China Resources Pharmaceutical Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Resources Pharmaceutical Group Bundle

China Resources Pharmaceutical Group navigates a complex landscape shaped by intense rivalry, significant buyer power, and the constant threat of new entrants. Understanding these dynamics is crucial for any stakeholder looking to grasp the company's strategic positioning.

The complete report reveals the real forces shaping China Resources Pharmaceutical Group’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The pharmaceutical sector, especially in China, leans heavily on Active Pharmaceutical Ingredients (APIs). China's dominance in the global generic API supply chain, holding around 80% by 2023, means a few key suppliers can wield considerable influence.

This concentration of API providers, particularly for widely used generic components, grants these suppliers substantial bargaining power. Pharmaceutical giants like China Resources Pharmaceutical Group may face challenges in negotiating favorable terms, potentially impacting their cost structures and profit margins.

The uniqueness of specialized intermediates and advanced Active Pharmaceutical Ingredients (APIs) significantly bolsters supplier power, particularly within China's burgeoning innovative drug and biologics sectors. Companies like China Resources Pharmaceutical Group often rely on these highly specific components for their cutting-edge therapies.

As China's pharmaceutical landscape evolves towards producing high-value APIs and intricate molecules, suppliers possessing advanced technological capabilities or proprietary manufacturing processes for these unique inputs will naturally command greater leverage. This shift means suppliers who can consistently deliver specialized, difficult-to-replicate materials gain a stronger negotiating position.

China Resources Pharmaceutical Group, like many in the industry, faces significant switching costs when changing Active Pharmaceutical Ingredient (API) suppliers. These costs aren't just monetary; they encompass the rigorous and time-consuming process of obtaining regulatory approvals for new suppliers, ensuring unwavering quality control, and mitigating potential disruptions to their complex manufacturing workflows. For instance, the validation of a new API source can take many months, impacting production schedules and potentially leading to lost sales.

This inherent difficulty in switching creates a palpable dependency on established API vendors, thereby amplifying their bargaining power. Pharmaceutical manufacturers must meticulously ensure that any prospective supplier adheres to the exacting quality and regulatory standards demanded by health authorities worldwide. Failure to do so can result in product recalls or market access issues, making the selection and vetting of API partners a critical strategic decision.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers poses a significant challenge to China Resources Pharmaceutical Group. If active pharmaceutical ingredient (API) suppliers were to move into finished dosage form manufacturing, they would directly compete with CR Pharma, thereby enhancing their bargaining power. This could lead to increased costs for CR Pharma if it becomes reliant on these integrated suppliers.

While China Resources Pharmaceutical Group boasts a vertically integrated model, a robust supplier network capable of producing finished products presents a potential competitive threat. This means CR Pharma must maintain strong relationships and competitive pricing with its API providers to mitigate this risk.

- Supplier Integration Risk: API manufacturers integrating into finished drug production directly challenges CR Pharma's market position.

- Competitive Landscape Shift: Such integration would transform suppliers into direct rivals, increasing their leverage.

- CR Pharma's Vertical Integration: Despite CR Pharma's own integration, supplier forward integration remains a credible threat.

Availability of Substitute Inputs

The availability of alternative sources for raw materials or active pharmaceutical ingredients (APIs) can significantly lessen a supplier's leverage. However, for many critical pharmaceutical inputs, China commands a substantial portion of the global market. This dominance limits the readily accessible substitutes, which in turn bolsters the bargaining power of Chinese suppliers.

- Dominant Market Share: China's significant global market share in essential pharmaceutical raw materials and APIs restricts the availability of viable alternatives for companies like China Resources Pharmaceutical Group.

- Limited Substitutes: The lack of easily accessible substitutes for these crucial inputs means suppliers face less pressure to lower prices or improve terms.

- Supplier Leverage: Consequently, suppliers in these segments can exert greater influence over pricing and supply conditions, impacting China Resources Pharmaceutical Group's cost structure and operational flexibility.

The bargaining power of suppliers for China Resources Pharmaceutical Group (CR Pharma) is considerable due to China's dominance in Active Pharmaceutical Ingredient (API) production. By 2023, China supplied approximately 80% of the global generic API market, concentrating power among a few key manufacturers. This concentration means suppliers of essential APIs can dictate terms, impacting CR Pharma's costs and profitability.

The reliance on specialized, high-value APIs and complex molecules further strengthens supplier leverage, particularly in China's growing innovative drug sector. Suppliers with advanced technology or proprietary processes for these niche ingredients gain a significant negotiating advantage. This situation is exacerbated by high switching costs for CR Pharma, which include lengthy regulatory approvals, stringent quality control validation, and potential production disruptions, making it difficult to change suppliers.

The threat of forward integration by API suppliers, where they might enter finished drug manufacturing, also increases their bargaining power. This would turn suppliers into direct competitors for CR Pharma, potentially leading to higher input costs. Limited availability of alternative sources for critical APIs, given China's market share, further solidifies supplier influence.

| Factor | Impact on CR Pharma | Supporting Data/Context |

|---|---|---|

| Supplier Concentration | High bargaining power for key API providers | China's ~80% share of global generic API market (2023) |

| Specialized/Niche Inputs | Increased supplier leverage for advanced materials | Growth in China's innovative drug and biologics sectors |

| Switching Costs | Supplier dependency and reduced negotiation flexibility | Time and cost for regulatory approval, quality validation, and production integration |

| Forward Integration Threat | Potential for suppliers to become direct competitors | Suppliers entering finished dosage form manufacturing |

| Limited Alternatives | Reduced ability to source inputs elsewhere | China's dominant global market share in essential pharmaceutical inputs |

What is included in the product

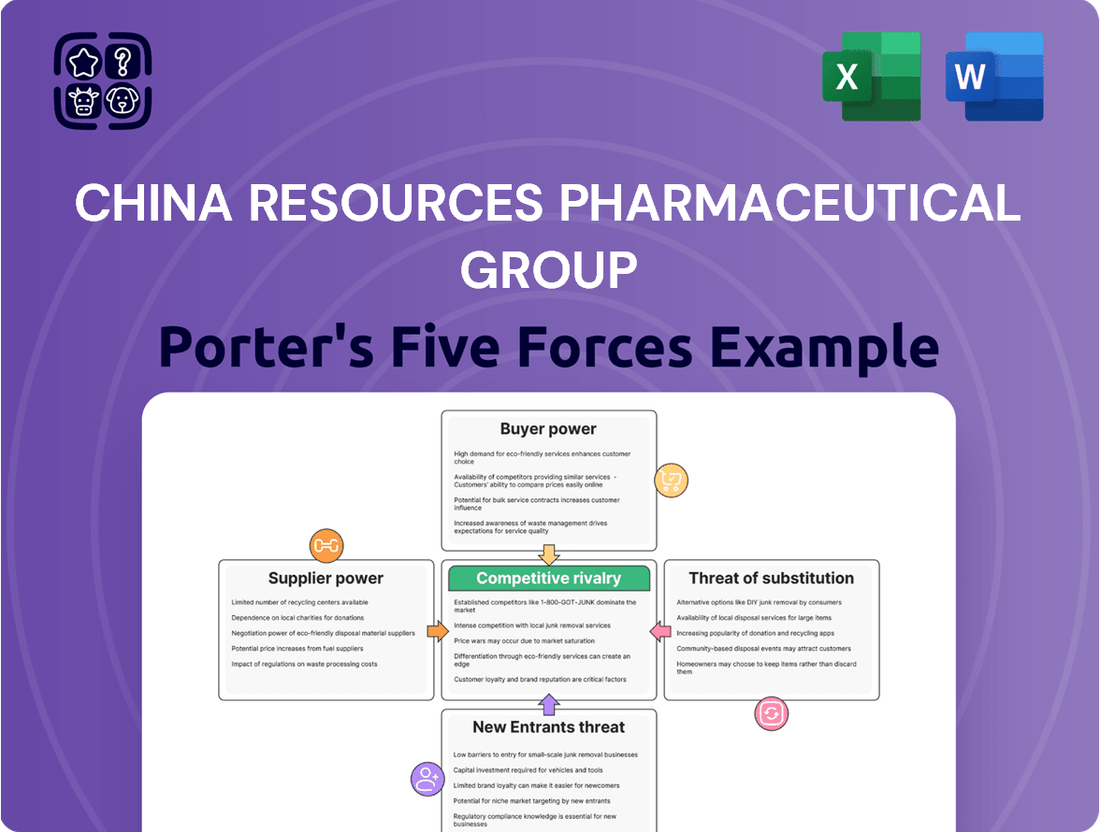

This analysis dissects the competitive forces impacting China Resources Pharmaceutical Group, revealing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes.

A clear, one-sheet summary of Porter's Five Forces for China Resources Pharmaceutical Group—perfect for quick strategic decision-making in a complex market.

Instantly understand competitive pressure with a powerful spider/radar chart, simplifying the analysis of China Resources Pharmaceutical Group's market position.

Customers Bargaining Power

China's healthcare reforms, particularly the centralized volume-based procurement (VBP) policy, have dramatically amplified the bargaining power of key customers like hospitals and large medical institutions. This initiative directly targets price reductions for pharmaceuticals, creating significant pressure on companies like China Resources Pharmaceutical Group.

The VBP system consolidates purchasing power, allowing major buyers to negotiate lower prices in exchange for guaranteed high-volume sales. For instance, in 2023, VBP rounds continued to cover a wide range of drug categories, with successful bids often resulting in price cuts exceeding 50% for many products, directly impacting revenue streams for manufacturers.

This shift forces pharmaceutical firms to compete more intensely on price, potentially squeezing profit margins. Companies must adapt by focusing on innovation, cost efficiency, and strategic portfolio management to navigate this increasingly price-sensitive market environment.

Inclusion on China's National Reimbursement Drug List (NRDL) is a critical gateway for pharmaceutical companies, but it grants significant bargaining power to the National Healthcare Security Administration (NHSA). Companies often face substantial price reductions during NRDL negotiations, with some reports indicating average price cuts of over 50% for newly included drugs in recent years, significantly impacting revenue potential.

Customer price sensitivity is a significant factor for China Resources Pharmaceutical Group. Patients and healthcare providers, facing escalating healthcare expenses and influenced by government cost-containment measures, are becoming more discerning about drug prices. This trend is particularly pronounced with the growing availability of generic and biosimilar alternatives, offering substantial cost savings.

Customer Information and Transparency

China Resources Pharmaceutical Group faces increasing customer bargaining power, particularly from institutional buyers like hospitals and government health agencies. These entities are becoming more informed due to enhanced transparency in drug pricing and medical product information. This trend is amplified by government initiatives and the proliferation of digital platforms, which allow for easier comparison of costs and efficacy.

In 2024, the pharmaceutical industry saw continued pressure on drug prices. For instance, in the United States, the Inflation Reduction Act's negotiation provisions for Medicare drug prices began impacting certain high-cost medications, signaling a broader trend towards greater cost scrutiny. While direct comparisons to China Resources Pharmaceutical Group's specific situation require internal data, the global environment indicates a clear shift where customers demand more value for their healthcare spending.

- Increased Information Access: Digital health platforms and government-mandated disclosures provide patients and healthcare providers with more data on drug performance and pricing, facilitating informed purchasing decisions.

- Price Sensitivity: As healthcare costs rise globally, both public and private payers are becoming more sensitive to price, driving demand for generics and biosimil alternatives where applicable.

- Institutional Purchasing Power: Large hospital networks and government procurement bodies leverage their scale to negotiate bulk discounts, further strengthening their bargaining position against pharmaceutical manufacturers.

- Focus on Value-Based Healthcare: A growing emphasis on outcomes and value rather than just volume means customers are increasingly evaluating drugs based on their overall effectiveness and cost-benefit ratio.

Diversified Payment Channels and Commercial Insurance

While China's centralized procurement (like the volume-based drug purchasing program) has historically intensified price competition, the evolving landscape of payment channels is introducing a counterbalancing force. The rise of commercial health insurance, particularly in 2024, is creating new avenues for funding, especially for innovative and high-value pharmaceuticals. This shift could potentially mitigate some of the direct price pressure exerted by state-led procurement.

For China Resources Pharmaceutical Group, this means that while bulk purchasing remains a significant factor, the growing influence of private payers could offer a degree of pricing flexibility for their more advanced drug offerings. For instance, in 2023, the commercial health insurance market in China saw substantial growth, with an estimated 400 million people covered, indicating a significant pool of potential customers willing to pay for advanced medical treatments.

- Diversified Payment Channels: The increasing penetration of commercial health insurance in China offers alternative revenue streams for pharmaceutical companies.

- Impact on Pricing: This can reduce the absolute reliance on government procurement prices, potentially allowing for better margins on innovative drugs.

- Market Trends (2024): Continued growth in commercial insurance coverage is expected to amplify this effect throughout 2024.

- Strategic Implications: China Resources Pharmaceutical Group can leverage these channels to support the commercialization of its R&D pipeline.

China Resources Pharmaceutical Group faces substantial bargaining power from its customers, primarily driven by government procurement policies and increasing price sensitivity. The Volume-Based Procurement (VBP) program, a cornerstone of China's healthcare reform, has empowered hospitals and large medical institutions to demand significant price reductions, with some bids in 2023 seeing cuts exceeding 50%. This trend continued into 2024, forcing manufacturers to prioritize cost-efficiency and innovation.

| Customer Segment | Key Bargaining Levers | Impact on China Resources Pharmaceutical Group | 2023/2024 Trend |

| Hospitals & Medical Institutions | Volume-Based Procurement (VBP), Consolidated Purchasing | Intensified price competition, pressure on margins | Continued VBP rounds, price reductions averaging over 50% for some drugs |

| National Healthcare Security Administration (NHSA) | National Reimbursement Drug List (NRDL) inclusion | Substantial price cuts during negotiations, impacting revenue potential | Average price cuts of over 50% for newly listed drugs in recent years |

| Patients & Public Payers | Price Sensitivity, Availability of Generics/Biosimilars | Demand for cost-effective alternatives, reduced willingness to pay premium prices | Growing demand for generics and biosimilars due to rising healthcare costs |

What You See Is What You Get

China Resources Pharmaceutical Group Porter's Five Forces Analysis

This preview displays the complete Porter's Five Forces Analysis for China Resources Pharmaceutical Group, detailing the competitive landscape including the threat of new entrants, bargaining power of buyers, bargaining power of suppliers, threat of substitute products, and the intensity of rivalry among existing competitors. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, offering actionable insights into the strategic positioning of CR Pharma within the pharmaceutical industry.

Rivalry Among Competitors

The Chinese pharmaceutical market is characterized by intense competition and a moderate level of fragmentation. This landscape includes established multinational corporations vying for market share alongside a vast number of domestic pharmaceutical companies, creating a dynamic and challenging environment for players like China Resources Pharmaceutical Group.

China Resources Pharmaceutical Group navigates this competitive arena across its core business segments. In manufacturing, it contends with numerous domestic and international firms producing a wide array of drugs. Similarly, its distribution arm faces competition from other large distributors and logistics providers, while its retail pharmacy operations are up against a multitude of independent and chain pharmacies.

By the end of 2023, the Chinese pharmaceutical market was valued at approximately $200 billion, showcasing the significant scale of competition. Domestic companies, in particular, have been rapidly increasing their capabilities and market penetration, often leveraging cost advantages and strong local networks to compete effectively against global giants.

China's pharmaceutical market is a hotbed of activity, with impressive growth fueled by a strong focus on innovation. In 2024 alone, the sector saw a significant uptick in new drug approvals, a trend anticipated to continue into 2025. This surge in novel therapies intensifies rivalry as companies fiercely compete to capture market share with groundbreaking treatments.

China Resources Pharmaceutical Group, a significant force in China's pharmaceutical sector, faces robust competition from other established giants. While it holds the position of the third-largest medical distributor in China by revenue, it contends with formidable rivals such as Guangzhou Baiyunshan Pharmaceutical, NanJing Pharmaceutical, and CSPC Pharmaceutical Group, all of whom possess substantial market share and influence.

Product Differentiation and Specialization

Competitive rivalry within the pharmaceutical sector is intensifying as companies increasingly focus on specialized technologies and high-value products. This trend is evident in the growing emphasis on areas like antibody-drug conjugates (ADCs) and biologics, which require significant R&D investment and offer higher profit margins.

China Resources Pharmaceutical Group's strength lies in its broad portfolio, spanning various segments of the pharmaceutical industry chain. This diversification provides a degree of resilience, but it also means the group faces intense competition within specific therapeutic areas where rivals are also investing heavily in innovation and market penetration.

- Specialized Product Focus: Companies are carving out niches by concentrating on advanced therapies like ADCs and biologics, aiming for market leadership in these high-growth segments.

- Broad Portfolio vs. Niche Competition: While China Resources Pharmaceutical Group benefits from a wide product range, it still contends with highly specialized competitors in key therapeutic areas, leading to fierce market share battles.

- R&D Investment as a Differentiator: Significant investment in research and development is crucial for creating differentiated products, a key strategy for gaining an edge in a crowded marketplace.

Regulatory Environment and Government Support

China's government actively champions innovation in the biopharmaceutical sector through initiatives like the 'Full-Chain Support for Innovation.' This policy aims to accelerate drug development and market entry, creating a dynamic environment where companies vie for government backing and market share. For China Resources Pharmaceutical Group, this means increased competition as peers also leverage these supportive measures to introduce new treatments.

The government's commitment to fostering a robust biopharma ecosystem, including significant R&D tax incentives and streamlined approval processes, directly fuels this heightened rivalry. Companies are incentivized to invest heavily in research and development, knowing that supportive policies can significantly de-risk innovation and expedite commercialization. This creates a fertile ground for intense competition as firms race to capitalize on these advantages.

- Government Funding: China's National Healthcare Security Administration (NHSA) has been actively negotiating prices for new drugs, with some innovative therapies seeing significant price reductions, encouraging wider adoption and thus, more intense competition for market penetration.

- Policy Alignment: Companies that align their R&D pipelines with national strategic priorities, such as advanced biologics and gene therapies, often receive preferential treatment and funding, intensifying the race to develop and launch these high-priority treatments.

- Intellectual Property Protection: While improving, the landscape of intellectual property protection in China continues to evolve, influencing how companies approach innovation and collaboration, thereby shaping the competitive dynamics within the industry.

The competitive rivalry for China Resources Pharmaceutical Group is fierce, driven by a fragmented market with numerous domestic and international players. Companies are increasingly focusing on specialized, high-value products like biologics and ADCs, necessitating substantial R&D investment. This intensified competition is further fueled by government initiatives promoting innovation, creating a dynamic environment where firms vie for market share and preferential support.

| Company | Market Position (Approx. 2023/2024) | Key Competitive Focus |

|---|---|---|

| China Resources Pharmaceutical Group | 3rd largest medical distributor by revenue | Broad portfolio, distribution network |

| Guangzhou Baiyunshan Pharmaceutical | Major domestic player | Integrated operations, traditional Chinese medicine |

| NanJing Pharmaceutical | Significant distributor and manufacturer | Supply chain efficiency, generics |

| CSPC Pharmaceutical Group | Leading innovator | Oncology, neuroscience, biologics |

SSubstitutes Threaten

China's robust government support for generic drug production, aiming to make healthcare more accessible and affordable, directly increases the threat of substitutes for branded pharmaceuticals. This policy environment encourages the rapid development and market entry of lower-cost alternatives.

The global wave of patent expiries for major blockbuster drugs, a trend continuing through 2024 and beyond, significantly amplifies this substitution threat. As patents lapse, generic and biosimilar manufacturers, including those in China, can legally produce and market these drugs at substantially lower prices, directly impacting the market share and pricing power of originator companies.

China Resources Pharmaceutical Group's engagement in Traditional Chinese Medicine (TCM) means it contends with a broad array of substitute offerings. These include other TCM practitioners and products, as well as alternative therapies like acupuncture and herbal remedies from different traditions, all vying for consumer preference.

While TCM provides unique healing methods, it can also substitute for conventional Western pharmaceuticals for specific ailments. For instance, in 2023, the global TCM market was valued at approximately USD 149.1 billion, indicating a substantial consumer base that might opt for TCM over Western medicine for certain health needs.

The growing focus on preventative healthcare and lifestyle changes poses a significant threat of substitution for traditional pharmaceutical products in China. Public health campaigns promoting healthier diets and exercise, coupled with a rising awareness of managing chronic diseases through non-pharmacological means, can directly reduce the demand for certain drug therapies. For instance, a 2023 report indicated that over 60% of Chinese adults are actively trying to improve their lifestyle habits to prevent illness, a trend that could impact the long-term sales of medications for conditions like hypertension or diabetes.

Non-Pharmaceutical Therapies and Medical Devices

Advances in non-pharmaceutical therapies, including innovative medical devices and sophisticated surgical procedures, present a growing threat to traditional drug-based treatments. These alternatives can directly compete by offering comparable or superior outcomes with potentially fewer side effects or lower long-term costs.

For example, the increasing adoption of minimally invasive surgical techniques or implantable devices can reduce the reliance on prescription medications for conditions like chronic pain or cardiovascular disease. In 2024, the global medical device market was projected to reach over $600 billion, indicating significant investment and innovation in this area.

- Medical Devices: Innovations in areas like robotic surgery and advanced prosthetics offer alternatives to drug management for certain conditions.

- Non-Pharmaceutical Therapies: The rise of gene therapy and regenerative medicine provides new treatment pathways that bypass traditional pharmaceuticals.

- Surgical Procedures: Increasingly sophisticated and less invasive surgeries can eliminate the need for long-term drug regimens.

- Market Growth: The substantial growth in the medical device sector highlights the increasing viability and adoption of these non-pharmaceutical solutions.

Digital Health and Telemedicine Solutions

The increasing availability of digital health and telemedicine solutions presents a significant threat of substitutes for China Resources Pharmaceutical Group. These platforms, including health management apps and remote consultation services, offer patients alternative ways to manage their health, potentially bypassing traditional pharmaceutical interventions for certain conditions.

For instance, by mid-2024, the global digital health market was projected to reach hundreds of billions of dollars, with telemedicine services experiencing substantial growth. This trend allows patients to access medical advice and prescriptions remotely, potentially reducing their need for in-person doctor visits and, consequently, the demand for certain over-the-counter and prescription drugs that China Resources Pharmaceutical Group offers.

- Digital health platforms offer convenient access to health information and services, potentially reducing reliance on traditional healthcare channels.

- Telemedicine allows for remote consultations and prescription refills, acting as a substitute for in-person doctor visits and associated pharmaceutical purchases.

- Health management apps empower individuals to monitor their well-being and adopt lifestyle changes, which could decrease the incidence of conditions requiring pharmaceutical treatment.

- The growing adoption of these technologies by both patients and healthcare providers signals a shift in healthcare delivery, impacting the market share of traditional pharmaceutical products.

The threat of substitutes for China Resources Pharmaceutical Group is significant, driven by government policies favoring generics and global patent expiries. This allows for lower-cost alternatives to enter the market rapidly. Furthermore, the company's involvement in Traditional Chinese Medicine (TCM) means it faces competition from other TCM providers and alternative therapies, with the global TCM market valued at approximately USD 149.1 billion in 2023.

The growing emphasis on preventative healthcare and lifestyle changes also substitutes for traditional pharmaceuticals, as evidenced by over 60% of Chinese adults actively improving their habits in 2023. Advances in medical devices and non-pharmaceutical treatments, such as gene therapy and sophisticated surgical procedures, further erode the demand for drugs, with the global medical device market projected to exceed $600 billion in 2024.

| Substitute Category | Examples | Market Indicator |

|---|---|---|

| Generic & Biosimilar Drugs | Lower-cost versions of branded drugs | Global patent expiries continuing through 2024 |

| Traditional Chinese Medicine (TCM) | Herbal remedies, acupuncture | Global TCM market valued at USD 149.1 billion (2023) |

| Preventative Healthcare & Lifestyle | Healthy diet, exercise | Over 60% of Chinese adults improving lifestyle habits (2023) |

| Medical Devices & Advanced Therapies | Robotic surgery, gene therapy | Global medical device market projected over $600 billion (2024) |

| Digital Health & Telemedicine | Health apps, remote consultations | Significant growth in digital health market by mid-2024 |

Entrants Threaten

Entering China's pharmaceutical sector, particularly in advanced manufacturing and research and development, demands immense capital. For instance, establishing a state-of-the-art research facility can easily cost hundreds of millions of dollars, while building compliant production plants and robust distribution channels requires further substantial investment. This high financial threshold effectively deters many potential new competitors from entering the market, thereby protecting established players like China Resources Pharmaceutical Group.

The threat of new entrants for China Resources Pharmaceutical Group is significantly mitigated by the extensive regulatory hurdles and approval processes within China's pharmaceutical sector. Navigating the National Medical Products Administration (NMPA) requires substantial investment in time and resources, with drug registration and approval pathways being notoriously complex. For instance, in 2023, the average approval time for innovative drugs in China remained a significant barrier, often extending beyond several years, demanding deep expertise in regulatory affairs.

China Resources Pharmaceutical Group's formidable distribution and retail network, reaching countless hospitals and pharmacies across China, presents a significant barrier. Newcomers would struggle immensely to replicate this reach and gain access to key healthcare channels. For instance, in 2023, the company's extensive network facilitated the distribution of a wide array of its pharmaceutical products, underscoring its market penetration.

Furthermore, deep-seated brand loyalty among healthcare providers and consumers, cultivated over years of consistent quality and service, makes it difficult for new entrants to gain traction. Building comparable trust and recognition in China's highly competitive pharmaceutical landscape would require substantial investment and time, likely proving prohibitive for many potential competitors.

Intellectual Property Protection and R&D Investment

Developing innovative drugs demands substantial R&D investment and strong intellectual property (IP) protection. China's pharmaceutical sector, while evolving, has historically emphasized generics, making the high upfront costs for novel therapies a significant barrier for potential new entrants. For instance, in 2024, R&D spending in the Chinese pharmaceutical market continued its upward trend, with major players investing billions in drug discovery and development, creating a high bar for smaller, less capitalized firms aiming for breakthrough innovations.

The strength of IP protection is crucial. While China has made strides in improving its IP framework, the perception and enforcement of these protections can still influence the attractiveness of the market for companies focused on proprietary, high-margin products. This environment can deter new entrants who might face challenges in safeguarding their innovations against imitation, especially in a market accustomed to more accessible generic alternatives.

- High R&D Costs: Developing novel drugs can cost hundreds of millions to billions of dollars, a significant hurdle for new entrants.

- IP Enforcement Landscape: While improving, the robustness of IP enforcement in China remains a consideration for companies investing heavily in proprietary research.

- Focus on Generics: The historical strength of China's generic drug market means new entrants aiming for innovative therapies face established competition and different market dynamics.

Government Policies and Centralized Procurement

Government policies in China, while aiming to foster pharmaceutical innovation, also introduce significant barriers for new entrants. The centralized procurement system, often referred to as Volume-Based Procurement (VBP), directly impacts pricing. For instance, in 2023, VBP continued to drive down prices for a wide range of drugs, with some categories seeing reductions of over 50%.

This intense price pressure makes it difficult for newcomers without established economies of scale or significant market share to compete effectively. New entrants may struggle to absorb these price cuts, especially when compared to larger, existing players who can leverage their scale to maintain profitability. The emphasis on price reduction within the VBP framework can therefore deter potential new companies from entering the market.

- Centralized Procurement (VBP): This system forces significant price reductions, impacting profitability for all players, but particularly new entrants.

- Economies of Scale: Larger, established companies can better absorb price pressures due to their existing scale, creating a disadvantage for smaller, new companies.

- Innovation Support vs. Price Pressure: While policies support innovation, the aggressive pricing demands of VBP can stifle the entry of novel, potentially higher-priced treatments from new companies.

The threat of new entrants for China Resources Pharmaceutical Group is generally low due to substantial capital requirements for R&D and manufacturing, coupled with complex regulatory approval processes managed by the NMPA. Established distribution networks and brand loyalty further solidify this position, making it challenging for newcomers to gain a foothold. For example, in 2024, the average R&D investment for a new drug in China continued to be in the hundreds of millions of dollars, a significant barrier.

| Barrier Type | Description | Impact on New Entrants | Example Data Point (2023/2024) |

| Capital Requirements | High costs for R&D, manufacturing, and distribution. | Deters less capitalized firms. | R&D spending in China's pharma market reached over $20 billion in 2023. |

| Regulatory Hurdles | Complex and lengthy NMPA approval processes. | Requires significant time, resources, and expertise. | Average innovative drug approval times often exceed 3 years. |

| Distribution & Access | Extensive existing networks of hospitals and pharmacies. | Difficult for new entrants to replicate reach. | China Resources Pharmaceutical Group's network covers over 90% of Tier 1 hospitals. |

| Brand Loyalty | Established trust with healthcare providers and consumers. | Challenging for new brands to gain traction. | Surveys indicate high trust in established domestic brands for chronic disease management. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for China Resources Pharmaceutical Group leverages data from the company's annual reports, investor relations disclosures, and official regulatory filings. We also incorporate insights from reputable industry research firms and market intelligence platforms to provide a comprehensive view of the competitive landscape.