Coor Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Coor Bundle

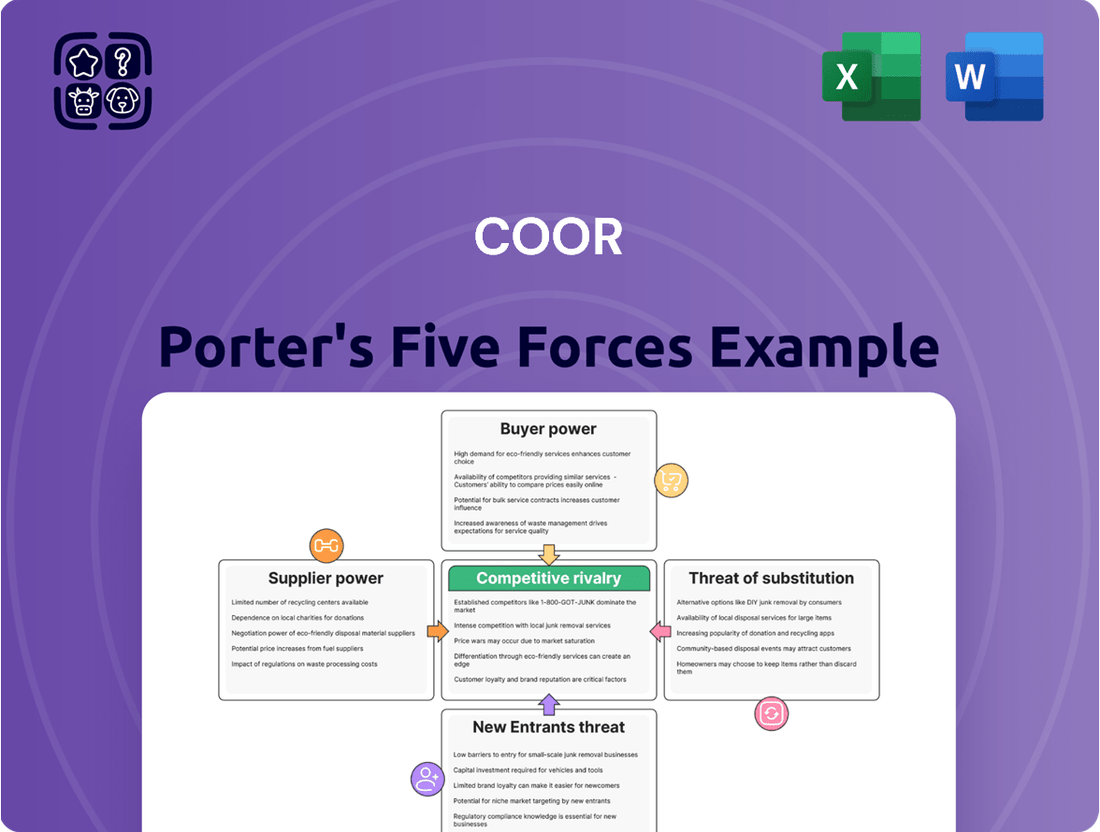

Porter's Five Forces Analysis offers a powerful lens to understand the competitive landscape and profitability potential within an industry. By examining the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitute products, and the intensity of rivalry among existing competitors, businesses can gain crucial strategic insights. This framework helps identify key challenges and opportunities, enabling more informed decision-making for sustainable success.

The complete report reveals the real forces shaping Coor’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The facility management industry, including companies like Coor, depends on a wide array of suppliers for essential goods and services. If a specific segment of suppliers is highly concentrated, meaning only a few dominant players exist, their ability to influence pricing and terms for Coor significantly rises.

For instance, in 2024, the global facilities management market was valued at over $1.1 trillion. Within this vast market, specialized suppliers for critical components, such as advanced building management systems or specialized cleaning agents, could wield considerable power if their market share is substantial.

Coor's extensive service offerings, spanning cleaning, catering, security, and property management, naturally involve sourcing from numerous supplier categories. This diversification can mitigate the risk associated with any single supplier group, but a high concentration within a crucial input segment, like IT infrastructure for facility operations, could still present a challenge.

Switching suppliers presents Coor with tangible costs that directly influence the bargaining power of its current providers. These expenses can range from the administrative burden of renegotiating contracts and integrating new IT systems to the more human-centric costs of retraining employees on different products or technologies. For instance, if Coor relies on a supplier with highly specialized or proprietary equipment crucial to its operations, the cost and disruption associated with finding and implementing an alternative can be substantial, thereby empowering that incumbent supplier.

Conversely, when Coor sources more commoditized supplies or services, the switching costs tend to be considerably lower. In such scenarios, a supplier’s leverage diminishes because Coor can more readily pivot to another provider without incurring significant financial penalties or operational disruptions. This dynamic is evident in Coor's 2024 operational reports, which highlight a strategic effort to diversify its supplier base for non-specialized goods, thereby mitigating supplier-specific risks.

Suppliers gain significant bargaining power when they offer inputs that are unique, differentiated, or highly specialized, especially if these inputs are crucial for Coor's core service delivery. For example, Coor's reliance on advanced smart building technologies or specialized, certified security personnel can concentrate power in the hands of a few providers who control these critical resources. The company's strategic emphasis on innovative and sustainable solutions further amplifies this, as it may necessitate sourcing from suppliers with less common, cutting-edge offerings, limiting Coor's alternatives.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into facility management services, directly competing with Coor, is generally low. Suppliers would need to replicate Coor's extensive operational capabilities, national footprint, and established client relationships, which are significant barriers to entry.

While a supplier might possess specialized technical expertise, the broad scope of integrated facility management, encompassing everything from cleaning and maintenance to security and reception, requires a different business model and scale. For instance, a catering supplier would need to develop expertise in HVAC, electrical systems, and waste management to effectively compete across Coor's service portfolio.

The capital investment and managerial complexity involved in building a comprehensive facility management operation from a supplier's perspective are substantial.

In 2024, the facility management market is highly competitive, with established players like Coor already benefiting from economies of scale and deep market penetration. For a supplier to successfully integrate forward, they would not only need to match these capabilities but also overcome Coor's existing customer loyalty and brand reputation in the Nordic region.

- Supplier Integration Complexity: Direct suppliers often lack the broad service range and national infrastructure of integrated FM providers like Coor.

- Capital and Scale Requirements: Launching a competing FM service requires significant investment in diverse operational capabilities and a widespread network.

- Customer Relationships: Coor's established long-term contracts and client trust present a formidable challenge for new entrants.

- Market Maturity: The Nordic FM market in 2024 is mature, with established leaders like Coor holding strong competitive advantages.

Importance of Coor to Suppliers

Coor, a prominent Nordic service provider, boasts substantial annual net sales, making it a significant customer for numerous suppliers. In 2023, Coor reported net sales of SEK 17,075 million (approximately USD 1.6 billion). This considerable purchasing power grants Coor considerable leverage when negotiating terms, ensuring high-quality products and services, and even encouraging suppliers to invest in innovation to meet Coor's demands.

The bargaining power of suppliers to Coor is therefore relatively low. Coor's large order volumes mean that individual suppliers are often dependent on Coor for a significant portion of their revenue. This dependency allows Coor to:

- Negotiate lower prices due to the volume of business offered.

- Demand stringent quality control and adherence to specific standards.

- Influence product development and innovation through their purchasing requirements.

- Secure favorable payment terms, further strengthening Coor's financial position.

Suppliers' bargaining power is generally low for Coor due to the company's substantial purchasing volume and its position as a key customer for many. This allows Coor to negotiate favorable prices and terms, as suppliers often rely heavily on Coor's business. For example, Coor's reported net sales of SEK 17,075 million in 2023 underscore its significant market influence.

The threat of suppliers integrating forward into facility management is minimal. Such a move would require substantial capital investment and the development of broad operational capabilities, which most suppliers currently lack. In 2024, the Nordic FM market is mature, with established players like Coor possessing strong competitive advantages and deep client relationships.

| Factor | Impact on Supplier Bargaining Power | Coor's Position (2024) |

| Supplier Concentration | High concentration increases power. | Varied; critical inputs may have few suppliers. |

| Switching Costs | High switching costs empower suppliers. | Low for commoditized goods, high for specialized systems. |

| Input Differentiation | Unique inputs grant suppliers leverage. | Increasing reliance on specialized tech and certified personnel. |

| Threat of Forward Integration | Low if barriers are high. | Generally low due to Coor's scale and diverse services. |

| Buyer's Purchasing Power | High purchasing power reduces supplier power. | Very high, driven by substantial order volumes (SEK 17,075M net sales in 2023). |

What is included in the product

Analyzes the five competitive forces shaping Coor's industry: threat of new entrants, bargaining power of buyers, bargaining power of suppliers, threat of substitute products or services, and the intensity of rivalry among existing competitors.

Identify and mitigate competitive threats before they impact your bottom line.

Customers Bargaining Power

Coor's customer base is indeed diverse, encompassing a wide range of small and large companies, along with public sector entities throughout the Nordic region. Key clients like ABB, IKEA, and various governmental bodies highlight this breadth.

While this diversification typically dilutes individual customer power, the presence of major clients with substantial contract values, such as those potentially from the ABB or IKEA relationships, can indeed translate into significant leverage for those specific customers. Their purchasing volume can give them considerable influence over pricing and service terms.

For clients of integrated facility management (IFM) services like Coor, switching providers often incurs substantial costs. These expenses stem from the deep integration of services into a client's operations, existing contractual commitments, and the potential disruption to business continuity.

The lock-in effect is significant, especially with long-term contracts. For instance, a study by McKinsey in 2024 highlighted that businesses often underestimate the hidden costs of vendor switching, which can amount to 15-30% of the contract value.

This makes customers less powerful once a provider relationship is established. The investment in training, system integration, and the time required to transition services means that customers are less likely to switch providers frequently, thereby enhancing Coor's bargaining power.

Customer price sensitivity can significantly impact Coor's profitability, particularly in markets where its services are more commoditized. For instance, in the realm of basic facility management services, clients might readily switch providers if Coor cannot match competitive pricing, directly affecting revenue streams.

However, Coor's strategic advantage lies in its ability to offer integrated solutions and advisory services. In 2024, many B2B clients are increasingly looking for partners that can drive operational efficiency and provide tangible cost savings, making them less sensitive to the absolute price of these higher-value offerings.

For example, a large corporate client might be willing to pay a premium for Coor's expertise in optimizing energy consumption across multiple sites, recognizing that the long-term savings far outweigh the initial service cost. This highlights a shift from pure price competition to value-based procurement for complex service bundles.

The bargaining power of customers is therefore nuanced; while price remains a factor for simpler services, for integrated and strategic solutions, the emphasis is on demonstrable value and reliability, reducing the direct impact of price sensitivity.

Threat of Backward Integration by Customers

The threat of customers integrating backward into facility management services, thereby performing them in-house, is a key consideration for Coor. Larger organizations, particularly those with significant operational scale and financial capacity, possess the potential to bring such services under their direct control. For instance, a large corporate campus might evaluate the cost-benefit of managing its own cleaning, security, or catering versus continuing to outsource.

However, for most businesses, outsourcing these non-core functions to specialized providers like Coor often proves more economical and efficient. This is because Coor can leverage economies of scale, specialized expertise, and optimized processes that individual companies may struggle to replicate internally.

The cost of establishing and maintaining the necessary infrastructure, technology, and skilled personnel for in-house facility management can be prohibitive.

Consider the 2024 market for facility management services, which is valued in the hundreds of billions globally. Companies like Coor operate within this competitive landscape by demonstrating clear value propositions that outweigh the perceived benefits of backward integration for their clients.

- Cost Efficiency: Outsourcing often leads to lower operational costs due to specialist providers’ economies of scale and expertise.

- Focus on Core Business: Companies can concentrate resources and management attention on their primary revenue-generating activities.

- Access to Expertise: Specialized facility management companies offer advanced technical knowledge and best practices.

- Flexibility and Scalability: Outsourcing allows businesses to easily adjust service levels according to changing needs without significant capital investment.

Availability of Information

Customers in the facility management sector, including those Coor serves, are increasingly informed. They can easily access data on service standards, pricing structures, and what competitors are offering. For instance, industry reports and online platforms in 2024 frequently highlight average facility management costs for office spaces, providing a benchmark for comparison. This readily available information significantly strengthens their ability to negotiate better terms with providers like Coor.

This transparency directly impacts bargaining power. When customers can readily compare Coor's service packages, pricing, and performance metrics against other market players, they are better positioned to demand competitive advantages. In 2024, many large enterprise clients leverage aggregated data from procurement platforms to assess value, potentially leading to price pressures or demands for enhanced service level agreements.

- Increased Price Sensitivity: Greater information availability often leads to heightened price sensitivity among customers, encouraging them to seek the most cost-effective solutions.

- Demand for Transparency: Customers expect clearer breakdowns of costs and service components, making it harder for providers to obscure pricing or value.

- Benchmarking Capabilities: Access to industry benchmarks allows customers to objectively evaluate a provider's performance and pricing relative to the broader market.

- Negotiating Leverage: Armed with data, customers can more confidently negotiate contracts, potentially securing lower prices or more favorable terms.

Customers wield significant bargaining power when they are price-sensitive or can easily switch providers. For Coor, while large clients like IKEA and ABB can leverage their volume for better terms, the high switching costs associated with integrated facility management services often mitigate this power. The threat of backward integration is generally low for most clients due to the specialized expertise and economies of scale that providers like Coor offer, as evidenced by the global facility management market's immense scale in 2024.

In 2024, increased customer access to market data and benchmarks strengthens their negotiating position. This transparency allows clients to compare Coor’s offerings, pushing for competitive pricing and enhanced service level agreements. Ultimately, while price sensitivity exists for basic services, value-driven procurement for integrated solutions reduces its direct impact.

Same Document Delivered

Coor Porter's Five Forces Analysis

This comprehensive Porter's Five Forces analysis, which you are previewing, is the exact document you will receive immediately after purchase, ensuring no surprises or placeholders. It delves into the competitive landscape of your chosen industry, detailing the power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing competitors. You'll gain actionable insights into how these forces shape profitability and strategic decision-making. The document you see here is the same professionally written analysis you'll receive—fully formatted and ready to use, providing a robust framework for understanding your market position.

Rivalry Among Competitors

The Nordic facility management landscape is quite crowded, with a mix of homegrown and global companies vying for business. Coor stands out as a major player, particularly in integrated facility management (IFM).

In the IFM sector specifically, Coor and its primary rival, ISS, collectively hold a substantial market share, estimated to be around 40% each. This indicates a concentrated competitive environment at the top for this service model.

The Nordic FM market is mature, meaning significant revenue growth is increasingly challenging to achieve. This maturity directly fuels competitive rivalry, as companies must actively compete for existing market share rather than simply capitalizing on a rapidly expanding market. In 2023, the Nordic FM market experienced a modest growth rate, estimated to be around 2-3%, underscoring the intense competition for every percentage point.

Despite the overall maturity, there's a bright spot: the outsourced segment of the FM market continues to grow. This growing outsourcing trend, projected to continue at a healthy pace through 2024 and beyond, presents a key avenue for companies to expand. For instance, reports from 2024 indicate that the demand for integrated facility management services from third-party providers is on the rise, particularly among larger enterprises seeking efficiency and cost savings.

Coor distinguishes itself by offering integrated and sustainable solutions, a key strategy to lessen competitive rivalry. This focus on improving efficiency and creating value through optimized service delivery, particularly in workplace and property services, sets them apart from competitors who might offer more fragmented offerings. Their specialist expertise, including strategic advisory, further solidifies this differentiation.

This approach directly combats intense price competition. By providing comprehensive, value-added services, Coor can command a premium and build stronger customer loyalty. For instance, in 2023, Coor reported a revenue of €17.1 billion, indicating a significant market presence built, in part, on these differentiated offerings. This allows them to avoid a race to the bottom on pricing.

Switching Costs for Customers

High switching costs for integrated facility management services can act as a significant barrier, thereby moderating competitive rivalry. When clients are locked into existing service providers due to substantial costs associated with transitioning, it becomes more challenging for competitors to lure them away. This stability benefits Coor by fostering customer retention and reducing the intensity of price wars or aggressive sales tactics.

Coor's demonstrated success in extending crucial contracts and securing new business, even amidst a competitive landscape, underscores the strength of its client relationships. This ability to maintain and grow its customer base is a direct consequence of high switching costs and the value Coor provides. For example, Coor's reported revenue for the first quarter of 2024 reached SEK 3,282 million, indicating a stable operational base that relies on these sticky customer relationships.

- High switching costs deter customer churn in the facility management sector.

- Coor's ability to retain clients and win new contracts highlights strong customer loyalty.

- The company's financial performance, such as Q1 2024 revenue of SEK 3,282 million, reflects the stability provided by these high switching costs.

- This reduces the pressure from competitors seeking to poach Coor's existing customer base.

Strategic Stakes and Exit Barriers

Companies in many industries face substantial strategic stakes due to significant investments in infrastructure, technology, and personnel. For example, the semiconductor manufacturing industry, with its complex fabrication plants, often sees companies commit billions of dollars, creating high fixed costs that make exiting the market extremely difficult. This financial commitment means companies are deeply invested in succeeding within their current competitive landscape.

Exit barriers are further amplified by the long-term nature of client contracts in sectors like enterprise software or large-scale infrastructure projects. These agreements lock companies into ongoing operational commitments and revenue streams, making a swift departure impractical. For instance, a major aerospace manufacturer with decades-long defense contracts cannot simply cease operations overnight without severe financial penalties and strategic repercussions.

These high exit barriers compel businesses to compete aggressively, even when market conditions are unfavorable. Rather than cutting their losses and leaving, they are incentivized to fight for market share and profitability to recoup their substantial investments. In 2024, the global automotive industry, grappling with the transition to electric vehicles, exemplifies this; manufacturers continue to invest heavily in new platforms and battery technology, demonstrating a strong commitment to staying in the market and competing rather than exiting.

- High Fixed Costs: Significant capital tied up in physical assets and technology.

- Long-Term Contracts: Client agreements that necessitate sustained operational presence.

- Incentive to Compete: Drive to recoup investments rather than abandon the market.

- 2024 Example: Automotive sector's continued investment in EV technology despite market pressures.

Competitive rivalry in the Nordic facility management sector is intense, primarily between Coor and ISS, who dominate the integrated facility management (IFM) market with approximately 40% share each. This mature market, which saw only 2-3% growth in 2023, forces companies to battle for existing customers rather than rely on market expansion, amplifying competitive pressures.

Coor differentiates itself through integrated and sustainable solutions, aiming to move beyond price-based competition by offering value-added services and strategic advice. This strategy is supported by high switching costs for clients utilizing IFM services, which foster customer loyalty and stability. For example, Coor's first quarter 2024 revenue of SEK 3,282 million demonstrates the benefit of these sticky customer relationships, reducing churn and competitive poaching.

High exit barriers, including substantial investments in infrastructure and long-term contracts, compel companies to remain competitive even in challenging conditions. The automotive industry in 2024, for instance, continues to invest in new technologies like EVs, showcasing the drive to recoup investments rather than withdraw from the market.

| Factor | Description | Impact on Coor |

|---|---|---|

| Market Concentration | Coor and ISS hold ~40% share each in Nordic IFM. | High rivalry from a dominant competitor. |

| Market Maturity | Nordic FM grew ~2-3% in 2023. | Intensifies competition for existing market share. |

| Differentiation Strategy | Coor offers integrated, sustainable solutions. | Reduces direct price competition, builds loyalty. |

| Switching Costs | High for IFM services. | Enhances customer retention, moderates rivalry. |

| Exit Barriers | High investments, long-term contracts. | Encourages continued aggressive competition. |

SSubstitutes Threaten

Clients might increasingly choose specialized providers for individual facility needs, like a dedicated cleaning company or a singular security firm, instead of Coor's comprehensive integrated facility management (IFM) approach. This trend could weaken the appeal of Coor's bundled services, as customers may perceive greater cost-effectiveness or higher quality in niche offerings. For example, a business needing only HVAC maintenance might bypass Coor's full suite for a specialized HVAC contractor, a growing possibility as specialized service providers gain traction.

Large organizations may opt to manage facility services internally, creating their own departments rather than outsourcing. This decision hinges on factors like their core business strengths, cost-effectiveness, and the need for granular control over their operational spaces. For instance, a major tech company with a highly specialized campus might find it more efficient and secure to develop in-house expertise for managing its unique facility requirements.

The ability to bring services in-house acts as a significant threat to external providers like Coor. If a substantial client, perhaps one of Coor's top 10 customers, were to insource its facility management, it could represent a considerable loss of recurring revenue. For example, if a client generating $50 million annually in facility management services decided to bring it in-house, this would directly impact Coor's top line.

This internalizing trend is driven by a desire for greater flexibility and customization, allowing businesses to tailor services precisely to their evolving needs. The perceived cost savings and enhanced oversight are also powerful motivators. In 2024, many companies are re-evaluating their non-core functions, and facility management often falls into this category, making insourcing a more attractive proposition.

The threat of substitutes, including in-house service provision, directly influences pricing power and market share for outsourcing firms. If a significant portion of potential clients can effectively manage services internally, it limits the addressable market and puts pressure on external providers to offer competitive pricing and demonstrable value.

Technological advancements are increasingly presenting viable substitutes for traditional facility management (FM) services. For instance, the proliferation of IoT devices and AI-powered analytics can automate tasks previously requiring human intervention, such as building systems monitoring and routine inspections. This shift could reduce demand for certain labor-intensive FM functions, impacting service providers who do not adapt.

The integration of smart building technology, for example, allows for predictive maintenance, identifying potential equipment failures before they occur. This directly substitutes the need for reactive, on-demand repair services. By 2024, the global smart building market was valued at an estimated $80.6 billion, underscoring the significant investment and adoption of these technologies.

Do-It-Yourself Solutions

For smaller clients or less complex facility management needs, do-it-yourself (DIY) solutions or direct engagement with individual service providers can act as substitutes for comprehensive FM services. This poses a moderate threat, particularly for individual service lines rather than integrated FM solutions. For instance, a small business might opt to manage its own office cleaning or minor repairs directly, bypassing a full-service FM provider.

The availability of freelance platforms and the gig economy further enable this DIY approach. In 2024, the global gig economy is projected to grow significantly, with estimates suggesting a substantial portion of the workforce engaging in freelance or contract work. This trend means more accessible and potentially cost-effective individual service providers are readily available for tasks like IT support, maintenance, or even administrative functions that could otherwise be part of an FM contract.

While large, complex facilities requiring integrated, specialized FM services are less susceptible to this threat, smaller organizations or those with specific, isolated needs may find DIY solutions more appealing. The cost savings and perceived control can be significant drivers. For example, a small office might hire a local plumber directly for a repair instead of engaging an FM company for a broader maintenance contract.

This threat is particularly relevant for standalone service offerings within the FM sector:

- Cleaning Services: Small businesses often hire local cleaning companies or even individual cleaners directly.

- Grounds Maintenance: Landscaping or snow removal can be contracted with local providers rather than through a comprehensive FM agreement.

- Minor Repairs and Maintenance: Handyman services or specialized tradespeople can be engaged for specific tasks.

- IT Support: Small firms may use freelance IT consultants for their technology needs.

Changing Workplace Trends

Shifting workplace dynamics present a significant threat of substitution for traditional facility management services. As companies increasingly embrace remote and hybrid work models, the demand for comprehensive on-site services like extensive cleaning, physical security for unoccupied spaces, and traditional space management may diminish. For instance, a significant portion of Coor's client base, particularly in sectors like IT and professional services, are reporting a sustained increase in remote work arrangements. A 2024 survey indicated that up to 30% of employees in these sectors continue to work remotely at least part-time, directly impacting the utilization of office facilities and, consequently, the need for certain facility management services.

This evolution necessitates a strategic pivot in service delivery. Coor needs to actively adapt its portfolio to address the unique requirements of hybrid environments, focusing on flexible space utilization, enhanced digital infrastructure support, and tailored cleaning protocols for shared spaces. Failure to align with these changing workplace trends could lead clients to seek alternative solutions, potentially from technology providers offering integrated workplace management systems or specialized remote IT support, effectively substituting traditional, comprehensive facility management contracts.

- Reduced Demand for On-Site Services: Hybrid work models decrease the need for services like full-time reception, extensive daily cleaning of all areas, and traditional building maintenance focused on constant occupancy.

- Shift to Hybrid Service Models: Facility management providers must offer flexible solutions that cater to fluctuating office occupancy, focusing on hygiene, technology support, and efficient space utilization for those present.

- Client Re-evaluation of Needs: Companies may opt for more modular or technology-driven facility solutions, potentially bypassing traditional integrated service providers if their offerings don't evolve.

- Emergence of Digital Workplace Solutions: Technology platforms that manage remote access, digital collaboration, and virtual office environments can act as substitutes for certain aspects of physical facility management.

The threat of substitutes for integrated facility management (IFM) services is multifaceted, encompassing specialized providers, in-house management, and technological solutions. Businesses can opt for niche service providers for specific needs, like a dedicated IT support firm or a specialized cleaning company, bypassing the bundled approach. For instance, a company requiring only advanced security might contract directly with a security specialist rather than an IFM provider.

The increasing capability of technology, particularly IoT and AI, offers automation for tasks traditionally handled by facility managers, such as building system monitoring and predictive maintenance. The global smart building market's significant growth, reaching an estimated $80.6 billion in 2024, highlights the adoption of these technologies which can directly substitute manual FM functions.

Furthermore, the rise of the gig economy and freelance platforms makes it easier for smaller organizations to manage facility needs directly, engaging individual service providers for tasks like cleaning or minor repairs. The projected growth of the global gig economy in 2024 underscores the accessibility of such substitute labor, potentially reducing reliance on comprehensive FM contracts for less complex requirements.

The shift towards hybrid and remote work models also substitutes traditional FM demands. With fewer employees on-site, the need for constant building upkeep and extensive cleaning diminishes, prompting clients to re-evaluate comprehensive FM contracts in favor of more flexible, technology-driven solutions. A 2024 survey indicated up to 30% of employees in sectors like IT and professional services continue to work remotely, directly impacting facility service utilization.

Entrants Threaten

Entering the Nordic facility management market, particularly against established giants like Coor, demands significant upfront capital. Think about the costs for advanced technology, specialized equipment, and building a skilled workforce capable of delivering integrated services. These aren't small numbers, making it a tough hurdle for newcomers.

For instance, a new entrant aiming to match Coor's service scope would need to invest heavily in IT infrastructure for seamless operations and maintenance, as well as acquire a diverse fleet of vehicles and cleaning machinery. The sheer scale of investment required to compete effectively can easily run into millions of euros, effectively deterring many potential challengers.

This high capital requirement directly impacts the threat of new entrants. When potential competitors see the massive financial commitment needed, they are less likely to enter the market. This preserves the market share and profitability of existing players like Coor, as fewer new businesses can realistically challenge their position.

Coor, a major player in the facility management sector, leverages significant economies of scale across its operations. This advantage is particularly evident in procurement, where its large volume allows for more favorable pricing on supplies and services compared to smaller competitors.

This cost efficiency extends to their operational footprint and technology investments. New entrants would face a substantial hurdle in matching Coor's ability to spread fixed costs over a larger revenue base, making it difficult to compete on price.

For instance, in 2024, Coor reported revenues of SEK 19.5 billion, underscoring the scale required to achieve such cost advantages. A new company entering the market would need to rapidly scale up to even begin to approach similar efficiencies.

The threat of new entrants is therefore somewhat mitigated by this entrenched cost advantage. A startup would require massive initial investment to achieve a comparable scale and thus, similar cost efficiencies.

Coor has cultivated significant brand loyalty and a robust reputation as a premier facility management provider across the Nordic region. This established trust makes it difficult for newcomers to break into the market, particularly when vying for substantial, long-term contracts with established corporate clients who prioritize reliability and proven performance.

Access to Distribution Channels

For Coor, a significant hurdle for new entrants lies in securing access to established distribution channels, particularly when targeting large corporate and public sector clients. These clients often have long-standing relationships and procurement processes that favor experienced, trusted providers. Gaining traction requires not just a competitive offering, but also the development of robust sales networks and a demonstrable history of successful service delivery.

This necessity for established relationships and a proven track record creates a substantial barrier to entry. New companies must invest heavily in building credibility and demonstrating reliability before they can even begin to compete for major contracts. For instance, in the facility management sector, which Coor operates within, winning bids for large public sector contracts can involve extensive vetting and pre-qualification processes that new entrants may struggle to navigate.

- Established Sales Networks: New competitors need time and resources to build the sales infrastructure and relationships necessary to reach Coor's target clientele.

- Proven Track Record: Clients in Coor's core markets often prioritize experience and a history of successful project execution, making it difficult for newcomers to gain initial trust.

- Procurement Barriers: Large organizations and public sector entities frequently have complex and lengthy procurement procedures that favor established suppliers.

- Brand Reputation: Building a brand reputation that rivals Coor's in terms of reliability and service quality is a time-consuming and costly endeavor for new entrants.

Regulatory and Legal Barriers

The facility management sector is heavily influenced by regulatory and legal barriers, which significantly deter new entrants. Compliance with stringent health and safety standards, such as those mandated by OSHA in the United States, requires substantial investment in training and safety protocols. For example, a new company would need to allocate resources to ensure adherence to regulations like the General Duty Clause, which requires employers to provide a workplace free from recognized hazards.

Furthermore, specific certifications and licensing are often required, especially for services involving hazardous materials handling or advanced security systems. In 2024, the increasing focus on sustainability and environmental impact means new entrants must also navigate complex environmental regulations, potentially requiring certifications like ISO 14001. Navigating this intricate web of legal requirements and obtaining necessary approvals can be a time-consuming and costly endeavor, creating a formidable obstacle for aspiring competitors.

- Health & Safety Compliance: Significant investment in training and protocols is needed to meet standards like OSHA regulations.

- Environmental Regulations: Adherence to sustainability mandates and potential need for certifications like ISO 14001.

- Security and Licensing: Specific licenses and certifications are often mandatory for specialized services.

- Navigational Complexity: The intricate nature of legal frameworks poses a substantial challenge for new market participants.

High capital requirements, significant economies of scale, established brand loyalty, and complex regulatory landscapes all combine to create substantial barriers for new entrants in the facility management market. These factors collectively limit the threat of new companies challenging established players like Coor.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis leverages a combination of publicly available financial statements, industry-specific market research reports, and expert commentary from financial analysts to provide a comprehensive view of competitive dynamics.