Create Restaurants Holdings PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Create Restaurants Holdings Bundle

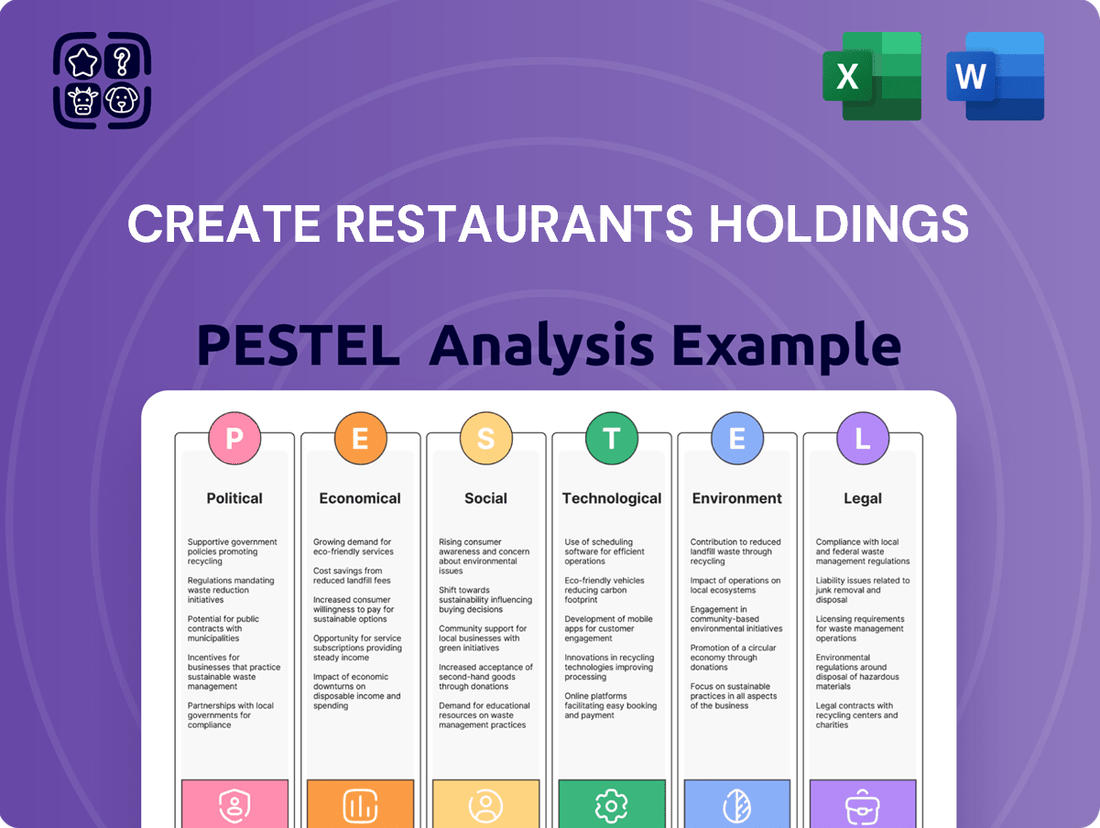

Unlock the strategic landscape surrounding Create Restaurants Holdings with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that are shaping their operational environment and future growth. Gain a critical edge by identifying potential opportunities and mitigating emerging risks.

Don't get left behind – our expert-crafted PESTLE analysis for Create Restaurants Holdings offers actionable intelligence to inform your investment decisions and strategic planning. Discover how external forces are creating both challenges and significant opportunities for the company. Download the full version now to gain the insights you need to stay ahead of the curve.

Political factors

The Japanese government is consistently refining its food safety and labeling regulations, directly influencing how restaurants like Create Restaurants Holdings operate. Recent updates in 2024 and 2025 have introduced stricter requirements for allergen declarations, clarified nutrition claim guidelines, and extended notification timelines for specific food items.

Adherence to these dynamic governmental policies is paramount for Create Restaurants Holdings. Failure to comply with the updated allergen labeling or nutrition claim rules, for instance, could lead to significant fines and damage to the brand's reputation, impacting consumer confidence and sales.

Japan's labor laws, covering working hours, overtime, and employment contracts, are undergoing potential revisions that could impact Create Restaurants Holdings' staffing strategies and operational expenses. These changes are crucial for managing labor costs effectively.

The Japanese government is considering easing foreign worker regulations for hotel restaurants, with potential implementation by early spring 2025. This policy shift could significantly improve labor availability for Create Restaurants Holdings, particularly in alleviating current staff shortages across its outlets.

The Japanese government's proactive tourism promotion strategies have significantly boosted inbound visitor numbers. In 2023, Japan welcomed a record-breaking 25.07 million foreign tourists, a substantial increase from the 3.83 million recorded in 2022, and nearing the pre-pandemic peak of 31.88 million in 2019. This surge directly fuels demand for dining establishments.

Create Restaurants Holdings is well-positioned to capitalize on this resurgence in tourism. Higher visitor traffic translates to increased patronage across their diverse restaurant brands, from casual dining to more specialized culinary experiences. This influx provides a robust opportunity for revenue growth and market penetration as tourists seek authentic and varied dining options.

Economic Stimulus and Consumer Spending Policies

Government initiatives to boost consumer spending, like tax rebates or direct subsidies, can significantly benefit the restaurant industry. These policies directly translate into increased disposable income for households, encouraging more dining out. For instance, Japan's Go To Eat campaign, which ran in various forms, aimed to revitalize the food service sector by offering points and discounts for restaurant visits.

The current economic climate in Japan, characterized by active domestic consumer spending, is a strong tailwind for Create Restaurants Holdings. This trend is projected to contribute to revenue growth for the company in the 2024-2025 period. As of early 2024, consumer confidence surveys indicated a gradual improvement, suggesting a sustained appetite for discretionary spending, including dining out.

- Government stimulus measures directly fuel consumer spending in the food service sector.

- Japan's Go To Eat campaign demonstrated the positive impact of such policies on restaurant traffic.

- Projected revenue increases for Create Restaurants Holdings are underpinned by robust domestic consumer spending trends in 2024-2025.

- Improvements in consumer confidence in Japan support continued spending on dining experiences.

Food Waste Reduction Initiatives

The Japanese government is pushing hard to reduce food waste, aiming for a significant 100% cut in commercial food waste by 2030. This strong political push means companies like Create Restaurants Holdings must adapt their practices to align with these ambitious environmental goals.

To help achieve this, policies are being introduced to ease restrictions on food expiration dates and actively encourage food donations. These governmental nudges are designed to make it easier and more appealing for restaurants to implement sustainable food management and waste reduction strategies.

- 2030 Target: 100% reduction in commercial food waste.

- Policy Levers: Relaxed expiration date regulations and promotion of food donations.

- Impact on Restaurants: Encourages adoption of sustainable food handling and donation practices.

Political stability in Japan is a significant advantage for Create Restaurants Holdings, providing a predictable operating environment. The government's focus on economic growth and consumer welfare, evidenced by initiatives like the Go To Eat campaign, directly supports the restaurant sector. Furthermore, evolving labor laws and tourism policies are shaping operational landscapes and labor availability for the company.

| Policy Area | 2024/2025 Focus | Impact on Create Restaurants Holdings |

|---|---|---|

| Food Safety & Labeling | Stricter allergen declarations, clarified nutrition claims | Requires compliance to avoid fines and reputational damage. |

| Labor Laws | Potential revisions to working hours, overtime | May impact staffing strategies and operational costs. |

| Foreign Worker Regulations | Consideration of easing for hotel restaurants (early 2025) | Could alleviate staff shortages and improve labor availability. |

| Tourism Promotion | Record inbound visitor numbers (25.07 million in 2023) | Drives increased patronage and revenue opportunities. |

| Consumer Spending Initiatives | Tax rebates, subsidies (e.g., Go To Eat) | Boosts disposable income and dining-out frequency. |

| Environmental Policy | 100% commercial food waste reduction by 2030 | Necessitates adoption of sustainable food management practices. |

What is included in the product

This PESTLE analysis offers a comprehensive examination of the external macro-environmental factors impacting Create Restaurants Holdings, detailing how political, economic, social, technological, environmental, and legal forces present both challenges and strategic advantages.

A clear, actionable PESTLE analysis for Create Restaurants Holdings that translates complex external factors into manageable insights, simplifying strategic decision-making and reducing the burden of market uncertainty.

Economic factors

Inflationary pressures are a major concern for Create Restaurants Holdings, directly impacting the cost of essential inputs like raw materials, energy, and labor. For instance, the U.S. Producer Price Index for food away from home saw a notable increase in early 2024, reflecting these rising operational costs.

To navigate these challenges, Create Restaurants Holdings must implement robust supply chain management and dynamic pricing strategies. The ability to absorb or pass on these increased costs without alienating customers is critical for maintaining profitability.

Consumer spending in Japan showed resilience, with household spending increasing by 4.1% year-on-year in the first quarter of 2024, indicating a generally positive environment for dining out. However, the growth in disposable income remains a key factor; while nominal wages saw a slight uptick, real wages have been pressured by inflation, potentially moderating discretionary spending on services like restaurant meals.

For Create Restaurants Holdings, with its global footprint, exchange rate volatility directly impacts the cost of sourcing ingredients from abroad and the revenue generated from international markets. For instance, a stronger US dollar might make imported food supplies cheaper but reduce the repatriated profits from its European subsidiaries.

Managing these currency fluctuations is paramount; a significant depreciation of a foreign currency where Create Restaurants Holdings operates could substantially erode its reported earnings. In 2024, the Euro experienced fluctuations against the dollar, impacting companies with significant cross-border transactions, a factor Create Restaurants Holdings must actively monitor.

The company's financial strategy must therefore incorporate robust hedging mechanisms to mitigate the unpredictable nature of foreign exchange markets, ensuring stable profitability across all its operating regions.

Market Competition and Pricing Strategies

The Japanese restaurant market is incredibly crowded, featuring a vast array of dining experiences. Create Restaurants Holdings needs to constantly re-evaluate its pricing and find ways to stand out to keep customers coming back, especially with so many other choices available.

In 2024, the casual dining sector in Japan saw intense price competition, with many chains offering value sets and promotions to capture market share. For instance, reports indicate that average meal prices in popular family restaurants remained relatively stable, with some even implementing slight discounts to attract diners.

- Intense Competition: Over 300,000 restaurants operate in Japan, creating a highly saturated market.

- Pricing Sensitivity: Consumers are often price-conscious, especially in the casual dining segment.

- Differentiation Necessity: Unique menu items, service quality, or ambiance are crucial for customer retention.

- Promotional Activities: Limited-time offers and loyalty programs are common tactics employed by competitors.

Access to Capital and Investment Climate

The availability of capital is a significant driver for Create Restaurants Holdings' expansion and modernization plans. In early 2024, the U.S. Federal Reserve maintained its benchmark interest rate, a move that can influence borrowing costs for businesses. This stability, coupled with generally positive investor sentiment towards the consumer discretionary sector, suggests a potentially supportive environment for accessing funds.

A robust investment climate directly impacts Create Restaurants Holdings' capacity to execute its growth strategies, including potential acquisitions and investments in new technologies like AI-driven customer service or advanced supply chain management. For instance, in Q1 2024, venture capital funding for the food tech sector saw a notable uptick, indicating a renewed investor interest in innovation within the restaurant industry.

- Capital Availability: Access to loans and equity financing remains crucial for restaurant chains like Create Restaurants Holdings to fund new store openings and technology upgrades.

- Interest Rate Environment: As of mid-2024, interest rates, while higher than recent historical lows, have shown some signs of stabilization, impacting the cost of debt financing.

- Investor Confidence: Broader economic indicators and consumer spending trends in 2024 are influencing overall investor confidence in the restaurant sector, affecting the ease of raising capital.

- Mergers & Acquisitions: The M&A landscape in the restaurant industry in 2024 presents opportunities for consolidation and strategic acquisitions, contingent on favorable capital access.

Economic factors present a mixed landscape for Create Restaurants Holdings. While consumer spending in markets like Japan showed resilience in early 2024, with household spending up 4.1% year-on-year in Q1, inflationary pressures continue to impact operational costs. For example, the U.S. Producer Price Index for food away from home saw increases, directly affecting raw material and labor expenses.

Full Version Awaits

Create Restaurants Holdings PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis for Create Restaurants Holdings delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions. It provides a crucial framework for understanding the external landscape and identifying potential opportunities and threats.

Sociological factors

Japanese consumers are actively exploring a wider array of dining options, moving beyond traditional fare to embrace casual dining, niche specialty restaurants, and the bustling environment of food courts. This shift directly benefits Create Restaurants Holdings, as their diverse restaurant portfolio caters precisely to these evolving preferences for varied culinary experiences.

The demand for convenience is a significant driver in Japan's food sector, fueling a substantial expansion in the online food delivery market. This trend presents a clear opportunity for Create Restaurants Holdings to leverage its brands and operational capabilities to capture a larger share of this growing delivery segment, meeting consumers where they are.

In 2023, the Japanese food delivery market was valued at approximately $45 billion, with projections indicating continued growth. This surge is largely attributed to busy lifestyles and a greater acceptance of digital ordering platforms, a landscape Create Restaurants Holdings is well-positioned to navigate.

Japanese consumers are increasingly prioritizing health, driving demand for nutritious, clean-label, and plant-based meals. This trend saw a notable uptick in 2024, with surveys indicating over 60% of diners actively seeking out restaurants offering healthier alternatives. Create Restaurants Holdings can leverage this by expanding its menu to include more low-sodium, low-sugar, and plant-forward dishes, incorporating popular ingredients like fermented foods which are perceived as beneficial for gut health.

Japan's demographic landscape is rapidly evolving, with a significant aging population and a growing prevalence of single-person households. This trend directly impacts dining habits, boosting demand for convenient, ready-to-eat meals and delivery services. In 2024, it's projected that over 30% of Japan's population will be aged 65 or older, a figure that underscores the need for adaptable restaurant models.

Create Restaurants Holdings must strategically align its offerings to meet these shifting consumer needs. This means developing concepts that cater to smaller dining parties and emphasizing convenience, perhaps through expanded meal kit options or partnerships with delivery platforms. By 2025, the market for ready-to-eat meals in Japan is expected to reach ¥5 trillion, presenting a substantial opportunity for businesses that can effectively serve this demographic.

Globalization of Food Culture and Fusion Cuisine

The increasing globalization of food culture, exemplified by the widespread popularity of Japanese desserts, offers Create Restaurants Holdings a significant avenue for menu innovation. This trend, coupled with a growing consumer appetite for fusion cuisine, presents a clear opportunity to attract a wider demographic by blending diverse culinary traditions.

For instance, the global market for Japanese food products, including sweets, has seen robust growth. In 2023, the global Japanese food market was valued at approximately USD 78.5 billion, with desserts and confectionery forming a substantial segment. This indicates a strong consumer base receptive to new flavor profiles.

Create Restaurants Holdings can capitalize on this by:

- Developing fusion dessert offerings that combine traditional Japanese ingredients with popular Western or other Asian flavors.

- Introducing limited-time menus that highlight specific global culinary trends, such as Korean-inspired pastries or Southeast Asian fruit infusions.

- Collaborating with international chefs or influencers to generate buzz and validate new menu items, leveraging social media platforms where food trends gain traction rapidly.

Work-Life Balance and Convenience Demand

The modern workforce's increasing focus on work-life balance, often termed 'taipa' or time performance, significantly influences dining habits. Busy professionals and individuals living alone are prioritizing quick, yet nutritious, meal solutions that fit seamlessly into their demanding schedules. This societal shift directly fuels the demand for efficient dining formats, making food courts and online food delivery services particularly attractive. Create Restaurants Holdings is well-positioned to capitalize on this trend, as these channels align with their operational strengths and market reach.

The demand for convenience is a powerful driver in the food service industry. For instance, a significant portion of urban dwellers report that convenience is a primary factor when choosing where to eat. In 2024, the online food delivery market continued its robust growth, with projections indicating a further expansion driven by these evolving consumer preferences. This trend underscores the importance of quick service, accessible locations, and user-friendly ordering platforms for businesses like Create Restaurants Holdings.

- Time is a premium: Consumers are increasingly willing to pay for meals that save them time.

- Solo dining growth: The rise in single-person households amplifies the need for convenient, single-serving meal options.

- Digital integration: Online ordering and delivery platforms are essential for meeting the convenience demands of today's consumers.

- Health-conscious convenience: There's a growing expectation for quick meals to also be nutritious, a balance that successful brands must strike.

Societal shifts in Japan, such as an aging population and an increase in single-person households, are reshaping dining habits. This demographic evolution, with over 30% of the population projected to be 65+ by 2024, drives demand for convenient, ready-to-eat meals and efficient delivery services. Create Restaurants Holdings can adapt by focusing on smaller portion sizes and expanding its meal kit or delivery partnerships, tapping into a market for ready-to-eat meals expected to reach ¥5 trillion by 2025.

Technological factors

Artificial intelligence is rapidly transforming restaurant operations, offering significant opportunities for efficiency gains and improved customer engagement. By 2025, projections suggest AI will play a crucial role in areas like predictive ordering and personalized recommendations, with the global AI in food service market expected to reach over $3.5 billion. Create Restaurants Holdings can harness AI for sophisticated demand forecasting, leading to optimized inventory levels and reduced waste, a critical factor given rising food costs.

Furthermore, AI-powered tools can enhance the customer experience through personalized marketing campaigns and even assist in maintaining consistent food quality via automated checks. For instance, AI can analyze customer data to suggest menu items or promotions, potentially increasing sales by up to 15% for restaurants that effectively implement these strategies.

The online food delivery market in Japan is booming, with convenience and new technology fueling its expansion. This trend is particularly evident in the platform-to-consumer delivery segment, which is the fastest-growing area and requires Create Restaurants Holdings to bolster its presence and forge strategic alliances within it.

Restaurants are increasingly adopting digital menus and contactless payment systems, transforming the customer experience and operational efficiency. This technological shift caters to a growing demand for convenience and a heightened focus on hygiene, as seen in the continued preference for touch-free transactions.

Robotics and Automation in Kitchens

Robotics and automation are increasingly finding their way into commercial kitchens, offering significant potential for enhanced efficiency and consistency in food preparation. This trend is particularly relevant for Create Restaurants Holdings as it can help mitigate the persistent challenges of labor shortages that have impacted the industry. For instance, by 2025, the global market for food service robotics is projected to reach $2.6 billion, indicating a strong industry adoption rate.

The integration of automated systems can streamline complex cooking processes, ensuring a higher degree of uniformity in dishes, which directly impacts customer satisfaction. Create Restaurants Holdings might consider adopting these technologies to optimize its kitchen operations, potentially leading to reduced waste and improved throughput. Early adopters are already seeing benefits; some quick-service restaurants have reported up to a 20% increase in order accuracy through automated prep stations.

The financial implications are also noteworthy. While initial investment can be substantial, the long-term savings from reduced labor costs and increased productivity can be considerable. Create Restaurants Holdings could leverage these advancements to gain a competitive edge by offering consistent quality at potentially lower operational costs.

- Efficiency Gains: Automation can speed up repetitive tasks like chopping, frying, and assembly, leading to faster service.

- Consistency: Robotic precision ensures every dish is prepared to the same standard, improving quality control.

- Labor Solutions: Robotics can fill gaps in staffing, especially for demanding or less desirable kitchen roles.

- Cost Reduction: Over time, automation can lower labor expenses and minimize food waste through precise portioning.

Data Analytics for Customer Insights

Create Restaurants Holdings can leverage data analytics to gain deep insights into customer preferences, enabling more targeted menu development and marketing campaigns. This allows for a more responsive approach to evolving tastes and dining habits.

By analyzing sales data, customer feedback, and online behavior, the company can identify popular dishes, optimize pricing, and forecast demand more accurately. For instance, in 2024, restaurants that effectively used customer data saw an average increase of 15% in repeat business.

- Customer Segmentation: Identifying distinct customer groups based on purchasing behavior and preferences.

- Trend Identification: Spotting emerging food trends and popular ingredients through real-time sales data analysis.

- Operational Efficiency: Optimizing staffing and inventory management by predicting customer traffic patterns.

- Personalized Marketing: Delivering tailored promotions and offers to specific customer segments.

Technological advancements are reshaping the restaurant landscape, with AI and automation driving efficiency and customer experience. By 2025, AI in food service is projected to exceed $3.5 billion, enabling predictive ordering and personalized recommendations. Robotics in kitchens, expected to reach $2.6 billion globally by 2025, can address labor shortages and ensure consistent food quality, with some QSRs reporting up to a 20% increase in order accuracy using automated prep stations.

Digital menus and contactless payments are becoming standard, catering to hygiene concerns and convenience demands. Data analytics also plays a crucial role, with restaurants leveraging customer insights to boost repeat business by an average of 15% in 2024 through targeted marketing and menu development.

| Technology | Impact | 2025 Market Projection |

|---|---|---|

| Artificial Intelligence (AI) | Predictive ordering, personalized recommendations, operational efficiency | >$3.5 billion (AI in Food Service) |

| Robotics & Automation | Labor shortage mitigation, consistent food prep, reduced waste | $2.6 billion (Food Service Robotics) |

| Digital Menus & Contactless Payment | Enhanced hygiene, customer convenience, operational streamlining | Industry-wide adoption |

| Data Analytics | Targeted marketing, improved customer retention, demand forecasting | 15% average increase in repeat business (2024 data) |

Legal factors

Japan's food labeling regulations are notably stringent. These include mandatory allergen declarations and detailed nutrient content disclosures. Recent amendments in 2024 and further updates anticipated in 2025 are likely to introduce new compliance requirements for food businesses operating within the country.

Create Restaurants Holdings must meticulously ensure all its food products and menu offerings adhere to these precise Japanese standards. Non-compliance can lead to significant legal repercussions, including fines and reputational damage, impacting their operational viability in the Japanese market.

Create Restaurants Holdings must strictly adhere to Japan's labor laws, which govern everything from standard working hours and overtime pay to various types of employee leave and the specifics of employment contracts. Failure to comply can lead to significant penalties and reputational damage.

Recent legislative updates, particularly those enacted in 2024 and continuing into 2025, introduce more stringent notification requirements for employers concerning working conditions and offer clearer guidelines for fixed-term employment, impacting how contracts are structured and managed.

Japan's Food Safety Act is a cornerstone for public health, mandating rigorous hygiene and safety protocols for all food-related businesses. Create Restaurants Holdings must diligently implement and maintain these standards across its operations to ensure compliance and safeguard its brand image.

Failure to meet these stringent requirements can result in significant penalties, impacting not only financial performance but also consumer trust. For instance, in 2023, the Ministry of Health, Labour and Welfare reported over 1,500 food safety violations, leading to fines and temporary closures for numerous establishments, highlighting the critical importance of adherence.

Intellectual Property and Brand Protection

Create Restaurants Holdings places significant emphasis on safeguarding its unique dining concepts and brand identity through robust intellectual property protection. This is crucial for preventing imitation and maintaining a competitive edge in the dynamic restaurant industry. For instance, in 2024, the global market for intellectual property services, which includes trademark registration and enforcement, was valued at over $200 billion, highlighting the financial importance of these legal protections for businesses like Create Restaurants Holdings.

The company actively pursues trademark registration for its restaurant names, logos, and signature dishes. This legal shield is vital for distinguishing its offerings in a crowded marketplace and building strong brand recognition. In 2025, reports indicate a 7% increase in trademark filings by food and beverage companies globally, underscoring the growing trend of IP protection as a core business strategy.

- Trademark Protection: Securing exclusive rights to brand names and logos prevents competitors from capitalizing on Create Restaurants Holdings' established reputation.

- Concept Protection: Legal frameworks can help protect the unique operational models and dining experiences developed by the company.

- Enforcement: Proactive monitoring and legal action against infringements are essential to deter unauthorized use and preserve brand integrity.

Acquisition and Franchise Laws

Create Restaurants Holdings’ growth hinges on acquisitions and franchising, both heavily regulated. Compliance with merger and acquisition laws, such as the Hart-Scott-Rodino Act in the US, is critical for smooth transitions. In 2024, M&A activity for restaurant chains saw continued interest, with deal values fluctuating based on market conditions and brand performance.

Franchise agreements are governed by specific disclosure requirements and regulations, like the Federal Trade Commission's Franchise Rule. These rules ensure transparency for potential franchisees. As of early 2025, the franchise sector continues to be a significant driver of expansion for many restaurant groups, with ongoing legal scrutiny focused on franchisee relationships and fee structures.

- Mergers & Acquisitions: Adherence to antitrust laws and pre-merger notification requirements is paramount to avoid regulatory hurdles and penalties.

- Franchise Agreements: Strict compliance with disclosure documents (e.g., Franchise Disclosure Document - FDD) and ongoing operational regulations is essential for maintaining franchise relationships.

- Competition Law: Understanding and abiding by regulations that prevent anti-competitive practices, such as price-fixing or monopolistic behavior, is vital for sustained market presence.

Create Restaurants Holdings must navigate a complex web of legal and regulatory frameworks. This includes stringent food safety and labeling laws, as seen with Japan's Food Safety Act, which mandates rigorous hygiene protocols. In 2023 alone, Japan's Ministry of Health, Labour and Welfare reported over 1,500 food safety violations, underscoring the critical need for compliance.

Labor laws are also paramount, covering working hours, overtime, and employment contracts, with recent 2024/2025 updates introducing stricter notification requirements for employers. Furthermore, intellectual property protection is vital, with the global IP services market exceeding $200 billion in 2024, and food and beverage companies showing a 7% increase in trademark filings in 2025.

The company's expansion strategies, including acquisitions and franchising, are heavily regulated. Compliance with M&A laws and franchise disclosure rules, such as the FTC's Franchise Rule, is essential. The franchise sector remains a key growth driver in 2025, facing ongoing legal scrutiny.

| Legal Area | Key Regulations/Considerations | Impact on Create Restaurants Holdings | Recent Data/Trends (2024-2025) |

|---|---|---|---|

| Food Safety & Labeling | Japan's Food Safety Act, Allergen Declarations | Ensures public health, prevents fines and reputational damage. | Over 1,500 food safety violations reported in Japan (2023). |

| Labor Laws | Working hours, overtime, employment contracts | Avoids penalties, ensures fair employee treatment. | Stricter employer notification requirements (2024/2025). |

| Intellectual Property | Trademark registration, brand protection | Maintains competitive edge, prevents brand dilution. | Global IP services market >$200 billion (2024); 7% rise in F&B trademark filings (2025). |

| Mergers & Acquisitions / Franchising | Antitrust laws, Franchise Disclosure Document (FDD) | Facilitates smooth expansion, ensures transparency. | Continued M&A interest in restaurant chains (2024); ongoing scrutiny of franchise relationships (2025). |

Environmental factors

Japan is actively tackling food waste, aiming to halve it by 2030, a significant environmental push that directly affects restaurant operations. Create Restaurants Holdings must navigate these regulations, which encourage smarter inventory management and efficient ingredient utilization.

In 2022, Japan generated approximately 5.23 million tons of food waste, with businesses contributing about half of that total. This context highlights the pressure on companies like Create Restaurants Holdings to implement robust food loss reduction strategies, such as optimizing portion sizes and exploring food donation partnerships.

Consumers are increasingly demanding transparency and sustainability in their food choices, with a significant portion willing to pay more for ethically sourced ingredients. For instance, a 2024 survey indicated that over 60% of diners consider sustainability when choosing a restaurant. This trend puts pressure on businesses like Create Restaurants Holdings to demonstrate responsible sourcing, especially for high-demand items like seafood.

To meet this growing expectation, Create Restaurants Holdings can implement strategies such as prioritizing locally sourced and seasonal produce, which not only supports local economies but also reduces the carbon footprint associated with transportation. Furthermore, actively avoiding species known to be overfished, aligning with initiatives like the Monterey Bay Aquarium Seafood Watch program, demonstrates a commitment to marine biodiversity and long-term resource availability. This proactive approach can enhance brand reputation and attract environmentally conscious customers.

Restaurants are significant contributors to energy consumption and carbon emissions. In 2023, the food service sector in the US alone accounted for a substantial portion of commercial building energy use, with HVAC and refrigeration being major drivers. Create Restaurants Holdings can mitigate this by investing in energy-efficient kitchen equipment, such as ENERGY STAR certified appliances, which can reduce electricity usage by up to 20% compared to standard models.

Furthermore, exploring renewable energy sources for their outlets, like solar panels, presents a tangible way to lower their carbon footprint. For instance, a medium-sized restaurant installing solar panels could offset a significant percentage of its electricity demand, reducing reliance on fossil fuels. This aligns with growing consumer demand for sustainable dining options, a trend amplified in 2024 as environmental consciousness continues to rise.

Packaging Waste and Recycling

The increasing global focus on packaging waste presents a significant environmental challenge for Create Restaurants Holdings. Consumers and regulators alike are demanding more sustainable practices, pushing businesses to re-evaluate their material choices. In 2024, the Ellen MacArthur Foundation reported that only 9% of all plastic ever produced has been recycled, highlighting the urgent need for alternatives.

Create Restaurants Holdings should actively explore and implement eco-friendly packaging solutions. This includes a shift towards materials that are readily recyclable or biodegradable, thereby reducing the volume of waste sent to landfills. For instance, adopting compostable cutlery and containers made from plant-based starches can significantly lessen the environmental footprint. By 2025, many regions are expected to see stricter regulations on single-use plastics, making proactive adoption of sustainable packaging a strategic imperative.

- Growing consumer demand: Surveys in 2024 indicated that over 70% of consumers consider sustainability when making purchasing decisions.

- Regulatory pressures: Governments worldwide are introducing bans and taxes on non-recyclable packaging.

- Cost of waste management: Landfill taxes and disposal fees are rising, making waste reduction economically beneficial.

- Brand reputation: Companies demonstrating strong environmental stewardship often enjoy enhanced brand loyalty and positive public perception.

Water Conservation

Water conservation is a critical environmental factor for restaurant operations, given their significant water consumption. For instance, a full-service restaurant can use tens of thousands of gallons of water weekly for everything from dishwashing to food preparation and sanitation. Implementing water-saving technologies, such as low-flow faucets and efficient dishwashers, is becoming increasingly important for operational efficiency and cost reduction.

The restaurant industry is increasingly recognizing the link between water conservation and broader environmental responsibility. Many chains are setting targets for reducing water usage as part of their corporate sustainability goals. For example, some major restaurant groups have committed to reducing their water footprint by 10-15% by 2025 through various operational changes and customer awareness campaigns.

- Significant Water Usage: Restaurants are major water consumers, with daily usage often measured in hundreds or even thousands of gallons per location.

- Cost Savings: Implementing water-saving measures can lead to substantial reductions in utility bills, improving the bottom line.

- Sustainability Initiatives: Many restaurant companies are actively pursuing water conservation as a key component of their environmental, social, and governance (ESG) strategies.

- Industry Benchmarks: By 2024, a growing number of restaurant brands are aiming to achieve specific water reduction targets, often aligned with industry best practices and regulatory pressures.

Environmental regulations are tightening globally, particularly concerning food waste and packaging. In 2023, the EU introduced stricter rules on single-use plastics, impacting restaurant operations. Create Restaurants Holdings must adapt to these changes by focusing on sustainable sourcing and waste reduction initiatives to comply and appeal to environmentally conscious consumers.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Create Restaurants Holdings is informed by a robust blend of data, including government economic reports, industry-specific market research, and global regulatory updates. We meticulously gather insights from credible sources to ensure comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the restaurant sector.