Comvita Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Comvita Bundle

Comvita's competitive landscape is shaped by intense rivalry and the significant bargaining power of buyers in the health and wellness sector. Understanding these forces is crucial for navigating its market. The full analysis delves into the threat of substitutes and the influence of suppliers, offering a comprehensive view of Comvita's strategic positioning.

Ready to move beyond the basics? Get a full strategic breakdown of Comvita’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

Comvita's reliance on beekeepers for Manuka honey means that supplier concentration is a key factor. If a small number of large beekeeping operations dominate the supply, they gain considerable leverage over Comvita, influencing both the price and availability of raw materials.

The New Zealand honey sector has experienced a decline in the number of beekeepers and hives. For instance, reports from 2023 indicated a notable reduction in hive numbers, a trend that could further consolidate power among the remaining suppliers, potentially increasing Comvita's sourcing costs and supply chain risks.

The uniqueness of Manuka honey, especially high-grade UMF/MGO rated varieties, significantly bolsters supplier bargaining power. This specialized product, predominantly sourced from New Zealand and Australia, possesses distinct bioactive properties that make direct substitution challenging for buyers.

For Comvita, switching honey suppliers can incur significant costs. These include the expense of re-establishing quality control protocols, building new relationships with apiarists, and ensuring the consistent availability of specialized Manuka honey, which is crucial for their premium products. For instance, in the 2023 financial year, Comvita reported that its cost of goods sold was NZ$164.7 million, highlighting the importance of efficient and stable supply chains.

Supplier's Ability to Forward Integrate

The potential for beekeepers or other raw material suppliers to engage in forward integration presents a significant threat to Comvita's bargaining power. If these suppliers were to begin processing and marketing their own finished Manuka honey products, they would effectively become direct competitors. This would dramatically shift the power dynamic, allowing them to dictate terms more forcefully.

While smaller-scale operations might already exist, the prospect of large-scale forward integration by key suppliers is a more substantial concern. Such a move would mean Comvita would not only be buying raw materials but also facing its suppliers as rivals in the marketplace. This scenario could lead to increased costs for Comvita and reduced control over its supply chain.

For instance, if a significant portion of Comvita's raw Manuka honey supply came from a few large beekeeping cooperatives that decided to launch their own branded honey products, Comvita would be in a weaker position. They might have to pay higher prices for honey or face reduced availability, impacting their production and profitability. This is a critical factor to monitor in the competitive landscape of the Manuka honey industry.

- Threat of Forward Integration: Suppliers starting their own processing and marketing of finished Manuka honey products.

- Impact on Bargaining Power: Direct competition significantly increases supplier leverage.

- Scale of Integration: Large-scale integration poses a greater threat than smaller, individual efforts.

- Potential Consequences: Higher raw material costs and reduced supply chain control for Comvita.

Importance of Comvita to Suppliers

Comvita's position as a global leader in Manuka honey significantly influences its relationships with beekeepers. As a major buyer, Comvita likely accounts for a substantial portion of many beekeepers' sales, giving Comvita considerable leverage. This dependence on Comvita can diminish the bargaining power of individual suppliers, as losing Comvita as a customer would represent a significant financial setback for them. For example, in the 2023 financial year, Comvita reported sourcing a substantial volume of honey, underscoring its importance to its supplier network.

The bargaining power of suppliers, in the context of Comvita, is somewhat constrained by the company's market dominance. While beekeepers might have alternative buyers, Comvita's scale and established brand recognition offer a consistent and often premium outlet for their product. This can lead to suppliers being more amenable to Comvita's terms and conditions. The company's commitment to quality and traceability, often a selling point for Comvita, can also mean suppliers need to meet specific standards, further aligning their interests with Comvita's needs.

- Comvita's Global Market Share: Comvita holds a significant share of the global Manuka honey market, making it a crucial partner for many beekeepers.

- Supplier Dependence: Many beekeepers rely heavily on Comvita for a substantial portion of their sales, reducing their ability to dictate terms.

- Brand Value for Suppliers: Supplying to a recognized brand like Comvita can enhance a beekeeper's reputation and access to other markets.

- Quality Standards: Comvita's emphasis on quality and traceability encourages suppliers to meet specific operational standards, fostering a collaborative rather than adversarial relationship.

The bargaining power of Comvita's suppliers is influenced by the concentration of beekeepers and the unique nature of Manuka honey. A decline in the number of beekeepers, as seen in 2023 reports indicating fewer hives, can consolidate power among remaining suppliers, potentially increasing Comvita's sourcing costs. The specialized, bio-active properties of high-grade Manuka honey make it difficult to substitute, further strengthening supplier leverage.

Switching costs for Comvita are significant, encompassing quality control, relationship building, and ensuring consistent supply of specialized honey, which is vital for their premium products. For instance, Comvita's cost of goods sold reached NZ$164.7 million in the 2023 financial year, underscoring the importance of a stable supply chain. The threat of forward integration, where suppliers might begin processing and marketing their own finished products, could turn them into competitors, drastically shifting the power dynamic and potentially increasing Comvita's raw material expenses.

Comvita's market dominance, however, offers a degree of counter-leverage. As a major buyer, Comvita represents a substantial sales outlet for many beekeepers, making them reliant on Comvita's business. This dependence can temper suppliers' ability to dictate terms, especially as supplying a recognized brand like Comvita can enhance a beekeeper's reputation and market access. Comvita's emphasis on quality and traceability also encourages suppliers to meet specific standards, fostering a more collaborative relationship.

| Factor | Impact on Comvita | Supporting Data/Observation |

|---|---|---|

| Supplier Concentration | Increases supplier bargaining power if few large suppliers exist. | Reports in 2023 indicated a decline in beekeepers and hives, potentially leading to consolidation. |

| Uniqueness of Product | Strengthens supplier leverage due to difficulty in substitution. | High-grade UMF/MGO Manuka honey has distinct bioactive properties. |

| Switching Costs | High costs for Comvita to change suppliers, reinforcing supplier power. | Costs include quality control, relationship building, and securing consistent supply. |

| Forward Integration Threat | Suppliers becoming competitors can significantly increase their leverage. | Large-scale integration by key suppliers could lead to higher prices and reduced control for Comvita. |

| Comvita's Market Dominance | Reduces supplier bargaining power by making them reliant on Comvita. | Comvita is a major buyer, representing a significant portion of many beekeepers' sales. |

What is included in the product

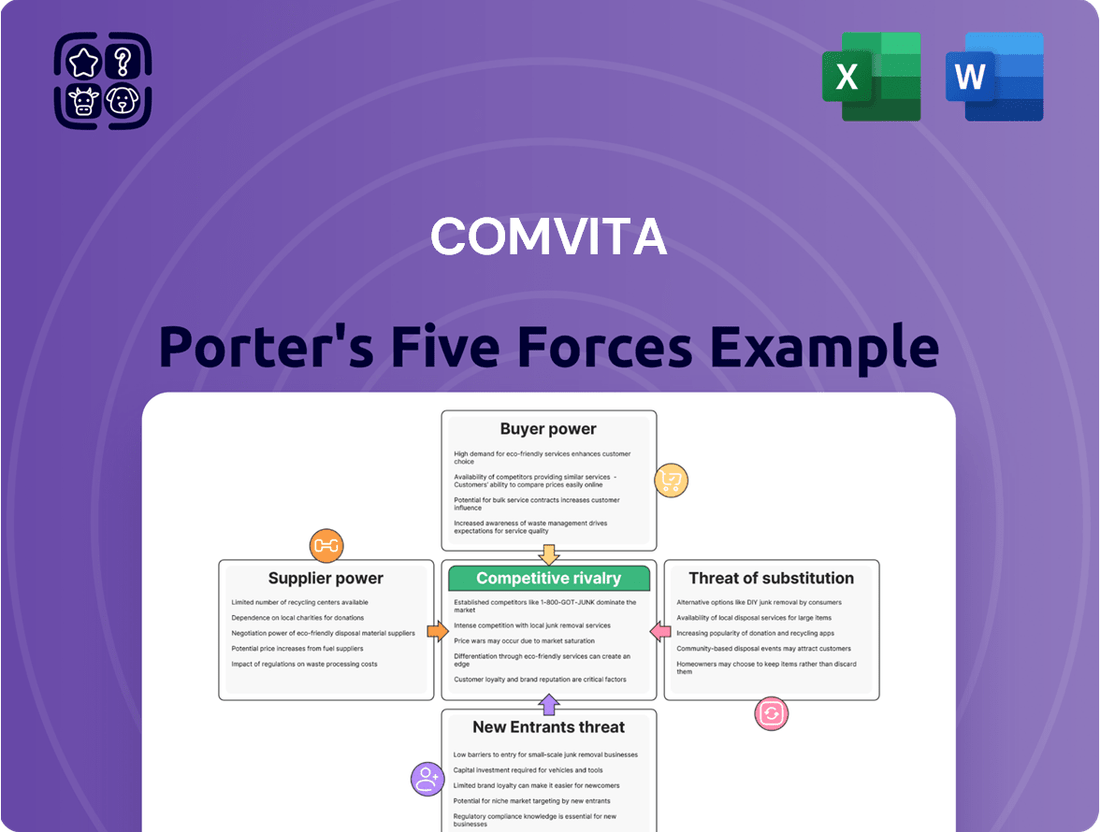

This analysis unpacks the competitive forces influencing Comvita's position in the health and wellness market, assessing supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry.

Instantly identify competitive pressures and opportunities within the natural health sector, enabling Comvita to proactively address threats and capitalize on market advantages.

Customers Bargaining Power

Comvita operates in the premium natural health sector, where Manuka honey is a key offering. However, even for high-value items, customer price sensitivity is a significant factor. In 2024, Comvita observed this firsthand, particularly in markets like China, where consumers demonstrated a willingness to switch to less expensive alternatives. This shift directly affected Comvita's sales volume and, consequently, its gross profit margins.

The availability of substitutes significantly impacts Comvita's customer bargaining power. With numerous other natural health products and a wide array of honey types, including less expensive alternatives, consumers have ample choices. This abundance of options empowers customers to seek out better deals or products that better suit their needs, thereby increasing their leverage in the market.

Comvita has directly experienced this pressure, as evidenced by the competitive landscape featuring aggressive price-driven promotions from rivals. For instance, in the 2024 financial year, Comvita noted ongoing competitive activity, including pricing pressures, which underscores the direct impact of substitute availability on its market position and customer negotiations.

Comvita's buyer volume, particularly in North America, highlights the significant bargaining power of large customers. The loss of a major North American buyer in 2024 had a substantial impact on Comvita's sales, underscoring how a few key accounts can wield considerable influence over revenue streams.

Buyer Information

In today's interconnected world, customers wield significant influence due to readily available product and pricing information. This transparency allows them to easily compare offerings across various suppliers, driving down prices and increasing their negotiating leverage.

Comvita's customers, particularly in the health and wellness sector, benefit from this information accessibility. For instance, online reviews and direct-to-consumer sales channels empower consumers to make informed decisions. In 2024, the global e-commerce market for health and wellness products continued its upward trajectory, with consumers actively seeking the best value and quality.

- Informed Consumer Choices: Increased access to product reviews, ingredient transparency, and price comparisons directly impacts Comvita's ability to command premium pricing without justification.

- Availability of Substitutes: The proliferation of alternative health supplements and natural remedies means customers can easily switch if Comvita's offerings are perceived as too expensive or less effective.

- Price Sensitivity: For many health products, particularly those with established markets, customers are highly sensitive to price, making them more likely to bargain or seek lower-cost alternatives.

Threat of Backward Integration by Customers

The threat of backward integration by customers, while generally low for individual consumers, poses a potential concern for large retail chains or distributors. These powerful buyers could theoretically develop their own private label Manuka honey products or establish direct sourcing relationships with beekeepers, effectively cutting out established brands like Comvita. This would significantly shift bargaining power towards the customer, allowing them to dictate terms and potentially reduce Comvita's margins.

For instance, a major supermarket chain might leverage its extensive distribution network and brand recognition to launch its own "premium" Manuka honey line. This could involve negotiating directly with beekeepers for supply, bypassing the established brand equity and marketing costs associated with companies like Comvita. In 2023, the global retail sector saw continued consolidation, with large players like Walmart and Amazon expanding their private label offerings across various categories, including health and wellness products, demonstrating a clear trend towards greater control over their supply chains.

- Customer Integration Threat: Large retailers or distributors could produce their own Manuka honey, bypassing brands like Comvita.

- Impact on Bargaining Power: Direct sourcing by customers would increase their leverage over honey producers.

- Market Trend: Major retailers globally are increasingly expanding private label offerings in health and wellness sectors.

- Potential Margin Erosion: This integration could lead to reduced profit margins for established Manuka honey brands.

Comvita's customers possess significant bargaining power, particularly due to the increasing availability of substitutes and heightened price sensitivity. In 2024, Comvita observed customers in key markets, like China, readily switching to less expensive alternatives, directly impacting sales volume and profit margins.

The ease with which consumers can compare products and prices online further amplifies their leverage. This transparency, coupled with a growing array of natural health products, allows customers to demand better value, putting pressure on Comvita's premium pricing strategy.

Large buyers, such as major North American accounts, wield substantial influence; the loss of a significant buyer in 2024 demonstrated the profound impact a few key customers can have on Comvita's revenue.

| Factor | Impact on Comvita | 2024 Observation |

|---|---|---|

| Substitute Availability | Lowers Comvita's pricing power | Customers switching to cheaper honey types |

| Price Sensitivity | Increases customer negotiation leverage | Observed in key international markets |

| Information Transparency | Facilitates easy price comparison | Online reviews and direct-to-consumer channels |

| Buyer Volume | Concentrates power with large accounts | Loss of a major North American buyer |

What You See Is What You Get

Comvita Porter's Five Forces Analysis

This preview displays the complete Comvita Porter's Five Forces Analysis, offering a thorough examination of the competitive landscape within the manuka honey industry. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact, professionally formatted file, ready for your strategic planning needs.

Rivalry Among Competitors

The Manuka honey market is quite crowded, with many companies competing for consumer attention. This means Comvita often finds itself in a tough spot, especially when it comes to its more affordable honey products, where price wars are common.

In 2024, the global Manuka honey market is estimated to be worth billions, with numerous brands, from large corporations to smaller, specialized producers, all vying for a piece of this lucrative market. This high number of participants fuels intense price competition, particularly for products positioned at lower price points, impacting Comvita's market share and profitability.

While the global Manuka honey market is expected to see growth, Comvita has encountered revenue declines in significant regions such as China and North America. This suggests that Comvita is navigating fierce competition within a market that isn't experiencing uniform expansion for all participants.

Comvita actively cultivates a premium image for its Manuka honey, highlighting its unique properties, scientific research, and strong brand reputation to stand out. This strategy aims to position its products as distinct and superior in the market.

However, the competitive landscape is marked by frequent and aggressive price discounting from other brands. This suggests that for a segment of consumers, Manuka honey is treated more like a generic product, diminishing the perceived differentiation that Comvita strives for.

For instance, while Comvita might emphasize MGO ratings and specific health benefits, competitors offering similar Manuka honey at significantly lower prices can erode this perceived uniqueness, especially for price-sensitive buyers. This dynamic pressures Comvita to continually reinforce its value proposition beyond just the product itself.

Exit Barriers

High fixed costs in research, development, manufacturing, and global distribution act as significant exit barriers in the natural health products sector. These substantial investments mean companies may continue operating even when facing profitability challenges, leading to sustained competitive pressure.

For instance, companies like Comvita invest heavily in specialized beekeeping operations, processing facilities, and stringent quality control, all of which represent considerable sunk costs. In 2024, the global natural health products market was valued at approximately USD 260 billion, with growth projections indicating continued investment in infrastructure and innovation.

- High R&D Investment: Significant capital is required for product innovation, clinical trials, and regulatory approvals, making it costly to cease operations.

- Specialized Manufacturing: Facilities designed for specific natural product extraction and formulation are not easily repurposed, increasing exit costs.

- Global Supply Chains: Establishing and maintaining international distribution networks involves substantial logistical and marketing expenditures that are difficult to recoup upon exit.

- Brand Equity and Reputation: Years of building trust and brand recognition in the natural health space represent an intangible asset that is lost if a company exits, further discouraging departure.

Brand Loyalty and Switching Costs

Comvita strives to cultivate deep brand loyalty among its customer base, particularly in the premium health and wellness sector. However, recent events, such as the loss of a significant North American client to a competitor offering lower prices, highlight that for some segments, switching costs may not be substantial enough to completely override price considerations.

This situation suggests that while brand reputation is a key asset, it doesn't always insulate Comvita from price-driven competition. For instance, in the fiscal year ending June 30, 2023, Comvita's revenue saw a dip, partly attributed to challenging market conditions and increased competition, indicating that customer retention can be influenced by factors beyond just brand affinity.

- Brand Loyalty Challenges: Comvita’s efforts to build strong brand loyalty are tested by customer sensitivity to price differences.

- Switching Cost Assessment: The loss of a major North American customer to a cheaper alternative indicates that switching costs are not always a significant deterrent.

- Price Sensitivity Impact: This suggests that a segment of Comvita's customer base prioritizes cost savings over unwavering brand allegiance.

- Competitive Landscape: The incident underscores the intense competition within the health and wellness market where price plays a crucial role in customer retention.

The competitive rivalry in the Manuka honey market is fierce, with numerous players, including large corporations and niche producers, vying for market share. This intense competition often leads to price wars, particularly for products positioned at lower price points, impacting Comvita's profitability and market positioning.

Comvita differentiates itself by emphasizing its premium image, unique properties, and scientific research, but aggressive price discounting from competitors can undermine this perceived uniqueness, especially among price-sensitive consumers. High exit barriers, such as significant investments in R&D, specialized manufacturing, and global supply chains, mean companies may continue to compete even when facing profitability challenges, sustaining the intense rivalry.

While brand loyalty is a key strategy for Comvita, recent instances of losing clients to lower-priced competitors indicate that price sensitivity can override brand allegiance for certain customer segments. This dynamic highlights the constant pressure Comvita faces to maintain its value proposition in a crowded and price-competitive market.

| Metric | 2023 Value | 2024 Trend | Impact on Comvita |

|---|---|---|---|

| Global Manuka Honey Market Value | Estimated billions (specific figures vary by source) | Continued growth, but uneven expansion | Intensified competition for market share |

| Number of Competitors | High and diverse | Stable to increasing | Price pressure, need for differentiation |

| Price Discounting Frequency | Frequent and aggressive | Ongoing | Erodes perceived product uniqueness |

| Exit Barriers (R&D, Mfg., Supply Chain) | High | Consistent investment | Sustains competitive intensity |

SSubstitutes Threaten

While Manuka honey boasts unique antibacterial properties and a premium price point, a wide array of other honey varieties, such as clover, wildflower, and acacia, are readily available and significantly more affordable. These common honeys serve as direct substitutes for general culinary and sweetening purposes, representing a constant threat to Comvita's market share among consumers prioritizing cost and accessibility over specialized benefits. For instance, the global honey market, excluding Manuka, is vast, with countries like China and Turkey being major producers of more conventional types of honey, making them easily accessible alternatives.

Comvita's range of other natural health products, such as olive leaf extract, faces competition from a wide spectrum of substitutes in the broader natural health and wellness market. This market is populated by numerous supplements, herbal remedies, and functional foods, all vying to provide similar health benefits. For instance, consumers seeking immune support might choose between Comvita's offerings and various vitamin C supplements, echinacea tinctures, or probiotic-rich foods, depending on perceived efficacy and price point.

The price-performance trade-off is a major threat for Manuka honey. With Manuka honey often costing significantly more than conventional honey, consumers weigh its purported health benefits against the higher price. For instance, as of early 2024, high-grade Manuka honey can retail for over $50 per pound, while regular honey might be under $10. If consumers don't perceive the unique properties of Manuka honey as justifying this substantial cost difference, they will readily switch to more affordable alternatives.

Ease of Substitution

The threat of substitutes for Manuka honey is relatively low for its premium health applications but moderate for general use. For everyday purposes like sweetening, consumers can easily switch to other honey varieties or artificial sweeteners, as these alternatives are widely available and often cheaper. For instance, the global honey market, excluding Manuka, is vast, with conventional honey prices typically ranging from $5 to $15 per kilogram, offering a stark contrast to Manuka honey's premium pricing.

However, when considering Manuka honey's specific therapeutic benefits, such as wound healing or digestive health, substitutes become less direct. Consumers might explore alternative natural remedies or even conventional pharmaceuticals if Manuka honey proves too costly or doesn't meet their health expectations. The global market for natural health products, which includes honey, is projected to reach over $200 billion by 2027, indicating a strong demand for health-focused alternatives, though the unique properties of Manuka honey still carve out a distinct niche.

- General Use Substitution: High availability of other honey types and sweeteners makes switching easy and cost-effective.

- Health Application Substitution: Consumers may turn to alternative remedies or pharmaceuticals if Manuka honey is perceived as too expensive or lacking efficacy for specific health needs.

- Market Contrast: Conventional honey prices are significantly lower than Manuka honey, highlighting the price sensitivity for general use.

- Growing Health Market: The expanding natural health product market indicates consumer interest in alternatives, but Manuka honey's unique properties offer differentiation.

Consumer Awareness and Education

The distinct health benefits of Manuka honey, particularly its antibacterial properties, are a key selling point for Comvita. However, if consumers are not fully aware of or convinced by these benefits, they are more likely to choose more readily available and cheaper substitutes. For instance, a 2023 survey indicated that while 60% of consumers recognized Manuka honey for its health properties, only 35% could articulate its specific antibacterial advantages. This knowledge gap directly impacts the perceived value and thus the threat of substitution.

The availability of alternative sweeteners and health supplements presents a significant threat. While Manuka honey offers unique UMF (Unique Manuka Factor) ratings, consumers can opt for regular honey, artificial sweeteners, or even certain medicinal products that address similar health concerns at a lower price point. In 2024, the global honey market, excluding Manuka, was valued at over $9 billion, highlighting the sheer volume of accessible alternatives. This broad availability means consumers have many choices if Manuka honey’s unique value proposition isn't clearly communicated or sufficiently differentiated.

- Consumer Education Gap: A significant portion of consumers may not fully grasp the specific antibacterial properties of Manuka honey, making them more susceptible to cheaper alternatives.

- Market Saturation of Alternatives: The vast global honey market and the availability of artificial sweeteners and health supplements provide readily accessible and often less expensive substitutes.

- Price Sensitivity: If the premium price of Manuka honey is not justified by perceived unique benefits, consumers will likely switch to more budget-friendly options.

The threat of substitutes for Comvita's Manuka honey is multifaceted, with conventional honey and other sweeteners posing a significant challenge for general consumption. For instance, in early 2024, the average retail price for a kilogram of conventional honey in many markets hovered between $8 and $20, a stark contrast to premium Manuka honey which could exceed $60 per kilogram. This price disparity means that for everyday uses like sweetening beverages or baking, consumers can easily opt for more affordable alternatives, impacting Comvita's volume sales in these segments.

| Product Category | Typical Price Range (per kg, early 2024) | Key Substitute Characteristics | Comvita's Differentiator |

|---|---|---|---|

| Conventional Honey (e.g., Clover, Wildflower) | $8 - $20 | Widely available, affordable, general sweetening properties. | Unique antibacterial properties (UMF/MGO), perceived health benefits. |

| Artificial Sweeteners (e.g., Stevia, Sucralose) | Varies (often sold in smaller quantities, cost-effective per serving) | Zero-calorie, highly sweet, readily available in supermarkets. | Natural origin, complex flavor profile, specific health claims. |

| Other Natural Health Products (for immune support, etc.) | Varies widely (e.g., Vitamin C supplements $15-$30 per bottle) | Target specific health concerns, often scientifically backed for certain benefits. | Holistic health approach, unique Manuka properties, brand trust. |

Entrants Threaten

Launching a global natural health enterprise akin to Comvita, which heavily invests in R&D, sophisticated manufacturing, and extensive distribution networks for unique products like Manuka honey, demands considerable financial resources. These high initial capital outlays for facilities, technology, and brand building create a significant hurdle for potential new competitors.

The threat of new entrants into the Manuka honey market, particularly for companies like Comvita, is significantly influenced by the challenge of securing consistent access to high-quality raw materials. This involves building and maintaining reliable relationships with beekeepers across New Zealand and Australia, the primary sourcing regions. New players face a steep learning curve in navigating this complex supply chain, which is crucial for product quality and brand reputation.

Comvita has cultivated a robust global brand over many years, a significant barrier for any potential new entrants. Newcomers would face substantial marketing and brand-building expenses to erode the deep-seated brand loyalty Comvita commands, especially within the premium Manuka honey market. For instance, in the fiscal year ending June 30, 2023, Comvita reported strong brand health indicators, with their flagship Manuka honey products consistently ranking high in consumer preference surveys in key markets like China and Australia, underscoring the challenge new players face in gaining traction.

Regulatory Hurdles and Quality Standards

The natural health product industry, particularly for specialized items like Manuka honey, faces significant regulatory scrutiny. New companies entering this market must adhere to stringent quality standards and certifications, such as the UMF (Unique Manuka Factor) or MGO (methylglyoxal) ratings, which are crucial for product authenticity and consumer trust. Navigating these complex regulatory frameworks can be a substantial barrier, demanding considerable time and financial investment for compliance.

These regulatory requirements act as a deterrent to potential new entrants. For instance, in 2024, the New Zealand government continued to enforce strict guidelines on Manuka honey production and labeling to protect its reputation and market integrity. Companies looking to enter must invest in robust testing, traceability systems, and potentially obtain specific accreditations, which can significantly increase initial startup costs and operational complexity.

- Regulatory Compliance Costs: New entrants face substantial costs associated with meeting UMF/MGO certification requirements, including laboratory testing and auditing.

- Time-to-Market Delays: Obtaining necessary regulatory approvals and certifications can extend the time it takes for new products to reach the market.

- Quality Assurance Investment: Significant investment in quality assurance infrastructure and processes is required to meet industry standards.

- Brand Reputation Risk: Failure to comply with regulations can lead to severe reputational damage and market exclusion.

Economies of Scale and Experience Curve

Comvita, a significant player in the health and wellness sector, likely leverages substantial economies of scale. This means they probably have lower per-unit costs for everything from sourcing raw materials like Manuka honey to manufacturing and getting their products to market. For instance, in 2023, Comvita reported a revenue of NZ$230.9 million, indicating a substantial operational footprint that smaller new entrants would struggle to match initially.

Newcomers entering the market would face considerably higher per-unit costs. This cost disadvantage makes it difficult for them to compete on price with established companies like Comvita, which can absorb lower margins due to their scale. Furthermore, the experience curve effect, where costs decrease with accumulated production volume, also favors Comvita, making it harder for new entrants to achieve profitability swiftly.

- Economies of Scale: Comvita's large operational size allows for bulk purchasing and efficient production processes, reducing overhead per unit.

- Experience Curve: As an established company, Comvita has likely benefited from learning-by-doing, leading to optimized production and lower costs over time.

- Cost Disadvantage for New Entrants: Start-up companies would incur higher initial costs for raw materials, manufacturing setup, and distribution networks.

- Pricing Pressure: The cost advantage of Comvita means new entrants may struggle to offer competitive pricing without sacrificing profitability.

The threat of new entrants for Comvita is moderate, primarily due to the substantial capital investment required for R&D, sophisticated manufacturing, and establishing global distribution networks. Securing consistent access to high-quality Manuka honey, navigating stringent regulatory environments, and building a strong brand reputation are significant hurdles.

Economies of scale and the experience curve further deter new players, as Comvita's established operational size allows for lower per-unit costs. For instance, Comvita's revenue of NZ$230.9 million in the fiscal year ending June 30, 2023, highlights its significant market presence, which new entrants would struggle to match initially.

| Barrier to Entry | Impact on New Entrants | Comvita's Advantage |

|---|---|---|

| Capital Investment | High initial costs for facilities, technology, and brand building. | Established infrastructure and brand equity. |

| Raw Material Access | Difficulty securing consistent, high-quality Manuka honey supply. | Strong relationships with beekeepers and established supply chains. |

| Regulatory Compliance | Significant investment in certifications (UMF/MGO) and adherence to strict standards. | Existing compliance framework and expertise. |

| Brand Reputation | High marketing and brand-building costs to compete with established loyalty. | Years of building trust and premium positioning. |

| Economies of Scale | Higher per-unit costs compared to established players. | Lower production and operational costs due to large volume. |

Porter's Five Forces Analysis Data Sources

Our Comvita Porter's Five Forces analysis is built upon a foundation of reliable data, incorporating insights from Comvita's annual reports, investor presentations, and industry-specific market research reports. We also leverage information from reputable financial news outlets and competitor disclosures to gain a comprehensive understanding of the competitive landscape.