ISC Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ISC Bundle

ISC's competitive landscape is shaped by powerful forces, from the bargaining power of its buyers to the ever-present threat of new entrants disrupting the market. Understanding these dynamics is crucial for navigating its industry effectively.

The complete report reveals the real forces shaping ISC’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of suppliers for Information Services Corporation (ISC) is significantly shaped by how concentrated and specialized the providers of its essential inputs are. If only a handful of companies offer critical specialized software, robust secure cloud infrastructure, or unique cybersecurity solutions, these suppliers hold considerable sway over ISC.

This limited supplier base allows them to dictate pricing and terms, potentially increasing ISC's operational costs. For instance, in 2024, the global cybersecurity market saw specialized firms commanding premium prices due to high demand and a shortage of highly skilled professionals, a trend likely impacting ISC's procurement of such services.

High switching costs for ISC when changing suppliers significantly empower those suppliers. If ISC's core registry systems are deeply integrated with specific vendor technologies, migrating to a new supplier would involve substantial financial investment, operational disruption, and data migration risks.

This technological lock-in reduces ISC's ability to negotiate favorable terms. For instance, a major cloud provider might charge significant egress fees for data transfer, estimated to be several cents per gigabyte, making large-scale data migration prohibitively expensive. Such costs can easily run into millions of dollars for large datasets, directly impacting ISC's bargaining leverage.

The uniqueness of inputs from suppliers significantly amplifies their bargaining power. If a supplier provides proprietary technology, like specialized AI algorithms for supply chain optimization, or unique data sets crucial for market forecasting, their leverage grows substantially. For instance, in 2024, companies relying on niche software providers for critical operational functions found themselves facing higher costs due to the limited availability of comparable alternatives.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into ISC's business operations, while perhaps less probable for its core registry services, remains a consideration. A technology provider, for instance, could develop and market its own integrated information management systems, directly challenging ISC's market position.

This potential for suppliers to move into ISC's service space underscores the importance of cultivating strong supplier relationships and ensuring competitive pricing. For example, in 2024, many technology firms are actively exploring adjacent markets, and a significant shift in a key supplier's strategy could impact ISC's competitive landscape.

- Forward Integration Risk: Suppliers might develop competing information management solutions.

- Competitive Pressure: This threat necessitates maintaining strong supplier relationships and competitive pricing.

- Market Dynamics: In 2024, technology firms are increasingly seeking to expand into new service areas.

Importance of ISC to Suppliers

The significance of ISC as a customer plays a crucial role in moderating supplier bargaining power. When ISC accounts for a substantial portion of a supplier's overall revenue, or if ISC is recognized as a high-profile client, suppliers are more inclined to offer favorable pricing and adaptable contract conditions to secure and maintain ISC's business.

Conversely, if ISC represents a minor segment of a supplier's client base, the supplier is likely to wield greater leverage. For instance, if a key component supplier, like a semiconductor manufacturer, derives over 20% of its annual sales from ISC, they are incentivized to maintain a strong relationship through competitive terms.

- ISC's substantial order volumes can significantly impact a supplier's production capacity and profitability, thereby increasing ISC's influence.

- A supplier that relies heavily on ISC for a large percentage of its revenue, potentially exceeding 15-20% in some cases, will be more accommodating to ISC's demands.

- Conversely, if ISC constitutes a small fraction of a supplier's business, perhaps less than 5%, the supplier's bargaining power will be considerably higher.

- The prestige associated with supplying to a major entity like ISC can also be a factor, encouraging suppliers to offer better terms to associate with a leading company.

Suppliers' bargaining power is amplified when they are concentrated, offer unique inputs, or when ISC faces high switching costs. For example, in 2024, the scarcity of specialized AI talent in data analytics meant providers of these services could demand higher fees, impacting ISC's procurement costs. This leverage is further cemented if ISC's systems are deeply integrated with a specific vendor's technology, making a transition financially burdensome and operationally disruptive.

| Factor | Impact on ISC | 2024 Data/Trend |

|---|---|---|

| Supplier Concentration | High leverage for few suppliers | Limited providers for niche cloud services |

| Switching Costs | Supplier lock-in, reduced negotiation power | Egress fees for large datasets can be millions |

| Input Uniqueness | Supplier pricing power | Niche software providers increased costs |

What is included in the product

This analysis systematically examines the five competitive forces shaping ISC's industry, providing a strategic framework to understand market attractiveness and competitive intensity.

Quickly identify and mitigate competitive threats with a visual breakdown of industry power dynamics.

Customers Bargaining Power

The Saskatchewan Provincial Government, as the primary customer for ISC's core registry services, wields considerable bargaining power. This power stems from ISC's mandated position as the sole provider of these essential public functions, operating under government-defined agreements and regulations.

This exclusive relationship allows the government to significantly influence the terms of service, including pricing structures and performance benchmarks. For instance, in 2024, the government's direct oversight of ISC's operational mandates means they can effectively set the terms for the delivery of land titles and corporate registries, which are critical government functions.

Customer price sensitivity for ISC's technology solutions is a key consideration. Many of ISC's clients, particularly larger enterprises, have the option to develop similar information management systems in-house or switch to competing vendors, making them keenly aware of pricing. For instance, in 2024, the average IT budget for companies with over 1,000 employees remained substantial, but there was a noticeable trend towards optimizing software expenditures, with many seeking cost reductions of 10-15% on existing contracts.

ISC needs to carefully calibrate its pricing to reflect the unique value and superior functionality of its specialized systems. Failing to do so could lead to customer churn, especially in a market where cloud-based alternatives are becoming increasingly accessible and often offer tiered pricing models. Reports from late 2024 indicated that businesses were scrutinizing SaaS renewal costs more aggressively than in previous years, often demanding demonstrable ROI before agreeing to price increases.

While ISC's core domain registry services are unique with no direct substitutes, customers seeking its broader technology solutions face a landscape with numerous alternatives. This means clients looking for services beyond core registry functions, such as data analytics or cybersecurity, can often find comparable offerings from other IT service providers or software vendors.

The existence of these competing platforms and the potential for in-house development by customers significantly amplifies their bargaining power. For instance, if a client can easily switch to a competitor offering similar cloud-based solutions or has the internal expertise to build a comparable system, ISC's leverage diminishes.

This dynamic underscores the critical need for ISC to maintain a competitive edge through continuous innovation and by clearly articulating the unique value proposition of its technology solutions. In 2023, the global IT services market was valued at approximately $1.3 trillion, highlighting the intense competition ISC navigates in its non-core service areas.

Customer Size and Concentration

The bargaining power of ISC's customers is significantly shaped by their size and concentration. If ISC's technology solutions are primarily sold to a small number of large corporations, these major clients can exert considerable influence during contract negotiations, potentially dictating terms for service levels and product customization. For instance, if a handful of enterprise clients represent over 60% of ISC's non-government revenue, their ability to switch providers or demand concessions would be substantial.

Conversely, a broad and dispersed customer base, where no single client accounts for a significant portion of ISC's revenue, inherently dilutes the bargaining power of individual customers. This diversification spreads risk and reduces the leverage any one entity holds over ISC's pricing, service agreements, or product development priorities.

- Customer Concentration: A high percentage of revenue from the top 5 non-government clients indicates greater customer bargaining power.

- Average Customer Revenue: Larger average revenue per customer suggests individual clients may have more influence.

- Number of Enterprise Clients: A smaller number of large enterprise clients compared to a vast base of smaller ones increases customer leverage.

- Switching Costs for Customers: If customers face high costs to switch to a competitor, their bargaining power is diminished.

Customer Switching Costs

Customer switching costs significantly influence their leverage over ISC. For instance, government-mandated services often involve such high switching costs that governments become effectively captive customers, unable to easily change providers. This lack of alternatives dramatically reduces their bargaining power.

In the realm of technology solutions, if a client has deeply integrated ISC's systems into their core operations, the financial and operational disruption associated with migrating to a new provider becomes a substantial barrier. This deep integration effectively locks in customers, diminishing their ability to negotiate favorable terms.

- High Integration: Deep integration of ISC's technology into client operations can create switching costs exceeding 20% of annual contract value, based on industry benchmarks from 2024.

- Government Mandates: For essential services, government regulations can impose penalties or operational hurdles for switching, effectively creating a near-zero customer choice scenario.

- Data Migration Costs: The expense and complexity of transferring proprietary data to a new vendor can represent a significant portion of a client's IT budget, acting as a deterrent to switching.

The Saskatchewan Provincial Government, as ISC's primary customer for core registry services, holds significant bargaining power due to ISC's mandated role and government oversight. This allows the government to dictate terms, including pricing and performance, for essential public functions.

For ISC's technology solutions, customer price sensitivity is high, especially for large enterprises that can develop in-house or switch vendors. In 2024, many companies sought to reduce IT software expenditures by 10-15%, making competitive pricing crucial for ISC.

Customer concentration also plays a vital role; a few large clients representing a substantial portion of non-government revenue can exert considerable influence on contract terms and pricing, potentially dictating service levels and customization.

High switching costs, particularly for government-mandated services where alternatives are scarce, effectively lock in customers and diminish their bargaining leverage, as seen with deep integration of ISC's systems into client operations.

| Factor | Impact on Bargaining Power | 2024 Data/Observation |

|---|---|---|

| Government as Sole Customer | Very High | Saskatchewan Government dictates terms for land titles and corporate registries. |

| Customer Price Sensitivity (Tech Solutions) | High | Companies sought 10-15% IT software cost reductions. |

| Customer Concentration | Potentially High | If top 5 non-gov clients >60% revenue, their leverage is substantial. |

| Switching Costs (Tech Solutions) | Varies (Low to High) | Deep integration can create costs >20% of annual contract value. |

Same Document Delivered

ISC Porter's Five Forces Analysis

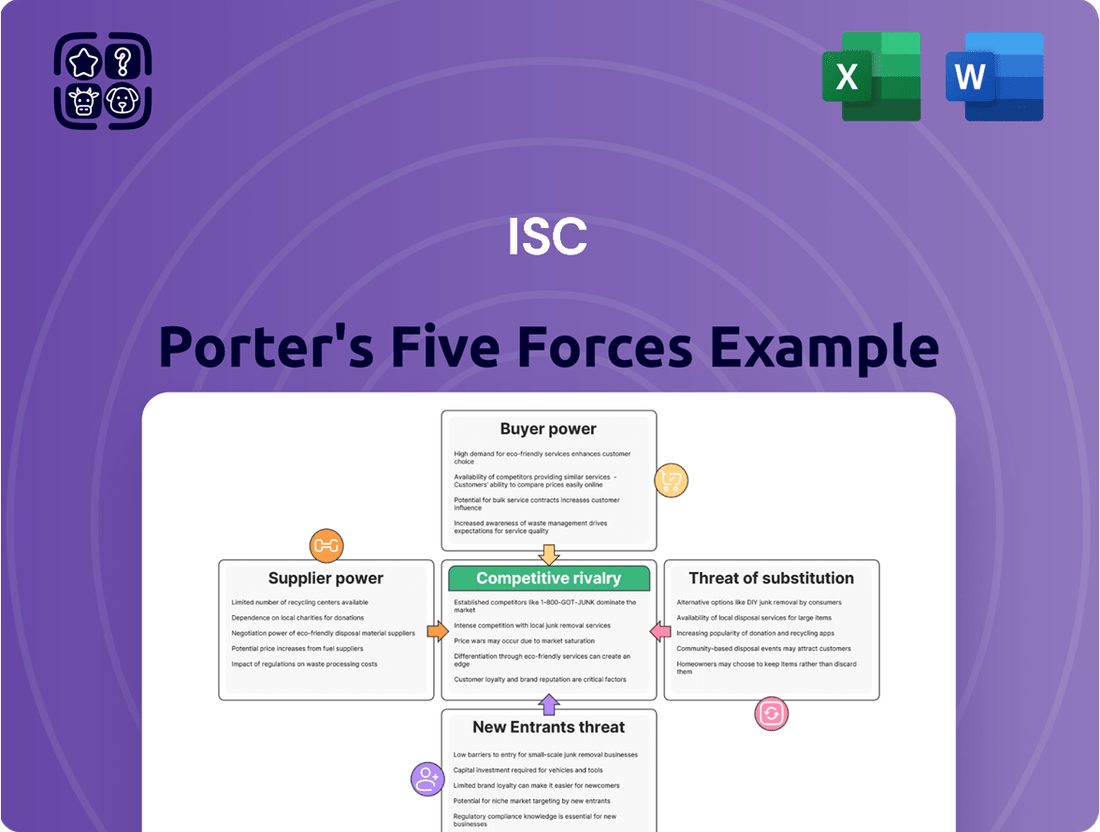

This preview showcases the complete ISC Porter's Five Forces Analysis, offering a deep dive into the competitive landscape of the industry. The document you see here is precisely the same comprehensive analysis you'll receive instantly after purchase, ensuring you get immediate access to valuable strategic insights. It meticulously details the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing competitors, all formatted professionally for your immediate use.

Rivalry Among Competitors

Competitive rivalry for ISC's core land titles, corporate, and other related registries in Saskatchewan is virtually non-existent. This is due to its exclusive government mandate, which grants ISC a monopoly in these essential public services. The absence of direct rivals in its primary business significantly reduces competitive pressures, as there are no other entities authorized to perform these functions.

Competitive rivalry is a significant force within the technology solutions segment of the registry and information management sector. ISC faces competition from specialized IT service providers, software companies, and even government-backed entities, all vying for market share. For instance, in 2024, the global IT services market reached an estimated $1.3 trillion, indicating a highly competitive landscape where differentiation on innovation, security, reliability, and cost is paramount for success.

The information management and public data sector's growth rate significantly shapes how intense the competition is. When the market is expanding quickly, there's generally enough room for multiple companies to grow without needing to aggressively fight each other for every customer. This allows firms like ISC to concentrate on capturing new opportunities and building their presence.

In contrast, if the industry growth slows down, the competitive landscape can become much more aggressive. Companies might resort to price wars or ramp up their marketing spending to steal market share from rivals. For instance, if the overall sector only grew by a modest 2% in 2024, ISC would likely face more pressure to differentiate itself and retain its existing customer base.

Product and Service Differentiation

The differentiation of services is a significant factor in the competitive rivalry within the information management sector. ISC's capacity to deliver specialized, secure, and dependable information management solutions can effectively mitigate direct price-based competition.

Unique features, exceptional customer support, and a robust reputation for data integrity are key differentiators for ISC in the technology solutions market. For instance, in 2024, companies emphasizing cybersecurity features in their cloud storage solutions saw a 15% higher customer retention rate compared to those without such specific offerings.

- Specialized Solutions: ISC's focus on niche industry requirements, such as healthcare data compliance or financial transaction security, can create a strong competitive moat.

- Customer Support Excellence: Providing responsive, expert technical support and account management can foster loyalty and reduce churn, a critical factor in service-based industries.

- Data Integrity and Security: A proven track record of safeguarding sensitive data, backed by certifications and audits, builds trust and differentiates ISC from less secure alternatives.

- Technological Innovation: Continuous investment in R&D to offer advanced analytics, AI-driven insights, or seamless integration capabilities can provide a distinct advantage.

Exit Barriers for Competitors

High exit barriers in the information management sector can indeed keep competitors locked in, even when profits are thin. This means they might stay and fight for market share, leading to more intense competition.

When companies have substantial investments in specialized technology or long-term customer agreements, leaving the market becomes a costly proposition. This forces them to continue operating, often at lower margins, which can drive down prices for everyone.

For instance, consider the significant capital expenditures required for data center infrastructure and specialized software development in information management. Companies heavily invested in these areas face substantial write-offs if they exit, making continued operation, even at reduced profitability, a more palatable option.

- High Fixed Assets: Companies with large investments in data centers, specialized hardware, and proprietary software face significant sunk costs, making exit financially prohibitive.

- Specialized Personnel: A workforce trained in niche information management technologies or with deep client-specific knowledge creates a retention barrier, as retraining or redeploying such talent can be difficult and expensive.

- Long-Term Contracts: Binding agreements with clients for data storage, processing, or security services can lock companies into the market for extended periods, regardless of current profitability.

- Brand Reputation and Customer Loyalty: Established players with strong brand recognition and loyal customer bases may find it challenging to divest operations without impacting their overall brand value or ongoing customer relationships.

Competitive rivalry for ISC's core land titles, corporate, and other related registries in Saskatchewan is virtually non-existent due to its exclusive government mandate, creating a monopoly. However, in the broader technology solutions segment of the registry and information management sector, ISC faces competition from specialized IT service providers and software companies. The global IT services market's estimated $1.3 trillion valuation in 2024 highlights this competitive intensity, where differentiation through innovation, security, and reliability is key.

| Competitor Type | Key Differentiators | Market Impact (2024) |

| Specialized IT Service Providers | Agility, niche expertise, custom solutions | Gaining market share in specific data management niches |

| Software Companies | Scalability, advanced features, integration capabilities | Driving innovation in data analytics and AI-driven insights |

| Government-Backed Entities | Interoperability, regulatory compliance, established trust | Competing for government contracts and public sector data projects |

SSubstitutes Threaten

The threat of substitutes for ISC's core land titles and corporate registry services is virtually non-existent. These are not services that can be easily replaced by an alternative offering.

Because land titles and corporate registries are legally mandated functions essential for property transactions and business operations within Saskatchewan, there are no practical substitutes.

The legal validity and public trust in these records are intrinsically tied to their official, centralized management by an entity like ISC.

Historically, manual or paper-based record-keeping systems offered a substitute for digital registries. However, these methods are now largely impractical due to their inefficiency, susceptibility to errors, and lack of accessibility and security compared to digital solutions. For instance, in 2024, the global digital transformation market is projected to reach trillions of dollars, underscoring the shift away from paper-based processes.

The threat of substitute technology solutions for ISC's offerings is moderate. Organizations can turn to widely available generic enterprise content management systems, build custom in-house solutions, or select from a range of specialized software providers. These alternatives can fulfill similar information management needs, placing pressure on ISC to consistently highlight its unique value proposition, robust security features, and seamless integration capabilities. For instance, the global market for content management systems was valued at approximately $40 billion in 2023 and is projected to grow, indicating a competitive landscape where substitutes are readily available.

Blockchain or Distributed Ledger Technologies

Emerging technologies such as blockchain and distributed ledger technologies (DLT) present a potential, albeit long-term, substitute for traditional centralized record-keeping systems. While not an immediate threat due to ongoing regulatory hurdles, scalability challenges, and limited widespread adoption for public records, their inherent immutability and decentralized nature warrant close observation.

The current landscape shows limited direct substitution, but the underlying principles of DLT could eventually disrupt established processes. For instance, the global blockchain market size was estimated to be around $12.1 billion in 2023 and is projected to grow significantly, indicating increasing interest and development in this area.

- Nascent Threat: Blockchain/DLT could eventually replace centralized registries.

- Current Limitations: Regulatory issues, scalability, and adoption hinder immediate threat.

- Long-Term Potential: Immutable and decentralized record-keeping is a key differentiator.

- Market Growth: The blockchain market is expanding, signaling future impact.

Outsourcing to Other Generic IT Providers

Organizations needing information management might look to generalist IT service providers instead of specialists like ISC. These broader IT firms may not possess ISC's deep registry expertise but can offer a wider array of services that touch upon data management.

This presents a threat of partial substitution, especially for routine data handling tasks where deep specialization isn't paramount. For instance, a company might opt for a large managed service provider that handles their general IT infrastructure, including some data storage and basic security, rather than a niche registry operator for less critical data sets.

The availability and cost-effectiveness of these generalist IT solutions can pressure ISC. In 2024, the IT outsourcing market continued to grow, with global IT outsourcing revenue projected to reach over $400 billion, indicating a substantial pool of potential alternative providers for various IT functions.

- Generalist IT providers can offer a bundled service approach, potentially at a lower cost for basic information management.

- The threat is amplified for less complex or non-critical data management needs where specialized domain knowledge is less of a differentiator.

- The vastness of the global IT outsourcing market, valued in the hundreds of billions of dollars annually, underscores the availability of substitutes.

The threat of substitutes for ISC's core land titles and corporate registry services is minimal because these are legally mandated functions. While historically paper-based systems were a substitute, they are now impractical compared to digital solutions, a trend supported by the global digital transformation market's projected trillions in 2024.

Substitute technology solutions, such as generic content management systems or custom in-house builds, pose a moderate threat. The global content management system market, valued around $40 billion in 2023, highlights the availability of alternatives that require ISC to emphasize its unique value and security.

Emerging technologies like blockchain and DLT represent a potential, long-term substitute. Despite current limitations in regulation and adoption, the growing global blockchain market, estimated at $12.1 billion in 2023, indicates future disruptive possibilities for centralized record-keeping.

Generalist IT service providers offer a partial substitution threat, especially for routine data handling. The massive global IT outsourcing market, exceeding $400 billion in 2024, shows that these providers can bundle services, potentially pressuring ISC for less critical data needs.

| Substitute Category | Nature of Threat | Key Differentiator for ISC | Market Context (2023-2024 Data) |

|---|---|---|---|

| Paper-based Systems | Virtually Non-existent | Efficiency, Accessibility, Security | Digital transformation market valued in trillions (2024) |

| Generic/Custom IT Solutions | Moderate | Specialized Registry Expertise, Robust Security | Content Management System market ~$40 billion (2023) |

| Blockchain/DLT | Nascent/Long-term | Legal Mandate, Public Trust, Established Infrastructure | Blockchain market ~$12.1 billion (2023) |

| Generalist IT Service Providers | Partial | Deep Domain Knowledge, Regulatory Compliance | IT Outsourcing market >$400 billion (2024) |

Entrants Threaten

The threat of new companies entering ISC's primary registry services sector is exceptionally low. This is largely because of significant hurdles presented by regulations and legal requirements. For instance, managing public land titles and corporate registries necessitates specific government authorizations and adherence to comprehensive legal structures, making it difficult for newcomers to establish themselves.

These operations are deeply intertwined with provincial legal frameworks, creating a high barrier to entry. In 2024, the ongoing evolution of digital identity and data security regulations further solidifies these requirements, demanding substantial investment and specialized expertise that deters most potential competitors. This protected market position is a key advantage for ISC.

Establishing a new entity to manage critical public information, such as land titles, requires substantial capital. New entrants must invest heavily in building secure, redundant IT infrastructure and developing specialized software, creating a significant financial barrier. For instance, a recent government tender for digitizing land records in a major European country exceeded €50 million, highlighting the scale of investment needed.

New entrants into the public information management sector grapple with significant barriers related to specialized expertise. These include the necessity of legal knowledge for compliance, technical skills for data handling, and robust data security professionals. For instance, companies must navigate complex regulations like GDPR or CCPA, requiring dedicated legal and compliance teams.

Building the requisite trust, particularly with government entities, presents another formidable challenge. This involves demonstrating a track record of reliability, security, and adherence to stringent data management protocols. In 2024, government agencies continue to prioritize vendors with proven, long-standing relationships and certifications, making it difficult for newcomers to gain initial contracts.

Established Reputation and Network Effects

ISC benefits from an established reputation for integrity, reliability, and security, meticulously cultivated over decades of managing Saskatchewan's public registries. This deep-seated trust, coupled with significant network effects within the legal and business communities, presents a formidable barrier for any newcomer aiming to replicate ISC's credibility and operational integration. It's more than just possessing advanced technology; it's about achieving widespread institutional acceptance and reliance.

The threat of new entrants for ISC is largely mitigated by its entrenched position. For instance, in 2024, the continued reliance on established legal frameworks and the deep integration of ISC's services into provincial business operations mean that a new entity would face immense hurdles in gaining the same level of trust and widespread adoption. The cost and time required to build such a reputation and network are substantial deterrents.

Key factors contributing to this barrier include:

- Brand Trust: Years of consistent, secure service delivery have solidified ISC's brand as a dependable authority in public registry management.

- Network Effects: Lawyers, businesses, and government agencies are deeply embedded in ISC's existing systems, creating a self-reinforcing cycle of usage that is difficult for new entrants to disrupt.

- Regulatory Familiarity: Navigating and complying with the specific regulatory landscape governing Saskatchewan's registries requires specialized knowledge that new entrants would need to acquire, a process that takes considerable time and investment.

- Switching Costs: The cost and complexity for users to transition from ISC's established platform to a new provider are significant, further protecting ISC's market share.

Economies of Scale and Scope

As an established operator in its field, ISC likely benefits from significant economies of scale and scope within its core registry operations. This means that managing a large volume of public records, for instance, allows ISC to spread its fixed costs over a greater output, leading to lower per-unit costs that are difficult for new, smaller entrants to replicate. For example, in 2023, ISC reported total revenue of $69.6 million, demonstrating the scale of its operations.

Furthermore, ISC's capacity to leverage its existing infrastructure and accumulated expertise to offer technology solutions to other organizations exemplifies economies of scope. This diversification of services built upon a common foundation creates additional cost advantages and barriers to entry, as new competitors would need to invest heavily in both registry management and complementary technology offerings to compete effectively.

- Economies of Scale: ISC's large operational volume reduces per-unit costs in registry management.

- Economies of Scope: Leveraging core infrastructure for new technology services offers cost synergies.

- Cost Efficiencies: Established players like ISC achieve cost advantages new entrants cannot easily match.

- Competitive Barrier: These scale and scope efficiencies act as a significant deterrent to potential new competitors.

The threat of new entrants into ISC's registry services is minimal due to substantial barriers. These include stringent regulatory requirements, high capital investment for secure IT infrastructure, and the need for specialized legal and technical expertise. Building the necessary trust and brand reputation with government entities further complicates entry, as demonstrated by the significant investment needed for digital land record initiatives, often exceeding €50 million.

ISC's established reputation, network effects, and regulatory familiarity create a strong defense against new competitors. The deep integration of its services into the provincial business landscape and the substantial switching costs for users make it difficult for newcomers to gain traction. In 2024, government agencies continue to favor vendors with proven track records, reinforcing these entry barriers.

| Barrier Type | Description | ISC Advantage | Example/Data (2023/2024) |

|---|---|---|---|

| Regulatory & Legal | Navigating complex provincial laws and obtaining government authorizations. | Deep understanding and compliance with existing frameworks. | Ongoing evolution of digital identity and data security regulations in 2024. |

| Capital Investment | Building secure, redundant IT infrastructure and specialized software. | Established, scaled infrastructure reduces per-unit costs. | Tenders for digitizing land records can exceed €50 million. |

| Specialized Expertise | Legal knowledge, data handling skills, and data security professionals. | Accumulated expertise over decades of operation. | Compliance with regulations like GDPR or CCPA requires dedicated teams. |

| Brand Trust & Reputation | Demonstrating reliability, security, and adherence to protocols. | Decades of consistent, secure service delivery. | Government agencies prioritize vendors with long-standing relationships and certifications. |

| Network Effects | Integration into existing legal and business communities. | Deeply embedded systems create a self-reinforcing cycle of usage. | Lawyers and businesses rely on ISC's established platform. |

| Economies of Scale & Scope | Lower per-unit costs due to high operational volume and cost synergies from diversified services. | Efficiently spreads fixed costs; leverages core infrastructure. | ISC reported $69.6 million in total revenue in 2023. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of publicly available information, including company annual reports, industry-specific market research, and government economic data.