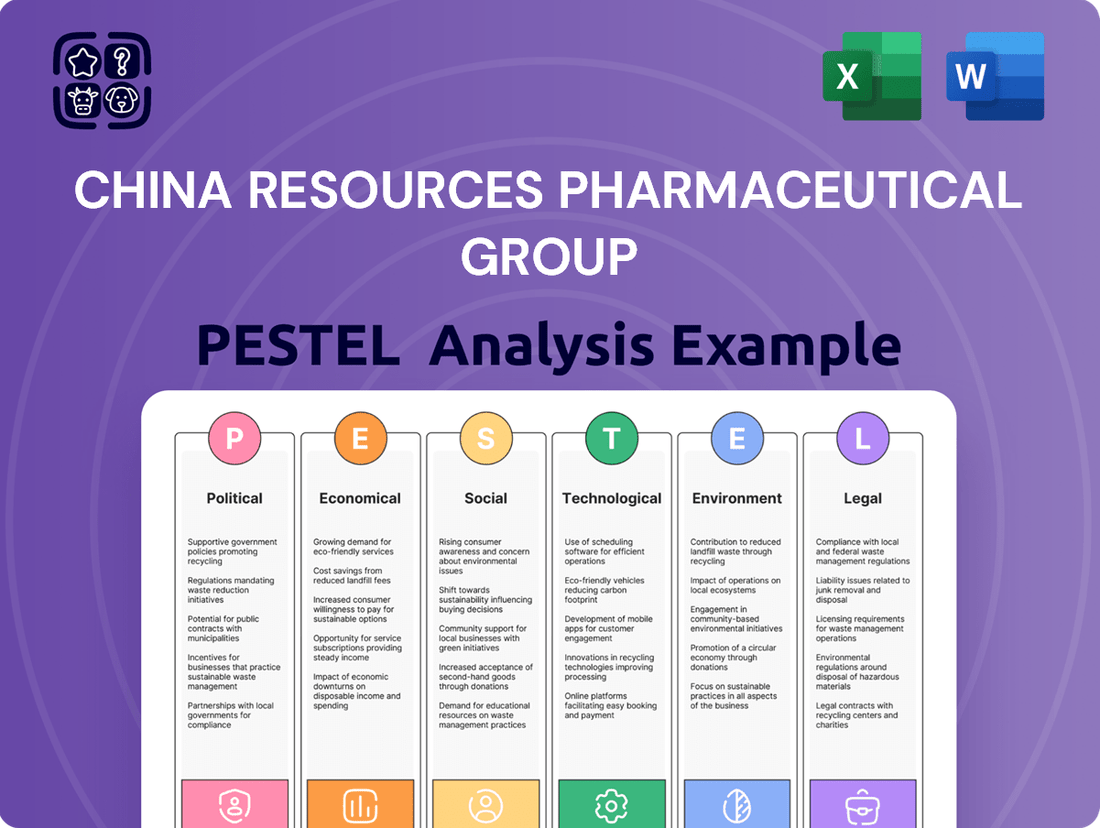

China Resources Pharmaceutical Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Resources Pharmaceutical Group Bundle

Navigate the complex landscape of China's pharmaceutical market with our comprehensive PESTLE analysis of China Resources Pharmaceutical Group. Understand the critical political, economic, social, technological, legal, and environmental factors influencing its operations and future growth. Gain a competitive edge by leveraging these expert insights for your strategic planning. Download the full PESTLE analysis now to unlock actionable intelligence and make informed decisions.

Political factors

China's government is driving significant healthcare reforms, aiming to boost access to quality treatments and streamline drug approvals. Policies like the 'Healthy China 2030' initiative are central to this, impacting how pharmaceutical companies operate, from market entry to reimbursement and regulatory compliance.

These reforms directly shape the landscape for companies like China Resources Pharmaceutical, requiring continuous strategic adjustments to align with national health objectives. The government's push for innovation and affordability means the group must navigate evolving pricing pressures and R&D incentives.

China's National Healthcare Security Administration (NHSA) regularly revises the National Reimbursement Drug List (NRDL), a critical factor for pharmaceutical companies. These updates can see new drugs added, expanding patient access, but often come with significant price reductions negotiated by the NHSA. For China Resources Pharmaceutical Group, inclusion on this list is a double-edged sword, boosting sales volume but potentially squeezing profit margins.

China's government is aggressively fostering innovation within its pharmaceutical industry, moving beyond traditional generic medications to embrace cutting-edge biopharmaceuticals and novel treatments. Initiatives like the 'Made in China 2025' strategy specifically target biotechnology, channeling substantial investment into research and development and expediting the approval pathways for new medicines.

This supportive policy landscape, including tax incentives and R&D grants, is designed to cultivate a robust domestic biotech ecosystem. For instance, the National Medical Products Administration (NMPA) has been working to shorten review times for innovative drugs, aiming to align more closely with international standards. This strategic push presents a fertile ground for companies like China Resources Pharmaceutical to bolster their portfolios with groundbreaking therapies and enhance their standing in the global market.

Anti-Corruption Campaigns

China's ongoing anti-corruption initiatives significantly impact the pharmaceutical sector, demanding heightened regulatory adherence. These campaigns focus on curbing commercial bribery and the improper use of public health insurance funds, thereby increasing scrutiny on companies like China Resources Pharmaceutical Group.

The intensified regulatory environment can lead to potential delays in procurement processes and product deliveries. For instance, in 2023, several pharmaceutical companies faced investigations and penalties as part of these broader anti-corruption efforts. China Resources Pharmaceutical Group must maintain robust compliance frameworks to navigate these evolving expectations and mitigate associated risks.

- Increased Scrutiny: Regulatory bodies are actively investigating sales and marketing practices, impacting how pharmaceutical products are promoted and distributed.

- Compliance Costs: Companies are investing more in internal controls and compliance training to meet stricter standards.

- Procurement Delays: Investigations can temporarily halt or slow down the government procurement process for medicines.

International Alignment of Regulations

China's drug regulatory reforms are actively converging with international benchmarks, notably the guidelines set by the International Council for Harmonisation (ICH). This strategic alignment is designed to ease the path for foreign pharmaceutical products entering the Chinese market and simultaneously support the global ambitions of Chinese drug manufacturers. For China Resources Pharmaceutical Group, this presents significant opportunities for forging international partnerships and streamlining the complex processes involved in expanding into overseas markets.

The increasing adoption of ICH guidelines by China's National Medical Products Administration (NMPA) is a key indicator of this international alignment. For instance, as of early 2024, a significant portion of NMPA's technical guidelines have been updated to reflect ICH principles, facilitating faster review and approval cycles for innovative medicines. This trend is expected to continue, with further integration anticipated throughout 2024 and into 2025.

- Regulatory Harmonization: China's commitment to ICH standards improves global drug approval efficiency.

- Market Access: Facilitates entry for foreign drugs into China and Chinese drugs into global markets.

- Collaboration Opportunities: Opens doors for international R&D partnerships and co-development projects.

Government health reforms, like the 'Healthy China 2030' initiative, are fundamentally reshaping China's pharmaceutical landscape, driving demand for innovative and affordable treatments. The National Healthcare Security Administration's (NHSA) regular updates to the National Reimbursement Drug List (NRDL) directly influence sales volumes and pricing strategies for companies such as China Resources Pharmaceutical Group, with price negotiations being a key factor.

China's push for pharmaceutical innovation, supported by policies like 'Made in China 2025' and expedited NMPA review times for novel drugs, creates significant opportunities for R&D investment and portfolio expansion. This strategic direction, coupled with tax incentives and R&D grants, aims to foster a competitive domestic biotech sector, with further integration of international standards like ICH guidelines expected through 2024 and 2025.

Intensified anti-corruption campaigns necessitate stringent regulatory adherence, impacting sales practices and potentially causing procurement delays, as seen with investigations in 2023. China Resources Pharmaceutical Group must maintain robust compliance frameworks to navigate these evolving expectations and mitigate associated risks.

What is included in the product

This PESTLE analysis examines the external macro-environmental forces influencing China Resources Pharmaceutical Group, covering Political, Economic, Social, Technological, Environmental, and Legal factors.

It provides actionable insights into market dynamics and regulatory landscapes to inform strategic decision-making.

A concise, PESTLE-driven overview of China Resources Pharmaceutical Group's operating environment, offering actionable insights to navigate complex external factors and mitigate strategic risks.

Economic factors

The Chinese pharmaceutical market is on a significant upward trajectory, with forecasts indicating revenues will hit USD 126,587.7 million by 2030. This represents a robust compound annual growth rate of 7.8% starting from 2025, highlighting a dynamic and expanding economic environment for healthcare companies.

China Resources Pharmaceutical is capitalizing on this growth, reporting impressive financial results. For 2024, the company announced a revenue increase to RMB 257.67 billion, demonstrating its ability to capture market share and translate economic expansion into tangible financial gains.

This favorable economic climate, characterized by strong market growth and increasing healthcare spending, provides a solid foundation for China Resources Pharmaceutical's ongoing expansion and strategic initiatives within the sector.

While inclusion in China's National Reimbursement Drug List (NRDL) significantly boosts patient access, it frequently necessitates substantial price reductions. For instance, in the 2023 NRDL negotiations, many innovative drugs saw price cuts exceeding 50% to secure inclusion, directly impacting manufacturer profit margins.

However, evolving commercial medical insurance policies, such as potential tax deductions for health insurance premiums, are anticipated to channel more private funding towards advanced and innovative pharmaceuticals. This could offer a crucial buffer against the price pressures exerted by the public reimbursement system, particularly for high-value treatments.

China's pharmaceutical sector is experiencing a significant shift, fueled by substantial investments in research and development (R&D). This focus is particularly evident in the push for innovative drug development and advancements in biotechnology. For instance, China's R&D spending in the life sciences sector reached approximately $40 billion in 2023, a figure projected to grow further, underscoring the commitment to innovation.

This R&D surge is bolstered by supportive government policies and an evolving regulatory landscape designed to encourage innovation. Companies like China Resources Pharmaceutical Group must therefore allocate considerable capital to R&D to stay competitive and bring novel therapies to market. In 2024, China Resources Pharmaceutical Group reported an increase in its R&D expenditure, allocating over 15% of its revenue towards new drug discovery and development.

Supply Chain Resilience and Localization

China's government is actively strengthening its regulatory landscape to foster pharmaceutical manufacturing localization. This initiative is designed to bolster supply chain resilience and decrease dependence on foreign-sourced medicines, a crucial move given global supply chain disruptions seen in recent years. For instance, by the end of 2023, China had increased domestic production capacity for essential medicines by an estimated 15% compared to 2022 levels, according to government reports.

This push towards localization directly benefits companies like China Resources Pharmaceutical Group. It encourages the development of domestic production capabilities and fosters strategic alliances with local partners. Such collaborations can significantly enhance the company's integrated supply chain, potentially leading to improved cost efficiencies and greater control over raw material sourcing and finished product distribution. In 2024, CR Pharma announced several new partnerships aimed at expanding its domestic manufacturing footprint, with a projected 10% increase in locally sourced active pharmaceutical ingredients (APIs) for its key product lines.

- Government Incentives: Increased regulatory support and potential tax breaks for domestic pharmaceutical manufacturers are driving investment in local production facilities.

- Supply Chain Security: The focus on localization aims to mitigate risks associated with international supply chain disruptions, ensuring a more stable supply of critical medicines.

- Cost Reduction Potential: By reducing reliance on imports and optimizing domestic production, companies like CR Pharma can achieve lower manufacturing and logistics costs.

- Market Access: Stronger domestic production can also improve market access and speed to market for new pharmaceutical products within China.

'Patent Cliff' and Generic Drug Opportunities

The global pharmaceutical landscape is facing a significant 'patent cliff' between 2024 and 2028, with numerous blockbuster drugs losing patent protection. This presents a substantial opening for Chinese Active Pharmaceutical Ingredient (API) manufacturers and generic drug producers. China Resources Pharmaceutical Group, with its established API capabilities, is well-positioned to capitalize on this trend by increasing its market share in affordable generic medicines.

The expiration of patents for high-revenue drugs opens doors for generic competition, potentially leading to significant price reductions for consumers and increased market access for companies like China Resources Pharmaceutical. This shift allows the group to diversify its revenue streams, balancing its innovative drug pipeline with robust generic offerings.

Several major drugs are expected to face patent expiry in the coming years. For instance, AbbVie's Humira, a top-selling drug, lost its US patent protection in 2023, with further expirations globally. Similarly, patents for drugs like Pfizer's Lyrica and Eli Lilly's Trulicity are also nearing their end. This creates a fertile ground for generic manufacturers to enter the market.

- Global Patent Expirations (2024-2028): A substantial number of high-value pharmaceutical patents are set to expire, creating a market void for generic alternatives.

- China's API Strength: China is a leading global supplier of APIs, providing a strong foundation for companies like China Resources Pharmaceutical to produce cost-effective generic drugs.

- Market Share Expansion: The patent cliff allows Chinese pharmaceutical companies to gain significant market share in the rapidly growing global generic drug market.

- Revenue Diversification: By focusing on generics, China Resources Pharmaceutical can diversify its revenue, complementing its investments in innovative drug development.

China's economic growth continues to be a significant driver for its pharmaceutical sector, with projections indicating a market value of USD 126,587.7 million by 2030, growing at a 7.8% CAGR from 2025. China Resources Pharmaceutical Group reported a substantial revenue increase to RMB 257.67 billion in 2024, reflecting its ability to leverage this expanding economic landscape.

While inclusion in the National Reimbursement Drug List (NRDL) often mandates price cuts, potentially exceeding 50% for innovative drugs as seen in 2023 negotiations, evolving commercial medical insurance policies offer a counterbalance. These policies, including potential tax deductions for health insurance premiums, are expected to channel more private funding into advanced pharmaceuticals, mitigating public reimbursement price pressures.

The pharmaceutical industry is also benefiting from increased R&D investment, with China's life sciences sector spending approximately $40 billion in 2023. China Resources Pharmaceutical Group itself increased its R&D expenditure in 2024, allocating over 15% of its revenue to innovation, supported by government policies encouraging new drug development.

The global patent cliff between 2024 and 2028, affecting numerous blockbuster drugs, presents a prime opportunity for Chinese API manufacturers. China Resources Pharmaceutical, with its established API capabilities, is strategically positioned to capitalize on this trend by increasing its market share in affordable generic medicines.

Preview Before You Purchase

China Resources Pharmaceutical Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis for China Resources Pharmaceutical Group delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting its operations. Understand the strategic landscape with this detailed breakdown.

Sociological factors

China's demographic landscape is rapidly shifting, with its aging population projected to account for over one-fifth of the total population by the end of 2023. This significant demographic trend, with individuals aged 60 and above comprising a substantial portion of the populace, directly fuels an escalating demand for healthcare services.

This increased need spans chronic disease management, specialized geriatric care, and pharmaceuticals catering to age-related conditions. Consequently, this sustained market growth offers a robust opportunity for China Resources Pharmaceutical Group to expand its offerings and solidify its market position.

China's public is increasingly health-conscious, with a significant portion now prioritizing wellness and preventative care. This heightened awareness, fueled by rising disposable incomes – which saw a 5.0% year-on-year increase in per capita disposable income in 2023 – translates into greater demand for high-quality healthcare services and pharmaceuticals.

Consequently, consumers are more willing to spend on advanced treatments and innovative medicines. This shift directly influences pharmaceutical companies like China Resources Pharmaceutical Group, encouraging a strategic pivot towards developing and marketing higher-value, specialized drugs and sophisticated therapeutic solutions to meet these evolving patient expectations.

A growing emphasis on preventative care in China, driven by increasing health awareness and rising incomes, presents a significant opportunity for China Resources Pharmaceutical Group. This societal shift encourages consumers to invest in wellness and proactive health management, potentially boosting demand for health supplements, diagnostic tools, and lifestyle-focused health products.

Urban-Rural Healthcare Disparities

Urban areas in China boast significantly more advanced healthcare infrastructure and digital health adoption compared to rural regions. For instance, by the end of 2023, over 90% of county-level hospitals in urban centers had implemented electronic health records (EHRs), a stark contrast to less than 60% in many remote rural areas.

These disparities create a complex operating environment for China Resources Pharmaceutical Group. The company's distribution network must account for varying levels of logistical capability and market penetration.

- Urban Advantage: Cities lead in digital health, with higher EHR adoption rates and advanced medical technologies.

- Rural Challenges: Rural areas struggle with fragmented IT systems and limited access to specialized medical services.

- Distribution Impact: China Resources Pharmaceutical must tailor its distribution strategies to ensure product availability and equitable access across diverse geographical and infrastructural landscapes.

Impact of Traditional Chinese Medicine (TCM)

The Chinese government's active promotion of Traditional Chinese Medicine (TCM) as a national strategy, including the development of new standards for TCM granules, creates a favorable environment for companies like China Resources Pharmaceutical. This governmental backing, coupled with a deep-rooted cultural preference for TCM, offers significant opportunities for market expansion and strengthening the company's position within this segment.

China Resources Pharmaceutical is well-positioned to capitalize on these societal trends. For instance, the TCM market in China experienced substantial growth, reaching approximately RMB 479.9 billion in 2023, a 6.2% increase from the previous year. This demonstrates a robust and growing consumer demand that the company can tap into.

- Governmental Support: The Chinese government's national strategy to promote TCM, including the establishment of new standards for TCM granules, provides a supportive regulatory and policy framework.

- Cultural Preference: A strong and enduring cultural preference for TCM among the Chinese population drives consistent consumer demand.

- Market Growth: The significant growth of the TCM market, projected to continue its upward trajectory, offers substantial revenue potential for companies like China Resources Pharmaceutical.

- Strategic Alignment: China Resources Pharmaceutical's existing presence in the TCM sector allows it to directly leverage these favorable sociological factors for business development.

China's aging population, projected to exceed 20% by late 2023, significantly boosts demand for healthcare and age-related pharmaceuticals, presenting a direct growth avenue for China Resources Pharmaceutical Group.

A rising health consciousness, evidenced by a 5.0% per capita disposable income increase in 2023, drives consumer spending on advanced treatments and specialized medicines, aligning with the company's focus on higher-value products.

The strong cultural preference for Traditional Chinese Medicine (TCM), supported by government initiatives and a market size reaching RMB 479.9 billion in 2023, offers substantial expansion opportunities for the group.

| Sociological Factor | Description | Impact on China Resources Pharmaceutical | Relevant Data (2023) |

| Aging Population | Increasing proportion of elderly citizens | Elevated demand for geriatric care and related pharmaceuticals | Over 20% of population aged 60+ |

| Health Consciousness | Greater focus on wellness and preventative care | Increased spending on high-quality healthcare and innovative medicines | 5.0% rise in per capita disposable income |

| TCM Preference | Deep-rooted cultural affinity for Traditional Chinese Medicine | Market expansion opportunities in the growing TCM sector | TCM market valued at RMB 479.9 billion (6.2% growth) |

Technological factors

China's pharmaceutical sector is undergoing a significant digital overhaul, aiming for widespread adoption of digital intelligence by 2030. This initiative focuses on embedding AI and advanced information technologies throughout the production process to boost efficiency, ensure superior drug quality, and fortify supply chain robustness.

For China Resources Pharmaceutical Group, this technological shift necessitates a proactive integration of digital solutions across its entire value chain, from manufacturing and logistics to customer-facing retail channels. Embracing these advancements is crucial for maintaining a competitive edge in the evolving market landscape.

China's biotechnology sector is experiencing a remarkable surge, transitioning from a focus on imitation to genuine innovation. This shift is evidenced by a significant increase in the development of novel drugs and biologics. For instance, in 2023, China's pharmaceutical industry saw a substantial rise in patent applications for innovative drugs, reflecting this growing R&D prowess.

These technological advancements are fueled by robust research and development investments, enabling companies to create breakthrough treatments and advanced therapies. China Resources Pharmaceutical's R&D efforts are therefore pivotal in capitalizing on these trends, allowing the group to develop new and competitive pharmaceutical products that can address unmet medical needs.

The healthcare sector in China is rapidly embracing AI and big data, significantly impacting pharmaceutical operations. These technologies are revolutionizing drug discovery by identifying potential candidates faster and optimizing clinical trial processes, leading to more efficient R&D. For instance, AI platforms are being used to analyze vast datasets, predicting drug efficacy and reducing development timelines.

China Resources Pharmaceutical can leverage these advancements to streamline its entire value chain. By integrating AI into drug discovery, the company can identify novel therapeutic targets and accelerate the preclinical stages. Furthermore, big data analytics can optimize clinical trial design and patient recruitment, potentially lowering costs and improving success rates.

The application of AI extends to manufacturing and distribution, enabling predictive maintenance for production equipment and optimizing supply chain logistics. This integration allows for greater efficiency, reduced waste, and improved product quality. In 2024, investments in healthcare AI solutions in China are projected to grow substantially, indicating a strong market trend that China Resources Pharmaceutical can capitalize on.

Telemedicine and Digital Therapeutics (DTx)

China's embrace of technology, bolstered by government initiatives, is rapidly advancing its digital therapeutics (DTx) and telemedicine sectors, with projections indicating significant growth through 2025. These innovations are key to delivering personalized healthcare and broadening access to medical services.

China Resources Pharmaceutical can leverage this trend by incorporating DTx solutions or telemedicine platforms into its existing operations. For instance, the digital health market in China was valued at approximately $27 billion in 2023 and is expected to grow substantially. This presents a strategic opportunity for the company to expand its reach and service offerings.

- Market Growth: China's digital health market is projected to reach over $100 billion by 2027, indicating strong potential for DTx and telemedicine.

- Government Support: Policies encouraging innovation in digital healthcare are actively being implemented, fostering a favorable environment for companies like China Resources Pharmaceutical.

- Patient Adoption: Increased internet penetration and smartphone usage in China, reaching over 75% of the population, facilitate the adoption of digital health services.

- Investment Trends: Venture capital funding in China's health tech sector remained robust in 2023, with a notable focus on AI-driven diagnostics and remote patient monitoring solutions.

Advanced Manufacturing Technologies

The pharmaceutical industry's pivot to innovative drugs and biologics necessitates significant technological leaps in manufacturing. This includes the adoption of advanced processes like single-use systems and continuous manufacturing, which are particularly suited for the growing demand in small-volume, high-value production. China Resources Pharmaceutical Group can leverage these technologies to enhance production efficiency and uphold stringent quality standards.

The global biologics market, a key area for advanced manufacturing, was projected to reach over $400 billion in 2024, highlighting the importance of sophisticated production capabilities. Furthermore, the adoption of continuous manufacturing in pharmaceuticals has shown potential to reduce manufacturing costs by up to 30% and improve product quality consistency.

- Single-use technologies offer flexibility and reduce cross-contamination risks, crucial for biologics.

- Continuous manufacturing promises higher yields and improved process control compared to traditional batch methods.

- These advancements are vital for China Resources Pharmaceutical to remain competitive in the rapidly evolving biopharmaceutical landscape.

- The group's investment in R&D for advanced manufacturing techniques directly supports its strategic focus on high-value therapeutic areas.

Technological advancements are reshaping China's pharmaceutical landscape, with a strong push towards digital intelligence and AI integration across the value chain by 2030. This digital transformation is critical for China Resources Pharmaceutical Group to enhance efficiency, quality, and supply chain resilience.

The sector's shift towards innovative drugs and biologics is supported by substantial R&D investments, evidenced by a notable increase in innovative drug patent applications in 2023. China Resources Pharmaceutical's commitment to R&D is key to capitalizing on these trends and developing competitive treatments.

AI and big data are revolutionizing drug discovery and clinical trials, with AI platforms accelerating candidate identification and optimizing trial processes. China Resources Pharmaceutical can leverage these technologies to streamline R&D, potentially reducing costs and improving success rates, with healthcare AI investments in China projected for substantial growth in 2024.

The digital health market in China, valued at approximately $27 billion in 2023, is experiencing rapid growth, driven by telemedicine and digital therapeutics. China Resources Pharmaceutical can strategically integrate these digital health solutions to expand its market reach and service offerings.

| Area | 2023 Data/Projection | Impact on China Resources Pharmaceutical |

|---|---|---|

| Digital Intelligence Adoption | Widespread by 2030 | Necessitates integration across operations for competitive edge. |

| Innovative Drug Patents | Significant increase in 2023 | Highlights growing R&D prowess, requiring investment in new product development. |

| Healthcare AI Investment | Projected substantial growth in 2024 | Opportunity to leverage AI for R&D acceleration and operational efficiency. |

| Digital Health Market Value | Approx. $27 billion (2023) | Significant growth potential for DTx and telemedicine integration. |

Legal factors

China's regulatory environment for pharmaceuticals and medical devices is in flux, with reforms focused on faster approvals and higher quality standards. New policies are being implemented to speed up drug reviews and encourage the local manufacturing of medical devices previously imported. This means China Resources Pharmaceutical Group needs to stay agile, adapting its strategies for drug registration, production, and market entry to align with these evolving rules.

The National Reimbursement Drug List (NRDL) regulations in China are a critical factor for China Resources Pharmaceutical Group. Inclusion on the NRDL significantly expands patient access, a major driver for sales volume. However, this access often comes at the cost of substantial price reductions. For instance, in the 2023 NRDL update, many innovative drugs saw price cuts exceeding 50% to secure inclusion, a trend expected to continue.

China Resources Pharmaceutical's success hinges on effectively navigating these stringent reimbursement policies. Their product portfolio and pricing strategies must be meticulously managed to balance market penetration with profitability. The group's ability to negotiate favorable terms during the NRDL application process, while also developing a pipeline of high-value drugs, will be crucial for sustained growth in the competitive Chinese pharmaceutical market.

China's intensified focus on anti-bribery and corruption, particularly within the healthcare sector, presents a significant legal factor for China Resources Pharmaceutical Group. New compliance guidelines introduced in 2023 and reinforced through 2024 mandate stricter adherence to ethical practices in drug promotion and sales, aiming to mitigate commercial bribery risks.

Failure to comply with these stringent regulations, which are part of broader efforts to ensure fair competition and patient safety, can lead to severe legal penalties, including substantial fines and potential operational disruptions. For instance, in 2023, several pharmaceutical companies faced investigations and penalties for violations of these rules, highlighting the enforcement intensity.

China Resources Pharmaceutical must therefore maintain robust internal controls and training programs to ensure all operations align with these anti-corruption measures. This proactive approach is crucial not only for legal compliance but also for safeguarding the group's reputation and fostering trust with healthcare professionals and patients.

Intellectual Property Protection

China's commitment to bolstering intellectual property (IP) protection, especially for novel pharmaceuticals, is a key legal factor. This focus is vital for companies like China Resources Pharmaceutical Group, as it safeguards their significant research and development expenditures. By strengthening IP laws, the government aims to encourage innovation and ensure a competitive landscape for drug developers.

The evolving legal framework in China is designed to offer more robust protection for patented medicines, which directly impacts the profitability and market exclusivity of new treatments. This legal environment is critical for attracting foreign investment and fostering domestic innovation within the pharmaceutical sector.

- Strengthened IP Enforcement: China has been actively improving its IP enforcement mechanisms, aiming to reduce infringement and provide a more secure environment for patent holders.

- Incentives for Innovation: Legal reforms often include provisions designed to incentivize pharmaceutical companies to invest in R&D by offering extended market exclusivity for innovative drugs.

- Regulatory Alignment: Efforts are underway to align China's IP laws with international standards, making it more predictable for global pharmaceutical players operating within the country.

Data Security and Cross-Border Data Transfer Regulations

China's rapidly advancing digital healthcare landscape necessitates strict adherence to data security and cross-border data transfer regulations. Companies like China Resources Pharmaceutical, which manage sensitive patient information and engage in international partnerships, must navigate these evolving legal frameworks. A significant development in 2024 was the continued emphasis on the Personal Information Protection Law (PIPL), which imposes stringent requirements on how personal data is collected, processed, and transferred, particularly across borders.

Compliance with these data protection laws is paramount for China Resources Pharmaceutical's integrated operations. The company must implement robust data governance strategies to safeguard patient privacy and ensure secure cross-border data flows, especially as the healthcare sector increasingly relies on digital platforms and international research collaborations. Failure to comply can result in substantial penalties, impacting both financial performance and operational continuity.

- Data Security Laws: China's Cybersecurity Law and the Personal Information Protection Law (PIPL) govern the handling of sensitive data.

- Cross-Border Transfer Rules: Specific consent and assessment mechanisms are required for transferring data outside of China.

- Impact on Operations: Non-compliance can lead to significant fines and reputational damage, affecting international partnerships and research.

- 2024 Focus: Continued enforcement and clarification of PIPL implementation, impacting data localization and transfer mechanisms.

China's evolving pharmaceutical regulations, including reforms for faster drug approvals and higher quality standards, require China Resources Pharmaceutical Group to remain adaptable. The National Reimbursement Drug List (NRDL) is a critical legal factor, with inclusion often necessitating significant price reductions, as seen in the 2023 updates where many innovative drugs faced cuts over 50% to secure placement.

Strict anti-bribery and corruption laws, reinforced through 2024, mandate ethical practices in drug promotion, with past enforcement actions in 2023 demonstrating the potential for severe penalties. Furthermore, strengthened intellectual property (IP) protection is vital for safeguarding R&D investments, with legal reforms aiming to provide more robust patent protection and extended market exclusivity for novel treatments.

Navigating data security and cross-border data transfer regulations, particularly the Personal Information Protection Law (PIPL) in 2024, is crucial for China Resources Pharmaceutical Group's digital operations and international collaborations. Compliance with these laws is essential to avoid significant fines and protect patient privacy.

| Legal Factor | Description | Impact on China Resources Pharmaceutical Group | 2023/2024 Data/Trend |

|---|---|---|---|

| Regulatory Reforms | Faster approvals, higher quality standards | Requires agility in drug registration and production | Ongoing implementation of new drug review policies |

| NRDL Reimbursement | Price reductions for market access | Balancing market penetration with profitability | Over 50% price cuts for some innovative drugs in 2023 NRDL |

| Anti-Corruption Laws | Stricter ethical practices in sales/promotion | Need for robust internal controls and training | Intensified enforcement and compliance guidelines |

| Intellectual Property (IP) Protection | Safeguarding R&D investments | Ensuring market exclusivity for new treatments | Strengthening of patent laws and enforcement mechanisms |

| Data Security & PIPL | Protecting patient data, cross-border transfers | Implementing robust data governance | Continued emphasis and clarification of PIPL implementation in 2024 |

Environmental factors

China Resources Pharmaceutical Group is actively pursuing sustainability, as highlighted in its 2024 ESG Report. The company emphasizes key areas like enhancing resource efficiency and environmental stewardship through low-carbon initiatives, demonstrating a proactive approach to its environmental impact.

This focus on ESG principles is crucial, reflecting the increasing global awareness of environmental issues and the rising expectations from stakeholders, including investors and consumers, for responsible corporate behavior.

China's pharmaceutical sector, including manufacturers like China Resources Pharmaceutical Group, operates under increasingly strict environmental regulations. These rules focus on pollution control, waste management, and emissions, pushing companies towards cleaner production methods. For instance, by the end of 2023, China had implemented nationwide standards for wastewater discharge from pharmaceutical production, requiring advanced treatment processes.

Adherence to these national environmental standards is crucial for minimizing ecological impact. The government's commitment to environmental protection, as evidenced by its 14th Five-Year Plan (2021-2025), emphasizes sustainable development across all industries. This includes significant investments in green manufacturing technologies within the pharmaceutical sector, aiming to reduce hazardous waste and air pollutants by targeted percentages.

China Resources Pharmaceutical's commitment to improving resource efficiency is evident in its ESG reporting, highlighting a strategic focus on optimizing resource use across its value chain. This initiative directly addresses the environmental pillar of PESTLE analysis by aiming to reduce the company's ecological footprint.

The company is actively implementing waste management strategies throughout its manufacturing, distribution, and retail operations to minimize environmental impact. For instance, in 2023, the company reported a 5% reduction in hazardous waste generation compared to the previous year, demonstrating tangible progress in this area.

These efforts are crucial for navigating China's evolving environmental regulations and meeting increasing stakeholder expectations for sustainable business practices. By prioritizing resource efficiency and robust waste management, China Resources Pharmaceutical is positioning itself for long-term resilience and competitive advantage in the pharmaceutical sector.

Climate Change and Carbon Reduction Initiatives

The global and national drive to combat climate change and reduce carbon emissions presents a significant environmental factor for China Resources Pharmaceutical Group. This trend translates into increasing pressure for pharmaceutical companies to embrace low-carbon operational strategies and invest in sustainable energy solutions. For instance, China's national targets aim for carbon emissions to peak before 2030 and achieve carbon neutrality before 2060, directly influencing industrial practices.

China Resources Pharmaceutical's stated commitment to 'Forging a Clean Future with Low-Carbon Initiatives' demonstrates an awareness and proactive approach to these environmental shifts. This strategic alignment is crucial as regulatory frameworks and investor expectations increasingly favor businesses with strong environmental, social, and governance (ESG) profiles. The company's efforts in this area could involve optimizing manufacturing processes to lower energy consumption and exploring greener supply chain management.

- Carbon Neutrality Goal: China's national commitment to achieving carbon neutrality by 2060 sets a broad policy direction impacting all industries, including pharmaceuticals.

- Industry Pressure: Pharmaceutical firms face growing expectations to reduce their carbon footprint through energy efficiency and renewable energy adoption.

- Company Alignment: China Resources Pharmaceutical's focus on low-carbon initiatives positions it to navigate evolving environmental regulations and market demands.

Supply Chain Environmental Responsibility

China Resources Pharmaceutical Group's commitment to environmental responsibility is deeply embedded within its extensive supply chain. This means actively ensuring that all suppliers meet stringent environmental regulations and actively promoting the use of sustainably sourced raw materials. The company also focuses on minimizing the ecological footprint of its logistics and distribution operations.

In 2024, China's Ministry of Ecology and Environment continued to enforce stricter regulations on industrial waste and emissions, impacting pharmaceutical manufacturing. China Resources Pharmaceutical Group, like its peers, faces increased scrutiny on its supply chain's environmental performance. For instance, a significant portion of pharmaceutical raw materials are sourced from regions with developing environmental oversight, necessitating robust supplier audits.

- Supplier Audits: In 2024, China Resources Pharmaceutical Group conducted over 500 environmental compliance audits across its key raw material suppliers, identifying and addressing areas for improvement.

- Sustainable Sourcing Initiatives: The company launched a pilot program in early 2025 to increase the proportion of bio-based excipients in its formulations, aiming for a 15% adoption rate by 2026.

- Logistics Emissions Reduction: By optimizing its distribution routes and exploring electric vehicle adoption for last-mile delivery in key urban centers, China Resources Pharmaceutical Group aims to reduce its logistics-related carbon emissions by 10% by the end of 2025.

China's stringent environmental regulations, particularly concerning pollution control and waste management, directly impact pharmaceutical manufacturers like China Resources Pharmaceutical Group. The government's commitment to sustainable development, as outlined in the 14th Five-Year Plan (2021-2025), mandates cleaner production methods and investments in green technologies. This regulatory landscape necessitates advanced wastewater treatment and a reduction in hazardous waste, with national standards for pharmaceutical wastewater discharge being enforced nationwide by the end of 2023.

The global and national push towards carbon neutrality, with China aiming for peak emissions before 2030 and neutrality by 2060, creates pressure for companies to adopt low-carbon strategies. China Resources Pharmaceutical Group's focus on low-carbon initiatives aligns with these environmental shifts, encouraging energy efficiency and sustainable energy solutions. This proactive stance is vital for meeting evolving regulatory frameworks and investor expectations for strong ESG performance.

China Resources Pharmaceutical Group is actively enhancing its supply chain's environmental performance, including rigorous supplier audits and promoting sustainably sourced raw materials. Initiatives like increasing bio-based excipients and reducing logistics emissions by optimizing routes and exploring electric vehicles are key to minimizing the company's ecological footprint. By the end of 2025, the company aims for a 10% reduction in logistics-related carbon emissions.

| Environmental Factor | China Resources Pharmaceutical Group's Response | Key Data/Initiatives (2023-2025) |

| Pollution Control & Waste Management | Adherence to strict national regulations, investment in cleaner production | Nationwide wastewater discharge standards enforced by end of 2023; 5% reduction in hazardous waste generation reported in 2023. |

| Climate Change & Carbon Emissions | Adoption of low-carbon operational strategies, focus on energy efficiency | Alignment with China's 2060 carbon neutrality goal; exploring electric vehicles for last-mile delivery. |

| Supply Chain Sustainability | Supplier environmental compliance audits, promotion of sustainable sourcing | Over 500 environmental compliance audits of key raw material suppliers in 2024; pilot program for bio-based excipients launched early 2025. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for China Resources Pharmaceutical Group is built on a robust foundation of official government reports from China's National Health Commission and Ministry of Commerce, alongside data from leading market research firms and international financial institutions like the IMF and World Bank. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting the pharmaceutical sector in China.