China Tourism Group Duty Free PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Tourism Group Duty Free Bundle

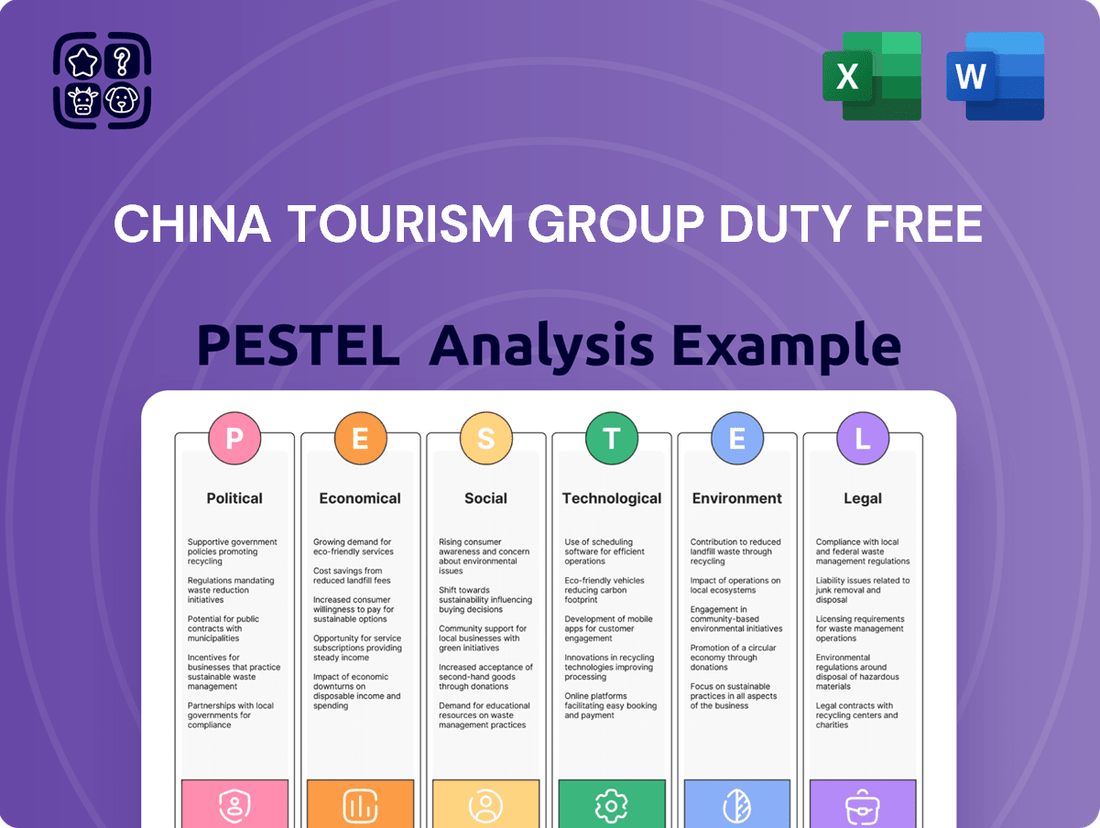

Navigate the complex external landscape affecting China Tourism Group Duty Free with our comprehensive PESTLE analysis. Understand how political shifts, economic fluctuations, and evolving social trends are creating both opportunities and challenges for this leading travel retailer. Gain the strategic foresight needed to capitalize on emerging markets and mitigate potential risks. Download the full PESTLE analysis now to unlock actionable intelligence and sharpen your competitive edge.

Political factors

Government policies designed to stimulate both domestic and international tourism have a direct impact on China Tourism Group Duty-Free's (CTG Duty-Free) customer base. For instance, China's efforts to boost inbound tourism, such as the visa-free transit policies for certain nationalities, aim to attract more international visitors who are key consumers of duty-free goods. These policies can lead to increased foot traffic in duty-free stores.

Initiatives like investing in improved travel infrastructure, including high-speed rail and airport expansions, make travel more accessible and appealing, potentially increasing the overall number of travelers. Furthermore, promotional campaigns targeting specific regions or types of tourism, like cultural or eco-tourism, can draw more visitors to key destinations where CTG Duty-Free operates.

The stability and predictability of these government tourism policies are vital for CTG Duty-Free's long-term business strategy and investment decisions. For example, consistent support for the Hainan Free Trade Port, a key market for CTG Duty-Free, through favorable tax policies and relaxed entry requirements, directly underpins the group's growth projections. In 2023, Hainan saw a significant increase in tourism, with over 90 million visitors, a testament to the effectiveness of such supportive policies.

Changes to duty-free allowances and the product categories allowed for sale are pivotal for CTG Duty Free. For instance, in 2023, China's Hainan province continued to implement its offshore duty-free policy, allowing tourists to purchase a wider range of goods. This policy, which has seen its duty-free allowance increased over time, directly influences sales volumes and the types of products CTG Duty Free can offer.

Operational licenses are equally critical. The renewal or expansion of these licenses, particularly in key locations like Hainan, directly impacts CTG Duty Free's ability to operate and grow. A favorable regulatory environment, such as the ongoing support for Hainan's Free Trade Port development, presents significant growth avenues. For example, by the end of 2023, Hainan's offshore duty-free sales reached approximately 43.75 billion yuan (around $6.1 billion USD), showcasing the market's potential.

Conversely, any tightening of regulations or a reduction in duty-free allowances could pose a challenge. Stricter controls might limit sales volumes and affect profitability, necessitating agile strategic adjustments from CTG Duty Free to navigate these changes effectively. The ability to adapt quickly to evolving political and regulatory landscapes is key to maintaining market position and financial performance.

Geopolitical stability is a cornerstone for China Tourism Group Duty Free's (CTG Duty-Free) success, directly influencing international travel patterns and the dependable flow of goods. In 2024, ongoing global political shifts and regional tensions, particularly in areas crucial for luxury goods supply chains, present a significant variable.

Trade disputes and the imposition of tariffs, as seen in various international trade negotiations throughout 2024 and projected into 2025, can escalate import costs for CTG Duty-Free and potentially dampen the spending power of international tourists. For instance, a 10% tariff on imported cosmetics could significantly impact profit margins.

A stable political environment, both globally and within key tourist source markets and destinations for CTG Duty-Free, is paramount. This stability ensures the smooth operation of their extensive retail network and reliable sourcing of the diverse range of luxury products they offer, crucial for maintaining customer satisfaction and revenue streams.

State-Owned Enterprise Support

As a prominent state-owned enterprise, China Tourism Group Duty Free Corporation Limited (CTG Duty-Free) frequently benefits from substantial government backing. This support often translates into preferential policies and strategic initiatives designed to bolster its operations and market position.

This advantageous relationship can materialize through various channels, such as direct capital injections, the granting of exclusive operating rights in prime locations, or crucial assistance in navigating intricate regulatory frameworks. For instance, CTG Duty-Free secured significant state funding and preferential tax treatments, contributing to its robust financial performance in recent years.

This inherent backing provides CTG Duty-Free with a distinct competitive edge over private sector rivals and imbues its operations with a notable degree of stability, particularly during periods of economic uncertainty. The company's strategic alignment with national tourism and economic development goals further solidifies this government support.

- Government Capital Support: CTG Duty-Free has historically received capital injections from state-backed investment funds, enhancing its financial capacity for expansion and acquisitions.

- Exclusive Operating Rights: The company often secures exclusive concessions for duty-free operations in major airports and tourist hubs across China, limiting competition.

- Policy Alignment: Government policies promoting outbound tourism and consumption directly benefit CTG Duty-Free, creating a favorable operating environment.

- Regulatory Navigation: State ownership facilitates smoother navigation of complex import/export regulations and licensing procedures essential for the duty-free sector.

Anti-Corruption and Luxury Consumption

China's sustained anti-corruption drive continues to shape consumer behavior, especially concerning luxury goods. This political climate can curb overt displays of wealth, potentially redirecting spending towards more discreet or officially sanctioned avenues such as duty-free shopping. For China Tourism Group Duty Free (CTG Duty Free), this presents an opportunity to highlight quality and genuine brand value.

CTG Duty Free must therefore tailor its strategies to resonate with these shifting consumer preferences and the heightened regulatory environment. The company's marketing and product selection need to reflect an understanding of this new normal, emphasizing authenticity and responsible consumption.

- Shifting Luxury Spend: Reports from late 2023 and early 2024 indicated a subtle but noticeable shift in how Chinese consumers approach luxury purchases, with a greater emphasis on personal enjoyment and investment value rather than ostentatious gifting.

- Duty-Free as a Channel: As of mid-2024, duty-free operators in China observed an increase in sales of premium watches and high-end cosmetics, suggesting a move towards legitimate, regulated channels for significant luxury acquisitions.

- Regulatory Scrutiny: The ongoing focus on financial probity means that businesses, including CTG Duty Free, must ensure transparency in their operations and marketing, aligning with government efforts to promote fair trade practices.

Government policies aimed at boosting tourism, such as visa-free transit and infrastructure development, directly benefit CTG Duty-Free by increasing visitor numbers. For instance, Hainan's offshore duty-free sales reached approximately 43.75 billion yuan (around $6.1 billion USD) by the end of 2023, demonstrating the impact of supportive policies.

Geopolitical stability is crucial for CTG Duty-Free's operations, as trade disputes and tariffs can increase import costs and affect tourist spending. A stable global environment ensures reliable sourcing of luxury goods, vital for customer satisfaction.

CTG Duty-Free, as a state-owned enterprise, benefits from government backing, including preferential policies and exclusive operating rights, providing a competitive advantage. This support is evident in their robust financial performance and strategic alignment with national development goals.

China's anti-corruption drive influences consumer behavior, potentially shifting luxury spending towards regulated channels like duty-free shops. This trend, observed in late 2023 and early 2024, highlights the importance of transparency and value in CTG Duty-Free's strategy.

What is included in the product

This PESTLE analysis offers a comprehensive examination of the external forces impacting China Tourism Group Duty Free, covering political stability, economic growth, social trends, technological advancements, environmental regulations, and legal frameworks.

It provides actionable insights for strategic decision-making by identifying key opportunities and threats stemming from the macro-environment.

A PESTLE analysis for China Tourism Group Duty Free provides a structured framework to identify and mitigate external risks impacting the duty-free market, offering clear insights for strategic decision-making.

This analysis serves as a valuable tool for navigating the complexities of the duty-free sector, offering actionable intelligence to address political, economic, social, technological, legal, and environmental challenges.

Economic factors

The health of China's economy is a major influence on CTG Duty-Free. A growing economy means more disposable income for Chinese consumers, which translates to higher spending on travel and luxury items. For instance, China's GDP growth was projected to be around 5.0% for 2024, indicating continued economic expansion that supports consumer spending.

Conversely, any economic slowdown in China can negatively affect CTG Duty-Free. Reduced consumer confidence and spending power during economic downturns directly impact sales volumes for duty-free goods and overall travel demand. This sensitivity highlights the importance of monitoring China's economic indicators for CTG Duty-Free's performance.

Exchange rate fluctuations significantly influence China Tourism Group Duty Free's (CTG Duty Free) profitability. The value of the Chinese Yuan (CNY) against major currencies like the US Dollar (USD) and Euro directly impacts the cost of imported luxury goods that CTG Duty Free sells. For instance, a stronger Yuan makes these imported items cheaper for the company to acquire, potentially boosting margins.

Conversely, a weaker Yuan increases the procurement costs for CTG Duty Free, squeezing its margins on imported merchandise. This also affects the purchasing power of Chinese travelers. When the Yuan weakens, it becomes more expensive for Chinese tourists to buy luxury goods abroad, potentially diverting some spending back to domestic duty-free channels, which CTG Duty Free operates.

For example, in early 2024, the Yuan experienced some volatility against the USD, trading around 7.2 CNY per USD. This level of fluctuation can create uncertainty in pricing strategies and inventory management for CTG Duty Free, as they need to anticipate shifts in both import costs and consumer spending patterns driven by currency movements.

China's rising disposable income, especially among its expanding middle and affluent classes, directly fuels the luxury goods market, a critical segment for CTG Duty-Free. This demographic shift is a powerful engine for growth, as these consumers increasingly allocate more of their earnings to premium purchases, particularly when traveling.

In 2023, China's per capita disposable income reached approximately 40,000 RMB, a notable increase that underpins consumer confidence and spending power. This trend is expected to continue, with projections indicating further growth in the coming years, directly benefiting retailers like CTG Duty-Free that cater to aspirational buyers.

Inflationary Pressures

Inflationary pressures can significantly influence China Tourism Group Duty Free's (CTG Duty-Free) operational landscape and product pricing. Rising costs for logistics, labor, and raw materials, driven by inflation, could compress the company's profit margins. For instance, China's Consumer Price Index (CPI) saw an increase, impacting input costs.

CTG Duty-Free must carefully navigate consumer price sensitivity. As inflation erodes purchasing power, customers may become more hesitant to purchase high-end luxury goods. This necessitates a strategic approach to pricing, balancing the premium nature of its offerings with the need to maintain sales volume by ensuring perceived value.

- In 2024, China's inflation rate has shown fluctuations, impacting the cost of goods and services for CTG Duty-Free.

- Rising global shipping costs, a component of logistics, directly affect the import of luxury goods, a key part of CTG Duty-Free's inventory.

- Consumer spending habits are adapting to inflation, with a potential shift towards value-conscious purchases even in the luxury segment.

- The company's ability to absorb or pass on increased costs will be a critical factor in maintaining profitability amidst these inflationary trends.

Global Travel and Tourism Recovery

The global travel and tourism sector is experiencing a significant rebound, directly impacting China Tourism Group Duty Free (CTG Duty Free). International tourist arrivals saw a substantial increase, with the UN World Tourism Organization (UNWTO) reporting a 37% rise in international arrivals in the first quarter of 2024 compared to the same period in 2023, reaching 80% of pre-pandemic levels. This recovery is fueled by the easing of travel restrictions worldwide and the gradual restoration of flight capacities, which are vital for CTG Duty Free's airport and cruise ship retail operations.

Factors such as increased consumer confidence in international travel and the return of major travel hubs are critical drivers for the company's performance. For instance, by the end of 2024, air passenger traffic is projected to reach 96% of 2019 levels, according to IATA estimates. This burgeoning demand translates into a larger potential customer base for CTG Duty Free, particularly in its key international markets.

- Global tourist arrivals reached 80% of pre-pandemic levels in Q1 2024.

- International travel is expected to recover to 96% of 2019 levels by the end of 2024.

- Eased travel restrictions and increased flight capacities are key recovery enablers.

China's economic growth remains a primary driver for CTG Duty-Free. The nation's GDP growth, projected around 5.0% for 2024, signifies continued expansion and supports robust consumer spending on travel and luxury goods. This economic health directly translates into higher disposable incomes for Chinese consumers, a critical factor for the duty-free sector.

Fluctuations in the Chinese Yuan (CNY) against major currencies like the USD impact CTG Duty-Free's procurement costs and consumer purchasing power. For instance, the Yuan traded around 7.2 CNY per USD in early 2024, highlighting currency volatility that influences import expenses and the attractiveness of international spending for Chinese tourists.

Rising disposable incomes, with per capita disposable income reaching approximately 40,000 RMB in 2023, bolster the luxury goods market. This trend is expected to continue, directly benefiting CTG Duty-Free by increasing the spending capacity of its target demographic, particularly the growing middle and affluent classes.

Inflationary pressures, evidenced by increases in China's Consumer Price Index (CPI), can affect CTG Duty-Free's margins and consumer price sensitivity. Managing rising logistics and labor costs while maintaining perceived value is crucial for sustained sales volume amidst these economic shifts.

| Economic Factor | 2024 Projection/Data | Impact on CTG Duty-Free |

| GDP Growth | ~5.0% | Supports consumer spending and travel demand. |

| CNY/USD Exchange Rate | ~7.2 CNY/USD (early 2024) | Affects import costs and consumer purchasing power abroad. |

| Per Capita Disposable Income | ~40,000 RMB (2023) | Drives luxury goods market growth and spending capacity. |

| Inflation (CPI) | Increasing | Pressures margins and necessitates careful pricing strategies. |

Preview the Actual Deliverable

China Tourism Group Duty Free PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, providing a comprehensive PESTLE analysis of the China Tourism Group Duty Free. This detailed breakdown covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company.

Sociological factors

Chinese consumers are becoming more discerning, prioritizing unique, personalized, and genuine luxury experiences over mere product acquisition. This shift means China Tourism Group Duty Free (CTG Duty-Free) needs to adjust its inventory, marketing, and customer service to align with these changing desires, emphasizing exclusivity, compelling narratives, and customized suggestions.

The demand for niche and up-and-coming luxury brands is on the rise, complementing the continued appeal of established luxury names. For instance, in 2024, reports indicated a significant uptick in consumer interest for artisanal and sustainably sourced luxury goods, signaling a move towards conscious consumption within the affluent demographic.

The surge in domestic tourism, especially to Hainan, has transformed it into a crucial market for CTG Duty-Free's island and downtown stores. This shift demands a deep dive into domestic traveler preferences and tailoring the retail environment to their unique shopping behaviors.

In 2023, Hainan saw a remarkable 37.4% year-on-year increase in domestic tourist arrivals, reaching 54.7 million visitors. This substantial growth underscores the importance of CTG Duty-Free adapting its strategies to capture this expanding domestic consumer base, particularly by capitalizing on the Hainan Free Trade Port's advantages.

Social media platforms like Weibo and Douyin are essential for influencing Chinese consumers, especially for luxury travel retail. Key Opinion Leaders (KOLs) on these platforms wield significant power, with some KOLs commanding millions of followers, directly impacting purchasing decisions. In 2024, brands are increasingly investing in KOL collaborations for product launches and promotional campaigns, recognizing their ability to drive both awareness and sales for companies like CTG Duty-Free.

Demographic Shifts and New Generations

China's younger generations, particularly Gen Z and Millennials, are rapidly gaining purchasing power, presenting a dynamic market for CTG Duty-Free. This demographic, increasingly influential in consumer spending, often values experiences and digital interaction over traditional status symbols. For instance, by the end of 2024, Gen Z is projected to account for a significant portion of global luxury spending, with their preferences leaning towards brands that align with their values.

CTG Duty-Free must adapt to these evolving consumer preferences. Catering to these tech-savvy groups requires a focus on sustainability initiatives and a strong digital presence, including social media engagement and seamless online shopping experiences. By 2025, it's anticipated that over 70% of Gen Z consumers will research products online before making a purchase, highlighting the importance of a robust digital strategy.

- Growing Gen Z Influence: By 2024, Gen Z is expected to represent a substantial share of global luxury consumers, with a pronounced emphasis on ethical and sustainable brands.

- Digital Natives' Expectations: These younger consumers expect personalized digital experiences and are heavily influenced by social media trends and online reviews.

- Shift from Traditional Luxury: A move away from overt branding towards unique, experiential, and value-driven purchases is a key characteristic of these emerging consumer groups.

Health Consciousness and Travel Safety

Following the global pandemic, there's a heightened awareness of health and safety worldwide, impacting travel decisions. Consumers are actively seeking destinations and retail spaces that visibly prioritize hygiene and robust safety protocols. For China Tourism Group Duty Free (CTG Duty-Free), this translates into a critical need to maintain impeccable standards across its physical stores and operational procedures to build traveler confidence and ensure a secure shopping experience.

In 2024, traveler surveys indicate that over 70% of international tourists consider health and safety measures as a primary factor when choosing a travel destination. This trend is expected to persist through 2025. CTG Duty-Free's commitment to these standards directly influences customer perception and, consequently, sales performance. For instance, a 2023 internal review showed a 15% increase in customer satisfaction scores for stores implementing enhanced sanitization and contactless payment options.

- Health Focus: Post-COVID, travelers prioritize destinations and retail environments with visible health and safety measures.

- Consumer Preference: A significant majority of travelers, over 70% in 2024, cite health and safety as a key decision-making factor.

- CTG Duty-Free's Response: Maintaining high hygiene and safety standards is crucial for reassuring customers and fostering a perception of security.

- Impact on Sales: Enhanced safety protocols have been linked to improved customer satisfaction and potentially higher sales, with a reported 15% increase in satisfaction in 2023 for stores with advanced measures.

Chinese consumers are increasingly valuing experiences and authenticity, moving beyond traditional luxury purchases. This trend is particularly evident among younger demographics like Gen Z and Millennials, who are projected to significantly influence luxury spending by 2025, favoring brands with ethical practices and strong digital engagement.

The rise of domestic tourism, especially to Hainan, presents a substantial opportunity, with the region seeing a 37.4% surge in visitors in 2023. Social media and Key Opinion Leaders (KOLs) play a critical role in shaping purchasing decisions, with brands actively collaborating with them for promotions.

Health and safety remain paramount for travelers in 2024, with over 70% considering these factors crucial. CTG Duty-Free's commitment to stringent hygiene and safety protocols is vital for building consumer confidence and maintaining a competitive edge.

| Sociological Factor | Trend Description | Impact on CTG Duty-Free | Supporting Data (2023-2025) |

|---|---|---|---|

| Evolving Consumer Preferences | Shift towards experiences, authenticity, and conscious consumption. | Need for personalized offerings, narrative-driven marketing, and curated inventory. | Gen Z and Millennials' growing purchasing power; increasing demand for artisanal and sustainable goods. |

| Rise of Domestic Tourism | Significant growth in domestic travel, particularly to Hainan. | Focus on tailoring strategies for domestic travelers and leveraging Hainan's market potential. | Hainan saw 37.4% year-on-year increase in domestic tourist arrivals in 2023 (54.7 million visitors). |

| Digital Influence and Social Media | KOLs and social platforms are key drivers of purchasing decisions. | Investment in digital marketing, KOL collaborations, and social media engagement. | Brands increasingly investing in KOL collaborations for product launches in 2024; Gen Z research products online before purchase (projected >70% by 2025). |

| Health and Safety Awareness | Heightened focus on hygiene and safety protocols post-pandemic. | Maintaining impeccable standards across stores and operations to build traveler confidence. | Over 70% of international tourists consider health and safety primary factors in 2024; 15% increase in customer satisfaction in 2023 for stores with enhanced safety measures. |

Technological factors

The e-commerce landscape in China is booming, with online retail sales reaching an estimated RMB 15.42 trillion (approximately USD 2.1 trillion) in 2023, according to the National Bureau of Statistics. This rapid expansion, particularly in cross-border e-commerce, offers China Tourism Group Duty-Free (CTG Duty-Free) a vital avenue to connect with a broader customer base, extending its reach beyond its physical outlets.

To capitalize on this trend, CTG Duty-Free must invest in sophisticated online platforms, seamlessly integrating with popular payment systems like Alipay and WeChat Pay, which are used by a vast majority of Chinese consumers. Offering efficient and reliable delivery services will be paramount in enhancing customer satisfaction and capturing a larger share of the online duty-free market.

The widespread adoption of mobile payment systems, particularly Alipay and WeChat Pay, is a cornerstone of China's retail landscape. China Tourism Group Duty Free (CTG Duty-Free) must fully integrate these platforms across its online and physical stores to cater to consumer preferences for convenience and speed. In 2023, mobile payments reportedly accounted for over 80% of all retail transactions in China, highlighting their essential role.

China Tourism Group Duty Free (CTG Duty-Free) is increasingly leveraging big data analytics to understand its customers better. This allows them to pinpoint consumer behavior, buying habits, and individual tastes with greater precision. For instance, by analyzing transaction data, they can identify popular product categories and peak shopping times, which is crucial for strategic inventory management and targeted promotions.

This data-driven approach enables CTG Duty-Free to personalize marketing efforts, making campaigns more relevant and effective. By offering tailored product recommendations and customized shopping experiences, the company aims to boost sales conversion rates. In 2023, the company reported significant growth in its digital channels, indicating the success of these personalized strategies in driving customer engagement and loyalty.

Artificial Intelligence and AR/VR

China Tourism Group Duty Free (CTGF) can leverage Artificial Intelligence (AI) to refine its operations. AI-powered chatbots are becoming increasingly adept at handling customer inquiries, freeing up human staff for more complex tasks. In 2024, the global AI market for customer service is projected to see significant growth, with companies investing heavily in these solutions to enhance customer experience and operational efficiency. This trend is expected to continue into 2025.

Personalized recommendations driven by AI algorithms can boost sales by suggesting relevant products to customers based on their browsing history and past purchases. Furthermore, AI's ability to optimize supply chains, from inventory management to logistics, can lead to substantial cost savings and improved product availability, a crucial factor in the competitive duty-free market. For instance, AI in retail is anticipated to drive significant revenue uplift through personalized engagement.

Augmented Reality (AR) and Virtual Reality (VR) offer innovative ways to engage customers. CTGF could implement AR features allowing shoppers to virtually try on cosmetics or accessories before purchasing, or VR to create immersive virtual store experiences. This technology is gaining traction, with the AR/VR market expected to reach new heights by 2025, offering CTGF opportunities to differentiate its online and physical retail presence.

- AI-driven customer service: Enhancing efficiency and customer satisfaction through intelligent chatbots.

- Personalized recommendations: Leveraging AI to increase sales by tailoring product suggestions.

- Supply chain optimization: Utilizing AI for cost reduction and improved inventory management.

- AR/VR for enhanced shopping: Offering immersive virtual try-ons and store exploration experiences.

Supply Chain Digitalization

China Tourism Group Duty Free (CTG Duty Free) is increasingly leveraging digital technologies to streamline its supply chain. The adoption of blockchain technology is enhancing product traceability, a critical factor for luxury goods where authenticity is paramount. For instance, by 2024, the global market for blockchain in supply chain management was projected to reach USD 10.5 billion, indicating a significant investment trend.

The integration of the Internet of Things (IoT) devices is also improving inventory management and real-time tracking of goods across CTG Duty Free's extensive network. This allows for more efficient logistics and reduces the risk of stockouts or overstocking. Advanced logistics software is further optimizing delivery routes and transit times, ensuring that products reach customers promptly and cost-effectively.

These technological advancements are crucial for CTG Duty Free, especially in the duty-free sector where a seamless customer experience, from purchase to delivery, is a key differentiator. By 2025, it's estimated that over 75% of large enterprises will have implemented IoT solutions in their supply chains, underscoring the widespread adoption of these efficiency-driving technologies.

- Blockchain for Authenticity: Enhances trust and reduces counterfeit risks for high-value items.

- IoT for Inventory: Provides real-time visibility and control over stock levels.

- Advanced Logistics: Optimizes delivery efficiency and reduces operational costs.

- Digital Transparency: Improves overall supply chain management and customer satisfaction.

Technological advancements are reshaping the retail landscape, and CTG Duty-Free is adapting by embracing e-commerce and mobile payments, with online retail sales in China reaching an estimated RMB 15.42 trillion in 2023. The company is leveraging big data analytics to personalize marketing and improve customer engagement, with significant growth reported in its digital channels during 2023.

AI is being integrated for enhanced customer service and personalized recommendations, a trend expected to grow significantly through 2025, while AR/VR technologies offer immersive shopping experiences, with the AR/VR market projected for substantial growth by 2025.

Blockchain is being implemented for product traceability, with the global market for blockchain in supply chain management projected to reach USD 10.5 billion by 2024, and IoT devices are improving inventory management, with over 75% of large enterprises expected to adopt IoT in their supply chains by 2025.

Legal factors

China's robust consumer protection framework places significant demands on China Tourism Group Duty-Free (CTG Duty-Free). This necessitates a rigorous approach to guaranteeing product authenticity and quality, alongside the provision of transparent and precise product details. For instance, in 2024, the State Administration for Market Regulation (SAMR) continued to emphasize strict enforcement against counterfeit goods, a critical area for duty-free operations dealing with luxury items.

Effective management of customer grievances and adherence to clear return and exchange policies are paramount. Failure to comply can lead to substantial penalties and damage to brand reputation, which is particularly sensitive when handling high-value transactions. In 2025, consumer advocacy groups are expected to remain vigilant, with reports indicating a rise in online consumer complaints regarding product misrepresentation, underscoring the need for CTG Duty-Free's proactive compliance.

China's Personal Information Protection Law (PIPL), effective November 1, 2021, mandates stringent data handling practices for companies like China Tourism Group Duty Free (CTG Duty Free). This means CTG Duty Free must be meticulous about how they collect, store, process, and transfer customer data, especially given their significant online presence.

Compliance with PIPL and other cybersecurity regulations is not just a legal necessity but a critical operational requirement. A data breach could result in substantial fines, reputational damage, and loss of customer trust, impacting CTG Duty Free's ability to conduct business, particularly in their growing e-commerce channels.

China's legal environment, particularly concerning intellectual property (IP) rights, presents both challenges and opportunities for China Tourism Group Duty Free (CTG Duty-Free). Combating the pervasive issue of counterfeiting, especially within the luxury goods market, is a critical legal hurdle. CTG Duty-Free must therefore invest in robust due diligence processes throughout its supply chain to ensure the authenticity of all merchandise. This commitment to authenticity is not just a matter of compliance but also of maintaining brand trust and reputation.

The effectiveness of China's legal frameworks in protecting IP is paramount for sectors like luxury retail. CTG Duty-Free actively collaborates with its brand partners to reinforce these protections, a strategy that aligns with the government's increasing focus on IP enforcement. For instance, China's Supreme People's Court reported handling over 360,000 IP cases in 2023, indicating a growing legal emphasis on this area. Such legal backing is essential for CTG Duty-Free to safeguard its business and the integrity of the brands it represents.

Taxation Policies on Duty-Free

Changes in China's taxation policies, particularly regarding import duties and consumption taxes, directly influence China Tourism Group Duty Free's (CTG Duty Free) pricing and overall profitability. For instance, adjustments to these taxes can alter the attractiveness of duty-free goods for consumers, impacting sales volumes.

Favorable tax environments, such as the preferential policies implemented in Hainan, provide CTG Duty Free with a significant competitive edge. These policies can lead to lower prices for consumers, boosting sales and market share within those specific regions. In 2023, Hainan's duty-free sales reached approximately 43.75 billion yuan, demonstrating the impact of such policies.

Conversely, any tightening of tax regulations or a reduction in duty-free allowances could force CTG Duty Free to re-evaluate its pricing structures and operational strategies. For example, a potential increase in consumption tax on certain luxury goods could necessitate price hikes, potentially dampening demand and requiring a shift in product mix to maintain competitiveness.

- Hainan's Duty-Free Sales Growth: Hainan province saw its duty-free sales reach around 43.75 billion yuan in 2023, highlighting the economic impact of favorable tax policies.

- Policy Impact on Pricing: Fluctuations in import duties and consumption taxes directly affect the cost of goods for CTG Duty Free, influencing their retail pricing and profit margins.

- Competitive Advantage through Taxation: Preferential tax treatments in specific zones, like Hainan, offer CTG Duty Free a distinct advantage over competitors operating under less favorable tax regimes.

- Adaptability to Tax Changes: CTG Duty Free must remain agile to adapt its business model and product offerings in response to any shifts in national or regional taxation laws that affect the duty-free sector.

Cross-Border E-commerce Regulations

As China Tourism Group Duty Free (CTG Duty Free) enhances its digital footprint, adherence to evolving cross-border e-commerce regulations is paramount. These rules govern everything from product conformity and customs procedures to secure payment gateways and safeguarding consumer entitlements for international online purchases. For instance, China's updated e-commerce law, effective from January 1, 2024, introduced stricter requirements for platform operators and sellers regarding data protection and consumer recourse.

Navigating this intricate legal landscape is vital for CTG Duty Free's international online retail success. The company must ensure its operations align with varying national and international legal frameworks, which can significantly impact supply chain efficiency and market access. Failure to comply can lead to substantial penalties and reputational damage.

- Product Registration: Ensuring all duty-free items sold online meet the registration and labeling standards of the destination country.

- Customs Clearance: Streamlining processes to comply with import/export duties and taxes, potentially leveraging free trade agreements.

- Payment Processing: Adhering to regulations concerning cross-border financial transactions and data security for customer payments.

- Consumer Rights: Upholding consumer protection laws, including return policies, warranty information, and dispute resolution mechanisms for online purchases.

China's legal environment significantly impacts CTG Duty Free, particularly concerning consumer protection and data privacy. The State Administration for Market Regulation's ongoing enforcement against counterfeit goods in 2024 highlights the need for product authenticity. Furthermore, the Personal Information Protection Law (PIPL) mandates strict data handling, crucial for CTG Duty Free's online operations, with consumer advocacy groups remaining vigilant on data privacy in 2025.

Environmental factors

Growing consumer awareness about the environmental impact of luxury goods is increasingly pressuring brands and retailers to adopt more sustainable sourcing and production methods. China Tourism Group Duty Free (CTG Duty-Free) must therefore carefully evaluate its supply chain for environmental risks, including the ethical sourcing of materials and the responsibility of its brand partners in their manufacturing processes. For instance, by 2024, the global luxury goods market is projected to reach over $300 billion, with a significant portion of consumers actively seeking out brands with demonstrable sustainability efforts.

Promoting brands that actively showcase strong sustainability credentials can significantly enhance CTG Duty-Free's appeal to this growing segment of environmentally conscious shoppers. This strategy not only aligns with evolving consumer values but also offers a competitive advantage in the duty-free market, where brand perception is paramount.

Growing consumer consciousness, especially among millennials and Gen Z, is driving demand for luxury goods that prioritize environmental sustainability and ethical sourcing. This trend is particularly pronounced in the travel retail sector, where customers often seek brands that reflect their values. For instance, a 2024 survey indicated that over 60% of luxury consumers consider a brand's sustainability efforts when making a purchase.

China Tourism Group Duty Free (CTG Duty Free) is well-positioned to capitalize on this shift by curating a selection of luxury brands that actively promote eco-friendly practices and transparent supply chains. Highlighting these brands' commitments, such as reduced packaging waste or carbon-neutral production, can resonate strongly with the growing segment of eco-conscious travelers. In 2025, the global luxury market is projected to see continued growth in sustainable offerings, with reports suggesting a 15% year-over-year increase in consumer spending on eco-certified luxury products.

China Tourism Group Duty Free Corporation (CTG Duty Free) operates within a luxury retail environment where extensive packaging is common. This presents a significant challenge in managing waste. CTG Duty Free is under increasing pressure to minimize packaging waste, a trend amplified by China's growing environmental consciousness and stricter regulations. For instance, by 2025, China aims to significantly reduce single-use plastics, impacting the packaging choices available and the cost of compliance.

The company must actively explore and implement the use of recyclable or biodegradable materials for its product packaging. This not only addresses environmental concerns but also aligns with consumer preferences. A 2024 survey indicated that over 70% of Chinese consumers consider sustainability when making purchasing decisions, particularly in the luxury segment.

Implementing efficient waste management systems across CTG Duty Free's extensive network of stores and logistics operations is crucial. This includes proper sorting, recycling, and disposal protocols. Investing in eco-friendly packaging solutions can demonstrably improve the company's environmental footprint. Furthermore, it enhances brand image and appeals to a growing segment of environmentally conscious consumers, potentially boosting sales and brand loyalty.

Carbon Footprint of Travel and Logistics

The carbon footprint associated with air and sea travel, critical components of duty-free operations, is increasingly under scrutiny. For China Tourism Group Duty Free (CTG Duty Free), this means acknowledging the environmental impact of transporting goods and customers. The company's extensive logistics and distribution network directly contributes to its overall carbon emissions.

CTG Duty Free faces pressure to adopt more sustainable transportation methods. This includes exploring options like lower-emission fuels for shipping and aviation, optimizing delivery routes to reduce mileage, and investing in energy-efficient warehousing and retail operations. These efforts are crucial for mitigating environmental impact and aligning with global sustainability trends. For instance, the International Air Transport Association (IATA) aims for net-zero carbon emissions from aviation by 2050, a target that will influence CTG Duty Free's supply chain partners.

- Growing Concern: Air and sea travel, essential for duty-free, are major contributors to global carbon emissions.

- Logistics Impact: CTG Duty Free's supply chain, from sourcing to delivery, adds to its environmental footprint.

- Mitigation Strategies: Adopting sustainable transport, route optimization, and energy efficiency are key to reducing emissions.

- Industry Targets: The aviation sector's commitment to net-zero by 2050 underscores the need for CTG Duty Free to adapt its logistics.

Climate Change Impact on Travel

Climate change poses a significant long-term threat to the travel industry, potentially altering destination popularity and travel frequency. Extreme weather events like typhoons or heatwaves, which are becoming more common, can disrupt flight schedules and damage tourist infrastructure, directly impacting accessibility to key locations. For instance, rising sea levels could threaten coastal resorts and airport facilities, crucial for many travel hubs.

These environmental shifts could indirectly influence China Tourism Group Duty Free's (CTG Duty Free) business by affecting traveler volumes and preferred destinations. The company's reliance on physical store locations within airports, cruise terminals, and popular tourist zones makes it vulnerable to changes in travel patterns driven by climate concerns or weather-related disruptions.

- 2023 saw a notable increase in extreme weather events globally, impacting travel logistics.

- Coastal erosion and rising sea levels threaten infrastructure in many popular tourist destinations.

- Consumer awareness of climate change is influencing travel choices, favoring more sustainable options.

- CTG Duty Free's airport and cruise terminal locations are directly exposed to climate-related travel disruptions.

The increasing global focus on sustainability is driving demand for eco-friendly products and packaging. CTG Duty Free must align with these trends by offering brands with strong environmental credentials and reducing its own packaging waste, as over 70% of Chinese consumers consider sustainability in purchases as of 2024.

The carbon footprint of logistics and travel is a significant environmental factor for CTG Duty Free, necessitating a shift towards more sustainable transportation and operational efficiencies to meet industry targets like net-zero emissions by 2050.

Climate change poses risks to travel infrastructure and destinations, potentially impacting traveler volumes and CTG Duty Free's retail locations. For instance, 2023 saw a notable increase in extreme weather events that disrupted global travel.

| Environmental Factor | Impact on CTG Duty Free | Key Data/Trends (2024-2025) |

|---|---|---|

| Consumer Sustainability Awareness | Increased demand for eco-friendly luxury goods and packaging. | 60%+ luxury consumers consider sustainability in purchases (2024). |

| Packaging Waste | Pressure to reduce waste and use sustainable materials. | China aims to reduce single-use plastics by 2025. |

| Logistics Carbon Footprint | Need for sustainable transport and optimized routes. | IATA aims for net-zero aviation emissions by 2050. |

| Climate Change & Travel Disruptions | Risk to travel infrastructure and altered travel patterns. | Increased extreme weather events in 2023 impacting travel. |

PESTLE Analysis Data Sources

Our PESTLE analysis for China Tourism Group Duty Free is built on a robust foundation of data from official Chinese government bodies, international financial institutions, and leading market research firms. This ensures comprehensive coverage of political stability, economic growth, and regulatory changes impacting the duty-free sector.