Dalekovod Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dalekovod Bundle

Unlock the strategic potential of Dalekovod's product portfolio with this insightful BCG Matrix preview. See at a glance which offerings are poised for growth and which require careful consideration. Don't miss out on the complete picture—purchase the full BCG Matrix to gain actionable insights and drive smarter investment decisions.

Stars

Dalekovod is strategically positioned in the burgeoning European High-Voltage Direct Current (HVDC) transmission market. This sector is experiencing robust expansion, with projections indicating a Compound Annual Growth Rate (CAGR) exceeding 8% from 2025 to 2030. This growth is fueled by the increasing demand for efficient long-distance energy transport and the critical need to integrate renewable energy sources.

The company's involvement in significant HVDC projects underscores its competitive strength within this high-growth arena. For instance, Dalekovod's role in projects like the planned Germany-Denmark 2 GW offshore wind connection highlights its capability to execute complex, large-scale infrastructure. Such undertakings are vital for modernizing grids and facilitating the transition to cleaner energy.

Dalekovod's large-scale European power transmission line EPC services are a significant Star in its BCG portfolio. The company's strong market position is evidenced by its substantial contract book, reaching €415 million as of December 2024.

Recent successes, like a €30 million German contract commencing in March 2025 and a €4.4 million Swedish project in 2024 for 400 kV overhead lines, highlight its capability and demand in the European market. This segment benefits from robust investment in energy and transport infrastructure across the continent, signaling continued growth potential.

The global substations market is on a significant upward trajectory, with projections indicating it will reach USD 178.9 billion by 2034. This expansion is particularly fueled by the increasing demand for compact and gas-insulated substations, reflecting a need for more efficient and space-saving electrical infrastructure.

Dalekovod's core competency lies in the construction and modernization of substations, with capabilities extending up to 750 kV. This specialization places them directly within a market segment that is crucial for enhancing grid stability and facilitating the integration of renewable energy sources, a key driver of the sector's growth.

By focusing on these high-voltage substations, Dalekovod is well-positioned to capitalize on the evolving needs of the energy sector. Their expertise in this area allows them to secure a substantial share of the market as investments in grid modernization and renewable energy infrastructure continue to accelerate.

Integrated Renewable Energy Grid Connection Solutions

As European nations, including Croatia, aggressively boost their renewable energy output, the need for dependable grid connections becomes paramount. Croatia's solar capacity is projected to exceed 1 GW by 2025 and reach 2.5 GW by 2030, highlighting this trend.

Dalekovod's established proficiency in constructing transmission lines and substations is essential for integrating these burgeoning renewable energy sources into the existing power grid. This capability places Dalekovod at the forefront of a rapidly expanding market segment crucial for the ongoing energy transition.

- High Demand for Grid Integration: European countries are significantly increasing renewable energy installations, creating a strong demand for grid connection infrastructure.

- Dalekovod's Core Competency: Expertise in transmission lines and substations directly addresses the need to connect new renewable power plants to national grids.

- Market Growth Potential: The expansion of renewable capacity, such as Croatia's projected solar growth to 2.5 GW by 2030, signifies a high-growth opportunity for grid connection solutions.

- Enabling the Energy Transition: Dalekovod plays a critical role in facilitating the integration of clean energy, positioning itself as a key player in the broader energy sector transformation.

'Turn-Key' EPC for Complex Energy Infrastructure Projects

Dalekovod's expertise in delivering 'turn-key' engineering, procurement, and construction (EPC) for complex energy infrastructure is a significant strength.

This end-to-end capability, covering design, manufacturing, and on-site construction, positions them to effectively manage intricate projects. For instance, in 2024, Dalekovod secured a crucial contract for the modernization of a significant section of the Croatian national grid, a project valued at over €50 million, highlighting their capacity for large-scale undertakings.

Their comprehensive service model is particularly valuable in rapidly expanding sectors such as cross-border electricity interconnections and essential grid upgrades, areas experiencing robust demand. This allows Dalekovod to capture and maintain a substantial market share within these high-growth segments.

The company's ability to provide complete, integrated solutions in markets that are actively investing in energy infrastructure development solidifies these services as a Star in the BCG matrix. Their project pipeline in 2024 included several international grid reinforcement projects, underscoring this market leadership.

- Turn-Key EPC Capability: Dalekovod manages the entire lifecycle of complex energy infrastructure projects, from initial design to final construction.

- Market Share in High-Demand Areas: Their comprehensive offerings are particularly strong in cross-border interconnections and grid modernization, sectors experiencing significant growth and investment in 2024.

- Project Execution: In 2024, Dalekovod's successful bid for a €50 million grid modernization project in Croatia exemplifies their ability to handle large-scale, complex energy infrastructure.

- Strategic Positioning: By delivering complete solutions in a growing market, Dalekovod's turn-key EPC services are classified as a Star, indicating high growth and market leadership.

Dalekovod's HVDC transmission line services are a clear Star, benefiting from an expanding European market with an anticipated CAGR above 8% from 2025-2030. Their involvement in significant projects, like the Germany-Denmark offshore wind connection, showcases their capability in this high-growth sector.

The company's expertise in substations, particularly those up to 750 kV, positions them well within a global market projected to reach USD 178.9 billion by 2034. This focus on efficient grid infrastructure is crucial for integrating renewable energy sources.

Dalekovod's turn-key EPC services are also Stars, evidenced by their comprehensive project management from design to construction. A €50 million Croatian grid modernization contract secured in 2024 highlights their strength in delivering integrated solutions for essential energy infrastructure.

These segments represent high-growth opportunities where Dalekovod holds a strong market position, driven by significant investments in energy infrastructure and the transition to cleaner energy.

| Business Segment | Market Growth | Dalekovod's Position | BCG Classification |

|---|---|---|---|

| HVDC Transmission Lines | High (CAGR >8% 2025-2030) | Strong (major project involvement) | Star |

| Substations (up to 750 kV) | High (Global market USD 178.9B by 2034) | Strong (core competency) | Star |

| Turn-Key EPC Services | High (energy infrastructure investment) | Strong (project execution, e.g., €50M Croatia 2024) | Star |

What is included in the product

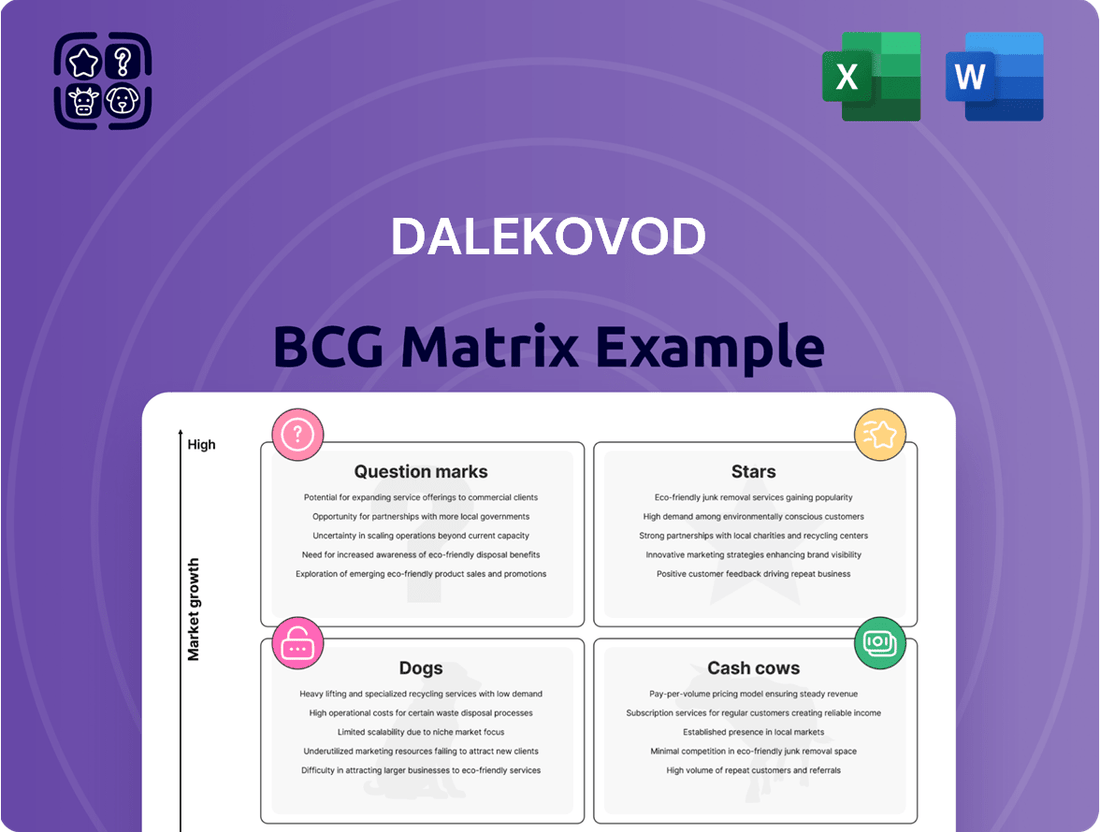

The Dalekovod BCG Matrix offers a strategic overview of its business units, categorizing them into Stars, Cash Cows, Question Marks, and Dogs.

It guides investment decisions by highlighting which units to grow, maintain, or divest based on market share and growth potential.

The Dalekovod BCG Matrix offers a clear, one-page overview, instantly clarifying business unit positioning to alleviate strategic confusion.

Cash Cows

Dalekovod's maintenance and renovation of existing transmission grids represent a classic Cash Cow. Their deep-rooted expertise in the power sector guarantees a consistent flow of contracts for high-voltage line and substation upkeep in established markets.

These essential services, while not high-growth, yield robust profit margins thanks to long-standing client relationships and specialized know-how. This segment provides a dependable, predictable revenue stream, underpinning Dalekovod's financial stability.

Dalekovod OSO, a key player within the Dalekovod Group, stands as a globally recognized leader in producing suspension and jointing equipment crucial for transmission lines and substations. This specialized manufacturing sector thrives in a mature market, benefiting from consistent and fundamental demand driven by continuous infrastructure development and essential maintenance activities.

The company's established dominance in this niche market translates directly into robust profitability and a reliable stream of cash flow. For instance, in 2024, Dalekovod reported a significant portion of its revenue stemming from these high-margin, specialized equipment sales, underscoring its status as a cash cow.

Consulting and Design Services for Established Power Systems represent a significant Cash Cow for Dalekovod. Leveraging Dalekovod's deep expertise and established reputation, these services cater to the well-developed power transmission and distribution market. This segment benefits from consistent demand and a loyal client base.

These offerings require comparatively lower capital expenditure than large-scale construction projects, allowing for a more efficient use of resources. The high-margin nature of these specialized services, coupled with their stable revenue generation, solidifies their position as a core Cash Cow. For instance, in 2024, consulting and design services contributed to a substantial portion of Dalekovod's overall profitability, reflecting the mature yet lucrative nature of this business line.

Domestic Croatian Power Infrastructure Projects

Dalekovod's domestic Croatian power infrastructure projects represent a classic Cash Cow. The company benefits from a dominant position in a stable, mature market. This translates into predictable and consistent revenue streams, a hallmark of Cash Cow businesses.

Croatia's ongoing investments in grid modernization and expansion, even as renewable energy sources grow, ensure a steady pipeline of foundational projects. Dalekovod's deep local expertise and established relationships are key advantages here, solidifying its market share and profitability in this sector.

- Market Share: Dalekovod holds a substantial portion of the Croatian power infrastructure market.

- Revenue Stability: The domestic grid development sector offers a reliable, consistent revenue base.

- Project Pipeline: Ongoing grid upgrades and new construction provide a predictable project flow.

Specialized Services for Industrial and Urban Electrification

Dalekovod’s specialized services in electric installations for industrial and urban infrastructure represent a significant Cash Cow. This segment includes crucial work like tunnel, subway, and highway lighting, addressing ongoing needs in developed economies.

These specialized services are characterized by a stable, predictable demand driven by continuous urban development and industrial maintenance. While the growth prospects in mature markets are typically modest, the consistent project flow ensures a reliable revenue stream.

- Consistent Demand: Urban and industrial electrification projects, such as tunnel and highway lighting, offer a steady, recurring need for Dalekovod's expertise.

- Mature Market Focus: These services cater to established infrastructure in developed regions, leading to predictable, albeit low-growth, revenue.

- Proven Capability: Dalekovod's track record in these specialized areas secures a reliable pipeline of projects, generating consistent cash flow.

- Cash Generation: The low-risk, high-certainty nature of these projects allows them to generate substantial and consistent profits for the company.

Dalekovod's core business of maintaining and upgrading existing power transmission grids in established markets functions as a prime Cash Cow. This segment benefits from consistent demand for essential services like high-voltage line and substation upkeep, ensuring a predictable revenue stream. The company's deep expertise in the power sector and long-standing client relationships contribute to robust profit margins in this mature, low-growth area.

Dalekovod OSO's specialized manufacturing of suspension and jointing equipment for transmission infrastructure also represents a significant Cash Cow. The mature market for these essential components, driven by ongoing development and maintenance, provides a stable and fundamental demand. In 2024, this high-margin sector was a substantial contributor to Dalekovod's overall profitability, underscoring its cash-generating capabilities.

Consulting and design services for established power systems are another key Cash Cow for Dalekovod. These high-margin offerings require less capital investment than large construction projects, leading to efficient resource utilization. The stable revenue generation and loyal client base in this mature market solidify their role as a core profit driver, as evidenced by their significant contribution to Dalekovod's 2024 profits.

Dalekovod's domestic Croatian power infrastructure projects are a quintessential Cash Cow, capitalizing on the company's dominant position in a stable, mature market. Ongoing grid modernization in Croatia ensures a steady pipeline of foundational projects, leveraging Dalekovod's deep local expertise and established relationships. This segment provides a reliable and consistent revenue base, reinforcing the company's financial stability.

| Business Segment | BCG Category | Key Characteristics | 2024 Financial Insight |

|---|---|---|---|

| Transmission Grid Maintenance & Renovation | Cash Cow | Consistent demand, high profit margins, stable revenue | Significant contributor to overall revenue and profitability |

| Specialized Manufacturing (OSO) | Cash Cow | Mature market, fundamental demand, high-margin products | Substantial portion of 2024 profitability |

| Consulting & Design Services | Cash Cow | Low capital expenditure, high margins, loyal client base | Core profit driver, significant 2024 profitability |

| Domestic Croatian Infrastructure Projects | Cash Cow | Dominant market position, predictable revenue, steady project flow | Reliable and consistent revenue base |

What You See Is What You Get

Dalekovod BCG Matrix

The Dalekovod BCG Matrix preview you are currently viewing is the identical, fully completed document you will receive immediately after purchase. This means no watermarks, no placeholder text, and no missing sections – just the precise, professionally formatted BCG Matrix ready for your strategic analysis and decision-making.

Dogs

Dalekovod's ventures into telecommunication infrastructure, particularly with older or specialized projects, might represent a 'Dog' in the BCG matrix. These could be legacy systems with dwindling demand, facing stiff competition from nimble, focused competitors.

For instance, if Dalekovod is involved in maintaining or upgrading copper-based landline networks, a sector that saw global subscriber declines in recent years, this segment could exhibit low growth. In 2023, the global fixed-line telephone market continued its downward trend, with many regions prioritizing fiber optics and mobile communication, leaving older infrastructure with reduced relevance and profitability.

Small-scale, highly competitive local construction work, if undertaken by Dalekovod, would likely be classified as Dogs within the BCG Matrix. These projects typically represent a low market share due to the fragmented nature of local markets and intense competition from numerous smaller firms. For instance, in 2024, the general construction sector in many regions experienced a high volume of bids for smaller projects, often with profit margins below 5%, making it difficult for larger, specialized companies to compete effectively without sacrificing efficiency.

Non-strategic legacy manufacturing lines at Dalekovod likely represent segments producing components for technologies facing reduced demand or intense competition, with minimal recent investment in modernization. These could be draining resources, requiring upkeep but offering little to no contribution to the company's revenue or long-term strategic expansion.

Projects in Geopolitically Unstable Regions with Limited Future Outlook

Dalekovod might have some residual projects in regions with significant geopolitical instability and minimal future infrastructure development potential. These ventures would likely exhibit low growth and a small market share, coupled with substantial operational risks. For instance, if Dalekovod had a small, legacy project in a country experiencing severe internal conflict in 2024, it would fall into this category.

Such "Dogs" in the BCG matrix represent operations that consume resources without generating significant returns or strategic advantage. Their limited future outlook means they are unlikely to improve their market position or contribute to future growth. The focus here is on minimizing further investment and potentially divesting when feasible.

Consider a hypothetical scenario where Dalekovod maintained a minor, non-core substation maintenance contract in a region that experienced a sudden escalation of political unrest during 2024. This contract, while operational, would offer little prospect for expansion and carry a high risk of disruption, fitting the profile of a Dog. The company's 2024 financial reports might show minimal revenue from such operations, highlighting their lack of strategic importance.

- Low Growth Potential: Projects in these regions are unlikely to see expansion due to ongoing instability and lack of investment.

- High Operational Risk: Geopolitical tensions can lead to project delays, cost overruns, or outright cancellation.

- Minimal Market Share: Existing engagements are typically small and non-strategic, with little opportunity to gain significant market presence.

- Resource Drain: These projects can tie up capital and management attention without providing a commensurate return.

Inefficient Internal Service Divisions Not Supporting Core Business

Inefficient internal service divisions that don't directly contribute to Dalekovod's core energy and infrastructure operations can become a drag on resources. These units, if operating with low demand from other group entities or demonstrating poor performance, represent potential candidates for strategic review. For instance, if a non-core administrative department in 2024 saw a 15% increase in operating costs without a corresponding rise in efficiency or support for revenue-generating activities, it might be flagged.

Such divisions might consume capital and management attention that could be better allocated to core business growth. In 2024, Dalekovod's focus on expanding its renewable energy projects meant that any internal service not directly facilitating these ventures, or struggling with its own operational efficiency, would be scrutinized. A key consideration would be whether these units could be outsourced, restructured, or even divested if they fail to demonstrate a clear value proposition.

- Low Return on Investment: Internal service divisions showing a negative or negligible return on investment compared to group averages.

- Lack of External Demand: Units that do not generate significant revenue or provide essential services to external clients or partners.

- High Operational Costs: Departments with escalating operational expenses that are not offset by demonstrable value creation or efficiency gains.

- Strategic Misalignment: Services that do not align with Dalekovod's strategic objectives in energy and infrastructure development.

Dalekovod's "Dogs" are business segments with low market share and low growth potential. These often include legacy projects, niche markets with declining demand, or operations facing intense competition. For instance, if Dalekovod is involved in maintaining older, less utilized telecommunication infrastructure, this would likely be a Dog. In 2023, the global market for traditional landline services continued its decline, with many regions accelerating fiber optic and 5G deployments.

Small, fragmented construction projects in highly competitive local markets also fit the Dog category. These typically offer low margins and struggle to achieve significant market share for a company of Dalekovod's scale. The general construction sector in 2024 saw many smaller bids with profit margins often below 5%, making it difficult for larger firms to compete profitably.

These segments consume resources without offering substantial returns or strategic growth opportunities. The emphasis for such "Dogs" is on minimizing investment and exploring divestment options to reallocate capital to more promising ventures.

| Segment Example | Market Share | Market Growth | Strategic Fit | 2024 Outlook |

|---|---|---|---|---|

| Legacy Telecom Infrastructure Maintenance | Low | Declining | Low | Continued pressure on margins |

| Small-Scale Local Construction | Low | Low | Low | Intense competition, low profitability |

| Non-Core Legacy Manufacturing | Low | Low | Low | Resource drain, minimal future potential |

Question Marks

Dalekovod Projekt is strategically positioning itself in the burgeoning solar photovoltaic (PV) market by developing projects for power plants up to 1 MW, while also manufacturing essential steel carriers for PV modules. This initiative taps into Croatia's rapidly expanding solar sector, which is projected to exceed 1 GW in capacity by 2025.

While Dalekovod's established strength lies in transmission infrastructure, its direct participation in the sub-1 MW solar segment is a newer venture. This makes it a potential star or question mark in a BCG matrix context; it's a high-growth area, but Dalekovod's current market share within this specific niche, relative to its larger transmission business, is likely still developing, presenting both opportunity and uncertainty.

Dalekovod Projekt is actively pursuing growth in the renewable energy sector by developing biomass projects and offering comprehensive turn-key solutions for small hydropower plants, specifically those with capacities up to 10 MW. These initiatives align with the global trend towards cleaner energy sources, a market segment that has seen substantial investment and expansion in recent years. For instance, the global renewable energy market was valued at over $1 trillion in 2023 and is projected to continue its upward trajectory.

While these areas represent a high-growth segment, Dalekovod's current market share within these particular niches may still be in its formative stages. Establishing a strong, dominant market presence would necessitate significant capital investment and strategic development to transition these ventures from potential growth opportunities into established market leaders, akin to moving them into the 'Star' category of a BCG matrix.

The market for advanced digital substation and smart grid integration services is experiencing significant expansion, with projections indicating it will reach $9.1 billion by 2025. This growth is fueled by the adoption of technologies like AI and IoT for real-time monitoring and predictive maintenance, enhancing grid efficiency and reliability.

While Dalekovod possesses expertise in substation construction, its current market share in the specialized area of cutting-edge digital integration and smart grid solutions may be limited. This segment represents a high-growth opportunity, but it necessitates substantial investment to achieve meaningful market penetration and capture a significant portion of this expanding market.

Energy Efficiency Projects and Consulting for New Market Segments

Dalekovod Projekt's expansion into new energy efficiency market segments, such as public sector solar plants and heat pumps, positions them to capitalize on the burgeoning demand for sustainable energy solutions. This strategic move aligns with global trends and regulatory pushes toward decarbonization. In 2024, the global renewable energy market was valued at approximately $1.5 trillion, with significant growth projected in distributed energy generation and efficiency services.

While Dalekovod has established expertise in large-scale infrastructure, its market share in these newer, more fragmented energy efficiency projects might currently be limited. This suggests that these ventures could be considered 'Question Marks' within the BCG matrix, requiring careful investment and strategic development to achieve significant market penetration. For instance, the European heat pump market alone saw a growth of over 15% in 2023, indicating a substantial opportunity.

- Market Growth: The global energy efficiency services market is projected to reach over $300 billion by 2030, driven by government incentives and corporate sustainability goals.

- Dalekovod's Position: While strong in traditional infrastructure, Dalekovod's presence in niche energy efficiency segments like public solar installations may be nascent, indicating a potential 'Question Mark' status.

- Investment Opportunity: These segments represent high-growth potential but also carry higher risk due to evolving technologies and competitive landscapes, necessitating strategic resource allocation.

- Strategic Focus: To convert these 'Question Marks' into 'Stars,' Dalekovod needs to invest in targeted marketing, technology adoption, and potentially strategic partnerships to build market share.

New Geographic Market Expansions for Niche Offerings

Expanding Dalekovod's niche offerings, such as specialized high-voltage transmission solutions or advanced renewable energy integration services, into new geographic markets presents significant growth potential. These markets, where Dalekovod may have minimal existing presence, represent potential Stars or Question Marks in the BCG matrix.

For instance, entering a rapidly developing African nation with a growing demand for grid modernization and renewable energy infrastructure could be a prime example. While the initial market share would be low, the projected growth rate for such infrastructure projects in 2024 and beyond is substantial, possibly exceeding 10% annually in key regions.

- Emerging Markets: Targeting regions with increasing energy demand and government investment in infrastructure, such as Southeast Asia or parts of Latin America, offers high growth prospects.

- Renewable Energy Focus: Expanding niche services related to solar, wind, or geothermal integration into markets actively transitioning to renewables can capture early market share.

- Strategic Partnerships: Collaborating with local entities in these new markets can mitigate risks and accelerate market penetration, a strategy crucial for Question Mark segments.

- Investment Requirements: Significant upfront investment in market research, local operations, and tailored service development is necessary to convert these opportunities into successful ventures.

Question Marks represent business segments with low market share in high-growth industries. For Dalekovod, this includes newer ventures like specialized solar PV components and emerging energy efficiency services. These areas demand significant investment to capture market share and could potentially become Stars if successful.

The company's expansion into smaller solar projects (under 1 MW) and niche renewable integrations like biomass and small hydropower (up to 10 MW) fall into this category. While the renewable energy sector is growing rapidly, Dalekovod's current position in these specific sub-segments is likely developing, requiring strategic focus to gain traction.

Similarly, the digital substation and smart grid integration market, though expanding significantly, represents a potential Question Mark for Dalekovod if their market share in these advanced services is currently minimal. Converting these into Stars will require targeted investment and strategic development to build a stronger market presence.

Dalekovod's foray into energy efficiency solutions, such as public sector solar plants and heat pumps, also aligns with the Question Mark profile. The global renewable energy market's substantial growth, projected to continue, offers fertile ground, but establishing leadership in these newer segments requires dedicated capital and strategic planning.

BCG Matrix Data Sources

Our Dalekovod BCG Matrix leverages comprehensive financial disclosures, industry-specific market research, and official company reports to provide a robust strategic overview.