Culligan International Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Culligan International Bundle

Culligan International navigates a competitive landscape shaped by moderate buyer power and the ever-present threat of substitutes in water treatment solutions. Understanding these forces is crucial for any business operating within or looking to enter this sector.

The complete report reveals the real forces shaping Culligan International’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Culligan International's reliance on specialized component suppliers, such as those providing membranes for reverse osmosis systems or advanced filtration media, can significantly impact its bargaining power. The proprietary nature of these essential parts means suppliers can wield considerable influence if alternative sources are scarce or if switching costs for Culligan are prohibitively high. For instance, in 2024, the global market for water treatment membranes was valued at approximately $5.2 billion, with a compound annual growth rate projected to reach 7.5% through 2030, indicating a concentrated and potentially powerful supplier base for these critical components.

For highly commoditized raw materials such as plastics, metals, and common chemicals essential for manufacturing, Culligan International likely benefits from a wide selection of potential suppliers. This broad availability generally diminishes the bargaining power of any single supplier, as Culligan can readily shift its business to alternatives that offer more favorable pricing or better availability. For instance, the global plastics market, a key input for many water filtration components, saw prices for polyethylene terephthalate (PET) resin fluctuate significantly in 2024, with average prices ranging from $1,200 to $1,500 per metric ton, demonstrating the competitive landscape where suppliers must remain price-sensitive.

Suppliers who are leaders in water treatment technology or hold crucial patents can exert significant influence. Culligan's reliance on cutting-edge products to stay ahead means it might be dependent on these niche providers for its competitive advantage.

Global Supply Chain Dynamics

Culligan's extensive global operations allow it to source from diverse regions, which can spread risk and reduce reliance on any single supplier. This diversification generally weakens supplier bargaining power. However, widespread industry-wide disruptions, like those seen in 2021 and 2022 impacting semiconductor availability, can temporarily shift power towards suppliers across many sectors, including those Culligan might engage with.

The bargaining power of suppliers for Culligan is influenced by several factors:

- Supplier Concentration: If a critical component or raw material is sourced from a few dominant suppliers, their power increases. For instance, in 2024, the market for certain specialized water filtration membranes might be dominated by a handful of manufacturers, giving them leverage.

- Switching Costs: The effort and expense involved in changing suppliers. If Culligan faces high costs to qualify new suppliers for specialized parts, existing suppliers gain power.

- Input Differentiation: If the inputs provided by suppliers are unique or highly differentiated, their bargaining power is amplified.

- Threat of Forward Integration: Suppliers who could potentially enter Culligan's business themselves have more leverage.

Supplier Concentration and Switching Costs

Supplier concentration significantly impacts bargaining power. For instance, if the market for specialized water filtration membranes, a critical component for Culligan's systems, is dominated by a few manufacturers, those suppliers can dictate terms more effectively. In 2024, industries reliant on niche components often saw price increases from suppliers facing limited competition.

High switching costs also bolster supplier leverage. If changing to a new component supplier requires substantial investment in retooling manufacturing lines, rigorous quality testing, and lengthy requalification processes, Culligan may be hesitant to switch, even if better pricing is available elsewhere. These costs can effectively lock in existing supplier relationships.

- Supplier Concentration: A market with few dominant suppliers for critical components grants them increased bargaining power.

- Switching Costs: Expenses related to retooling, quality assurance, and requalification deter switching, strengthening existing supplier leverage.

- Impact on Culligan: These factors can lead to less favorable pricing and supply terms for Culligan International.

Culligan's bargaining power with suppliers is influenced by the concentration of suppliers for critical components and the cost associated with switching providers. For specialized items like advanced filtration membranes, where a few key players dominate, suppliers can command higher prices. For example, in 2024, the global market for water treatment membranes, a vital input, showed a trend of price adjustments by dominant manufacturers due to limited competition in niche segments.

High switching costs, involving retooling, rigorous testing, and requalification, can lock Culligan into existing supplier relationships, further empowering those suppliers. This dynamic can lead to less favorable pricing and supply terms for Culligan.

| Factor | Impact on Supplier Bargaining Power | Example for Culligan (2024 Data) |

| Supplier Concentration | Increases power for dominant suppliers | Limited number of manufacturers for specialized membranes |

| Switching Costs | Increases leverage for existing suppliers | High investment needed for retooling and requalification |

| Input Differentiation | Amplifies power for unique or patented inputs | Reliance on proprietary filtration technologies |

What is included in the product

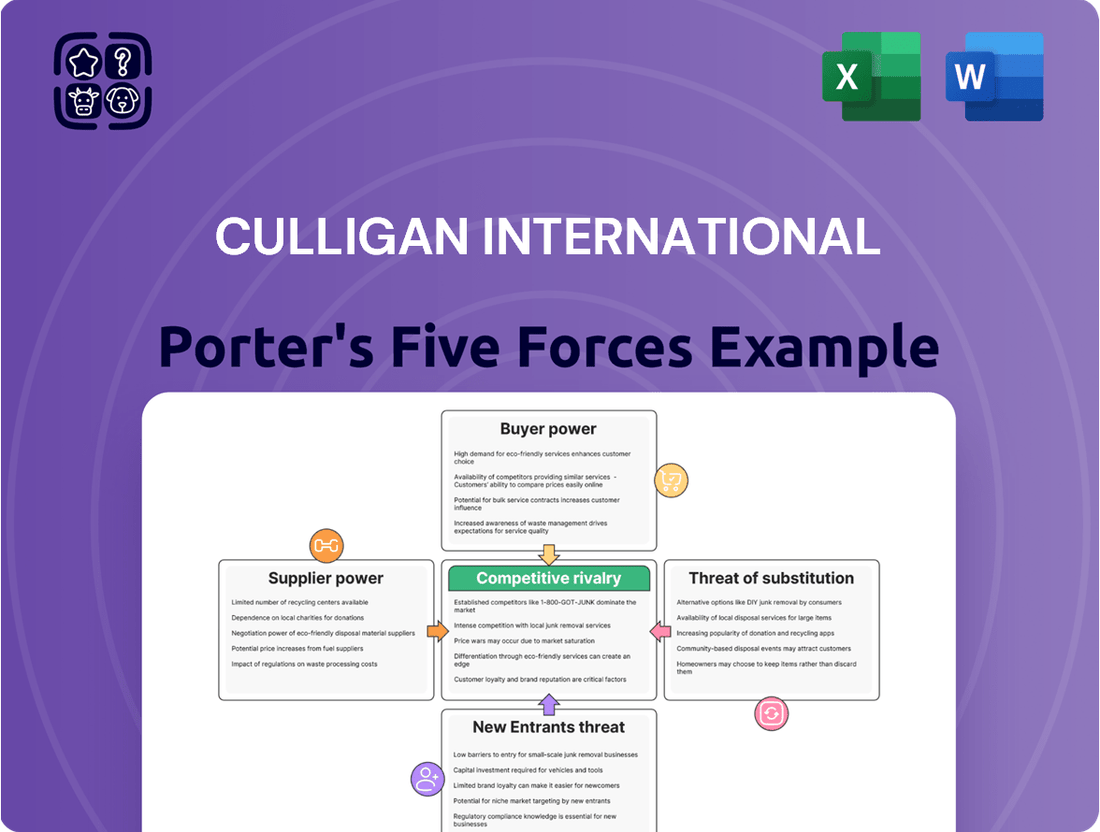

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Culligan International's water treatment and filtration industry.

Effortlessly identify and mitigate competitive threats with a visual breakdown of each Porter's Five Forces, empowering strategic responses.

Customers Bargaining Power

Residential customers, though a vast group, are individually small players. Their fragmented nature means no single customer, or even a small group, can significantly sway Culligan's pricing or terms. Think of it like buying a single bottle of water; your individual purchase doesn't affect the overall market price.

This fragmentation is a key reason why their bargaining power is generally low. While collectively they represent a significant market, their individual purchasing power is limited, making it difficult for them to negotiate bulk discounts or dictate specific product features.

Culligan's strategy often capitalizes on this by focusing on brand loyalty and the perceived benefits of their systems, such as improved water quality and convenient service through their established dealer network. For instance, in 2024, consumer spending on home water filtration systems continued to grow, reflecting a demand for convenience and perceived health benefits, which further solidifies Culligan's market position against individual customer leverage.

Commercial and industrial customers often wield significant bargaining power due to their substantial purchase volumes and the specialized, often complex, water treatment solutions they require. This necessitates tailored approaches from providers like Culligan, giving these clients leverage.

These larger clients frequently participate in competitive bidding, allowing them to negotiate aggressively on pricing, service level agreements, and the terms of long-term contracts. For instance, in 2024, many industrial sectors saw increased pressure on operational costs, leading to more stringent price negotiations with suppliers across the board.

Customers wield significant bargaining power due to the wide array of alternatives available. They can opt for bottled water, rely on municipal water supplies, or choose filtration systems from numerous competitors, all of which offer readily accessible substitutes for Culligan's products and services.

This abundance of choices means customers can easily switch if they find Culligan's pricing too high or their offerings unsatisfactory. For instance, the global bottled water market was valued at approximately $360 billion in 2023 and is projected to grow, indicating a substantial competitive landscape.

However, Culligan can mitigate this power through the creation of switching costs. The initial investment in a Culligan water treatment system, coupled with the established reliance on their specialized service network for maintenance and filter replacements, can make it inconvenient and potentially costly for customers to transition to a competitor.

Information Access and Price Sensitivity

Customers today have unprecedented access to information, allowing them to easily compare pricing, product features, and user reviews across various water treatment providers. This ease of comparison significantly increases price sensitivity, especially among residential and small to medium-sized business clients. Culligan must therefore focus on delivering clear value and maintaining competitive pricing to retain these customer segments.

In 2024, the global water treatment market saw continued growth, with online channels playing a crucial role in customer acquisition and information gathering. For instance, consumer spending on home water filtration systems, a key area for Culligan, continued to rise, driven by increased awareness of water quality issues. This trend underscores the importance of transparent pricing and robust online customer support.

- Increased Online Price Comparison: Customers can readily compare Culligan's offerings with competitors like Brita, Aquasana, and Pentair based on price and features.

- Heightened Price Sensitivity: A significant portion of residential customers in 2024 cited price as a primary decision-making factor, often influenced by online promotions and discounts.

- Demand for Clear Value Propositions: To counter price sensitivity, Culligan needs to clearly articulate the long-term benefits and cost savings associated with its solutions, such as reduced reliance on bottled water.

- Impact on Smaller Commercial Clients: Small businesses, often operating on tighter margins, are particularly susceptible to price-based decisions, making competitive pricing essential for market penetration.

Service and Support Expectations

Culligan's commitment to comprehensive service directly impacts customer bargaining power. Clients, particularly industrial ones reliant on uninterrupted water systems, expect meticulous installation, proactive maintenance, and responsive support. This elevates their leverage in negotiating service level agreements and ensuring quick issue resolution.

For instance, in 2024, the demand for integrated water management solutions, which include ongoing service contracts, has surged. Businesses understand that downtime due to water quality issues can cost them significantly, potentially millions in lost production. This understanding allows them to negotiate more favorable terms with providers like Culligan, demanding guaranteed uptime and rapid response times.

- High Service Demands: Industrial clients often require 24/7 operational uptime, making them sensitive to service interruptions.

- Negotiating Leverage: The criticality of water quality and system reliability gives these customers significant power to negotiate service terms and pricing.

- Industry Trends: In 2024, the trend towards outsourcing facility management and maintenance, including water treatment, means customers are more focused on comprehensive support packages.

- Customer Retention: Culligan's ability to meet these high service expectations is crucial for retaining large commercial and industrial accounts, influencing their bargaining position.

While individual residential customers have limited power due to their small purchase volumes, their collective demand is substantial. However, their ability to negotiate is further diminished by the ease with which they can access alternative solutions like bottled water or simpler filtration systems. The global bottled water market, valued at around $360 billion in 2023, highlights the widespread availability of substitutes, but Culligan aims to mitigate this by building brand loyalty and emphasizing the convenience and quality of its systems.

Preview the Actual Deliverable

Culligan International Porter's Five Forces Analysis

This preview provides a comprehensive look at the Culligan International Porter's Five Forces Analysis, showcasing the exact document you'll receive immediately after purchase. You'll gain detailed insights into the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the water treatment industry. This professionally formatted analysis is ready for your immediate use, offering no surprises and no placeholders.

Rivalry Among Competitors

The water treatment sector is highly fragmented, featuring a blend of major global corporations, specialized regional firms, and a vast number of smaller, local operators. This broad spectrum of competitors fuels a very intense rivalry for market share. For instance, in 2024, reports indicated over 5,000 companies operating within the global water and wastewater treatment market, highlighting its dispersed nature.

Culligan's competitive battle extends beyond direct water treatment system manufacturers. The company also faces competition from entities providing alternative water solutions, such as bottled water delivery services or companies focused on specific niche treatment technologies. This diverse competitive set demands constant innovation and strategic positioning to maintain an edge.

Competitive rivalry in the water treatment industry, including for Culligan International, is significantly fueled by how effectively companies can stand out. This differentiation often hinges on innovative technology, unique product features, the quality of service provided, and the overall strength of a company's brand. For instance, in 2024, companies investing heavily in smart home integration for water purifiers saw increased market interest.

Culligan leverages its advanced purification systems and a robust service network as core differentiators. In a market where customers prioritize performance and dependability, these aspects are critical for customer loyalty and satisfaction. The company's commitment to developing next-generation filtration technologies, such as those announced in late 2023 for improved contaminant removal, directly addresses these customer needs.

The global water treatment market is experiencing robust growth, projected to reach approximately $150 billion by 2024, according to various industry analyses. This expansion is primarily driven by heightened consumer awareness regarding water quality and the escalating demands from industrial sectors, including manufacturing and energy. Such a dynamic market environment naturally intensifies competitive rivalry as both established companies and emerging players vie for market share.

This increasing demand for clean water solutions, estimated to grow at a compound annual growth rate (CAGR) of around 6-7% through 2025, acts as a magnet for new entrants and encourages existing competitors to innovate and broaden their offerings. Companies are actively investing in research and development to create more efficient and sustainable water treatment technologies, leading to a more crowded and competitive landscape.

Brand Reputation and Distribution Reach

Culligan's strong brand recognition, built over decades, acts as a substantial barrier to entry. This reputation translates into customer loyalty, making it challenging for new entrants to gain market share without significant marketing investment.

The company's extensive network of authorized dealerships is a key differentiator, offering widespread distribution and local service capabilities. Competitors aiming to match this reach would need to replicate this complex and costly infrastructure, a significant hurdle.

- Brand Equity: Culligan's brand is associated with reliability and water quality, a perception cultivated through consistent product performance and customer service.

- Distribution Network: The company operates through a vast network of over 600 authorized dealers across North America, providing localized sales, installation, and maintenance.

- Customer Trust: This widespread presence fosters customer trust and accessibility, crucial factors in the water treatment industry where service and support are paramount.

- Competitive Barrier: New entrants face substantial capital requirements to build a comparable distribution and service infrastructure, directly impacting their ability to compete effectively on reach and reliability.

Pricing Strategies and Promotions

Competitive rivalry in the water treatment industry, including companies like Culligan International, often intensifies through aggressive pricing strategies and promotional activities. This is especially noticeable in the residential and small commercial sectors where companies frequently offer discounts, bundled packages, and flexible financing to attract and retain customers. For instance, in 2024, many water softener and filtration system providers ran seasonal sales, with discounts averaging 10-15% on popular models. This constant push for market share means companies must remain agile, quickly responding to competitor pricing adjustments and promotional campaigns to maintain their competitive edge.

The landscape is further shaped by companies actively seeking to differentiate their offerings beyond price, emphasizing product features, service quality, and brand reputation. However, price remains a significant factor for many consumers, leading to a dynamic environment where promotional cycles are common. Companies often leverage limited-time offers, such as free installation or extended warranties, to create urgency and drive sales. This intense competition necessitates continuous monitoring of market trends and competitor actions to ensure pricing and promotional strategies remain effective and aligned with overall business objectives.

Key competitive tactics observed in 2024 included:

- Aggressive Price Matching: Many regional and national providers actively matched or beat competitor prices on comparable water filtration systems.

- Bundled Service Packages: Offering installation, maintenance, and filter replacements as a single package at a discounted rate.

- Financing Incentives: Introducing zero-interest financing options or extended payment plans to lower the upfront cost barrier for consumers.

- Loyalty Programs: Rewarding existing customers with discounts on upgrades or recurring filter subscriptions.

The intense competitive rivalry in the water treatment sector is driven by a fragmented market with numerous players, from global giants to local operators. This dynamic environment sees companies like Culligan differentiating through innovation, service, and brand strength, with significant investment in R&D for advanced purification technologies. For instance, in 2024, the global water treatment market was valued at approximately $150 billion, fueling competition as companies vie for a share of this growing demand.

Culligan's established brand equity and extensive dealer network, boasting over 600 locations in North America, present a formidable barrier to entry for new competitors. This infrastructure ensures widespread distribution and localized service, crucial for customer trust and loyalty in the water treatment industry. Replicating this reach requires substantial capital investment, making it difficult for emerging players to compete on accessibility and reliability.

Aggressive pricing and promotional activities are common tactics, particularly in the residential sector, with many providers offering discounts and bundled packages. In 2024, price matching and financing incentives were prevalent, with discounts often ranging from 10-15% on popular models. This necessitates constant market monitoring and agile responses to competitor strategies to maintain market position.

SSubstitutes Threaten

Bottled water and water delivery services pose a significant threat to Culligan, particularly for households and small businesses. The convenience factor is high, as these options bypass the need for initial system installation. For instance, the U.S. bottled water market was valued at approximately $38.5 billion in 2023, demonstrating substantial consumer preference for these alternatives.

For basic hydration, municipal water supplies are a significant substitute for Culligan's services. If a municipality's water is considered safe and palatable by consumers, it directly lessens the perceived need for in-home water purification systems. This is particularly relevant in areas where public water quality is high.

Boiling water also presents a low-cost, albeit less convenient, substitute for purification. While it effectively eliminates many contaminants, it doesn't address issues like taste or dissolved solids, making it a partial substitute at best for those seeking comprehensive water improvement.

Lower-cost, less comprehensive point-of-use filters, such as pitcher filters and faucet-mounted options, present a significant threat. These alternatives satisfy basic filtration needs at a fraction of the cost of Culligan's more advanced systems. For instance, a leading pitcher filter brand might cost around $30-$50 annually for refills, compared to potentially hundreds for a Culligan system and its ongoing maintenance.

Do-It-Yourself (DIY) Solutions

Some technically adept customers might bypass integrated solutions by opting for do-it-yourself (DIY) water treatment systems. They could source individual components from various suppliers to assemble their own filtration or purification setups, effectively substituting Culligan's comprehensive offerings.

This trend is fueled by a desire for customization and potential cost savings. For instance, the global DIY home improvement market was projected to reach over $1.1 trillion by 2025, indicating a strong consumer inclination towards self-sufficiency in home maintenance and upgrades, including water systems.

- DIY Water Treatment Systems: Customers assemble their own filtration and purification solutions.

- Component Sourcing: Individuals purchase parts from multiple suppliers, bypassing integrated providers.

- Cost and Customization Drivers: DIY solutions appeal due to potential savings and tailored configurations.

- Market Trend: The growing DIY home improvement market, valued in the trillions, reflects a broader consumer preference for self-managed solutions.

Emerging Technologies and Decentralized Solutions

New technologies, such as advanced membrane filtration or localized, community-level water treatment systems, represent a significant threat of substitutes. These innovations can offer alternative solutions to traditional centralized water purification, potentially at different cost points or with greater flexibility. For instance, the increasing accessibility of portable water purification devices and decentralized wastewater treatment units could reduce reliance on large-scale infrastructure, especially in remote or underserved areas.

These emerging solutions might compete by offering:

- Reduced upfront capital expenditure compared to large municipal systems.

- Greater adaptability to specific local water quality challenges.

- Potentially lower operational and maintenance costs for smaller-scale applications.

- Enhanced resilience against disruptions affecting centralized infrastructure.

The threat of substitutes for Culligan is multifaceted, encompassing readily available consumer products and evolving technological solutions. Bottled water, a significant substitute, saw its U.S. market valued at approximately $38.5 billion in 2023, highlighting consumer preference for convenience and perceived purity. Basic municipal water, when deemed safe and palatable, also serves as a direct substitute, reducing the perceived need for home purification systems. Even simple boiling offers a low-cost, albeit less convenient, method for basic water treatment.

Lower-cost point-of-use filters, such as pitcher and faucet-mounted options, directly compete by offering basic filtration at a significantly lower annual cost, potentially around $30-$50 for refills compared to Culligan's system costs. Furthermore, the growing DIY home improvement market, projected to exceed $1.1 trillion by 2025, indicates a consumer trend towards self-sufficiency, enabling individuals to assemble their own water treatment solutions by sourcing components, thereby bypassing integrated providers like Culligan.

| Substitute Category | Examples | Key Competitive Factor | Estimated Market Size/Trend (2023/2025) |

|---|---|---|---|

| Bottled Water | Various brands, delivery services | Convenience, perceived purity | US Market: ~$38.5 billion (2023) |

| Municipal Water | Tap water | Cost, perceived safety/palatability | Varies by region |

| Basic Filters | Pitcher filters, faucet filters | Low cost, ease of use | Annual refill cost: ~$30-$50 |

| DIY Systems | Component-based filtration | Customization, potential cost savings | DIY Home Improvement Market: >$1.1 trillion (2025 projection) |

Entrants Threaten

Establishing a water treatment business, similar to Culligan International, demands considerable financial outlay. This includes setting up advanced manufacturing plants, investing in ongoing research and development for new filtration technologies, and creating an extensive network for sales, installation, and after-sales service. For instance, in 2024, the global water and wastewater treatment market was valued at approximately $630 billion, with significant portions dedicated to capital expenditures for infrastructure and technology.

Developing cutting-edge water treatment solutions, like advanced filtration and purification systems, requires substantial investment in research and development, a significant hurdle for potential new entrants. Culligan's commitment to innovation is evident in its continuous product development, aiming to stay ahead of evolving market needs and technological advancements.

In the water quality sector, brand recognition and customer trust are absolutely critical. Culligan has spent decades building a reputation for reliability, a significant hurdle for any new competitor trying to break in. For example, in 2024, consumer surveys consistently showed that established brands like Culligan held a much higher trust rating for essential services like water treatment compared to newer, less-known entities.

This deep-seated trust means new entrants face an uphill battle in convincing consumers to switch. People are often wary of entrusting something as vital as their household water supply to a company without a proven track record. This reluctance to experiment with unproven brands acts as a substantial barrier, protecting Culligan's market position.

Extensive Distribution and Service Network

Culligan International's extensive distribution and service network presents a significant barrier to new entrants. The company boasts a vast footprint of authorized dealerships and direct operations, ensuring widespread availability for sales, installation, and crucial ongoing service. This established infrastructure represents a substantial hurdle for any newcomer aiming to replicate its reach and operational efficiency.

The logistical and financial undertaking required to build a comparable network is immense. New companies would face considerable challenges in establishing a similar level of market penetration and customer support. For instance, in 2023, Culligan's service network supported millions of customer touchpoints, a scale that is difficult and costly to match quickly.

- Extensive Network: Culligan operates through thousands of authorized dealers and direct service centers globally.

- High Setup Costs: Replicating this infrastructure requires significant capital investment in logistics, inventory, and trained personnel.

- Customer Trust: An established service network builds customer loyalty and trust, which is hard for new entrants to gain rapidly.

- Operational Expertise: Managing a widespread service operation demands considerable experience and efficient systems.

Regulatory Hurdles and Certifications

The water treatment sector is heavily regulated, with stringent health, safety, and environmental standards that new companies must meet. Obtaining necessary product certifications, such as NSF/ANSI standards for drinking water treatment units, is a crucial but often lengthy and expensive process. For instance, in 2024, the time to obtain certain environmental permits in the US averaged between 6 to 18 months, depending on the complexity and jurisdiction.

These regulatory complexities and certification requirements act as a substantial barrier to entry. New players must invest significant resources in understanding and complying with these rules, which can deter smaller or less capitalized entrants. The ongoing evolution of environmental regulations, such as stricter wastewater discharge limits being considered by the EPA in late 2024, further adds to the compliance burden and cost for potential new competitors.

- Regulatory Compliance Costs: New entrants face substantial upfront costs for legal counsel, testing, and documentation to meet varied national and international standards.

- Certification Timelines: The process for obtaining certifications like NSF or WRAS can take many months, delaying market entry and product launch.

- Environmental Standards: Evolving environmental regulations, such as those pertaining to PFAS treatment, require ongoing investment in research and development and specialized equipment.

- Market Access Restrictions: Non-compliance with specific regional certifications can outright prevent market access, even for technically sound products.

The threat of new entrants for Culligan International is moderated by significant capital requirements and established brand loyalty. The substantial investment needed for manufacturing, R&D, and a robust service network, coupled with decades of building consumer trust, creates considerable barriers. For example, in 2024, the global water and wastewater treatment market's capital expenditure was a significant driver, making it challenging for new, less-funded players to compete effectively against established brands like Culligan.

Newcomers also face the challenge of replicating Culligan's extensive distribution and service infrastructure, which is crucial for customer support and market penetration. The time and financial resources required to build a comparable network, which in 2023 supported millions of customer touchpoints for Culligan, are immense. This operational scale and customer reach are difficult for new entrants to match quickly.

Stringent regulatory compliance and the need for product certifications, such as NSF/ANSI standards, further deter new entrants. The lengthy and costly process of obtaining these approvals, with some environmental permits taking up to 18 months in 2024, adds significant hurdles. Evolving regulations, like those concerning PFAS treatment, also demand continuous investment, increasing the cost of market entry.

| Barrier Type | Description | Impact on New Entrants | Example Data (2024) |

|---|---|---|---|

| Capital Requirements | High investment in manufacturing, R&D, and service infrastructure. | Significant financial hurdle, favors established players. | Global water treatment market CapEx significant. |

| Brand Loyalty & Trust | Decades of building reputation for reliability. | Customers hesitant to switch to unproven brands. | Surveys show higher trust for established water treatment brands. |

| Distribution & Service Network | Extensive global network of dealers and service centers. | Replication requires immense logistical and financial investment. | Culligan's network supported millions of customer touchpoints (2023). |

| Regulatory Compliance | Stringent health, safety, and environmental standards. | Lengthy and costly certification processes delay market entry. | Environmental permits can take 6-18 months; evolving PFAS regulations. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Culligan International is built upon a foundation of verified data, including company annual reports, industry-specific market research from firms like IBISWorld, and relevant government regulatory filings.