Colowide Co PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Colowide Co Bundle

Uncover the critical political, economic, and technological forces shaping Colowide Co's trajectory with our meticulously researched PESTLE analysis. This essential tool provides actionable intelligence to navigate market complexities and anticipate future challenges. Download the full version to gain a strategic advantage and make informed decisions.

Political factors

The Japanese government's commitment to reducing food waste presents a significant political factor for Colowide. New draft guidelines from the Ministry of Health, Labor, and Welfare, slated for finalization by March 2025 and implementation in April 2025, will encourage restaurants to allow customers to take home leftovers, provided hygiene standards are maintained.

This policy directly supports the national goal of halving food waste by 2030, using 2000 as the baseline year. For Colowide, this could mean increased customer engagement with takeaway options, potentially impacting their waste management strategies and operational costs related to food packaging and handling.

Japan's recent labor law revisions in 2024 and 2025 introduce stricter notification rules for employees and clearer parameters for fixed-term contracts. These updates, designed to bolster worker protections, could necessitate adjustments in Colowide's HR practices, potentially impacting recruitment and retention strategies.

Specifically, the new regulations mandate explicit employee consent for discretionary work hours, a change that may affect operational flexibility and overtime cost management for Colowide. With approximately 70% of Japanese companies expecting some impact from these labor law changes, Colowide must proactively assess its compliance and adapt its workforce management to mitigate potential cost increases or operational disruptions.

Japan is actively reviewing its immigration and foreign worker regulations, particularly for sectors facing critical labor shortages like hospitality. The government is considering expanding the scope of its specified skilled worker program to include hotel and restaurant staff. This potential policy shift, with implementation eyed for spring 2025, could significantly ease staffing pressures for companies like Colowide Co.

The severe labor shortage in Japan's service industry, including restaurants, has been a persistent challenge. In 2023, the Japan National Tourism Organization reported a significant increase in inbound tourism, further exacerbating the demand for service workers. If the proposed changes are enacted, Colowide could see a substantial increase in available talent, potentially improving operational efficiency and service quality.

Food Safety and Labeling Regulations

Japan is implementing substantial regulatory shifts in 2025 to bolster consumer health and industry transparency. These changes include more rigorous requirements for nutrition claims and nutrient labeling, alongside the full establishment of a positive list system for food contact materials by June 2025.

Colowide must adapt its packaging and labeling to align with these updated Japanese regulations, which aim to provide consumers with clearer, more accurate information. For instance, the new rules could impact how ingredients are declared or how health benefits are communicated on product packaging.

- Stricter Nutrition Labeling: Compliance with updated rules for nutrition claims and nutrient labeling is essential.

- Food Contact Material Safety: Adherence to the positive list system for food contact materials, effective June 2025, is critical.

- Enhanced Consumer Transparency: Regulations focus on providing consumers with more accurate and understandable product information.

Government Support for Sustainable Agriculture

Japan's commitment to sustainable agriculture, as outlined in the Ministry of Agriculture, Forestry and Fisheries' 2021 Strategy for Sustainable Food Systems MIDORI, directly impacts the food industry by targeting reductions in agrochemical and chemical fertilizer use. This strategic shift by the Japanese government is likely to foster more environmentally conscious sourcing throughout the sector.

This policy could encourage more sustainable sourcing practices within the food industry, influencing Colowide's supply chain and potentially offering opportunities for partnerships with eco-friendly suppliers. Such initiatives align with a growing global demand for transparency and sustainability in food production, a trend expected to continue through 2025.

Specifically, the MIDORI strategy aims for a significant reduction in the use of chemical pesticides and fertilizers, with targets that will become more pronounced by 2025. This governmental push creates a favorable environment for companies like Colowide to integrate sustainable practices into their operations, potentially leading to cost efficiencies and enhanced brand reputation.

- Government Mandates: Japan's MIDORI strategy aims to reduce chemical pesticide use by 50% and chemical fertilizer use by 30% by 2050, with interim goals set for 2025.

- Supply Chain Impact: This policy encourages food companies to seek suppliers adhering to stricter environmental standards, potentially increasing sourcing costs but also improving product quality and brand image.

- Partnership Opportunities: Colowide may find opportunities to collaborate with innovative agricultural technology firms or organic farms that meet these new sustainability criteria.

The Japanese government is actively promoting food waste reduction, with new guidelines by March 2025 encouraging restaurants to allow customers to take home leftovers, a move that could impact Colowide's waste management and packaging needs.

Labor law revisions effective in 2024 and 2025 introduce stricter rules for work hours and contracts, potentially affecting Colowide's operational flexibility and labor costs, with around 70% of Japanese companies anticipating an impact.

Potential expansion of the specified skilled worker program in spring 2025 could alleviate Japan's severe hospitality labor shortage, benefiting Colowide by increasing the available talent pool.

Stricter nutrition labeling and food contact material regulations, fully implemented by June 2025, will require Colowide to ensure its packaging and product information are compliant and transparent for consumers.

What is included in the product

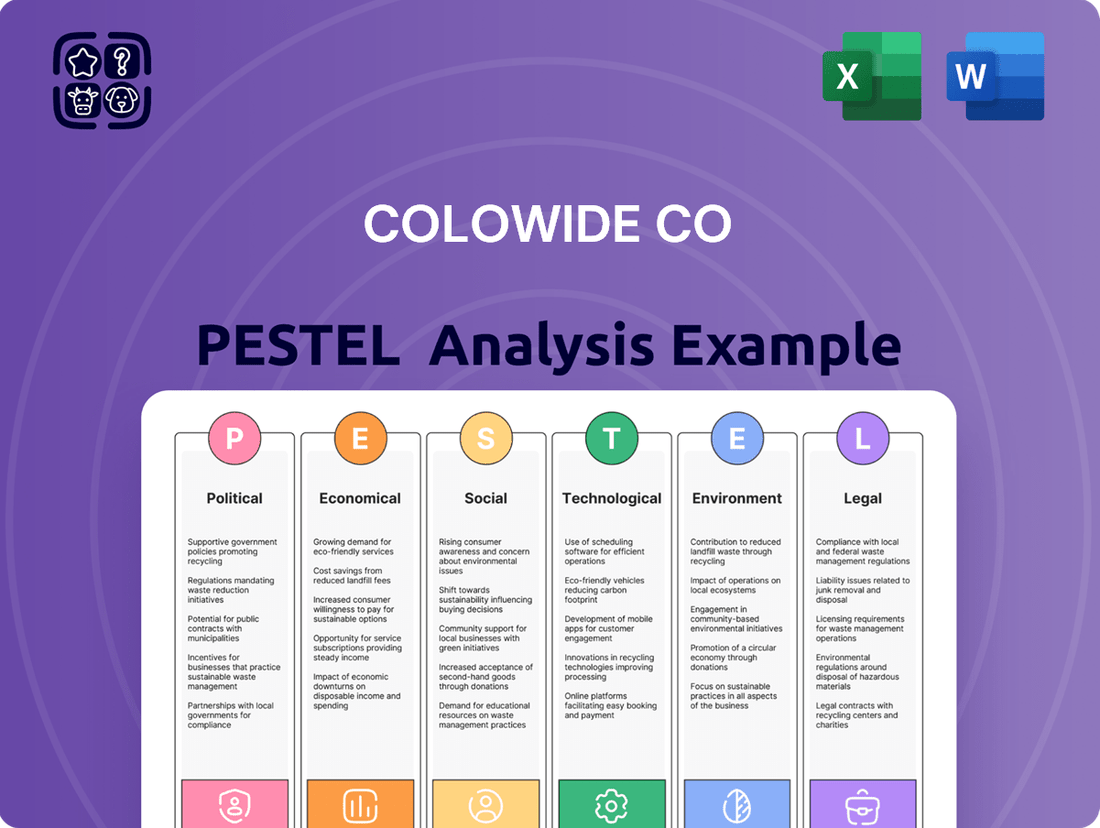

This PESTLE analysis provides a comprehensive examination of the external forces impacting Colowide Co across Political, Economic, Social, Technological, Environmental, and Legal landscapes.

It offers actionable insights for strategic decision-making by highlighting potential threats and opportunities derived from current market and regulatory trends.

The Colowide Co PESTLE Analysis offers a clear and actionable framework, simplifying complex external factors into easily digestible insights that directly address the pain point of strategic uncertainty.

By providing a visually segmented breakdown of PESTEL categories, the Colowide Co analysis alleviates the pain of information overload, enabling rapid understanding of market dynamics.

Economic factors

Japan's economy is grappling with persistent inflation, particularly in the food and beverage sectors. Throughout 2024, these prices have seen consistent increases, a trend anticipated to persist into 2025, directly impacting consumer spending and operational costs for businesses like Colowide.

Colowide Co. is feeling the pinch from these broader economic shifts. The company is contending with elevated costs for essential raw materials, a significant uptick in utility expenses, and escalating labor and transportation charges. These combined pressures directly affect Colowide's profit margins, necessitating careful consideration of strategic pricing adjustments to maintain financial health.

Japan's consumer spending is showing a mixed picture. While spending on experiences like dining out has held up, overall demand has seen ups and downs. For instance, in Q1 2024, household spending in Japan increased by a modest 0.5% year-on-year, indicating cautious consumer behavior amidst economic uncertainties.

Rising costs for essentials like food and energy are impacting household budgets. This is causing consumers to look for more budget-friendly options. In April 2024, Japan's core inflation rate was 2.2%, a slight decrease from previous months, but still a factor influencing purchasing decisions.

These trends directly affect Colowide Co. The shift towards seeking cheaper alternatives could reduce customer traffic and the average spend per customer across its various restaurant brands. For example, if consumers cut back on dining out frequency or opt for lower-priced menu items, it will impact revenue streams.

Japan's economy has experienced a noticeable uptick in wage growth, with a significant 5.2% increase in wages for 2024, and projections indicating a similar 5% rise in 2025. This trend, while beneficial for boosting consumer purchasing power, directly impacts companies like Colowide by increasing their operational expenses through higher labor costs.

For Colowide, these rising labor expenses necessitate a strategic focus on operational efficiency. Implementing measures such as workforce optimization and exploring automation technologies will be crucial for the company to mitigate the impact of increased wages and sustain its profitability in the evolving economic landscape.

Mergers and Acquisitions Activity

Colowide Co's aggressive mergers and acquisitions (M&A) strategy is a significant economic factor shaping its trajectory. In 2024 and 2025, the company completed several key acquisitions, including Nifs Co., Ltd., Socio Food Service Inc., and Seagrass Holdco Pty Ltd. These moves are clearly aimed at expanding its operational footprint and diversifying its business interests.

The company has also been proactive in securing capital for further M&A endeavors, notably through new share issuances. This financial maneuver underscores a commitment to growth and market consolidation. For instance, a significant capital raise in early 2025 provided substantial funds to fuel these strategic acquisitions.

The M&A activity reflects a broader economic trend of consolidation within Colowide's operating sectors. By acquiring complementary businesses, Colowide aims to achieve economies of scale and strengthen its competitive advantage. This strategy is supported by favorable market conditions and a robust financial outlook for the period.

- Acquisitions in 2024-2025: Nifs Co., Ltd., Socio Food Service Inc., Seagrass Holdco Pty Ltd.

- Funding Strategy: New share issuances to support M&A growth.

- Strategic Objectives: Business expansion, diversification, and market position enhancement.

- Economic Context: Aligns with industry-wide consolidation trends.

Impact of Yen's Weakening

The Japanese Yen's depreciation presents a significant challenge for Colowide Co. by increasing the cost of imported raw materials and ingredients, directly impacting its procurement expenses. For instance, in early 2024, the Yen traded around 150 JPY to the USD, a notable weakening compared to previous years, making dollar-denominated imports substantially more expensive.

This currency trend exacerbates inflationary pressures already present in the global economy, creating a dual cost challenge for Colowide. The company faces higher input costs, which could squeeze profit margins if not effectively passed on to consumers.

Key impacts for Colowide include:

- Increased import costs: Higher prices for raw materials sourced internationally due to Yen weakness.

- Inflationary pressures: The depreciating Yen contributes to broader cost increases, affecting overall operational expenses.

- Potential margin squeeze: Difficulty in fully offsetting higher import costs through price adjustments, impacting profitability.

- Supply chain vulnerability: Dependence on imported goods makes Colowide susceptible to currency market volatility.

Japan's economy is experiencing persistent inflation, particularly in food and beverages, with prices expected to continue rising through 2025, impacting consumer spending and Colowide's operational costs.

Colowide faces higher expenses for raw materials, utilities, labor, and transportation, squeezing profit margins and necessitating strategic pricing. While consumer spending on experiences remains strong, overall demand is mixed, with a 0.5% year-on-year increase in household spending in Q1 2024 reflecting cautious behavior.

Wage growth in Japan is projected to be around 5% for both 2024 and 2025, boosting purchasing power but increasing Colowide's labor costs, requiring a focus on operational efficiency and automation.

Colowide's aggressive M&A strategy, including acquisitions like Nifs Co., Ltd. and Socio Food Service Inc. in 2024-2025, is fueled by new share issuances and aims for market consolidation and economies of scale.

The depreciating Japanese Yen, trading around 150 JPY to the USD in early 2024, increases the cost of imported raw materials for Colowide, exacerbating inflation and potentially squeezing profit margins.

| Economic Factor | 2024 Data/Projection | 2025 Projection | Impact on Colowide |

|---|---|---|---|

| Inflation (Core) | 2.2% (April 2024) | Projected to remain elevated | Increased operational costs, potential need for price adjustments |

| Wage Growth | 5.2% (2024) | Projected 5% | Higher labor expenses, driving need for efficiency |

| Household Spending | +0.5% YoY (Q1 2024) | Mixed, cautious consumer behavior | Impacts demand and average spend per customer |

| Yen to USD Exchange Rate | ~150 JPY/USD (Early 2024) | Volatile, potential for further depreciation | Increased cost of imported goods, higher procurement expenses |

Preview Before You Purchase

Colowide Co PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use for Colowide Co's PESTLE analysis.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing a comprehensive PESTLE analysis for Colowide Co.

The content and structure shown in the preview is the same document you’ll download after payment, offering a complete PESTLE analysis for Colowide Co.

Sociological factors

Japanese consumers are showing a clear shift towards more diverse and personalized dining. There's a notable trend of interest in Western-style cafes and bakeries, indicating a willingness to explore new culinary experiences. This evolving palate means companies like Colowide must consider how to integrate these preferences into their Japanese market strategies.

The demand for healthier food options continues to grow, a significant factor for any food service business. Coupled with this is the increasing reliance on convenience, with home delivery services becoming a staple. In 2024, the Japanese food delivery market saw substantial growth, with projections indicating a continued upward trajectory, highlighting the need for Colowide to optimize its delivery infrastructure and offerings to meet this demand.

Japanese consumers are increasingly prioritizing health and sustainability, driving a significant expansion in the plant-based food market. Projections indicate this sector could reach approximately ¥500 billion (around $3.3 billion USD) by 2025, reflecting a strong consumer shift.

Colowide can leverage this societal movement by broadening its vegetarian and vegan menu selections. Highlighting the inherent health advantages of these plant-forward dishes will resonate with this growing demographic.

The global appetite for Japanese cuisine, especially sushi, has surged, significantly shaping dining habits worldwide and within Japan itself. This trend presents a prime opportunity for international growth.

Colowide Co, with its varied Japanese restaurant concepts, is well-positioned to capitalize on this cultural phenomenon. The company can attract a wide range of customers, both at home and abroad, by tapping into the widespread appeal of Japanese food.

For instance, the global Japanese food market was valued at approximately $80 billion in 2023 and is projected to grow steadily. This expansion is driven by increasing consumer interest in healthy eating and authentic culinary experiences, directly benefiting companies like Colowide.

Changing Lifestyles and Convenience Demands

Japan's increasingly fast-paced lifestyle significantly drives demand for convenient food solutions. This includes a growing preference for quick-service restaurants, innovative cloud kitchen models, and streamlined self-ordering technologies that minimize wait times.

Colowide Co. is well-positioned to capitalize on these evolving consumer habits. By leveraging its diverse network of dining outlets, the company can focus on enhancing service efficiency and exploring new formats specifically designed for convenience, such as express lunch sets or grab-and-go options.

- Demand for Convenience: In 2024, the Japanese food service industry saw a surge in demand for convenient dining, with quick-service restaurants accounting for a significant portion of market growth.

- Cloud Kitchen Growth: The cloud kitchen market in Japan is projected to expand by over 15% annually through 2027, reflecting a strong consumer shift towards delivery and off-premise dining.

- Technology Adoption: Over 60% of Japanese consumers now utilize self-ordering kiosks or mobile apps when dining out, indicating a clear preference for efficient, contactless service.

Increased Environmental Consciousness

Consumers in Japan are increasingly prioritizing environmental responsibility, with a significant portion of the population actively seeking out products and brands that demonstrate ethical and sustainable practices. This growing eco-consciousness directly influences purchasing decisions, creating a stronger market pull for companies that align with these values.

This societal trend is prompting companies like Colowide to re-evaluate and enhance their operational sustainability. This includes scrutinizing supply chains for responsible sourcing, implementing robust waste reduction strategies, and exploring eco-friendly packaging solutions to meet consumer expectations. For instance, a 2024 survey indicated that over 60% of Japanese consumers are willing to pay a premium for sustainably produced goods.

- Growing Demand: Japanese consumers are actively seeking out products that align with environmental and ethical standards.

- Sustainable Operations: Colowide is encouraged to adopt sustainable practices across its value chain.

- Consumer Willingness to Pay: Data from 2024 shows a significant percentage of consumers are willing to pay more for eco-friendly products.

Japanese society is increasingly focused on health and wellness, driving demand for nutritious food options and dietary transparency. This trend is further amplified by a growing interest in plant-based diets, with the market for vegan and vegetarian products in Japan projected to see significant expansion through 2025.

The embrace of global culinary trends, particularly the popularity of Western-style cafes and bakeries, indicates a diversifying palate among Japanese consumers. This openness to new flavors and dining experiences presents opportunities for companies like Colowide to innovate their offerings and cater to evolving tastes.

Convenience remains a paramount factor, with the rapid pace of life in Japan fueling demand for quick-service options and efficient delivery systems. The continued growth of food delivery services in 2024 underscores the need for businesses to optimize their logistics and accessibility to meet consumer expectations.

| Sociological Factor | Trend Description | Impact on Colowide |

|---|---|---|

| Health & Wellness | Growing demand for healthy, plant-based, and transparently sourced food. | Opportunity to expand healthy menu options and highlight nutritional benefits. |

| Culinary Diversification | Increased interest in Western-style dining and diverse global cuisines. | Potential to introduce new concepts and adapt existing menus to cater to varied preferences. |

| Convenience & Lifestyle | Demand for quick-service, delivery, and efficient dining solutions due to fast-paced lifestyles. | Need to optimize service speed, explore grab-and-go formats, and enhance delivery infrastructure. |

Technological factors

The Japanese food service sector is rapidly embracing digital transformation, evident in the surge of online ordering platforms and delivery app usage. This trend is further amplified by the integration of smart restaurant technologies, aiming to optimize everything from kitchen workflows to customer interactions.

Colowide can capitalize on these technological shifts by integrating robust online ordering systems and partnering with popular delivery services, thereby expanding its reach and catering to evolving consumer preferences for convenience. For instance, in 2023, the Japanese online food delivery market was valued at approximately $14.5 billion, showing significant growth potential.

High-tech dining innovations are increasingly prevalent, with Japanese restaurants notably adopting AI-powered chefs, automated food conveyors, and robotic servers. Colowide could leverage these advancements to enhance hygiene standards, boost operational efficiency, and strategically mitigate ongoing labor shortages, a significant challenge across the industry.

Colowide can significantly enhance its strategic site selection and menu development by leveraging advanced data analytics, particularly location intelligence. Understanding consumer spending habits, dining preferences, and lifestyle patterns in specific geographic areas is paramount. For instance, by analyzing data from 2024, Colowide could identify urban centers with a high concentration of young professionals who exhibit a preference for quick-service, health-conscious meals, informing location and menu optimization decisions.

Supply Chain Technology and Logistics

Advancements in food factory technology, particularly automation and digital solutions, are crucial for major food manufacturers like Colowide. These technologies directly impact food safety and overall management, leading to more streamlined operations. For instance, the global food and beverage automation market was valued at approximately $15.9 billion in 2023 and is projected to reach $27.8 billion by 2028, indicating significant investment and adoption trends.

Colowide can significantly enhance its food product development, procurement, manufacturing, and logistics by integrating these cutting-edge technologies. This adoption can lead to improved efficiency, reduced waste, and better quality control across its entire value chain. The increasing demand for traceability and transparency in the food industry further underscores the importance of digital solutions in supply chain management.

Key technological factors impacting Colowide's supply chain and logistics include:

- Automation in Manufacturing: Implementing robotic systems for tasks like sorting, packaging, and quality inspection can boost production speed and consistency. In 2024, investments in food processing automation are expected to rise, with companies seeking to mitigate labor shortages and improve output.

- Digital Supply Chain Management: Cloud-based platforms and IoT sensors offer real-time visibility into inventory, transportation, and storage conditions, enabling proactive problem-solving. The global supply chain management market is anticipated to grow from $26.7 billion in 2023 to $43.2 billion by 2028.

- Data Analytics for Optimization: Predictive analytics can forecast demand, optimize inventory levels, and identify potential disruptions, leading to cost savings and improved customer service.

- Food Safety Technologies: Advanced monitoring systems and AI-driven solutions for detecting contaminants and ensuring compliance with regulations are becoming standard. The global food safety testing market is projected to reach $24.4 billion by 2027.

Innovation in Food Preparation and Menu Development

Technological advancements are revolutionizing how food is prepared and menus are designed. Innovations like 3D food printing and novel ingredient applications are opening up entirely new culinary possibilities. Colowide can leverage these technologies to craft distinctive and enticing menu items, appealing to shifting consumer preferences and carving out a niche in a crowded marketplace.

The integration of these technologies allows for greater customization and novelty in food offerings. For instance, 3D food printing can create intricate designs and textures previously impossible, while new ingredient applications can lead to healthier or more sustainable options. By embracing these innovations, Colowide can differentiate itself and capture the attention of diners seeking unique experiences.

- 3D Food Printing: Expected to grow significantly, with market projections indicating a substantial increase in adoption across the food service industry by 2025.

- Novel Ingredient Applications: Growing consumer demand for plant-based and lab-grown alternatives, with the global alternative protein market anticipated to reach over $160 billion by 2030.

- AI in Menu Development: AI-powered analytics are increasingly used to predict food trends and optimize menu offerings, with companies reporting improved customer satisfaction and reduced waste.

Technological advancements are significantly reshaping the food service industry. Colowide can leverage AI for menu optimization and data analytics for site selection, enhancing operational efficiency and customer engagement. The global food and beverage automation market, valued at approximately $15.9 billion in 2023, is projected to reach $27.8 billion by 2028, highlighting the trend towards smart kitchen technologies.

Colowide's adoption of digital supply chain management and food safety technologies, supported by a projected $24.4 billion global food safety testing market by 2027, will improve traceability and compliance. Innovations like 3D food printing and novel ingredient applications, including the plant-based market projected to exceed $160 billion by 2030, offer opportunities for menu differentiation and meeting evolving consumer demands.

Legal factors

Colowide must navigate Japan's stringent food safety and hygiene regulations, which are continuously updated. For instance, recent amendments to guidelines regarding the handling and provision of take-home leftovers necessitate meticulous compliance to prevent contamination and ensure customer well-being.

Failure to adhere to these evolving standards, such as those outlined by the Ministry of Health, Labour and Welfare, can result in severe penalties, including fines and operational suspensions. Maintaining impeccable hygiene practices is not just a legal obligation but crucial for preserving Colowide's reputation and consumer confidence in the highly competitive Japanese food service market.

Colowide must navigate Japan's increasingly complex labor laws, which dictate everything from standard working hours and overtime pay to mandated rest periods and various forms of employee leave. Recent legislative changes, particularly those impacting employment contracts and the treatment of fixed-term employees, require diligent compliance to uphold fair labor standards and avoid potential legal challenges.

Colowide Co. is proactively enhancing its corporate governance, aligning with stringent legal frameworks such as Japan's Food Sanitation Law and the Corporate Governance Code. This commitment is vital for fostering long-term expansion and securing the trust of its investors. For instance, in fiscal year 2023, the company reported a significant increase in its ESG (Environmental, Social, and Governance) scores, reflecting these governance improvements.

Adherence to these regulations ensures operational integrity and mitigates legal risks, which is particularly important in the food and beverage sector. The Corporate Governance Code's principles, which Colowide is actively implementing, aim to improve board effectiveness and shareholder rights, contributing to a more stable financial outlook.

Mergers & Acquisitions Legal Framework

Colowide's aggressive mergers and acquisitions strategy necessitates a deep understanding of the legal landscape governing business combinations. Navigating these regulations is crucial for seamless integration and avoiding potential penalties.

Compliance with antitrust legislation, such as the Hart-Scott-Rodino Antitrust Improvements Act in the US, is paramount to prevent anti-competitive practices. In 2024, the Federal Trade Commission and the Department of Justice continued to scrutinize large-scale mergers, with the FTC blocking or demanding significant divestitures in several deals, underscoring the importance of robust legal counsel in M&A activities.

- Antitrust Review: Ensuring deals do not unduly concentrate market power is a primary legal concern.

- Regulatory Approvals: Obtaining necessary clearances from relevant governmental bodies is a critical step.

- Due Diligence: Thorough legal vetting of target companies helps identify and mitigate risks.

- Contractual Agreements: Crafting legally sound acquisition agreements protects Colowide's interests.

Food Labeling and Advertising Standards

New regulations in Japan, effective from April 2024, are significantly tightening requirements for nutrition claims and nutrient labeling on food products. These changes mandate clearer presentation of nutritional information and restrict the use of certain health-related claims unless substantiated by rigorous scientific evidence.

Colowide Co. must meticulously review and update all its food labels and advertising materials to ensure they are accurate, transparent, and fully compliant with these updated Japanese standards. Non-compliance could lead to substantial penalties, including fines up to ¥1 million (approximately $6,500 USD as of July 2025) and reputational damage, impacting consumer trust and market share.

- Mandatory Nutrition Facts: Japan's updated food labeling laws require specific nutrient information, such as calories, protein, fat, carbohydrates, and sodium, to be clearly displayed on packaged foods.

- Claim Substantiation: Advertising claims related to health benefits or specific nutrient content must be backed by scientific data approved by regulatory bodies.

- Enforcement and Penalties: Violations can result in product recalls, fines, and public warnings, as seen in past cases where companies faced penalties for misleading health claims.

- Consumer Trust Impact: Adherence to these regulations is crucial for maintaining consumer confidence and brand reputation in the competitive Japanese food market.

Colowide must stay abreast of Japan's evolving food labeling laws, particularly those effective April 2024, which mandate clearer nutrition facts and restrict unsubstantiated health claims. Non-compliance risks fines up to ¥1 million (approx. $6,500 USD as of July 2025) and reputational damage.

The company's M&A activities require strict adherence to antitrust regulations, exemplified by the FTC's active scrutiny of large mergers in 2024, which led to blocked deals or divestitures. Thorough legal due diligence and sound contractual agreements are essential to mitigate risks and ensure seamless integration.

Colowide's operations are subject to Japan's stringent food safety and hygiene regulations, with recent amendments concerning take-home leftovers demanding meticulous compliance. Failure to meet these standards, as enforced by the Ministry of Health, Labour and Welfare, can lead to significant penalties, including fines and operational suspensions.

Navigating Japan's complex labor laws, covering working hours, overtime, and employee leave, is critical, especially with recent legislative changes impacting employment contracts. Diligent compliance is necessary to avoid legal challenges and uphold fair labor practices.

Environmental factors

Japan's commitment to reducing food waste, a significant environmental concern, directly impacts Colowide Co. The country aims to halve food loss by 2030, a target that necessitates proactive measures from businesses like Colowide. This national focus creates a landscape where efficient resource management is not just good practice, but a regulatory expectation.

Colowide must therefore integrate robust food waste reduction strategies across its entire value chain. This includes optimizing kitchen inventory and preparation to minimize spoilage, as well as encouraging customers to take home uneaten food. Such initiatives are crucial for aligning with Japan's environmental goals and maintaining a positive brand image.

In 2022, Japan's food loss was estimated at 5.22 million tons, with businesses accounting for 2.77 million tons of that figure. By implementing effective waste reduction, Colowide can not only contribute to this national effort but also potentially realize cost savings through improved operational efficiency.

Growing consumer and governmental pressure for eco-friendly practices is pushing companies like Colowide to prioritize sustainable sourcing. This means looking for ingredients that are produced with minimal environmental impact and can be traced back to their origin. For instance, in 2024, the global market for sustainable food and beverage ingredients was valued at over $150 billion, indicating a significant shift.

Colowide can leverage this trend by highlighting its commitment to plant-based and locally-sourced ingredients. This not only appeals to environmentally conscious consumers but also strengthens its brand image. Reports from 2025 show that brands with clear sustainability commitments saw a 10% higher customer loyalty rate compared to those without.

As a large restaurant operator, Colowide's energy use and carbon emissions are key environmental concerns. In 2023, the restaurant industry in the US alone accounted for a substantial portion of commercial building energy consumption, with many chains facing increasing pressure to reduce their environmental impact.

Adopting energy-saving measures, such as LED lighting and efficient kitchen equipment, can help Colowide lower its carbon footprint. For instance, many chains have reported significant energy savings, sometimes in the double digits, by upgrading to more efficient HVAC systems and kitchen appliances.

Exploring renewable energy, like solar power for its locations, presents another avenue for sustainability. By 2025, it's projected that renewable energy sources will play an even larger role in powering commercial operations, offering both environmental benefits and potential long-term cost reductions for companies like Colowide.

Packaging and Plastic Waste

Japan's upcoming 'positive list' system for food contact materials, starting in June 2025, will significantly impact Colowide Co. This new regulation, focusing on chemical composition in plastics and polymers, necessitates strict adherence for all food packaging. Colowide must proactively ensure its current packaging meets these stringent standards.

The shift towards stricter chemical regulations in Japan highlights a broader global trend concerning plastic waste. Colowide should prioritize exploring and adopting more eco-friendly and sustainable packaging alternatives. This not only ensures compliance but also aligns with growing consumer demand for reduced environmental impact.

- Regulatory Compliance: Japan's positive list system (effective June 2025) mandates specific chemical allowances in food packaging.

- Sustainability Focus: Colowide Co. needs to invest in and implement sustainable packaging solutions to mitigate plastic waste.

- Market Demand: Consumer preference for environmentally conscious products is increasing, making sustainable packaging a competitive advantage.

Climate Change Impact on Food Supply

Climate change poses a significant threat to the stability of Colowide's food supply chain. Extreme weather events, such as droughts and floods, directly impact agricultural yields, affecting the availability and cost of key ingredients. For instance, the U.S. Department of Agriculture (USDA) reported that in 2023, severe weather conditions led to an estimated 10% reduction in corn yields in certain key producing regions, a factor that could influence ingredient procurement for food manufacturers.

To mitigate these risks, Colowide should prioritize diversifying its sourcing strategies and investing in climate-resilient food production methods. This proactive approach is crucial for ensuring long-term operational resilience in the face of an increasingly unpredictable climate. The Food and Agriculture Organization of the United Nations (FAO) has highlighted that adopting drought-resistant crop varieties can improve yields by up to 20% in water-scarce areas, a tangible benefit for supply chain stability.

- Impact on Yields: Climate change-induced shifts in temperature and precipitation patterns can reduce crop yields, impacting the availability of essential food ingredients.

- Supply Chain Volatility: Increased frequency of extreme weather events can disrupt transportation and storage, leading to price fluctuations and shortages.

- Ingredient Availability: Certain ingredients may become scarce or prohibitively expensive due to climate-related production challenges, forcing adaptation in product formulations.

- Resilience Strategies: Exploring climate-resilient agriculture, such as precision farming and drought-tolerant crops, is vital for securing future ingredient supply.

Colowide Co. faces increasing scrutiny regarding its environmental footprint, particularly concerning food waste and carbon emissions. Japan's ambitious goal to halve food loss by 2030, with businesses contributing significantly to the 5.22 million tons lost in 2022, places direct pressure on the company to implement efficient waste reduction strategies. Furthermore, the restaurant industry's substantial energy consumption highlights the need for Colowide to adopt energy-saving measures and explore renewable energy sources by 2025, when their role in commercial operations is projected to expand.

The company must also navigate evolving regulations on food packaging, such as Japan's 'positive list' system effective June 2025, which dictates chemical allowances in food contact materials. This necessitates a proactive approach to adopting sustainable packaging solutions, aligning with a global trend where brands with clear sustainability commitments saw a 10% higher customer loyalty rate in 2025. Consumer demand for eco-friendly products is a significant driver, making sustainable sourcing and ingredient choices, valued at over $150 billion globally in 2024, a competitive advantage.

Climate change presents a tangible risk to Colowide's supply chain stability, with extreme weather events impacting agricultural yields. For instance, U.S. corn yields saw an estimated 10% reduction in 2023 due to severe weather. To counter this, Colowide should diversify sourcing and invest in climate-resilient agriculture, as drought-resistant crop varieties can improve yields by up to 20% in water-scarce regions, according to FAO data.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Colowide Co. is meticulously constructed using data from reputable sources including government economic reports, international trade organizations, and leading market research firms. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.