Corteva Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Corteva Bundle

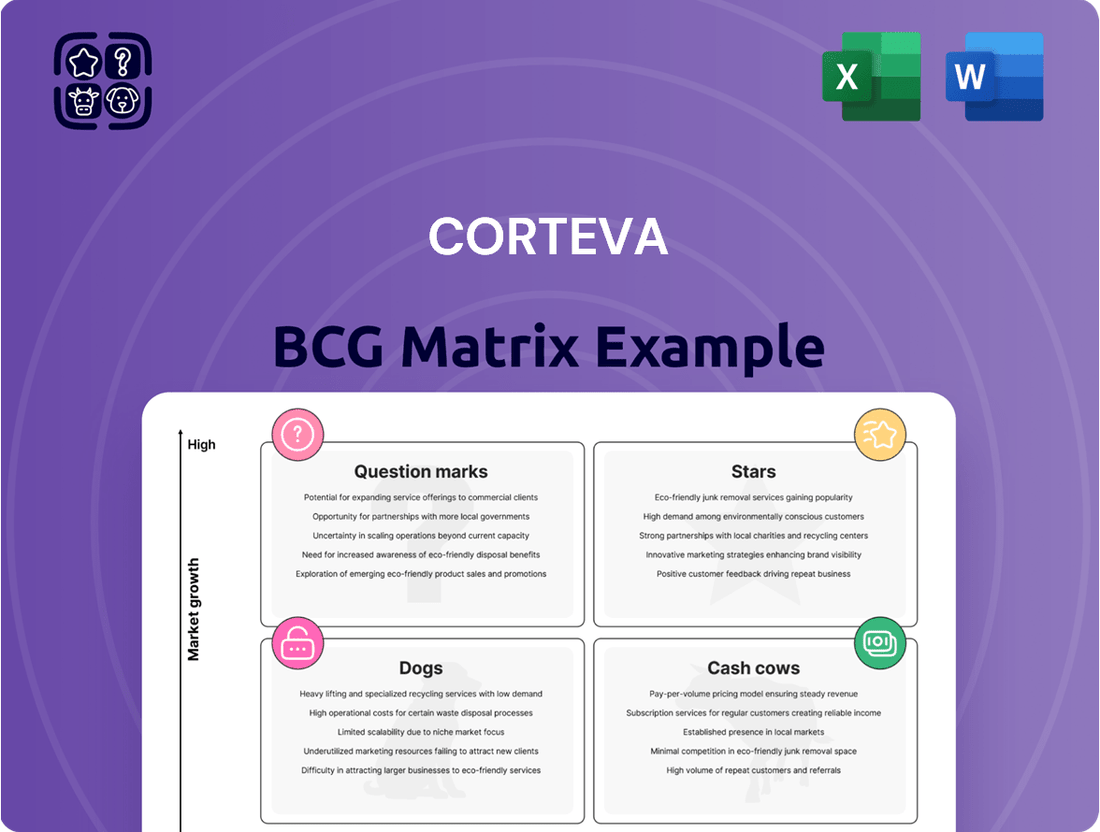

Curious about Corteva's strategic product portfolio? Our BCG Matrix preview offers a glimpse into their market position, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Understand where their innovations are thriving and where challenges lie.

Don't miss out on the full picture! Purchase the complete Corteva BCG Matrix report to unlock detailed quadrant placements, data-driven recommendations, and a clear roadmap for optimizing their product investments and strategic growth.

Stars

Corteva's Enlist E3® soybeans, particularly with Vorceed® Enlist® technology, are a prime example of a Star in the BCG matrix. This innovation boasts robust market adoption and a leading position in the herbicide-tolerant soybean category.

The technology directly addresses critical farmer needs for superior weed management and yield preservation, significantly bolstering Corteva's seed segment performance. For instance, in 2023, Corteva reported strong growth in its Seed segment, with Enlist E3® soybeans being a key contributor to this success.

The sustained demand for these advanced seed traits fuels Corteva's organic sales growth within the Seed division. This positions Enlist E3® soybeans as a vital component of Corteva's strategy for continued market leadership and revenue expansion.

Corteva is making significant strides in crop protection with the introduction of new technologies like Gapper and Elevore herbicides in Brazil, and Tolvera, Enversa, and Kyro herbicides in the U.S. These products are designed to tackle pressing issues such as weed resistance, employing innovative modes of action.

The company's strategic investment in research and development fuels this pipeline of disruptive technologies. As these solutions gain broader registration and market adoption, they are poised for substantial growth and increased market share.

Corteva's biologicals portfolio, featuring the new Corteva Biologicals brand and products like Utrisha N and Utrisha P, represents a significant growth engine. This expansion is fueled by a strong market demand for sustainable agricultural inputs that improve nutrient use and plant health. By the close of 2024, Corteva aims to solidify its position in this burgeoning market as it works towards its ambitious goal of achieving $1 billion in annual biologicals revenue by 2030.

Gene Editing Technologies

Corteva's gene editing technologies are a significant driver of its growth, leveraging its extensive germplasm library. This innovation allows for precise genetic modifications to enhance crop performance.

These advancements are crucial for developing seeds with improved yield potential and robust disease resistance. For example, Corteva has developed corn varieties resistant to lethal necrosis, a significant threat to corn production, and sorghum resistant to striga parasites, a major agricultural pest in Africa. These targeted solutions address critical agricultural challenges and open new market opportunities.

The company's investment in cutting-edge gene editing positions it for future leadership in the agricultural solutions market. By 2024, the global gene editing market was projected to reach substantial figures, highlighting the immense commercial potential of these technologies in agriculture.

- Enhanced Yield: Precise edits can unlock higher yield ceilings in staple crops.

- Disease Resistance: Development of crops naturally resistant to prevalent diseases and pests.

- Value-Added Traits: Creation of seeds with improved nutritional profiles or processing characteristics.

- Market Leadership: Corteva's early adoption and expertise in gene editing solidify its competitive advantage.

Digital Solutions (Granular Insights, LandVisor)

Corteva is strategically repositioning its digital offerings, notably Granular Insights and LandVisor, to deliver enhanced value through data-driven farm management. This shift moves away from a pure Software-as-a-Service (SaaS) model, reflecting a commitment to integrating digital tools directly with their core seed and crop protection portfolios. The objective is to provide farmers with actionable intelligence that optimizes yields and manages expenses effectively.

This strategic pivot emphasizes the practical application of data to maximize the utility of Corteva's physical products. By focusing on tangible outcomes, these digital solutions are designed to become indispensable components of a farmer's operational strategy. This approach aims to solidify market leadership by demonstrating clear economic benefits derived from digital integration.

- Granular Insights: This platform offers advanced analytics for farm operations, providing insights into field performance and resource allocation.

- LandVisor: Focused on land management, it assists in optimizing land use and maximizing agricultural potential.

- Strategic Integration: Corteva is embedding these digital capabilities within its broader product ecosystem, enhancing the value proposition for customers.

- Data-Driven Optimization: The core aim is to empower farmers with data to improve decision-making, leading to better yields and cost efficiencies.

Corteva's Enlist E3® soybeans represent a significant Star product, demonstrating high market share and strong growth potential in the herbicide-tolerant soybean market. This innovation directly addresses farmer needs for effective weed control and yield enhancement.

The company's investment in gene editing technologies, exemplified by corn varieties resistant to lethal necrosis and sorghum resistant to striga, also positions it strongly. These advancements are critical for developing seeds with improved yields and disease resistance, a key driver for future market leadership.

Corteva's biologicals portfolio, branded under Corteva Biologicals and including products like Utrisha N, is another key growth area. With a target of $1 billion in annual biologicals revenue by 2030, this segment is poised for substantial expansion, meeting the growing demand for sustainable agricultural inputs.

The strategic repositioning of digital offerings like Granular Insights and LandVisor to provide data-driven farm management solutions further solidifies Corteva's Star status. By integrating these tools with their core seed and crop protection portfolios, Corteva enhances value and optimizes farmer operations.

| Product/Technology | BCG Category | Market Growth | Market Share | Corteva's Position |

|---|---|---|---|---|

| Enlist E3® Soybeans | Star | High | High | Leading |

| Gene Editing Technologies | Star | High | Growing | Pioneer |

| Biologicals Portfolio | Star | High | Emerging | Aggressive Growth |

| Digital Farm Management | Star | High | Growing | Integrated Provider |

What is included in the product

The Corteva BCG Matrix analyzes its business units based on market share and growth, guiding investment decisions.

The Corteva BCG Matrix provides a clear, visual guide to portfolio optimization, relieving the pain of resource allocation uncertainty.

Cash Cows

Corteva's Pioneer® brand seeds, especially its established corn and soybean hybrids, are prime examples of cash cows within the company's portfolio. These offerings command a substantial market share in well-developed seed markets, consistently generating robust cash flow. This stability is a direct result of decades of strong brand equity, deep farmer loyalty, and a proven track record of superior yields.

In 2024, the agricultural sector continued to see strong demand for high-performance seeds. While specific market share figures for individual Pioneer® hybrids aren't publicly broken down, Corteva's overall Seed segment revenue for the first quarter of 2024 reached $3.6 billion, indicating the strength of its mature product lines. The predictable revenue from these established hybrids provides critical financial backing for Corteva's innovation and expansion into emerging markets.

Corteva's core herbicides, including older Enlist generations and established pasture management solutions like Ultra-S and XT-S Technologies, are firmly positioned as Cash Cows. This mature portfolio commands a significant market share within a slower-growing segment, reflecting their proven efficacy and widespread adoption.

These established products deliver robust profit margins and consistent cash flow, requiring less promotional investment due to their strong competitive advantage. For instance, in 2024, Corteva reported that its Enlist E3 soybeans, which utilize these core herbicide technologies, continued to see strong adoption and market penetration, contributing significantly to the company's agricultural solutions segment profitability.

Corteva's established fungicides, including those powered by Inatreq™ active and Adavelt™ active, are cornerstones of its portfolio, thriving in a mature market. These products command significant market share due to their dependable performance in managing crop diseases, translating into steady revenue streams and robust profit margins.

The consistent efficacy and established trust among farmers solidify their position as cash cows. This allows Corteva to benefit from substantial cash flow with relatively lower investment needs for market expansion compared to newer offerings.

Insecticides (e.g., Closer® 240 SC, Uphold® 360 SC, Delegate® 250 WG)

Corteva's insecticides, such as Closer® 240 SC, Uphold® 360 SC, and Delegate® 250 WG, represent significant cash cows within its portfolio. These products have achieved substantial market share in the mature crop protection sector, a testament to their widespread adoption and efficacy in managing a broad spectrum of insect pests. Their established presence ensures a consistent and reliable stream of revenue, bolstering Corteva's financial stability.

The sustained demand for these insecticides is driven by their proven performance and critical role in safeguarding crop yields. This consistent cash flow generation allows Corteva to invest in research and development for future innovations and support other business segments. For instance, in 2023, the global insecticide market was valued at approximately $20.6 billion, with North America being a key region, highlighting the significant revenue potential of established products like Corteva's.

- High Market Share: Products like Closer®, Uphold®, and Delegate® hold strong positions in the mature insecticide market.

- Reliable Cash Flow: Their established effectiveness and demand generate consistent revenue for Corteva.

- Financial Support: These cash cows contribute significantly to the company's overall financial health and investment capacity.

- Market Context: The global insecticide market's substantial value underscores the importance of these established product lines.

Seed and Trait Out-licensing

Corteva's strategy of out-licensing its seed and trait intellectual property is a prime example of a cash cow. The company aims to achieve royalty neutrality by 2028, indicating a mature and stable revenue stream generated from its existing technological assets. This business model requires minimal incremental investment, as it leverages the company's established patent portfolio and market position.

This approach allows Corteva to monetize its innovations across a broader market, generating consistent income without the need for extensive new product development or capital expenditure. The focus is on maximizing returns from existing intellectual property.

- Royalty Neutrality Target: Corteva aims to be royalty-neutral by the end of 2028, signifying a stable and predictable revenue generation from its out-licensing activities.

- Intellectual Property Monetization: This strategy effectively capitalizes on Corteva's extensive patent portfolio and technological advancements in seeds and traits.

- Low Investment, High Return: As a cash cow, seed and trait out-licensing generates consistent revenue with minimal additional investment, maximizing profitability from existing assets.

Corteva's established seed brands, particularly its mature corn and soybean hybrids, function as significant cash cows. These products benefit from high market penetration and farmer loyalty, ensuring consistent revenue generation with relatively low marketing costs. For instance, Corteva's Seed segment revenue in Q1 2024 was $3.6 billion, reflecting the ongoing strength of these established offerings.

Similarly, core herbicides and fungicides, such as those utilizing Enlist and Inatreq™ technologies, are well-established in slower-growing markets. Their proven efficacy and widespread adoption translate into robust profit margins and predictable cash flow, requiring minimal incremental investment. Corteva's agricultural solutions segment continues to show strong performance, driven by these mature product lines.

Corteva's strategy of out-licensing seed and trait intellectual property also operates as a cash cow, aiming for royalty neutrality by 2028. This approach leverages existing assets to generate stable income with minimal further investment, bolstering the company's financial flexibility.

| Corteva Product Category | BCG Matrix Classification | Key Characteristics | 2024 Financial Insight |

|---|---|---|---|

| Pioneer® Seed Hybrids | Cash Cow | High market share, strong brand equity, consistent yield performance | Seed segment revenue $3.6B (Q1 2024) |

| Core Herbicides (e.g., Enlist) | Cash Cow | Mature market, proven efficacy, widespread farmer adoption | Contributes significantly to Agricultural Solutions profitability |

| Established Fungicides (e.g., Inatreq™) | Cash Cow | Dependable performance, significant market share, robust profit margins | Steady revenue streams with lower investment needs |

| Seed & Trait Out-licensing | Cash Cow | Monetizes existing IP, low incremental investment, stable royalty income | Targeting royalty neutrality by 2028 |

What You See Is What You Get

Corteva BCG Matrix

The Corteva BCG Matrix document you are currently previewing is the identical, fully-formatted report you will receive immediately after completing your purchase. This means no watermarks, no placeholder text, and no altered content—just the comprehensive strategic analysis ready for your immediate use.

Dogs

Corteva's decision to divest the Granular Business software to Traction Ag and discontinue Granular Agronomy highlights their strategic shift away from standalone SaaS offerings. These moves suggest the products struggled with low market share and limited growth potential within Corteva's portfolio.

The discontinuation likely stemmed from these SaaS products being cash traps, consuming resources without yielding substantial returns. Corteva's strategy now focuses on embedding digital capabilities directly into their core seed and crop protection businesses, rather than maintaining separate software ventures.

Older seed varieties that don't offer unique benefits might be classified as dogs in Corteva's portfolio. These products likely struggle with low market share and diminishing demand due to increased competition and evolving agricultural needs.

Such varieties could generate very little revenue or even require ongoing investment without significant returns, impacting overall profitability. Corteva's commitment to innovation, including the introduction of new traits and technologies, aims to phase out or improve these less competitive offerings.

Legacy crop protection products facing declining efficacy due to pest resistance or environmental concerns, alongside the rise of superior alternatives, often fall into the 'dog' category. These products typically have a low market share and stagnant or negative growth, making revitalization efforts costly and often unfruitful.

Corteva's strategic portfolio optimization, including restructuring within its crop protection network, likely aims to divest or phase out such underperforming legacy products. This allows for reallocation of resources towards more innovative and higher-growth segments.

Products Heavily Impacted by Regional Market Shifts or Currency Headwinds

Corteva's products facing significant regional market contractions, like reduced planted acreage in key Latin American markets, can be categorized as Dogs. For instance, if a specific herbicide sees its market share erode due to these shifts, it becomes a resource drain.

Currency headwinds also play a critical role. In 2024, the volatility of currencies like the Brazilian Real and the Turkish Lira, coupled with a weaker Euro, directly impacted the profitability of certain Corteva offerings. When these currency impacts are sustained and lead to persistently low profitability in those regions, these products can be classified as Dogs within the BCG matrix, despite their underlying technological merit.

- Regional Market Contractions: Reduced planted areas in Latin America, a significant agricultural region, directly affect sales volumes for Corteva's seed and crop protection products.

- Currency Volatility: Unfavorable movements in currencies such as the Brazilian Real, Turkish Lira, and Euro in 2024 have negatively impacted revenue and profit margins for products sold in these regions.

- Sustained Low Profitability: When these regional and currency pressures result in a prolonged period of low market share and diminished profitability, the affected products can be considered Dogs.

- Resource Drain: Despite potentially strong underlying technology, these products require ongoing investment for market presence but yield minimal returns, acting as a drain on company resources.

Unsuccessful R&D Projects that Fail to Commercialize

Unsuccessful R&D projects that fail to commercialize are categorized as Dogs within Corteva's BCG Matrix. These represent investments that have not yielded market success or progressed significantly, draining resources without generating revenue. For instance, a new seed trait that shows promise in early trials but ultimately fails regulatory approval or lacks farmer adoption would fall into this category.

Corteva's commitment to innovation means a portion of its R&D pipeline is expected to underperform. In 2024, the agricultural sector continues to face challenges in bringing novel solutions to market due to evolving pest resistance, climate variability, and stringent regulatory landscapes. Projects that don't meet commercial viability benchmarks become dogs, underscoring the high-risk, high-reward nature of agricultural innovation.

- Significant R&D Investment: Corteva's 2023 R&D expenditure was approximately $1.1 billion, a substantial commitment to developing new products.

- Commercialization Hurdles: A percentage of these R&D projects inevitably fail to achieve market acceptance, representing sunk costs.

- Resource Drain: These "dog" projects consume capital and management attention that could be allocated to more promising ventures.

Products in Corteva's portfolio that are considered Dogs are those with low market share and limited growth prospects. These could include older seed varieties that no longer offer a competitive edge or legacy crop protection products that have seen their efficacy decline due to resistance or newer alternatives.

These underperforming assets often represent a drain on resources, requiring investment without generating substantial returns. Corteva's strategy involves optimizing its portfolio by phasing out or divesting these "dog" products to reallocate capital towards more promising innovations.

For example, specific herbicides with declining market share in regions experiencing reduced agricultural activity, like certain Latin American markets in 2024, can become dogs. Similarly, R&D projects that fail to reach commercialization also fall into this category, representing sunk costs.

Currency fluctuations, such as those impacting the Brazilian Real and Turkish Lira in 2024, can exacerbate the low profitability of certain products in specific regions, pushing them into the "dog" classification despite their underlying technological value.

| Product Category | BCG Classification | Reasoning | Example Scenario |

|---|---|---|---|

| Older Seed Varieties | Dog | Low market share, diminishing demand due to competition. | A hybrid corn seed with outdated traits facing strong competition from newer, higher-yielding varieties. |

| Legacy Crop Protection | Dog | Declining efficacy, low market share, stagnant growth. | An insecticide that is less effective against evolving pest populations and has been superseded by newer formulations. |

| Unsuccessful R&D Projects | Dog | Failed commercialization, no revenue generation. | A novel seed treatment that did not receive regulatory approval or farmer adoption after significant investment. |

| Regionally Affected Products | Dog | Low market share due to regional contraction or currency headwinds. | A specific crop protection product with reduced sales in Latin America due to lower planted acreage in 2024, further impacted by currency devaluation. |

Question Marks

Corteva's efforts in biofuels feedstock, like its expanded Winter Canola Program, are positioned as question marks within the BCG matrix. This sector is experiencing rapid growth due to the global push for energy transition, with demand for sustainable fuel sources increasing. For instance, the global biofuels market was valued at approximately $120 billion in 2023 and is projected to reach over $200 billion by 2030, indicating substantial growth potential.

Corteva's market share in this emerging area is still being established, requiring significant investment to build capacity and secure a leading position. The company's investment in winter canola, a crop known for its high oil yield and suitability for biofuel production, highlights its strategic move into this high-potential market. Success here could lead to substantial returns, but it also carries inherent risks given the competitive landscape and evolving regulatory environment.

Corteva's proprietary hybrid wheat system is a prime example of a question mark in their business portfolio. This innovative technology has demonstrated the potential for significant yield increases, often in the range of 10-20%, which is substantial for a staple global crop like wheat.

Currently, this hybrid wheat system is in its early stages of development and market introduction. This means it possesses high potential for future growth but commands a relatively low market share today.

The success of this system hinges on continued investment in its research, development, and commercialization efforts. If these investments pay off, it could transition from a question mark to a future star performer for Corteva.

Corteva's emerging biologicals, while part of a strong overall portfolio, can be viewed as question marks. These are newer solutions or those targeting specialized markets where their current adoption is limited, despite a clear upward trend in demand for sustainable agricultural practices.

These products represent significant growth opportunities, driven by the increasing preference for environmentally friendly farming inputs. For instance, the global biopesticides market, a key segment for biologicals, was valued at approximately USD 5.5 billion in 2023 and is projected to reach over USD 15 billion by 2030, indicating substantial room for expansion.

However, realizing this potential requires substantial investment in marketing, farmer education, and distribution channels to overcome adoption barriers. Corteva's strategic focus on these areas will be crucial for these question mark products to gain traction, increase market share, and transition towards becoming stars in their portfolio.

Digital Solutions for Carbon Programs (Corteva Carbon Initiative)

Corteva's Carbon Initiative is a prime example of a question mark within its business portfolio. This program aims to reward farmers for adopting regenerative agriculture practices, thereby enabling them to generate and sell carbon credits. This aligns with the expanding market demand for sustainable farming and carbon sequestration solutions.

While innovative, the initiative faces challenges in achieving widespread market adoption and establishing a robust presence. Significant investment is necessary to develop the underlying technology platform and scale up farmer engagement.

- Market Potential: The global carbon farming market is projected to reach tens of billions of dollars in the coming years, with estimates varying but consistently showing strong growth.

- Investment Needs: Building out digital platforms for credit verification and farmer onboarding requires substantial upfront capital.

- Farmer Adoption: Early adoption rates are crucial for demonstrating program viability and attracting further investment.

- Regulatory Landscape: Evolving regulations around carbon markets can impact the program's profitability and scalability.

Advanced Gene-Edited Products in Early Commercialization

Corteva's advanced gene-edited products, such as those offering enhanced drought resistance or improved nutrient uptake, are currently in the early stages of commercialization. These innovative traits represent a high-growth technology area, but as new introductions, they possess a low market share among farmers.

Success for these gene-edited products hinges on substantial investment in market education and driving farmer adoption. For instance, Corteva's Enlist E3 soybeans, a significant gene-editing advancement, saw continued expansion in 2024, indicating a growing market acceptance for such technologies.

- Product Examples: Gene-edited traits for drought tolerance and enhanced nitrogen utilization.

- Market Position: High-growth technology with currently low market share.

- Investment Focus: Market education and farmer adoption are critical for success.

- 2024 Data Point: Continued farmer adoption of gene-edited traits like Enlist E3 soybeans in the US market.

Corteva's question marks represent emerging business areas with high growth potential but currently low market share. These ventures require significant investment to gain traction and establish a competitive position.

The success of these question marks is contingent on factors like market adoption, technological advancement, and navigating evolving regulatory landscapes. Corteva's strategic investments in areas like biofuels feedstock and advanced gene-edited products are key to transforming these into future market leaders.

For example, the global biopesticides market, a segment of biologicals, was valued at approximately USD 5.5 billion in 2023 and is expected to grow substantially. Similarly, advanced gene-edited traits are seeing increasing farmer acceptance, as evidenced by the continued expansion of products like Enlist E3 soybeans in 2024.

| Business Area | Current Market Share | Growth Potential | Key Investment Focus |

|---|---|---|---|

| Biofuels Feedstock (Winter Canola) | Low | High | Capacity building, market development |

| Hybrid Wheat System | Low | High | R&D, commercialization |

| Emerging Biologicals | Low to Moderate | High | Marketing, farmer education, distribution |

| Carbon Initiative | Low | High | Platform development, farmer engagement |

| Advanced Gene-Edited Products | Low | High | Market education, farmer adoption |

BCG Matrix Data Sources

Our Corteva BCG Matrix leverages comprehensive market data, including internal sales figures, agricultural sector growth projections, and competitor product performance analyses to provide accurate strategic insights.