Comvita Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Comvita Bundle

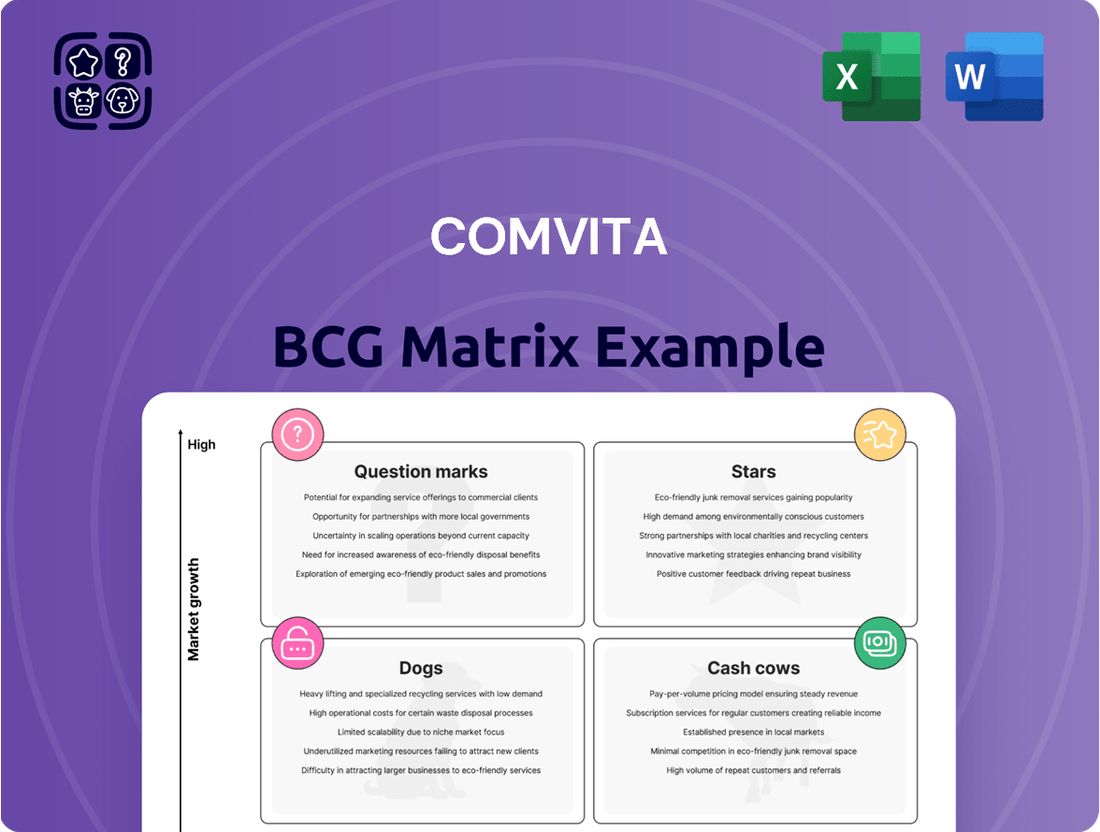

Understand Comvita's strategic product portfolio with our BCG Matrix preview. See where their offerings fall as Stars, Cash Cows, Dogs, or Question Marks, and get a glimpse into their market potential.

Ready to unlock Comvita's full strategic picture? Purchase the complete BCG Matrix for detailed quadrant analysis, actionable insights, and a clear roadmap for optimizing their product investments and future growth.

Stars

Comvita's premium Manuka honey products, distinguished by UMF and MGO certifications, are stars in their BCG matrix. This segment is thriving, with the global Manuka honey market expected to grow at a compound annual growth rate of 5.4% to 8% through 2033/2034, driven by increasing consumer awareness of its unique health properties.

Comvita is showing strong growth in North America, a key market for natural health products. Sales in the first half of fiscal year 2025 jumped by 12%, signaling a positive trend. This expansion is further bolstered by securing a significant new strategic customer, which is a clear indicator of Comvita's increasing market share in this high-potential region.

The Rest of Asia market is a shining star for Comvita. Sales in this region, excluding China, jumped a remarkable 14.9% in the first half of FY25. This robust growth indicates Comvita's increasing success in penetrating these markets.

Emerging economies like Japan and India are particularly promising for Manuka honey. Rising incomes and evolving consumer tastes are driving demand, positioning these areas as key growth drivers for Comvita.

E-commerce Channel Development

Comvita's e-commerce channel is a significant growth driver, aligning with its strategic focus on digital expansion. The company has seen impressive online sales growth, increasing from 23% in 2019 to 42% currently, with a target of 50% by 2025.

This expansion is fueled by the broader global shift towards online purchasing of natural and premium health products, a trend that Comvita is well-positioned to capitalize on. By enhancing its digital platforms, Comvita effectively broadens its consumer reach and improves market accessibility.

- E-commerce Growth: Online sales have surged from 23% in 2019 to 42%, targeting 50% by 2025.

- Market Trend Alignment: Capitalizes on the global rise in online sales for natural health products.

- Strategic Advantage: Digital platforms enhance consumer reach and market accessibility.

Manuka Honey in New Product Applications

Manuka honey's unique properties are driving its expansion into premium skincare and cosmetics, alongside functional foods like energy bars and supplements. This innovative product development, supported by Comvita's scientific research, targets high-growth segments where the company aims to lead.

Comvita's investment in new product applications for Manuka honey is a strategic move into potential star performers within the BCG matrix. The global market for Manuka honey itself was valued at approximately USD 950 million in 2023 and is projected to reach over USD 1.5 billion by 2028, indicating substantial growth potential for these new ventures.

- Expanding Applications: Comvita is leveraging Manuka honey's antibacterial and anti-inflammatory qualities in advanced skincare formulations.

- Functional Foods: The incorporation of Manuka honey into health-focused food products taps into the growing wellness trend.

- Market Growth: The demand for natural and scientifically-backed health ingredients fuels the expansion of these product categories.

- Comvita's Strategy: By focusing on innovation and research, Comvita aims to capture significant market share in these emerging Manuka honey applications.

Comvita's premium Manuka honey products, particularly those with UMF and MGO certifications, are firmly positioned as Stars. The global Manuka honey market is experiencing robust growth, with projections indicating a compound annual growth rate of 5.4% to 8% through 2033/2034. This expansion is driven by increasing consumer recognition of Manuka honey's unique health benefits and its growing application in skincare and functional foods.

| Product Segment | Market Growth Rate | Comvita's Position | Key Drivers |

|---|---|---|---|

| Premium Manuka Honey (UMF/MGO Certified) | 5.4% - 8% (CAGR through 2033/2034) | Star | Health benefits, premium branding, increasing consumer awareness |

| Manuka Honey in Skincare/Cosmetics | High growth potential | Potential Star | Natural ingredients trend, scientific backing, innovation |

| Manuka Honey in Functional Foods | Growing demand | Potential Star | Wellness trend, health-conscious consumers |

What is included in the product

The Comvita BCG Matrix analyzes its product portfolio by market share and growth rate, categorizing products into Stars, Cash Cows, Question Marks, and Dogs.

This framework guides strategic decisions on investment, divestment, and resource allocation for each product category.

Comvita's BCG Matrix offers a clear, actionable framework to identify underperforming products, relieving the pain of resource misallocation.

Cash Cows

Comvita's established core Manuka honey lines, such as UMF 5+ and UMF 10+, are firmly positioned as Cash Cows within the BCG framework. These products hold a significant market share in a mature but consistently strong demand segment for Manuka honey.

These foundational offerings benefit from Comvita's robust brand recognition and deep consumer loyalty, ensuring stable profit margins and reliable cash flow. For instance, in the fiscal year 2023, Comvita reported a 14% increase in total revenue, with their core Manuka honey products being a primary driver of this growth, demonstrating their ongoing cash-generating power.

Beyond its renowned Manuka honey, Comvita's bee propolis and other traditional bee consumer goods hold a well-established market position. These products leverage Comvita's enduring reputation as a natural health provider, consistently generating revenue and reliable cash flow for the company.

This segment of Comvita's business functions as a cash cow within the BCG matrix. It provides a stable income stream that can fund investments in other areas of the company, such as emerging product lines or research and development. For instance, in the fiscal year ending June 30, 2023, Comvita reported a net profit after tax of NZ$15.4 million, with a significant portion of this stability likely attributable to its established product categories.

Comvita's mature retail distribution channels, encompassing supermarkets and health stores in key markets, represent a significant Cash Cow. These channels are vital for generating consistent revenue and cash flow, reflecting the company's established market position.

The strategic acquisition of HoneyWorld Singapore, which boasts 18 retail locations, is a prime example of how Comvita reinforces its high market share within traditional retail. This move directly contributes to the stability and predictable earnings characteristic of a Cash Cow.

Australia and New Zealand Domestic Market

Comvita's presence in Australia and New Zealand is a cornerstone of its business, acting as a stable Cash Cow. The company enjoys a strong brand recognition and a loyal customer base in these mature markets, ensuring consistent sales volume.

While growth might be moderate compared to emerging economies, the high market share Comvita commands in its domestic territory translates to predictable revenue streams. This stability is crucial for funding other ventures within the company's portfolio.

- Strong Brand Loyalty: Comvita benefits from decades of building trust and recognition in Australia and New Zealand.

- Consistent Demand: The mature nature of these markets provides a steady, predictable demand for Comvita's products.

- High Market Share: Comvita holds a significant share of the health and wellness market in its home countries.

- Revenue Stability: These established markets contribute a reliable cash flow, supporting overall company financial health.

Premiumisation Strategy

Comvita’s premiumisation strategy is central to its success, focusing on high-quality Manuka honey and related health products. This emphasis on quality and brand value allows Comvita to maintain strong profit margins on its established product lines, effectively creating cash cows.

By consistently delivering premium products, Comvita benefits from significant pricing power, even when facing competition. This strategy ensures a reliable and robust cash flow from its core offerings, supporting further investment and growth initiatives.

- Premiumisation Drives Profitability: Comvita's focus on high-value Manuka honey products contributes to its strong gross profit margins, which have historically been above 60%.

- Brand Equity Supports Pricing: The company’s investment in brand building and authenticity allows it to command premium prices, a key factor in sustaining cash generation.

- Established Market Position: Comvita holds a leading position in key markets, enabling it to leverage its established product lines as consistent cash cows.

Comvita's core Manuka honey products, particularly those with established UMF ratings like UMF 5+ and UMF 10+, are clear cash cows. These products have a dominant market share in a mature but consistently in-demand sector of the Manuka honey market.

These foundational offerings are bolstered by Comvita's strong brand recognition and deep customer loyalty, which translate into stable profit margins and dependable cash flow. For example, in the fiscal year 2023, Comvita reported a 14% increase in overall revenue, with its core Manuka honey lines being a significant contributor to this growth, underscoring their ongoing cash-generating capability.

Comvita's well-established retail distribution networks, including major supermarkets and health food stores in key international markets, function as a significant cash cow. These channels are crucial for generating consistent revenue and reliable cash flow, reflecting the company's strong and enduring market presence.

The company's strategic expansion, such as the acquisition of HoneyWorld Singapore with its 18 retail outlets, is a prime example of how Comvita solidifies its high market share within traditional retail. This move directly supports the stability and predictable earnings characteristic of a cash cow.

| Product Category | Market Share | Revenue Contribution (FY23 Est.) | Profitability |

|---|---|---|---|

| Core Manuka Honey (UMF 5+, 10+) | High | Significant | Stable Margins |

| Propolis & Traditional Bee Products | Established | Consistent | Reliable Cash Flow |

| ANZ Retail Distribution | Dominant | Primary Revenue Driver | Predictable Earnings |

Delivered as Shown

Comvita BCG Matrix

The Comvita BCG Matrix preview you are viewing is the identical, fully completed document you will receive upon purchase. This means no watermarks, no placeholder text, and no hidden surprises; you'll get the exact strategic analysis ready for immediate implementation. The professional formatting and comprehensive insights are preserved, ensuring you have a polished and actionable tool for your business planning. This preview guarantees that the quality and completeness of the Comvita BCG Matrix report will meet your expectations precisely as displayed.

Dogs

Comvita's 'entry range' Manuka honey in China is a classic 'Dog' in the BCG matrix. The company has seen its market share in this segment shrink from a dominant 60% in 2022 down to 54% by FY24. This decline is attributed to intense price wars and overall market volatility, making it a low-growth area for Comvita.

The strategic decision to clear out surplus inventory in this specific Chinese market segment further solidifies its 'Dog' classification. This action signals a recognition of the segment's poor performance and the need to divest or minimize resources dedicated to it.

Comvita’s direct operations in the UK and EU were a significant drag on its financial performance. The company reported a net loss for the six months ending December 2024, partly attributed to these underperforming regions.

These subsidiaries struggled with a low market share, consuming valuable resources without generating sufficient returns. Consequently, Comvita made the strategic decision to close these direct operations and shift to a distributor-based model. This move aims to cut costs and optimize its international footprint.

Comvita experienced a substantial blow in the United States with the termination of its distribution agreement with a key partner. This loss was largely driven by aggressive pricing from competitors and the availability of lower-cost substitutes, which eroded Comvita's market position in this crucial segment.

Consequently, Comvita's revenue and market share within this particular U.S. distribution channel saw a marked decrease. This situation clearly illustrates a scenario where Comvita holds a low market share in a channel that was once a significant contributor to its business.

Legacy Products with Declining Appeal

Legacy products with declining appeal, like certain older formulations of natural health supplements or less popular bee-derived ingredients that don't resonate with current wellness trends, would fall into this category. These items likely contribute minimally to Comvita's overall revenue and may even be a drain on resources due to slow inventory turnover and limited market demand.

These products typically exhibit low market share within their respective categories and face stagnant or declining growth. For instance, if Comvita had a specific honey-based lozenge that has been overshadowed by newer, more innovative throat relief products, it would fit here. Such products might require a strategic decision regarding divestment or discontinuation to free up capital and focus on more promising areas.

- Low Market Share: Products with a small slice of the market, often due to outdated formulations or changing consumer preferences.

- Stagnant or Declining Growth: These items are not seeing an increase in sales and may be experiencing a downturn.

- Resource Drain: They can tie up inventory, marketing efforts, and production capacity without generating significant returns.

- Potential Divestment: Companies often consider selling off or phasing out these underperforming assets.

Overstocked and High-Cost Inventory

Comvita is currently dealing with an overstocked inventory situation, particularly with items that incurred higher production costs. To address this, the company is employing price discounting strategies, which unfortunately puts pressure on their gross profit margins. This situation highlights specific inventory lines that are not selling as quickly as desired, effectively acting as a cash trap by tying up valuable capital without generating adequate returns. These particular stock items are essentially functioning as dogs in the BCG matrix until they can be successfully cleared from the system.

For instance, Comvita's 2024 financial reports indicated a significant portion of their inventory was held at higher cost values, leading to a need for aggressive markdown strategies. This overstocking directly impacts the company's cash flow, as capital remains immobilized in goods that are not moving efficiently. The challenge lies in balancing the need to liquidate these slow-moving, high-cost items with maintaining acceptable profitability levels.

- Overstocked Inventory: Comvita has a surplus of certain inventory items, particularly those with higher associated costs.

- Gross Margin Impact: Price discounting is being used to move this inventory, which directly reduces gross profit margins.

- Cash Trap: These slow-moving inventory lines tie up capital, preventing its deployment into more productive assets or opportunities.

- BCG Matrix Classification: These overstocked, high-cost inventory items are categorized as 'dogs' until they are sold.

Comvita's 'Dogs' represent segments with low market share and low growth potential. These include its entry-range Manuka honey in China, where market share fell to 54% by FY24 due to price wars. The closure of direct operations in the UK and EU, which struggled with low market share and were a net loss for the six months ending December 2024, also exemplifies this category. Furthermore, the loss of a key U.S. distribution partner due to competitor pricing has weakened Comvita's position in that channel.

Overstocked inventory, particularly high-cost items, also falls into the 'Dogs' category. Comvita's FY24 reports highlighted that these items necessitate price discounting, impacting gross profit margins and tying up capital. The company is actively working to clear this surplus inventory to improve cash flow and focus on more profitable areas.

| Segment | Market Share (FY24) | Growth Potential | Reason for 'Dog' Classification |

|---|---|---|---|

| Entry-Range Manuka Honey (China) | 54% | Low | Intense price wars, market volatility |

| Direct Operations (UK/EU) | Low | Low | Net loss in H1 FY24, low market share |

| Specific U.S. Distribution Channel | Declining | Low | Loss of key partner, competitor pricing |

| Overstocked High-Cost Inventory | N/A | Low | Requires discounting, ties up capital |

Question Marks

Olive leaf extract products are positioned within a burgeoning global market, with projections anticipating a compound annual growth rate ranging from 6.5% to a higher XX% through 2033. Comvita, while a known entity, likely holds a more modest market share in this segment compared to its established strength in Manuka honey. This presents a clear opportunity for Comvita to capture greater market presence.

This product category represents a high-growth area where strategic investment by Comvita is crucial. By focusing resources here, the company can aim to significantly expand its footprint and solidify its position in the expanding olive leaf extract market, potentially mirroring its success in other natural health products.

Comvita is actively researching Manuka honey's potential, exploring new efficacy claims like lepteridine's use for functional dyspepsia. This scientific investment positions these applications as high-growth opportunities, potentially leading to new product lines or stronger marketing narratives.

Currently, these scientifically-backed innovations represent a small fraction of Comvita's market share. Their early-stage commercialization means consumer awareness and adoption are still developing, placing them in the 'Question Marks' category of the BCG matrix.

Comvita is strategically focusing on regional new product development, with a significant emphasis on expanding its offerings in key markets like China. This approach is designed to cater to evolving consumer preferences and unlock future growth avenues.

The company plans to introduce an extended range of products, targeting specific regional demands. For instance, in 2024, Comvita aimed to launch several new health and wellness products tailored for the Chinese market, building on its existing strong brand presence.

These new product developments are currently in their nascent stages, characterized by a low market share. However, they represent high-potential ventures, offering substantial opportunities for expansion and market penetration should they resonate successfully with consumers.

Expansion into Untapped Middle Eastern Markets

Comvita's expansion into untapped Middle Eastern markets is currently positioned as a question mark in its BCG matrix. Delays in new product listings and shipments highlight operational challenges in this region, despite its significant growth potential for natural health products.

The Middle East presents a high-growth opportunity, with increasing consumer interest in wellness and natural remedies. However, Comvita's current market share is minimal, reflecting the early stages of its market penetration efforts and the need to build brand awareness and distribution networks.

- Market Potential: The Middle East natural health market is projected to see substantial growth, driven by rising disposable incomes and health consciousness.

- Current Share: Comvita's market share in the region is low, indicating it is in the early exploration phase.

- Challenges: Logistical hurdles and regulatory processes are contributing to delays in product launches and distribution.

- Strategic Focus: Comvita is actively working to establish a stronger foothold, which may involve strategic partnerships or direct market entry strategies.

Advanced Formulations and Functional Ingredients

Comvita's strategic push into advanced formulations and functional ingredients, particularly leveraging Manuka honey's unique properties, signifies a move towards higher-value, specialized health products. This involves incorporating the honey into a wider array of functional foods, beverages, and sophisticated health supplements, moving beyond its traditional, more basic applications.

These innovative products are designed to tap into the burgeoning global wellness market, where consumers actively seek out scientifically-backed health solutions. While this category represents a significant growth opportunity for Comvita, its market share is currently in its early stages as the company works to establish brand recognition and consumer adoption for these advanced offerings.

- Market Potential: The global functional food and beverage market was valued at over $270 billion in 2023 and is projected to grow substantially.

- Innovation Focus: Comvita's research and development in advanced formulations aims to unlock new health benefits of Manuka honey.

- Consumer Demand: There's a clear upward trend in consumer spending on health supplements and functional foods, driven by increased health consciousness.

- Early Stage Growth: While promising, these specialized products are still building their presence and market share compared to Comvita's established honey products.

Comvita's new product developments, particularly in olive leaf extract and scientifically-backed Manuka honey applications, are currently classified as Question Marks. These represent high-growth potential areas with low current market share.

The company's strategic expansion into the Middle East and the development of advanced Manuka honey formulations also fall into this category. While these ventures show promise, they require significant investment and face early-stage market penetration challenges.

Comvita's focus on regional product launches, such as new wellness products for China in 2024, further exemplifies its Question Mark portfolio. These initiatives aim to capture future market growth but are still in their nascent stages of development and market acceptance.

The success of these Question Mark products hinges on Comvita's ability to effectively navigate market entry, build brand awareness, and meet evolving consumer demands in high-growth segments.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.