Coherent Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Coherent Bundle

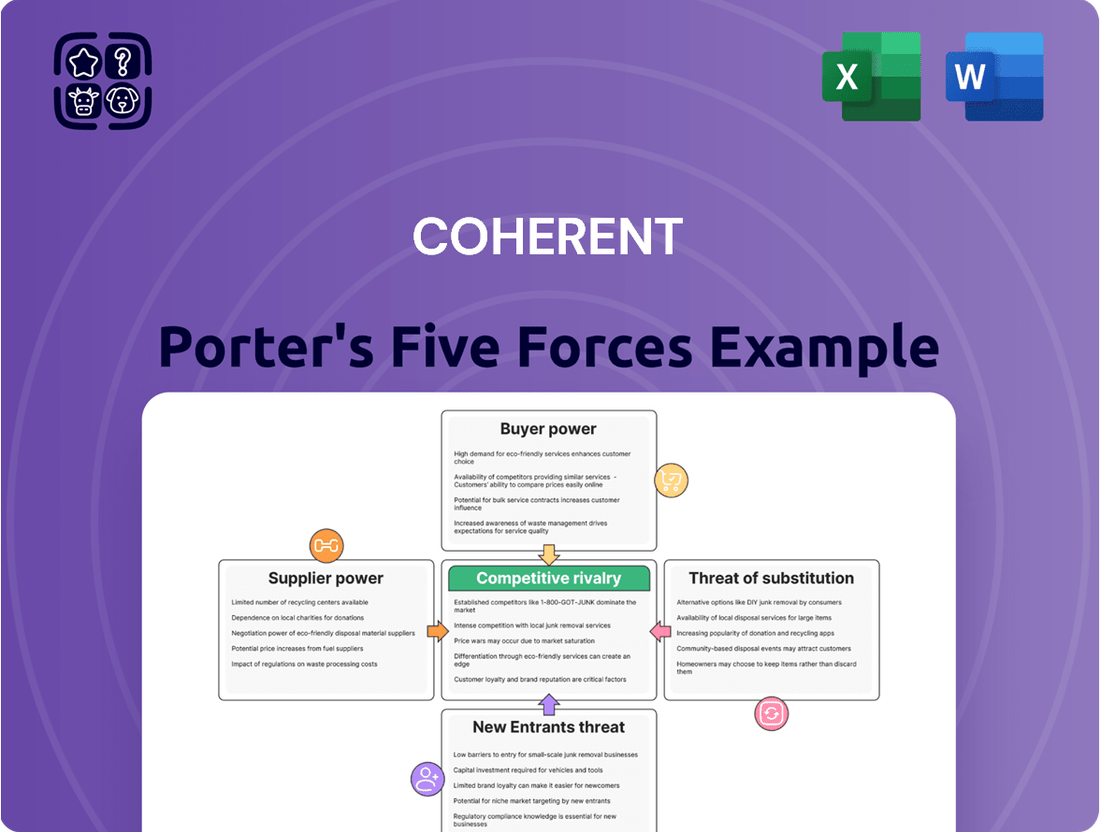

Coherent’s position in the photonics industry is shaped by several key forces. Understanding the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the presence of substitutes is crucial for strategic planning. This brief overview highlights these dynamics, but the full Porter's Five Forces analysis provides a comprehensive, data-driven assessment.

The complete report reveals the real forces shaping Coherent’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Coherent, operating in specialized fields like photonics and laser systems, faces significant supplier power due to reliance on a few key providers for critical materials such as rare earth elements and advanced components. This limited supplier base means Coherent has fewer options when sourcing essential inputs, directly amplifying supplier leverage.

The concentration of suppliers in these niche technology sectors grants them considerable bargaining strength. When a company like Coherent depends on a small number of highly specialized suppliers, these suppliers can dictate terms more effectively, impacting Coherent's cost structure and operational flexibility.

Coherent's global supply chain, while extensive, is inherently susceptible to external shocks. Geopolitical events and trade disputes can further empower these specialized suppliers, especially if they are concentrated in specific regions, by limiting Coherent's ability to diversify its sourcing options.

The bargaining power of suppliers for Coherent is influenced by substantial switching costs. For instance, the intricate nature of Coherent's laser systems and optics often necessitates specialized components. Transitioning to a new supplier for these critical parts can incur significant expenses related to re-tooling manufacturing equipment, rigorous re-qualification processes for performance and safety, and potential production downtime, all of which can extend lead times.

These high switching costs effectively bolster the leverage of Coherent's current suppliers. When customers face considerable difficulty and expense in changing providers, suppliers gain more pricing power and influence over contract terms. This dynamic is particularly relevant in niche markets where specialized expertise and manufacturing capabilities are concentrated among a limited number of suppliers.

Coherent's strategic approach to supply chain management, which includes adapting to minimize the impact of tariffs and other geopolitical disruptions, underscores its recognition of these potential switching challenges. By actively diversifying and building resilience, Coherent aims to mitigate the risks associated with supplier dependency and the associated costs of shifting supply chains, thereby indirectly managing supplier bargaining power.

Suppliers offering highly unique or proprietary materials, intellectual property, or specialized manufacturing processes wield significant bargaining power over Coherent. When Coherent relies on these distinct inputs, the supplier's ability to dictate terms, including pricing and availability, increases substantially. For instance, if a key component for Coherent's advanced laser systems can only be sourced from a single, highly specialized manufacturer, that supplier gains considerable leverage.

Coherent's strategic focus on innovation within complex fields like compound semiconductors and precision optics means that access to cutting-edge supplier technologies is not just beneficial, but often critical for maintaining its competitive edge. Suppliers who possess or can deliver these advanced capabilities are therefore in a strong position to command higher prices or favorable contract terms. This dependence on specialized know-how inherently shifts power towards these suppliers.

Coherent's ongoing vertical integration initiatives are designed, in part, to lessen its reliance on external suppliers for critical components and technologies. By bringing more of its manufacturing and development in-house, Coherent aims to reduce the bargaining power of suppliers who currently hold a strong position due to the uniqueness of their offerings. This strategy seeks to internalize some of the value chain and gain greater control over its inputs.

In 2024, the semiconductor industry, a key area for Coherent, continued to experience supply chain complexities. While demand for advanced materials remained robust, leading suppliers of specialized wafers and epitaxy services often maintained strong pricing power due to high R&D costs and limited production capacity for cutting-edge technologies. This environment highlights the ongoing challenge Coherent faces in managing supplier leverage.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into Coherent's business operations as direct competitors significantly amplifies their bargaining power. This potential move means suppliers could capture a larger portion of the value chain, directly impacting Coherent's market share and profitability. For instance, if a key component supplier for Coherent's optical networking equipment were to develop and market its own end-to-end solutions, it would create a formidable competitive challenge.

While this threat is less pronounced for suppliers of highly commoditized inputs, it becomes a critical consideration for those providing specialized materials or advanced components essential to Coherent's technological edge. The mere possibility of such forward integration incentivizes Coherent to cultivate robust supplier relationships, ensuring reliable supply and potentially exploring collaborative ventures or long-term agreements to mitigate this risk.

Coherent's own strategic initiatives, including its investments in vertical integration, serve as a direct response to and a preemptive measure against the escalating bargaining power of its suppliers. By controlling more stages of its production process, Coherent aims to reduce its reliance on external suppliers and neutralize their ability to leverage forward integration as a competitive weapon. For example, Coherent's acquisition of companies involved in earlier stages of material processing or component manufacturing demonstrates this strategy in action.

- Forward Integration Threat: Suppliers integrating forward into Coherent's market increases their bargaining power by allowing them to compete directly, potentially capturing more value.

- Supplier Specialization: The risk is higher with specialized component suppliers who possess unique capabilities Coherent relies on.

- Relationship Management: Coherent must foster strong supplier relationships and consider strategic partnerships to counter this threat.

- Coherent's Response: Coherent's own vertical integration efforts are a key strategy to reduce dependence and mitigate the bargaining power of suppliers who might consider forward integration.

Importance of Coherent to Suppliers

The bargaining power of Coherent's suppliers is significantly shaped by how crucial Coherent is as a customer to them. If Coherent accounts for a substantial percentage of a supplier's total sales, that supplier might be more accommodating to Coherent's demands, thereby reducing their leverage. For instance, if a key component for Coherent's laser systems comes from a supplier whose business is heavily reliant on Coherent, that supplier's power to dictate terms or prices would likely be diminished.

Conversely, if Coherent is a relatively minor client to a large, well-diversified supplier, Coherent's ability to negotiate favorable terms or influence supplier behavior is weakened. Suppliers who serve many customers across various industries are less dependent on any single buyer, allowing them to exert more power. This dynamic means Coherent must carefully assess its supplier relationships, understanding that its own purchasing volume directly impacts its influence.

- Customer Dependence: If Coherent represents a large share of a supplier's revenue, the supplier's bargaining power decreases as they are more reliant on Coherent's continued business.

- Supplier Diversification: When Coherent is a small customer to a diversified supplier, the supplier has less incentive to concede to Coherent's demands, increasing their bargaining power.

- Impact on Pricing: A supplier with significant power due to Coherent's low dependence on them can potentially command higher prices for raw materials or components.

- Supply Chain Strategy: Coherent's procurement strategy, including supplier diversification and long-term contracts, plays a vital role in mitigating supplier bargaining power.

The bargaining power of suppliers for Coherent is amplified when they offer highly differentiated or specialized products, making it difficult and costly for Coherent to switch. This is particularly true for suppliers of critical components in photonics and laser systems, where unique materials or manufacturing processes are involved.

In 2024, the semiconductor supply chain, crucial for Coherent, continued to show supplier strength. Companies providing advanced materials and specialized manufacturing services often commanded higher prices due to high R&D investments and limited capacity for cutting-edge technologies, directly impacting Coherent's input costs.

Coherent's strategy of vertical integration aims to reduce its reliance on such powerful suppliers, bringing more production in-house to gain greater control over its supply chain and mitigate the leverage held by its key component providers.

A key factor influencing supplier power is the degree to which Coherent is a significant customer. If Coherent represents a large portion of a supplier's revenue, the supplier has less incentive to exert strong bargaining power. Conversely, if Coherent is a minor client to a diversified supplier, the supplier's leverage increases.

What is included in the product

This analysis evaluates the five competitive forces impacting Coherent's industry, revealing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes on Coherent's profitability and strategic positioning.

Visualize competitive intensity across all five forces, instantly identifying and prioritizing key threats to your strategy.

Customers Bargaining Power

Coherent's customer base spans industries like industrial, communications, electronics, and instrumentation. Within these sectors, a few major original equipment manufacturers (OEMs) and system integrators represent significant customer volume.

These large-volume customers wield considerable bargaining power. Their ability to place substantial orders allows them to negotiate for better pricing and more flexible delivery terms, directly impacting Coherent's profitability and operational planning.

Coherent's 2024 annual report explicitly states that customers with larger purchasing volumes generally exhibit greater negotiation leverage. This highlights a key dynamic in managing customer relationships and securing favorable contracts.

Customer switching costs for Coherent's products, a key factor in their bargaining power, vary significantly. While many of Coherent's laser systems and optical components are deeply integrated into customers' complex manufacturing processes, creating a degree of inertia, this isn't uniform across their entire portfolio. For highly specialized or custom-engineered solutions, the cost and effort involved in finding an alternative supplier and retooling can be substantial, thus limiting customer power. However, for more commoditized or standard offerings, customers may face comparatively lower switching costs, granting them greater leverage to negotiate pricing or terms. Coherent's ongoing investment in research and development, aiming to deliver unique and proprietary technologies, directly targets the enhancement of these switching costs, thereby reinforcing customer loyalty and reducing their ability to easily shift to competitors.

Customers hold more sway when readily available substitutes exist. In the photonics and laser technology industries, this means if a customer can easily find another company offering a comparable product, their ability to negotiate prices or terms increases significantly. This is particularly true for more standardized or less technologically unique offerings.

The photonics market, projected to reach over $130 billion by 2024, showcases this dynamic. While innovation drives growth, the sheer number of players means customers often have choices, especially for components or systems that aren't highly proprietary. This intense competition directly translates to greater customer bargaining power.

Customer Price Sensitivity

Customer price sensitivity is a significant factor impacting Coherent's bargaining power. This sensitivity is amplified when Coherent's products represent a substantial portion of a customer's total cost or are critical to the quality or performance of the customer's own end product. For instance, in markets where customers face intense competition and thin margins, they are naturally more inclined to seek the lowest possible prices, directly pressuring Coherent.

Coherent's broad market reach means that the degree of price sensitivity varies considerably across its diverse customer base. While some customers might operate in niche markets with less price pressure, others are in highly commoditized sectors where price is a primary differentiator. This uneven landscape means Coherent must manage pricing strategies carefully to balance market demands with its profitability goals.

For example, in 2024, many industries experienced inflationary pressures, which could heighten customer price sensitivity. Companies that rely heavily on Coherent's components for high-volume, lower-margin products, such as certain consumer electronics or industrial equipment, are likely to be more vocal about price increases. Conversely, customers in specialized sectors like advanced medical devices or semiconductor manufacturing, where Coherent's technology provides unique value and is difficult to substitute, may exhibit lower price sensitivity.

- Product Cost Share: If Coherent's offerings constitute a large percentage of a customer's overall production cost, customers will be more sensitive to price changes.

- Market Competition: In highly competitive end markets for Coherent's customers, the customers' own price sensitivity increases, pushing them to negotiate harder with suppliers like Coherent.

- Product Importance: The criticality of Coherent's product to the customer's final product quality or functionality influences how much they are willing to pay.

- Customer Diversification: Coherent's varied exposure across different industries means price sensitivity isn't uniform; some customer segments are inherently more price-conscious than others.

Threat of Backward Integration by Customers

Customers, particularly major Original Equipment Manufacturers (OEMs), often possess the technical expertise and financial resources to produce components or entire systems that Coherent currently supplies. This potential for backward integration directly enhances their bargaining power, as it presents a viable alternative to relying on Coherent's offerings.

For instance, in the semiconductor industry, large chip manufacturers have been known to develop their own specialized materials or even manufacturing equipment to gain greater control over their supply chain and costs. This capability acts as a constant pressure point for suppliers like Coherent, encouraging competitive pricing and service levels.

- Customer Leverage: The threat of customers vertically integrating backward into Coherent's operations significantly increases their leverage.

- Credible Alternative: Backward integration provides customers with a credible alternative, reducing their dependence on Coherent.

- Industry Trend: In sectors with high R&D investment and proprietary technology, like advanced materials for electronics, backward integration is a notable trend. For example, major players in the display technology sector have, at times, explored in-house production of critical optical films, a market Coherent serves.

- Coherent's Strategy: Coherent counters this by offering integrated solutions, spanning from foundational materials to complex systems, thereby increasing the switching costs and complexity for customers considering backward integration.

Customers' bargaining power is a significant force shaping Coherent's market dynamics. Large customers, particularly major OEMs, can leverage their substantial order volumes and the availability of substitutes to negotiate favorable pricing and terms. This power is amplified by the threat of backward integration, where customers might consider producing components themselves.

In 2024, the photonics market's growth to over $130 billion underscores intense competition, giving customers more choices and thus greater leverage, especially for standardized products. Coherent's strategy to mitigate this involves developing proprietary technologies that increase switching costs and offer integrated solutions.

Price sensitivity also plays a key role. When Coherent's products represent a large portion of a customer's costs or are critical to their product's performance, customers are more inclined to negotiate prices aggressively, particularly in competitive end markets.

| Factor | Impact on Coherent | 2024 Context |

|---|---|---|

| Customer Volume | High volume customers exert more pricing pressure. | Major OEMs in industrial and electronics sectors drive significant volume. |

| Availability of Substitutes | Increases customer negotiation leverage. | The broad photonics market offers numerous suppliers for standard components. |

| Switching Costs | High switching costs reduce customer power. | Deep integration of Coherent's specialized laser systems into manufacturing processes creates inertia. |

| Backward Integration Threat | Customers can threaten to produce components in-house. | Semiconductor manufacturers have historically explored in-house production of critical materials. |

| Price Sensitivity | Customers are more sensitive when products are a large cost component. | Inflationary pressures in 2024 may heighten sensitivity for customers in lower-margin sectors. |

Full Version Awaits

Coherent Porter's Five Forces Analysis

This preview displays the complete, professionally written Coherent Porter's Five Forces Analysis. What you see here is precisely the same document you will receive immediately after purchase, ensuring full transparency and no hidden surprises. You can trust that this detailed framework, ready for immediate application, will provide valuable strategic insights for your business. This exact file, formatted and ready for use, is your deliverable, empowering you to understand and navigate your competitive landscape effectively.

Rivalry Among Competitors

Coherent operates in markets brimming with competitors, from giants like IPG Photonics and Lumentum to nimble startups. This broad spectrum of players, each with their own specializations in photonics, laser tech, and compound semiconductors, means Coherent faces a complex and dynamic competitive landscape. For instance, IPG Photonics is a major force in fiber lasers, a core area for Coherent.

The photonics, compound semiconductor, and industrial laser sectors are currently enjoying robust growth. This expansion can temper competitive rivalry because companies can achieve their growth targets by simply tapping into the expanding market. For instance, the global photonics market is projected to reach USD 1.75 trillion in 2025, with further growth anticipated to USD 2.39 trillion by 2030.

However, this very dynamism also acts as a magnet for new entrants and increased investment. As more capital flows into these promising markets, the potential for intensified competition in the future rises significantly. Companies must therefore remain vigilant, as the current growth trajectory might not always insulate them from aggressive competitive pressures.

Coherent actively differentiates itself through significant investment in innovation across key areas like compound semiconductors, photonics, and precision optics. This focus on advanced technology allows them to offer unique solutions that stand out in the market.

The company's market-leading roadmap for pluggable and CPO transceivers is a prime example of how high product differentiation can lessen direct competition based solely on price. Customers are willing to pay a premium for these advanced, specialized capabilities.

However, the dynamic nature of the technology sector means Coherent must commit to ongoing research and development to sustain this competitive edge. For instance, in 2024, the semiconductor industry saw R&D spending increase significantly, highlighting the crucial need for continuous innovation to avoid falling behind.

High Fixed Costs and Exit Barriers

Coherent's competitive landscape is shaped by industries with substantial fixed costs, particularly in advanced manufacturing and research and development. These sectors demand significant upfront investment in specialized machinery and proprietary technology, creating a high cost of entry and operation. For instance, semiconductor manufacturing equipment, a key area for Coherent, can cost tens to hundreds of millions of dollars per facility. This capital intensity means companies must maintain high production volumes to spread these costs, leading to aggressive pricing strategies when demand softens, thereby intensifying rivalry among players.

The presence of high exit barriers further exacerbates competitive pressures. In Coherent's operating environments, assets are often highly specialized and not easily transferable or repurposed. Think of custom-built laser systems or advanced materials processing equipment; selling these assets at a significant loss is often not feasible. Long-term supply agreements or contractual obligations can also tie companies to specific markets or technologies. Consequently, even underperforming businesses may remain in the market rather than exit, continuing to compete and potentially engaging in price wars to cover their fixed expenses.

- High Fixed Costs: Industries like semiconductor equipment manufacturing and laser technology require immense capital for specialized machinery and R&D, with individual advanced systems potentially costing millions.

- Aggressive Pricing: To cover these high fixed costs and maintain utilization rates, companies may resort to aggressive pricing during economic downturns, intensifying competition.

- Exit Barriers: Specialized, non-fungible assets and long-term contractual commitments make exiting these markets difficult, trapping even unprofitable competitors and sustaining rivalry.

- Impact on Rivalry: The combination of high fixed costs and high exit barriers creates a scenario where price competition is a common feature, particularly when market demand fluctuates.

Strategic Stakes and Acquisitions

The photonics and semiconductor sectors are strategically vital, fueled by advancements in AI and 5G. This criticality intensifies rivalry, as companies are driven to secure or expand their market positions through aggressive tactics.

Consequently, we're observing a surge in strategic alliances and consolidation. Companies are channeling significant capital into expanding their operations and acquiring smaller, innovative firms to bolster their competitive edge.

- Strategic Importance: Photonics and semiconductors are foundational to AI, 5G, and advanced computing, making market share crucial.

- Aggressive Competition: High stakes encourage companies to engage in partnerships, mergers, and acquisitions to gain or defend market share.

- Investment Trends: In 2024, significant capital flowed into semiconductor R&D and manufacturing, with companies like TSMC and Intel announcing multi-billion dollar expansion plans.

- Acquisition Activity: The trend of acquiring smaller technology firms to integrate specialized capabilities continues, reflecting a strategic imperative to enhance product portfolios and technological prowess.

Coherent faces intense competition from established players like IPG Photonics and Lumentum, as well as emerging tech firms. This rivalry is fueled by the rapid growth in photonics and semiconductors, sectors projected for substantial expansion, with the global photonics market expected to reach USD 2.39 trillion by 2030.

High fixed costs, particularly in advanced manufacturing and R&D for specialized equipment, drive aggressive pricing strategies to maintain utilization. Coupled with high exit barriers due to specialized assets, this traps even underperforming firms, sustaining competitive pressure.

The strategic importance of photonics and semiconductors, driven by AI and 5G, intensifies rivalry, leading to significant capital investment in R&D and acquisitions. For instance, major semiconductor players announced multi-billion dollar expansion plans in 2024.

| Competitor | Key Product Areas | Market Position Example |

|---|---|---|

| IPG Photonics | Fiber Lasers | Dominant in high-power fiber lasers. |

| Lumentum | Optical components, lasers | Strong presence in telecom and datacom optics. |

| Coherent | Photonics, lasers, semiconductors | Leader in precision optics and advanced materials processing. |

SSubstitutes Threaten

The threat of substitutes for Coherent is significant as customers can often find alternative technologies to meet their core application needs, bypassing Coherent's specialized offerings. For example, in the realm of high-speed data transmission, advancements in non-optical communication methods, or entirely different semiconductor technologies, could potentially replace the need for Coherent's photonics solutions. The market for silicon photonics itself is a prime example of this dynamic, with various technological approaches vying for dominance, each representing a substitute for another within the broader category.

The threat of substitutes for Coherent's laser and photonics solutions hinges significantly on their performance-to-price ratio. If alternative technologies emerge that deliver comparable or even better performance at a reduced cost, or superior performance at a similar price point, they pose a significant challenge. For instance, advancements in non-laser material processing or novel display technologies could displace Coherent's products if they achieve greater economic viability.

The photonics market's increasing emphasis on energy-efficient products underscores a broader trend towards enhanced performance relative to cost. Companies are actively seeking solutions that offer greater output or functionality with lower energy consumption, directly impacting the perceived value of existing offerings and highlighting the competitive pressure from substitutes that can meet these evolving demands more cost-effectively.

Customer willingness to switch to substitutes hinges on how easy it is to adopt them, the perceived risks involved, and the advantages the new option provides. For instance, in sectors rapidly adopting new technologies, customers are more likely to embrace substitutes offering significant gains in efficiency or cost savings.

Coherent's broad customer base presents a spectrum of adoption rates; some segments are quite open to innovative alternatives, while others remain more hesitant due to established practices or integration challenges. This varied propensity influences the overall threat of substitutes across Coherent's markets.

Emerging Technologies and Research

Emerging technologies outside Coherent's core business present a significant threat of substitution. Advancements in areas like quantum computing or advanced materials science could yield entirely new solutions that bypass Coherent's current product ecosystems. For instance, a breakthrough in room-temperature superconductors could drastically alter the landscape for electronics, a sector Coherent serves. The pace of innovation means that solutions developed today could be supplanted by unforeseen technologies tomorrow, necessitating constant vigilance and adaptation.

Coherent's investment in research and development is a critical defense against this threat. In 2024, the company continued to allocate substantial resources to R&D, aiming to stay at the forefront of technological evolution. While specific figures for 2024 R&D spending are often proprietary until released in annual reports, industry trends show significant investment in areas that could lead to disruptive substitutes. For example, global R&D spending in advanced materials was projected to reach over $150 billion in 2024, highlighting the competitive landscape.

- Quantum Computing: Potential to revolutionize computation, impacting fields like simulation and cryptography, which could indirectly affect Coherent's laser and photonics solutions.

- Novel Material Science: Development of new materials with superior properties could create alternatives to current components used in advanced manufacturing and electronics.

- Artificial Intelligence in Design: AI-driven design tools might accelerate the creation of entirely new product architectures that are more efficient or cost-effective than existing ones.

- Biotechnology Advancements: Breakthroughs in bio-integrated electronics or photonics could offer alternative pathways for certain applications currently reliant on traditional semiconductor or laser technologies.

Regulatory and Environmental Shifts

Regulatory and environmental shifts can significantly alter the threat of substitutes. New environmental regulations, for example, might penalize industries using less sustainable materials or processes, making greener alternatives more attractive. This can accelerate the adoption of substitute technologies that align with evolving environmental standards, even if their initial cost or performance is not yet fully competitive.

Consider the photonics industry, where there's a growing emphasis on energy efficiency. If a substitute technology emerges that offers comparable or superior performance with lower energy consumption, it could quickly gain market share. For instance, advancements in organic light-emitting diodes (OLEDs) compared to traditional liquid-crystal displays (LCDs) are partly driven by their energy-saving capabilities, a key factor in consumer electronics where battery life is paramount.

The push towards sustainability is a powerful driver of substitution.

- Increased environmental regulations can make existing products or processes less viable, thereby increasing the appeal of substitutes.

- Government incentives for green technologies, such as tax credits for energy-efficient manufacturing, can directly lower the cost of adopting substitutes.

- Consumer demand for eco-friendly products, influenced by greater awareness of climate change, also pushes businesses to explore and adopt substitute solutions.

- The global photonics market, valued at over $100 billion in 2023, is increasingly scrutinizing the environmental footprint of its components and manufacturing processes.

The threat of substitutes for Coherent's offerings is amplified by the potential for alternative technologies to offer comparable or superior performance at a lower cost, or improved performance at a similar price point. This dynamic is particularly evident in markets where technological advancements are rapid, and customers are keen to adopt solutions that provide greater economic viability or efficiency gains. For example, in 2024, the semiconductor industry saw continued innovation in materials and architectures that could potentially offer pathways to higher performance at reduced costs, presenting a challenge to established photonics solutions.

Customer adoption of substitutes is influenced by ease of integration, perceived risk, and the magnitude of advantages offered by the alternative. In sectors actively embracing new technologies, there's a higher propensity to switch to substitutes that promise significant efficiency or cost savings. Coherent's diverse customer base exhibits varied adoption rates, with some segments more receptive to innovation than others, impacting the overall threat level across different markets.

Emerging technologies outside Coherent's current focus areas, such as quantum computing and advanced materials science, represent a significant substitution threat by potentially yielding entirely new solutions that bypass existing product ecosystems. The accelerating pace of innovation necessitates continuous adaptation and vigilance to counter the risk of unforeseen technologies disrupting current markets.

Coherent's substantial investment in research and development, a key strategy to counter substitute threats, continued in 2024. Global R&D spending in related fields like advanced materials was projected to exceed $150 billion in 2024, underscoring the competitive intensity and the constant emergence of potential substitutes driven by innovation.

| Substitute Area | Potential Impact on Coherent | Example Technologies (2024 Focus) | Key Driver |

|---|---|---|---|

| Advanced Materials | Displacement of current components | Graphene, 2D materials, metamaterials | Superior properties, novel applications |

| Quantum Computing | Indirect impact on simulation/data processing | Superconducting qubits, trapped ions | Revolutionary computation power |

| AI in Design | Accelerated development of alternatives | Generative design, machine learning optimization | Efficiency and cost reduction |

| Biotechnology | Bio-integrated electronics | Organic electronics, biosensors | Novel functionalities, miniaturization |

Entrants Threaten

The industries Coherent operates in, like advanced materials, photonics, and laser systems, necessitate considerable financial outlay. This includes significant investment in research and development, sophisticated manufacturing plants, and precision equipment, creating a substantial hurdle for new players.

For instance, establishing a new photonics manufacturing facility in 2024 could easily cost between $50 million and $150 million. These high initial capital requirements effectively deter many potential entrants who may lack the necessary financial resources to compete at scale.

Coherent's robust patent portfolio, particularly in compound semiconductors and precision optics, acts as a significant barrier to entry. These intellectual property rights make it exceedingly difficult for newcomers to compete without substantial investment in research and development or securing expensive licensing agreements.

For instance, Coherent's strength in areas like laser technology means new entrants would need to develop comparable or superior technologies, a costly and time-consuming endeavor. This protects Coherent's market share by raising the ante for potential competitors.

Established players like Coherent leverage significant economies of scale in their operations. For instance, Coherent's substantial investment in advanced laser manufacturing facilities allows for lower per-unit production costs, a hurdle for newcomers. This scale also extends to their procurement power, enabling them to negotiate better terms for raw materials and components.

Coherent's vertical integration, controlling everything from laser materials to complex system integration, presents a formidable barrier. By managing more of the value chain, they achieve greater cost efficiencies and supply chain reliability. This comprehensive control makes it exceptionally difficult for new entrants to replicate Coherent's cost structure or match their integrated product offerings, thereby diminishing the threat of new entrants.

Access to Distribution Channels and Customer Relationships

Securing access to established distribution channels presents a significant hurdle for new entrants. Building these networks, which often involve complex logistics and long-term contracts with diverse customer segments like OEMs and industrial users, is both time-consuming and resource-intensive. For instance, in the semiconductor industry, where Coherent operates, new players must navigate existing relationships that have been cultivated over years, a task made even more challenging by the need to gain the trust of a sophisticated clientele accustomed to reliable supply and technical support.

Newcomers also struggle to establish strong, enduring relationships with customers. These relationships are built on a foundation of trust, consistent performance, and tailored solutions, which take considerable time and effort to develop. Coherent's established brand recognition, a result of its long history and consistent delivery of high-quality products, provides a distinct advantage in retaining customers and attracting new ones, making it difficult for nascent competitors to gain traction.

Breaking into existing distribution networks requires substantial investment and strategic partnerships. New entrants often lack the established infrastructure and market penetration to compete effectively with incumbents. For example, in 2024, many emerging technology firms found it challenging to secure shelf space or preferred supplier status with major retailers or industrial distributors without a proven track record and significant upfront commitment.

- Distribution Channel Access: New entrants face significant barriers in accessing established distribution networks, requiring substantial investment and time to build comparable infrastructure.

- Customer Relationships: Cultivating strong, long-term relationships with sophisticated customers like OEMs and industrial users is a protracted process that incumbents have perfected.

- Brand Recognition and Trust: Coherent's established brand equity and global presence foster customer loyalty, making it difficult for new players to win market share.

- Time and Resource Investment: The considerable time and financial resources needed to replicate existing distribution capabilities and customer loyalty pose a substantial threat to potential new entrants.

Technological Expertise and Talent Pool

The barrier to entry for new companies in Coherent's specialized sectors is significantly elevated by the critical need for deep technological expertise. Building and maintaining a competitive edge requires a continuous investment in highly skilled scientists, engineers, and manufacturing professionals. For instance, the semiconductor industry, a key area for Coherent, faces persistent talent shortages; a 2024 report indicated a global deficit of approximately 20,000 skilled semiconductor engineers. This scarcity makes it challenging for newcomers to quickly assemble the necessary human capital to compete effectively.

Attracting and retaining this specialized talent is a substantial hurdle. New entrants must not only offer competitive compensation but also provide an environment that fosters innovation and development, often requiring years to cultivate. The high demand for individuals with expertise in areas like laser technology and photonics, where Coherent operates, drives up labor costs and intensifies competition for top talent. Companies like Coherent have invested heavily in their R&D teams, which often comprise individuals with advanced degrees and years of industry experience, making it difficult for less established players to replicate this intellectual capital.

- Talent Acquisition Cost: New entrants face significant costs in recruiting and onboarding specialized engineers and scientists, a process that can take months or even years.

- Industry Experience Premium: Companies with established reputations, like Coherent, can leverage their brand to attract talent, often commanding a premium for experienced professionals.

- R&D Investment Barrier: The substantial and ongoing investment required for research and development necessitates a deep pool of specialized knowledge, which is hard for new entrants to access quickly.

- Global Talent Competition: The demand for high-tech skills is global, meaning new entrants must compete not only with established players but also with other burgeoning tech companies worldwide.

The threat of new entrants in Coherent's markets is generally low due to substantial capital requirements, estimated at $50 million to $150 million for a photonics facility in 2024. Strong patent portfolios in areas like laser technology and compound semiconductors also present significant barriers, requiring newcomers to invest heavily in R&D or costly licensing. Economies of scale achieved through advanced manufacturing and procurement power further disadvantage potential competitors.

| Barrier Type | Description | Impact on New Entrants | Example Metric (2024) |

| Capital Requirements | High investment in R&D, manufacturing, and equipment | Deters entrants lacking financial resources | $50M - $150M for a new photonics facility |

| Intellectual Property | Patents in laser technology, photonics, semiconductors | Requires costly R&D or licensing | N/A (proprietary) |

| Economies of Scale | Lower per-unit costs from large-scale production | Makes it difficult for new entrants to match cost structures | Coherent's advanced laser manufacturing investments |

| Technological Expertise | Need for specialized scientists and engineers | Challenges in assembling skilled workforce; talent shortage | Global deficit of ~20,000 semiconductor engineers |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, incorporating financial statements, market research reports from firms like Gartner and Forrester, and company-specific investor relations materials to provide a comprehensive view of the competitive landscape.