ISC SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ISC Bundle

Curious about ISC's competitive edge and potential hurdles? Our comprehensive SWOT analysis dives deep, revealing crucial internal strengths and external opportunities that shape their market presence.

Want the full story behind ISC's strategic advantages and areas for development? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to illuminate their path forward.

Strengths

ISC benefits significantly from exclusive, long-term government contracts, particularly for managing Saskatchewan's land titles and corporate registries. These agreements provide a bedrock of stability and predictable revenue. For example, the Master Service Agreement with the Government of Saskatchewan was extended through 2053, securing cash flows for nearly three decades.

These contracts are often tied to inflation through Consumer Price Index (CPI) escalators, ensuring that ISC's revenue streams grow in line with economic conditions. This CPI linkage offers a degree of protection against inflationary pressures, contributing to consistent and reliable financial performance.

ISC's strength lies in its diversified business segments: Registry Operations, Services, and Technology Solutions. This structure creates a robust revenue base, mitigating risks associated with over-reliance on any single market.

This diversification proved beneficial in 2024, a year marked by record revenue and adjusted EBITDA for ISC. All segments contributed to this growth, with Technology Solutions seeing a significant 30% revenue surge and the Services segment expanding by 8% compared to the previous year.

ISC's core strength lies in its expertise in managing and safeguarding critical public information, a function essential for sectors like real estate and business registration. This ensures data accuracy and availability, making ISC an indispensable partner for countless transactions and operations.

In 2024, the demand for reliable digital information management surged, with ISC playing a pivotal role in maintaining the integrity of over 100 million public records. This robust data management capability underpins its value proposition.

Strong Financial Performance and Growth Trajectory

ISC is showing impressive financial strength. In 2024, the company achieved record revenue of $247.4 million and adjusted EBITDA of $90.3 million, highlighting significant operational success.

This strong performance sets a solid foundation for future expansion. ISC has ambitious plans to double both its revenue and adjusted EBITDA by 2028, a goal they've clearly made headway on with their 2024 results.

- Record 2024 Revenue: $247.4 million

- Record 2024 Adjusted EBITDA: $90.3 million

- Five-Year Goal: Double revenue and adjusted EBITDA by 2028

Technology Solutions and Innovation

ISC's strength lies in its technology solutions and innovation, allowing it to move beyond core registry services. This diversification is a key advantage.

The Technology Solutions segment is projected to experience robust double-digit growth in 2025. This growth is underpinned by a solid pipeline of contracts, both from external clients and related parties.

Key projects contributing to this forecasted growth include initiatives in Cyprus, Guernsey, Michigan, and Liechtenstein, showcasing ISC's expanding global reach and diverse service applications.

- Diversified Revenue Streams: Technology solutions offer new avenues for income beyond traditional registry operations.

- Strong Growth Outlook: Double-digit growth is anticipated for the Technology Solutions segment in 2025.

- Robust Contract Pipeline: Future revenue is secured by a healthy mix of third-party and related-party contracts.

- Global Project Footprint: Successful engagements in Cyprus, Guernsey, Michigan, and Liechtenstein highlight international capabilities.

ISC's primary strength is its exclusive, long-term government contracts, such as the one with Saskatchewan extending to 2053, which provide stable, predictable revenue streams, often indexed to inflation. This ensures consistent financial performance and a secure operational base.

The company's diversified business segments—Registry Operations, Services, and Technology Solutions—create a robust revenue model, reducing reliance on any single area. This diversification was evident in 2024, a record year for revenue and adjusted EBITDA, with Technology Solutions growing by 30% and Services by 8%.

ISC's expertise in managing critical public information, like land titles and corporate registries, makes it an indispensable partner. In 2024, ISC safeguarded over 100 million public records, underscoring its vital role in data integrity.

Financially, ISC is exceptionally strong, reporting record revenue of $247.4 million and adjusted EBITDA of $90.3 million in 2024. This performance supports their ambitious goal to double revenue and EBITDA by 2028.

| Financial Metric | 2024 Value | 2023 Value | Growth (YoY) |

|---|---|---|---|

| Revenue | $247.4 million | $219.3 million | 13.0% |

| Adjusted EBITDA | $90.3 million | $75.4 million | 19.8% |

| Technology Solutions Revenue | $26.0 million | $20.0 million | 30.0% |

What is included in the product

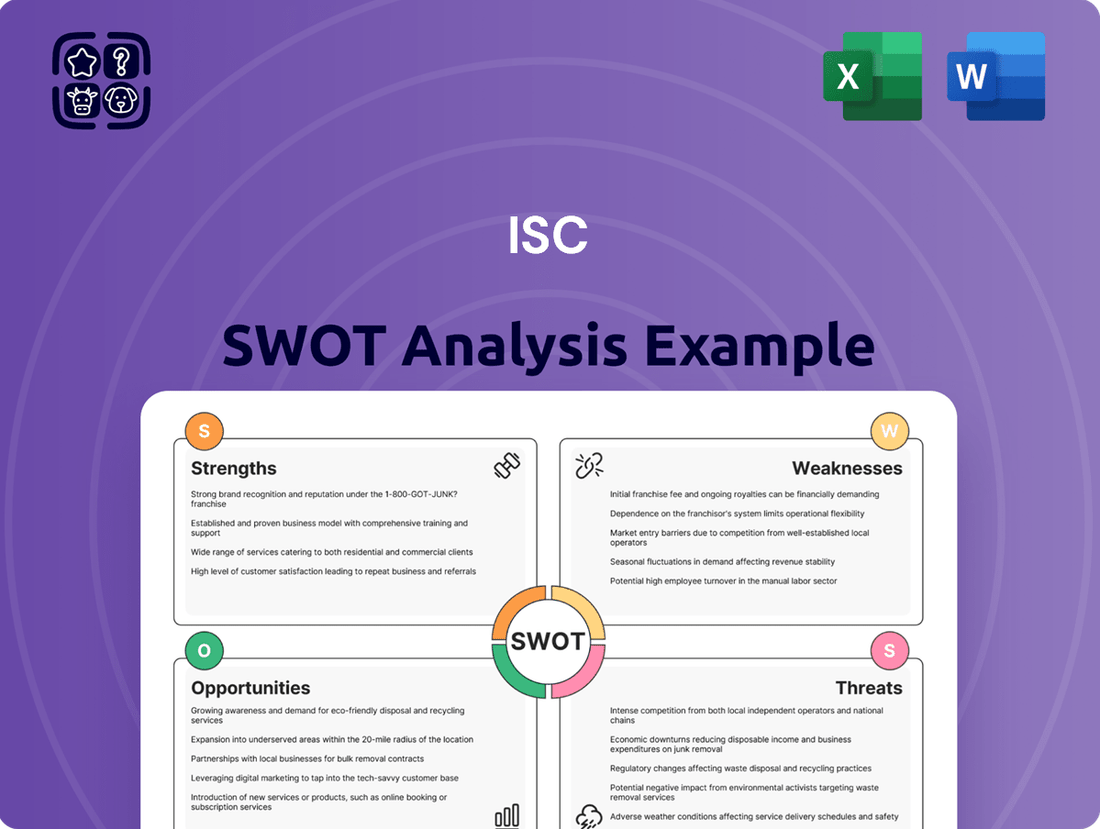

Analyzes ISC’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Simplifies the complex process of identifying and prioritizing strategic factors, alleviating the pain of overwhelming analysis.

Weaknesses

Despite efforts to diversify, Information Services Corporation (ISC) remains heavily reliant on its exclusive contract with Saskatchewan registries. This single-province dependency, particularly for land and corporate registries, represents a significant vulnerability. For instance, in the first quarter of 2024, Saskatchewan's land titles and corporate registries generated approximately 70% of ISC's total revenue, highlighting the concentration risk.

ISC's Registry Operations, a significant revenue driver, are susceptible to shifts in economic cycles. For instance, a downturn in the real estate market, often correlated with interest rate changes, could directly reduce the volume of property-related transactions processed by ISC, thereby impacting its top line.

While the Saskatchewan Registries division has demonstrated a degree of stability, it's not entirely immune. For example, in Q4 2023, ISC reported a 7% year-over-year decrease in revenue, partly attributed to lower transaction volumes in its Registry Operations, highlighting the sensitivity to external market forces.

ISC's growth strategy heavily relies on mergers and acquisitions (M&A), but this presents significant integration risks. For instance, in 2023, the average integration cost for a tech acquisition was reported to be 15-20% of the deal value, a substantial figure that can erode expected benefits if not managed meticulously. Failure to smoothly combine IT systems, company cultures, and operational processes can lead to disruptions, impacting productivity and potentially delaying the realization of crucial synergies.

Competition in Technology Solutions and Services

While ISC's Technology Solutions segment shows robust growth, the overall information management and technology solutions market remains intensely competitive. This means ISC must consistently invest in new ideas and find ways to stand out from other tech providers. For instance, the global IT services market was projected to reach over $1.3 trillion in 2024, indicating a crowded landscape where differentiation is key.

ISC could face pricing pressure and challenges in maintaining market share if competitors offer similar or more advanced solutions. This necessitates ongoing research and development to ensure ISC's offerings remain cutting-edge. In 2023, global IT spending was estimated to be around $4.7 trillion, with a significant portion allocated to services and software, highlighting the scale of competition.

- Intense Market Competition: The information management and technology solutions sector is highly crowded, with numerous established players and emerging disruptors.

- Innovation Imperative: ISC must continuously innovate to maintain its competitive edge and avoid commoditization of its technology solutions and services.

- Potential for Price Wars: Increased competition can lead to pricing pressures, potentially impacting ISC's profit margins if it cannot effectively differentiate its value proposition.

- Need for Strategic Partnerships: Collaborating with other technology firms or forming strategic alliances might be necessary to enhance ISC's market reach and technological capabilities.

Regulatory and Policy Changes

Changes in government regulations or policies present a significant vulnerability for ISC. Even shifts in rules outside of Saskatchewan can disrupt operations and affect revenue streams. For instance, the Ontario government's June 2024 ban on Notices of Interest (NOSIs) created a headwind, partially offsetting the positive growth seen in ISC's Services segment for that period.

This regulatory uncertainty means ISC must remain agile and adaptable. The financial impact of such changes can be substantial, as demonstrated by the NOSI ban.

- Regulatory Uncertainty: ISC's reliance on various land and business registration processes makes it susceptible to evolving government policies and regulations.

- Impact of External Policies: Regulatory changes in other jurisdictions, not directly controlled by ISC, can still negatively influence its financial performance, as seen with the Ontario NOSI ban.

- Revenue Disruption: Policy shifts can directly impact the demand for or legality of specific services offered by ISC, leading to unexpected revenue shortfalls.

ISC's heavy reliance on Saskatchewan registries, which accounted for approximately 70% of its revenue in Q1 2024, creates significant concentration risk. Economic downturns, particularly in real estate, directly impact transaction volumes and revenue, as seen with a 7% year-over-year revenue decrease in Q4 2023. Furthermore, the company's growth strategy through M&A carries substantial integration risks, with acquisition integration costs potentially reaching 15-20% of deal value in 2023, threatening synergy realization.

| Weakness | Description | Supporting Data/Example |

|---|---|---|

| Revenue Concentration | Heavy dependence on Saskatchewan registries. | Saskatchewan registries generated ~70% of revenue in Q1 2024. |

| Economic Sensitivity | Vulnerability to economic cycles affecting transaction volumes. | Q4 2023 revenue decreased 7% YoY due to lower transaction volumes. |

| M&A Integration Risk | Challenges in integrating acquired businesses. | 2023 tech acquisition integration costs averaged 15-20% of deal value. |

| Regulatory Uncertainty | Susceptibility to changes in government policies. | Ontario's June 2024 ban on NOSIs impacted Services segment revenue. |

Preview Before You Purchase

ISC SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use.

The content below is pulled directly from the final ISC SWOT analysis. Unlock the full report when you purchase.

You’re viewing a live preview of the actual SWOT analysis file. The complete version becomes available after checkout.

Opportunities

ISC has a significant opportunity to broaden its reach by offering its technology solutions and services to a wider array of jurisdictions and organizations outside of Saskatchewan. This global expansion is a key growth avenue.

The company is actively pursuing and securing new contracts and projects on an international scale. Recent examples of this global engagement include successful projects in Cyprus, Guernsey, Michigan, and Liechtenstein, demonstrating a tangible track record of international business development.

ISC's commitment to a disciplined mergers and acquisitions (M&A) strategy presents a significant opportunity for inorganic growth, directly supporting its ambitious 2028 expansion objectives. This strategic approach allows the company to proactively seek out and integrate complementary businesses.

By identifying and successfully integrating accretive acquisitions within the registry and information management sector, ISC can significantly accelerate both its revenue streams and EBITDA growth. This inorganic expansion complements organic efforts, driving a more robust overall growth trajectory.

The Services segment, especially Regulatory Solutions, is poised for significant expansion. This growth is fueled by financial institutions intensifying their due diligence efforts, creating a prime opportunity for ISC to broaden its offerings in compliance and information verification services.

Digital Transformation and Service Enhancement

The ongoing digital transformation across public and private sectors presents a significant opportunity for ISC to expand its service offerings. By modernizing existing registry systems and developing new digital platforms, ISC can cater to the evolving demands of its clientele. For instance, the global digital transformation market was valued at over $500 billion in 2023 and is projected to grow substantially in the coming years, indicating a robust demand for such services.

ISC can capitalize on this trend by focusing on enhanced digital registry and information management solutions. This strategic move aligns with the increasing reliance on efficient data handling and accessibility. The International Data Corporation (IDC) reported that worldwide spending on digital transformation technologies and services reached $1.9 trillion in 2023, a figure expected to climb further.

- Leverage Digitalization: Capitalize on the growing demand for digital registry and information management services driven by public and private sector digital transformation initiatives.

- Modernize Infrastructure: Invest in updating legacy systems and developing advanced digital platforms to improve efficiency and user experience.

- Expand Service Portfolio: Introduce new digital solutions that address the evolving needs of clients in data management and accessibility.

- Market Growth: Tap into the expanding global digital transformation market, which saw significant growth in 2023 and is forecasted to continue its upward trajectory.

Leveraging Data and Analytics for New Offerings

Leveraging its vast public data holdings, ISC can unlock significant opportunities by developing innovative data-driven products and analytical services. This strategic move would not only enhance client value but also forge new revenue streams, moving beyond its core registry functions.

For instance, by analyzing trends in company registrations and filings, ISC could offer predictive analytics to businesses seeking market entry insights or competitive intelligence. Imagine providing a service that identifies emerging industry sectors based on registration patterns observed in 2024 and early 2025 data. This data-centric approach can transform ISC from a passive registrar into an active information provider.

- Enhanced Client Value: Offering bespoke analytical reports on market trends, competitor activity, and regulatory changes derived from ISC's data.

- New Revenue Streams: Monetizing proprietary datasets and analytical tools, potentially through subscription models or per-report fees.

- Competitive Differentiation: Establishing ISC as a leader in data intelligence within the corporate registry space.

- Market Insight Generation: For example, a Q1 2025 analysis of new business formations could reveal a 15% year-over-year increase in technology sector registrations, a valuable insight for investors and entrepreneurs.

ISC's existing international projects in places like Cyprus and Michigan highlight a clear path for global expansion, allowing them to tap into new markets beyond Saskatchewan.

The company's strategic focus on mergers and acquisitions presents a significant opportunity to accelerate growth by integrating complementary businesses, thereby boosting revenue and EBITDA.

The increasing demand for regulatory compliance and due diligence services, especially within financial institutions, offers a substantial avenue for ISC's Services segment to broaden its offerings.

By developing new digital platforms and modernizing existing registry systems, ISC can align with the global digital transformation trend, which saw the market valued at over $500 billion in 2023.

Threats

Significant economic downturns, especially those hitting real estate and new business ventures, could shrink transaction volumes within ISC's registries, directly impacting revenue streams. For instance, a projected 1.5% contraction in Canadian GDP for late 2024, as forecasted by the Bank of Canada, would likely translate to fewer property transfers and business registrations.

While Saskatchewan's registries have demonstrated a degree of resilience, a prolonged period of economic weakness presents a persistent threat. Should inflation remain elevated through 2025, potentially keeping interest rates higher for longer, consumer spending and business investment could be further dampened, exacerbating this risk.

The information management sector, particularly in technology, faces constant threats from new players and disruptive innovations. Companies like Microsoft with its Azure AI services and Google Cloud are continually evolving their offerings, potentially impacting ISC's market share. For example, the rapid advancements in generative AI, as seen in the widespread adoption of tools like ChatGPT, could redefine customer expectations for information management solutions, creating a significant challenge for established providers if they cannot adapt quickly.

As a custodian of critical public data, ISC is inherently exposed to significant cybersecurity risks. The increasing sophistication of cyber threats means a successful attack could cripple operations. In 2024, the average cost of a data breach reached $4.73 million globally, a figure ISC would certainly feel acutely.

A major data breach or system failure poses a severe threat to ISC's reputation, potentially eroding public trust built over years. Beyond reputational damage, financial penalties for non-compliance with data protection regulations, such as GDPR or CCPA, could be substantial, impacting the organization's bottom line and operational capacity.

Government Policy and Regulatory Changes

Adverse shifts in government policies, particularly concerning fee structures or the terms of exclusive contracts, represent a significant threat to ISC's existing revenue. For instance, the unexpected prohibition of Novel Oral Smoking Cessation products (NOSIs) in Ontario, effective January 2024, demonstrates a clear vulnerability to abrupt regulatory changes that can directly impact sales channels and market access. This regulatory uncertainty could lead to a substantial reduction in revenue streams that rely on specific market conditions or government approvals.

The potential for increased scrutiny and the imposition of new regulations on pharmaceutical products and their distribution could also hinder ISC's growth. For example, if similar bans or restrictions were to be implemented in other key markets, ISC's financial performance could be severely impacted. In 2023, the global pharmaceutical market experienced regulatory shifts that affected product approvals and market entry, a trend that is likely to continue into 2024 and 2025.

- Regulatory Uncertainty: The Ontario ban on NOSIs illustrates the risk of sudden policy changes impacting product availability and sales.

- Revenue Stream Vulnerability: ISC's reliance on specific contract terms and fee structures makes it susceptible to unfavorable policy adjustments.

- Market Access Restrictions: Future regulatory actions could limit ISC's ability to operate in or access key geographic markets, affecting overall revenue.

- Increased Compliance Costs: New regulations may necessitate significant investment in compliance, potentially impacting profitability.

Technological Obsolescence

Failure to consistently invest in and adopt emerging technologies poses a significant threat to ISC. For instance, in 2024, the global IT spending was projected to reach $5.1 trillion, highlighting the rapid pace of technological advancement. If ISC lags behind, its current systems and service offerings could quickly become outdated, diminishing its market position.

This technological obsolescence directly impacts ISC's competitive edge. Companies that fail to innovate risk losing market share to more agile competitors. In 2024, the average lifespan of a technology in the enterprise sector is shrinking, often necessitating upgrades every 3-5 years to maintain relevance.

Consequently, ISC could face challenges in attracting new clients and retaining existing ones if its technology stack is perceived as antiquated. A recent survey indicated that 65% of B2B buyers consider technology capabilities a key factor when selecting a new service provider.

Key areas of concern include:

- Outdated software platforms

- Lack of integration with new industry standards

- Inability to offer cutting-edge digital solutions

- Increased vulnerability to cybersecurity threats due to legacy systems

Economic slowdowns can significantly reduce transaction volumes in ISC's registries, impacting revenue. For example, a 1.5% GDP contraction in Canada for late 2024, as forecast by the Bank of Canada, would likely mean fewer property transfers and business registrations.

The threat of cyberattacks is substantial, with the global average cost of a data breach reaching $4.73 million in 2024. A successful breach could cripple ISC's operations and severely damage its reputation, leading to potential financial penalties for non-compliance with data protection laws.

Technological obsolescence is a major risk, as the average lifespan of enterprise technology is shrinking, often requiring upgrades every 3-5 years. Failure to invest in new technologies could make ISC's systems outdated, impacting its competitive edge and ability to attract clients, especially since 65% of B2B buyers consider technology capabilities crucial.

Regulatory uncertainty, as seen with the Ontario ban on certain products in early 2024, highlights ISC's vulnerability to abrupt policy changes that can directly affect revenue streams and market access. Future regulatory actions could limit market access, increase compliance costs, and reduce profitability.

| Threat Category | Specific Risk | Potential Impact | Relevant Data Point |

| Economic Downturn | Reduced Transaction Volumes | Lower Revenue | Canada GDP forecast -1.5% (late 2024) |

| Cybersecurity | Data Breach/System Failure | Reputational Damage, Financial Penalties | Global average data breach cost: $4.73 million (2024) |

| Technological Obsolescence | Outdated Systems | Loss of Competitive Edge, Client Attrition | B2B buyers valuing tech: 65% |

| Regulatory Changes | Policy Shifts Affecting Operations | Revenue Stream Disruption, Market Access Issues | Ontario NOSI ban (Jan 2024) |

SWOT Analysis Data Sources

This ISC SWOT analysis is built upon a robust foundation of data, drawing from internal financial reports, comprehensive market research, and expert industry analysis to provide a well-rounded and actionable perspective.