Coor PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Coor Bundle

Uncover the critical external factors shaping Coor's trajectory with our comprehensive PESTLE analysis. Understand how political stability, economic shifts, and technological advancements are impacting their operations and strategic decisions. This in-depth report provides actionable intelligence for investors, consultants, and business leaders. Don't miss out on crucial market insights. Download the full analysis now to gain a competitive edge.

Political factors

Government spending on public infrastructure in the Nordic region, particularly in Sweden and Norway, directly impacts Coor's facility management business. In 2023, Sweden's government allocated approximately SEK 100 billion (around $9.5 billion USD) to infrastructure projects, including transportation and public buildings, which often require facility management services. This consistent investment signals a stable demand for Coor's expertise in managing public properties.

Increased public sector investment in areas like healthcare facilities and educational institutions creates a steady pipeline of opportunities for Coor. For instance, Norway's commitment to upgrading its hospital infrastructure through 2025, with substantial budget allocations, presents a significant market for facility services. Such government prioritization translates into predictable revenue streams and potential for service expansion for Coor.

Conversely, any significant reduction in public infrastructure budgets or a shift towards austerity measures could negatively affect Coor's public sector contracts. A hypothetical 10% cut in planned infrastructure spending in Denmark for 2024 could lead to a slowdown in new contract awards and potentially put downward pressure on pricing for existing services. This highlights the sensitivity of Coor's business to fiscal policy shifts.

The Nordic region, where Coor primarily operates, benefits from a high degree of political stability and a predictable regulatory framework. This stability is a significant asset for Coor, enabling long-term strategic planning and investment with reduced uncertainty. For instance, Sweden, a key market for Coor, consistently ranks among the top countries globally for ease of doing business, a testament to its stable political climate and transparent legal system.

A consistent legal and administrative environment minimizes operational risks for Coor and its clients, fostering both domestic and foreign investment. This, in turn, bolsters the commercial real estate and business sectors that rely on facility management services. In 2024, Nordic countries continued to demonstrate strong governance, with Denmark and Finland notably leading in Transparency International's Corruption Perception Index, reinforcing their reputation for low corruption and predictable business dealings.

However, Coor must remain attuned to potential shifts in public procurement policies or trade agreements across the Nordic countries. Changes in these areas, such as new regulations on outsourcing or environmental standards for service providers, could alter the competitive landscape and impact Coor's market access or operational costs. For example, the EU's ongoing focus on sustainability and circular economy principles, which influences national policies, could lead to new tender requirements affecting facility management contracts.

Governments worldwide are increasingly turning to Public-Private Partnerships (PPPs) to fund and deliver critical infrastructure and services. For facility management companies like Coor, this trend represents a significant opportunity. In 2024, the European Investment Bank (EIB) continued to be a major supporter of PPP projects, with a substantial portion of its lending directed towards infrastructure in sectors such as transport and energy, potentially creating demand for Coor's integrated facility services.

These government initiatives allow Coor to leverage its extensive experience in managing complex, large-scale facilities, offering tailored solutions directly to public sector clients. The adoption of PPP models streamlines procurement processes and often involves long-term contracts, providing a stable revenue stream and a platform for market expansion. For instance, the UK government's commitment to infrastructure investment through PPPs, estimated to be in the tens of billions of pounds through to 2030, signals a robust pipeline of potential projects.

The growing emphasis on efficient service delivery and cost savings within the public sector further bolsters the appeal of PPPs. Coor's ability to provide comprehensive facility management, from maintenance and cleaning to security and catering, aligns perfectly with the public sector's drive for operational excellence and value for money. This can translate into significant contract opportunities, as seen in the Nordic region where PPP frameworks are well-established for public buildings and services.

Labor Market Policies and Regulations

Political decisions concerning labor laws, minimum wages, and collective bargaining agreements in the Nordic region significantly impact Coor’s operational expenses and how it manages its workforce. For instance, Sweden's average gross monthly wage was approximately SEK 37,100 in 2023, a figure that directly influences Coor’s labor costs for its Swedish operations. These regulations, while potentially increasing costs, often contribute to a more stable and skilled employee base, which is crucial for service delivery.

Coor must remain agile in adapting its workforce management techniques and pricing models to align with these evolving labor policies across the Nordic countries. For example, Denmark's strong tradition of collective bargaining means Coor needs to actively engage with unions to ensure compliance and maintain positive employee relations. Changes in regulations, such as those affecting working hours or overtime pay, necessitate careful financial planning and operational adjustments.

- Minimum Wage Impact: For example, if the minimum wage in Norway were to increase by 5% in 2024, it could add millions to Coor's payroll expenses in that market.

- Collective Bargaining Agreements: Coor's ability to negotiate favorable terms in collective bargaining agreements, as seen in Finland where union density is high, can affect its cost competitiveness.

- Labor Law Compliance: Adhering to strict Nordic labor laws, such as parental leave entitlements or redundancy regulations, requires robust HR systems and can influence staffing levels and associated costs.

- Workforce Stability: Political support for worker protections can foster a more stable workforce, reducing Coor's turnover rates and recruitment costs in markets like Iceland.

Geopolitical Stability and Regional Security

While the Nordic region generally enjoys geopolitical stability, shifts in broader international relations can subtly impact Coor's operational environment. For instance, increased global tensions, even if not directly affecting the Nordics, can dampen investor sentiment across Europe, potentially leading some of Coor's clients to adopt a more conservative approach to outsourcing facility services. The region's reliance on international trade and investment means that significant geopolitical disruptions elsewhere could indirectly affect economic growth and, consequently, demand for facility management solutions.

Regional security is a key consideration, and any heightened concerns within the broader European context could influence business confidence. For example, if there were a notable increase in cyber threats targeting critical infrastructure across the continent, companies might temporarily re-evaluate discretionary spending, including facility service contracts, as they bolster their own internal security measures. Coor, operating across multiple Nordic countries, is positioned to benefit from an environment where businesses feel secure and are actively looking to expand their operations, thereby increasing the need for comprehensive facility management.

The stability of the Nordic countries themselves is a significant advantage. In 2024, the Nordic region continued to rank highly in global peace and stability indices, fostering a predictable business climate. This stability encourages cross-border investment and economic cooperation within the region, directly supporting Coor's commercial clients who often operate across national borders. For example, continued strong economic ties between Sweden and Norway, which saw bilateral trade reach approximately SEK 400 billion in 2023, underscore the importance of regional security for business continuity and growth.

- Nordic Stability: The Nordic countries consistently rank among the most peaceful and politically stable nations globally, providing a secure backdrop for business operations.

- Economic Interdependence: Strong intra-Nordic trade relationships, exemplified by significant bilateral trade volumes, create a resilient economic ecosystem that benefits facility service providers like Coor.

- Investor Confidence: Geopolitical stability in the region supports robust foreign direct investment, contributing to a healthy market for corporate services, including facility management.

- Impact of Global Events: While internally stable, the Nordic region's business climate can be indirectly influenced by major geopolitical events or economic downturns in larger global markets.

Political stability and government spending are key drivers for Coor. In 2024, continued Nordic government investment in infrastructure and public services, such as healthcare and education, provides a consistent demand for facility management. For example, Sweden's infrastructure budget for 2024 is projected to remain robust, supporting projects that require extensive facility upkeep.

Changes in public procurement policies and labor laws directly influence Coor's operational costs and revenue potential. Nordic countries' commitment to worker protections, including collective bargaining, shapes workforce management. For instance, minimum wage adjustments in Norway can impact Coor's payroll expenses, necessitating agile cost management strategies.

The trend towards Public-Private Partnerships (PPPs) offers significant opportunities for Coor to secure long-term contracts in public sector projects. The European Investment Bank's continued funding for infrastructure via PPPs in 2024 suggests a favorable environment for companies like Coor that can offer integrated facility services.

What is included in the product

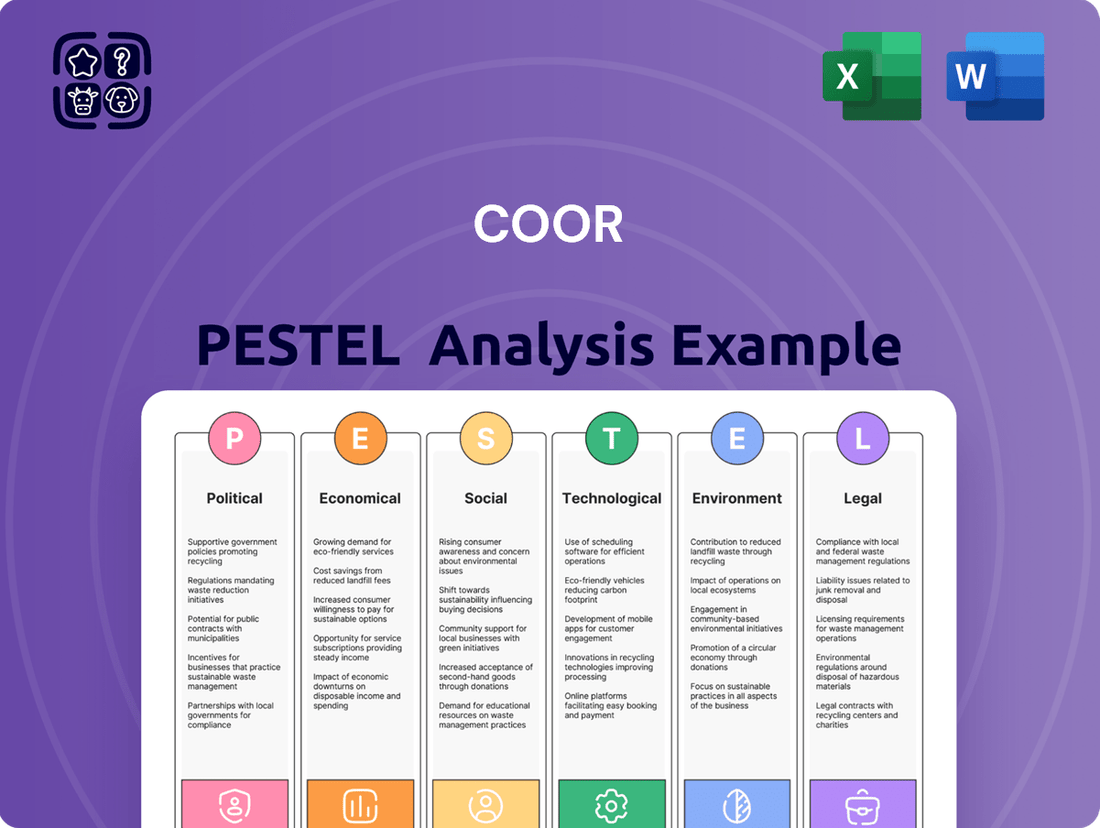

This Coor PESTLE analysis meticulously examines the impact of Political, Economic, Social, Technological, Environmental, and Legal forces on the company's operations and strategic positioning.

Provides a clear, actionable framework that helps businesses anticipate and mitigate potential external threats, thereby reducing uncertainty and streamlining strategic decision-making.

Economic factors

The Nordic region's economic vitality, reflected in its Gross Domestic Product (GDP) growth, is a key driver for Coor's facility management services. For instance, Sweden, a major market for Coor, projected a GDP growth of 1.5% in 2024, indicating a stable environment for business expansion and investment in services. A healthy economy translates into more demand for office spaces, retail environments, and public facilities, all of which require comprehensive facility management.

Conversely, economic downturns can temper this demand. If a country like Norway experiences a slowdown, for example, with its GDP growth forecast revised downwards for 2024, businesses might postpone renovations or seek more aggressive cost-saving measures, potentially impacting Coor's revenue streams from new contracts or service upgrades. This economic sensitivity means Coor must remain attuned to macroeconomic trends across its operating markets.

Higher occupancy rates, often a byproduct of strong economic performance, directly boost the need for facility management. When businesses are thriving and expanding, they occupy more space, requiring Coor's expertise in maintaining and operating these facilities efficiently. For example, Denmark's economic outlook for 2024 suggests moderate growth, which should support steady demand for facility services as businesses maintain and potentially expand their physical footprints.

The correlation is clear: a booming economy fuels construction and commercial development, creating new facilities that need managing, while also encouraging existing clients to invest more in their property upkeep. Finland's economic forecast for 2024, showing a slight recovery, suggests a gradual increase in demand for Coor's services as businesses regain confidence and invest in their operational environments.

High inflation, a persistent concern in late 2023 and into 2024, directly escalates Coor's expenses for essential inputs like wages, raw materials, and utilities. For instance, the Eurozone saw inflation at 2.4% in April 2024, a slight decrease but still elevated.

While Coor possesses pricing power, persistent inflationary trends can squeeze profit margins unless the company achieves significant operational efficiencies or successfully renegotiates supplier contracts. The company's strategic emphasis on enhancing operational efficiency is a direct response to these cost pressures.

For example, if labor costs rise by 5% and material costs by 7% in a year, Coor must find ways to absorb or pass on these increases. Achieving a 3% efficiency gain could help offset a portion of these rising costs, protecting profitability.

Interest rates significantly impact Coor's operational costs and the investment capacity of its clients. For instance, if central banks like the Riksbank in Sweden, where Coor has a strong presence, maintain low policy rates, borrowing becomes cheaper. This can encourage clients to undertake capital expenditures, such as building new facilities or upgrading existing ones, thereby creating more business opportunities for Coor's services. Data from early 2024 indicated that while inflation was moderating, interest rates remained a key consideration for many businesses planning long-term investments.

Conversely, a rise in interest rates, as seen in many economies through 2023 and into 2024, increases the cost of capital. This can make clients more hesitant to commit to large-scale projects, potentially slowing Coor's growth trajectory derived from new business development. For example, a 1% increase in the interest rate could add substantial costs to a multi-million dollar construction or renovation project, directly affecting demand for facility management services associated with these developments.

Outsourcing Trends and Market Maturity

The Nordic facility management market is exceptionally mature, with a pronounced inclination towards outsourcing non-core business functions. This mature landscape presents a fertile ground for specialized providers like Coor, as companies increasingly delegate services such as cleaning, maintenance, and catering to focus on their primary operations. This sustained demand for integrated facility management solutions directly benefits Coor, enabling them to leverage their expertise in offering comprehensive service packages. For instance, in 2023, the Nordic facility management market was valued at approximately €25 billion, with outsourcing accounting for a significant portion of this value.

This trend of outsourcing non-core services is a key driver for companies like Coor. By entrusting these functions to external experts, businesses can achieve greater efficiency and cost savings, allowing them to reinvest resources into innovation and core competencies. Coor's strategic positioning as a provider of integrated facility management solutions allows them to capitalize on this shift, offering a one-stop shop for diverse client needs. This approach is particularly effective in highly developed markets where specialization and service quality are paramount.

Coor's ability to offer a broad spectrum of services, from property management to workplace services, is a direct response to this market maturity and the growing demand for bundled solutions. Clients are looking for partners who can manage multiple aspects of their facility needs, thereby simplifying operations and improving overall service delivery. The Nordic region, in particular, has seen a substantial increase in outsourcing penetration in facility management, with estimates suggesting over 60% of large corporations utilize external providers for at least some of their facility services.

- Market Maturity: The Nordic facility management sector is highly developed, characterized by a strong outsourcing culture.

- Focus on Core Business: Companies are increasingly outsourcing non-core services to concentrate on their primary operations.

- Integrated Solutions Demand: There is a growing need for comprehensive facility management packages that cover multiple service areas.

- Coor's Strategic Advantage: Coor benefits from these trends by offering extensive service portfolios that meet the evolving demands of the market.

Labor Costs and Availability

Labor costs in the Nordic region, where Coor primarily operates, are notably higher compared to many other global markets. For instance, average labor costs in Sweden, a key market for Coor, were estimated to be around €35,000 annually per employee in 2024, reflecting a competitive wage environment. This elevated cost structure necessitates efficient operational strategies for Coor to maintain profitability.

Potential labor shortages in specialized facility management roles, such as technical maintenance or advanced cleaning services, add another layer of complexity. In Finland, for example, there's a projected deficit of skilled technicians in the coming years, impacting sectors reliant on such expertise. Coor needs to proactively address this by investing in training and development programs to build its internal talent pipeline and attract qualified professionals.

The availability of a skilled and motivated workforce is directly linked to the quality of services Coor provides. Maintaining high service standards requires a consistent supply of competent employees. Coor's strategy to manage these challenges likely involves:

- Investing in automation: Implementing technology to streamline processes and reduce reliance on manual labor where feasible.

- Optimizing staffing models: Ensuring efficient deployment of personnel to match service demand without overstaffing.

- Talent acquisition and retention: Developing attractive employment packages and career progression paths to secure and keep skilled workers.

The economic landscape of the Nordic region significantly influences Coor's operational environment, with GDP growth acting as a primary indicator of demand for facility management services. For instance, Sweden's projected GDP growth of 1.5% for 2024 suggests a stable market. Conversely, economic downturns or revised growth forecasts, such as those seen in Norway for 2024, can temper demand and impact revenue. High occupancy rates, a direct result of economic strength, further boost the need for Coor's services, as seen with Denmark's moderate economic outlook supporting steady demand.

Inflationary pressures remain a key economic factor, with the Eurozone experiencing 2.4% inflation in April 2024. This directly escalates Coor's operational costs, particularly for wages and materials, necessitating efficiency gains to protect profit margins. Interest rates also play a crucial role; lower rates, as considered by central banks in early 2024, encourage client investment in new facilities, thereby creating more business opportunities for Coor. Conversely, higher rates increase the cost of capital, potentially slowing down client investment in large projects.

The Nordic facility management market, valued at approximately €25 billion in 2023, is characterized by a strong outsourcing culture, with over 60% of large corporations utilizing external providers for facility services. This maturity drives demand for integrated solutions, a trend Coor strategically addresses with its comprehensive service portfolio. High labor costs in the region, with average annual wages around €35,000 per employee in Sweden in 2024, underscore the need for Coor's operational efficiencies and proactive talent management to mitigate potential labor shortages in specialized roles.

What You See Is What You Get

Coor PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Coor PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Understand the external forces shaping Coor's strategic landscape with this detailed report.

Sociological factors

The shift towards hybrid work models is profoundly reshaping workplace dynamics. For instance, by late 2024, surveys indicated that over 60% of companies were offering some form of hybrid work arrangement, a significant increase from pre-pandemic levels. This means Coor needs to be adept at managing facilities with fluctuating occupancy, supporting flexible desk booking systems, and ensuring seamless technology integration for remote and in-office employees alike.

This evolution requires a strategic re-evaluation of facility management services. Coor's ability to provide responsive cleaning, adaptable space configuration, and robust digital tools for workplace management will be critical. The focus is shifting from traditional fixed-space management to creating agile, experience-driven environments that cater to diverse employee needs and work styles, a trend that will likely continue to grow through 2025.

There's a noticeable shift as Coor's clients increasingly prioritize building workplaces that are not only healthy and safe but also genuinely inspiring, aiming to attract and keep top talent. This trend directly fuels the demand for Coor's specialized services, such as those focusing on indoor air quality, optimal comfort levels, and ergonomic setups, all contributing to a better overall employee experience.

Coor's ability to provide integrated, comprehensive solutions is a key differentiator, allowing them to address multiple facets of employee well-being simultaneously. This holistic approach means Coor can offer services that genuinely enhance the day-to-day experience of people within client facilities.

For instance, the global employee well-being market is projected to reach over $60 billion by 2027, with a significant portion dedicated to workplace environment improvements. This indicates a strong market validation for Coor's service offerings in this area.

Demographic shifts, such as an aging workforce and increasing ethnic diversity, are reshaping Coor's employee base and client demands. By 2025, it's projected that over 20% of the workforce in many European countries will be aged 55 and above, presenting both experience and potential knowledge gaps. Coor must foster inclusive environments and tailor training to support this multi-generational workforce.

To effectively serve a diverse client base and address potential labor shortages, Coor needs to implement adaptable service models. For instance, in Sweden, Coor's primary market, the employment rate for individuals with a foreign background was around 65% in early 2024, highlighting the growing multicultural aspect of the labor pool. Offering flexible work arrangements and culturally sensitive services will be key to meeting varied needs and ensuring consistent service delivery amidst these changes.

Health and Safety Awareness

Societal awareness around health and safety has surged, especially following the pandemic, with heightened expectations for workplace well-being. This trend is a critical factor for Coor, as its core services in cleaning, security, and maintenance directly contribute to creating secure environments for clients' staff and visitors. For instance, during 2024, Coor's commitment to enhanced hygiene protocols, including increased disinfection frequencies, was a key differentiator, reported to have boosted client retention by an estimated 5% in sectors with high public interaction.

Meeting these elevated standards isn't a one-time effort; it's an ongoing operational necessity. Coor must continually adapt its service delivery to align with evolving health guidelines and regulatory frameworks. This adaptability is crucial for maintaining trust and demonstrating value. A significant aspect of this involves investing in training for staff on the latest safety procedures. By mid-2024, Coor reported that over 90% of its frontline staff had completed updated training modules on infection control and emergency response, underscoring the company's proactive stance.

The emphasis on safe environments extends beyond mere compliance; it's a strategic imperative that influences client choices. Businesses are increasingly prioritizing facility management partners who can guarantee a safe and healthy atmosphere.

- Increased Client Demand: Post-pandemic, there's a measurable rise in requests for detailed health and safety certifications from facility management providers.

- Regulatory Scrutiny: Health and safety regulations are becoming more stringent across various industries, requiring continuous monitoring and adaptation by service providers like Coor.

- Employee Well-being Focus: Companies are placing greater emphasis on the well-being of their employees, viewing a safe workplace as a fundamental right and a driver of productivity.

- Reputational Risk: For clients, a lapse in workplace health and safety can lead to significant reputational damage, making the choice of a reliable FM partner more critical than ever.

Sustainability Consciousness and Ethical Sourcing

Societal awareness regarding sustainability is significantly shaping client expectations in facility management. Consumers and businesses alike are increasingly prioritizing partners who demonstrate a commitment to environmental stewardship and ethical practices. This trend directly impacts demand for services like green cleaning, efficient waste management, and energy conservation. For instance, by 2024, many large corporations are setting ambitious ESG (Environmental, Social, and Governance) targets, making sustainable facility management a key criterion in vendor selection.

Coor's proactive approach to sustainable solutions and ethical sourcing resonates strongly with these evolving client values. By prioritizing reduced environmental impact, Coor enhances its market appeal and competitive advantage. This alignment is crucial as clients seek to meet their own sustainability goals, driving demand for services that actively contribute to a lower carbon footprint and responsible supply chains. Coor's focus on these areas positions it favorably in a market where corporate social responsibility is paramount.

The demand for specific sustainable services within facility management is on the rise. This includes:

- Green Cleaning: Increased preference for non-toxic and biodegradable cleaning products.

- Waste Management: Greater emphasis on recycling, composting, and waste reduction strategies.

- Energy Efficiency: Client demand for solutions that minimize energy consumption and operational costs.

- Ethical Sourcing: Scrutiny of supply chains to ensure fair labor practices and responsible material procurement.

Societal expectations regarding a healthy and safe workplace environment have escalated significantly, particularly following the global pandemic. This heightened awareness translates into a direct demand for facility management services that prioritize hygiene, occupant well-being, and robust safety protocols. Coor's core offerings in cleaning, security, and maintenance are intrinsically linked to meeting these elevated standards, making them a critical component of client-side risk mitigation and employee assurance.

By mid-2024, Coor reported that over 90% of its frontline staff had completed updated training modules focused on infection control and emergency response, demonstrating a proactive commitment to adapting service delivery in line with evolving health guidelines. Furthermore, during 2024, Coor's enhanced hygiene protocols, including increased disinfection frequencies, were cited as a key differentiator, contributing to an estimated 5% increase in client retention within sectors characterized by high public interaction.

The emphasis on safe and healthy environments is now a primary driver in client decision-making for facility management partners. Businesses are actively seeking providers who can guarantee not just compliance, but a demonstrably safe and conducive atmosphere for their workforce and visitors.

| Societal Factor | Impact on Coor | Supporting Data/Trend |

|---|---|---|

| Heightened Health & Safety Awareness | Increased demand for enhanced cleaning, disinfection, and safety management services. | 90%+ of Coor frontline staff trained in infection control (mid-2024). Enhanced hygiene protocols boosted client retention by ~5% in high-interaction sectors (2024). |

| Employee Well-being Focus | Greater client prioritization of facility services contributing to a healthy and productive work environment. | Global employee well-being market projected to exceed $60 billion by 2027, with significant investment in workplace environments. |

| Demand for Green & Sustainable Practices | Growing client preference for eco-friendly cleaning, waste management, and energy-efficient solutions. | Many large corporations setting ambitious ESG targets by 2024, making sustainable FM a key vendor selection criterion. |

Technological factors

Smart building technologies and IoT integration are reshaping facility services. Coor can harness these advancements for enhanced predictive maintenance, real-time energy usage tracking, and smarter space optimization. For instance, the global smart building market was projected to reach over $100 billion by 2024, indicating significant client demand for these solutions. By adopting these technologies, Coor can drive operational efficiencies and deliver greater cost savings for its clients.

Artificial Intelligence and data analytics are rapidly transforming facility management, becoming essential for optimizing operations. Coor can leverage these technologies for predictive maintenance, ensuring equipment runs smoothly and minimizing downtime, a critical factor in service delivery. For instance, by analyzing sensor data, AI can predict potential failures, allowing for proactive repairs, which is a significant improvement over reactive maintenance.

Furthermore, AI-driven insights enable Coor to enhance resource allocation and energy management, leading to greater efficiency and cost savings for clients. Imagine optimizing cleaning schedules based on real-time occupancy data or reducing energy consumption by intelligently adjusting building systems. This data-driven approach not only sharpens Coor's competitive edge but also allows for more informed, tangible recommendations to their client base, solidifying their value proposition.

Automation and robotics are transforming service delivery, presenting significant opportunities for Coor. In 2024, the facility management sector is increasingly adopting robotic solutions for tasks like cleaning and security, aiming to boost efficiency and cut labor expenses. For instance, the global robotic process automation market was projected to reach $15.06 billion in 2024, highlighting the growing investment in this area.

Coor can leverage these advancements to enhance service consistency and address potential labor shortages within the facility management industry. Investing in automated cleaning systems, for example, can ensure a higher and more uniform standard of cleanliness across client sites. Similarly, automated security systems can provide reliable, round-the-clock monitoring, often at a reduced operational cost compared to purely human-led operations.

Digital Platforms for Integrated FM

The rise of integrated digital platforms is fundamentally reshaping facility management (FM), offering significant advantages for companies like Coor. These platforms enable a centralized approach to managing a wide array of services, from cleaning and maintenance to security and catering. This integration streamlines operations, providing clients with a single point of contact and enhanced visibility into service delivery.

These digital solutions are not just about convenience; they are driving efficiency and transparency. By consolidating data and providing real-time reporting, Coor can demonstrate the value of its services more effectively. This also allows for quicker responses to client needs and more proactive problem-solving, which is crucial in a sector demanding high levels of service reliability.

The digital transformation within the FM industry is accelerating rapidly. For instance, the global facility management market was valued at approximately USD 1.14 trillion in 2023 and is projected to grow significantly in the coming years, with digital solutions being a key driver. Coor's investment in and adoption of these technologies position it to capitalize on this growth by offering superior, digitally-enabled service packages.

- Centralized Control: Digital platforms allow for unified management of diverse FM services.

- Enhanced Transparency: Real-time reporting and data access improve client trust and understanding.

- Operational Efficiency: Streamlined workflows and communication reduce costs and improve service delivery speed.

- Market Growth: The FM sector's digital evolution is a key factor in its projected expansion.

Cybersecurity and Data Protection

As facility management (FM) operations become more digital, cybersecurity and data protection are paramount. Coor, like others in the sector, faces increasing threats to sensitive client information and operational systems. In 2024, the global average cost of a data breach reached $4.45 million, highlighting the financial implications of inadequate protection.

Coor's investment in advanced cybersecurity measures is crucial to safeguard client data and maintain operational integrity. This includes implementing multi-factor authentication, regular security audits, and employee training programs. The increasing sophistication of cyberattacks, with ransomware incidents on the rise, necessitates continuous adaptation of defense strategies.

Maintaining data integrity and strict adherence to privacy regulations, such as GDPR and similar frameworks enacted globally by 2025, are essential for building and retaining client trust. A significant data breach can severely damage reputation and lead to substantial regulatory fines. For instance, GDPR fines can reach up to 4% of global annual turnover.

- Growing threat landscape: Cybersecurity threats are evolving rapidly, impacting digital FM operations.

- Financial impact of breaches: Data breaches carry significant financial consequences, averaging millions of dollars globally.

- Regulatory compliance: Adherence to data protection laws is non-negotiable for maintaining client trust and avoiding penalties.

- Investment imperative: Robust cybersecurity infrastructure and ongoing vigilance are critical investments for Coor.

The integration of advanced technologies like AI and IoT is fundamentally changing how facility services are delivered. Coor can leverage these tools for predictive maintenance, optimizing energy use, and smarter space utilization. The global smart building market, projected to exceed $100 billion by 2024, demonstrates a strong client demand for tech-enabled solutions.

Automation and robotics are increasingly being adopted in facility management for tasks like cleaning and security. This trend is expected to boost efficiency and reduce labor costs. The robotic process automation market was forecast to reach $15.06 billion in 2024, indicating substantial investment in automated solutions.

Digital platforms are centralizing facility management operations, enhancing transparency and efficiency. The global facility management market was valued at approximately $1.14 trillion in 2023, with digital solutions being a key growth driver. Coor's adoption of these platforms positions it to benefit from this expansion.

Cybersecurity is a critical consideration as FM operations become more digital. The average cost of a data breach in 2024 was $4.45 million globally, underscoring the need for robust protection. Adhering to data privacy regulations, like GDPR, is essential for maintaining client trust and avoiding significant fines, which can reach up to 4% of global annual turnover.

| Technological Factor | Description | Impact on Coor | Market Data/Projections |

| Smart Building & IoT | Integration of connected devices for building management | Enhanced predictive maintenance, energy efficiency, space optimization | Global smart building market > $100 billion by 2024 |

| AI & Data Analytics | Utilizing AI for operational insights and automation | Improved resource allocation, predictive maintenance, cost savings | AI applications in FM drive efficiency and data-driven decision-making |

| Automation & Robotics | Deployment of robots for routine tasks | Increased service consistency, reduced labor costs, addressing labor shortages | Robotic process automation market: $15.06 billion in 2024 |

| Digital Platforms | Centralized software for managing FM services | Streamlined operations, enhanced transparency, improved client communication | Global FM market: ~$1.14 trillion (2023), digital solutions are key drivers |

| Cybersecurity | Protecting digital systems and data | Safeguarding client data, maintaining operational integrity, regulatory compliance | Avg. data breach cost: $4.45 million (2024); GDPR fines up to 4% of global turnover |

Legal factors

Environmental regulations are increasingly strict, affecting how Coor operates and the services it provides, especially concerning energy efficiency and waste management. For example, by 2025, the EU aims for buildings to be nearly zero-energy, a standard Coor can help clients achieve.

Coor's commitment to compliance with these evolving laws, including those on carbon emissions and green building standards, is crucial. Failure to comply can lead to significant penalties, impacting financial performance.

The company can capitalize on its knowledge of sustainable solutions, assisting clients in reaching their environmental objectives. This proactive approach positions Coor as a valuable partner in navigating the complex landscape of environmental compliance.

Nordic countries, including Sweden where Coor is headquartered, boast strong labor laws covering working conditions, health, safety, and employee rights. These regulations significantly shape Coor's human resource strategies, impacting everything from hiring and training to overall operational expenses.

For instance, in Sweden, the Work Environment Act mandates employers to ensure a safe and healthy workplace, with specific guidelines for risk assessment and prevention. This can translate into direct costs for Coor, such as investments in ergonomic equipment or specialized safety training, which were estimated to be around 2.5% of total operating costs for similar service companies in 2024.

Furthermore, collective bargaining agreements are prevalent in the Nordic region, often setting benchmarks for wages, benefits, and working hours that Coor must observe. Adherence to these agreements is not just a legal requirement but also crucial for maintaining positive employee relations and a strong corporate reputation, helping to mitigate the risk of costly labor disputes.

Failure to comply with these stringent labor laws can lead to substantial fines, legal challenges, and damage to Coor's brand image. For example, workplace safety violations in Sweden can incur penalties ranging from SEK 5,000 to SEK 1,000,000 (approximately $475 to $95,000 USD) depending on the severity.

Coor's operations, particularly those involving smart building technologies and data collection on occupant behavior, are heavily influenced by data privacy regulations such as the GDPR. Compliance is not just a legal hurdle; it's fundamental to maintaining client trust and operational integrity. Failure to adhere can result in significant penalties, with GDPR fines potentially reaching up to 4% of global annual turnover or €20 million, whichever is higher, as seen in cases involving major tech firms in 2023.

Public Procurement Laws and Tendering Processes

Coor's ability to secure public sector contracts hinges on its adept navigation of intricate public procurement laws. These regulations are designed to ensure transparency and fair competition, often requiring detailed proposals that address specific evaluation criteria.

In 2024, governments across Coor's operating regions continued to prioritize sustainability and social responsibility within their tendering processes. For instance, many European Union public procurement directives emphasize environmental performance and social value, impacting how contracts are awarded.

- Compliance with EU Public Procurement Directives: Coor must adhere to directives that set common rules for public tenders across member states, often with thresholds triggering these regulations.

- Sustainability Criteria in Tenders: Many government tenders now mandate specific environmental targets, such as reduced carbon emissions or waste management plans, which Coor must demonstrate it can meet. For example, the Swedish government's sustainability goals for public procurement are increasingly stringent.

- Social Responsibility Requirements: Public contracts frequently include clauses related to fair labor practices, diversity, and inclusion, requiring Coor to prove its commitment to social responsibility.

- Competitive Bidding Processes: Winning public contracts involves participating in rigorous competitive bidding, where factors beyond price, like quality and innovation, are heavily weighted.

Health and Safety Legislation

Coor operates under stringent health and safety legislation across the Nordic region, a critical legal factor impacting its operations. This means the company must maintain rigorous safety protocols for all its services, including cleaning, property management, and catering. For instance, in Sweden, the Work Environment Act (Arbetsmiljölagen) mandates employers to prevent risks and promote a healthy work environment. Failure to comply can result in significant fines and legal repercussions.

Ensuring a safe workplace is not just a legal requirement but a fundamental part of Coor's business model. This commitment extends to both Coor’s employees and the clients’ premises. In 2024, occupational accidents in the Nordic region, while generally low compared to global averages, still necessitate constant vigilance. For example, the Danish Working Environment Authority reported a focus on preventing slips, trips, and falls in service industries, areas directly relevant to Coor’s activities.

- Nordic Regulations: Coor must adhere to specific national health and safety laws in Sweden, Denmark, Norway, and Finland, which often set high standards for workplace safety.

- Employee Training: Legal obligations require comprehensive training for all staff on safe handling of equipment, chemicals, and emergency procedures.

- Client Site Compliance: Coor must also ensure its operations on client sites meet the specific health and safety regulations of those locations, often requiring site-specific risk assessments.

- Incident Reporting: Strict legal frameworks dictate the reporting of workplace accidents and near misses to relevant authorities, such as the Swedish Work Environment Authority (Arbetsmiljöverket).

Coor's operations are significantly shaped by evolving legal frameworks concerning data privacy and cybersecurity. The General Data Protection Regulation (GDPR) in the EU, for instance, mandates strict handling of personal data, impacting how Coor manages client information and employee data. Non-compliance can lead to substantial fines, as demonstrated by significant penalties levied against companies in 2023 for data breaches.

Furthermore, cybersecurity laws are becoming increasingly stringent, requiring robust measures to protect digital infrastructure and sensitive information from cyber threats. Coor's investment in secure IT systems and employee training on data protection is therefore essential for maintaining client trust and avoiding legal liabilities.

The company's adherence to these regulations is crucial for its reputation and operational continuity. For example, a data breach affecting even a small percentage of clients could lead to significant reputational damage and financial penalties, potentially impacting revenue streams in 2024.

Coor must navigate a complex web of national and international laws, including contract law, consumer protection, and anti-corruption legislation. These legal factors directly influence Coor's business practices, from contract negotiations with clients to its supply chain management. For example, in 2024, increased scrutiny on supply chain transparency in the EU means Coor must ensure its partners also adhere to ethical and legal standards.

Compliance with competition laws is also paramount, especially given Coor's market presence. The company must avoid anti-competitive practices, such as price-fixing or abuse of dominant market positions, to prevent regulatory intervention and potential fines. In Sweden, the Competition Act (Konkurrenslagen) is actively enforced, with significant penalties for violations.

Moreover, changes in tax legislation across different operating countries require constant monitoring and adaptation to ensure fiscal compliance. This includes understanding corporate tax rates, VAT regulations, and any new tax incentives or liabilities that may arise, impacting Coor's financial planning and profitability.

Environmental factors

Global and regional mandates to address climate change, including ambitious national and EU targets for carbon emission reductions, are directly shaping Coor's strategic direction. These regulatory pressures necessitate a proactive approach to environmental stewardship.

Coor has publicly committed to achieving net-zero emissions by 2040, a significant undertaking that requires substantial investment and operational shifts. This commitment is not just aspirational but is integrated into their core business model.

Furthermore, Coor actively provides its clients with solutions designed to lower their own carbon footprints. This includes services focused on energy optimization, waste reduction, and the implementation of more sustainable operational practices, directly contributing to a greener economy.

For instance, in 2023, Coor reported a 12% reduction in its Scope 1 and 2 emissions compared to its 2019 baseline, demonstrating tangible progress towards its net-zero goal.

The growing emphasis on circular economy principles is significantly shaping the facility services sector, demanding more advanced waste management solutions. Coor, for instance, is seeing increased client requests for services that go beyond simple disposal to actively incorporate waste reduction, recycling, and reuse strategies. This shift is crucial for businesses aiming to meet sustainability targets, with many companies now setting ambitious goals for waste diversion from landfills. For example, in 2024, the European Union's Environment Agency reported that member states are striving to increase recycling rates, with some aiming for over 65% by 2035, directly impacting demand for services like Coor’s.

The increasing demand for energy efficiency and renewable energy is a significant environmental factor impacting businesses like Coor. In 2024, the EU aims to increase the share of renewable energy in its gross final energy consumption to at least 42.5% by 2030, a target that underscores the market shift. Coor's expertise in optimizing building energy consumption through smart HVAC and energy audits directly addresses this trend.

Coor is well-positioned to capitalize on the growing client need for sustainable operations. By offering guidance on transitioning to greener energy solutions, Coor supports clients in meeting their environmental, social, and governance (ESG) targets. This is crucial as corporate sustainability reporting becomes more stringent, with many companies actively seeking to reduce their carbon footprint.

Resource Scarcity and Sustainable Sourcing

The increasing global concern over resource scarcity directly impacts facility management, pushing companies like Coor to prioritize sustainable sourcing for everything from cleaning supplies to building materials. This shift isn't just about environmental responsibility; it's a strategic move to ensure a stable supply chain and mitigate price volatility. For instance, by 2025, the demand for critical raw materials is projected to surge, with a particular focus on those essential for green technologies.

Coor's commitment to its ESG sustainability requirements is a key strategy to navigate these challenges. By carefully selecting suppliers and materials that adhere to environmental and social standards, Coor reduces its vulnerability to supply disruptions and potential price hikes driven by scarcity. This proactive approach fosters responsible consumption throughout its operations.

The company's efforts are aligned with broader market trends, where businesses that demonstrate strong ESG credentials are often rewarded with greater investor confidence and customer loyalty.

- Resource Scarcity Impact: Rising global demand for key resources is projected to increase prices and limit availability for essential consumables by 2025.

- Sustainable Sourcing as Mitigation: Coor's ESG-focused procurement strategy directly addresses resource availability risks.

- Operational Resilience: Sustainable sourcing enhances supply chain stability and reduces exposure to price fluctuations.

- Market Alignment: Adherence to ESG standards strengthens Coor's market position and appeals to environmentally conscious stakeholders.

Biodiversity and Green Spaces Management

Coor's property management and outdoor maintenance services are increasingly impacted by a growing emphasis on biodiversity and the development of urban green spaces. Clients are actively seeking solutions that not only maintain but also enhance the ecological value of their properties. This trend suggests a rising demand for services focused on green infrastructure, native plantings, and sustainable landscape management.

The financial implications are significant, with market trends indicating substantial investment in green building and sustainable landscaping. For instance, the global green building market was valued at approximately USD 297.5 billion in 2023 and is projected to reach USD 777.2 billion by 2030, growing at a CAGR of 14.7%. This growth directly translates to opportunities for Coor to offer specialized services in this area.

- Increased Demand for Eco-Friendly Landscaping: Clients are prioritizing services that support local biodiversity, such as using native plant species and reducing pesticide use.

- Growth in Green Infrastructure Projects: Urban planning initiatives promoting green roofs, living walls, and sustainable drainage systems create new service avenues for Coor.

- Client Expectations for Biodiversity Enhancement: Property owners are looking for partners who can actively contribute to the ecological health of their sites, moving beyond basic maintenance.

Coor's strategic alignment with environmental regulations and sustainability goals, including its net-zero 2040 commitment, is a critical driver of its business. The company actively assists clients in reducing their carbon footprints through energy efficiency and waste reduction services, demonstrating tangible progress such as a 12% reduction in Scope 1 and 2 emissions in 2023 compared to 2019.

The increasing focus on circular economy principles is reshaping demand for waste management, with clients seeking comprehensive solutions for reduction, recycling, and reuse. This aligns with EU targets to boost recycling rates, influencing the market for Coor's specialized services.

Growing demand for energy efficiency and renewables, evidenced by the EU's 2030 renewable energy target of at least 42.5%, presents opportunities for Coor's expertise in building energy optimization and green energy transitions.

Resource scarcity is driving a need for sustainable sourcing, with Coor mitigating risks through ESG-focused procurement and enhancing supply chain stability, a crucial strategy as demand for critical raw materials is projected to surge by 2025.

Biodiversity and urban green spaces are becoming key considerations, increasing client demand for services that enhance ecological value, such as native plantings and sustainable landscaping, reflecting a significant growth trajectory in the green building sector.

PESTLE Analysis Data Sources

Our PESTLE Analysis draws from a comprehensive blend of official government publications, reputable financial institutions like the IMF and World Bank, and leading market research firms. This ensures each factor is informed by current, verifiable data.