China Tourism Group Duty Free Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Tourism Group Duty Free Bundle

China Tourism Group Duty Free operates in a dynamic market shaped by intense competition and evolving consumer demands. Understanding the forces of buyer power, supplier leverage, and the threat of new entrants is crucial for navigating its landscape.

The full Porter's Five Forces Analysis provides a comprehensive, data-driven framework to dissect these pressures, revealing the underlying strengths and weaknesses that define China Tourism Group Duty Free's competitive position. Unlock actionable insights to drive smarter strategic decisions and gain a significant market advantage.

Suppliers Bargaining Power

The bargaining power of suppliers for China Tourism Group Duty Free (CTG Duty-Free) is notably high, primarily driven by the concentrated structure of the global luxury goods sector. CTG Duty-Free's business model heavily depends on sourcing products from a select group of dominant international luxury brands.

These key suppliers, including giants like LVMH and Kering, command significant influence due to their established brand equity and exclusive product lines. This exclusivity and brand loyalty empower them to negotiate favorable terms with retailers like CTG Duty-Free, impacting pricing and product availability.

Suppliers of luxury goods to China Tourism Group Duty Free (CTG Duty-Free) enjoy significant bargaining power due to high brand exclusivity and product differentiation. This makes it difficult for CTG Duty-Free to switch to alternative suppliers without impacting its product offering and customer appeal. For instance, in 2023, the luxury goods market, a core segment for duty-free operators, saw continued robust growth, with many premium brands reporting strong sales performance, underscoring their market leverage.

The desirability of these luxury items is a major draw for travelers frequenting duty-free shops, directly contributing to CTG Duty-Free's sales volume. This reliance on sought-after brands allows these suppliers to negotiate favorable terms, including pricing and distribution arrangements, essential for preserving their brand prestige and controlling their supply chain.

Switching costs for established luxury brands dealing with CTG Duty-Free can be substantial. These costs aren't just about direct negotiation fees; they also encompass the potential damage to a brand's carefully cultivated consumer appeal if they were to shift their distribution strategy. For instance, a luxury watch brand might face significant marketing and re-branding expenses to establish a new presence in duty-free channels.

Building and maintaining strong relationships with top-tier luxury brands demands considerable investment from CTG Duty-Free, fostering trust and securing favorable terms. This deep integration means that any disruption to these partnerships could directly affect CTG's product assortment and, consequently, its overall attractiveness to international travelers. In 2023, CTG reported over 1000 luxury brand partners, highlighting the scale of these relationships.

Supplier Forward Integration Threat

The threat of supplier forward integration looms for China Tourism Group Duty Free (CTG Duty Free). Luxury brands could increasingly establish their own direct-to-consumer duty-free channels, especially in burgeoning markets like Hainan. This strategic shift would diminish their dependence on established domestic operators, thereby enhancing supplier leverage.

This trend is already visible, with reports indicating that several major luxury conglomerates are exploring or actively developing their own retail footprints in duty-free zones. For instance, in 2023, Hainan saw significant investment in new retail infrastructure, with many international brands seeking prime locations. This move allows brands to capture more of the value chain and exert greater control over their customer experience, potentially impacting CTG Duty Free's market share and pricing power.

- Supplier Forward Integration: Luxury brands may establish their own direct-to-consumer duty-free operations.

- Hainan's Role: Key regions like Hainan are seeing increased brand investment in retail expansion.

- Reduced Reliance: Brands could lessen their dependence on domestic operators like CTG Duty Free.

- Increased Supplier Power: This trend has the potential to strengthen the bargaining power of suppliers over time.

CTG's Market Position and Relationships

China Tourism Group Duty Free (CTG) occupies a dominant position as a premier global travel retailer, fostering enduring partnerships with its suppliers. This strong market standing grants CTG considerable leverage, enabling it to negotiate effectively even with influential brands.

CTG's extensive retail footprint, spanning airports, urban centers, and cruise ships, coupled with its substantial market share, particularly in the vital Hainan region, makes it a critical gateway for luxury brands targeting the affluent Chinese travel market. For instance, CTG's operations in Hainan are a significant driver of sales for many international brands, underscoring its importance as a distribution channel.

- Dominant Global Position: CTG is a leading travel retailer worldwide.

- Long-Term Supplier Relationships: CTG cultivates stable, long-term ties with its suppliers.

- Strategic Market Access: CTG's extensive network offers crucial access to the Chinese travel retail market, especially in Hainan.

- Supplier Dependence: Many luxury brands rely on CTG for significant sales within this lucrative market.

The bargaining power of suppliers for China Tourism Group Duty Free (CTG Duty-Free) remains significant, largely due to the highly concentrated nature of the global luxury goods market. CTG Duty-Free's reliance on a select group of dominant international luxury brands, such as LVMH and Kering, grants these suppliers considerable leverage. Their strong brand equity and exclusive product offerings allow them to dictate terms, impacting pricing and product availability for CTG Duty-Free.

These powerful suppliers can command favorable terms due to the high desirability and limited availability of their products, which are crucial draws for travelers. For example, in 2023, many premium luxury brands reported substantial sales growth, reinforcing their market influence. This reliance means CTG Duty-Free must maintain strong relationships, investing heavily to secure favorable terms and product assortments, with over 1000 luxury brand partners in 2023 highlighting the scale of these dependencies.

The threat of supplier forward integration also amplifies their bargaining power. Luxury brands are increasingly exploring direct-to-consumer duty-free channels, particularly in key growth areas like Hainan. This strategic move, evident in the significant retail infrastructure investment in Hainan during 2023, allows brands to capture more value and control their customer experience, potentially reducing their dependence on established operators like CTG Duty-Free and strengthening their negotiating position.

| Key Factor | Impact on CTG Duty-Free | Supplier Leverage | 2023 Data/Example |

| Market Concentration (Luxury Goods) | High dependence on few brands | High | Dominance of LVMH, Kering, Richemont |

| Brand Exclusivity & Desirability | Essential for sales volume | High | Premium brands reporting strong sales growth |

| Switching Costs | Significant investment in relationships | Moderate to High | Marketing & re-branding costs for new channels |

| Supplier Forward Integration Threat | Potential loss of market share | Increasing | Brands exploring direct retail in Hainan |

What is included in the product

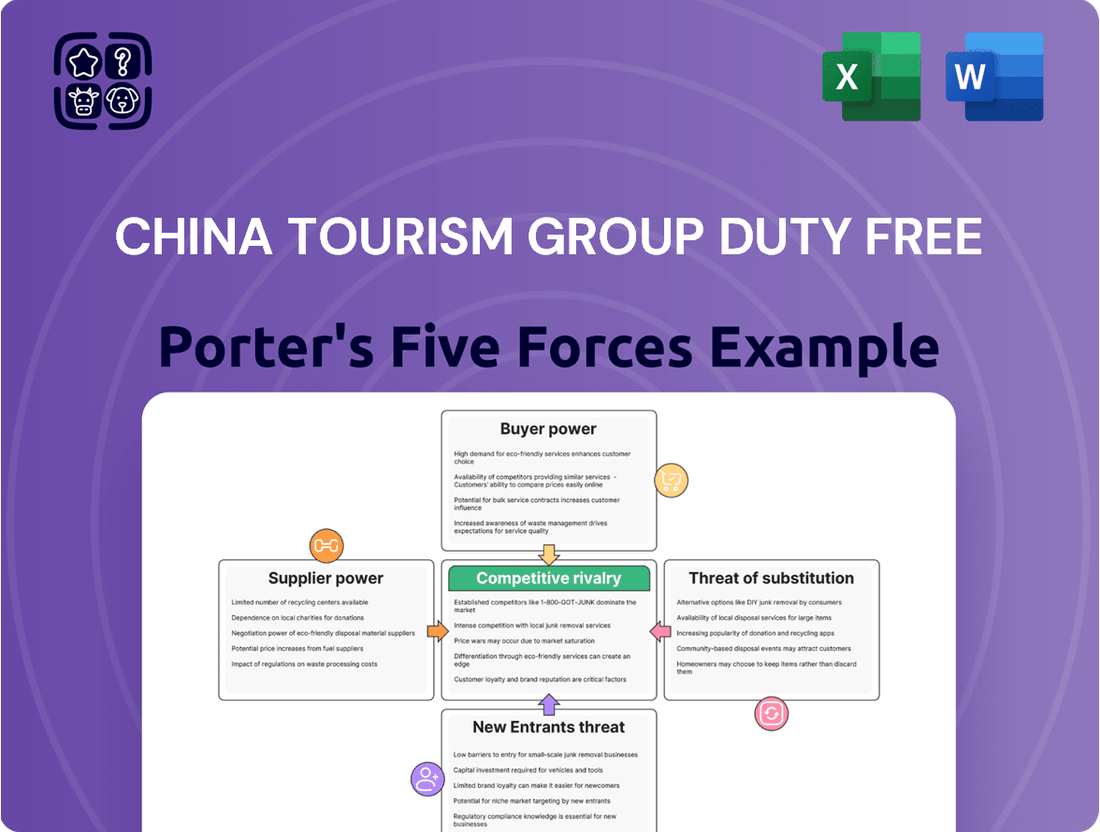

This Porter's Five Forces analysis for China Tourism Group Duty Free dissects the competitive intensity, buyer and supplier power, threat of new entrants, and the impact of substitutes within the duty-free retail sector.

Effortlessly identify and address competitive threats by visualizing the China Tourism Group Duty Free's bargaining power of suppliers and buyers.

Customers Bargaining Power

Customers wield increasing power, especially when price sensitivity rises and attractive overseas options become more readily available. Chinese travelers are increasingly choosing destinations such as Japan and Malaysia, drawn by favorable currency exchange rates and appealing travel policies that make shopping more economical. This trend directly affects domestic duty-free sales, compelling CTG Duty-Free to maintain competitive pricing strategies.

Recent policy shifts, like the enhanced duty-free allowances for Chinese tourists visiting Hong Kong and Macau, significantly bolster customer purchasing power in these alternative destinations. This development directly impacts China Tourism Group Duty Free (CTG Duty Free) by presenting consumers with more choices and intensifying competition for its mainland operations, especially in the crucial Hainan market.

For instance, the 2024 policy allowing each traveler to purchase up to RMB 10,000 worth of goods duty-free per trip to Hong Kong and Macau, an increase from the previous RMB 8,000, directly diverts spending that might otherwise go to CTG Duty Free's domestic outlets. This heightened consumer flexibility means CTG Duty Free must work harder to retain its market share and attract customers to its Hainan stores.

Modern consumers, particularly Chinese travelers, are incredibly informed and adept with digital tools. They routinely research products and prices well in advance of their journeys, leveraging online platforms and integrated super apps. This widespread access to information significantly diminishes information asymmetry.

This heightened digital savviness empowers customers by enabling them to easily compare prices across various vendors and actively seek the most advantageous deals. For instance, in 2023, Chinese outbound tourism saw a substantial rebound, with millions of travelers actively using e-commerce and review sites to inform their purchasing decisions, directly impacting price sensitivity and negotiation power.

Shifting Consumer Preferences

Consumer preferences are definitely changing, with people increasingly looking for special, limited-edition items and wanting a more tailored shopping experience. This means that just offering lower prices isn't always enough to get shoppers through the door.

Customers are now seeking out curated exclusivity and want to feel good about their purchases, not just get a deal. For companies like China Tourism Group Duty Free (CTG Duty Free), this shift means they need to provide more than just discounts to keep customers engaged and loyal.

- Evolving Demand: Consumers are actively seeking unique and limited-edition products, moving beyond basic availability.

- Personalization is Key: A desire for personalized shopping experiences is growing, influencing purchasing decisions.

- Value Beyond Price: While price still matters, shoppers are increasingly prioritizing curated exclusivity and justification for their spending.

- Retailer Adaptation: CTG Duty Free and similar retailers must innovate their offerings beyond discounts to attract and retain this evolving customer base.

Impact of Economic Downturn

A slowdown in China's economy, particularly evident in 2024, has directly impacted consumer confidence, leading to a noticeable decrease in spending on non-essential goods. This economic pressure translates into reduced purchasing power for customers, making them more discerning and price-sensitive. Consequently, customers gain greater leverage when making decisions, as businesses must work harder to attract and retain their patronage.

The waning consumer confidence observed throughout 2024 has amplified the bargaining power of customers. With less disposable income and greater economic uncertainty, consumers are more inclined to seek value and compare offerings meticulously. This shift forces companies like China Tourism Group Duty Free to be more competitive on price and to enhance the perceived value of their products and services to secure sales.

- Economic Slowdown Impact: China's GDP growth, while projected to remain positive in 2024, has seen a moderation compared to previous years, influencing consumer sentiment.

- Consumer Confidence: Surveys in late 2023 and early 2024 indicated a dip in consumer confidence, with households expressing more caution about future economic prospects.

- Discretionary Spending: Luxury and travel-related expenditures, key areas for duty-free operators, are particularly vulnerable to economic downturns, increasing customer price sensitivity.

Customers are increasingly empowered due to greater price transparency and the availability of attractive overseas alternatives. Chinese travelers, for example, are exploring destinations like Japan and Malaysia, benefiting from favorable exchange rates and travel policies that make shopping more economical. This trend directly pressures CTG Duty Free to maintain competitive pricing.

The 2024 policy allowing RMB 10,000 duty-free purchases per trip to Hong Kong and Macau, up from RMB 8,000, diverts spending from domestic outlets. This heightened consumer flexibility intensifies competition, especially for CTG Duty Free's operations in Hainan.

Chinese consumers are digitally savvy, using online platforms to compare prices and seek the best deals. In 2023, millions of outbound travelers utilized e-commerce and review sites, significantly boosting their price sensitivity and bargaining power.

| Factor | Description | Impact on CTG Duty Free |

|---|---|---|

| Price Sensitivity | Consumers actively compare prices across domestic and international options. | Requires competitive pricing strategies and value enhancement. |

| Information Access | Digital tools enable easy product and price research. | Reduces information asymmetry, strengthening customer negotiation power. |

| Alternative Destinations | Policies in Hong Kong and Macau offer increased duty-free allowances. | Diverts spending away from mainland duty-free, increasing competitive pressure. |

| Economic Climate (2024) | Slowdown in China impacts consumer confidence and discretionary spending. | Amplifies customer bargaining power as they seek more value. |

Full Version Awaits

China Tourism Group Duty Free Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for China Tourism Group Duty Free, detailing the competitive landscape and strategic positioning within the industry. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, providing actionable insights without any placeholders or surprises.

Rivalry Among Competitors

The Chinese duty-free market is heavily concentrated, with China Tourism Group Duty Free (CTG Duty Free) holding a commanding position as the leading player. This dominance grants CTG significant leverage and a strong competitive edge over its rivals.

Despite CTG's leading status, the market is characterized by fierce competition from other substantial domestic and international operators. This intense rivalry means that even a dominant firm must constantly adapt its strategies to sustain its market leadership.

For instance, in 2023, CTG Duty Free reported a substantial revenue increase, reflecting its strong market presence. However, this growth occurs within an environment where competitors are actively seeking to capture market share, requiring CTG to remain vigilant and innovative.

Competitive rivalry in the duty-free sector is heating up as both domestic and international players aggressively expand their footprints. New downtown duty-free stores are popping up, and key travel hubs are seeing increased competition for valuable concessions. This intensified geographic expansion by rivals, mirroring China Tourism Group Duty Free's (CTG) own growth ambitions, is shaping a highly dynamic market environment.

The resurgence of Chinese outbound travel, a significant trend observed in 2024, directly impacts China Tourism Group Duty Free (CTG Duty Free) by diverting consumer spending away from its domestic hubs, particularly Hainan. As Chinese travelers increasingly choose international destinations, they also opt for duty-free shopping in those locations.

This shift intensifies competitive pressure on CTG Duty Free. Overseas duty-free retailers gain an advantage as Chinese consumers have more accessible and diverse options for luxury goods abroad. For instance, in the first quarter of 2024, outbound Chinese tourism saw a substantial recovery, with millions of citizens traveling internationally, many of whom would have previously shopped domestically.

Price Competition and Promotions

Price competition is a significant factor for China Tourism Group Duty Free (CTGF), often seen in aggressive pricing and promotional efforts to capture market share. While the in-store experience is gaining prominence, price remains a key consideration for consumers who might otherwise bypass duty-free shopping.

- Price Sensitivity: Despite the allure of premium brands, price remains a critical driver for many consumers, especially those not actively seeking a specific luxury item.

- Promotional Activities: CTGF frequently engages in sales, discounts, and loyalty programs to incentivize purchases and counter competitor pricing.

- Balancing Act: The company must carefully balance its premium brand image with the necessity of offering competitive pricing and attractive promotions to maintain customer traffic and sales volume.

- 2024 Market Dynamics: As of early 2024, the duty-free market in China continues to be highly competitive, with ongoing promotional campaigns from various players impacting CTGF's pricing strategies.

Strategic Initiatives and Diversification

Competitors are actively pursuing strategic initiatives to gain an edge, including broadening their product selections, improving their online presence, and weaving in travel experiences. For instance, Hainan Tourism Investment Group is heavily investing in developing integrated tourism and shopping complexes, aiming to capture a larger share of the growing domestic travel market.

China Tourism Group Duty Free Corporation (CTG Duty-Free) is counteracting these moves by refining its product assortments and bringing in more desirable brands. The company is also pushing its 'duty-free+' strategy. This approach seeks to blend duty-free shopping with cultural attractions, commercial activities, sporting events, and broader tourism offerings.

- Diversification of Product Offerings: Competitors are expanding beyond traditional luxury goods to include local crafts, specialty foods, and unique experiential products.

- Enhanced Digital Engagement: Many rivals are investing in advanced e-commerce platforms and personalized digital marketing to reach consumers more effectively.

- Integration of Tourism Experiences: A key strategy involves creating seamless shopping experiences that are part of a larger travel itinerary, often through partnerships with hotels and tour operators.

- CTG Duty-Free's Response: CTG Duty-Free is optimizing its merchandise mix and brand partnerships, alongside its 'duty-free+' initiative, to create a more holistic and appealing customer journey.

Competitive rivalry in China's duty-free market is intense, with China Tourism Group Duty Free (CTG Duty Free) holding a dominant position but facing aggressive competition. This rivalry is fueled by both domestic and international players expanding their reach and product offerings. For instance, in 2023, CTG Duty Free reported significant revenue growth, yet this success is achieved amidst competitors actively vying for market share through strategic expansions and enhanced customer experiences.

The resurgence of outbound Chinese tourism in 2024 presents a dual challenge: it boosts CTG Duty Free's international operations but also diverts spending from its domestic hubs, like Hainan, to overseas duty-free retailers. This trend intensifies price competition as consumers have more global shopping options. CTG Duty Free actively counters this by refining its product assortments and implementing its 'duty-free+' strategy, which integrates shopping with cultural and tourism activities to create a more compelling customer proposition.

| Competitor Action | CTG Duty Free Response | Market Impact |

|---|---|---|

| Geographic Expansion (New Stores) | Optimizing Store Locations and Formats | Increased accessibility for consumers, higher operational costs for CTG |

| Product Diversification (Beyond Luxury) | Enhancing Brand Partnerships and Merchandise Mix | Broader appeal, potential for higher average transaction value |

| Digital Engagement (E-commerce, Marketing) | Strengthening Online Presence and 'Duty-Free+' Integration | Improved customer reach and loyalty, data-driven insights |

| Pricing and Promotions | Strategic Discounts and Loyalty Programs | Maintaining price competitiveness, impact on profit margins |

SSubstitutes Threaten

The most significant threat to China Tourism Group Duty Free Corporation (CTG Duty Free) comes from direct overseas duty-free shopping. Chinese travelers are increasingly opting to buy luxury items while abroad. This shift is driven by factors like favorable exchange rates and appealing travel policies in international locations, directly challenging CTG's domestic duty-free sales.

This trend has demonstrably affected CTG's performance, especially in key markets like Hainan. For instance, while CTG saw significant growth in previous years, the allure of international shopping destinations presents a persistent headwind. In 2023, outbound Chinese tourism continued its strong recovery, with millions of citizens traveling internationally, many of whom would have previously relied on domestic duty-free options.

Domestic luxury retail, encompassing both physical stores and brand-managed e-commerce sites, presents a significant substitute for China Tourism Group Duty Free. Consumers seeking immediate access to luxury goods or those who do not travel internationally can opt for these domestic channels, diminishing the exclusive appeal of duty-free purchases. For instance, in 2024, the Chinese luxury market continued its robust growth, with domestic consumption accounting for a substantial portion of sales.

Cross-border e-commerce platforms further intensify this threat by offering a vast selection of international luxury brands. These platforms provide consumers with a convenient alternative to traditional duty-free shopping, often with competitive pricing and direct access to global product lines. In 2023, the value of cross-border e-commerce transactions in China reached hundreds of billions of dollars, highlighting its significant market penetration and consumer adoption.

The 'Daigou' market, once a substantial channel for parallel imports, has experienced a notable downturn. This decline is partly due to stricter regulations and increased scrutiny of these unofficial resale operations.

Despite its reduction, the historical presence and continued existence of informal 'Daigou' channels underscore a persistent consumer demand for price advantages. This consumer behavior inherently positions these informal networks as indirect substitutes for official duty-free channels, influencing purchasing decisions.

Tax-Refund Schemes for Inbound Tourists

New tax-refund policies in China, allowing immediate sales tax refunds directly in stores for inbound tourists, present a significant substitute for traditional duty-free shopping. This shift makes general retail purchases more appealing to foreign visitors, potentially diverting spending away from dedicated duty-free zones. For instance, in 2024, China expanded its tax-free shopping program, increasing the number of participating cities and simplifying the refund process, making it easier for tourists to reclaim VAT on eligible purchases across a wider range of retailers.

These enhanced tax-refund schemes effectively lower the overall cost of shopping for inbound tourists, diminishing the price advantage previously held by duty-free outlets. As more retailers can offer immediate tax rebates, the convenience and broader product selection available outside of duty-free zones become more attractive. This competitive pressure can impact the sales volume and revenue of companies heavily reliant on duty-free channels.

- Increased Accessibility: The immediate refund process in regular stores removes the logistical hurdles often associated with claiming duty-free refunds, making it more convenient for tourists.

- Broader Product Range: Tourists can access a wider array of goods and brands in general retail environments compared to the often curated selections in duty-free shops.

- Competitive Pricing: By offering tax refunds on general purchases, these policies create a more price-competitive landscape, directly challenging the traditional price advantage of duty-free shopping.

Changing Consumer Priorities

Shifting consumer priorities represent a significant threat of substitutes for China Tourism Group Duty Free. For instance, a growing preference for experiential travel over material possessions means consumers might allocate their discretionary income towards activities like unique tours or cultural immersion rather than duty-free luxury goods. This trend was highlighted in 2024 surveys indicating a 15% increase in spending on travel experiences compared to the previous year.

Economic uncertainties can also drive consumers towards more budget-conscious choices. Instead of purchasing high-end cosmetics or electronics at duty-free shops, travelers might opt for more affordable alternatives or simply reduce their overall spending on non-essential items. This shift can manifest as a substitution of duty-free purchases with everyday essentials or savings.

- Changing Consumer Priorities: A notable trend observed in 2024 is the increasing consumer emphasis on experiences, potentially diverting spending away from luxury goods.

- Economic Uncertainty Impact: Economic headwinds in 2024 encouraged more budget-conscious spending, leading consumers to substitute duty-free luxury items with more economical options or savings.

- Substitution with Discretionary Spending: Luxury purchases at duty-free outlets face substitution from other forms of discretionary spending, such as travel activities or local artisanal products.

The threat of substitutes for China Tourism Group Duty Free is multifaceted, encompassing direct overseas purchases, domestic retail, cross-border e-commerce, and evolving consumer preferences. Chinese travelers increasingly favor international destinations for luxury shopping due to favorable exchange rates and travel policies. For instance, outbound Chinese tourism saw a robust recovery in 2023, with millions traveling abroad.

Domestic luxury retail and cross-border e-commerce platforms offer convenient alternatives, often with competitive pricing, directly challenging CTG's market share. The Chinese luxury market's domestic consumption continued its strong growth in 2024. Furthermore, new tax-refund policies in China enhance the appeal of general retail for inbound tourists, diminishing the price advantage of duty-free zones. China expanded its tax-free shopping program in 2024, simplifying the refund process.

Shifting consumer priorities, with a growing preference for experiences over material goods, also pose a threat. Surveys in 2024 indicated a 15% increase in spending on travel experiences. Economic uncertainties in 2024 further encouraged budget-conscious choices, leading consumers to substitute duty-free luxury items with more economical options.

| Substitute Channel | Key Driver | Impact on CTG Duty Free | 2023/2024 Data Point |

|---|---|---|---|

| Overseas Duty-Free/Retail | Favorable Exchange Rates, Travel Policies | Diverts domestic duty-free sales | Millions of outbound Chinese tourists in 2023 |

| Domestic Luxury Retail | Convenience, Immediate Access | Reduces reliance on duty-free | Robust growth in Chinese luxury market 2024 |

| Cross-Border E-commerce | Wide Selection, Competitive Pricing | Offers direct global access | Hundreds of billions USD in cross-border e-commerce 2023 |

| Enhanced Tax-Refund Policies | Lower overall cost for tourists | Diminishes duty-free price advantage | Expansion of tax-free shopping program in China 2024 |

| Experiential Travel | Shift in Consumer Priorities | Reduces spending on luxury goods | 15% increase in spending on travel experiences (2024 surveys) |

Entrants Threaten

The duty-free sector, particularly for high-end items, demands significant capital for prime retail spaces, extensive inventory, and robust supply chains. China Tourism Group Duty Free's broad presence across airports, city centers, and cruise ships, complemented by its online channels, highlights the substantial financial outlay and operational intricacy involved, effectively deterring new entrants.

The threat of new entrants into China's duty-free market is significantly low due to stringent government regulations and licensing requirements. Obtaining the necessary permits is a complex and lengthy process, often favoring established, state-backed entities.

For instance, the establishment and operation of duty-free shops are strictly controlled by the Ministry of Commerce and other relevant authorities, with licenses awarded on a selective basis. This regulatory environment creates a substantial barrier, making it exceedingly difficult for new, independent players to enter and compete.

The government's strategic development of areas like the Hainan Free Trade Port further solidifies this, with policies designed to support and expand existing, approved operators rather than encourage broad new market entry. This strong government backing and regulatory framework effectively deters potential new competitors.

New entrants would face significant challenges in establishing strong relationships with global luxury brand suppliers. CTG Duty-Free benefits from long-term, entrenched partnerships with major luxury brands, which are crucial for securing desirable product portfolios and competitive pricing. For instance, in 2023, CTG Duty-Free continued to expand its exclusive brand offerings, a testament to its deep supplier ties.

Economies of Scale and Distribution Network

China Tourism Group Duty Free (CTG Duty Free) benefits immensely from significant economies of scale, a direct result of its extensive network and substantial sales volumes. This scale translates into more efficient procurement, streamlined logistics, and cost-effective marketing efforts, giving it a strong competitive edge.

A new entrant would face considerable challenges in matching CTG Duty Free's cost efficiencies. Without a comparable scale of operations and an already established distribution network that spans various retail channels, new players would struggle to achieve similar price points and market penetration.

- Economies of Scale: CTG Duty Free's large operational footprint allows for bulk purchasing and optimized inventory management, driving down per-unit costs.

- Distribution Network: The company's established presence across numerous locations, including airports and popular tourist destinations, provides a significant barrier to entry for newcomers.

- Procurement Power: With high sales volumes, CTG Duty Free can negotiate favorable terms with suppliers, further enhancing its cost advantage.

- Market Access: New entrants would need substantial investment to build a comparable distribution system and secure prime retail locations, which are often controlled by existing players.

Brand Loyalty and First-Mover Advantage

China Tourism Group Duty Free (CTG Duty-Free) benefits significantly from its established brand loyalty, a direct result of its long-standing presence and early entry into key Chinese duty-free markets. This deep-rooted customer trust and recognition act as a considerable hurdle for any potential new competitors. New entrants would face the daunting task of matching CTG's brand equity, requiring substantial investment in marketing and unique value propositions to even begin chipping away at its market share.

The company's first-mover advantage has allowed it to secure prime locations and build extensive operational experience, further solidifying its market position. For instance, CTG Duty-Free reported revenue of ¥65.8 billion in 2023, demonstrating its significant market penetration. Newcomers would need to overcome not only brand perception but also the logistical and operational efficiencies CTG has honed over time.

- Established Brand Loyalty: CTG Duty-Free has cultivated a strong connection with Chinese travelers, making it difficult for new brands to gain traction.

- First-Mover Advantage: Early entry into key markets has provided CTG with a significant head start in building infrastructure and customer relationships.

- High Marketing Investment Required: New entrants must commit substantial resources to marketing and differentiation to compete effectively.

- Operational Experience: CTG's years of experience translate into efficient operations and supply chain management, a barrier for less experienced competitors.

The threat of new entrants in China's duty-free sector is remarkably low, primarily due to substantial capital requirements for prime retail locations and inventory. CTG Duty Free's extensive network across airports, city centers, and cruise ships, alongside its online presence, represents a significant financial and operational hurdle for newcomers.

Strict government regulations and licensing processes, managed by authorities like the Ministry of Commerce, further deter new players. These requirements favor established, state-backed entities, making market entry a complex and lengthy endeavor. For instance, the development of the Hainan Free Trade Port is geared towards expanding existing operators, not broad new market entry.

New entrants would also struggle to replicate CTG Duty Free's established supplier relationships, particularly with global luxury brands, which are vital for securing desirable product portfolios and competitive pricing. CTG's deep supplier ties, evident in its continued expansion of exclusive brand offerings in 2023, create a significant barrier.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Prime retail space, extensive inventory, robust supply chains | High barrier due to significant investment needed |

| Government Regulations | Strict licensing and permits, favoring established players | Complex and lengthy entry process, limiting new competition |

| Supplier Relationships | Exclusive partnerships with luxury brands | Difficulty in securing competitive product portfolios and pricing |

| Economies of Scale | Bulk purchasing, optimized logistics, cost-effective marketing | Challenges in matching CTG's cost efficiencies and price points |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for China Tourism Group Duty Free is built upon a foundation of comprehensive data, including the company's official annual reports, investor presentations, and filings with regulatory bodies like the Shanghai Stock Exchange. We also incorporate insights from reputable industry research firms and macroeconomic data to capture the broader market landscape.