Culligan International SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Culligan International Bundle

Culligan International, a leader in water treatment, boasts strong brand recognition and a vast distribution network, but faces intense competition and evolving consumer preferences. Understanding these dynamics is crucial for any stakeholder looking to navigate the water purification market.

Want the full story behind Culligan's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Culligan International stands as a prominent global leader in water treatment, with operations spanning over 90 countries. This vast reach is supported by an extensive network of authorized dealerships and direct operational sites, enabling them to effectively serve a diverse international customer base with sales, installation, and ongoing service for their advanced water treatment technologies.

Culligan International boasts an extensive range of water treatment solutions, catering to diverse needs across residential, commercial, and industrial sectors. Their offerings include everything from water softeners and reverse osmosis systems to whole-house filters and bottled water services. This broad product and service spectrum allows them to address a wide variety of water quality concerns, from basic softening to advanced purification.

Culligan's dedication to innovation is clear through its introduction of advanced filtration, including ZeroWater Technology, which removes 99.6% of total dissolved solids. This commitment extends to developing new products that enhance water quality and user experience.

The company's strong sustainability drive aims to significantly reduce single-use plastic bottle consumption. By offering filtered water solutions, Culligan is working towards replacing billions of plastic bottles, aligning with increasing global environmental consciousness and regulatory pressures.

Proven Track Record of Growth and Strategic Acquisitions

Culligan International boasts a robust history of expansion, evidenced by an impressive average annual revenue growth rate of around 30% between 2016 and 2023. This consistent performance highlights the company's ability to scale effectively in the water treatment sector.

The company's strategic 'buy-and-build' approach has been a significant driver of its success. Since 2017, Culligan has successfully integrated over 200 acquisitions, a testament to its disciplined M&A execution. A notable example is the acquisition of Primo Water Corporation's European operations, which broadened its geographical footprint and product portfolio.

- Consistent Growth: Averaged 30% annual revenue growth from 2016-2023.

- Acquisition Prowess: Completed over 200 acquisitions since 2017.

- Strategic Expansion: Acquired Primo Water Corporation's European businesses.

- Market Leadership: Consolidates a fragmented industry through strategic M&A.

Recurring Revenue Model and Customer Focus

Culligan's business model thrives on a significant portion of recurring revenue, which directly translates into robust cash conversion. This stability is a key strength, providing a predictable financial foundation.

The company's emphasis on end-to-end service, encompassing installation and ongoing maintenance, cultivates deep, long-lasting customer relationships. This customer-centric approach ensures a consistent and reliable revenue stream over time.

Culligan's dedication to enhancing water quality for over 155 million consumers annually highlights its strong customer focus. This extensive reach and commitment to service solidify its market position and customer loyalty.

- Recurring Revenue: A high percentage of recurring revenue boosts cash conversion.

- Customer Loyalty: Comprehensive service builds strong, long-term customer bonds.

- Customer Reach: Serving over 155 million consumers annually demonstrates significant customer engagement.

Culligan's market leadership is underpinned by a consistent and impressive growth trajectory, averaging 30% annual revenue growth between 2016 and 2023. This expansion is fueled by a strategic 'buy-and-build' approach, evidenced by over 200 acquisitions since 2017, including key acquisitions like Primo Water Corporation's European operations. The company's strong recurring revenue model ensures financial stability and robust cash conversion.

| Metric | Value | Period |

|---|---|---|

| Average Annual Revenue Growth | 30% | 2016-2023 |

| Acquisitions Completed | >200 | Since 2017 |

| Recurring Revenue Percentage | High | Ongoing |

What is included in the product

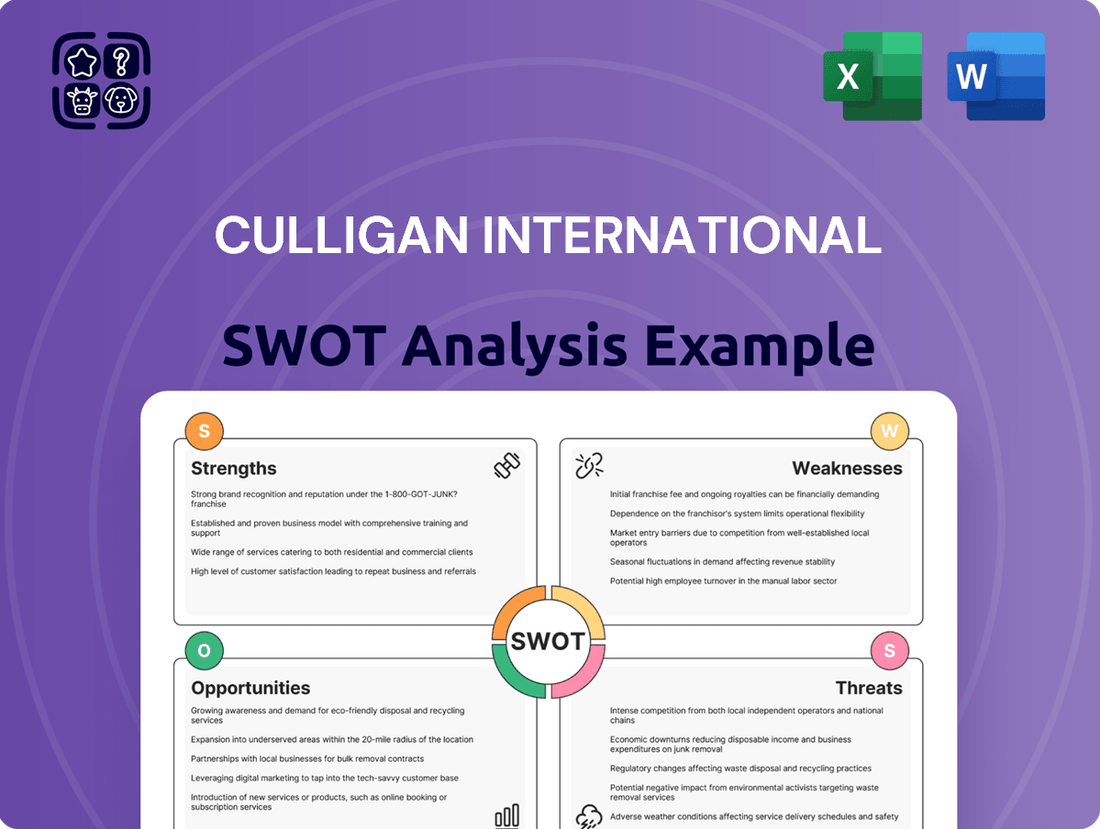

Delivers a strategic overview of Culligan International’s internal and external business factors, highlighting its brand strength and market opportunities while acknowledging potential operational weaknesses and competitive threats.

Highlights Culligan's competitive advantages and areas for improvement, enabling targeted strategies to address market challenges.

Weaknesses

The initial investment for advanced water treatment systems, such as those Culligan might offer, can be substantial. For homeowners and businesses, the upfront cost of purchasing and installing equipment like reverse osmosis or whole-house filtration systems can range from hundreds to thousands of dollars, potentially deterring budget-conscious consumers.

Culligan's reliance on its extensive dealership network, a key strength for market penetration, also presents a significant weakness. The performance of these independent businesses directly impacts Culligan's brand image and customer experience. For instance, if a dealership fails to maintain high service standards or consistent sales practices, it can dilute the overall brand perception, even if Culligan itself operates efficiently. This decentralized model means that ensuring uniform quality and customer satisfaction across thousands of locations, as of recent reports, remains a considerable operational hurdle.

Culligan's reliance on products that can be viewed as discretionary, especially for residential clients, makes it susceptible to economic slowdowns. When consumers tighten their belts during recessions, spending on non-essential home upgrades like advanced water purification systems may decline. For instance, a significant economic contraction, like the one experienced in early 2020 due to the pandemic, saw a temporary dip in durable goods sales as consumer confidence wavered.

Competition in a Fragmented Market

Despite its global leadership in water treatment, Culligan faces significant competition. The market is quite fragmented, featuring a mix of large, established corporations and smaller, regional providers. This intense rivalry can create pressure on pricing, forcing Culligan to constantly innovate and differentiate its offerings to hold onto its market share.

The water treatment sector saw global market size estimates around $70 billion in 2023, with projections to reach over $100 billion by 2030, indicating substantial growth but also a crowded landscape. For instance, competitors like Pentair and Xylem have also been actively expanding their portfolios through acquisitions and R&D, directly challenging Culligan’s dominance in various segments.

This competitive environment necessitates ongoing investment in product development and marketing to maintain brand visibility and customer loyalty. Culligan's ability to adapt to evolving consumer needs and technological advancements will be crucial in navigating these market dynamics effectively.

Challenges with Emerging Contaminants and Infrastructure

The water treatment sector, including companies like Culligan, grapples with the increasing prevalence of emerging contaminants such as microplastics, pharmaceuticals, and per- and polyfluoroalkyl substances (PFAS). These substances are notoriously difficult and expensive to eliminate from water supplies. For instance, studies in 2024 indicated that removing PFAS can add significant costs to water treatment processes, sometimes doubling operational expenses.

Furthermore, the deterioration of existing municipal water infrastructure in many developed nations presents a substantial hurdle. Aging pipes and treatment facilities may not be equipped to handle these novel contaminants effectively. This situation can inadvertently place a greater responsibility and cost burden on individual consumers and private water treatment providers to ensure safe drinking water, impacting demand for advanced home and commercial solutions.

- Emerging Contaminant Threat: Difficulty and high cost associated with removing microplastics, pharmaceuticals, and PFAS.

- Infrastructure Deficiencies: Aging municipal systems are often ill-equipped to tackle new contaminants.

- Burden Shift: Increased responsibility and cost passed to consumers and private water treatment solutions.

Culligan faces challenges with the high upfront cost of advanced water treatment systems, potentially deterring budget-conscious customers. The reliance on a decentralized dealership network also presents a weakness, as inconsistent service quality from individual dealerships can negatively impact the overall brand image and customer experience. Furthermore, the company's products can be viewed as discretionary, making sales vulnerable during economic downturns.

Full Version Awaits

Culligan International SWOT Analysis

This is the same Culligan International SWOT analysis document you'll receive upon purchase—no surprises, just professional quality. You'll gain a comprehensive understanding of their Strengths, Weaknesses, Opportunities, and Threats.

The preview below is taken directly from the full Culligan International SWOT report you'll get. Purchase unlocks the entire in-depth version, providing actionable insights.

This is a real excerpt from the complete Culligan International SWOT analysis. Once purchased, you’ll receive the full, editable version, ready for strategic planning.

Opportunities

The world's population is growing, and more people are moving to cities, while industries are expanding. This all adds up to a much bigger need for clean, safe water everywhere, from our homes to factories. Culligan's products directly address this escalating demand across all these areas.

This creates a massive and growing market for water treatment and purification solutions like those Culligan offers. Estimates suggest the global water purifier market could reach over $50 billion by 2027, showing a really strong upward trend for companies in this space.

The ongoing advancements in water treatment technologies present a significant opportunity for Culligan. Innovations like smart water management systems, nanotechnology, and advanced oxidation processes are continuously evolving, allowing for more efficient and effective water purification. For instance, the global water and wastewater treatment market was valued at approximately $665.8 billion in 2023 and is projected to reach $1.1 trillion by 2030, indicating substantial growth potential driven by these technological leaps.

By investing in and integrating these cutting-edge innovations, Culligan can enhance its product portfolio with solutions that are not only more efficient but also more sustainable. This strategic move can help the company meet increasingly stringent global water quality standards and rising consumer demand for superior water solutions. The integration of AI-powered diagnostics in water treatment systems, for example, is expected to improve operational efficiency by up to 30% in commercial applications, a tangible benefit Culligan can leverage.

The escalating global concern for environmental issues, particularly water pollution and the proliferation of single-use plastics, is a significant tailwind for sustainable water solutions. This heightened awareness directly translates into increased market demand for products and services that address these challenges.

Culligan's established focus on minimizing plastic waste and offering environmentally sound alternatives positions it favorably to capitalize on this growing trend. This strategic alignment is a prime opportunity to capture environmentally conscious consumers and businesses seeking sustainable water management options.

For instance, a 2024 report indicated that 72% of consumers are willing to pay more for sustainable products, a sentiment that extends to water filtration and purification services, directly benefiting companies like Culligan that prioritize eco-friendly practices.

Stricter Water Quality Regulations and Enforcement

Governments globally are tightening water quality standards, with a significant focus on emerging contaminants such as PFAS, lead, and nitrates. This trend is driving demand for sophisticated water treatment technologies and compliance support, areas where Culligan can leverage its expertise for municipal, commercial, and industrial sectors. For instance, the US Environmental Protection Agency (EPA) proposed new regulations in 2024 targeting PFAS, requiring extensive monitoring and treatment upgrades for public water systems.

This regulatory shift presents a substantial opportunity for Culligan to offer advanced filtration and purification solutions. The market for water treatment chemicals and equipment is expected to see robust growth, with projections indicating a global market size of over $100 billion by 2025, driven by these stricter mandates. Culligan's established product lines and service capabilities position it to capitalize on this expanding need for compliant water management.

- Increased demand for advanced filtration systems to remove emerging contaminants like PFAS.

- Growth in the market for compliance and consulting services related to new water quality regulations.

- Opportunities for product innovation in developing more effective and efficient treatment technologies.

- Potential for expanded partnerships with municipalities and industries seeking to meet stricter standards.

Expansion into Decentralized and Industrial Wastewater Treatment

The decentralized water treatment market is booming, with projections indicating significant growth as communities and businesses seek localized solutions for water purification and conservation. This trend is particularly strong in regions facing water scarcity. For instance, the global decentralized water and wastewater treatment market was valued at approximately $30 billion in 2023 and is expected to reach over $50 billion by 2030, growing at a CAGR of around 7.5%.

Simultaneously, industrial wastewater treatment is undergoing a transformation, fueled by increasingly strict environmental regulations worldwide and a growing industry focus on sustainability and resource recovery. Companies are actively investing in advanced technologies to meet zero liquid discharge (ZLD) goals. The ZLD market alone is anticipated to grow from roughly $3 billion in 2023 to over $6 billion by 2028, with a CAGR exceeding 15%.

Culligan International is well-positioned to leverage these converging trends. By expanding its product portfolio and service offerings to cater specifically to the needs of decentralized systems and advanced industrial wastewater solutions, the company can tap into these high-growth segments.

- Decentralized Water Treatment Growth: The market is expanding rapidly due to the need for localized purification and freshwater conservation.

- Industrial Wastewater Demand: Rising demand for advanced solutions is driven by stringent discharge regulations and the pursuit of zero liquid discharge systems.

- Market Size Projections: The global decentralized water treatment market is projected to exceed $50 billion by 2030.

- ZLD Market Expansion: The zero liquid discharge market is expected to double in size by 2028, indicating strong industrial investment.

Culligan can capitalize on the increasing global demand for clean water, driven by population growth and industrial expansion. The global water purifier market is projected to surpass $50 billion by 2027, highlighting a significant opportunity for companies like Culligan that offer essential water treatment solutions.

Advancements in water treatment technologies, such as AI-powered diagnostics and nanotechnology, present avenues for product enhancement and efficiency gains. The water and wastewater treatment market, valued at approximately $665.8 billion in 2023, is expected to reach $1.1 trillion by 2030, underscoring the impact of technological innovation.

Heightened environmental awareness and stricter government regulations on water quality, including emerging contaminants like PFAS, create demand for advanced filtration and compliance services. For instance, the US EPA's proposed PFAS regulations in 2024 necessitate upgrades for water systems, benefiting providers of specialized treatment solutions.

The burgeoning decentralized water treatment market and the growing focus on industrial zero liquid discharge (ZLD) systems offer substantial growth prospects. The ZLD market is anticipated to double by 2028, reaching over $6 billion, while decentralized treatment is projected to exceed $50 billion by 2030.

| Opportunity Area | Market Data Point | Implication for Culligan |

|---|---|---|

| Global Water Demand | Global water purifier market to exceed $50B by 2027 | Increased sales potential for core products. |

| Technological Advancements | Water & wastewater treatment market to reach $1.1T by 2030 | Opportunity to integrate innovative, efficient solutions. |

| Regulatory Environment | EPA's 2024 PFAS proposal | Demand for advanced filtration and compliance services. |

| Decentralized & ZLD Markets | ZLD market to double by 2028; Decentralized market > $50B by 2030 | Expansion into high-growth, specialized water treatment segments. |

Threats

While the global water treatment market is expanding, developed regions like North America and Europe are seeing intensified competition and potential saturation in certain segments. This makes it more challenging for Culligan to capture new market share.

Key rivals such as Pentair, 3M, and Brita are strong players in the water filter and treatment systems space. For instance, Pentair's Water segment reported revenue of $3.9 billion in 2023, showcasing the scale of established competitors.

This fierce competition often translates into significant pricing pressures. Companies like Culligan must therefore allocate substantial resources towards innovation through research and development and aggressive marketing campaigns to stand out.

Regulatory changes present a significant threat to Culligan. For instance, shifts in government water policies, like potential deregulation in some areas, might lessen the demand for sophisticated water treatment solutions if compliance burdens are reduced. This could impact the company's market for advanced technologies.

Conversely, stricter or rapidly evolving regulations pose their own set of challenges. Companies like Culligan must invest heavily in adapting their products and processes to meet new standards, leading to increased compliance costs and potential delays in product launches. For example, in 2024, several regions saw updated drinking water standards, requiring significant R&D investment from water treatment providers.

Global economic instability, including the lingering effects of supply chain disruptions and geopolitical tensions, poses a significant threat. For instance, the International Monetary Fund (IMF) projected global growth to slow to 2.9% in 2024, down from 3.5% in 2023, highlighting a challenging macroeconomic environment.

Inflationary pressures continue to impact key inputs for Culligan, such as raw materials, energy, and labor. In the US, the Consumer Price Index (CPI) saw an annual increase of 3.4% as of April 2024, demonstrating persistent cost pressures that can erode profit margins if not effectively managed through pricing strategies or cost efficiencies.

Fluctuations in consumer and commercial disposable income, directly tied to economic volatility, can dampen demand for Culligan's products and services. Furthermore, the rising costs associated with water procurement and wastewater disposal, potentially exacerbated by infrastructure investments and evolving environmental regulations, could make industrial and commercial clients more hesitant to commit to new water treatment system investments in 2024 and 2025.

Technological Disruptions and Rapid Innovation Cycles

While innovation presents opportunities, it also poses a significant threat. If Culligan International is slow to adopt or integrate new, disruptive technologies, it could fall behind competitors. For instance, rapid advancements in AI for water quality monitoring or IoT-enabled smart water systems could create competitive disadvantages if not continuously integrated into their product and service offerings.

The water treatment industry is experiencing rapid innovation cycles, particularly in areas like advanced membrane technologies and sustainable water solutions. Companies failing to keep pace risk obsolescence. According to a 2024 market report, the global water treatment chemicals market is projected to reach $114.5 billion by 2029, indicating a strong demand for innovative solutions.

- Emergence of AI-driven water management systems

- Rapid development of next-generation filtration and purification membranes

- Increased adoption of IoT for real-time water monitoring and control

Water Scarcity and Climate Change Impacts

While water scarcity is a significant driver of demand for Culligan's services, extreme weather events and broader climate change impacts present considerable operational threats. Unpredictable rainfall patterns and prolonged drought conditions, as seen in many regions globally, can disrupt the consistent availability and quality of source water essential for treatment processes. For instance, reports from the World Meteorological Organization in early 2024 highlighted that several major river basins experienced significantly below-average water levels, directly impacting water utilities and, by extension, companies like Culligan that rely on stable water sources.

Shifting groundwater rights policies, often a consequence of increasing water stress, can also directly affect Culligan's access to raw materials. As governments implement stricter regulations to manage scarce water resources, the operational footprint and supply chain stability for water treatment facilities could be compromised. This necessitates adaptive strategies to secure alternative water sources or invest in technologies capable of treating a wider range of water qualities, potentially increasing operational costs.

Furthermore, the increasing frequency and intensity of extreme weather events, such as floods and severe storms, pose risks to physical infrastructure. Damage to treatment plants, distribution networks, or even the company's own facilities due to these events could lead to significant downtime and repair expenses. The economic impact of climate change on water resources is substantial, with estimates suggesting that by 2050, water scarcity could cost some regions up to 6% of their GDP, underscoring the systemic risks involved.

- Operational Disruption: Extreme weather can damage facilities and interrupt service.

- Source Water Instability: Droughts and policy changes threaten raw water availability and quality.

- Supply Chain Vulnerability: Climate impacts on water sources can cascade through the supply chain.

- Increased Costs: Adapting to changing water conditions may require significant investment in new technologies and sourcing strategies.

Intensified competition from established players like Pentair, which reported $3.9 billion in revenue for its Water segment in 2023, creates significant pricing pressures for Culligan. The rapid pace of technological advancement, particularly in AI-driven water management and IoT integration, necessitates continuous investment to avoid falling behind. Furthermore, evolving regulatory landscapes, whether deregulation reducing demand or new standards increasing compliance costs, pose substantial challenges. Global economic instability, evidenced by the IMF's projected slowdown in global growth to 2.9% for 2024, coupled with persistent inflation (US CPI at 3.4% annually as of April 2024), impacts input costs and consumer spending. Extreme weather events and climate change also threaten operational stability by disrupting source water availability and potentially damaging infrastructure.

| Threat Category | Specific Threat | Impact on Culligan | Supporting Data/Example |

|---|---|---|---|

| Competition | Intensified Market Competition | Pricing pressure, reduced market share capture | Pentair Water segment revenue: $3.9 billion (2023) |

| Technology | Rapid Technological Advancements | Risk of obsolescence, competitive disadvantage | Growth in AI/IoT for water management |

| Regulatory | Evolving Water Policies | Reduced demand (deregulation) or increased compliance costs (new standards) | Updated drinking water standards in various regions (2024) |

| Economic | Global Economic Instability & Inflation | Increased input costs, reduced consumer/commercial spending | IMF Global Growth Projection: 2.9% (2024); US CPI: 3.4% (April 2024) |

| Environmental | Climate Change & Extreme Weather | Operational disruption, source water instability, infrastructure damage | Below-average water levels in major river basins (early 2024) |

SWOT Analysis Data Sources

This Culligan International SWOT analysis is built upon a foundation of credible data, including publicly available financial reports, comprehensive market research, and insights from industry experts. These sources provide a robust understanding of the company's operational landscape and competitive positioning.