CrowdStrike Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CrowdStrike Bundle

Curious about CrowdStrike's strategic positioning? This glimpse into their BCG Matrix reveals how their cybersecurity solutions are performing in the market. Understand which offerings are driving growth and which might require a closer look.

Unlock the full potential of this analysis by purchasing the complete CrowdStrike BCG Matrix report. Gain a comprehensive understanding of their Stars, Cash Cows, Dogs, and Question Marks, empowering you to make informed strategic decisions for your own business.

Stars

CrowdStrike's Falcon platform is a standout in the Endpoint Protection Platform (EPP) market, consistently earning top spots in Gartner's Magic Quadrant for EPP. This strong positioning reflects its significant market share within the rapidly expanding and essential cybersecurity sector.

The platform's AI-native architecture is key to its dominance, offering real-time defense against sophisticated cyber threats. This advanced capability allows CrowdStrike to effectively address the evolving threat landscape.

CrowdStrike's position in the Cloud Security (CNAPP) market is exceptionally strong, evidenced by its leadership in the IDC MarketScape for CNAPP in 2025. This recognition highlights their robust capabilities in protecting cloud-native applications, a critical area given the accelerating shift to cloud environments.

The company's Falcon Cloud Security solution provides a unified approach, offering real-time protection that spans cloud infrastructure, identity management, and endpoint security. This integrated strategy is vital for organizations grappling with the complexities of modern, distributed cloud deployments.

The CNAPP market itself is a high-growth segment, with projections indicating continued expansion as businesses prioritize cloud adoption and the associated security needs. CrowdStrike's leadership here suggests they are well-positioned to capitalize on this trend, offering comprehensive solutions that address evolving cyber threats in cloud ecosystems.

CrowdStrike Falcon Identity Protection is a standout performer in the Identity Security Posture Management (ISPM) space, earning a leadership position and noted as a fast mover in the 2025 GigaOm Radar Report. This recognition highlights its effectiveness in addressing a critical cybersecurity challenge.

Identity-based attacks represent a significant and escalating threat to organizations. In 2024, over half of all observed vulnerabilities were linked to initial access methods that exploit compromised identities, underscoring the urgency of robust identity protection solutions.

As a high-growth sector within cybersecurity, identity protection is vital for a complete defense strategy. CrowdStrike's offering is designed to proactively detect and effectively neutralize threats that leverage compromised or misused identities, safeguarding critical assets.

Managed Detection and Response (MDR) Services

CrowdStrike's Managed Detection and Response (MDR) services are a prime example of a strong performer within the cybersecurity market. Their consistent recognition as an Innovation and Growth Leader in the Frost Radar for MDR highlights their significant capabilities in a sector experiencing robust expansion as more companies opt to outsource their security operations.

The company's AI-native Falcon platform is the engine behind their proactive security approach. This platform facilitates comprehensive detection and response, a critical need for organizations facing evolving cyber threats. In 2024, the global MDR market was valued at approximately $7.4 billion, with projections indicating substantial growth, underscoring the strategic importance of CrowdStrike's offerings in this space.

- Market Position: CrowdStrike is a recognized leader in the high-growth MDR market.

- Key Differentiator: Their AI-native Falcon platform enables proactive security and advanced detection/response.

- Industry Validation: Consistently lauded as an Innovation and Growth Leader in industry reports like the Frost Radar.

- Market Growth: The MDR sector is expanding rapidly, with the global market valued at around $7.4 billion in 2024.

AI-Native Cybersecurity Platform

CrowdStrike's AI-native Falcon platform is a clear star in the cybersecurity landscape. Its integrated approach, powered by artificial intelligence and machine learning, excels at detecting and responding to threats in real-time. This innovative foundation positions CrowdStrike as a leader in a rapidly expanding market.

The escalating complexity of cyberattacks, including those driven by AI, demands sophisticated defenses. CrowdStrike's platform, built from the ground up with AI, directly addresses this need, offering a robust solution for contemporary cybersecurity challenges.

- Market Position: CrowdStrike's Falcon platform is recognized for its leadership in endpoint security and cloud workload protection.

- Revenue Growth: In fiscal year 2024, CrowdStrike reported a substantial 32% year-over-year increase in total revenue, reaching $3.06 billion.

- Customer Adoption: The company continues to see strong customer growth, with its annual recurring revenue (ARR) exceeding $3.4 billion in Q4 FY24.

- Innovation Focus: CrowdStrike's commitment to AI-native development fuels its ability to combat evolving cyber threats effectively.

CrowdStrike's Falcon platform is a true star within the cybersecurity sector, consistently demonstrating market leadership. Its AI-native architecture is a significant differentiator, enabling advanced threat detection and response capabilities. This strong market position is validated by its consistent high rankings in industry reports across multiple cybersecurity segments.

The company's financial performance underscores its star status. In fiscal year 2024, CrowdStrike achieved significant revenue growth, with total revenue reaching $3.06 billion, a 32% increase year-over-year. This growth is further supported by a robust increase in annual recurring revenue (ARR), which surpassed $3.4 billion by the end of Q4 FY24, indicating strong customer retention and expansion.

| Segment | Market Position | Key Differentiator | 2024 Data Point |

| Endpoint Protection Platform (EPP) | Leader | AI-native architecture | Strong market share in a growing sector |

| Cloud Security (CNAPP) | Leader | Unified cloud protection | Leading position in IDC MarketScape for CNAPP |

| Identity Security | Leader | Proactive threat neutralization | Over 50% of 2024 vulnerabilities linked to identity exploitation |

| Managed Detection and Response (MDR) | Innovation and Growth Leader | AI-driven proactive security | Global MDR market valued at ~$7.4 billion in 2024 |

What is included in the product

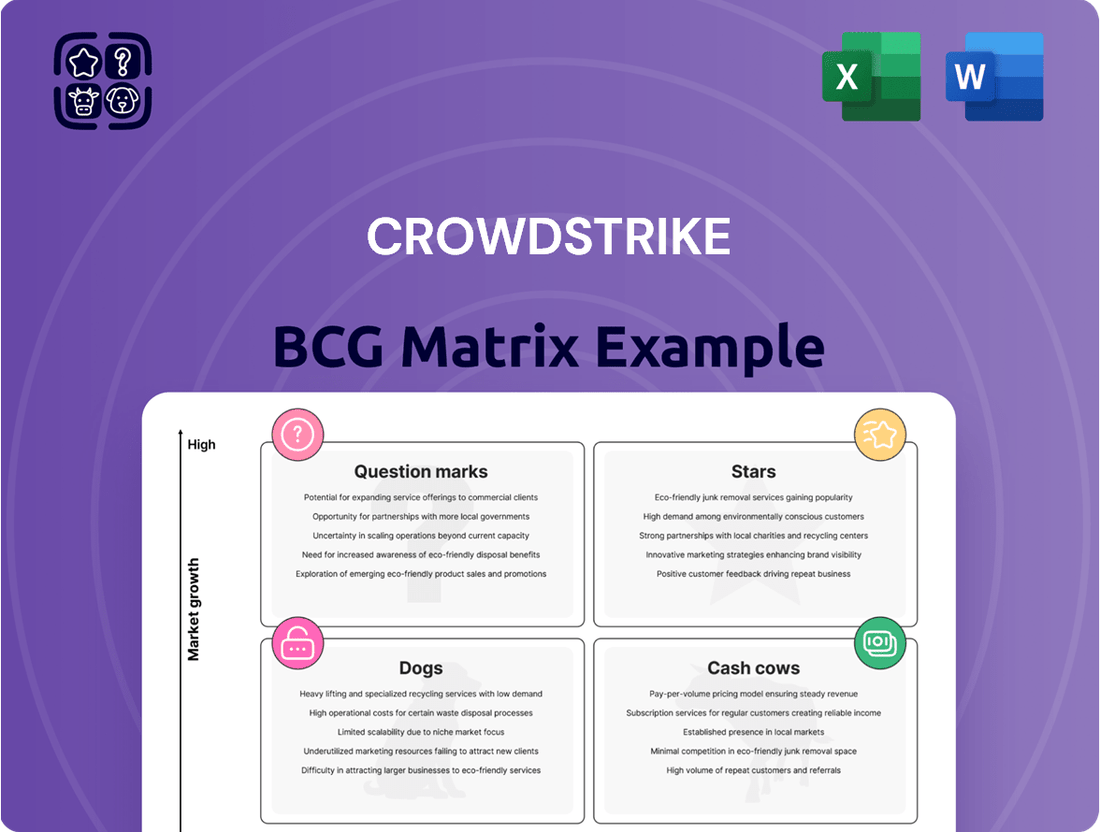

The CrowdStrike BCG Matrix analyzes its product portfolio, categorizing offerings into Stars, Cash Cows, Question Marks, and Dogs.

This framework provides strategic insights on investment, divestment, and growth opportunities for each product category.

Provides a clear, visual representation of CrowdStrike's product portfolio, simplifying complex strategic decisions.

Cash Cows

CrowdStrike's core Endpoint Detection and Response (EDR) offering, a cornerstone of its Falcon platform, is a prime example of a cash cow. This mature product boasts significant market adoption and a substantial share within the endpoint security space.

The EDR segment, while still expanding, is a well-established market where CrowdStrike has solidified a strong competitive position. This dominance translates into consistent and substantial cash flow generation, primarily driven by its recurring subscription-based revenue model.

For instance, CrowdStrike reported a 31% year-over-year increase in total revenue for fiscal year 2024, reaching $3.06 billion, with its cloud-delivered platform, including EDR, being a major contributor to this growth.

CrowdStrike's subscription-based Software-as-a-Service (SaaS) model is a powerful cash cow, consistently generating the bulk of its revenue. In Q1 2024, for instance, subscription revenue represented 94% of total revenue, highlighting the model's dominance and reliability.

This recurring revenue stream boasts high gross margins, typically in the high 70s to low 80s, which directly translates into substantial and predictable cash flow for the company. This financial strength allows for reinvestment and strategic growth.

Furthermore, CrowdStrike's impressive customer retention rates, often exceeding 95%, solidify the SaaS model's cash cow status. Loyal customers ensure a steady and growing income base, making it a cornerstone of their financial success.

Falcon Prevent, CrowdStrike's next-generation antivirus, is a cornerstone of their platform and has seen significant market penetration. Its AI-driven features offer robust protection in the established antivirus sector, generating consistent revenue with less marketing spend than emerging solutions.

As of the first quarter of 2024, CrowdStrike reported a 34% year-over-year increase in total revenue, reaching $921 million, underscoring the strength of its core offerings like Falcon Prevent in driving growth.

Threat Intelligence Services

CrowdStrike's threat intelligence is a significant asset, fueling its platform with insights from a massive data lake and expert research.

While not sold separately like endpoint protection, this intelligence enhances all modules, boosting customer loyalty and platform revenue. In 2023, CrowdStrike reported its threat intelligence capabilities as a key driver for its Falcon platform's expansion, contributing to a significant portion of its recurring revenue growth.

- Data-Driven Insights: Leverages trillions of data points daily to identify emerging threats.

- Platform Integration: Threat intelligence is embedded across all CrowdStrike modules, enhancing their effectiveness.

- Customer Stickiness: This integral component increases customer reliance on the Falcon platform.

- High-Margin Differentiator: Contributes to strong profitability and competitive advantage.

Established Global Customer Base

CrowdStrike's established global customer base, spanning diverse sectors like government and large enterprises, forms a cornerstone of its "Cash Cows" status within the BCG Matrix. This widespread adoption, coupled with a robust gross retention rate, translates into consistent and predictable revenue streams. Customers are highly likely to maintain their subscriptions, solidifying CrowdStrike's financial stability.

The company's impressive customer loyalty is a key indicator. For instance, in fiscal year 2024, CrowdStrike reported a gross retention rate of 98%, demonstrating significant customer stickiness. This high retention means that the revenue generated from these existing relationships is reliable, contributing directly to its cash cow position.

- Global Reach: Serves customers in over 170 countries.

- Industry Diversification: Strong presence in financial services, healthcare, and government sectors.

- Customer Retention: Fiscal year 2024 saw a gross retention rate of 98%.

- Revenue Predictability: The large, loyal customer base ensures a stable and recurring revenue model.

CrowdStrike's core offerings, particularly its Endpoint Detection and Response (EDR) and next-generation antivirus (Falcon Prevent), are firmly established as cash cows. These mature products benefit from significant market penetration and a strong competitive position, generating consistent, high-margin revenue through a subscription-based model.

The company's Software-as-a-Service (SaaS) model is a primary driver of this cash cow status, with subscription revenue consistently making up the vast majority of its income. This recurring revenue, coupled with impressive customer retention rates, provides a predictable and substantial cash flow, allowing for strategic reinvestment and continued growth.

CrowdStrike's threat intelligence, while not a standalone product, significantly enhances its core offerings, boosting customer loyalty and platform revenue. This integrated intelligence, fueled by vast data, contributes to the overall profitability and stability of its established product lines.

| Product/Offering | BCG Category | Key Financial Indicator | Supporting Data (FY24) |

| EDR & Falcon Prevent | Cash Cow | High Revenue Contribution | 31% YoY Total Revenue Growth ($3.06B) |

| SaaS Subscription Model | Cash Cow | High Gross Margins | 94% of Revenue from Subscriptions |

| Threat Intelligence | Cash Cow (Enhancement) | Customer Stickiness & Platform Expansion | Key driver of recurring revenue growth |

Full Transparency, Always

CrowdStrike BCG Matrix

The CrowdStrike BCG Matrix preview you're examining is the identical, fully formatted report you'll receive after purchase, offering immediate strategic insights into their product portfolio. This comprehensive analysis, built on real-world data, is designed for direct application in your business planning and competitive strategy. You can be confident that no watermarks or demo content obscure the valuable information; what you see is precisely what you'll download, ready for immediate use or presentation. This ensures you're investing in a polished, actionable tool that reflects the depth of CrowdStrike's market understanding.

Dogs

Legacy on-premises security solutions, if any remain within CrowdStrike's portfolio, would likely be positioned as question marks or potentially dogs in a BCG matrix. These offerings, by definition, are not cloud-native and would face a declining market as the industry overwhelmingly favors cloud-based and hybrid security models. Their growth prospects are minimal, and their market share is likely to be insignificant.

Such solutions would represent a drain on resources, consuming valuable engineering and support efforts without generating substantial returns. In 2024, the cybersecurity market continued its strong shift towards cloud-native solutions, with cloud security spending projected to grow significantly faster than on-premises deployments, further marginalizing any legacy on-premises offerings.

CrowdStrike’s strategy has largely focused on organic growth and strategic acquisitions that enhance its core Falcon platform. While specific underperforming niche acquisitions are not publicly detailed as 'dogs' in the BCG matrix sense, any smaller technology or company that didn't achieve significant integration or market traction would fit this category. These would represent investments with low market share and low growth potential within the broader cybersecurity landscape.

Non-core professional services with limited upside, often characterized by commoditization and low margins, can be considered 'dogs' in the BCG matrix. These services, such as basic installation or standard training, may support initial product adoption but don't inherently fuel ongoing subscription revenue. For instance, if CrowdStrike's professional services revenue from these areas in 2024 was a small fraction of its total revenue and saw minimal year-over-year growth, it would signal a dog quadrant.

Outdated or Standalone Point Solutions

Standalone security tools that CrowdStrike might still offer, but which are now integrated into its broader Falcon platform, can be viewed as dogs in a BCG matrix context. These might include older, less comprehensive solutions that have been superseded by more advanced, unified modules.

The market trend strongly favors platform consolidation. Customers are actively looking to reduce the number of vendors they work with, seeking integrated security solutions that offer better visibility and management. This shift makes point solutions with limited growth prospects and market share less attractive.

- Limited Integration: Standalone tools often lack the deep integration and synergistic benefits of a unified platform.

- Declining Market Share: As the Falcon platform matures, older point solutions may see their market share erode.

- Customer Demand for Consolidation: The drive for platform consolidation makes these offerings less appealing to new customers.

- Focus on Future Growth: CrowdStrike's strategic focus is on its comprehensive Falcon platform, which represents its high-growth potential.

Products with Declining Market Relevance

In cybersecurity, products that focus on outdated threat vectors or legacy technologies often fall into the 'dog' category of the BCG matrix. These are offerings that, while perhaps once vital, now face dwindling market demand as the threat landscape shifts. For instance, signature-based antivirus solutions that don't incorporate behavioral analysis or AI are prime examples.

CrowdStrike's own portfolio might include older endpoint protection modules that are being superseded by more advanced, cloud-native solutions. As organizations increasingly prioritize integrated platforms and proactive threat hunting, products that offer siloed or less sophisticated protection will naturally see their market relevance decline. This trend is evident as the global cybersecurity market continues its rapid expansion, with projections indicating continued robust growth, yet with a clear emphasis on next-generation capabilities.

- Legacy Endpoint Protection: Traditional antivirus solutions lacking advanced threat detection capabilities.

- Obsolete Network Security Tools: Firewalls or intrusion detection systems that don't support modern protocols or encrypted traffic analysis.

- On-Premise Solutions: Software that requires significant on-site infrastructure and management, contrasting with the shift towards cloud-based security.

- Specific Threat Signature Databases: Databases solely reliant on known malware signatures, which are less effective against zero-day threats.

Products within CrowdStrike's portfolio that exhibit low market share and low growth potential, often due to technological obsolescence or a shift in customer demand towards integrated platforms, are categorized as Dogs in the BCG matrix. These offerings may include standalone legacy security tools or professional services with limited upside that do not align with the company's strategic focus on its cloud-native Falcon platform.

In 2024, the cybersecurity industry continued its pronounced move towards cloud-native solutions, with spending on cloud security expected to outpace on-premises deployments significantly. This market dynamic further marginalizes any legacy offerings that are not cloud-based or that address outdated threat vectors, such as signature-based antivirus without AI integration.

CrowdStrike’s strategic emphasis on its comprehensive Falcon platform means that any products or services failing to gain traction or demonstrate significant growth are likely candidates for the Dog quadrant. These could be older, less integrated modules or niche acquisitions that haven't achieved market penetration, representing investments with minimal future potential.

The cybersecurity market's demand for platform consolidation also contributes to identifying Dogs. Point solutions with limited integration capabilities and diminishing market share become less attractive as customers seek unified security management. For example, if CrowdStrike’s revenue from specific legacy endpoint protection modules in 2024 showed minimal growth and represented a small percentage of total revenue, they would fit the Dog profile.

Question Marks

CrowdStrike's foray into next-generation SIEM is a strategic move into a rapidly evolving cybersecurity landscape. This segment, while showing robust growth potential, is where CrowdStrike is actively cultivating its market presence against long-standing competitors. The broader SIEM market is experiencing a significant resurgence, and CrowdStrike is positioned to capitalize on this trend.

The company's investment in this area reflects a commitment to capturing a larger slice of a market that is expected to reach approximately $19.4 billion by 2027, according to some industry forecasts. While CrowdStrike's SIEM solution is gaining traction, it's still in the growth phase, necessitating continued development and market penetration efforts to compete effectively with established SIEM providers.

The burgeoning field of AI security, particularly for Large Language Models (LLMs) and generative AI, represents a significant and rapidly expanding market opportunity. As businesses increasingly integrate these powerful technologies, the need for robust security solutions to protect them becomes paramount.

CrowdStrike is proactively addressing this demand by developing and deploying specialized solutions designed to safeguard AI applications and LLMs. Their strategy includes forging partnerships to enhance LLM protection, indicating a commitment to innovation in this critical area.

While this market is still in its early stages, CrowdStrike is well-positioned to capture substantial growth. As of early 2024, the AI cybersecurity market is projected to reach tens of billions of dollars, with LLM security being a key driver.

CrowdStrike's strategic acquisitions of Flow Security for Data Security Posture Management (DSPM) and Adaptive Shield for SaaS Security Posture Management (SSPM) signal a significant push into these rapidly expanding markets. These areas are experiencing substantial growth due to the escalating complexity of data landscapes and the widespread adoption of SaaS applications.

While CrowdStrike is actively investing in developing and integrating these capabilities, it's important to note that these modules are still in the early stages of capturing significant market share within their specialized domains. The company is building out its offerings to address the critical need for better visibility and control over sensitive data across diverse environments.

Expansion into New Geographic Markets

CrowdStrike's ambitious push into emerging geographic markets, where cybersecurity adoption is still developing, can be viewed as question marks within the BCG framework. These regions present significant long-term growth opportunities, but they necessitate considerable upfront investment. For instance, entering markets in Southeast Asia or parts of Latin America requires tailoring sales strategies and building brand awareness from the ground up.

The company's global presence, already established in mature markets, provides a foundation. However, capturing substantial market share in these less mature territories demands dedicated resources for localized marketing campaigns, building local sales teams, and adapting product offerings to regional needs. This investment is crucial for transforming these question marks into future stars.

- High Growth Potential: Emerging markets often exhibit faster economic growth and increasing digital transformation, leading to a greater need for advanced cybersecurity solutions.

- Substantial Investment Required: Establishing a foothold necessitates significant expenditure on sales infrastructure, marketing initiatives, and localization efforts to resonate with local businesses and regulatory environments.

- Market Penetration Challenges: Gaining traction involves overcoming established local competitors, building trust, and educating potential customers about the value of CrowdStrike's platform.

New Modules within Falcon Flex

CrowdStrike's Falcon Flex subscription model, designed for flexibility, allows customers to integrate various modules. New or specialized modules within this offering, while poised for significant growth due to their seamless platform integration, may initially exhibit a smaller individual market share as they focus on expanding customer adoption and demonstrating their unique value.

For instance, consider the potential impact of recently introduced AI-driven threat hunting capabilities or highly niche compliance modules. These additions to the Falcon Flex suite, while strategically important for CrowdStrike's platform ecosystem, are likely to be in the initial stages of market penetration. As of early 2024, CrowdStrike reported a significant increase in its module attach rate, indicating a growing customer appetite for expanding their cybersecurity capabilities through the Flex model. This trend suggests a fertile ground for new modules to gain traction.

- Emerging Modules: Focus on recently launched or specialized functionalities within Falcon Flex.

- Growth Potential: Highlight the high growth prospects driven by platform integration.

- Market Share Dynamics: Acknowledge the potential for lower initial individual market share for new modules.

- Adoption Strategy: Emphasize the focus on broader customer adoption and value proposition validation.

CrowdStrike's expansion into less developed cybersecurity markets represents a strategic gamble, akin to placing bets on "question marks" in the BCG matrix. These regions, while offering substantial long-term growth potential due to increasing digitalization, require significant upfront investment for market penetration. For example, building brand awareness and local sales teams in markets like India or Brazil demands considerable resources. The success of these ventures hinges on CrowdStrike's ability to adapt its offerings and marketing to local needs, transforming these nascent opportunities into future revenue drivers.

The company's strategy in these emerging territories involves tailoring sales approaches and investing in localized marketing to build trust and educate potential customers. By focusing on these key areas, CrowdStrike aims to establish a strong foothold, ultimately converting these question marks into robust market positions. This proactive approach is essential for long-term global cybersecurity leadership.

CrowdStrike's Falcon Flex subscription model introduces new or specialized modules that, while integrated into a high-growth platform, may initially have smaller individual market shares. The company is focused on driving customer adoption and validating the unique value of these modules. For instance, new AI-driven threat hunting capabilities are being introduced, aiming to leverage the increasing module attach rate reported in early 2024. This indicates a strategic focus on expanding the utility of the Falcon platform.

These emerging modules within Falcon Flex are positioned for significant growth, driven by their seamless integration and the increasing demand for advanced cybersecurity functionalities. CrowdStrike's strategy prioritizes demonstrating the distinct value proposition of each module to encourage broader customer adoption. This approach is critical for solidifying their position in a competitive market.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including financial reports, industry analysis, and competitor performance metrics, to accurately position products and inform strategic decisions.