion (FY2023) | Broad portfolio, technological innovation |

| Hitachi Energy | Schneider Electric, Eaton | Growing global presence | CHF 10.5 billion (FY2023) | Grid modernization, renewable integration solutions |

SSubstitutes Threaten

The increasing adoption of distributed energy resources (DERs) like rooftop solar and local battery storage poses a growing, albeit indirect, threat to traditional power transmission companies. As more energy is generated closer to where it's consumed, the reliance on extensive, long-distance transmission infrastructure can diminish over time.

For instance, in 2024, many European nations, including those in the Adriatic region, continue to push for greater renewable energy integration. This trend means that while Dalekovod's core business remains vital, the long-term demand for new, large-scale transmission projects could be impacted by the decentralized nature of energy production.

The threat of substitutes for Dalekovod's core transmission line construction services is intensifying due to advancements in grid optimization and efficiency technologies. Smart grids, for instance, allow for more dynamic management of electricity flow, potentially increasing the capacity of existing lines. In 2024, investments in grid-enhancing technologies (GETs) are projected to reach billions globally, with a significant portion allocated to solutions like dynamic line ratings and advanced monitoring systems. These technologies offer a less capital-intensive alternative to building new transmission infrastructure, directly impacting the demand for traditional construction projects.

Reconductoring existing power lines presents a significant threat of substitution for new transmission line construction projects. By replacing older conductors with advanced, higher-capacity materials, utilities can dramatically increase power flow on existing rights-of-way, often at a fraction of the cost and time of building entirely new lines. This approach can effectively double the transmission capacity on many long-distance routes.

For instance, in 2023, several European nations continued to invest heavily in reconductoring programs. These initiatives are driven by the need to integrate more renewable energy sources and meet growing demand without the extensive permitting and construction timelines associated with new build projects. This makes reconductoring a compellingly faster and more economical alternative, directly impacting the market for traditional new transmission line development.

Energy Efficiency and Demand-Side Management

The increasing emphasis on energy efficiency and demand-side management (DSM) presents a threat of substitutes by potentially curbing the overall demand for electricity. For instance, in 2024, many utilities are investing heavily in smart grid technologies and customer incentive programs aimed at reducing peak load and overall consumption. This trend could lessen the urgency for new, large-scale transmission infrastructure projects, impacting companies like Dalekovod.

While not a direct replacement for the physical transmission lines Dalekovod builds, a substantial slowdown in electricity demand growth due to these efficiency measures could reduce the pipeline of future projects. For example, a 5% improvement in energy efficiency across the industrial sector in a key market could translate to billions in deferred investment for transmission upgrades. This broader energy sector shift necessitates a strategic re-evaluation of growth projections.

The threat is amplified as governments and regulatory bodies worldwide are setting ambitious energy efficiency targets. In 2024, the International Energy Agency reported that global energy intensity improvements are accelerating, indicating a structural shift in energy consumption patterns. This means that the demand for new transmission capacity might not grow as rapidly as previously forecast.

- Reduced Electricity Demand: Energy efficiency measures can directly lower the need for new power generation and transmission capacity.

- Demand-Side Management (DSM) Programs: Utility-led initiatives to manage customer energy use can flatten demand curves, lessening peak load requirements.

- Impact on Infrastructure Investment: A significant reduction in demand growth could lead to fewer new transmission projects, affecting companies involved in grid expansion.

- Broader Energy Sector Trends: The global push for sustainability and decarbonization is driving greater adoption of efficiency and DSM, a trend expected to continue through 2025.

Limitations of Substitutes for Core Business

While alternative energy transmission methods are developing, they currently struggle to match the scale and efficiency of traditional high-voltage power lines for long-distance, high-capacity needs. For instance, the significant investment required for advanced grid infrastructure, like superconducting cables, means they are not yet a widespread substitute for established networks, especially in emerging markets or for connecting remote renewable sources. The sheer volume of electricity, often generated in areas far from population centers, still relies heavily on conventional transmission infrastructure that Dalekovod specializes in.

The ongoing global energy transition, with its emphasis on integrating vast renewable energy projects, continues to bolster the demand for Dalekovod's core services. Many of these projects, such as offshore wind farms or large solar installations in deserts, require extensive new transmission infrastructure to connect them to the grid. For example, in 2024, numerous countries are still in the planning or construction phases for major transmission upgrades to accommodate these renewable sources, underscoring the continued relevance of traditional transmission line expertise.

The limitations of substitutes become particularly apparent when considering the robustness and proven reliability of existing transmission networks. While innovations like High-Voltage Direct Current (HVDC) offer advantages for very long distances, the widespread deployment and integration of these systems are still evolving. Dalekovod's expertise in constructing and maintaining the vast network of conventional high-voltage alternating current (HVAC) lines remains critical for grid stability and energy delivery.

- Limited Scalability: Many emerging transmission alternatives lack the capacity to handle the massive power flows required for national grids.

- Cost Barriers: The high upfront investment for novel transmission technologies often makes them less competitive than established methods.

- Infrastructure Integration Challenges: Seamlessly integrating new transmission technologies with existing power grids presents significant technical hurdles.

- Reliability Concerns: Traditional transmission lines have a long track record of reliability, which newer technologies are still proving.

The threat of substitutes for Dalekovod's transmission line construction is primarily driven by advancements in grid efficiency and the rise of distributed energy resources. While direct replacements for high-voltage transmission lines are limited, alternative approaches can reduce the need for new construction.

Smart grid technologies and reconductoring existing lines offer ways to increase capacity without building entirely new infrastructure. For instance, in 2024, global investment in grid-enhancing technologies (GETs) is substantial, with solutions like dynamic line ratings aiming to boost the efficiency of current assets. This trend means that utilities might opt for these upgrades over new line projects, impacting Dalekovod's traditional market.

Furthermore, increased energy efficiency and demand-side management (DSM) are curbing overall electricity demand growth. In 2024, many regions are implementing aggressive efficiency targets. For example, a 5% improvement in industrial energy efficiency could defer billions in transmission investments, directly affecting the pipeline for new projects.

| Substitute Category | Description | Impact on Dalekovod | 2024 Relevance |

|---|---|---|---|

| Distributed Energy Resources (DERs) | Rooftop solar, local battery storage reducing reliance on central grids. | Indirectly reduces demand for long-distance transmission. | Continued growth in adoption across many markets. |

| Grid-Enhancing Technologies (GETs) | Smart grids, dynamic line ratings, advanced monitoring. | Increases capacity of existing lines, potentially delaying new builds. | Billions invested globally in 2024 for grid modernization. |

| Reconductoring | Upgrading existing lines with higher-capacity conductors. | More cost-effective alternative to new line construction. | Key strategy for utilities in 2023-2024 to integrate renewables. |

| Energy Efficiency & DSM | Reducing overall electricity consumption and peak demand. | Lowers the need for new transmission capacity expansion. | Accelerating global energy intensity improvements reported in 2024. |

Entrants Threaten

The high-voltage power transmission and electrical infrastructure construction sector presents a formidable threat of new entrants due to exceptionally high capital investment requirements. Companies looking to enter this market need to secure significant funding for specialized equipment, advanced machinery, and substantial working capital to manage the long lead times and complex financial demands of large-scale projects.

For instance, a single high-voltage substation project can easily run into tens of millions of euros, and the construction of transmission lines requires extensive land acquisition, specialized vehicles, and highly skilled labor, all of which necessitate massive upfront investment. Dalekovod's financial reports for 2024, showing significant ongoing investments in infrastructure development and a robust order book, underscore the sheer financial muscle required to compete effectively.

The design, construction, and maintenance of high-voltage power infrastructure demand a deep well of specialized engineering knowledge and a highly skilled workforce. These are not easily replicated skills, forming a significant barrier for potential newcomers looking to enter the sector.

Furthermore, adherence to rigorous international and national safety and technical standards is paramount. Obtaining the necessary certifications and cultivating a qualified team represents a substantial upfront investment and a considerable hurdle for any new entrant, directly impacting the threat of new competition for established players like Dalekovod.

The power sector's infrastructure projects, like those Dalekovod undertakes, are characterized by exceptionally long development and execution timelines, frequently stretching over multiple years. These projects also carry substantial technical and financial risks, making them daunting for newcomers. For instance, in 2023, the average lead time for securing permits for major energy infrastructure projects in the EU was reported to be over 3 years, a significant hurdle for any new entrant.

New companies entering this space would find it challenging to secure the substantial long-term financing required and to effectively navigate the intricate complexities and inherent uncertainties. These factors, combined with persistent permitting delays that further extend project timelines, create a formidable barrier to entry, protecting established players like Dalekovod.

Established Relationships and Reputation

Established companies like Dalekovod benefit from deep-seated relationships with crucial clients, such as national grid operators. These incumbents possess a history of successful, large-scale project execution, making it difficult for newcomers to penetrate these trusted networks, especially for vital infrastructure projects.

New entrants would struggle to replicate the trust and established connections that Dalekovod and similar firms have cultivated over years. For instance, Dalekovod's recent success in securing contracts in Germany and Norway highlights the strength of these existing partnerships, which are not easily overcome by new competitors.

- Long-standing client partnerships: Dalekovod has cultivated deep relationships with key customers, particularly in the energy infrastructure sector.

- Proven track record: The company's history of successful project delivery builds significant credibility.

- Barriers to entry: Newcomers face challenges in establishing similar trust and access to critical infrastructure contracts.

- Recent contract wins: Dalekovod's recent projects in Germany and Norway underscore the value of its established network.

Regulatory and Licensing Hurdles

The power transmission sector is subject to extensive regulations, demanding a multitude of licenses, permits, and adherence to intricate environmental and safety standards. This complex regulatory environment, including initiatives like the EU Grid Action Plan and various national regulations, presents a substantial barrier for new entrants, making market entry a time-consuming and expensive undertaking.

Navigating these stringent requirements necessitates significant investment in legal expertise, compliance documentation, and potentially long lead times for approvals. For instance, obtaining all necessary certifications and permits can extend the initial setup phase for a new transmission company by several years, effectively deterring less capitalized or experienced players.

- Significant Capital Investment: New entrants must allocate substantial funds towards legal counsel, compliance officers, and the application processes for various licenses and permits.

- Extended Timeframes: The approval process for essential permits and licenses can take years, delaying market entry and impacting the return on investment for new companies.

- Evolving Regulatory Landscape: Keeping abreast of and complying with constantly updating regulations, such as those stemming from the EU Grid Action Plan, adds ongoing complexity and cost.

The threat of new entrants in the high-voltage power transmission sector remains relatively low for Dalekovod. This is primarily due to the immense capital requirements, specialized technical expertise, and established client relationships that act as significant barriers.

For example, securing the necessary permits and certifications can take years, as evidenced by the average 3-year lead time for major energy infrastructure projects in the EU reported in 2023. This lengthy process, coupled with the need for specialized equipment and a highly skilled workforce, deters many potential new players.

Dalekovod's strong track record and long-standing partnerships with national grid operators, as seen in their recent contract wins in Germany and Norway, further solidify their position and make it challenging for newcomers to gain traction.

| Barrier | Description | Impact on New Entrants |

|---|---|---|

| Capital Investment | High costs for specialized equipment, machinery, and working capital. | Significant financial hurdle; requires substantial funding. |

| Technical Expertise | Need for specialized engineering knowledge and skilled labor. | Difficult to replicate; requires extensive training and recruitment. |

| Regulatory Compliance | Adherence to stringent safety, technical, and environmental standards. | Time-consuming and costly; requires legal and compliance resources. |

| Client Relationships | Established trust and long-standing partnerships with grid operators. | Difficult for new entrants to penetrate; requires proven performance. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Dalekovod leverages data from annual financial reports, industry-specific market research, and publicly available company disclosures to understand competitive dynamics.