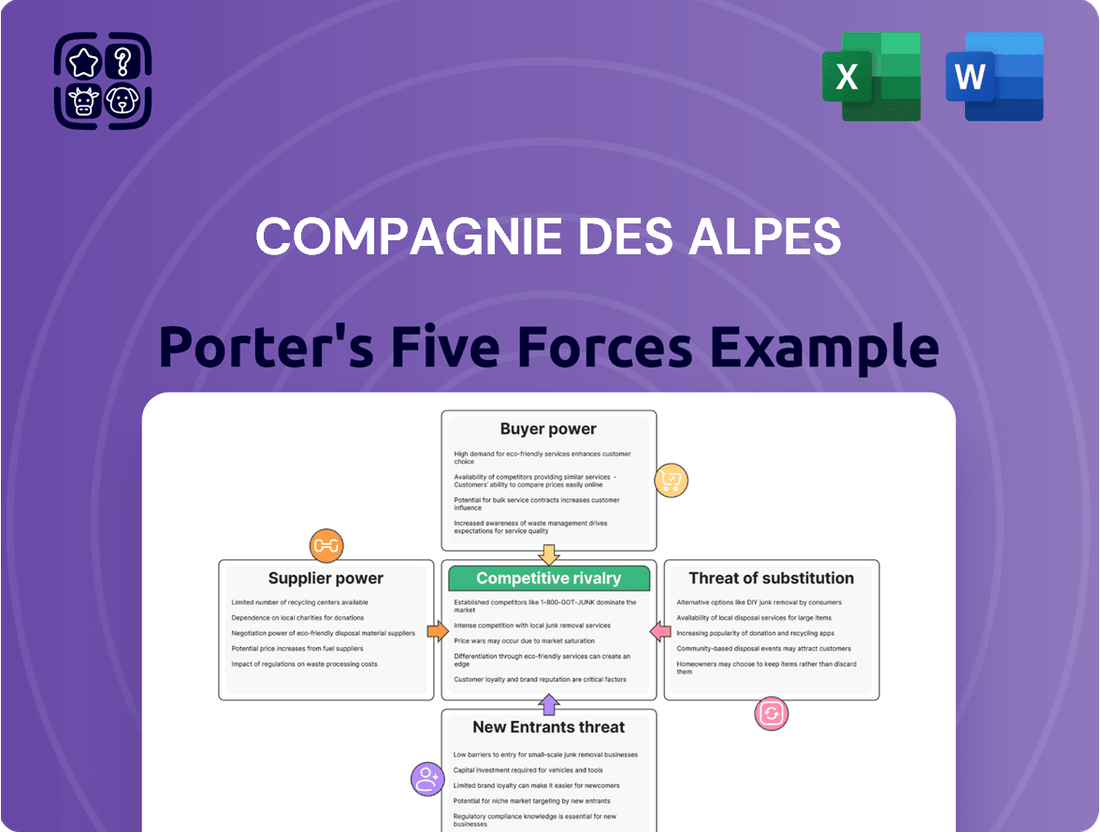

Compagnie des Alpes Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Compagnie des Alpes Bundle

Compagnie des Alpes faces moderate rivalry from established ski resorts and a growing threat from alternative leisure activities. While supplier power is somewhat limited, the bargaining power of buyers, particularly tour operators and individual skiers, can significantly impact pricing and service offerings. The threat of new entrants is moderate, given the capital-intensive nature of developing ski resorts.

The complete report reveals the real forces shaping Compagnie des Alpes’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The concentration of key suppliers and the uniqueness of their offerings for Compagnie des Alpes directly impact their bargaining power. Suppliers of specialized ski lift equipment and advanced snowmaking technology often have limited competition, meaning Compagnie des Alpes has fewer alternatives if these suppliers decide to increase prices or alter terms. For instance, Doppelmayr, a leading ski lift manufacturer, holds a significant market share globally, giving them considerable leverage.

Compagnie des Alpes faces significant supplier power when switching costs are high. This can manifest through the considerable expense and operational disruption involved in changing major equipment providers, such as ski lift manufacturers or snow-making system suppliers. For instance, if Compagnie des Alpes relies on specialized, proprietary technology from a single vendor for its resort operations, the cost and time to transition to an alternative could be prohibitive, thereby strengthening the supplier's leverage.

The company's reliance on long-term contracts with key suppliers also contributes to elevated switching costs. These agreements, often covering maintenance, parts, or even energy supply, can lock Compagnie des Alpes into specific relationships for extended periods. In 2023, the company reported capital expenditures of €115 million, a portion of which would likely be tied to such long-term equipment and infrastructure agreements, making it costly to alter these arrangements prematurely.

The threat of suppliers integrating forward into the leisure industry significantly boosts their bargaining power against Compagnie des Alpes. Imagine a leading manufacturer of specialized ski lift technology deciding to develop and operate its own ski resorts. This direct competition would give them leverage in pricing and terms for their existing equipment sales.

For instance, while a supplier of basic catering supplies might not pose this threat, a company providing advanced virtual reality entertainment systems for theme parks could potentially establish its own parks, directly challenging Compagnie des Alpes' market share. This is particularly relevant in niche, high-tech segments of the leisure sector.

Importance of Supplier's Input to Compagnie des Alpes

The bargaining power of suppliers for Compagnie des Alpes hinges on how critical their inputs are to the company's core operations. For instance, suppliers of specialized components for ski lift maintenance or unique ride technology for theme parks would wield significant influence due to the specialized nature and potential scarcity of their offerings.

Conversely, suppliers of more commoditized goods and services, such as general maintenance supplies or standard IT equipment, would have considerably less leverage. This distinction directly impacts Compagnie des Alpes' cost structure and operational continuity.

- Criticality of Inputs: Suppliers of safety-critical ski lift parts or proprietary theme park attraction technology possess higher bargaining power.

- Supplier Concentration: A market with few suppliers for essential components increases their power.

- Switching Costs: High costs for Compagnie des Alpes to switch suppliers for specialized equipment amplify supplier leverage.

- Differentiation: Unique or highly differentiated products/services from suppliers strengthen their position.

Availability of Substitute Inputs

The availability of substitute inputs significantly impacts the bargaining power of suppliers for Compagnie des Alpes. When numerous alternative suppliers exist for standard operational needs, such as common maintenance supplies or basic construction materials, Compagnie des Alpes can leverage this competition to negotiate better terms. This limits the power of any single supplier to dictate prices or terms.

However, the situation changes for highly specialized or proprietary equipment. If Compagnie des Alpes requires unique machinery or patented technology for its ski resorts or theme parks, the number of viable substitute suppliers may be very limited, or even non-existent. In such cases, the suppliers of these specialized items gain considerable bargaining power.

- Limited Substitutes for Specialized Equipment: For unique attraction components or advanced snowmaking technology, Compagnie des Alpes may face few, if any, alternative suppliers, increasing supplier leverage.

- Abundant Substitutes for Common Supplies: Standard operational items, like cleaning supplies or basic building materials, are readily available from multiple vendors, diminishing supplier bargaining power.

- Impact on Cost Structure: The reliance on specialized, non-substitutable inputs can directly increase Compagnie des Alpes's cost of goods sold and capital expenditures, impacting profitability.

Compagnie des Alpes faces considerable supplier power due to the specialized nature of its operational inputs. Suppliers of critical ski lift components and advanced snowmaking technology often operate in concentrated markets, limiting alternatives and giving them significant leverage. For instance, the reliance on manufacturers like Doppelmayr for ski lifts means Compagnie des Alpes has few options if these suppliers increase prices or alter contract terms.

High switching costs further amplify supplier bargaining power. The expense and operational disruption associated with changing providers for specialized resort equipment, such as proprietary ride technology for theme parks, can be substantial. This is compounded by long-term contracts for maintenance and parts, which lock the company into existing relationships, making premature changes costly.

The threat of forward integration by suppliers, where they might develop and operate their own leisure facilities, also strengthens their position. While suppliers of commoditized goods have little leverage, those providing unique, high-tech solutions for attractions can gain considerable power if they choose to compete directly.

| Factor | Impact on Compagnie des Alpes | Example |

|---|---|---|

| Criticality of Inputs | High power for suppliers of specialized, essential components. | Safety-critical ski lift parts, proprietary theme park ride technology. |

| Supplier Concentration | Increased power when few suppliers exist for key inputs. | Limited manufacturers of advanced snowmaking systems. |

| Switching Costs | Amplified supplier leverage due to high costs to change providers. | Transitioning from specialized ski lift manufacturers or theme park attraction suppliers. |

| Differentiation | Stronger supplier position with unique or proprietary offerings. | Exclusive virtual reality entertainment systems for parks. |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Compagnie des Alpes' ski resort and leisure park operations.

Instantly visualize the competitive landscape for Compagnie des Alpes with a dynamic spider chart, highlighting key pressure points from rivals, suppliers, and new entrants.

Customers Bargaining Power

Customer price sensitivity is a significant factor for Compagnie des Alpes, particularly within the leisure industry where spending is often discretionary. In 2024, with ongoing economic considerations, families are carefully evaluating the cost of holidays and entertainment. For instance, a family of four might spend upwards of €1,000 on a short ski trip, making them keenly aware of ticket prices and additional expenses.

Customers possess significant bargaining power due to the wide array of substitute leisure activities available. They can choose from numerous other ski resorts, a variety of theme parks, or opt for entirely different vacation experiences like beach getaways or cultural excursions.

This abundance of alternatives empowers consumers, allowing them to easily switch if Compagnie des Alpes' pricing or product offerings are perceived as unfavorable. For instance, in 2024, the global travel and tourism market saw a robust recovery, with diverse options catering to various budgets and preferences, further intensifying competition and customer choice.

The increasing availability of online information and sophisticated price comparison tools significantly bolsters customer bargaining power. Travelers can now effortlessly research various ski resorts and theme parks, scrutinize pricing structures, and access a wealth of user reviews. This heightened transparency directly challenges Compagnie des Alpes' capacity to unilaterally set prices, as customers are better equipped to identify and pursue more cost-effective options, as evidenced by the average 10% year-over-year increase in online travel bookings observed in 2024.

Importance of Compagnie des Alpes' Offering to the Customer

While leisure activities like ski trips and theme park visits are often significant annual events for consumers, they remain discretionary spending. For an individual customer, Compagnie des Alpes' offerings are generally not considered essential with high switching costs. This means customers can easily opt for alternative holiday destinations or different forms of entertainment without incurring substantial penalties.

The bargaining power of customers is influenced by the availability of substitutes and the relatively low cost of switching. For instance, in 2024, the European ski market offers numerous resorts, and the broader travel industry provides a vast array of leisure options. This abundance of choice means customers can readily shift their spending to competitors if they perceive better value or different experiences from Compagnie des Alpes.

- Discretionary Spending: Leisure activities represent a significant portion of disposable income, making them susceptible to price sensitivity and competitive offerings.

- Low Switching Costs: Customers can easily choose alternative ski resorts or theme parks without significant financial or practical barriers.

- Availability of Substitutes: The market offers a wide range of competing destinations and entertainment options, increasing customer choice and leverage.

Potential for Backward Integration by Customers

The threat of customers integrating backward, meaning they start their own operations to compete with Compagnie des Alpes, is generally quite low within the leisure industry. It’s highly improbable for individual holidaymakers to decide to buy and run their own ski resorts or theme parks.

However, there's a slight possibility for larger entities. Think about major tour operators or significant corporate clients who frequently book group events. These organizations might consider developing some of their own in-house leisure facilities or experiences to offer their customers or employees. This would be a way for them to control costs or tailor offerings, but it remains a very uncommon occurrence in practice.

- Low Likelihood of Individual Backward Integration: Individual consumers lack the capital and expertise to operate large-scale leisure facilities like ski resorts or theme parks.

- Potential for Large Corporate Clients: Major tour operators or corporate entities booking in bulk might explore developing limited in-house leisure options, though this is rare.

- Limited Threat to Compagnie des Alpes: This specific form of customer bargaining power poses a minimal direct threat to Compagnie des Alpes' core business operations.

Customers of Compagnie des Alpes wield considerable bargaining power, primarily driven by the abundance of substitutes and their low switching costs. In 2024, the travel and tourism sector continued its strong recovery, offering a vast array of leisure choices from competing ski resorts to diverse entertainment parks and alternative vacation types, all readily accessible through online platforms. This competitive landscape, coupled with heightened price transparency, empowers consumers to readily shift their patronage if they perceive better value elsewhere.

| Factor | Impact on Compagnie des Alpes | 2024 Context |

|---|---|---|

| Availability of Substitutes | High | Numerous competing ski resorts and theme parks, plus alternative leisure activities. |

| Switching Costs | Low | Minimal financial or practical barriers for customers to choose alternative providers. |

| Price Sensitivity | Moderate to High | Leisure spending is discretionary; customers are sensitive to pricing, especially for family outings. |

| Information Availability | High | Online comparison tools and reviews enable informed customer decisions. |

Full Version Awaits

Compagnie des Alpes Porter's Five Forces Analysis

This preview displays the comprehensive Porter's Five Forces analysis for Compagnie des Alpes, offering a detailed examination of industry competition, buyer and supplier power, threat of new entrants, and the impact of substitutes. The document you see here is precisely what you will receive instantly after completing your purchase, ensuring full transparency and immediate access to this valuable strategic tool.

Rivalry Among Competitors

Compagnie des Alpes operates in a competitive European leisure industry, facing both large international entities and smaller, localized businesses. This includes other major ski resort operators in the Alps, such as Vail Resorts which has been expanding its European presence, and prominent theme park companies like Merlin Entertainments across the continent.

The European amusement park market is poised for significant expansion, with projections indicating a compound annual growth rate (CAGR) of approximately 6.08% between 2025 and 2035. This robust growth suggests a dynamic and increasingly competitive landscape as companies like Compagnie des Alpes seek to capture a larger share of this expanding market.

Similarly, the European ski market is anticipated to grow at a CAGR of 3.80% from 2025 to 2034. Such growth, while positive, can also fuel intensified rivalry among existing players and potential new entrants, all vying for customer attention and revenue in a sector that relies heavily on seasonal demand and weather conditions.

Compagnie des Alpes stands out by offering a diverse collection of renowned ski resorts and sought-after amusement parks, each curated to provide distinct leisure experiences. This product differentiation is key to capturing market share and fostering customer engagement.

Building strong brand loyalty hinges on consistently delivering high-quality experiences, showcasing unique attractions, and employing strategic marketing campaigns. For instance, the company's investment in new attractions and services directly impacts customer retention and repeat visits, a vital component in a competitive landscape.

Exit Barriers

Compagnie des Alpes faces substantial exit barriers due to the immense fixed costs inherent in operating ski resorts and theme parks. These include significant investments in infrastructure, ongoing maintenance, and often, land ownership. For instance, the capital expenditure for a new ski lift can easily run into millions of euros, and maintaining extensive snow-making equipment or elaborate theme park rides requires continuous, high-cost upkeep.

These high fixed costs create a strong incentive for companies to continue operating even when market conditions are unfavorable. Rather than incurring further losses by shutting down and potentially abandoning assets, firms may choose to absorb losses through continued operation to cover at least some of their ongoing expenses. This dynamic can intensify competitive rivalry, as underperforming businesses remain in the market, contributing to overcapacity or price pressures.

- High Capital Intensity: Ski resorts and theme parks require massive upfront investment in infrastructure like lifts, trails, rides, and park facilities.

- Ongoing Maintenance Costs: Essential upkeep for safety, operational efficiency, and guest experience contributes to substantial recurring expenses.

- Asset Specificity: Specialized equipment and facilities have limited alternative uses, making them difficult to sell or repurpose if a business exits.

- Operational Continuity Incentive: The need to cover fixed costs often compels companies to operate at a loss rather than cease operations entirely.

Diversity of Competitors

Compagnie des Alpes faces a broad spectrum of competitors, each employing distinct strategies. These range from high-end, luxury-oriented mountain resorts and theme parks to more budget-conscious operators. The competitive landscape also includes large, diversified leisure groups alongside smaller, specialized niche providers.

This wide variety of competitors naturally leads to a dynamic and often aggressive competitive environment. Tactics employed can include intense price competition, particularly during off-peak seasons or for specific packages. Marketing efforts are often highly targeted, aiming to capture specific customer segments.

Furthermore, the need to stand out drives continuous innovation. Competitors are constantly investing in new attractions, upgrading facilities, and enhancing service offerings to attract and retain visitors. For instance, in the theme park sector, major players often announce significant new rides or themed areas years in advance to build anticipation.

- Diverse Competitor Strategies: Resorts and parks compete on price, luxury, and niche appeal.

- Aggressive Tactics: Price wars and targeted marketing are common competitive tools.

- Innovation Focus: Continuous investment in new attractions and services is crucial for differentiation.

- Market Segmentation: Competitors cater to various customer segments, from families seeking value to those desiring premium experiences.

Compagnie des Alpes operates in a highly competitive European leisure market, facing both large international players and smaller, specialized businesses. This rivalry is characterized by diverse strategies, including price competition, aggressive marketing, and a strong emphasis on innovation to attract and retain customers. For example, the European amusement park market is projected to grow at a CAGR of approximately 6.08% between 2025 and 2035, indicating an intensifying battle for market share.

The intensity of competition is further amplified by high capital intensity and significant exit barriers, such as the millions of euros required for new ski lifts and ongoing maintenance costs for extensive infrastructure. These factors incentivize companies to remain operational, potentially leading to price pressures and overcapacity within the sector.

| Competitor Type | Key Strategies | Example Companies |

| Major International Operators | Brand recognition, economies of scale, diversified offerings | Vail Resorts, Merlin Entertainments |

| Regional/Niche Operators | Local market focus, unique experiences, specialized attractions | Various smaller ski resorts and theme parks across Europe |

| Luxury Resorts | Premium services, exclusive amenities, high-end clientele | Specific high-altitude ski resorts |

| Budget-Friendly Options | Value-for-money packages, accessible pricing, family-oriented | Smaller amusement parks with lower entry fees |

SSubstitutes Threaten

The most significant threat of substitutes for Compagnie des Alpes, a major ski resort operator, stems from the vast array of alternative leisure activities competing for consumers' discretionary spending. These include everything from sun-drenched beach holidays and vibrant city breaks to enriching cultural tourism and relaxing cruises.

Furthermore, domestic entertainment options, such as theme parks, sporting events, and even staying home with streaming services, present a considerable challenge. In 2024, the global travel and tourism sector, while recovering, still sees significant competition from these diverse leisure pursuits, impacting the demand for traditional ski vacations.

The cost and perceived value of substitute leisure activities significantly impact Compagnie des Alpes. For instance, a family might choose a domestic camping trip or a visit to a local museum over an expensive ski holiday or theme park visit, especially if budget is a primary concern. In 2024, the average cost of a week-long family ski trip in the Alps can range from €2,000 to €5,000, whereas a comparable domestic camping holiday might cost under €1,000.

The performance of these alternatives in delivering a satisfying leisure experience is also crucial. If a substitute offers comparable enjoyment, relaxation, or cultural enrichment at a lower price point, it poses a substantial threat. For example, the growing popularity of staycations and accessible cultural events means consumers have more options that don't require significant travel or expenditure, directly competing with the core offerings of Compagnie des Alpes.

The threat of substitutes for Compagnie des Alpes' offerings, such as ski resorts and amusement parks, is amplified by the ease with which consumers can switch to alternative leisure activities. There are typically no significant contractual obligations or substantial financial penalties that tie a consumer to a specific resort or park. This low switching cost means a customer can easily opt for a different vacation destination, a local entertainment venue, or even a staycation, directly impacting demand for Compagnie des Alpes' services.

Changing Consumer Preferences and Trends

Shifting consumer preferences pose a significant threat of substitution for Compagnie des Alpes. For instance, a growing emphasis on 'log-out time' and 'bonding bubbles' can steer individuals towards more intimate, localized experiences rather than large-scale resort destinations. This trend is supported by a 2024 report indicating a 15% increase in demand for smaller, curated travel experiences compared to pre-pandemic levels.

Furthermore, the increasing demand for sustainable tourism presents an alternative. Travelers are increasingly seeking eco-friendly options, which could lead them to choose nature-based activities or destinations with a lower environmental impact over traditional ski resorts. In 2024, bookings for eco-lodges and sustainable travel packages saw a 20% year-over-year increase, highlighting this evolving consumer mindset.

- Evolving Consumer Trends: Increased focus on quality time with family and friends, often referred to as 'bonding bubbles'.

- Sustainability Focus: A growing preference for eco-friendly travel options and experiences with a lower environmental footprint.

- Shift in Leisure Spending: Potential redirection of discretionary spending towards alternative leisure activities that align with these new preferences.

- Market Data: A 2024 survey revealed that 60% of travelers consider sustainability when booking trips, up from 45% in 2022.

Technological Advancements in Other Leisure Sectors

Technological advancements in competing leisure sectors pose a significant threat to Compagnie des Alpes. For instance, the burgeoning virtual reality (VR) market offers increasingly sophisticated and immersive entertainment experiences that can be enjoyed from home, directly siphoning potential customer engagement and spending away from physical attractions. By 2024, the global VR market was valued at approximately $37 billion, with projections indicating substantial growth.

Furthermore, the continuous evolution of home entertainment systems, including high-definition streaming services and advanced gaming consoles, provides compelling alternatives to visiting theme parks or ski resorts. These at-home options often come with lower perceived costs and greater convenience, making them attractive substitutes. The global home entertainment market is a multi-billion dollar industry, demonstrating the scale of this competitive landscape.

Immersive digital experiences, such as augmented reality (AR) applications and interactive online platforms, also represent a growing threat. These technologies can create novel forms of entertainment that compete for leisure time and disposable income. Companies investing heavily in these digital realms are creating compelling alternatives that could impact attendance at traditional leisure venues.

The threat of substitutes for Compagnie des Alpes is substantial, as consumers have a wide array of alternative leisure activities. These range from domestic entertainment like theme parks and sporting events to international travel options such as beach holidays and cultural tours. In 2024, the global travel market continues to offer diverse choices, with many consumers prioritizing experiences that may not involve traditional ski resorts or amusement parks.

The cost-effectiveness and perceived value of substitutes are key drivers. For instance, a family might opt for a more budget-friendly camping trip or local attraction over a ski vacation. The average cost for a week-long ski trip in the Alps can be upwards of €3,000, while a comparable domestic getaway might cost less than €1,000, making alternatives increasingly attractive, especially in 2024.

Consumer preferences are also shifting, with a growing interest in sustainable and localized experiences. This trend, evidenced by a 15% rise in demand for curated travel in 2024, means that activities with a lower environmental impact or more intimate settings can draw customers away from larger resorts. Furthermore, advancements in VR technology offer immersive entertainment from home, valued at approximately $37 billion in 2024, presenting a direct digital substitute.

| Substitute Leisure Activity | Typical Cost (Family of 4, 1 Week) | Key Appeal | 2024 Trend Relevance |

| Ski Holiday (Alps) | €3,000 - €5,000 | Winter sports, mountain scenery | High cost, weather dependent |

| Domestic Camping/Staycation | €800 - €1,500 | Affordability, convenience, family bonding | Growing demand for budget-friendly options |

| Theme Park Visit | €1,000 - €2,000 | Entertainment, rides, family fun | Competition from digital entertainment |

| Virtual Reality (Home) | €500 - €1,500 (initial setup) + ongoing subscriptions | Immersive entertainment, convenience | Rapidly growing market, direct digital substitute |

| Sustainable/Eco-Tourism | €1,500 - €3,000 | Environmental consciousness, unique experiences | 20% year-over-year increase in bookings |

Entrants Threaten

Launching a new ski resort or theme park demands immense financial backing. For instance, building a single high-speed chairlift can cost millions, and acquiring suitable land in prime locations is also a significant expense. Compagnie des Alpes, for example, invests heavily in modernizing its existing parks and ski lifts, a cost that deters many potential newcomers.

Existing operators in the ski resort and leisure park industry, such as Compagnie des Alpes, benefit significantly from entrenched economies of scale. This advantage is evident in their ability to spread fixed costs across a larger operational base, leading to lower per-unit costs for services, marketing campaigns, and bulk purchasing of supplies and equipment. For instance, in 2023, Compagnie des Alpes reported revenue of €1.15 billion, demonstrating a substantial operational footprint.

New entrants face a considerable hurdle in matching these cost efficiencies. Without achieving a comparable scale of operations, newcomers would find it difficult to compete on price or achieve comparable profit margins. This makes it challenging for them to attract customers away from established, cost-effective providers like Compagnie des Alpes, thereby acting as a deterrent to entry.

Compagnie des Alpes faces a significant threat from new entrants due to the difficulty in securing prime locations for its ski resorts and theme parks. Limited availability of desirable sites, particularly in sought-after regions like the French Alps, coupled with complex regulatory approval processes, acts as a substantial barrier. For instance, developing a new large-scale ski resort requires extensive land, environmental impact assessments, and often lengthy negotiations with local authorities and landowners, making it a resource-intensive endeavor for newcomers.

Established players like Compagnie des Alpes also benefit from deeply entrenched relationships with tour operators, travel agencies, and online travel platforms. These existing distribution channels are crucial for reaching a broad customer base and driving ticket sales and bookings. New entrants would struggle to replicate these established networks, which have been built over years of operation and trust, often requiring significant investment and time to develop comparable reach and market penetration.

Brand Loyalty and Differentiation

Compagnie des Alpes benefits from significant brand loyalty cultivated over years of operation and investment in unique, memorable guest experiences. This strong brand equity acts as a considerable barrier, requiring potential new entrants to invest heavily in marketing and product innovation to even begin to rival its established presence and customer appeal.

For instance, in the 2023-2024 fiscal year, Compagnie des Alpes reported a revenue of €1.16 billion, showcasing the scale of its operations and the customer base it serves. This level of established recognition makes it challenging for newcomers to capture market share without substantial differentiation and marketing spend.

- Brand Recognition: Years of consistent service and investment in unique attractions have built strong customer recognition for Compagnie des Alpes.

- Customer Loyalty: Repeat visitation and positive word-of-mouth are significant assets, making it difficult for new players to attract customers away.

- Marketing Investment: New entrants would need to allocate substantial resources to marketing campaigns to build brand awareness and create a comparable appeal.

- Experiential Differentiation: Offering truly novel or superior experiences is crucial for new entrants to overcome the established customer preference.

Government Policy and Regulations

Government policy and regulations significantly impact the threat of new entrants in the leisure industry, including for Compagnie des Alpes. The sector is heavily regulated, covering environmental permits, stringent safety standards for attractions like ski lifts and rides, and complex land use policies. These requirements create substantial hurdles for any new player looking to enter the market.

Navigating these regulatory landscapes is often a lengthy and resource-intensive process. For instance, in 2024, obtaining new operating permits for large-scale attractions can take upwards of two years and involve multiple governmental agencies. This complexity and the associated costs act as a considerable deterrent, effectively raising the barrier to entry.

- Environmental Permits: New entrants must secure approvals related to ecological impact assessments and conservation efforts, which can be lengthy and costly.

- Safety Standards: Compliance with rigorous safety regulations for amusement rides, ski lifts, and operational procedures requires significant capital investment and ongoing oversight.

- Land Use Policies: Zoning laws and land development regulations can restrict where new leisure facilities can be built and how they can operate, limiting expansion opportunities for potential competitors.

The threat of new entrants for Compagnie des Alpes is moderate. While the capital required for new ski resorts or theme parks is substantial, and securing prime locations is challenging, established brands and distribution networks offer significant advantages to incumbents. However, innovative business models or niche market focus could potentially lower entry barriers.

The substantial capital investment needed to establish a new ski resort or theme park is a significant deterrent. For example, the cost of developing a new ski area can easily run into tens or hundreds of millions of euros, encompassing land acquisition, infrastructure like lifts and snowmaking, and initial operational setup. This high upfront cost limits the pool of potential new entrants.

Compagnie des Alpes, having reported revenues of €1.16 billion for the 2023-2024 fiscal year, benefits from economies of scale that new entrants would struggle to match. This allows for more competitive pricing and greater marketing reach. Without comparable scale, newcomers would face higher per-unit costs, making it difficult to compete effectively.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High upfront investment for land, infrastructure, and operations. | Significant deterrent. |

| Economies of Scale | Lower per-unit costs due to large operational base. | Makes it hard for smaller new entrants to compete on price. |

| Brand Loyalty & Reputation | Established customer preference and trust. | Requires substantial marketing to overcome. |

| Distribution Channels | Existing relationships with tour operators and travel platforms. | Difficult and time-consuming for new players to build. |

| Government Regulations | Permits, safety standards, land use policies. | Adds complexity, cost, and time to market entry. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Compagnie des Alpes leverages data from their annual reports, investor presentations, and industry-specific market research reports. We also incorporate insights from competitor financial statements and relevant tourism sector publications.