Compagnie des Alpes Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Compagnie des Alpes Bundle

The Compagnie des Alpes BCG Matrix offers a fascinating glimpse into their diverse portfolio. Explore which of their ski resorts and leisure activities are poised for growth and which might require a strategic re-evaluation.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for Compagnie des Alpes.

Stars

The Leisure Parks division shines as a star in Compagnie des Alpes' BCG Matrix, exhibiting robust high growth. Sales surged by an impressive 32.8% in the first half of the 2024/25 fiscal year and a substantial 29.9% over the first nine months, based on reported figures.

This remarkable performance stems from a significant uptick in both visitor numbers and the average spending per visitor, clearly signaling a strong market demand for their entertainment experiences.

Compagnie des Alpes' strategic focus on enhancing the division through investments in new attractions and extending operating hours has effectively propelled this growth, solidifying its position as a key performer.

Parc Astérix and Futuroscope are strong contenders within Compagnie des Alpes' Leisure Parks segment, demonstrating robust visitor engagement and strategic development. These parks are key contributors, reflecting significant capital allocation for growth initiatives.

Planned expansions include 300 new hotel rooms at Parc Astérix and 240 at Futuroscope, designed to boost overnight stays and appeal to a broader audience. New attractions such as Futuroscope's 'Mission Bermudes' and the upcoming Aquascope further solidify their positions in an expanding market.

The acquisition and increased stake in Urban Group, now 86.4% owned and consolidated since June 2024, positions it as a high-growth Star for Compagnie des Alpes. This strategic move significantly expands the company's presence in the vibrant urban sports and leisure sector.

Urban Group's integration has already boosted the Leisure Parks division's EBITDA and overall sales, demonstrating its capacity to capture market share in an expanding segment. Further expansion through new centers reinforces its promising high-growth trajectory.

New Strategic Acquisitions (e.g., Belantis)

The acquisition of Belantis leisure park in Germany in April 2025 positions it as a strategic 'Question Mark' within Compagnie des Alpes' BCG Matrix. This German park, with its current visitor base, is targeted for significant growth, with projections indicating a potential tripling of visitor numbers. This expansion into a new, high-growth geographical market is a key part of Compagnie des Alpes' strategy to enhance its European market share and diversify its leisure park offerings.

Compagnie des Alpes' investment in Belantis is designed to transform it into a 'Star' by capitalizing on its untapped potential. The company aims to nurture Belantis' growth prospects, thereby strengthening its overall portfolio. This strategic move underscores Compagnie des Alpes' commitment to expanding its international presence and diversifying its revenue streams within the competitive leisure industry.

- Strategic Expansion: Belantis acquisition in April 2025 signals entry into a new, high-growth German market.

- 'Question Mark' Potential: Park targeted to triple visitor numbers, indicating high growth prospects.

- Portfolio Diversification: Broadens European market share and diversifies Compagnie des Alpes' leisure park assets.

- Future 'Star' Ambition: Investment aims to cultivate Belantis into a high-performing 'Star' category asset.

Investment in New Attractions and Infrastructure

Compagnie des Alpes' strategic investment in new attractions and infrastructure is a key driver for its 'Stars' in the BCG Matrix. These substantial capital expenditures, amounting to approximately €276 million for the 2024/25 fiscal year, are designed to enhance the appeal and competitiveness of its leisure destinations.

This focus on upgrading facilities, such as new ski lifts in prestigious resorts like Les Arcs, Val d'Isère, and Tignes, alongside new features in theme parks, directly contributes to increasing visitor numbers and extending their length of stay. Such initiatives are crucial for capturing a larger market share in the highly competitive leisure industry.

- Investment Focus: New attractions and infrastructure upgrades across parks and ski areas.

- FY 2024/25 Capital Expenditure: Approximately €276 million.

- Strategic Objectives: Boost visitor appeal, extend stays, and increase market share.

- Examples: New ski lifts (Les Arcs, Val d'Isère, Tignes), new theme park features.

The Leisure Parks division is a clear 'Star' for Compagnie des Alpes, driven by impressive growth. Sales saw a 32.8% jump in the first half of fiscal year 2024/25 and a 29.9% increase over the first nine months. This surge is fueled by more visitors and higher spending per visitor, highlighting strong demand for their entertainment offerings.

Strategic investments in new attractions, like Parc Astérix's 300 new hotel rooms and Futuroscope's 'Mission Bermudes' and Aquascope, are key to this 'Star' status. The increased stake in Urban Group, now at 86.4%, also bolsters this segment, contributing significantly to EBITDA and sales by expanding into the urban sports and leisure market.

| Segment | BCG Category | Key Performance Indicators (First 9 Months FY 2024/25) | Strategic Initiatives | |

|---|---|---|---|---|

| Leisure Parks | Star | Sales Growth: 29.9% | New attractions, hotel expansions (Parc Astérix, Futuroscope), Urban Group integration | |

| Urban Group (within Leisure Parks) | Star | Significant EBITDA and Sales Contribution | New center expansion |

What is included in the product

The Compagnie des Alpes BCG Matrix offers a strategic overview of its diverse ski resorts and leisure parks, identifying growth opportunities and areas for optimization.

A clear BCG Matrix overview for Compagnie des Alpes, instantly highlighting strategic priorities.

Cash Cows

Compagnie des Alpes' established French Alps ski resorts are prime examples of Cash Cows within their portfolio. These locations consistently deliver robust financial performance, as evidenced by the Ski Areas and Outdoor Activities division's impressive €583.8 million in sales for the first nine months of the 2024/25 fiscal year.

Despite operating in a mature industry, these resorts command a significant market share and maintain strong profitability. This success is largely attributed to strategic pricing, consistent demand driven by favorable snow conditions, and their established brand reputation.

Core ski lift operations represent Compagnie des Alpes’ primary Cash Cow. These operations are the bedrock of the Ski Areas division, driving the majority of its revenue. The 2024/25 winter season saw a remarkable 13.9 million skier-days, a testament to their enduring appeal and operational success.

The financial performance is robust, with a notable 6.5% increase in average revenue per skier-day during the 2024/25 season. This growth directly translates into substantial and consistent cash flow generation, a hallmark of a mature and stable business segment.

Investment in these areas is carefully calibrated, focusing on essential maintenance and operational enhancements to sustain efficiency and profitability. The market for core ski lift operations is considered stable, allowing for predictable cash generation without the need for aggressive expansion capital.

MMV, a significant component of Compagnie des Alpes' Distribution & Hospitality segment, functions as a cash cow. It consistently delivers stable and expanding revenue streams primarily through its accommodation services.

In the 2023-2024 winter season, MMV achieved an impressive occupancy rate of 90%, demonstrating its strong market position. This high utilization, coupled with an increase in average revenue per night, solidifies MMV's role as a reliable cash generator, despite modest growth potential.

The consistent financial performance of MMV significantly contributes to the overall profitability and financial health of the Distribution & Hospitality division within Compagnie des Alpes.

Long-term Public Service Concessions

Long-term public service concessions, like the one for Saint-Chaffrey (Serre Chevalier) extended to 2034, are key cash cows for Compagnie des Alpes. These agreements offer a stable, predictable revenue stream, solidifying the company's market presence. They generate consistent cash flow with minimal need for additional marketing spend, allowing for sustained operations.

These concessions operate as reliable income generators, fitting the 'Cash Cow' profile perfectly. They represent mature businesses with established market positions that require little investment to maintain their cash-generating ability. This stability is crucial for funding other ventures within the company's portfolio.

- Stable Revenue: The extension of the Saint-Chaffrey (Serre Chevalier) concession through 2034 exemplifies this, providing a predictable income source.

- Market Position: These agreements solidify Compagnie des Alpes' standing in key operational areas.

- Consistent Cash Flow: They generate reliable cash with low promotional investment needs.

- Low Investment: The mature nature of these concessions means minimal capital expenditure is required for their upkeep.

Mature Real Estate Holdings in Established Resorts

Compagnie des Alpes' established real estate holdings in mature ski resorts, such as those in the French Alps, function as cash cows. These properties, including hotels, chalets, and commercial spaces, benefit from consistent demand and generate steady rental income. For instance, in the 2023-2024 season, resorts like Les Arcs and La Plagne, which boast significant real estate portfolios, continued to attract visitors, underpinning stable revenue streams.

These mature assets require minimal new capital investment for expansion, allowing Compagnie des Alpes to harvest profits with relative ease. The existing infrastructure and established customer base mean these properties can be 'milked' for their earnings, contributing significantly to the company's overall financial health. This passive income generation is crucial for funding growth in other areas of the business.

- Mature Real Estate Holdings: Properties in established resorts like Les Arcs and La Plagne.

- Revenue Generation: Primarily through rental income and supporting resort operations.

- Low Capital Expenditure: Existing infrastructure reduces the need for significant new investment.

- Profit Harvesting: These assets are leveraged to generate consistent, passive cash flow.

Compagnie des Alpes' core ski lift operations are definitive cash cows, consistently generating substantial revenue. The 2024/25 winter season saw 13.9 million skier-days, with average revenue per skier-day increasing by 6.5%, highlighting their stable demand and profitability. These operations require focused investment on maintenance rather than aggressive expansion, ensuring predictable cash flow.

MMV, a hospitality segment, also acts as a cash cow, evidenced by a 90% occupancy rate in the 2023-2024 winter season. This high utilization, coupled with rising average revenue per night, solidifies its role as a reliable cash generator with limited growth potential but strong profitability.

Long-term public service concessions, such as the Saint-Chaffrey (Serre Chevalier) agreement extending to 2034, provide predictable, stable revenue streams with minimal marketing investment. These mature businesses require little capital to maintain their cash-generating ability, contributing significantly to the company's financial stability.

Established real estate holdings in mature resorts, like those in Les Arcs and La Plagne, are also cash cows. They benefit from consistent demand, generating steady rental income and requiring minimal new capital for expansion, allowing for profit harvesting.

| Segment | Example | Key Metric (2024/25 unless noted) | Cash Cow Characteristic |

| Ski Areas | Core Ski Lift Operations | 13.9 million skier-days | Stable demand, high profitability, low investment needs |

| Distribution & Hospitality | MMV (Accommodation) | 90% occupancy (2023-24 season) | Consistent revenue, high utilization, reliable cash flow |

| Ski Areas | Public Service Concessions | Saint-Chaffrey (Serre Chevalier) concession to 2034 | Predictable revenue, minimal marketing spend, low capital requirements |

| Distribution & Hospitality | Mature Real Estate Holdings | Properties in Les Arcs and La Plagne | Steady rental income, low expansion investment, profit harvesting |

Preview = Final Product

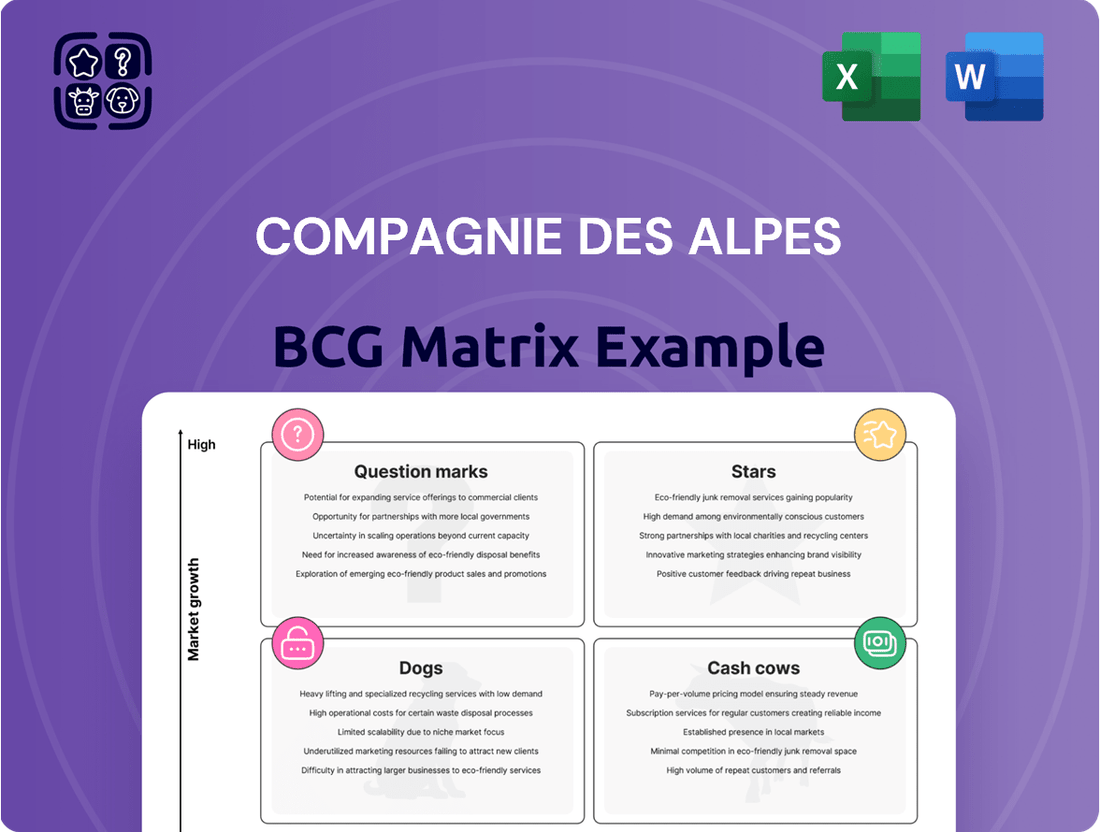

Compagnie des Alpes BCG Matrix

The preview you are viewing is the exact Compagnie des Alpes BCG Matrix report you will receive upon purchase, offering an unwatermarked, fully formatted analysis ready for immediate strategic application. This comprehensive document, meticulously crafted with industry-standard methodology, provides a clear visual representation of Compagnie des Alpes' business units and their market positions. You'll gain actionable insights into their Stars, Cash Cows, Question Marks, and Dogs, enabling informed decision-making for resource allocation and future growth strategies. Rest assured, the file you see is the final, polished version, devoid of any demo content or limitations, ensuring you receive a professional and complete strategic tool.

Dogs

Within Compagnie des Alpes' broader Outdoor Activities segment, very niche pursuits like specialized mountain biking trails or guided historical hikes could be classified as Dogs. These activities often cater to a small, dedicated audience, meaning their market share is inherently limited. For instance, while the overall outdoor recreation market is substantial, highly specific offerings might struggle to attract significant customer volume.

These niche segments typically exhibit low growth potential, as their appeal is narrow. Consequently, they may not generate substantial revenue or profit, often only covering their operational costs. In 2024, it's unlikely these specific, small-scale activities would see significant investment from Compagnie des Alpes, as resources are typically channeled towards higher-growth or more established offerings within their portfolio.

Underperforming ancillary services in mature Compagnie des Alpes sites, such as older, unrenovated food and beverage outlets or retail shops, can be categorized as Dogs. These facilities often exhibit lower per-visitor spending and declining appeal compared to newer, more modern attractions, contributing minimally to overall profitability. For instance, a dated souvenir shop in a well-established ski resort might see declining sales as visitor preferences shift towards more contemporary merchandise or online purchasing options.

Less Competitive Real Estate Assets in Compagnie des Alpes' portfolio might include properties in less desirable locations or those needing significant renovation. These could be older retail spaces or underutilized office buildings that struggle to attract consistent foot traffic or corporate leases. For instance, a small, outdated commercial property in a declining town center would likely fit this description, showing minimal rental income and low appreciation potential.

These assets represent a low market share within their niche and offer limited growth prospects for Compagnie des Alpes. In 2024, such properties might have seen a decline in occupancy rates, perhaps falling below 70%, and their market value could have stagnated or even decreased, representing a drag on overall portfolio performance and tying up capital that could be better invested elsewhere.

Outdated or Low-Engagement Digital Platforms

Outdated or low-engagement digital platforms within Compagnie des Alpes would represent Dogs in their digital strategy. These platforms, perhaps legacy websites or apps with minimal user interaction, struggle to gain traction in the competitive online landscape. They likely have a small digital market share and necessitate continued investment for upkeep without yielding substantial returns or fostering customer loyalty.

- Low Digital Market Share: These platforms capture a negligible portion of online traffic and engagement within the leisure and tourism sector.

- Minimal ROI: Despite maintenance costs, they fail to drive significant bookings, revenue, or brand advocacy.

- Resource Drain: Ongoing operational expenses for these underperforming digital assets divert resources that could be allocated to more promising initiatives.

Marginal or Non-Strategic Distribution Agreements

Marginal or non-strategic distribution agreements within Compagnie des Alpes' Distribution & Hospitality division could be classified as Dogs. These might include low-volume partnerships that drain resources without significant revenue generation. For instance, in 2024, certain niche tour operator agreements might have contributed less than 0.5% to the division's total revenue while consuming disproportionate management time.

These agreements often represent a drain on resources, offering minimal return on investment. They fail to align with the company's strategic objectives of focusing on high-margin or high-volume distribution channels. Such an agreement might have been a partnership with a small, regional travel agency that generated only a few thousand euros in sales annually by mid-2024.

The key characteristic is that the administrative effort outweighs the sales or market reach achieved. These "Dog" agreements do not contribute meaningfully to the division's growth or profitability. For example, a distribution deal for a minor ski resort accessory that required extensive logistical support but yielded negligible sales by the end of the 2023-2024 season would fit this classification.

- Low Revenue Contribution: Agreements generating less than 1% of divisional revenue.

- High Administrative Overhead: Partnerships requiring significant management attention with little return.

- Strategic Misalignment: Distribution channels that do not fit Compagnie des Alpes' core business focus.

- Limited Market Reach: Partnerships failing to expand the company's customer base or brand presence.

Within Compagnie des Alpes' portfolio, "Dogs" represent offerings with low market share and low growth potential. These could include niche, underperforming digital platforms or outdated ancillary services at established resorts. For example, a legacy website with minimal user engagement in 2024 would be a Dog, requiring upkeep without significant returns.

These segments often have limited appeal, struggling to attract substantial customer volume or generate significant revenue. In 2024, such assets might have seen stagnant or declining visitor numbers, contributing minimally to overall profitability and potentially representing a drag on resources.

The company's strategy would likely involve minimizing investment in these areas or divesting them to reallocate capital to more promising Stars or Cash Cows. For instance, a dated souvenir shop with declining sales in 2024 might be considered for closure or modernization.

Compagnie des Alpes' "Dogs" are characterized by their low market share and limited growth prospects, often requiring ongoing maintenance without substantial returns. These could manifest as underperforming digital assets or niche, low-volume distribution agreements that consume resources disproportionately. For example, a marginal distribution partnership in 2024 might have contributed less than 0.5% of divisional revenue while demanding significant management attention.

Question Marks

Belantis Leisure Park, recently acquired by Compagnie des Alpes, fits the profile of a 'Question Mark' in the BCG Matrix. Its current sales of approximately €11 million and 300,000 annual visitors suggest a relatively small market share.

However, the significant growth potential, with Compagnie des Alpes aiming to triple visitor numbers, places Belantis in a high-growth market. This combination of low current share and high market growth necessitates substantial future investment to transform it into a 'Star' performer.

Compagnie des Alpes' acquisition of a 33% stake in Terrésens, with plans to raise it to 80% within 3-4 years, clearly places this venture in the Question Mark category of the BCG Matrix. Terrésens operates in the premium mountain accommodation sector, a market with promising growth potential. However, Compagnie des Alpes' current market share within this specific niche is still in its nascent stages of development, necessitating significant investment and strategic integration to establish a stronger foothold.

This strategic alliance is a deliberate move by Compagnie des Alpes to bolster its portfolio of 'warm beds' across the Alps. The investment in Terrésens is expected to require substantial ongoing capital infusion and careful management to fully realize its market potential and contribute effectively to the group's overall performance. As of 2024, the premium segment of mountain accommodation continues to show resilience, with occupancy rates in high-end properties often exceeding 70% during peak seasons, highlighting the strategic importance of such acquisitions.

Travelski's planned overnight train service between Paris and Bourg-Saint-Maurice for the 2025/26 season is categorized as a Question Mark within the BCG Matrix. This new venture is designed to bolster sustainable transportation options to the French Alps, aligning with increasing consumer preference for eco-conscious travel. For instance, in 2024, the European travel market saw a notable surge in demand for rail travel, with some routes experiencing passenger increases of over 15% compared to pre-pandemic levels, underscoring the high-growth potential of this segment.

As a nascent offering, the service currently holds a low market share. However, it is positioned within a segment demonstrating significant growth potential, driven by environmental concerns and a desire for more relaxing travel experiences. This necessitates substantial investment in marketing and operational development to establish a strong foothold and attract customers, aiming to transition it from a question mark to a star performer in the future.

New Experimental Attractions/Technologies

New experimental attractions or technologies, currently in their nascent stages within Compagnie des Alpes' leisure parks, represent potential Stars or Question Marks on the BCG Matrix. These innovations, such as augmented reality overlays for existing rides or immersive digital storytelling experiences, are characterized by high investment requirements and uncertain market reception. For instance, the company might be piloting a new interactive projection mapping system at one of its parks, aiming to create a novel guest engagement.

These ventures, while holding the promise of significant future growth and differentiation, begin with a low market share. The initial rollout requires substantial capital for development, testing, and marketing to educate consumers and build demand. Compagnie des Alpes' 2024 strategy likely includes allocating resources to explore such technological frontiers, aiming to capture emerging market trends and enhance the overall guest experience.

- Early-stage AR/VR integration in themed areas: Exploring immersive digital layers to enhance physical attractions, potentially increasing dwell time and engagement.

- AI-powered personalized guest experiences: Piloting systems that tailor recommendations or interactive elements based on individual guest preferences.

- Sustainable technology showcases: Introducing novel eco-friendly operational technologies as guest-facing attractions to highlight environmental commitment.

Strategic Digital Transformation Initiatives

Compagnie des Alpes' strategic digital transformation initiatives, particularly those focused on piloting new technologies and platforms, would likely be categorized as Question Marks in the BCG Matrix. These ventures, while promising for future growth and customer engagement, are in their nascent stages.

For instance, the company's investment in AI-driven personalized guest experiences or the development of new immersive digital content for its resorts represent early-stage digital products. These initiatives require substantial capital for research, development, and initial rollout, aiming to capture future market share in an evolving digital landscape.

- Digital Transformation Investment: In 2024, Compagnie des Alpes continued to invest in digital solutions, aiming to enhance customer journeys and operational efficiency across its ski resorts and leisure parks.

- New Technology Pilots: The company has been exploring technologies like augmented reality for on-site experiences and advanced data analytics for better visitor management, which are currently in pilot phases.

- Market Potential vs. Share: While these digital ventures hold high growth potential, their current market share is minimal, necessitating further investment to establish and scale their impact.

- Resource Allocation: As Question Marks, these initiatives demand significant financial and human resources to mature and potentially transition into Stars or Cash Cows in the future.

Belantis Leisure Park, a recent acquisition, represents a classic Question Mark due to its low current market share and the significant investment required to capitalize on its high-growth potential, aiming to triple visitor numbers.

Terrésens, in which Compagnie des Alpes is increasing its stake, also fits the Question Mark profile, operating in a promising premium mountain accommodation sector but currently holding a nascent market share that demands substantial capital and strategic integration.

Travelski's new overnight train service is a Question Mark, positioned to benefit from the growing demand for sustainable travel, as evidenced by a 15% passenger increase on some European rail routes in 2024, but it requires significant investment to build market presence.

New experimental attractions and digital transformation initiatives, like AR overlays or AI-driven personalization, are Question Marks, requiring considerable investment to test and scale, despite their potential to capture emerging market trends and enhance guest experiences.

| Business Unit | BCG Category | Current Market Share | Market Growth Rate | Strategic Focus |

|---|---|---|---|---|

| Belantis Leisure Park | Question Mark | Low | High | Investment to increase visitors |

| Terrésens | Question Mark | Nascent | High (Premium Mountain Accommodation) | Capital infusion and integration |

| Travelski Train Service | Question Mark | Low | High (Sustainable Travel) | Marketing and operational development |

| New Tech/Digital Initiatives | Question Mark | Minimal | High (Emerging Technologies) | R&D, piloting, and scaling |

BCG Matrix Data Sources

Our Compagnie des Alpes BCG Matrix is built on verified market intelligence, combining financial data from annual reports, industry research on ski resort performance, and official company disclosures to ensure reliable, high-impact insights.