Cohort PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cohort Bundle

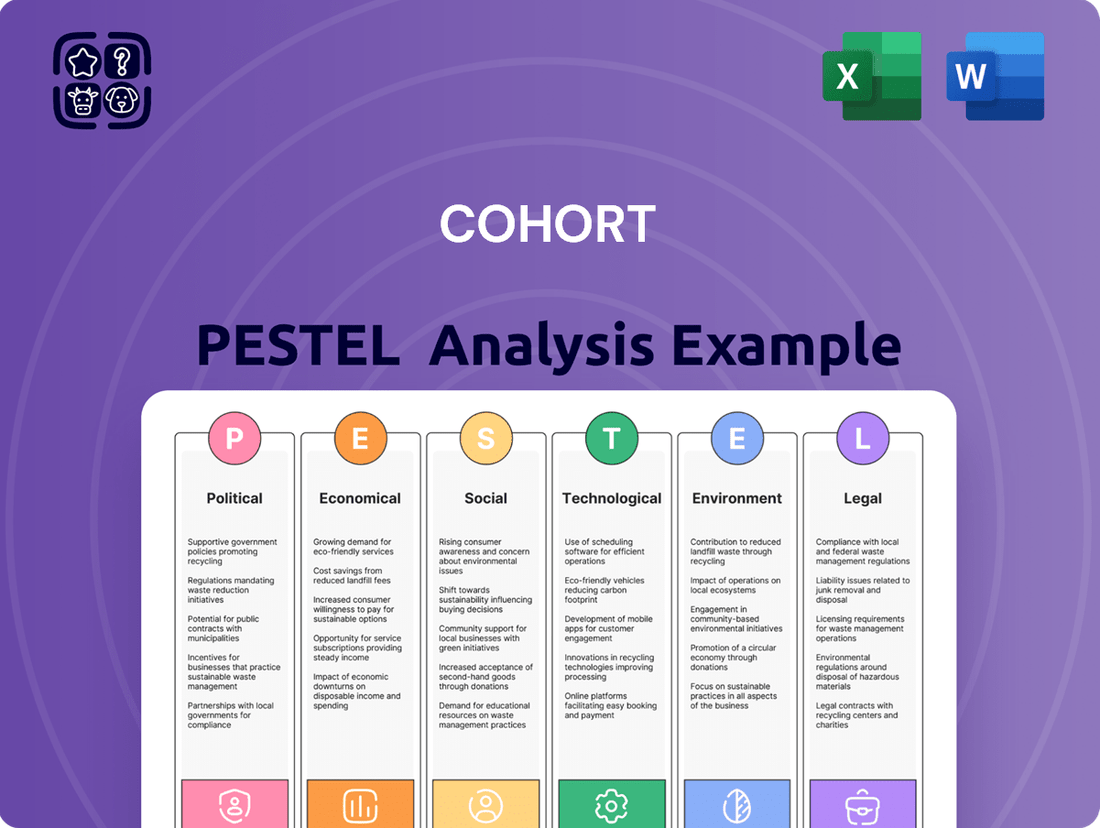

Navigate the complex external forces shaping Cohort's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that present both opportunities and challenges. Equip yourself with the strategic intelligence needed to make informed decisions and gain a competitive advantage. Download the full analysis now to unlock actionable insights.

Political factors

Government defense spending is a critical driver for Cohort plc. For instance, the UK's defense budget for 2024-2025 is projected at £57.5 billion, reflecting a commitment to national security that can translate into opportunities for Cohort's specialized offerings. Fluctuations in these budgets, influenced by geopolitical events and political priorities, directly shape the demand for Cohort's products and services.

Shifts in government policy, such as a renewed focus on cyber defense or naval modernization, can significantly alter Cohort's market landscape. For example, the US Department of Defense's FY2025 budget request highlights investments in advanced technologies, potentially benefiting Cohort's advanced engineering capabilities. Understanding these political undercurrents is key to anticipating market shifts and securing long-term contracts.

Rising geopolitical tensions, exemplified by the ongoing conflict in Eastern Europe and increased activity in the Indo-Pacific, are projected to drive significant growth in global defense spending. Estimates suggest the global defense market could reach approximately $800 billion by 2025, a notable increase from pre-2022 levels, directly impacting demand for Cohort plc's specialized technologies.

However, these same global dynamics introduce substantial risks, including potential supply chain disruptions for critical components and the imposition of export controls or sanctions. For instance, the semiconductor shortage experienced in 2023, partly exacerbated by geopolitical factors, highlighted the vulnerability of global tech supply chains, which could affect Cohort's manufacturing and delivery timelines.

The specific nature of international conflicts directly shapes market opportunities; for example, the emphasis on electronic warfare and intelligence, surveillance, and reconnaissance (ISR) capabilities in recent theaters of operation suggests a heightened demand for advanced solutions in these areas, aligning with Cohort's product portfolio.

International alliances and treaties significantly shape Cohort plc's global operations. Membership in organizations like NATO, for example, can create opportunities for defense contractors by standardizing equipment and fostering interoperability, as seen in the increased demand for compatible systems among member states. Conversely, arms control treaties can restrict market access for certain technologies, impacting sales volumes and requiring strategic adjustments to product portfolios.

National Security Policies

National security policies significantly influence the market for Cohort's offerings. For instance, a nation's focus on enhancing its cybersecurity posture, as seen in the EU's NIS2 Directive which aims to bolster cybersecurity resilience across critical sectors by 2024, directly increases demand for Cohort's advanced defense and intelligence solutions.

Governments prioritizing intelligence gathering and analysis, such as the United States' continued investment in its intelligence community, which saw an estimated $126 billion allocated to national intelligence programs in FY2024, create opportunities for Cohort's specialized subsidiaries. These policy directives shape the competitive landscape and can lead to the emergence of new market segments or a contraction in others, depending on the specific security challenges a nation chooses to address.

- Cybersecurity spending: Global cybersecurity spending is projected to reach $267.1 billion in 2024, up from $232.4 billion in 2023, highlighting a strong market driver for Cohort.

- Intelligence budgets: National intelligence budgets, like that of the US, represent substantial potential revenue streams for companies providing advanced analytical and technological solutions.

- Policy shifts: Changes in national security strategies, such as increased focus on AI in defense, can rapidly alter market demand for specific Cohort technologies.

Export Controls and Regulations

Cohort plc, operating in the defense and security sector, faces significant implications from export controls and regulations. These rules, often politically motivated or influenced by international relations, directly impact Cohort's ability to export sensitive technologies. For instance, the UK's Strategic Defence and Security Review (SDSR) often shapes the geopolitical landscape, influencing which nations are approved export destinations. In 2024, the ongoing geopolitical tensions, particularly concerning Eastern Europe and the Indo-Pacific, are likely to lead to stricter scrutiny and potential reclassifications of controlled technologies, demanding more rigorous compliance from Cohort.

Changes in these regulations can create substantial hurdles, potentially restricting market access and increasing the complexity and cost of international sales. Companies like Cohort must navigate intricate licensing processes, which can be time-consuming and uncertain. The evolving global security environment means that Cohort needs to remain agile, continuously adapting its compliance strategies to meet new or revised export control requirements. This adaptability is crucial for maintaining its competitive edge and global market presence.

Key considerations for Cohort regarding export controls include:

- Geopolitical Shifts: Monitoring international relations and political developments that could trigger new or amended export restrictions.

- Compliance Burden: Managing the increasing complexity and cost associated with obtaining and maintaining export licenses for sensitive technologies.

- Market Access: Assessing the impact of regulatory changes on Cohort's ability to serve key international defense markets.

- Technological Dual-Use: Understanding how regulations apply to technologies with both civilian and military applications, which often face stricter controls.

Government defense spending remains a primary driver for Cohort plc, with the UK's 2024-2025 defense budget set at £57.5 billion, indicating sustained investment in national security. Political shifts, such as increased focus on cyber defense and naval modernization, directly influence market demand for Cohort's advanced engineering solutions, as evidenced by the US Department of Defense's FY2025 budget request highlighting similar technological investments.

What is included in the product

This comprehensive PESTLE analysis examines the external macro-environmental forces impacting the Cohort, providing a strategic framework for understanding market dynamics and informing decision-making.

The Cohort PESTLE Analysis provides a clear, summarized version of complex external factors, making it easy to reference and discuss during strategic planning sessions, thus alleviating the pain of information overload.

Economic factors

Global defense spending is on an upward trajectory, driven by geopolitical tensions and a renewed focus on national security. For instance, the Stockholm International Peace Research Institute (SIPRI) reported that global military expenditure reached an estimated $2,443 billion in 2023, a 6.8% increase in real terms from 2022, marking the ninth consecutive year of growth.

This expansion directly impacts Cohort plc's market size, as increased government investment translates to greater potential for contracts in areas like naval, land, and aerospace systems. Economic prosperity in key nations often fuels these defense budgets, though government fiscal policies and national debt levels can also influence the pace and scale of defense investment.

Conversely, periods of economic downturn or austerity measures can lead to budget constraints, potentially reducing opportunities for defense contractors. Cohort plc must therefore closely monitor macroeconomic trends and fiscal policies within its primary operating regions to anticipate shifts in demand and contract availability.

Rising inflation presents a significant challenge for Cohort plc, potentially increasing the cost of essential raw materials, components, and labor. This directly impacts profit margins, especially on existing fixed-price contracts. For instance, the UK's Consumer Price Index (CPI) stood at 2.3% in April 2024, a slight decrease from previous months but still a factor in escalating input costs.

Effective supply chain management and the negotiation of adaptable contracts are crucial for Cohort to safeguard profitability. This includes building in clauses that allow for potential cost escalations, ensuring that unexpected price hikes don't erode margins. The company must also monitor global commodity prices closely, as these directly influence material expenses.

Wage inflation, particularly within specialized engineering and technology fields, poses another substantial concern. The UK faced a shortage of skilled engineers in 2023, driving up average salaries in the sector. Cohort needs to strategically manage its compensation packages to attract and retain top talent amidst this competitive landscape.

Operating globally, Cohort plc faces risks from currency exchange rate fluctuations. For instance, in the fiscal year ending March 31, 2024, the company reported that significant movements in exchange rates, particularly against the US Dollar and Euro, could impact the translation of its overseas earnings and expenses. A stronger Pound Sterling, for example, would reduce the value of revenues earned in foreign currencies when converted back to GBP, potentially affecting profit margins on contracts denominated in those currencies.

The impact of these fluctuations is particularly pronounced for long-term contracts. If Cohort plc secures a contract priced in US Dollars, and the Pound Sterling strengthens considerably against the Dollar over the contract's life, the realized GBP value of those payments will be lower than initially anticipated. This can directly erode profitability, as seen in past reporting periods where currency headwinds have been noted as a contributing factor to margin pressure.

To manage this exposure, Cohort plc employs hedging strategies. These can involve financial instruments like forward contracts or options to lock in exchange rates for future transactions. For example, if the company anticipates significant US Dollar revenue in the coming months, it might enter into forward contracts to sell those dollars at a predetermined GBP rate, thereby mitigating the risk of a depreciating Dollar or appreciating Pound.

Government Austerity Measures

Government austerity measures, often enacted during periods of economic strain or high national debt, can directly impact defense sector spending. For instance, in the UK, the 2021 Spending Review saw defense budgets maintained in real terms but faced scrutiny for efficiency savings. This means Cohort plc, a defense contractor, might encounter fewer large-scale contracts as public funds are reallocated or reduced.

These fiscal constraints necessitate a strategic response from companies like Cohort. They may need to intensify their efforts to secure existing contracts or explore new markets and customer segments beyond traditional government defense spending. The agility to adapt to shifting public finances is crucial for sustained success in this environment.

- Reduced Public Spending: Austerity can lead to direct cuts in defense budgets, shrinking the pool of available contracts.

- Increased Competition: With fewer opportunities, companies like Cohort plc face heightened competition for available defense work.

- Need for Diversification: Companies may need to explore non-defense sectors or international markets to mitigate the impact of domestic austerity.

- Focus on Efficiency: Governments implementing austerity often demand greater value and efficiency from their suppliers, pushing contractors to optimize operations.

Research and Development Funding

Government and private sector funding for defense-related research and development is a critical driver for Cohort plc's innovation. For instance, in the United States, the Department of Defense's R&D budget for fiscal year 2024 was projected at $145.8 billion, indicating significant investment in advanced technologies. This level of expenditure directly influences the pace of new product development and the availability of cutting-edge solutions for companies like Cohort.

Economic downturns can lead to substantial cuts in R&D investment, directly impacting Cohort's ability to develop next-generation technologies. For example, during periods of fiscal austerity, government defense budgets might be reallocated, potentially slowing down the introduction of new capabilities. This slowdown could erode Cohort's competitive advantage if rivals continue to invest heavily in their innovation pipelines.

Access to capital for internal R&D is equally vital for Cohort plc's sustained growth and market position. Companies rely on a healthy financial standing and favorable economic conditions to allocate sufficient resources to their own research initiatives. The ability to secure external funding or maintain strong internal cash flows directly correlates with the success of developing and bringing to market advanced defense technologies.

Key factors influencing R&D funding for Cohort plc include:

- Government Defense Budgets: Global defense spending trends significantly influence R&D investment. For example, NATO nations are increasing their defense spending, with many aiming to meet or exceed the 2% of GDP target, which can translate to more R&D opportunities.

- Private Sector Investment: Venture capital and private equity funding into defense technology startups and established players is a crucial indicator of innovation momentum.

- Economic Growth and Stability: Periods of strong economic growth often correlate with increased R&D budgets, while recessions can trigger budget contractions.

- Technological Advancements: The rapid evolution of technologies like AI, cyber, and advanced materials necessitates continuous R&D investment to remain competitive.

Economic growth directly fuels increased defense spending, as nations with robust economies can allocate more resources to national security. Conversely, economic slowdowns or recessions often lead to budget tightening, impacting Cohort plc's revenue potential. For instance, the International Monetary Fund (IMF) projected global growth to be around 3.2% in 2024, a moderate but positive outlook that could support defense budgets.

Inflationary pressures, as seen with the UK's CPI at 2.3% in April 2024, increase operational costs for Cohort plc, affecting raw materials, components, and labor expenses. This necessitates careful contract negotiation and supply chain management to protect profit margins. Wage inflation, particularly for skilled engineers, remains a challenge in attracting and retaining talent.

Currency fluctuations pose a risk, with movements against the US Dollar and Euro impacting Cohort's overseas earnings. Effective hedging strategies are crucial to mitigate these financial risks. Government austerity measures can also reduce defense spending, requiring Cohort to be agile and potentially seek diversification.

| Economic Factor | Impact on Cohort plc | Supporting Data/Trend (2024/2025) |

| Global Economic Growth | Supports increased defense budgets and potential for new contracts. | Projected global growth of 3.2% in 2024 (IMF). |

| Inflation | Increases operational costs (materials, labor), potentially squeezing profit margins. | UK CPI at 2.3% in April 2024; ongoing global inflationary pressures. |

| Currency Exchange Rates | Affects the value of overseas earnings and expenses when translated. | Significant fluctuations observed against USD and EUR; hedging strategies employed. |

| Government Fiscal Policy/Austerity | Can lead to reduced defense spending and fewer contract opportunities. | Continued scrutiny on public spending and efficiency savings in defense sectors. |

Same Document Delivered

Cohort PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use for your Cohort PESTLE Analysis.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises for your Cohort PESTLE Analysis.

The content and structure shown in the preview is the same document you’ll download after payment, providing a comprehensive Cohort PESTLE Analysis.

Sociological factors

Public sentiment regarding defense and security companies significantly impacts Cohort plc. Societal concerns about the ethical implications of advanced technologies, such as autonomous weapons or widespread surveillance, can shape public trust and influence government procurement decisions. For instance, a 2024 Pew Research Center study indicated that while public support for defense spending remains, there's growing unease about the ethical deployment of AI in warfare, with 58% of respondents expressing concern.

The defense and technology sectors, crucial for Cohort plc, demand specialized expertise in areas like advanced engineering, cybersecurity, and intelligence analysis. The ability to secure and keep highly skilled individuals directly fuels Cohort's capacity for innovation and smooth operations.

Demographic trends, the effectiveness of educational institutions in producing graduates with relevant skills, and intense competition from other tech-focused industries all play a significant role in shaping both the availability and the overall cost of this essential skilled workforce. For instance, in 2024, the UK faced a projected shortage of around 175,000 cybersecurity professionals, a figure that directly impacts companies like Cohort needing such expertise.

The ethical implications of Cohort's advanced defense technologies, particularly in surveillance and electronic warfare, are under intense public and governmental scrutiny. Concerns about data privacy and human rights are paramount, influencing how these technologies are regulated and accepted. For instance, the ongoing debate around the ethical deployment of AI in autonomous weapons systems, a field Cohort operates within, directly impacts market demand and regulatory approval processes globally.

Societal Impact of Cyber Threats

Societal reliance on digital systems is escalating, making cybersecurity a paramount concern. This heightened awareness directly fuels demand for Cohort plc's specialized cyber security solutions, as individuals and organizations alike seek robust protection. For instance, a 2024 report indicated that cybercrime costs are projected to reach $10.5 trillion annually by 2025, underscoring the critical need for effective defense mechanisms.

This increasing vulnerability creates a significant market opportunity for Cohort, but it also imposes stringent expectations. The public and governments alike anticipate that Cohort's technologies will reliably safeguard essential services and sensitive personal information. Failure to meet these expectations could have severe societal repercussions, impacting trust and national security.

- Growing Demand: Global spending on cybersecurity is expected to exceed $230 billion in 2024, reflecting the urgent societal need.

- High Expectations: Societies now demand near-perfect reliability from cybersecurity providers to protect critical infrastructure.

- Reputational Risk: Breaches in critical sectors, like healthcare or energy, could severely damage a provider's reputation and lead to significant financial penalties.

Corporate Social Responsibility (CSR) Expectations

Societal expectations around corporate social responsibility are significantly shaping business landscapes. Consumers and investors alike are increasingly scrutinizing companies based on their ethical conduct and environmental impact. For instance, a 2024 survey by Edelman found that 72% of consumers believe companies have a responsibility to address societal issues, a figure that has steadily climbed over the past few years.

These expectations translate into tangible demands for businesses like Cohort plc. This includes ensuring ethical sourcing throughout their supply chains, upholding fair labor practices, actively engaging with local communities, and demonstrating robust environmental stewardship. Companies that fail to meet these evolving standards risk reputational damage and loss of market share.

Conversely, strong CSR performance can be a significant competitive advantage. Cohort plc can expect that prioritizing these standards will not only bolster its public image but also prove instrumental in attracting and retaining top talent. Furthermore, cultivating positive relationships with stakeholders and clients, who are themselves prioritizing responsible business practices, can lead to increased loyalty and new opportunities.

- Consumer Demand for Ethical Practices: A 2024 Accenture report indicated that 66% of consumers globally are willing to pay more for sustainable brands, highlighting a direct financial incentive for CSR.

- Investor Scrutiny: ESG (Environmental, Social, and Governance) investing continued its upward trajectory in 2024, with global ESG assets projected to reach $50 trillion by 2025, demonstrating the financial sector's focus on responsible business.

- Talent Acquisition: Studies in late 2023 and early 2024 consistently show that a company's commitment to social and environmental causes is a key factor for job seekers, particularly among younger generations.

- Supply Chain Transparency: Growing pressure from regulators and consumers alike means companies are increasingly held accountable for the practices of their entire supply chain, demanding greater transparency and ethical oversight.

Societal views on technology's role in defense are evolving, with public opinion playing a crucial part in shaping procurement and ethical guidelines for companies like Cohort plc. Growing concerns about data privacy and the implications of advanced surveillance technologies, for example, are increasingly influencing regulatory frameworks and market acceptance.

The demand for skilled professionals in areas like cybersecurity and advanced engineering remains high, directly impacting Cohort's operational capacity and innovation potential. A 2024 report highlighted a significant deficit in cybersecurity talent in the UK, underscoring the competitive landscape for securing essential expertise.

Public trust in defense contractors is closely tied to perceptions of their ethical conduct and the societal impact of their products. Instances of cybercrime costing trillions annually by 2025 emphasize the critical need for robust security solutions, creating both opportunities and high expectations for companies like Cohort.

Societal expectations for corporate social responsibility are intensifying, with consumers and investors increasingly favoring businesses that demonstrate strong ethical and environmental performance. This trend is reflected in the growing ESG investment market, projected to reach $50 trillion by 2025, influencing company valuations and strategic decisions.

Technological factors

The defense sector is witnessing an unprecedented surge in technological innovation, with advancements in artificial intelligence, machine learning, quantum computing, and novel materials rapidly reshaping capabilities. Cohort plc must maintain a robust commitment to research and development, allocating significant resources to stay ahead of these transformative trends and ensure its offerings remain competitive.

For instance, the global defense technology market was valued at approximately $270 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 5% through 2030, driven by these very innovations. Failure to invest strategically in R&D could render Cohort's products obsolete, impacting its market position and ability to secure future contracts.

The cybersecurity threat landscape is a constantly shifting battlefield. In 2024, we're seeing an alarming rise in AI-powered attacks, making phishing and malware more sophisticated than ever. This means companies like Cohort, which offer cybersecurity solutions, must constantly innovate to stay ahead.

The increasing complexity of threats directly impacts Cohort plc's cybersecurity and intelligence services. As attackers develop novel methods, Cohort needs to perpetually enhance its defensive and offensive capabilities to deliver state-of-the-art solutions. This dynamic environment demands continuous investment in research and development, as well as the recruitment of top-tier cybersecurity talent.

The financial implications are significant. Global spending on cybersecurity is projected to reach $250 billion in 2024, according to Gartner. For Cohort, this presents both a challenge and an opportunity, requiring substantial R&D budgets to maintain a competitive edge in offering advanced threat detection and response.

Cohort plc's ability to integrate cutting-edge technologies like AI and advanced sensors into defense systems is paramount. This integration directly impacts the effectiveness of electronic warfare, surveillance, and communication solutions. For instance, in 2024, defense spending on AI-driven systems saw a significant uptick, with projections indicating continued growth through 2025, underscoring the market's demand for such capabilities.

The company's success hinges on its proficiency in merging these disparate technologies to deliver robust and efficient defense platforms. By seamlessly combining AI for data analysis with advanced sensors for enhanced situational awareness, Cohort can offer superior value and performance to its clients. This technological synergy is a key differentiator in a competitive landscape.

Obsolescence of Legacy Systems

Many defense and security clients are still reliant on aging legacy systems, creating a substantial market need for modernization and replacement. This situation offers Cohort plc a significant opportunity to provide crucial upgrades, seamless integration services, and cutting-edge technology solutions. For example, the UK Ministry of Defence alone has a significant backlog of legacy equipment requiring upgrades, with some estimates suggesting billions of pounds are needed for modernization efforts over the next decade.

Managing the lifecycle of Cohort's own product portfolio becomes critical in this environment. The company must balance the drive for innovation with the practical necessity of ensuring compatibility with both existing older client infrastructures and emerging new technologies. This ensures Cohort can effectively serve its diverse client base.

- Opportunity: Significant demand for modernization of defense legacy systems.

- Challenge: Ensuring Cohort's products are compatible with both old and new client systems.

- Market Context: Billions of pounds allocated by governments for defense equipment modernization.

- Strategic Imperative: Balancing innovation with the practicalities of legacy system integration.

Technological Convergence and Dual-Use

The merging of military and commercial technologies, often termed technological convergence, presents a significant dynamic for Cohort plc. This trend means that innovations developed for defense can find applications in the civilian sector, and vice versa. For instance, advancements in AI for autonomous drones in defense could be adapted for logistics or agricultural monitoring. This cross-pollination can accelerate product development and open up entirely new revenue streams.

The rise of dual-use technologies, which serve both defense and commercial purposes, is a key aspect of this convergence. Cohort's strategic planning must account for this duality. While it offers opportunities for broader market penetration and leveraging R&D across sectors, it also introduces regulatory hurdles. Export controls and the management of intellectual property rights become more intricate when a single technology has applications in sensitive defense areas and open commercial markets. For example, advanced materials or cybersecurity solutions developed for military use might face strict export licensing requirements before they can be sold commercially, impacting global sales strategies.

This technological landscape is already showing tangible effects. In 2024, the global market for dual-use technologies was estimated to be worth hundreds of billions of dollars, with significant growth projected in areas like artificial intelligence, advanced manufacturing, and cybersecurity. Cohort's ability to navigate these converging technological streams will be crucial for its competitive edge.

- Market Expansion: Dual-use technologies allow Cohort to tap into both defense and commercial markets, potentially increasing its addressable market size.

- Innovation Synergies: Cross-sectoral collaboration can foster rapid innovation, as R&D investments in one area can yield benefits in another.

- Regulatory Complexity: Managing export controls and intellectual property for dual-use items requires robust compliance frameworks and strategic legal counsel.

- Competitive Landscape: Competitors are also leveraging this convergence, necessitating a proactive approach to technology adoption and market positioning.

Technological factors are rapidly transforming the defense sector, with AI, quantum computing, and advanced materials driving innovation. Cohort plc must invest heavily in R&D to remain competitive, as the global defense technology market is projected to grow significantly. Cybersecurity threats are also escalating, requiring continuous innovation in defense solutions.

The integration of AI and advanced sensors into defense systems is crucial for effectiveness in areas like electronic warfare and surveillance. This trend is supported by increasing defense spending on AI-driven systems, highlighting a strong market demand for these capabilities. Cohort's success depends on its ability to merge these technologies effectively.

Many legacy defense systems require modernization, presenting a substantial opportunity for Cohort to offer upgrades and new technologies. This necessitates balancing innovation with the practical need for compatibility with existing client infrastructures. The market context shows billions allocated for defense equipment modernization, emphasizing the strategic importance of this integration.

The convergence of military and commercial technologies, or dual-use technologies, offers significant market expansion and innovation synergies for Cohort. However, this also introduces regulatory complexities like export controls, which require careful management. The dual-use technology market is substantial and growing, making navigation of this convergence critical for competitive advantage.

| Technology Area | 2024 Market Value (Est.) | Projected CAGR (to 2030) | Impact on Cohort |

|---|---|---|---|

| Defense Technology | $283.5 billion | 5%+ | Necessitates continuous R&D investment. |

| Cybersecurity | $250 billion | N/A | Requires constant innovation against evolving threats. |

| AI in Defense Systems | N/A (Significant Growth) | N/A | Key for enhancing system effectiveness and competitiveness. |

| Dual-Use Technologies | Hundreds of billions | Significant Growth | Offers market expansion but requires regulatory navigation. |

Legal factors

Defense procurement regulations significantly shape Cohort plc's operational landscape. These rules govern everything from bidding processes to contract specifics and compliance mandates, directly influencing market access and profitability. For instance, the UK Ministry of Defence, a key customer, adheres to stringent procurement frameworks designed to ensure value for money and national security.

Changes in these procurement laws, whether national or international, can introduce substantial shifts. These alterations might affect Cohort's capacity to win new contracts, potentially increasing the expenses associated with regulatory adherence. In 2024, the global defense market saw continued emphasis on sovereign capability, meaning countries are increasingly looking to bolster domestic defense industries, which could alter procurement priorities and favor local suppliers.

Cohort plc, as a provider of defense and security technologies, navigates a complex landscape of export control laws and international sanctions. These regulations, enforced by governments worldwide, govern the sale and transfer of sensitive technologies, necessitating rigorous adherence and obtaining specific licenses for international transactions. For instance, the UK's Strategic Defence and Security Export Controls framework requires detailed oversight of all exports.

The dynamic nature of these legal frameworks presents a significant factor for Cohort. Changes in export regulations or the imposition of new sanctions by key trading partners, such as the United States or European Union member states, can directly influence Cohort's ability to access global markets and execute its international sales strategies. This regulatory environment requires continuous monitoring and adaptation to ensure ongoing compliance and mitigate potential disruptions to business operations.

Cohort plc operates in a landscape increasingly shaped by stringent data protection and privacy laws. Given its focus on cyber security and intelligence advisory, the company handles a significant amount of sensitive client information, making compliance with regulations like the EU's General Data Protection Regulation (GDPR) and various national security data acts paramount.

Failure to adhere to these evolving legal frameworks can result in severe penalties. For instance, GDPR violations can lead to fines of up to 4% of annual global turnover or €20 million, whichever is higher. Beyond financial repercussions, non-compliance poses a substantial risk to Cohort's reputation and client trust, which are critical assets in the intelligence and security sectors.

To navigate this, Cohort must maintain and continuously update its data handling and security protocols. This includes implementing robust measures for data collection, storage, processing, and transfer, ensuring transparency with clients about data usage. Staying ahead of legislative changes is key to mitigating risks and fostering continued business operations.

Intellectual Property Rights Protection

Protecting its intellectual property (IP) is paramount for Cohort plc, especially given its reliance on advanced technology. The legal frameworks surrounding patents, trademarks, and copyrights are essential for shielding its innovations from unauthorized use and imitation. For instance, a strong patent portfolio can prevent competitors from replicating Cohort's unique technological solutions, thereby maintaining its market edge.

Changes in intellectual property laws or the effectiveness of their enforcement in Cohort's primary markets directly influence its competitive standing and its capacity to generate revenue from its proprietary technologies. For example, in 2024, the World Intellectual Property Organization (WIPO) reported an 8.1% increase in international patent filings, highlighting the growing importance of IP protection globally. Weakened enforcement in a key region could expose Cohort's innovations to infringement, potentially eroding its market share and profitability.

- Patent Protection: Securing patents for its core technologies is critical to prevent competitors from reverse-engineering and selling similar products.

- Trademark Safeguarding: Cohort's brand names and logos are protected through trademarks, ensuring brand recognition and preventing consumer confusion.

- Copyright for Software and Designs: Software code, technical drawings, and other creative works are protected by copyright, preventing unauthorized duplication.

- Enforcement Effectiveness: The ability to legally enforce IP rights against infringers is a key factor in maintaining competitive advantage and deterring piracy.

Cybersecurity Regulations and Standards

Governments worldwide are tightening cybersecurity regulations, especially for sectors like critical infrastructure and defense. For Cohort plc, this means staying compliant with evolving mandates that can cover everything from data protection protocols to how quickly security breaches must be reported. For instance, the NIST Cybersecurity Framework, widely adopted by US federal agencies and increasingly by private sector partners, sets a benchmark for security practices.

These regulations directly impact Cohort plc's operations, potentially requiring significant investment in security infrastructure and personnel training. Failure to comply can lead to hefty fines, loss of business opportunities, and damage to reputation. In 2024, the European Union's NIS2 Directive expanded cybersecurity obligations to a broader range of entities, highlighting the global trend towards more stringent requirements.

- Regulatory Landscape: Increasing government focus on cybersecurity mandates for critical sectors.

- Compliance Demands: Need to adhere to specific security protocols, incident reporting, and supply chain standards.

- Contractual Eligibility: Compliance is often a prerequisite for securing government and defense contracts.

- Client Trust: Demonstrating adherence to robust security standards builds confidence in Cohort's offerings.

Legal factors significantly influence Cohort plc's operations, particularly concerning defense procurement and export controls. Adherence to national and international regulations, such as the UK Ministry of Defence's procurement frameworks and global export control laws, is critical for market access and compliance. The increasing global emphasis on sovereign capabilities in 2024 means defense procurement priorities may shift, potentially favoring local suppliers.

Data protection and intellectual property (IP) laws also present key legal considerations for Cohort. Strict compliance with regulations like GDPR, with potential fines up to 4% of annual global turnover, is essential for maintaining client trust and reputation. The World Intellectual Property Organization reported an 8.1% increase in international patent filings in 2024, underscoring the growing importance of robust IP protection strategies for technology-driven companies like Cohort.

Cybersecurity regulations are also tightening globally, impacting Cohort plc's need to comply with evolving mandates. The EU's NIS2 Directive, expanded in 2024, exemplifies this trend, requiring broader adherence to security protocols and incident reporting. Compliance is often a prerequisite for securing defense contracts and maintaining client confidence.

Environmental factors

Cohort plc's manufacturing operations, though not typically in heavy industry, face environmental regulations concerning waste, emissions, and resource use. For instance, the UK's Environmental Permitting Regulations 2016 (as amended) govern emissions and waste management for many industrial activities, potentially impacting Cohort's facilities.

Stricter environmental laws could increase operational expenses, necessitating investments in cleaner technologies or more sustainable methods to ensure compliance and maintain competitiveness. The EU's proposed Carbon Border Adjustment Mechanism (CBAM), for example, could indirectly affect supply chains and manufacturing costs for companies operating within or trading with the EU, even if Cohort isn't directly exporting carbon-intensive goods.

Clients and stakeholders are increasingly pushing for environmental responsibility across the entire supply chain. This means Cohort plc might need to ensure its suppliers meet strict environmental standards, actively reduce their carbon emissions, and prioritize materials that are sourced ethically and sustainably.

Meeting these demands could necessitate more rigorous supplier audits and the adoption of greener procurement strategies. For instance, a 2024 report indicated that 75% of consumers consider sustainability a key factor in purchasing decisions, directly influencing corporate supply chain expectations.

Implementing these changes may lead to increased operational costs and potentially alter existing supplier relationships. However, proactive engagement can also foster innovation and build resilience, as seen with companies that have invested in circular economy principles, reporting an average 15% reduction in waste-related expenses by 2025.

Climate change is now a significant national security concern, directly impacting defense strategies and infrastructure resilience. This shift presents Cohort plc with opportunities to provide climate adaptation technologies for defense clients, including advanced weather monitoring systems and robust communication networks designed for extreme conditions.

The increasing frequency and intensity of climate-related events, such as the projected rise in global average temperatures and more severe weather patterns, are forcing defense organizations to reassess their operational environments and asset protection. For instance, the U.S. Department of Defense’s 2022 Climate Adaptation Plan highlights the need for infrastructure upgrades to withstand rising sea levels and extreme heat, indicating a substantial market for innovative solutions.

Carbon Footprint and Emissions Reduction

Cohort plc, like many businesses, is under increasing pressure from both society and regulators to shrink its carbon footprint and cut greenhouse gas emissions. This translates into a need to improve how efficiently energy is used in its operations, shift towards renewable energy sources, and minimize the environmental impact of business travel.

For Cohort, actively working on reducing emissions isn't just about compliance; it's a strategic move. A strong commitment to sustainability can significantly boost the company's public image and resonate with the environmental objectives of its key government clients. For instance, the UK government has set ambitious targets, aiming for a net-zero economy by 2050, which directly influences procurement decisions and supplier expectations.

In 2024, many defense and security sectors are prioritizing suppliers with clear environmental, social, and governance (ESG) strategies. Cohort's efforts in this area could be a competitive advantage. While specific emissions data for Cohort's 2024 operations might not be publicly detailed yet, industry trends show a growing emphasis on Scope 1, 2, and 3 emissions reporting. Companies are increasingly disclosing their energy consumption and renewable energy adoption rates.

- Regulatory Landscape: Governments worldwide, including the UK, are implementing stricter environmental regulations and carbon pricing mechanisms, impacting operational costs and strategic planning.

- Client Expectations: Defense and government clients are increasingly incorporating ESG criteria into their procurement processes, favoring suppliers with demonstrable sustainability commitments.

- Operational Efficiency: Investments in energy-efficient technologies and renewable energy sources can lead to long-term cost savings and reduced reliance on fossil fuels.

- Reputational Impact: A proactive approach to emissions reduction enhances brand image and stakeholder trust, potentially attracting talent and investment.

Resource Scarcity and Material Sourcing

The availability and cost of critical raw materials, like those used in advanced defense technologies, are increasingly influenced by environmental pressures and geopolitical dynamics. For instance, concerns over the environmental impact of mining rare earth elements, crucial for sophisticated electronics, can lead to supply chain volatility. In 2024, the global supply of certain critical minerals faced disruptions due to stricter environmental regulations in key producing nations, pushing up prices for specialized electronic components by an average of 8-12%.

Cohort plc must proactively address the environmental footprint of its material sourcing strategies. Ensuring supply chain resilience against potential disruptions stemming from resource limitations or evolving environmental regulations is paramount. For example, a 2025 forecast by the International Energy Agency highlights that demand for lithium and cobalt, essential for battery technologies in defense applications, could outstrip current production capacity by as much as 20% if new extraction projects face significant environmental permitting delays.

Key considerations for Cohort plc include:

- Assessing the environmental impact of mining and processing for critical materials.

- Diversifying sourcing locations to mitigate geopolitical and resource scarcity risks.

- Investing in material science research to identify and utilize more sustainable alternatives.

- Building robust inventory management systems to buffer against short-term supply shocks.

Environmental factors significantly shape Cohort plc's operational landscape, driven by tightening regulations and evolving client expectations for sustainability. Stricter compliance, such as the UK's Environmental Permitting Regulations, can increase costs, necessitating investments in cleaner technologies. Moreover, the growing demand for environmentally responsible supply chains, with 75% of consumers prioritizing sustainability in 2024, pushes Cohort to ensure its suppliers meet rigorous standards.

Climate change presents both challenges and opportunities, impacting defense strategies and infrastructure resilience. Cohort can capitalize on this by offering climate adaptation technologies, as the U.S. Department of Defense's 2022 plan highlights the need for infrastructure upgrades against extreme weather. The company faces pressure to reduce its carbon footprint, aligning with the UK's net-zero by 2050 target, which influences procurement decisions and supplier demands.

The availability and cost of critical raw materials are increasingly influenced by environmental pressures. For instance, concerns over the environmental impact of mining rare earth elements led to an 8-12% price increase for specialized electronic components in 2024. Forecasts for 2025 suggest demand for lithium and cobalt could outstrip production by 20% due to environmental permitting delays, underscoring the need for Cohort to diversify sourcing and explore sustainable alternatives.

| Environmental Factor | Impact on Cohort plc | Data/Trend (2024-2025) |

|---|---|---|

| Regulatory Compliance | Increased operational costs, need for cleaner tech investment | UK Environmental Permitting Regulations (amended 2016) |

| Client & Stakeholder Expectations | Pressure for supply chain sustainability, supplier audits | 75% of consumers consider sustainability in purchasing (2024) |

| Climate Change Adaptation | Opportunities in climate adaptation tech for defense | US DoD Climate Adaptation Plan (2022) |

| Carbon Footprint Reduction | Need for energy efficiency, renewables, reduced business travel | UK Net-Zero target by 2050 |

| Raw Material Sourcing | Supply chain volatility, price increases for critical minerals | 8-12% price increase for specialized electronics (2024) |

| Future Material Demand | Potential supply shortages for battery materials | Lithium/cobalt demand may exceed capacity by 20% (2025 forecast) |

PESTLE Analysis Data Sources

Our Cohort PESTLE Analysis is meticulously constructed using a blend of official government statistics, reputable market research reports, and academic publications. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting our target cohort.