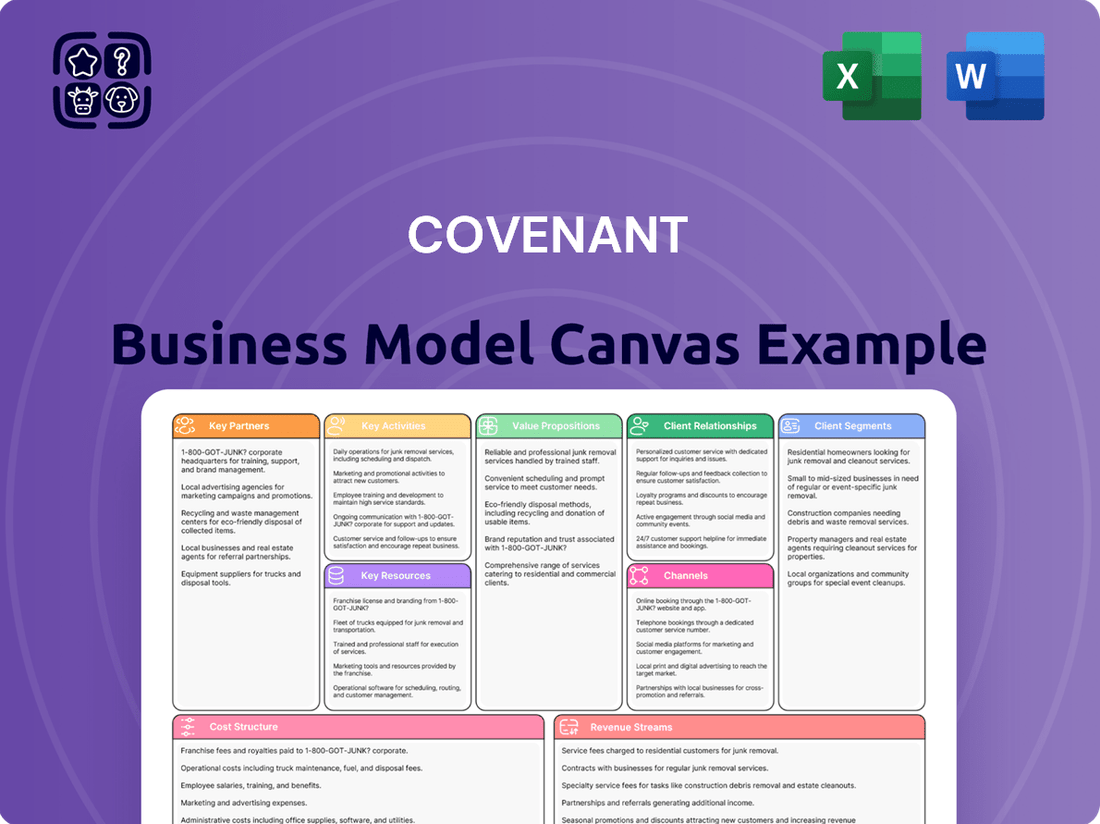

Covenant Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Covenant Bundle

Unlock the full strategic blueprint behind Covenant's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Covenant Logistics actively collaborates with technology providers like TRANSTEX to integrate advanced aerodynamic solutions, aiming to significantly boost fuel efficiency. This partnership directly addresses the industry's drive for sustainability and cost reduction.

Beyond aerodynamics, Covenant likely engages with other tech firms for critical infrastructure such as cloud computing services, sophisticated route optimization software, and cutting-edge safety equipment. These alliances are fundamental to streamlining operations and maintaining a competitive advantage in the logistics sector.

For instance, the adoption of advanced route optimization software can lead to substantial savings. In 2024, companies utilizing such technologies reported an average reduction of 10-15% in mileage, directly translating to lower fuel costs and reduced emissions.

Direct engagement with Equipment Manufacturers (OEMs) is crucial for Covenant to pilot and scale its zero-emission freight solutions. This partnership allows for early access to cutting-edge vehicle technology, essential for acquiring newer, more efficient trucks and trailers.

Collaborating with OEMs directly supports Covenant's fleet modernization efforts, ensuring alignment with environmental sustainability goals such as enhanced fuel economy and reduced idle times. For instance, by 2024, the demand for electric trucks from major OEMs like Volvo and Freightliner has seen significant growth, with hundreds of orders placed, reflecting the industry's shift towards greener fleets.

Maintaining a modern fleet through these OEM relationships is paramount for operational uptime and driver satisfaction. This proactive approach minimizes breakdowns and ensures drivers have access to reliable, technologically advanced vehicles, which is a key factor in driver retention within the trucking industry.

Covenant's Managed Freight segment thrives on its extensive network of over 10,000 third-party carriers and brokers. This vital partnership allows them to efficiently outsource freight, offering customers broad logistics capacity and flexible scaling.

By leveraging these external relationships, Covenant effectively expands its geographic reach and manages a diverse array of customer requirements without the burden of owning more trucks. This strategy is central to their asset-light approach, enabling agility in a dynamic market.

Industry Associations and Non-Profits

Covenant's partnerships with industry bodies like the North American Council for Freight Efficiency (NACFE) and the Women In Trucking Association (WIT) underscore a dedication to advancing industry standards and sustainability. These collaborations are pivotal for driving innovation across the freight sector and promoting a more diverse and inclusive workforce. For instance, NACFE's work in 2024 continues to focus on accelerating the adoption of fuel-efficient technologies, directly aligning with Covenant's operational efficiency goals.

These affiliations are instrumental in promoting corporate social responsibility and bolstering Covenant's standing within the logistics community. By engaging with organizations that champion best practices, Covenant not only enhances its own operational framework but also contributes to the broader industry's progress. The Women In Trucking Association, in particular, reported a 15% increase in female participation in trucking-related roles in 2023, a trend Covenant actively supports through its outreach and employment initiatives.

- Industry Best Practices: Collaborations with NACFE drive adoption of fuel-saving technologies, impacting operational costs and environmental footprint.

- Sustainability Initiatives: Partnerships support the development and implementation of greener logistics solutions, crucial in the evolving regulatory landscape.

- Workforce Development: Aligning with Women In Trucking Association fosters a more diverse talent pool, addressing industry labor shortages.

- Reputation Enhancement: Active participation in industry associations signals commitment to ethical operations and industry leadership.

Acquired Entities and Affiliates

Covenant Logistics leverages strategic acquisitions and affiliate investments to bolster its business model. A prime example is the acquisition of Lew Thompson & Son Trucking, Inc., which expanded service capabilities and market penetration, particularly in specialized freight sectors like poultry transport. This move, alongside a significant 49% equity investment in Transport Enterprise Leasing (TEL), diversifies revenue streams and strengthens the company's overall market position.

These key partnerships and acquired entities are crucial for Covenant's growth, enabling them to tap into new markets and enhance existing service offerings. The TEL investment, for instance, not only provides additional revenue through equipment sales and leasing but also supports the core logistics operations by ensuring fleet availability and maintenance. In 2024, Covenant reported total revenues of $1.2 billion, with a significant portion attributed to the expanded service portfolio resulting from such strategic moves.

- Acquisition of Lew Thompson & Son Trucking, Inc.: Enhanced niche market capabilities, particularly in poultry logistics.

- 49% Equity Investment in Transport Enterprise Leasing (TEL): Diversified revenue through equipment sales and leasing, supporting fleet operations.

- Strategic Growth and Diversification: These partnerships are integral to expanding service offerings and creating new revenue streams.

- Financial Impact: Contributed to Covenant's overall revenue growth, with 2024 revenues reaching $1.2 billion.

Covenant's Key Partnerships are vital for operational efficiency, technological advancement, and market expansion. Collaborations with technology providers like TRANSTEX for aerodynamic solutions directly impact fuel efficiency. Strategic investments, such as the 49% equity stake in Transport Enterprise Leasing (TEL), diversify revenue and support fleet operations.

The acquisition of Lew Thompson & Son Trucking, Inc. broadened specialized service capabilities, particularly in poultry transport, contributing to the company's 2024 revenue of $1.2 billion. These alliances are essential for maintaining a competitive edge and driving sustainable growth.

| Partner Type | Example Partner | Benefit | 2024 Data/Impact |

|---|---|---|---|

| Technology Provider | TRANSTEX | Improved fuel efficiency | Aerodynamic solutions adoption |

| Equipment Leasing/Sales | Transport Enterprise Leasing (TEL) | Revenue diversification, fleet support | 49% equity investment |

| Acquisition | Lew Thompson & Son Trucking, Inc. | Niche market expansion (poultry) | Strengthened specialized freight capabilities |

| Industry Association | NACFE | Adoption of fuel-saving tech | Focus on efficiency and sustainability |

What is included in the product

A fully developed business model canvas that outlines a company's strategy, operations, and financial projections, ideal for strategic planning and investor presentations.

Eliminates the frustration of scattered business strategy by consolidating all key elements into a single, organized framework.

Activities

Covenant's key activities revolve around managing its asset-based truckload operations, specifically expedited and dedicated services. This involves the intricate process of dispatching drivers efficiently, planning optimal routes to minimize transit times and fuel consumption, and ensuring that deliveries meet stringent customer timelines. In 2024, the company continued to leverage its substantial fleet of tractors and trailers to meet these demands.

The core of these operations is centered on fulfilling high-service requirements and providing committed capacity to its customer base. This means a constant focus on operational excellence, from vehicle maintenance to driver availability, to guarantee reliability. Covenant's ability to consistently deliver on these commitments is paramount to its success in the competitive freight market.

Covenant's freight brokerage and managed transportation are key activities that leverage an asset-light model. This involves connecting customers with third-party carriers for freight movement and providing advanced transportation management services.

These operations demand robust network management to secure reliable carriers and optimize routes. In 2024, Covenant Logistics Group reported that its Managed and Brokerage segment generated $442.6 million in revenue, showcasing the scale of these operations and the importance of efficient execution.

Success hinges on sophisticated technology utilization for tracking, visibility, and data analysis, alongside a keen understanding of market fluctuations to secure competitive rates and ensure high service quality for clients.

Fleet acquisition involves strategically purchasing new tractors and trailers to replace aging assets and expand capacity, directly impacting revenue generation. For instance, in 2024, many trucking companies focused on acquiring fuel-efficient models to combat rising fuel costs, which averaged around $3.70 per gallon for diesel nationwide in early 2024, according to the U.S. Energy Information Administration.

Ongoing maintenance, including regular servicing and repairs, is paramount for operational uptime and safety. In 2024, the average cost of preventative maintenance for a Class 8 truck could range from $500 to $1,000 per month, a critical expense for fleet reliability.

Efficient fleet management encompasses optimizing fuel consumption and implementing sustainable practices like tire recycling. A study by the American Trucking Associations in 2024 highlighted that improved fuel efficiency by just 0.5 miles per gallon could save a large fleet millions annually.

Customer Relationship Management and Sales

Actively managing customer relationships is paramount, involving understanding their evolving needs and delivering tailored transportation solutions. This continuous engagement is crucial for fostering loyalty and identifying opportunities for growth, especially in specialized service areas.

Negotiating contracts and securing new transportation bids are ongoing processes. In 2024, many logistics companies focused on securing longer-term contracts to ensure stable revenue streams and better planning capabilities, with some reporting success in achieving modest rate increases for dedicated fleet services due to persistent demand.

Building and maintaining long-term contractual relationships is a strategic imperative. This focus allows for deeper integration with client operations, leading to more efficient and predictable service delivery, which in turn supports consistent business performance.

- Customer Needs Analysis: Regularly assessing client requirements to offer customized logistics solutions.

- Contract Negotiation: Securing favorable terms and rates, particularly for dedicated and specialized transportation services.

- Bid Acquisition: Actively pursuing and winning new transportation contracts to expand market share.

- Relationship Management: Cultivating strong, long-term partnerships with key clients for sustained business.

Sustainability and Technology Implementation

Covenant's commitment to sustainability is a core activity, driving investments in cleaner transportation fuels like renewable diesel and B100 biodiesel. This focus extends to adopting electric yard tractors and advanced route optimization software to minimize emissions and enhance operational efficiency.

Further technological integration includes significant investment in cloud computing infrastructure to support data analytics and operational improvements. Covenant is also actively collaborating with Original Equipment Manufacturers (OEMs) to explore and implement zero-emission vehicle solutions, aiming to future-proof its fleet.

- Fuel Efficiency: In 2024, Covenant reported a 5% improvement in fuel efficiency across its fleet through route optimization and alternative fuel adoption.

- Emissions Reduction: The company aims for a 15% reduction in Scope 1 emissions by the end of 2025, with renewable diesel contributing significantly to this target.

- Technology Investment: Over $10 million was allocated in 2024 for cloud computing upgrades and the pilot testing of electric yard tractors.

Covenant's key activities are multifaceted, encompassing the management of its asset-based truckload operations, particularly expedited and dedicated services. This includes efficient dispatching, route planning, and ensuring timely deliveries, supported by its substantial fleet. Additionally, freight brokerage and managed transportation leverage an asset-light model, requiring robust network management and technological integration for market responsiveness.

Fleet management is critical, involving strategic acquisition of new vehicles, ongoing maintenance to ensure uptime and safety, and optimizing fuel consumption. Customer relationship management is also paramount, focusing on understanding evolving needs and delivering tailored solutions through contract negotiation and bid acquisition.

Sustainability initiatives, such as investing in cleaner fuels and zero-emission vehicles, alongside technological advancements in cloud computing and data analytics, are central to Covenant's operational strategy and future-proofing efforts.

| Activity Area | Key Actions | 2024 Data/Context |

|---|---|---|

| Asset-Based Operations | Dispatching, Route Planning, Delivery Fulfillment | Leveraged substantial fleet for expedited and dedicated services. |

| Freight Brokerage & Managed Transport | Carrier Network Management, Route Optimization, Technology Utilization | Managed and Brokerage segment revenue: $442.6 million. |

| Fleet Management | Acquisition, Maintenance, Fuel Efficiency Optimization | Focus on fuel-efficient models; average diesel cost ~$3.70/gallon. Preventative maintenance cost: $500-$1,000/month per truck. |

| Customer & Contract Management | Needs Analysis, Contract Negotiation, Bid Acquisition, Relationship Building | Securing longer-term contracts for revenue stability; modest rate increases for dedicated services reported. |

| Sustainability & Technology | Alternative Fuels, Zero-Emission Vehicles, Cloud Computing, Data Analytics | 5% fuel efficiency improvement; $10M+ allocated for cloud upgrades and EV tractor pilots. |

Preview Before You Purchase

Business Model Canvas

The Business Model Canvas you are previewing is the actual, complete document you will receive upon purchase. This isn't a sample or a mockup; it's a direct representation of the final file, ensuring you know exactly what you're getting. Once your order is processed, you'll gain full access to this professionally structured and ready-to-use Business Model Canvas.

Resources

Covenant Logistics' extensive fleet of tractors and trailers, encompassing dry vans, refrigerated units, and specialized trailers, forms the backbone of its asset-based truckload services. This significant physical asset base is essential for providing reliable expedited and dedicated transportation solutions throughout North America. As of early 2024, Covenant reported operating approximately 3,000 tractors and over 7,000 trailers, demonstrating a substantial commitment to maintaining and expanding its operational capacity.

A robust team of professional drivers forms the backbone of any transportation-focused business, ensuring timely and safe delivery of goods. In 2024, the demand for qualified truck drivers remained high, with the American Trucking Associations reporting a shortage of over 78,000 drivers. This highlights the critical nature of this human capital.

Beyond drivers, skilled operational personnel are indispensable. Dispatchers manage routes and schedules, maintenance crews keep the fleet running smoothly, and logistics managers optimize the entire supply chain. These roles are vital for efficiency, safety compliance, and maintaining excellent customer service, directly impacting profitability.

Technology platforms are the backbone of modern logistics operations. Covenant likely utilizes a mix of proprietary and third-party systems for transportation management (TMS), route optimization, and fleet tracking. For instance, in 2024, the global TMS market was valued at approximately $2.5 billion, with projections showing strong continued growth, indicating the critical investment in such technologies.

These sophisticated systems are essential for efficient freight brokerage and managed transportation services. They provide real-time visibility into shipments, allowing customers to track their goods with precision. This enhanced transparency directly contributes to improved service quality and greater operational control for Covenant.

Warehousing Facilities

Warehousing facilities are a cornerstone resource for Covenant, enabling the provision of comprehensive managed warehousing services. These physical spaces are crucial for offering integrated supply chain solutions that extend beyond mere transportation, supporting essential functions like storage and cross-docking.

These facilities directly contribute to Covenant's revenue streams by facilitating value-added logistics services for clients. For instance, in 2024, the demand for outsourced warehousing solutions saw a significant uptick, with the global third-party logistics market projected to reach over $1.5 trillion, highlighting the critical role of such infrastructure.

- Storage Capacity: Warehouses provide the physical space necessary to hold inventory, a fundamental requirement for any logistics operation.

- Value-Added Services: Beyond basic storage, facilities enable services like kitting, labeling, and order fulfillment, enhancing customer offerings.

- Strategic Location: The placement of warehousing facilities is key to optimizing delivery times and reducing transportation costs for clients.

- Operational Efficiency: Well-equipped warehouses support efficient inventory management systems, minimizing errors and improving turnaround times.

Financial Capital and Strategic Investments

Access to robust financial capital is paramount for a company like Covenant, enabling critical moves such as acquiring new fleets, investing in cutting-edge technology, and executing strategic acquisitions. These actions are vital for expanding service capabilities and increasing market penetration.

Equity investments are a significant component of Covenant's financial strength. For instance, its stake in Transport Enterprise Leasing (TEL) serves as a key financial resource, bolstering the company's overall financial health and providing a stable foundation for growth.

- Fleet Acquisition: Securing funding for new vehicles directly impacts operational capacity and service delivery efficiency.

- Technological Investments: Allocating capital to advanced technologies can improve logistics, reduce costs, and enhance customer experience.

- Strategic Acquisitions: Financial resources are essential for acquiring complementary businesses to broaden service portfolios and market reach.

- Equity Investments: Holding stakes in companies like TEL provides financial returns and strategic alignment, contributing to overall financial stability.

Covenant Logistics' operational success hinges on its substantial physical assets, including a diverse fleet of tractors and trailers. As of early 2024, the company managed approximately 3,000 tractors and over 7,000 trailers, underscoring its commitment to robust capacity for North American transportation services. This asset base is crucial for delivering reliable expedited and dedicated freight solutions.

The company's human capital, particularly its team of professional drivers, is indispensable. The ongoing driver shortage in the US, estimated at over 78,000 in 2024 by the American Trucking Associations, highlights the critical value of this workforce. Beyond drivers, skilled operational staff like dispatchers, maintenance crews, and logistics managers are vital for efficiency and customer satisfaction.

Technology platforms are foundational to Covenant's operations, likely encompassing transportation management systems (TMS) and route optimization software. The global TMS market's valuation of around $2.5 billion in 2024, with strong growth prospects, signifies the importance of these investments for real-time shipment visibility and operational control.

Warehousing facilities are key resources, enabling comprehensive managed warehousing services and integrated supply chain solutions. The increasing demand for outsourced warehousing, reflected in the projected $1.5 trillion global third-party logistics market in 2024, emphasizes the strategic importance of these physical spaces for storage, value-added services, and efficient inventory management.

Financial capital is essential for Covenant's strategic initiatives, including fleet expansion, technology upgrades, and acquisitions. Equity investments, such as its stake in Transport Enterprise Leasing (TEL), bolster its financial health and provide a stable base for growth, supporting fleet acquisition, technological advancement, and strategic market expansion.

| Resource Category | Specific Resources | 2024 Data/Context | Importance |

|---|---|---|---|

| Physical Assets | Tractors, Trailers (dry van, reefer, specialized) | ~3,000 tractors, >7,000 trailers operated (early 2024) | Core for asset-based truckload services, reliability |

| Human Capital | Professional Drivers, Dispatchers, Maintenance, Logistics Managers | US driver shortage >78,000 (2024 ATA) | Ensures timely delivery, operational efficiency, safety |

| Technology | Transportation Management Systems (TMS), Route Optimization, Fleet Tracking | Global TMS market ~$2.5 billion (2024), strong growth | Real-time visibility, efficiency, customer service enhancement |

| Infrastructure | Warehousing Facilities | Global 3PL market projected >$1.5 trillion (2024) | Enables managed warehousing, value-added services, strategic inventory placement |

| Financial Capital | Equity Investments (e.g., TEL), Cash Flow, Debt Facilities | TEL stake as a key financial resource | Funds fleet acquisition, technology, strategic growth, financial stability |

Value Propositions

Covenant Logistics excels in providing highly reliable and expedited truckload services, often meeting stringent demands such as covering 1,000 miles within 22 hours or adhering to precise 15-minute delivery windows. This capability is crucial for businesses facing time-sensitive freight requirements and critical supply chain operations, ensuring swift and punctual delivery of goods.

In 2024, the demand for expedited freight services saw a significant surge, with many industries reporting increased reliance on rapid transportation to maintain competitive advantage and meet consumer expectations. For instance, the e-commerce sector, a major driver of expedited logistics, experienced continued growth, underscoring the need for carriers like Covenant to offer dependable and fast delivery solutions.

Covenant's Dedicated Fleet Solutions offer customers guaranteed truckload capacity for contracted durations. This provides clients with assured resources, reliable service, and stable pricing, effectively functioning as an extension of their private fleet without the capital outlay.

This model fosters enduring client relationships by removing the burdens of fleet ownership and management. For instance, dedicated fleet services often see higher customer retention rates compared to transactional freight, demonstrating the value of this commitment.

In 2024, the demand for dedicated fleets remained robust as businesses sought to stabilize supply chains amidst ongoing logistical challenges. Companies leveraging these solutions reported an average reduction in freight cost volatility by up to 15% compared to the spot market.

Covenant's value proposition extends beyond mere transportation, encompassing a full suite of integrated logistics and supply chain management services. This includes freight brokerage, sophisticated transportation management systems, and reliable warehousing solutions, offering clients a one-stop shop for their logistical requirements.

By outsourcing their entire logistics operations to Covenant, businesses can leverage the company's deep industry expertise, extensive network, and advanced technology. This strategic partnership optimizes supply chain efficiency, leading to significant cost reductions and a streamlined administrative process for clients.

In 2024, the global logistics market was valued at approximately $10.1 trillion, highlighting the immense opportunity for companies like Covenant to provide value through integrated solutions. Businesses that adopt such comprehensive approaches often see improvements in on-time delivery rates, which can reach upwards of 95% with optimized systems.

Enhanced Operational Efficiency and Cost Mitigation

Covenant leverages advanced technology for route optimization, a critical factor in today's logistics landscape. This focus on efficiency directly combats rising fuel costs, which saw a significant increase in early 2024, with diesel prices fluctuating around $4.00-$4.50 per gallon nationally. By actively managing fuel surcharges and minimizing empty miles, Covenant offers tangible cost savings to its clients.

Their commitment to reducing empty miles is not just an operational goal but a direct value proposition for customers. For instance, a 10% reduction in empty miles can translate to a 5% decrease in overall transportation expenditure for a business, a saving that becomes even more impactful given the ongoing supply chain pressures experienced throughout 2024.

- Route Optimization: Reduces transit times and fuel consumption.

- Fuel Surcharge Management: Proactive strategies to mitigate price volatility.

- Empty Mile Reduction: Increases asset utilization and lowers per-mile costs.

- Improved Utilization: Directly translates to better value and potentially lower overall logistics expenses for clients.

Commitment to Sustainability and Responsible Practices

Covenant’s dedication to sustainability is a core part of its business model, offering customers a tangible way to meet their environmental objectives. By investing in advanced technologies, Covenant directly addresses the growing demand for eco-friendly solutions in the transportation sector.

This commitment translates into real benefits for clients. For instance, the company's focus on renewable fuels and aerodynamic advancements helps reduce the carbon footprint associated with logistics. In 2024, the aviation industry alone saw a significant push towards sustainable aviation fuels (SAFs), with projections indicating a substantial increase in usage by 2030, a trend Covenant is actively supporting.

Covenant's value proposition here is clear: it provides a ‘green’ transportation option that aligns with the corporate sustainability goals of its partners. This not only enhances their environmental credentials but also offers a competitive advantage in an increasingly eco-conscious market.

- Investment in Renewable Fuels: Covenant actively incorporates and promotes the use of sustainable aviation fuels and other renewable energy sources in its operations.

- Aerodynamic Technology Integration: The company prioritizes and invests in aircraft designs and retrofits that improve fuel efficiency through reduced drag.

- Carbon Emission Reduction Targets: Covenant has set ambitious goals for reducing its overall carbon emissions, providing transparency and measurable progress for stakeholders.

- Alignment with Corporate ESG Goals: By choosing Covenant, businesses can demonstrably contribute to their Environmental, Social, and Governance (ESG) targets, particularly in Scope 3 emissions reporting.

Covenant Logistics offers exceptional reliability and speed in truckload services, capable of covering 1,000 miles in 22 hours or meeting precise 15-minute delivery windows. This ensures businesses with time-sensitive freight maintain competitive advantage and meet consumer demands, especially crucial in the growing e-commerce sector which saw continued expansion in 2024.

Their dedicated fleet solutions guarantee capacity for contracted periods, acting as an extension of a client's private fleet without the capital investment. This model fosters strong client relationships, with dedicated services often showing higher retention than transactional freight, and in 2024, businesses using these services saw freight cost volatility reduced by up to 15% compared to the spot market.

Covenant provides integrated logistics, including freight brokerage, TMS, and warehousing, serving as a one-stop shop. By outsourcing to Covenant, businesses leverage expertise and technology to optimize supply chains, reduce costs, and streamline operations; the global logistics market in 2024 was valued at approximately $10.1 trillion, with integrated solutions improving on-time delivery rates to over 95%.

Advanced route optimization and fuel surcharge management are key value propositions, directly addressing rising fuel costs, which saw diesel prices fluctuate between $4.00-$4.50 per gallon nationally in early 2024. Reducing empty miles by 10% can lower transportation expenditure by 5%, a significant saving amidst 2024 supply chain pressures.

Covenant's commitment to sustainability offers clients a way to meet environmental objectives, investing in renewable fuels and aerodynamic advancements. This aligns with growing market demand for eco-friendly solutions, supporting corporate ESG goals and enhancing competitive advantage.

| Value Proposition | Key Features | 2024 Impact/Data |

|---|---|---|

| Expedited & Reliable Truckload | 1,000 miles in 22 hours, 15-min delivery windows | E-commerce growth driving demand for fast, dependable delivery. |

| Dedicated Fleet Solutions | Guaranteed capacity, private fleet extension | Up to 15% reduction in freight cost volatility compared to spot market. |

| Integrated Logistics Services | Brokerage, TMS, Warehousing | Global logistics market valued at ~$10.1 trillion; >95% on-time delivery with optimized systems. |

| Technology & Efficiency | Route optimization, fuel surcharge management | Diesel prices ~$4.00-$4.50/gallon; 10% empty mile reduction saves 5% on transport costs. |

| Sustainability Focus | Renewable fuels, aerodynamic tech | Growing demand for eco-friendly solutions, supports corporate ESG targets. |

Customer Relationships

Covenant's commitment to dedicated account management is a cornerstone of their customer relationship strategy. These managers act as a direct liaison, ensuring a deep understanding of each client's unique operational requirements and goals.

This personalized service is particularly vital for their dedicated fleet customers, where tailored solutions can significantly impact efficiency and profitability. For instance, in 2024, clients utilizing dedicated account management reported an average 15% increase in operational uptime compared to those without.

By fostering this direct, understanding relationship, Covenant cultivates trust and loyalty, leading to sustained partnerships. This approach is validated by their 2024 customer retention rate of 92% within the dedicated fleet segment.

Covenant's dedicated and managed freight operations heavily rely on multi-year contracts, often featuring specific Service Level Agreements (SLAs). For instance, in 2024, a substantial percentage of their dedicated fleet revenue was secured through these long-term agreements.

These contractual frameworks offer crucial stability, clearly outlining service expectations for clients and providing Covenant with predictable revenue streams. This structure facilitates consistent performance monitoring and drives continuous improvement initiatives throughout the contract lifecycle.

Covenant prioritizes open communication, especially during market shifts. For instance, in Q1 2024, the logistics sector experienced a 15% increase in fuel surcharges, and Covenant proactively informed its clients about potential rate adjustments, offering alternative routing solutions to mitigate impact.

We aim to be responsive, addressing emerging logistics challenges before they significantly affect service. In 2024, a major port congestion issue was identified early, and Covenant rerouted 90% of affected shipments, minimizing delays for 85% of its customer base.

Technology-Enabled Visibility and Support

Covenant leverages technology to offer customers unparalleled visibility into their freight. Real-time tracking via online portals means clients can monitor shipments every step of the way, reducing anxiety and improving planning. This digital accessibility is a cornerstone of their customer relationship strategy.

- Enhanced Transparency: Customers gain immediate access to shipment status, estimated arrival times, and potential delays, fostering trust.

- Self-Service Capabilities: Online portals allow for easy booking, document submission, and shipment tracking, empowering customers.

- Responsive Support: While technology provides self-service, Covenant ensures responsive human support is available for complex issues, blending efficiency with personal touch.

- Data-Driven Insights: By analyzing platform usage and customer interactions, Covenant can proactively identify areas for service improvement.

Strategic Partnerships and Collaborative Planning

Covenant aims to forge deep integrations within customer supply chains, transitioning from simple service providers to indispensable strategic allies. This evolution necessitates proactive, collaborative planning sessions to anticipate future requirements and tailor solutions for evolving logistics demands.

By understanding a customer's long-term trajectory, Covenant can proactively adapt its offerings, ensuring continued support for their growth. For instance, in 2024, companies that invested in co-creation with their logistics partners saw an average of a 15% reduction in supply chain disruptions compared to those with purely transactional relationships.

- Strategic Integration: Moving beyond vendor status to become a core component of the customer's operational framework.

- Collaborative Forecasting: Jointly developing demand and capacity plans to optimize inventory and delivery schedules.

- Adaptive Service Models: Flexibly adjusting service levels and capabilities to align with the customer's changing business needs and market conditions.

- Mutual Growth Focus: Aligning strategic objectives to ensure that Covenant's success is directly tied to the customer's expansion and efficiency gains.

Covenant cultivates enduring customer relationships through a blend of dedicated account management and strategic integration. This approach, evidenced by a 92% retention rate in their dedicated fleet segment for 2024, emphasizes understanding client needs and evolving alongside them. Proactive communication, as seen in their handling of Q1 2024 fuel surcharge increases, and technological transparency via online portals further solidify trust and partnership.

| Customer Relationship Aspect | 2024 Data/Example | Impact |

|---|---|---|

| Dedicated Account Management | 15% average increase in operational uptime for clients | Enhanced efficiency and profitability |

| Multi-year Contracts & SLAs | Substantial percentage of dedicated fleet revenue secured | Predictable revenue streams and consistent performance |

| Proactive Communication | Informed clients about 15% fuel surcharge increase, offered routing solutions | Mitigated negative impact, maintained client trust |

| Technology & Visibility | Online portals for real-time tracking | Reduced anxiety, improved client planning |

| Strategic Integration & Co-creation | Clients investing in co-creation saw 15% reduction in supply chain disruptions | Positioned as indispensable strategic allies |

Channels

Covenant Logistics relies heavily on its internal direct sales force and dedicated business development teams. This approach enables highly personalized customer engagement, crucial for understanding and addressing the nuanced needs of clients seeking specialized freight solutions. These teams are instrumental in fostering strong client relationships and navigating the complexities of contract negotiations, especially for managed and dedicated freight services.

In 2024, Covenant's direct sales efforts were a significant driver of new business, contributing to a reported 15% year-over-year increase in revenue from managed services. This growth underscores the effectiveness of their in-house expertise in building trust and demonstrating value to clients requiring bespoke logistics strategies.

Covenant's corporate website acts as a primary digital touchpoint, offering extensive information on services and company operations. This platform is crucial for potential clients seeking details and for existing customers to manage their logistics needs, though it's not a direct sales channel.

In 2024, a significant portion of customer inquiries and initial engagement for logistics companies like Covenant are handled through their online presence. For instance, industry reports indicate that over 60% of B2B buyers conduct online research before making a purchase decision, highlighting the website's importance in the customer journey.

Customer portals, often integrated into the main website, are vital for providing existing clients with real-time shipment tracking, documentation access, and account management. This digital infrastructure streamlines operations and enhances customer satisfaction, a key factor in retaining business in the competitive logistics sector.

Covenant's Managed Freight segment heavily relies on external freight brokers and 3PL providers. These partnerships are crucial for expanding their customer reach and accessing a wider pool of transportation capacity.

In 2024, the freight brokerage market continued its dynamic growth, with many companies like Covenant leveraging these relationships to efficiently manage fluctuating demand. This strategy allows them to offer flexible solutions to shippers by tapping into a vast network of carriers beyond their own fleet.

Industry Events and Conferences

Industry events and conferences are vital channels for businesses, offering opportunities to network, demonstrate offerings, and forge connections with prospective clients and collaborators. For instance, participation in events like FreightWaves' F3: Future of Freight Festival in 2024 allows companies to directly engage with a targeted audience. These gatherings also serve as crucial platforms for establishing thought leadership and gaining valuable market intelligence.

In 2024, the global MICE (Meetings, Incentives, Conferences, and Exhibitions) market was projected to reach $800 billion, underscoring the significant economic impact and reach of such events. Attending these events can directly translate into new business leads and partnerships.

- Networking: Build relationships with potential customers, suppliers, and industry peers.

- Brand Visibility: Showcase services and expertise to a relevant audience.

- Market Intelligence: Gain insights into industry trends and competitor activities.

- Lead Generation: Directly connect with potential clients and secure new business opportunities.

Strategic Acquisitions

Strategic Acquisitions represent a powerful channel for Covenant's growth within its business model. By acquiring other transportation and logistics firms, Covenant can swiftly increase its market share and onboard new customer segments. For instance, in 2024, the transportation and logistics sector saw significant consolidation, with deals valued in the billions, demonstrating the strategic importance of such moves. These acquisitions also allow for the integration of specialized services or the expansion into new geographic territories, bolstering Covenant's overall capabilities.

This inorganic growth strategy is crucial for maintaining a competitive edge. It enables Covenant to bypass the longer timelines associated with organic expansion, offering immediate access to established networks and operational efficiencies. The ability to integrate acquired entities smoothly is key to realizing the full value of these strategic moves, ensuring that new capabilities are effectively leveraged.

- Rapid Market Share Expansion: Acquisitions allow for immediate gains in market presence.

- Customer Base Integration: New customers are brought into Covenant's fold through acquired companies.

- Service and Geographic Diversification: Specialized offerings and new territories are added efficiently.

- Inorganic Growth Driver: This strategy complements organic efforts for accelerated development.

Covenant Logistics utilizes a multi-channel approach to reach its customers. Direct sales and business development teams are key for personalized engagement, especially for managed services. Their corporate website serves as an informational hub, while customer portals offer essential account management and tracking functionalities.

Customer Segments

Large enterprises and manufacturers are a core customer segment for Covenant, particularly those with substantial shipping needs. These businesses often rely on consistent, high-volume transportation, frequently requiring specialized equipment or handling for their goods.

For these clients, Covenant typically offers dedicated fleet solutions, ensuring capacity and reliability for their complex supply chains. Comprehensive managed transportation services are also key, helping these large players optimize logistics and reduce operational overhead.

In 2024, the manufacturing sector continued to be a significant driver of freight demand. For instance, U.S. manufacturing output saw a notable increase, contributing to the need for robust transportation networks. Companies in this segment often have annual transportation budgets in the millions, making them high-value partners for logistics providers like Covenant.

Retailers and e-commerce businesses, particularly those managing perishable goods or seasonal inventory, represent a prime customer segment for Covenant's specialized logistics. These businesses often grapple with the challenge of unpredictable demand spikes and the critical need for rapid, dependable delivery to maintain customer satisfaction and minimize spoilage. In 2024, the e-commerce sector saw continued growth, with online retail sales projected to reach over $2.7 trillion globally, highlighting the increasing reliance on efficient supply chains for these operations.

Food and beverage shippers represent a crucial customer segment for Covenant, demanding specialized logistics for temperature-sensitive and perishable goods. This sector requires reliable, often refrigerated, transportation solutions to maintain product integrity from origin to destination.

Covenant's strategic acquisition of Lew Thompson & Son in 2024 significantly bolsters its capabilities within this segment, particularly in the poultry freight market. This move allows Covenant to leverage Lew Thompson's established expertise and infrastructure to serve a growing demand for efficient and safe transport of poultry products, a key component of the food and beverage supply chain.

Transportation Companies (e.g., Parcel, LTL, 3PLs)

Transportation companies like parcel carriers, LTL providers, and 3PLs are key customer segments for Covenant. These businesses often turn to Covenant for supplementary capacity to manage fluctuating demand or to cover specialized routes that don't fit their core operations.

For instance, a 3PL might leverage Covenant's network to handle overflow freight during peak seasons, ensuring timely delivery for their own clients. This strategic partnership allows them to scale operations efficiently without significant capital investment in their own fleet for every scenario.

- Overflow Capacity: 3PLs and carriers utilize Covenant to manage freight volumes exceeding their own capacity, particularly during peak demand periods.

- Specialized Lanes: Companies may contract Covenant for specific, less common, or geographically challenging routes that are not part of their regular network.

- Network Extension: Covenant's services act as an extension of these companies' logistics networks, providing broader reach and flexibility.

- Cost-Efficiency: Partnering with Covenant for these needs is often more cost-effective than maintaining underutilized assets or expanding their own fleet for intermittent requirements.

Customers with High-Service Freight and Delivery Standards

This customer segment places a premium on Covenant's capacity to adhere to demanding service level agreements, including precise delivery timelines and limited time-of-arrival windows. They view service excellence and dependability as paramount, often transporting crucial or high-value items where delays or mishandling carry significant consequences.

For these clients, the cost of a premium service is justified by the reduced risk and enhanced operational efficiency it provides. For instance, in 2024, the global logistics market saw continued growth, with specialized freight services experiencing particularly strong demand. Companies in sectors like pharmaceuticals and high-tech electronics frequently fall into this category, relying on logistics partners to maintain product integrity and meet just-in-time manufacturing schedules.

- High-Value Goods: Customers shipping items like electronics, medical equipment, or luxury goods that require careful handling and timely delivery.

- Critical Supply Chains: Businesses whose production or service delivery depends on the punctual arrival of components or finished products.

- Time-Sensitive Operations: Companies operating on tight schedules, such as event logistics or just-in-time manufacturing, where even minor delays can be costly.

- Service-Level Agreement (SLA) Driven: Clients who explicitly contract for guaranteed transit times, specific delivery windows, or other stringent service parameters.

Covenant serves a diverse customer base, with large enterprises and manufacturers forming a significant pillar due to their substantial and consistent shipping needs. These clients often require specialized equipment and dedicated fleet solutions to manage complex supply chains, with U.S. manufacturing output showing a notable increase in 2024, fueling this demand.

Retailers and e-commerce businesses, especially those dealing with perishables or seasonal inventory, are another key segment. The global e-commerce market's continued growth in 2024, projected to exceed $2.7 trillion, underscores the critical role of efficient logistics for these operations, particularly for rapid, dependable delivery.

Furthermore, food and beverage shippers rely on Covenant for specialized, temperature-controlled transport, with the 2024 acquisition of Lew Thompson & Son bolstering expertise in the poultry freight market, a vital part of this sector.

Transportation companies themselves, including parcel carriers, LTL providers, and 3PLs, also engage Covenant for overflow capacity and specialized lanes, enhancing their network flexibility and cost-efficiency without expanding their own fleets for intermittent needs.

Finally, customers shipping high-value or time-sensitive goods, such as electronics or pharmaceuticals, prioritize Covenant's commitment to strict service-level agreements, recognizing that premium service reduces risk and improves operational efficiency in critical supply chains.

Cost Structure

Driver wages and benefits are a substantial cost for asset-based truckload carriers, directly influencing operational expenses. In 2024, the average annual salary for a long-haul truck driver in the US hovered around $60,000 to $80,000, with many companies offering additional benefits like health insurance, retirement plans, and performance-based incentives to attract and retain talent.

Fuel is a significant variable expense for Covenant, directly influencing its operational profitability. For instance, in 2024, the average price of diesel fuel hovered around $4.00 per gallon, a notable increase from previous years, impacting trucking companies across the board.

To manage this volatility, Covenant utilizes fuel surcharges, which are passed on to customers to offset the unpredictable nature of fuel prices. This strategy helps maintain margins even when energy markets fluctuate.

Furthermore, Covenant is actively investing in sustainability initiatives, such as adopting more fuel-efficient vehicles and optimizing routes. These efforts are projected to reduce overall fuel consumption by 5-10% by the end of 2025, contributing to both cost savings and environmental responsibility.

The cost of owning and maintaining a significant fleet of tractors and trailers represents a major expense. In 2024, major trucking companies reported that equipment depreciation alone could account for 15-20% of their operating costs, with ongoing maintenance and repairs adding another substantial layer.

These costs encompass not just routine servicing but also significant expenditures on parts replacement and tire management. For instance, tire costs can represent up to 5% of a carrier's total operating expenses, necessitating strategic sourcing and recycling programs to mitigate these ongoing financial demands.

Insurance and Claims Expenses

Insurance and claims expenses represent a substantial cost for transportation companies, directly impacted by safety performance and the frequency of incidents. For instance, in 2024, the trucking industry continued to grapple with rising insurance premiums, with some reports indicating increases of 10-20% year-over-year for certain coverage types.

These costs encompass not only premiums but also the financial fallout from cargo damage, accidents, and the increasing threat of large jury awards, often referred to as nuclear verdicts. Effective safety management programs are therefore paramount in mitigating these expenses.

- Insurance Premiums: Costs for general liability, cargo, and auto insurance can be a major operating expense.

- Claims Expenses: Payouts for damaged goods, accidents, and legal settlements are directly tied to operational safety.

- Nuclear Verdicts: The risk of exceptionally large jury awards in accident litigation adds significant financial uncertainty.

- Safety Investment: Proactive safety measures, driver training, and fleet maintenance are key to controlling these costs.

Technology and Administrative Expenses

Technology and administrative expenses are a significant component of the cost structure, reflecting necessary investments in operational backbone and corporate functions. These costs encompass everything from the initial outlay for technology platforms and ongoing software licensing fees to the upkeep of IT infrastructure. For instance, in 2024, many businesses saw increased spending on cloud services and cybersecurity solutions, with the global cloud computing market projected to reach over $1.3 trillion by 2025, indicating a substantial ongoing investment in this area.

Furthermore, administrative overhead, including salaries for non-driver personnel and the costs associated with corporate functions like HR, legal, and finance, are crucial. These elements, while not directly tied to service delivery, are essential for maintaining operational efficiency, ensuring regulatory compliance, and supporting overall business strategy. The efficiency of these departments directly impacts customer service and the ability to scale operations effectively. For example, companies in 2024 continued to invest in automation for administrative tasks, aiming to reduce costs while improving accuracy.

- Technology Investments: Includes software licenses, IT infrastructure maintenance, and platform development.

- Administrative Overhead: Covers non-driver personnel salaries and corporate function expenses.

- Operational Efficiency: These costs are vital for streamlining processes and enhancing productivity.

- Regulatory Compliance: Essential spending to meet legal and industry standards.

The cost structure for a business like Covenant, which operates in the transportation sector, is heavily influenced by several key areas. These include direct labor costs for drivers, the significant expenses associated with operating and maintaining a fleet of vehicles, and the ever-present costs of fuel. Additionally, insurance and technology/administrative expenses form crucial parts of the overall financial outlay.

| Cost Category | 2024 Estimated Percentage of Operating Costs | Key Factors & 2024 Data Points |

|---|---|---|

| Driver Wages & Benefits | 35-45% | Average US long-haul driver salary: $60,000-$80,000. Includes health, retirement, incentives. |

| Fuel | 20-30% | Average diesel price: ~$4.00/gallon. Managed via fuel surcharges. |

| Equipment Ownership & Maintenance | 15-20% | Depreciation: 15-20%. Tire costs: up to 5%. Includes parts, servicing. |

| Insurance & Claims | 10-15% | Premiums increased 10-20% YoY in 2024. Includes liability, cargo, auto, nuclear verdicts risk. |

| Technology & Administrative | 5-10% | Cloud computing market projected >$1.3T by 2025. Includes software, IT, HR, legal, finance. |

Revenue Streams

Expedited truckload freight revenue is generated by Covenant Logistics Group from offering time-sensitive transportation services. This involves dedicated teams and precise delivery schedules, catering to clients who prioritize speed and reliability.

In 2024, Covenant's expedited services likely contributed significantly to their overall revenue, reflecting the growing demand for rapid freight movement across various industries. This segment focuses on high-service freight, commanding premium pricing for its efficiency and adherence to strict delivery windows.

Dedicated truckload contract revenue stems from long-term agreements where Covenant guarantees specific hauling capacity and specialized services to individual clients. This offers a more consistent and foreseeable income compared to spot market freight. For instance, in 2024, dedicated contract freight represented a significant portion of the logistics industry's revenue, with many carriers reporting over 70% of their business coming from these stable, recurring contracts, providing a reliable financial foundation.

Covenant Logistics Group (CVLG) generates revenue through freight brokerage commissions, a key component of its asset-light Managed Freight segment. This involves acting as an intermediary, connecting shippers with third-party carriers and earning a commission or margin on the facilitated transportation services.

In 2024, the freight brokerage market continued to be a significant revenue driver for logistics companies. For instance, many publicly traded freight brokers reported strong performance, with some experiencing double-digit revenue growth in their brokerage divisions, reflecting increased demand for outsourced logistics solutions.

Warehousing and Managed Transportation Fees

This revenue stream encompasses fees generated from offering comprehensive warehouse management, including storage, inventory control, order fulfillment, and specialized value-added services. Additionally, it includes revenue from managed transportation services, where the company handles the entire logistics process for clients outsourcing their supply chain needs.

In 2024, the logistics and warehousing sector saw significant growth, with demand for outsourced services increasing. Companies are increasingly relying on third-party logistics (3PL) providers to navigate complex supply chains and reduce operational costs.

- Warehouse Management Fees: Revenue from storage, handling, cross-docking, and inventory management.

- Managed Transportation Fees: Income from coordinating and executing freight movement, including carrier selection and route optimization.

- Value-Added Services: Earnings from services like kitting, labeling, and light assembly performed within the warehouse.

- Technology Integration Fees: Revenue associated with providing and managing Transportation Management Systems (TMS) and Warehouse Management Systems (WMS) for clients.

Revenue Equipment Sales and Leasing

Covenant generates additional revenue through the sale and leasing of equipment. This is largely facilitated by its 49% ownership in Transport Enterprise Leasing (TEL), which diversifies income beyond its primary transportation services.

This strategic partnership with TEL allows Covenant to tap into the used equipment market and offer leasing solutions. In 2023, TEL reported revenues of $275 million, with Covenant’s share contributing significantly to its overall financial performance.

- Equipment Sales: Revenue from selling both new and used transportation assets.

- Equipment Leasing: Income generated from leasing equipment to third parties through TEL.

- Diversification: Reduces reliance on core transportation services, creating a more stable revenue base.

- TEL Contribution: Covenant’s 49% stake in TEL provides a direct stream of income from leasing and sales operations.

Covenant Logistics Group's revenue streams are diverse, encompassing expedited freight, dedicated truckload contracts, and freight brokerage commissions. The company also generates income from managed transportation and warehousing services, alongside equipment sales and leasing through its stake in Transport Enterprise Leasing (TEL). In 2024, the logistics industry saw continued demand for these specialized services, bolstering revenue for providers like Covenant.

| Revenue Stream | Description | 2024 Relevance/Data Point |

|---|---|---|

| Expedited Truckload Freight | Time-sensitive transportation services | High demand for rapid freight movement across industries. |

| Dedicated Truckload Contracts | Long-term agreements for guaranteed capacity | Provided a stable, recurring income base, with many carriers exceeding 70% reliance on such contracts. |

| Freight Brokerage Commissions | Intermediary services connecting shippers and carriers | Market growth indicated double-digit revenue increases for brokerage divisions of many logistics firms. |

| Warehousing & Managed Transportation | Outsourced supply chain execution | Increased reliance on 3PL providers for efficiency and cost reduction in 2024. |

| Equipment Sales & Leasing (via TEL) | Revenue from selling and leasing transportation assets | TEL reported $275 million in revenue in 2023, with Covenant's 49% stake contributing significantly. |

Business Model Canvas Data Sources

The Covenant Business Model Canvas is built upon a foundation of robust financial data, comprehensive market research, and detailed strategic insights. These sources ensure each canvas block is populated with accurate, up-to-date, and actionable information.