Create Restaurants Holdings Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Create Restaurants Holdings Bundle

Create Restaurants Holdings navigates a competitive landscape shaped by intense rivalry and the constant threat of new entrants. Understanding the power of their suppliers and the bargaining power of their customers is crucial for sustained success.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Create Restaurants Holdings’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The concentration of suppliers for essential, high-quality Japanese ingredients, such as sushi-grade fish and specialized rice, grants these suppliers considerable bargaining power. For instance, in 2024, the global market for premium seafood, a key component for sushi, saw price increases driven by factors like reduced catch volumes and increased demand from high-end restaurants, directly impacting sourcing costs for businesses like Create Restaurants Holdings.

Input cost volatility significantly impacts Create Restaurants Holdings, particularly within the Japanese food service sector. Rising prices for essential ingredients like rice, coupled with broader inflationary trends observed throughout 2024, put pressure on restaurant operators.

This heightened volatility in raw material costs can translate directly into increased bargaining power for suppliers. When suppliers face their own cost increases, they are more likely to pass these onto their customers, such as Create Restaurants Holdings, potentially squeezing profit margins.

The threat of suppliers engaging in forward integration, meaning they start their own restaurant operations, is a factor that could shift bargaining power. While not a widespread issue in the restaurant sector, if a key supplier for Create Restaurants Holdings were to launch its own branded food service, it would significantly enhance its leverage.

For Create Restaurants Holdings, this particular threat is typically considered low. However, a supplier providing highly specialized ingredients or unique food concepts might possess the capability and incentive to pursue such a strategy, thereby increasing their influence over Create Restaurants Holdings.

Importance of Supplier's Input to the Industry

For Create Restaurants Holdings, the significance of a single supplier's contribution can fluctuate across its varied restaurant concepts. However, for establishments relying on specialized or premium ingredients, a supplier's input becomes paramount, amplifying their leverage.

The ongoing challenges within Japan's logistics sector, exemplified by the 2024 trucking industry issues leading to workforce shortages and operational snags, underscore the fragility of supply chains. This situation can significantly bolster supplier bargaining power, driven by escalating delivery expenses and potential delays.

- Critical Ingredients: For niche or high-end dining, suppliers of unique produce or specialty meats hold considerable sway.

- Supply Chain Disruptions: Events like Japan's 2024 trucking labor shortage directly increase logistics costs and lead times for all food service providers.

- Supplier Dependence: If Create Restaurants Holdings cannot easily substitute a particular supplier's goods, that supplier's bargaining power increases.

Switching Costs for Create Restaurants Holdings

Switching costs for Create Restaurants Holdings can be significant, impacting their bargaining power with suppliers. Finding new suppliers that consistently meet the company's stringent quality standards for ingredients and operational supplies requires thorough vetting and testing. For instance, a shift in produce suppliers might necessitate menu adjustments to accommodate seasonal availability or different product characteristics, adding complexity and potential cost. Re-negotiating contracts with new vendors also involves time and resources, further elevating these switching costs.

The level of these switching costs directly influences supplier power. If it’s difficult and expensive for Create Restaurants Holdings to change suppliers, existing suppliers gain leverage, potentially leading to higher prices or less favorable terms. Conversely, a robust network of readily available alternative suppliers, capable of meeting quality and volume requirements, would diminish supplier bargaining power. For example, in 2024, the food service industry saw increased volatility in ingredient sourcing, making supplier diversification a key strategy for restaurant chains to mitigate risks and maintain competitive pricing.

Consider these factors influencing Create Restaurants Holdings' switching costs:

- Supplier Qualification: The time and resources spent identifying, auditing, and approving new suppliers for key ingredients like specialty meats or unique produce.

- Menu Adaptation: Costs associated with reformulating recipes or adjusting menu offerings due to changes in ingredient availability or quality from a new supplier.

- Contractual Obligations: Potential penalties or fees incurred if existing supply contracts are terminated early, alongside the legal and administrative effort of establishing new agreements.

- Operational Integration: The expense of training staff on new product handling, storage, or preparation methods required by a different supplier's offerings.

The bargaining power of suppliers for Create Restaurants Holdings is influenced by the concentration of suppliers for critical, high-quality ingredients, such as sushi-grade fish and specialized rice. In 2024, global premium seafood markets experienced price hikes due to reduced catches and increased demand, directly impacting sourcing costs.

Input cost volatility, exemplified by rising rice prices and general inflation in 2024, empowers suppliers. When suppliers face their own cost increases, they are more likely to pass these onto Create Restaurants Holdings, potentially squeezing profit margins.

Switching costs for Create Restaurants Holdings are significant, involving supplier qualification, menu adaptation, and contractual obligations. For instance, the time and resources spent approving new suppliers for specialty meats can be substantial, amplifying existing supplier leverage.

| Factor | Impact on Supplier Bargaining Power | Example (2024 Context) |

|---|---|---|

| Supplier Concentration | High | Limited suppliers for premium Japanese ingredients |

| Input Cost Volatility | High | Rising rice prices and general inflation |

| Switching Costs | High | Supplier qualification and menu adaptation |

| Logistics Disruptions | Moderate to High | Japan's 2024 trucking labor shortages |

What is included in the product

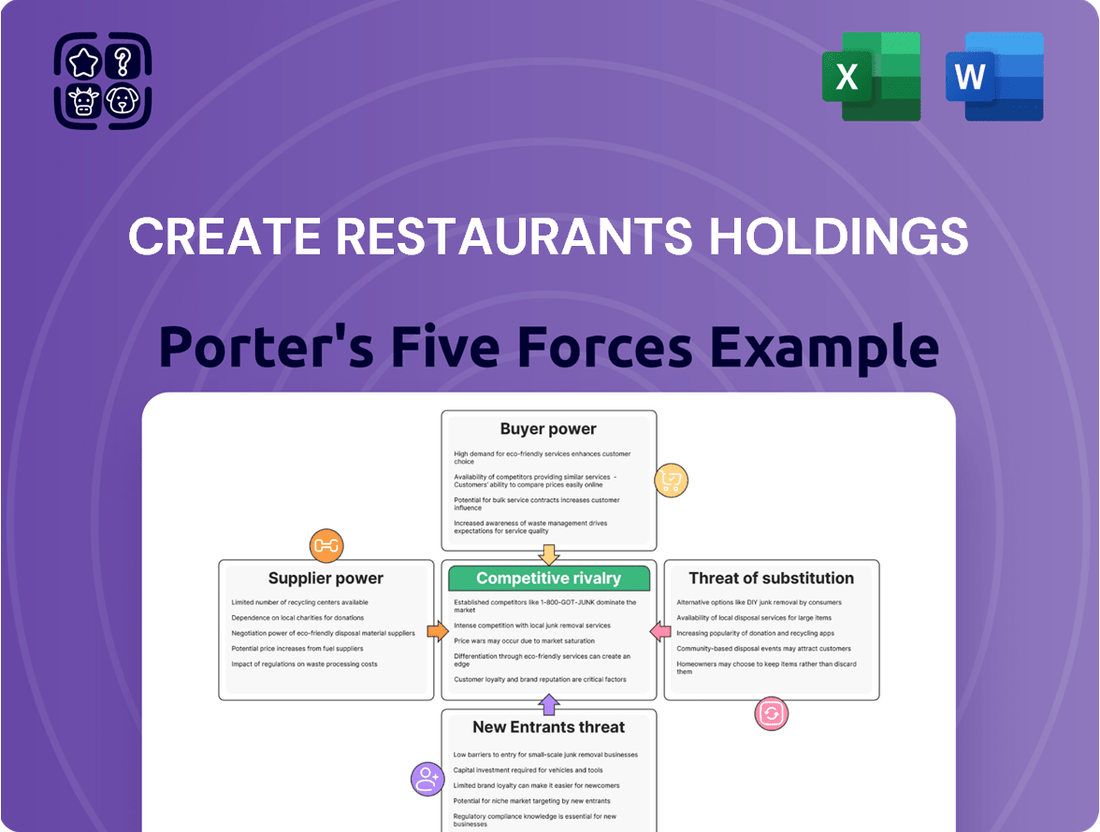

This analysis meticulously examines the five forces impacting Create Restaurants Holdings, revealing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes.

Instantly identify and strategize against competitive pressures with a visual, easy-to-understand breakdown of Create Restaurants Holdings' five forces.

Customers Bargaining Power

Japanese consumers are increasingly feeling the pinch of inflation, especially with rising costs for food and energy. This heightened price sensitivity means they are more likely to scrutinize menu prices and seek out the best value. For Create Restaurants Holdings, this dynamic is crucial; in 2024, persistent inflation continued to impact household budgets across Japan.

Create Restaurants Holdings' strategy of offering a diverse range of dining concepts, from affordable casual eateries to more upscale specialty restaurants, is well-suited to address this. This allows them to cater to a broad customer base with varying budgets, making them less vulnerable to a single segment's price sensitivity. For instance, their more accessible brands can absorb some of the inflationary pressure by offering competitive pricing.

To further combat customer price sensitivity in 2024, the company can leverage value-driven promotions and robust loyalty programs. Offering special deals, set menus, or rewarding repeat customers through points systems can encourage continued patronage even when consumers are more budget-conscious. These initiatives help build customer loyalty and provide tangible reasons for customers to choose their establishments over competitors.

The Japanese food service market is incredibly diverse, presenting customers with a vast array of dining choices. This includes not only other Japanese restaurants but also a wide range of international cuisines, fast-casual eateries, and even the convenience of meal delivery services and home cooking. In 2024, the sheer volume of options available means customers can easily switch providers if they find better value or a more appealing offering elsewhere, significantly amplifying their bargaining power.

The proliferation of quick-service restaurants (QSRs), the growing popularity of cloud kitchens preparing food for delivery only, and the increasing appeal of fusion cuisine all contribute to a landscape rich with alternatives. For a company like Create Restaurants Holdings, this means customers have many readily available substitutes. For instance, the Japanese QSR market alone saw significant growth in 2024, with many chains expanding their menus and reach, directly challenging traditional sit-down restaurants and increasing customer leverage.

Customers today possess unprecedented access to information. Online reviews, social media buzz, and the sheer volume of data on food delivery platforms empower diners to meticulously compare not just prices, but also the quality of ingredients, service, and the overall dining atmosphere. This heightened transparency directly translates into increased bargaining power for consumers.

For instance, in 2024, platforms like Yelp and Google Reviews showcase millions of user-generated insights, with a significant percentage of diners actively consulting these before making a reservation. This ease of comparison means customers can readily identify restaurants offering better value or a superior experience, making them more inclined to switch providers if their expectations aren't met, thereby intensifying competitive pressure on restaurants.

Customer Concentration and Volume

Create Restaurants Holdings benefits from a diverse customer base spread across numerous locations and distinct brands. This broad reach means that no single customer, or even a small cluster of customers, possesses substantial leverage to dictate terms or prices. In 2024, the company reported serving millions of customers annually across its portfolio, underscoring this wide distribution.

The decentralized nature of Create Restaurants Holdings' customer engagement significantly dilutes the bargaining power of any individual customer. Because transactions are typically small and numerous, the ability of any one customer to influence pricing or terms is minimal.

- Widespread Customer Base: Millions of individual customers served annually across various brands and locations.

- Low Individual Transaction Volume: Each customer's purchase is typically small relative to overall revenue.

- Reduced Buyer Power: No single customer or small group can exert significant pressure on pricing or terms.

Threat of Backward Integration by Customers

The threat of customers pursuing backward integration, such as preparing meals at home, is a significant consideration for Create Restaurants Holdings. This trend has been amplified by the growing popularity of meal kits and a sustained increase in home cooking habits observed since the pandemic. For instance, the global meal kit delivery service market was valued at approximately USD 15.2 billion in 2023 and is projected to grow significantly, indicating a strong consumer interest in at-home food preparation.

To effectively counter this threat, Create Restaurants Holdings must focus on delivering superior and unique dining experiences that cannot be easily replicated at home. This involves innovating the menu, enhancing the ambiance, and providing exceptional service. The company's ability to offer value beyond just the food itself is crucial. For example, in 2024, many successful restaurant chains are investing in experiential dining, such as interactive cooking classes or themed events, to differentiate themselves.

- Customer Integration Threat: The rise of meal kits and increased home cooking post-pandemic presents a direct threat of backward integration by customers.

- Market Data: The global meal kit delivery market was valued at around USD 15.2 billion in 2023, highlighting consumer engagement with at-home food solutions.

- Competitive Response: Create Restaurants Holdings must offer compelling dining experiences and value propositions to retain customers against home-based alternatives.

- Industry Trend: Investing in experiential dining and unique service offerings is a key strategy for restaurants to combat customer substitution in 2024.

The bargaining power of customers for Create Restaurants Holdings is moderate, influenced by a highly competitive market with numerous alternatives and increasing price sensitivity due to inflation. In 2024, Japanese consumers faced ongoing inflationary pressures, making them more discerning about dining expenditures.

While Create Restaurants Holdings benefits from a broad customer base, reducing the leverage of any single buyer, the ease with which customers can switch to competitors or opt for home-prepared meals remains a significant factor. The company's diversified brand portfolio helps mitigate this, but the sheer volume of dining options available in 2024 means customers hold considerable sway.

The accessibility of information through online reviews and social media further empowers customers, enabling them to easily compare offerings and value. This transparency intensifies the need for Create Restaurants Holdings to consistently deliver superior experiences and value propositions to retain its customer base against a backdrop of readily available substitutes and a growing trend towards home dining solutions.

| Factor | Impact on Create Restaurants Holdings | 2024 Relevance |

|---|---|---|

| Price Sensitivity | High | Persistent inflation increased consumer focus on value. |

| Availability of Substitutes | High | Diverse food service market and rise of home cooking options. |

| Information Accessibility | High | Online reviews and social media empower informed customer choices. |

| Customer Concentration | Low | Millions of individual customers dilute individual bargaining power. |

| Threat of Backward Integration | Moderate | Growing meal kit market and home cooking trends. |

What You See Is What You Get

Create Restaurants Holdings Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces Analysis for Create Restaurants Holdings, offering a detailed examination of industry competition, buyer and supplier power, threat of new entrants, and substitute products. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy. This comprehensive analysis is meticulously crafted to provide actionable insights into the strategic landscape of the restaurant sector.

Rivalry Among Competitors

The Japanese foodservice market is incredibly fragmented, featuring a massive number of local and international companies. This diversity means Create Restaurants Holdings faces competition from many different types of restaurants, from small, independent eateries to large global chains.

Create Restaurants Holdings itself operates a substantial portfolio, boasting around 230 brands and over 1,100 outlets. This extensive presence means the company is not just competing against external players but also indirectly against its own brands across various market segments, intensifying the rivalry.

The Japan foodservice market is experiencing robust growth, with projections indicating a compound annual growth rate of 10.29% between 2025 and 2033. This expansion presents significant opportunities for businesses within the sector.

However, this promising growth also fuels competitive rivalry. As the market expands, it naturally attracts new entrants and encourages existing players to increase their efforts to capture a larger share, intensifying the competition for Create Restaurants Holdings.

Create Restaurants Holdings actively cultivates differentiation through its diverse portfolio of unique dining concepts and a strategic multi-brand approach. This focus on distinct culinary experiences aims to foster robust brand loyalty, a key factor in weathering intense market competition.

In 2024, the restaurant industry continues to see consumers seeking novel and memorable dining experiences, making differentiation a critical success driver. For instance, a competitor like Bloomin' Brands, with its varied concepts such as Outback Steakhouse and Carrabba's Italian Grill, demonstrates the power of a multi-brand strategy in capturing different market segments and building loyalty across its offerings.

Exit Barriers

Create Restaurants Holdings faces intensified competition due to high exit barriers. Significant investments in restaurant properties, kitchen equipment, and specialized staff create substantial fixed costs. These assets are not easily liquidated, making it difficult for struggling businesses to exit the market gracefully.

The restaurant industry, in general, exhibits moderate to high exit barriers. Long-term lease agreements for prime locations further lock in operators, even when facing financial difficulties. This can lead to a situation where underperforming restaurants remain operational, continuing to vie for market share and customer attention.

- High Fixed Asset Investment: Restaurants require substantial capital for real estate, renovations, and kitchen equipment, often running into hundreds of thousands or even millions of dollars per location.

- Specialized Workforce: The industry relies on a skilled workforce, including chefs and experienced service staff, whose expertise may not be easily transferable, increasing the cost and difficulty of staff layoffs.

- Long-Term Leases: Many restaurant leases are for 5-10 years or more, obligating operators to ongoing rental payments even if the business is not profitable.

Strategic Alliances and Acquisitions

Create Restaurants Holdings actively pursues strategic alliances and acquisitions to bolster its competitive standing. A prime example is its comprehensive business alliance with JA ZEN-NOH, which significantly expands its operational reach and market influence within Japan.

This strategic move is central to its competitive strategy in the Japanese restaurant sector. By integrating with JA ZEN-NOH, Create Restaurants Holdings aims to secure greater market share and unlock valuable operational synergies.

The company's M&A activities are not just about growth; they are about building a more robust and integrated business model. This approach is crucial for navigating the dynamic competitive landscape.

- Strategic Alliance: Partnership with JA ZEN-NOH for market expansion.

- M&A Focus: Key strategy for gaining market share in Japan.

- Synergy Goals: Aiming for operational efficiencies and enhanced market position.

The Japanese foodservice market's fragmentation, with numerous local and international players, means Create Restaurants Holdings faces intense competition. Its own extensive portfolio of around 230 brands and over 1,100 outlets also creates internal rivalry, intensifying the battle for market share.

The robust growth projected for the Japan foodservice market, with an estimated 10.29% CAGR between 2025 and 2033, attracts new entrants and spurs existing companies to expand, heightening competitive pressures. Create Restaurants Holdings counters this by focusing on differentiation through unique dining concepts and a multi-brand strategy, aiming to cultivate strong customer loyalty.

High exit barriers, such as significant fixed asset investments in properties and equipment, coupled with long-term lease agreements, keep even struggling competitors in the market. This persistence from existing players, alongside the continuous influx of new ones drawn by market growth, ensures competitive rivalry remains a defining characteristic for Create Restaurants Holdings.

SSubstitutes Threaten

The threat of substitutes for Create Restaurants Holdings is significant, primarily stemming from the sheer volume and variety of dining options available in Japan. Consumers have a wide array of choices, from quick-service fast-food chains to casual and fine-dining establishments, cafes, and bars, all competing for the same customer spending.

This abundance means that if Create Restaurants Holdings' pricing becomes less attractive or their offerings fail to meet evolving consumer preferences, customers can easily switch to alternatives. For instance, in 2024, the Japanese food service industry saw continued growth, with the casual dining segment alone accounting for a substantial portion of the market, indicating strong competition from similar substitutes.

The rising popularity of home cooking and meal preparation presents a significant threat of substitutes for restaurants. Consumers are increasingly turning to preparing meals at home, fueled by a greater emphasis on health and wellness. This trend is amplified by the widespread availability of meal kits and an abundance of online recipes, making it easier than ever for individuals to create restaurant-quality dishes in their own kitchens.

The emergence of a 'new home cooking style' further solidifies this threat. This approach often highlights the health benefits of home-prepared meals and incorporates a social or communicative aspect, turning cooking into a shared experience. For instance, a 2023 survey indicated that 65% of consumers reported cooking at home more frequently than they did before 2020, a substantial shift impacting the dining-out market.

The proliferation of food delivery platforms and the rise of cloud kitchens present a significant threat to traditional dine-in restaurants like Create Restaurants Holdings. Consumers now have an unprecedented level of convenience, with a vast array of culinary options readily available for home delivery, directly competing with the in-restaurant dining experience.

In 2024, the global online food delivery market was valued at an estimated $200 billion, showcasing the immense scale of this substitution. This trend is expected to continue growing, further eroding market share from establishments that do not adapt to or integrate with these digital channels.

Ready-to-Eat Meals and Convenience Store Options

The demand for convenient, ready-to-eat meals from convenience stores and supermarkets poses a significant threat. These options are often low-cost and easily accessible, directly competing with restaurant offerings for consumers seeking quick dining solutions. For instance, the global ready-to-eat meal market was valued at approximately $177.6 billion in 2023 and is projected to reach $274.5 billion by 2030, highlighting the substantial consumer shift towards convenience.

This accessibility means consumers can bypass the traditional restaurant experience for immediate gratification. In 2024, convenience stores continued to expand their food service offerings, with many reporting increased sales in their prepared food sections. This trend underscores the growing preference for meals that require minimal preparation, directly impacting casual dining establishments like those under Create Restaurants Holdings.

- Convenience Store Market Growth: The convenience store sector saw a notable increase in sales of prepared foods in 2024, driven by consumer demand for quick and accessible meal solutions.

- Low-Cost Alternative: Ready-to-eat meals from supermarkets and convenience stores offer a price-sensitive alternative to dining out, attracting budget-conscious consumers.

- Market Size: The global ready-to-eat meal market's significant valuation and projected growth indicate a strong and expanding consumer preference for convenience.

- Consumer Behavior Shift: An ongoing shift in consumer behavior favors immediate consumption and minimal preparation, directly challenging traditional restaurant models.

Changing Consumer Preferences

Changing consumer preferences represent a significant threat of substitutes for Create Restaurants Holdings. Evolving tastes, such as a growing demand for health-conscious meals, plant-based alternatives, and unique dining experiences, can divert customers from traditional restaurant fare. For instance, the global plant-based food market was valued at approximately $27 billion in 2023 and is projected to grow substantially, indicating a clear shift in consumer choices.

Create Restaurants Holdings must agilely adapt its diverse brand portfolio to align with these emerging trends. Failure to innovate and cater to evolving consumer demands, like the increasing interest in sustainable sourcing and personalized dining options, could lead to a decline in market share as consumers opt for substitutes like meal kit services or specialized dietary restaurants. In 2024, the restaurant industry saw continued investment in technology to enhance customer experience, a key factor in retaining diners amidst shifting preferences.

- Health-Conscious Demand: Consumers are increasingly seeking healthier menu options, influencing choices away from traditional, less healthy offerings.

- Plant-Based Growth: The expanding plant-based market presents a direct substitute for meat-centric or dairy-heavy menus.

- Experiential Dining: A desire for unique culinary experiences can draw customers to niche restaurants or food events, bypassing established chains.

- Adaptability is Key: Create Restaurants Holdings' success hinges on its capacity to integrate these evolving preferences across its various restaurant concepts.

The threat of substitutes for Create Restaurants Holdings is amplified by the growing popularity of home cooking and meal kits. This trend, driven by health consciousness and convenience, saw 65% of consumers cooking more at home in 2023 compared to pre-2020. The substantial global ready-to-eat meal market, valued at approximately $177.6 billion in 2023, further underscores this shift, directly impacting casual dining establishments.

| Substitute Category | 2023 Market Value (USD Billions) | Key Driver |

|---|---|---|

| Home Cooking | N/A (Consumer Behavior Shift) | Health, Cost, Convenience |

| Meal Kits | N/A (Growing Segment) | Convenience, Recipe Variety |

| Ready-to-Eat Meals | 177.6 | Convenience, Accessibility |

Entrants Threaten

Opening and operating restaurants, particularly multi-brand and specialty concepts like those managed by Create Restaurants Holdings, demands significant capital. This includes securing prime real estate, outfitting kitchens with advanced equipment, creating appealing interiors, and covering initial operating expenses. For instance, establishing a new full-service restaurant in a major metropolitan area in 2024 could easily require upwards of $500,000 to $1 million in startup capital, making it a formidable barrier for potential new competitors.

Create Restaurants Holdings benefits from significant brand recognition across its diverse restaurant concepts and enjoys strong customer loyalty. This established presence makes it difficult for new entrants to quickly capture market share. For example, in 2024, major casual dining chains continued to see brand loyalty as a key differentiator, with many reporting that over 60% of their repeat customers cited brand as a primary reason for their patronage.

Established restaurant groups, like Create Restaurants Holdings, often command significant purchasing power, leading to preferential pricing and reliable access to key suppliers. For instance, in 2024, major food service distributors reported that large chains secured an average of 15% better pricing on core ingredients compared to smaller, independent operators. This makes it difficult for newcomers to match cost efficiencies.

New entrants may struggle to establish comparable relationships with suppliers, potentially facing higher costs for essential ingredients or limited availability of specialty items crucial for differentiation. This disparity in supply chain leverage can directly impact a new restaurant's ability to offer competitive pricing or maintain consistent quality, a significant barrier to entry.

Government Regulations and Licenses

Government regulations and licensing requirements significantly impact the threat of new entrants in the Japanese food service industry. Obtaining the necessary permits and adhering to strict hygiene and safety standards, such as those mandated by the Food Sanitation Act, can be a complex and time-consuming undertaking. These regulatory hurdles act as a substantial barrier, deterring potential new players from entering the market.

For instance, in 2024, the average time to secure all required food service licenses in major Japanese cities could extend several months, involving multiple inspections and documentation reviews. This process often necessitates specialized knowledge and can involve considerable upfront costs for legal and consulting fees, further increasing the barrier to entry.

- Strict Hygiene and Safety Standards: Japan's food service sector operates under stringent regulations to ensure public health.

- Complex Licensing Procedures: Obtaining the necessary permits and licenses is a multi-step, often lengthy process.

- Increased Barrier to Entry: These regulatory complexities and time commitments deter new businesses from entering the market.

- Cost Implications: Compliance and licensing can involve significant upfront financial investment for new entrants.

Economies of Scale and Experience Curve

The threat of new entrants is significantly mitigated by the substantial economies of scale enjoyed by established players like Create Restaurants Holdings. These large companies leverage their size for cost advantages in procurement, marketing campaigns, and streamlined operations, enabling them to set more competitive prices or achieve better profitability. For instance, in 2024, major restaurant chains often secured bulk discounts on ingredients, averaging 10-15% lower than what a new, smaller operator could negotiate.

Newcomers entering the restaurant industry face an immediate cost disadvantage due to their lack of scale. They cannot match the purchasing power or marketing reach of incumbents. This disparity means new entrants must absorb higher per-unit costs, making it challenging to compete on price or invest sufficiently in brand building and customer acquisition. The experience curve also plays a role; as companies grow, they refine processes and reduce costs through accumulated knowledge and efficiency gains, further widening the gap.

- Economies of Scale: Large chains benefit from bulk purchasing, reducing ingredient costs by as much as 15% compared to independent restaurants in 2024.

- Marketing Reach: Established brands have the capital for widespread advertising, reaching a larger audience more cost-effectively than new entrants.

- Operational Efficiency: Proven systems and supply chains lead to lower operating costs per unit for established entities.

- Experience Curve: Years of operation allow for process optimization, further driving down costs and improving service delivery.

The threat of new entrants for Create Restaurants Holdings is moderately high, primarily due to the relatively low capital requirements for opening basic food service establishments, although specialized concepts face higher barriers. However, established brands, strong supplier relationships, and economies of scale present significant deterrents. In 2024, the average startup cost for a quick-service restaurant was around $150,000 to $750,000, a figure that can be significantly higher for multi-brand operators like Create Restaurants Holdings.

| Barrier to Entry | Impact on New Entrants | 2024 Data/Example |

|---|---|---|

| Capital Requirements | High for full-service/specialty concepts, moderate for basic ones. | Full-service restaurant startup: $500,000 - $1,000,000+ |

| Brand Recognition & Loyalty | Difficult for new entrants to gain market share quickly. | Major casual dining chains report >60% repeat customers cite brand loyalty. |

| Supplier Relationships & Purchasing Power | Newcomers face higher costs and limited access. | Large chains secured ~15% better pricing on core ingredients. |

| Economies of Scale | New entrants have a cost disadvantage in procurement and marketing. | Bulk ingredient discounts for large chains: 10-15%. |

| Regulatory Hurdles (Japan example) | Complex licensing and hygiene standards increase time and cost. | Average licensing time: several months, with significant upfront fees. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Create Restaurants Holdings is built upon a foundation of industry-specific market research reports, company financial statements, and publicly available competitor data. We also incorporate insights from trade publications and economic indicators to provide a comprehensive view of the competitive landscape.