Cohort Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cohort Bundle

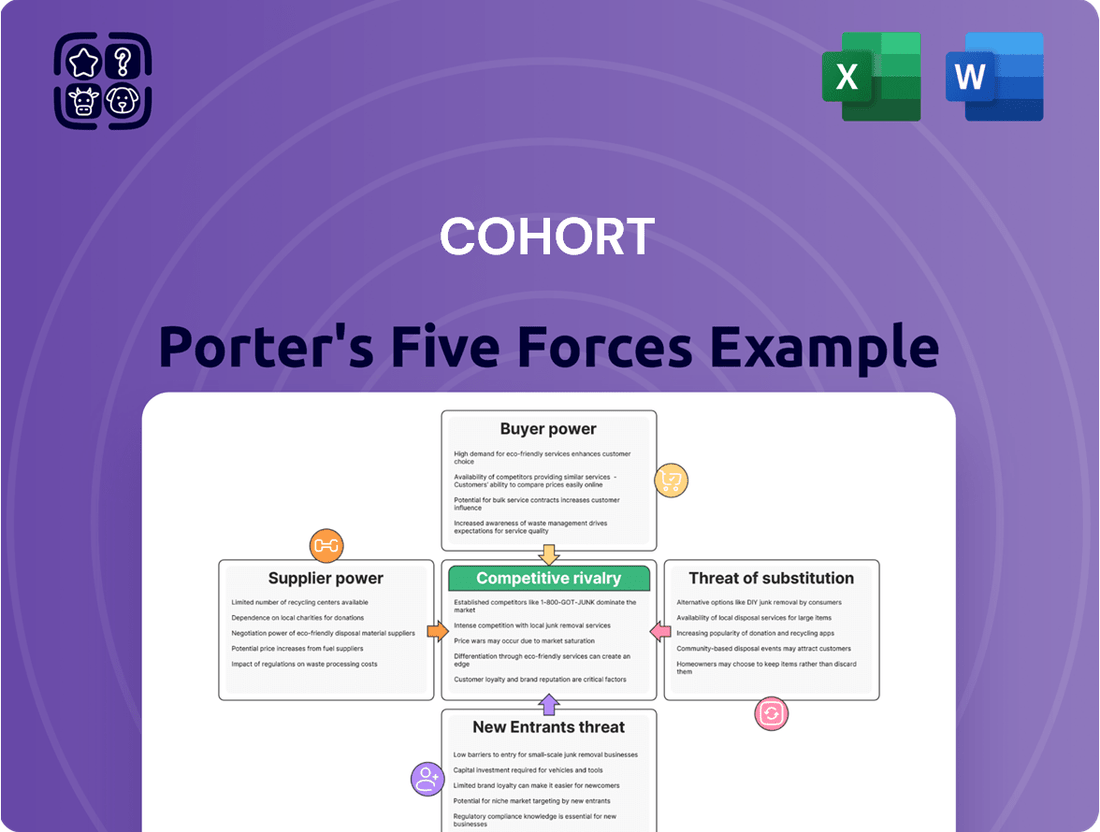

Our Porter's Five Forces analysis of Cohort reveals the intricate web of competitive pressures shaping its market. We've explored the power of buyers, the threat of new entrants, and the intensity of rivalry, offering a foundational understanding of Cohort's landscape.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Cohort’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Cohort plc's reliance on specialized components in the defense and security sectors significantly amplifies supplier bargaining power. Many of these critical inputs, from advanced materials to unique software, are not readily available from multiple sources, often originating from a select few providers with proprietary technology.

This scarcity means suppliers can dictate terms, as Cohort, and its peers, cannot easily substitute these bespoke elements. For instance, in 2024, the defense industry continued to see lead times for specialized electronic components extend, pushing up costs due to high demand and limited manufacturing capacity among key suppliers.

Suppliers possessing proprietary technology or exclusive intellectual property vital for Cohort's product development wield significant bargaining power. This exclusivity restricts Cohort's choices, fostering reliance on specific suppliers for crucial components or processes.

For instance, if a supplier holds patents for a unique chip design essential for Cohort's next-generation devices, they can dictate terms. In 2024, the semiconductor industry saw continued consolidation, with a few key players dominating advanced manufacturing processes, further amplifying the power of suppliers with specialized IP.

This dependency can lead to increased costs for Cohort due to limited alternatives and potentially less favorable contract negotiations. Companies that cannot secure access to these proprietary technologies may face production delays or be forced to accept higher prices, impacting their overall profitability and competitive edge.

Changing suppliers for mission-critical defense systems, like advanced radar components or specialized avionics, incurs massive costs. These include the expenses of redesigning existing systems, undergoing rigorous re-certification processes, and conducting extensive, time-consuming testing to ensure compatibility and performance. For instance, a delay in a major defense program due to supplier issues can cost taxpayers millions, if not billions, in extended development and operational readiness timelines.

The sheer volume of time and resources needed to validate a new supplier within the defense sector is immense. This lengthy and complex process, often involving multiple government agencies and stringent quality assurance protocols, makes it exceedingly difficult for companies like Cohort to switch even when facing less favorable pricing or terms. This inherent inertia significantly bolsters the bargaining power of existing, trusted suppliers who have already navigated these hurdles.

Supplier Concentration and Market Dominance

In specialized segments of the defense sector, a limited number of suppliers might hold the exclusive expertise or manufacturing capacity. This concentration means Cohort faces few alternatives, allowing these suppliers to exert significant influence over pricing and contract terms. For instance, in 2024, the global defense market saw continued consolidation, with key component suppliers in areas like advanced avionics and specialized materials often operating with a small number of competitors.

When suppliers are highly concentrated, their bargaining power escalates. This is particularly true for Cohort if it relies on unique or proprietary technologies that only a handful of firms can provide. The lack of competitive pressure among these suppliers translates directly into their ability to command higher prices and impose less favorable terms on Cohort.

- Supplier Concentration: In niche defense markets, a small number of specialized suppliers can dominate, limiting options for prime contractors like Cohort.

- Market Dominance: Highly concentrated suppliers can leverage their market position to dictate pricing and terms, increasing costs for Cohort.

- Lack of Alternatives: When viable substitutes are scarce, Cohort's dependence on these few suppliers significantly weakens its negotiating position.

- Impact on Cohort: This supplier power can directly affect Cohort's profitability and operational flexibility, especially for critical components or specialized services.

Importance of Supplier Relationships and Long-Term Contracts

Building and maintaining strong relationships with key suppliers is paramount in the defense industry, frequently resulting in long-term contracts. These agreements, while offering stability, can inadvertently grant suppliers significant leverage, particularly when Cohort becomes reliant on specialized components or services. For instance, a prolonged contract for a critical electronic warfare system component might limit Cohort's ability to renegotiate terms even if market conditions shift.

The strategic importance of these supplier relationships can make challenging supplier terms difficult to contest. If a supplier holds a near-monopoly on a vital technology or possesses unique manufacturing capabilities essential for Cohort's products, their bargaining power increases substantially. This dynamic was evident in the defense sector during 2024, where supply chain disruptions for advanced microchips and specialized materials led to increased costs and extended lead times for many defense contractors, including those with existing long-term agreements.

- Supplier Dependence: Cohort's reliance on a limited number of suppliers for critical defense technologies amplifies supplier bargaining power.

- Contractual Lock-in: Long-term contracts, while providing supply assurance, can restrict Cohort's flexibility to adapt to changing market dynamics or seek more favorable terms.

- Market Concentration: In specialized defense markets, a high degree of supplier concentration means fewer alternatives, strengthening the position of existing suppliers.

- Technological Exclusivity: Suppliers possessing unique or proprietary technologies essential for Cohort's defense systems command higher bargaining power due to the lack of viable substitutes.

The bargaining power of suppliers is a significant factor for Cohort plc, especially in specialized defense markets where a few providers often hold proprietary technology or exclusive manufacturing capabilities. This concentration means Cohort has limited alternatives, allowing these suppliers to dictate terms and potentially increase costs. For instance, in 2024, the defense industry experienced ongoing supply chain challenges for critical components like advanced semiconductors, leading to extended lead times and higher prices from dominant suppliers.

The cost and complexity of switching suppliers for mission-critical defense systems are substantial, involving redesign, re-certification, and rigorous testing. This inertia strengthens the hand of existing, trusted suppliers who have already cleared these regulatory hurdles. Consequently, Cohort may find it difficult to negotiate better terms, impacting profitability and operational flexibility.

| Factor | Impact on Cohort | 2024 Data/Trend |

|---|---|---|

| Supplier Concentration | Limited alternatives increase supplier leverage. | Continued consolidation in niche defense component markets. |

| Proprietary Technology | Exclusive IP allows suppliers to command higher prices. | Key players in advanced materials and avionics maintained strong IP positions. |

| Switching Costs | High costs for redesign and re-certification deter supplier changes. | Defense programs faced delays due to the difficulty of qualifying new suppliers for specialized parts. |

| Contractual Lock-in | Long-term agreements can reduce negotiation flexibility. | Existing contracts for critical systems limited Cohort's ability to renegotiate terms amidst rising input costs. |

What is included in the product

This analysis dissects the competitive forces impacting Cohort, revealing the intensity of rivalry, buyer and supplier power, threat of new entrants, and substitutes.

Quickly identify and prioritize competitive threats and opportunities, transforming complex market dynamics into actionable insights.

Customers Bargaining Power

Cohort's primary customers, national governments and large defense organizations, wield considerable bargaining power due to their sheer scale and sophisticated procurement processes. These entities, often procuring in multi-billion dollar contracts, represent significant revenue streams for suppliers.

Their purchasing decisions are deeply intertwined with national security and long-term strategic planning, meaning they are not solely driven by price but also by strategic alliances and capability requirements. This strategic importance grants them substantial negotiating leverage, allowing them to dictate terms and secure favorable pricing, especially in bulk purchases.

Governmental procurement, a significant channel for many businesses, often operates under stringent, transparent frameworks that mandate competitive bidding. This process allows public sector buyers to solicit proposals from numerous suppliers, fostering an environment where price and value are rigorously scrutinized, thereby amplifying customer bargaining power. For instance, in 2024, the U.S. federal government awarded over $7.3 trillion in contracts, with a substantial portion driven by competitive bidding processes designed to secure the best terms for taxpayers.

Cohort, like many firms engaging with public sector clients, must adeptly navigate these complex tender procedures. Success hinges not only on technical merit but also on a compelling cost-effectiveness proposition. The inherent structure of these tenders, which actively encourage multiple bids, inherently shifts leverage towards the customer, as they can readily compare and select the most economically advantageous offers.

Governmental clients, while needing Cohort's critical defense products, are bound by tight budgets and public oversight. This financial reality compels them to prioritize cost-effectiveness, granting them significant leverage to negotiate lower prices and more advantageous contract terms. For instance, in 2024, defense procurement budgets often face intense scrutiny, pushing agencies to secure the best value, which directly impacts Cohort's pricing power.

Consolidation and Buying Power of Prime Contractors

The bargaining power of customers, particularly large prime defense contractors, significantly impacts Cohort. These major players, integrating Cohort's components into larger defense systems, possess substantial buying power. This allows them to negotiate favorable pricing and dictate delivery timelines, creating a significant pressure point for Cohort.

This dynamic is evident in the defense sector where consolidation among prime contractors has intensified. For instance, in 2023, the global defense industry saw major mergers and acquisitions, increasing the concentration of buying power. Companies like Lockheed Martin, Boeing, and BAE Systems, as prime contractors, often command significant leverage over their suppliers, including Cohort.

- Consolidated Market Power: Prime contractors often represent a substantial portion of a supplier's revenue, giving them considerable sway.

- Volume Purchasing: Their large-scale orders allow them to demand lower unit costs.

- Alternative Sourcing: Prime contractors can often source similar components from multiple suppliers, increasing their ability to switch if terms are not met.

- Integration Expertise: Their deep understanding of the final system allows them to exert pressure on component suppliers regarding specifications and costs.

Long-Term Contracts and Relationship-Based Procurement

Long-term defense contracts, often spanning multiple years, inherently grant customers significant leverage. While these agreements provide revenue stability for suppliers, they also lock customers into a procurement relationship, allowing them to exert continuous pressure on pricing and terms throughout the contract's life. For instance, in 2024, the average duration of major defense procurement contracts in the US remained around five to seven years, highlighting the extended period of customer influence.

The substantial switching costs associated with integrating complex defense systems mean that once a customer commits, their bargaining power is amplified during subsequent negotiations or contract renewals. This can lead to intense initial negotiations, as seen in the bidding processes for major aircraft programs where initial contract values often reflect anticipated long-term support and upgrade packages. The ongoing nature of these relationships allows customers to leverage their established position to continually influence supplier behavior and pricing.

- Customer Leverage: Long-term contracts grant customers sustained influence over suppliers.

- Switching Costs: High integration costs for defense systems increase customer bargaining power.

- Negotiation Intensity: Initial contract negotiations are critical due to the long-term commitment.

- Relationship Pressure: Ongoing relationships allow for continuous exertion of customer pressure.

The bargaining power of Cohort's customers, primarily governments and large defense contractors, is substantial. Their ability to negotiate favorable terms is amplified by their significant order volumes and the strategic importance of the products they procure. This leverage is further enhanced by the competitive bidding processes inherent in public sector procurement, where multiple suppliers vie for contracts, driving down prices.

In 2024, the U.S. federal government's extensive contract awards, exceeding $7.3 trillion, underscore the scale of customer influence. Prime contractors, such as Lockheed Martin and Boeing, leverage their market consolidation and integration expertise to negotiate aggressively with component suppliers like Cohort. This dynamic is further solidified by the high switching costs associated with complex defense systems, giving long-term customers sustained leverage throughout contract lifecycles, which can extend for five to seven years.

| Customer Type | Key Leverage Factors | Impact on Cohort |

|---|---|---|

| National Governments | Large contract values, strategic importance, competitive bidding | Price pressure, stringent contract terms |

| Large Defense Contractors (Prime Contractors) | Volume purchasing, market consolidation, alternative sourcing options | Favorable pricing, delivery schedule dictates |

| Long-Term Contract Holders | High switching costs, extended commitment periods | Ongoing negotiation leverage, potential for price adjustments |

Preview the Actual Deliverable

Cohort Porter's Five Forces Analysis

This preview showcases the complete Cohort Porter's Five Forces Analysis, offering a detailed examination of competitive forces within your chosen market segment. The document you see here is precisely the same professionally formatted and ready-to-use analysis you will receive immediately after purchase, ensuring no discrepancies or missing information.

Rivalry Among Competitors

Cohort's strategy of specializing in niche defense and security technology segments, such as electronic warfare and cyber security, can mitigate direct competition with larger, more diversified defense contractors. However, within these specialized areas, rivalry remains significant as competitors often boast deep, established expertise.

For instance, in the electronic warfare market, which saw significant investment and development leading up to 2024, companies with decades of experience in signal intelligence and countermeasures face off. These specialized competitors are not easily replicated, intensifying the competitive dynamic within these focused segments.

The defense and security industry is dominated by a handful of massive, globally operating companies. Cohort, while specializing in niche technologies, finds itself competing against divisions or subsidiaries of these giants that also offer similar solutions. These established players possess substantial financial resources, large research and development budgets, and deep-seated customer relationships, creating a formidable competitive landscape.

Competitive rivalry within Cohort's market is intense, fueled by rapid technological advancements. Companies are locked in a perpetual race to innovate, with significant R&D investments being a prerequisite for survival and growth. For instance, in 2024, the global IT services market, a sector where Cohort likely operates, saw R&D spending increase by approximately 8% year-over-year, underscoring the pressure to deliver cutting-edge solutions.

This relentless pursuit of superior technology creates a dynamic and often volatile competitive landscape. Companies that fail to keep pace with innovation risk obsolescence, as newer, more advanced offerings quickly capture market share. The ability to not only develop but also effectively deploy these advanced solutions is a critical factor in differentiating oneself and mitigating competitive threats.

Long Sales Cycles and High Customer Loyalty

The defense industry is characterized by exceptionally long sales cycles, frequently extending over several years for a single contract. This protracted process, coupled with the critical nature of defense applications, fosters significant customer loyalty. Once a defense system or solution is integrated, switching costs become prohibitively high, reinforcing the incumbent's position and intensifying rivalry for new business.

This loyalty and the expense of switching mean that new entrants face substantial hurdles. For instance, the United States Department of Defense alone awarded over $700 billion in contracts in fiscal year 2023, highlighting the immense value of these long-term relationships. Companies that have successfully secured these multi-year deals benefit from predictable revenue streams, making it difficult for competitors to dislodge them.

- Defense contract sales cycles can last several years.

- High switching costs contribute to strong customer loyalty in the defense sector.

- Incumbents hold a significant advantage due to established relationships and integration.

- Rivalry is intense for new contracts, with established players often favored.

Competition for Government Contracts and Funding

Competition for government contracts and funding is a fierce battleground, especially within sectors like defense. Companies are constantly jockeying for position, aiming to secure lucrative deals from government entities. This intense rivalry is driven by the limited availability of these opportunities, forcing businesses to demonstrate not just innovation but also exceptional value and dependable performance.

In 2024, the global defense market, a prime example of this dynamic, was projected to reach approximately $2.4 trillion, highlighting the immense value of these contracts. Companies like Lockheed Martin and Boeing, for instance, are perpetually engaged in bidding wars for major aircraft and weapons system programs. Success hinges on a company's ability to present compelling technical proposals, prove cost efficiencies, and guarantee unwavering reliability, often involving extensive lobbying and strategic partnerships.

- Limited Budget Allocation: Government budgets, particularly for defense, are finite, creating a zero-sum game for contract awards.

- Technical and Cost Superiority: Bidders must prove they offer the best blend of advanced technology and cost-effectiveness to win contracts.

- Aggressive Bidding and Lobbying: The high stakes lead to intense price competition and significant investment in government relations.

- Key Program Wins: Securing a major program, such as a new fighter jet or naval vessel, can define a company's financial trajectory for years.

Competitive rivalry within Cohort's specialized defense technology markets is significant, even within niche areas. Companies with deep, established expertise in fields like electronic warfare and cyber security face intense competition from peers possessing similar specialized knowledge. This dynamic is further amplified by the presence of large, diversified defense contractors who also operate in these niche segments through dedicated divisions or subsidiaries, leveraging their substantial financial resources and R&D capabilities.

The defense sector's long sales cycles and high switching costs create strong customer loyalty, benefiting incumbents and intensifying rivalry for new business. Companies must demonstrate not only technological superiority but also cost-effectiveness and reliability to secure lucrative, multi-year government contracts. For instance, the global defense market was projected to reach approximately $2.4 trillion in 2024, underscoring the high stakes involved in securing these critical deals.

| Company | Specialization | 2024 Estimated Revenue (USD Billions) | Key Competitor in Niche |

|---|---|---|---|

| Cohort plc | Electronic Warfare, Cyber Security | ~0.3 (Estimate based on 2023 figures) | BAE Systems, Thales Group |

| BAE Systems | Electronic Warfare, Cyber Security, Platforms | ~25.5 | Cohort plc, L3Harris Technologies |

| Thales Group | Electronic Warfare, Cyber Security, Aerospace | ~21.0 | Cohort plc, Leonardo S.p.A. |

| L3Harris Technologies | Electronic Warfare, Communications, Space | ~10.0 | BAE Systems, Cohort plc |

SSubstitutes Threaten

The relentless march of technological progress presents a significant threat of substitutes for Cohort. New or alternative technologies can emerge that fulfill defense and security needs in fundamentally different ways, potentially rendering current solutions obsolete. For instance, breakthroughs in artificial intelligence or quantum computing might offer novel approaches to surveillance, cyber defense, or electronic warfare, directly challenging Cohort's existing product lines.

Governments, especially major global powers, increasingly leverage substantial in-house research and development capacities. This internal expertise allows them to develop critical defense technologies internally, bypassing external suppliers. For instance, the United States Department of Defense's R&D spending in 2024 is projected to be around $145 billion, a portion of which directly funds domestic technology creation, presenting a direct substitute for companies like Cohort.

The availability of Commercial Off-the-Shelf (COTS) solutions presents a notable threat of substitutes for Cohort. For non-critical defense applications, clients may increasingly turn to these readily available and often more cost-effective alternatives. This trend could potentially reduce the demand for Cohort's highly customized, bespoke offerings.

The growing sophistication and enhanced security features of COTS products mean they are becoming viable substitutes for less specialized defense needs. For instance, advancements in cybersecurity for COTS hardware and software could make them attractive for data handling that previously required custom-built systems. This shift could impact Cohort's market share in segments where customization is not the paramount requirement.

Changes in Defense Policy or Strategic Priorities

Shifts in national defense policies, such as a pivot towards cyber warfare, can significantly alter the demand for traditional military hardware. For example, in 2024, many nations continued to increase their cybersecurity budgets, with global spending projected to reach over $200 billion, indicating a growing preference for digital solutions over certain physical defense assets. This trend directly impacts companies like Cohort, which may see a substitution effect where demand for their established hardware products is replaced by a need for advanced software and digital defense capabilities.

The evolving geopolitical landscape also presents a threat of substitutes. As international relations change, so do the perceived threats and the strategies to counter them. A move away from large-scale conventional conflicts towards localized, asymmetric threats could lead defense ministries to favor more agile, technologically advanced solutions that may not align with Cohort's current product portfolio. For instance, the ongoing conflicts in various regions in 2024 highlighted the importance of intelligence, surveillance, and reconnaissance (ISR) capabilities, potentially substituting demand for heavy armor with advanced drone technology and data analytics platforms.

- Cyber Warfare Dominance: Global cybersecurity spending is expected to exceed $200 billion in 2024, signaling a shift in defense priorities away from traditional hardware.

- Geopolitical Realignment: Emerging threats in 2024 emphasize ISR and asymmetric warfare tactics, potentially substituting demand for legacy defense systems.

- Technological Advancement: Rapid innovation in areas like AI-driven defense and autonomous systems offers alternative solutions that could displace existing offerings.

Evolution of Threats and Adversary Capabilities

The threat of substitutes for Cohort's offerings is amplified by the relentless evolution of security threats and adversary capabilities. As cyber attackers develop increasingly sophisticated tactics and leverage new technologies, existing security solutions can become less effective. This dynamic forces customers to constantly re-evaluate their security posture and explore alternative approaches. For instance, the rise of AI-powered malware in 2024, with reports indicating a significant increase in its use by malicious actors, presents a direct challenge to traditional signature-based detection methods, pushing organizations to seek more advanced, AI-driven security platforms.

If Cohort's current solutions are perceived as lagging behind these emerging threats, customers may look for entirely different types of security capabilities that offer a more robust defense. This could include a shift towards Zero Trust architectures or advanced threat intelligence platforms that provide proactive threat hunting. The cybersecurity market in 2024 saw substantial growth in areas like extended detection and response (XDR) solutions, which offer a more integrated approach to threat detection and response, potentially serving as a substitute for fragmented security toolsets.

- Evolving Threat Landscape: Cyber adversaries are continuously innovating, developing new attack vectors and exploiting emerging technologies.

- Customer Perception: If Cohort's solutions are seen as less effective against new threats, customers will seek alternative capabilities.

- Demand for Novelty: This ongoing security arms race fuels demand for innovative solutions that can outperform existing ones.

- Market Shifts: The increasing adoption of AI in cyberattacks, observed throughout 2024, necessitates the adoption of AI-powered defenses, creating a substitute market.

The threat of substitutes for Cohort is significant as new technologies emerge that can fulfill defense needs differently, potentially making current solutions obsolete. For example, advancements in AI could offer novel surveillance or cyber defense methods, directly challenging Cohort's existing product lines.

Governments' increasing in-house R&D, like the US Department of Defense's projected $145 billion R&D spending in 2024, allows for internal technology development, bypassing external suppliers. This internal capability acts as a direct substitute for companies like Cohort.

Commercial Off-the-Shelf (COTS) solutions are becoming more sophisticated and secure, making them viable substitutes for less specialized defense needs. This trend could reduce demand for Cohort's customized offerings, especially as global cybersecurity spending is projected to exceed $200 billion in 2024, indicating a shift towards digital solutions.

| Threat of Substitute | Description | 2024 Impact/Data |

| Technological Advancements | Emerging technologies (AI, quantum computing) offer alternative defense capabilities. | AI-powered cyberattacks increased significantly in 2024, driving demand for AI-driven defense platforms. |

| In-House Government R&D | Governments developing critical defense technologies internally. | US DoD R&D spending projected at ~$145 billion in 2024 funds domestic technology creation. |

| COTS Solutions | Readily available, cost-effective alternatives for non-critical applications. | Growing sophistication of COTS cybersecurity makes them viable for tasks previously requiring custom systems. |

| Policy Shifts (Cyber Warfare) | Increased focus on cyber warfare over traditional hardware. | Global cybersecurity spending projected to exceed $200 billion in 2024. |

| Geopolitical Landscape | Shift towards asymmetric threats favors agile, advanced solutions. | 2024 conflicts highlighted ISR and drone technology demand, substituting heavy armor needs. |

Entrants Threaten

Entering the defense and security technology sector demands immense capital for research, development, and specialized manufacturing. For instance, developing advanced fighter jets or sophisticated cybersecurity platforms can easily run into billions of dollars, a significant hurdle for newcomers.

New entrants must commit substantial financial resources over extended periods before any return on investment materializes. This long gestation period, often a decade or more for complex systems, deters many potential competitors.

The sheer cost of developing cutting-edge defense technology is prohibitive. Companies must invest heavily in highly skilled personnel, advanced materials, and rigorous testing protocols, making the barrier to entry exceptionally high for most new businesses.

The defense industry presents a formidable barrier to entry due to its stringent regulatory landscape. Companies must navigate a complex web of certifications, security clearances, and adherence to national and international standards, a process that can take years and significant investment. For instance, obtaining ITAR (International Traffic in Arms Regulations) compliance in the US is a critical yet lengthy undertaking for any firm involved in defense exports.

The defense and security sector requires deep, specialized knowledge in fields such as electronic warfare, cybersecurity, and complex systems integration. New entrants face a significant barrier in acquiring and retaining personnel with these niche skills, as the talent pool is both limited and highly sought after. This scarcity of expertise makes it difficult and costly for emerging companies to build the necessary capabilities to compete.

Long Sales Cycles and Established Customer Relationships

The threat of new entrants to Cohort is significantly diminished by the protracted sales cycles inherent in serving governmental and defense sectors. These engagements can stretch over several years, from initial outreach to securing a contract, creating a substantial barrier for newcomers. For instance, major defense procurements often involve multi-year development and testing phases before any significant revenue is generated.

Established players like Cohort benefit from deeply entrenched customer relationships and a demonstrable history of successful project delivery. This creates a formidable hurdle for new companies seeking to gain trust and prove their capabilities. In 2024, defense spending globally continued to rise, with many nations prioritizing long-term strategic partnerships, further solidifying the advantage of incumbents.

- Extended Sales Timelines: Government and defense contracts typically involve lengthy negotiation, approval, and implementation processes, often spanning 2-5 years or more.

- Incumbent Advantage: Cohort's established reputation and existing contracts provide a significant competitive edge, making it challenging for new entrants to displace them.

- Trust and Proven Performance: The critical nature of defense and government projects necessitates a high degree of trust, which is built over time through consistent, reliable performance.

- High Switching Costs: Once a government or defense entity integrates a supplier's technology or services, the cost and complexity of switching to a new provider are often prohibitive.

Proprietary Technology and Intellectual Property Barriers

The defense sector presents a formidable threat from new entrants due to substantial proprietary technology and intellectual property held by established companies. Developing novel, competitive technologies is an exceptionally expensive and high-risk endeavor for newcomers.

Alternatively, securing licenses for existing intellectual property can be prohibitively costly and difficult to negotiate, effectively creating a high barrier to entry. This strong intellectual property moat serves to protect incumbent firms from significant competitive pressure from new players.

- Proprietary Technology: Defense contractors invest billions in R&D, creating unique technological advantages. For instance, Lockheed Martin's F-35 program involved over $400 billion in development costs, a figure almost impossible for a new entrant to match.

- Intellectual Property Protection: Patents and trade secrets in areas like advanced radar systems, stealth technology, and cybersecurity are heavily guarded, making it challenging for new firms to innovate independently or acquire necessary licenses.

- Cost of Innovation: The sheer scale of investment required to replicate or surpass existing technological capabilities in defense is a major deterrent. A new entrant would need to demonstrate a significant technological leap to overcome this hurdle.

The threat of new entrants in the defense and security technology sector is generally low due to significant capital requirements, lengthy development cycles, and stringent regulatory hurdles. Companies like Cohort benefit from established customer relationships and deep expertise, making it difficult for newcomers to gain traction. For example, the substantial R&D investment required for advanced defense systems, often in the billions, acts as a major deterrent.

The defense industry's reliance on proprietary technology and intellectual property further solidifies the position of incumbents. Acquiring or developing comparable technology is prohibitively expensive and time-consuming for potential new entrants. This, coupled with high switching costs for existing government clients, creates a robust barrier to entry.

| Barrier Type | Description | Example/Data Point (2024/Relevant) |

|---|---|---|

| Capital Requirements | Immense funding needed for R&D, specialized manufacturing, and talent acquisition. | Development of advanced fighter jets can exceed $100 billion. |

| Regulatory Hurdles | Complex certifications, security clearances, and compliance (e.g., ITAR). | ITAR compliance can add years and significant costs to product development and sales. |

| Proprietary Technology & IP | Existing firms hold significant patents and trade secrets in critical areas. | Lockheed Martin's F-35 development cost over $400 billion, showcasing the scale of technological investment. |

| Customer Relationships & Trust | Established track record and deep integration with government clients. | In 2024, nations prioritized long-term defense partnerships, favoring proven suppliers. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, including financial statements, industry market research reports, and government economic indicators. This comprehensive approach ensures a thorough understanding of competitive intensity, supplier and buyer power, and the threat of new entrants and substitutes.