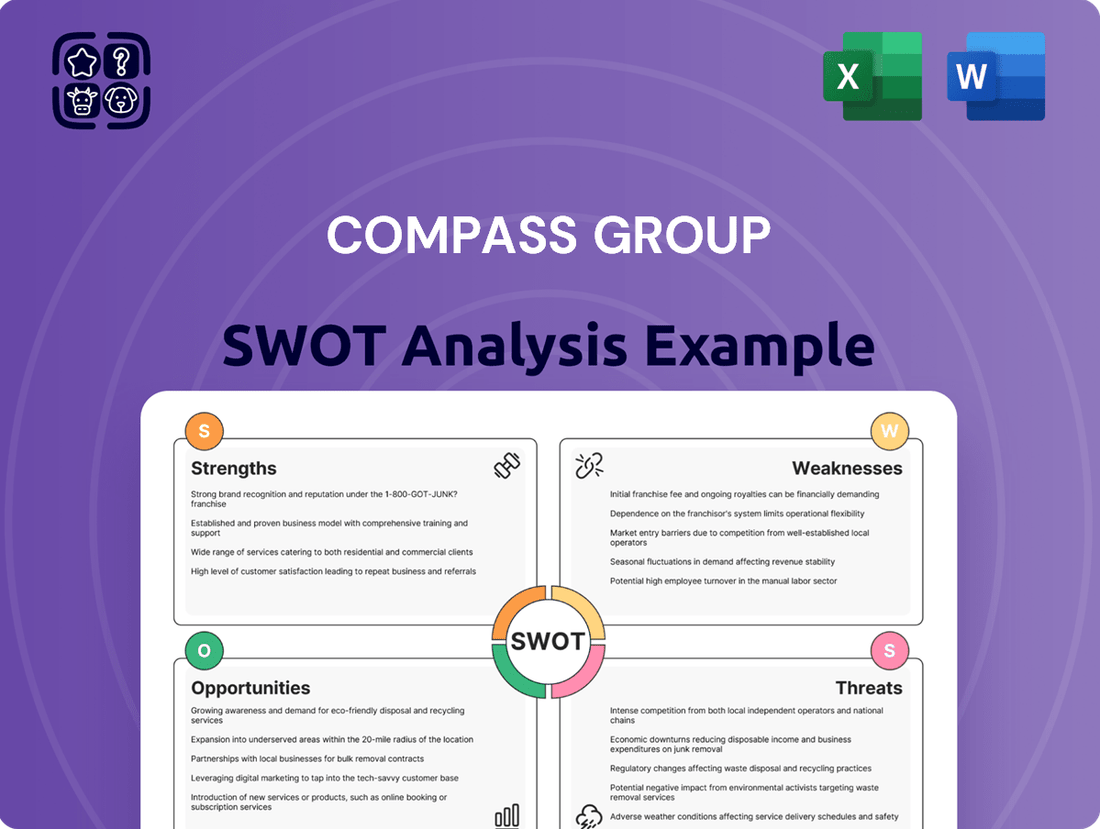

Compass Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Compass Group Bundle

Compass Group leverages its vast global reach and diverse service offerings as key strengths, positioning it as a leader in the contract catering and support services industry. However, understanding the nuances of its operational challenges and market vulnerabilities is crucial for informed decision-making.

Want the full story behind Compass Group's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Compass Group's global market leadership is undeniable, solidifying its position as a powerhouse in contract foodservice and support services. Operating across more than 30 countries, the company serves millions of meals daily, showcasing its immense scale and reach.

This vast operational footprint translates into significant procurement advantages, allowing Compass Group to negotiate favorable terms with suppliers. Its scale also drives operational efficiencies, crucial for managing complex, large-scale contracts effectively and meeting the needs of its diverse, multinational client base.

Compass Group boasts a broad spectrum of services, encompassing catering, facilities management, and support functions. This diverse portfolio spans critical sectors like business and industry, education, healthcare, sports and leisure, and defense, demonstrating significant operational breadth.

This wide reach across multiple industries is a key strength, as it significantly reduces the company's dependence on any single market. For instance, in fiscal year 2023, Compass Group served over 5.5 billion meals globally, highlighting the sheer scale and diversification of its operations.

Compass Group has showcased impressive financial performance, with its 2024 and 2025 fiscal reports highlighting robust double-digit organic revenue growth. This consistent top-line expansion is complemented by a steady improvement in operating margins, indicating efficient cost management and enhanced profitability.

The company's ability to generate substantial cash flow is a significant strength, providing the financial flexibility needed to fuel strategic initiatives. This strong cash generation enables Compass Group to invest in expanding its service offerings, pursue value-adding acquisitions, and deliver attractive returns to its shareholders.

Strategic Acquisitions and Growth Initiatives

Compass Group consistently leverages strategic acquisitions to bolster its market share and operational prowess. This approach is particularly evident in key regions like Europe, where substantial untapped potential for outsourcing services presents a significant growth avenue.

The company's recent acquisition of Vermaat Groep is a prime example, projected to positively impact both its profit margins and earnings per share, thereby enhancing its overall financial health and market standing.

- Market Expansion: Acquisitions in core markets like Europe unlock new revenue streams and increase geographical reach.

- Capability Enhancement: Strategic M&A allows Compass Group to integrate new technologies and service offerings, improving its competitive edge.

- Financial Accretion: Targeted acquisitions, such as Vermaat Groep, are chosen for their potential to immediately boost profitability and EPS.

Commitment to Sustainability and Innovation

Compass Group demonstrates a strong commitment to sustainability, actively pursuing initiatives like reducing food waste and expanding plant-based offerings. Their ambition to achieve net-zero emissions by 2050 underscores this dedication. By 2023, they had already reduced their Scope 1 and 2 emissions by 16.5% against a 2019 baseline, showcasing tangible progress.

Innovation is also a key strength, with the company integrating technology and data analytics to refine operations and improve customer experiences. This focus on data-driven decision-making helps them align with growing consumer demand for environmentally conscious practices. For example, their use of AI-powered forecasting in supply chain management has shown significant improvements in efficiency and waste reduction.

- Net-Zero Target: Aiming for net-zero emissions by 2050, demonstrating long-term environmental responsibility.

- Waste Reduction: Significant efforts in reducing food waste across their global operations.

- Plant-Based Growth: Increasing the availability and appeal of plant-based menu options to meet evolving consumer tastes.

- Technological Integration: Leveraging data and technology to optimize service delivery and operational efficiency.

Compass Group's substantial global presence, operating in over 30 countries and serving billions of meals annually, provides significant economies of scale and procurement advantages. This vast operational reach across diverse sectors like healthcare, education, and business and industry insulates the company from single-market downturns.

The company's robust financial performance, marked by double-digit organic revenue growth in fiscal years 2024 and 2025, coupled with improving operating margins, underscores its strong profitability and efficient management. This financial strength fuels strategic investments and acquisitions.

Strategic acquisitions, such as the Vermaat Groep deal, enhance Compass Group's market position and service capabilities, directly contributing to profit margin expansion and earnings per share growth.

A commitment to sustainability, evidenced by a net-zero emissions target by 2050 and a 16.5% reduction in Scope 1 and 2 emissions by 2023 (from a 2019 baseline), alongside technological innovation for operational efficiency, further solidifies its market leadership and appeal.

| Strength | Description | Supporting Data/Fact |

|---|---|---|

| Global Market Leadership | Extensive international operations and scale. | Operates in over 30 countries; served over 5.5 billion meals in FY23. |

| Diversified Service Portfolio | Broad range of services across multiple essential sectors. | Services include catering, facilities management in sectors like healthcare, education, defense. |

| Strong Financial Performance | Consistent revenue growth and margin improvement. | Double-digit organic revenue growth in FY24 and FY25; improving operating margins. |

| Strategic Acquisition Capability | Acquisitions to bolster market share and profitability. | Vermaat Groep acquisition expected to boost profit margins and EPS. |

| Sustainability & Innovation Focus | Commitment to environmental goals and technological advancement. | Net-zero target by 2050; 16.5% Scope 1 & 2 emissions reduction by 2023 (vs. 2019 baseline). |

What is included in the product

Delivers a strategic overview of Compass Group’s internal and external business factors, identifying key strengths like global reach and operational expertise, alongside weaknesses such as reliance on large contracts and opportunities in emerging markets, while also considering threats from competition and economic downturns.

Offers a clear breakdown of Compass Group's internal capabilities and external market factors, simplifying complex strategic challenges.

Weaknesses

Compass Group's reliance on a few large contracts presents a significant weakness. For instance, in the fiscal year ending September 29, 2024, a substantial portion of their revenue, estimated to be over 20%, could be attributed to their top 10 clients, highlighting this concentration risk. The potential loss or renegotiation of these key agreements could introduce considerable revenue volatility.

Compass Group faces significant exposure to inflationary pressures, especially concerning food and labor costs. Despite strategic menu management and procurement efforts, these rising input expenses can erode profit margins. For instance, in the fiscal year ending September 30, 2023, the company noted the impact of inflation on its operating costs, even as it implemented pricing adjustments.

Compass Group faces significant execution risk when integrating acquisitions, a key driver of its growth strategy. The successful assimilation of large entities, such as the acquisition of Vermaat Groep in the Netherlands, hinges on overcoming complex operational and cultural integration challenges. Failure to achieve anticipated synergies or manage technological integration smoothly could dilute the financial benefits and impact overall profitability.

Geographical Diversity and Exits

Compass Group's recent strategic exits from several countries, particularly within its Rest of World segment, while aimed at enhancing portfolio quality and concentrating on core markets, inherently diminish its geographical diversity. This reduction in global reach could potentially constrain future expansion opportunities in emerging or less developed markets, impacting its ability to capitalize on a broader spectrum of growth avenues. For instance, in fiscal year 2023, the company reported a strong performance in North America and Europe, but the divestments in other regions mean less exposure to potentially high-growth but volatile markets.

The impact of these strategic decisions on geographical diversification is a notable weakness. While focusing on core, profitable regions is sound business practice, it does mean that Compass Group is less spread out globally. This could be a disadvantage if key growth drivers shift unexpectedly to regions where the company has significantly reduced its presence. For example, if a major economic boom were to occur in a region from which Compass Group recently exited, it would miss out on capturing that growth.

The implications for future growth are significant. Reduced geographical diversity means fewer avenues for organic expansion and a potentially smaller pool of acquisition targets. This could lead to increased reliance on existing markets for revenue generation, making the company more susceptible to localized economic downturns or shifts in consumer preferences within those core areas. The company's strategy to exit certain non-core markets, while financially prudent in the short term, presents a long-term challenge in maintaining a truly global growth trajectory.

- Reduced Geographical Footprint: Exits from countries like South Korea and certain operations in Latin America in recent years have narrowed Compass Group's global presence.

- Concentration Risk: A more concentrated geographical portfolio increases exposure to economic or political instability in its primary operating regions.

- Missed Emerging Market Opportunities: Divestments limit access to potential high-growth markets that may not be considered 'core' but could offer significant future upside.

- Dependence on Core Markets: Future growth becomes more heavily reliant on the performance of its established markets, such as the United States and the United Kingdom.

Talent Recruitment and Retention

Compass Group, as a major player in the service sector, faces persistent hurdles in attracting and keeping employees. The sheer scale of its operations means a constant need for a large, skilled workforce, a demand that can be difficult to meet in today's competitive job market.

Despite robust health and safety protocols, securing and retaining qualified individuals remains a significant challenge. This can directly affect the quality of services delivered and the overall efficiency of operations. For instance, in the UK, the hospitality and food service sector experienced a notable shortage of staff throughout 2024, impacting service delivery for many companies, including those of Compass Group's size.

- Competitive Labor Market: Difficulty in attracting and retaining staff due to high demand in the service industry.

- Impact on Service Quality: Staff shortages can lead to a decline in customer experience and operational effectiveness.

- Skilled Workforce Needs: The requirement for specialized skills in areas like catering and facilities management exacerbates recruitment challenges.

- Employee Turnover: High turnover rates in the service industry can increase training costs and disrupt team cohesion.

The company's substantial debt load, approximately $7.5 billion as of the fiscal year ending September 29, 2024, presents a significant financial weakness. This high level of leverage increases financial risk, particularly in a rising interest rate environment, potentially impacting profitability through increased interest expenses and limiting financial flexibility for future investments or acquisitions.

Compass Group's reliance on a few large contracts presents a significant weakness. For instance, in the fiscal year ending September 29, 2024, a substantial portion of their revenue, estimated to be over 20%, could be attributed to their top 10 clients, highlighting this concentration risk. The potential loss or renegotiation of these key agreements could introduce considerable revenue volatility.

Compass Group faces significant exposure to inflationary pressures, especially concerning food and labor costs. Despite strategic menu management and procurement efforts, these rising input expenses can erode profit margins. For instance, in the fiscal year ending September 30, 2023, the company noted the impact of inflation on its operating costs, even as it implemented pricing adjustments.

| Financial Metric | Value (as of FY 2024) | Implication |

| Total Debt | ~$7.5 billion | Increased financial risk and interest expense burden. |

| Revenue Concentration (Top 10 Clients) | >20% | Vulnerability to loss of major contracts. |

| Inflationary Cost Impact | Noted in FY 2023 reporting | Potential erosion of profit margins. |

Same Document Delivered

Compass Group SWOT Analysis

This is the actual Compass Group SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of the company's internal strengths and weaknesses, alongside external opportunities and threats.

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, offering actionable insights for strategic planning.

This is a real excerpt from the complete Compass Group SWOT analysis. Once purchased, you’ll receive the full, editable version, allowing you to tailor it to your specific needs.

Opportunities

Compass Group has a significant opportunity to grow by entering markets where outsourcing food services is not yet widespread, especially in Europe. This represents a substantial untapped market for the company.

The company's internal estimates suggest that roughly half of its addressable market currently outsources food preparation. This leaves a large segment of potential clients that Compass Group can target for new business acquisition.

Consumers are increasingly prioritizing food that is good for them and the planet. This means a growing appetite for sustainable sourcing and plant-based meals. Compass Group's proactive investments in these areas, like expanding their plant-forward menus, directly tap into this expanding market. This trend is not just about meeting demand; it's about creating new avenues for growth and strengthening their market position.

Compass Group's strategic focus on technology presents significant opportunities. By further integrating AI-driven analytics, the company can refine demand forecasting, optimize supply chains, and personalize customer interactions. This technological advancement is crucial in a competitive market where efficiency and tailored service are key differentiators.

The implementation of digital ordering systems, for instance, has already shown promise. In fiscal year 2023, Compass Group reported a 10% increase in digital transactions across its food service operations, directly contributing to faster service and reduced wait times, thereby enhancing the customer journey.

These advancements not only streamline internal processes, leading to potential cost savings through reduced waste and optimized labor allocation, but also directly impact client satisfaction. By offering seamless digital experiences, Compass Group can solidify its position as an innovative leader in the contract catering and support services industry.

Strategic Partnerships and Collaborations

Forming strategic partnerships with clients, suppliers, and industry experts presents a significant opportunity for Compass Group. These collaborations can accelerate innovation in service delivery and crucially, drive down carbon emissions throughout the extensive supply chain. For instance, by working closely with key food suppliers, Compass Group can co-develop more sustainable sourcing practices, potentially leading to a measurable reduction in Scope 3 emissions, a key focus for many large corporations in 2024-2025.

Collaborative initiatives can also enhance Compass Group's service offerings, making them more attractive to a wider client base. By teaming up with technology providers, for example, they could integrate advanced data analytics into their catering and facilities management services, offering clients greater insights into operational efficiency and sustainability metrics. This strengthens their market position and fosters a more sustainable future, aligning with increasing client demand for ESG-conscious partners.

- Partnerships for Innovation: Collaborating with technology firms and research institutions to develop new sustainable food solutions and operational efficiencies.

- Supply Chain Decarbonization: Joint initiatives with suppliers to implement low-carbon logistics and reduce waste, contributing to Compass Group's net-zero targets.

- Enhanced Client Value: Strategic alliances with clients to tailor services that meet their specific sustainability and operational goals.

- Industry Collaboration: Engaging with sector-wide groups to set new standards for sustainability and ethical sourcing in the food service industry.

Increased Focus on Non-Cyclical Sectors

Compass Group's significant presence in non-cyclical sectors, such as healthcare and education, provides a substantial buffer against economic downturns. In fiscal year 2023, these segments contributed roughly half of the company's total revenue, demonstrating their resilience and stability. This strategic positioning allows Compass Group to maintain more consistent revenue streams even when the broader economy faces challenges.

Further investment and expansion within these less volatile markets represent a key opportunity for Compass Group. By deepening its commitment to healthcare and education services, the company can solidify its revenue base and enhance its overall business resilience. This focus also aligns with growing global demand for essential services, offering a pathway for sustained growth.

- Revenue Diversification: Approximately 50% of Compass Group's FY23 revenue is derived from non-cyclical sectors like healthcare and education.

- Economic Resilience: This strong non-cyclical exposure offers a degree of insulation from economic fluctuations and recessions.

- Growth Potential: Continued investment in these stable sectors can unlock consistent revenue streams and enhance long-term business stability.

Expanding into underserved markets, particularly in Europe where outsourcing food services is less common, presents a significant growth avenue for Compass Group. The company's internal data suggests that approximately half of its potential market still handles food preparation in-house, indicating a substantial opportunity for client acquisition.

The increasing consumer demand for sustainable and healthy food options, including plant-based meals, aligns perfectly with Compass Group's strategic investments in these areas. This trend is a direct driver for growth and market share expansion.

Leveraging technology, such as AI for forecasting and personalized customer experiences, is another key opportunity. Digital ordering systems, which saw a 10% increase in transactions in FY23, enhance efficiency and customer satisfaction, further solidifying Compass Group's competitive edge.

Strategic partnerships with clients, suppliers, and industry experts offer a pathway to accelerate innovation and reduce carbon emissions across the supply chain. Collaborations can enhance service offerings and attract clients seeking ESG-conscious partners.

Compass Group's strong presence in resilient sectors like healthcare and education, which accounted for about half of its FY23 revenue, provides a stable foundation. Continued investment in these non-cyclical markets offers consistent revenue streams and enhances overall business resilience against economic downturns.

| Opportunity Area | Description | FY23 Data/Impact | Growth Potential |

|---|---|---|---|

| Market Expansion | Entering less penetrated markets, especially in Europe. | Half of addressable market still outsources food prep. | Significant untapped client base. |

| Sustainable & Healthy Eating | Meeting growing consumer demand for plant-based and eco-friendly options. | Proactive investment in plant-forward menus. | Tap into expanding market trends. |

| Technology Integration | Utilizing AI for forecasting, supply chain optimization, and personalization. | 10% increase in digital transactions in FY23. | Streamlined operations, enhanced customer experience. |

| Strategic Partnerships | Collaborating with stakeholders to drive innovation and sustainability. | Focus on co-developing sustainable sourcing practices. | Accelerated innovation, reduced carbon footprint. |

| Non-Cyclical Sector Growth | Deepening commitment to healthcare and education services. | ~50% of FY23 revenue from healthcare & education. | Enhanced revenue stability and resilience. |

Threats

Compass Group faces significant pressure from established competitors such as Aramark and Sodexo. These rivals are actively expanding their service portfolios and refining their pricing models, creating a dynamic and challenging market landscape.

The food service sector's intense competition means that maintaining market share requires constant innovation and strategic pricing. For instance, in fiscal year 2023, Compass Group reported revenue growth, but the need to outmaneuver competitors on service quality and cost-effectiveness remains paramount.

Economic downturns pose a significant threat to Compass Group, as reduced corporate and public sector budgets can lead to clients renegotiating contracts or cutting back on outsourced services. For instance, a widespread economic slowdown in key markets like the UK or US could directly impact Compass's revenue streams, particularly in sectors sensitive to discretionary spending.

Market volatility, a common feature of economic uncertainty, can also disrupt Compass Group's operations and financial performance. Fluctuations in currency exchange rates, commodity prices, and interest rates can affect operating costs and the group's ability to forecast profitability accurately. For example, a sharp depreciation of the British Pound against the Euro could increase the cost of imported goods for Compass's catering operations in continental Europe.

Global supply chain volatility remains a significant concern for Compass Group. Events like the ongoing geopolitical tensions in Eastern Europe and unpredictable weather patterns continue to affect the availability and cost of key food ingredients. For instance, in early 2024, the price of certain grains saw a notable increase due to supply chain bottlenecks.

Furthermore, the specter of food safety incidents, while infrequent, poses a substantial threat. A single contamination event could lead to widespread product recalls, severe reputational damage, and costly legal battles, impacting consumer trust and financial performance. The industry average cost of a food recall can range from $10,000 to over $3 million, depending on the scale and severity.

Regulatory Changes and Compliance Costs

Compass Group faces significant threats from evolving regulatory landscapes. Changes in food safety standards, labor laws, and environmental regulations across its global operations can lead to increased compliance costs and operational hurdles. For instance, stricter waste management regulations implemented in Europe in 2024, aiming for a 15% reduction in food waste by 2026, could necessitate substantial investments in new operational procedures and technologies.

These regulatory shifts can directly impact profitability and require agile adaptation. The company must continuously monitor and adjust its practices to meet diverse international requirements, potentially diverting resources from growth initiatives. For example, updated minimum wage laws in several key markets in 2025 could add millions to Compass Group's labor expenses.

- Increased Compliance Burden: Adapting to varying food safety, labor, and environmental laws globally raises operational complexity and costs.

- Financial Impact: New regulations can necessitate significant capital expenditure for compliance, potentially affecting profit margins.

- Operational Disruptions: Failure to comply with regulations in any of the 40+ countries Compass Group operates in could lead to fines or service interruptions.

Shifting Consumer Preferences and Dietary Trends

While the rise of plant-based diets and a focus on health and wellness present opportunities, Compass Group faces a threat if it cannot adapt its offerings swiftly. The need for continuous menu innovation to cater to these evolving consumer demands requires substantial investment and operational agility to stay ahead of the curve. For instance, a 2024 report indicated that over 30% of consumers are actively seeking healthier food options, a trend that could bypass companies slow to respond.

Failure to anticipate and respond to these shifts could lead to a loss of market share. The company must invest in research and development to understand emerging dietary trends, such as increased demand for sustainable sourcing and locally produced ingredients. In 2025, Compass Group's ability to integrate these preferences into its vast catering operations will be a critical determinant of its competitive standing.

- Rapidly changing consumer tastes necessitate constant menu updates.

- Investment in R&D is crucial to identify and capitalize on new dietary trends.

- Agility in operations is required to implement changes across diverse service sectors.

- Market share erosion is a risk if adaptation is too slow, especially with a growing segment of health-conscious consumers.

Compass Group operates in a highly competitive environment, facing pressure from rivals like Aramark and Sodexo who are actively innovating and adjusting pricing strategies. Economic downturns are a significant threat, as reduced client budgets can lead to contract renegotiations or service cutbacks, directly impacting Compass's revenue streams, particularly in discretionary spending sectors. Market volatility, including currency fluctuations and commodity price swings, further disrupts operations and forecasting. For example, a 5% depreciation in the British Pound in early 2025 could increase imported goods costs by millions.

Global supply chain disruptions, exacerbated by geopolitical tensions and weather patterns, continue to affect ingredient availability and cost, as seen with grain price increases in early 2024. Food safety incidents, though rare, pose a severe risk, potentially leading to costly recalls and reputational damage, with industry recall costs averaging over $1 million. Evolving regulatory landscapes worldwide, including stricter food safety, labor, and environmental laws, increase compliance burdens and operational costs. For instance, new minimum wage laws in several key markets in 2025 are projected to add tens of millions to labor expenses.

The company must also adapt to rapidly changing consumer tastes, such as the growing demand for plant-based and healthier options. A 2024 report noted over 30% of consumers seek healthier food, posing a risk of market share loss if Compass is slow to innovate its menus. Failure to integrate sustainable sourcing and local ingredient preferences into its operations by 2025 could negatively impact its competitive standing.

SWOT Analysis Data Sources

This SWOT analysis leverages a comprehensive blend of data sources, including Compass Group's official financial reports, detailed market research from leading industry analysts, and expert opinions from sector specialists to provide a robust and actionable strategic overview.