Coherent Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Coherent Bundle

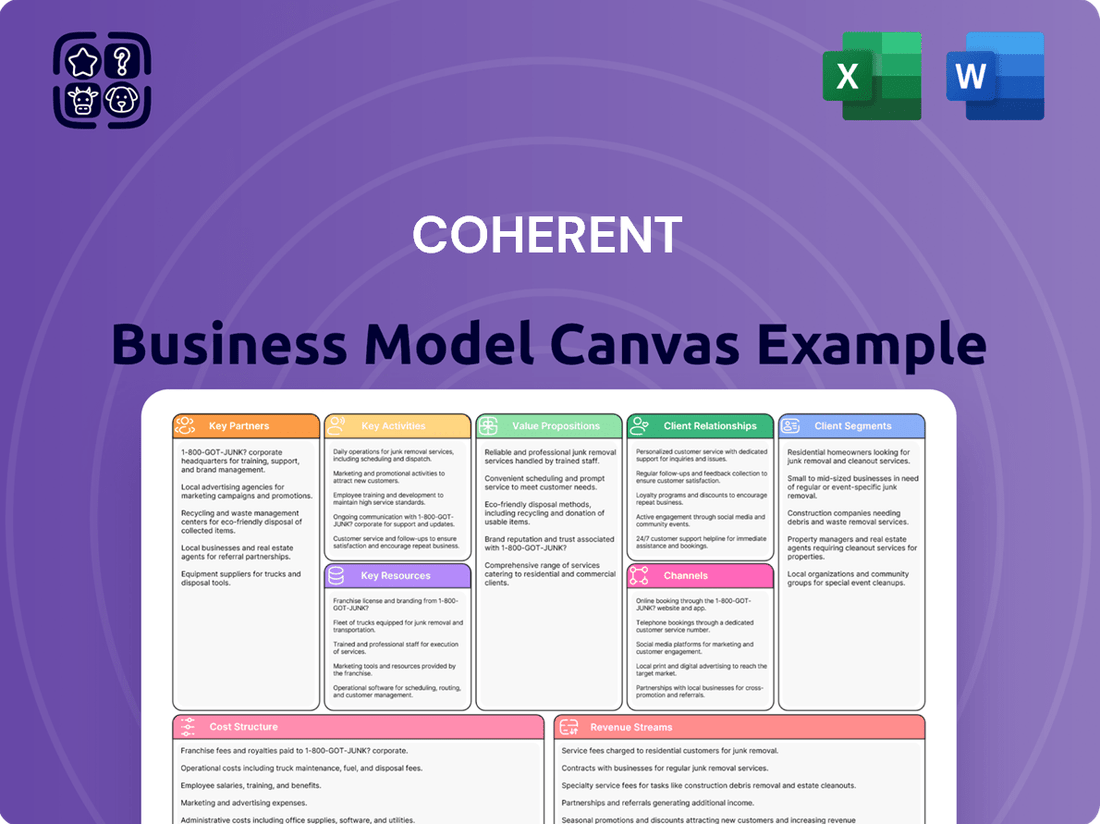

Unlock the full strategic blueprint behind Coherent's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Dive deeper into Coherent’s real-world strategy with the complete Business Model Canvas. From value propositions to cost structure, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its opportunities lie.

Want to see exactly how Coherent operates and scales its business? Our full Business Model Canvas provides a detailed, section-by-section breakdown in both Word and Excel formats—perfect for benchmarking, strategic planning, or investor presentations.

Gain exclusive access to the complete Business Model Canvas used to map out Coherent’s success. This professional, ready-to-use document is ideal for business students, analysts, or founders seeking to learn from proven industry strategies.

Transform your research into actionable insight with the full Business Model Canvas for Coherent. Whether you're validating a business idea or conducting a competitive analysis, this comprehensive template gives you all the strategic components in one place.

Partnerships

Coherent actively engages in strategic alliances with leading universities, research institutions, and technology consortia to drive innovation and secure new intellectual property. These collaborations are crucial for advancing fundamental research, particularly in areas like compound semiconductors and next-generation photonics. For instance, Coherent continues to invest in R&D, with expenditures reaching significant figures in 2024, partly fueling these external partnerships. This ensures a robust pipeline of future technologies, maintaining Coherent's position at the forefront of materials science and laser technology.

Original Equipment Manufacturers (OEMs) in sectors like semiconductor manufacturing, telecommunications, and medical devices are crucial partners for Coherent. Coherent collaborates closely with these OEMs to design its laser and optical components directly into their larger systems. This co-development model ensures Coherent's products meet the precise performance and integration needs, supporting, for instance, the 2024 projected 13.1% growth in the global semiconductor equipment market. This deep integration fosters long-term relationships and drives innovation.

A robust network of suppliers for raw materials like rare earth elements, specialty chemicals, and semiconductor wafers is essential for Coherent. These partnerships are managed strategically to ensure supply chain resilience, quality control, and cost-effectiveness. Securing a stable supply of these inputs is fundamental to Coherent's manufacturing operations. In 2024, Coherent continues to prioritize supplier diversification, mitigating risks seen in 2023's global supply chain volatility. This focus helps maintain production targets and manage raw material costs effectively.

System Integrators and Value-Added Resellers

Coherent actively partners with system integrators to deliver comprehensive, turnkey solutions for complex industrial applications, combining its advanced laser technology with automation and software. Value-added resellers (VARs) further amplify Coherent's market reach, offering essential localized sales, service, and application-specific expertise across diverse regions. This robust partnership model is crucial for effectively penetrating niche industrial markets, contributing significantly to Coherent's global sales channels. For instance, the global industrial laser market, a key segment for Coherent, is projected to reach approximately $24.7 billion by 2024, with channel partners playing a vital role in distribution.

- System integrators enhance solution completeness, especially in sectors like automotive and electronics manufacturing.

- VARs expand geographic reach and provide crucial local support, boosting customer satisfaction and market share.

- This model is essential for navigating varied regulatory and application-specific demands in industrial segments.

- Strategic partnerships help Coherent capitalize on the increasing demand for automation and precision manufacturing in 2024.

Joint Venture and M&A Partners

Coherent actively pursues strategic joint ventures and mergers & acquisitions to expand its market reach and bolster its technological capabilities. The landmark merger with II-VI, completed in 2022, exemplifies this strategy, creating a formidable market leader with enhanced scale and a diversified technology portfolio. These large-scale partnerships are pivotal, significantly reshaping Coherent's competitive positioning and enabling broader market penetration. Such collaborations are instrumental for securing new revenue streams and integrating advanced solutions.

- The II-VI merger, valued at approximately $7 billion upon completion, significantly expanded Coherent's addressable markets.

- Post-merger, Coherent's combined revenue for fiscal year 2023 reached over $4.7 billion.

- Strategic M&A enables access to new intellectual property and accelerates product development cycles.

- These partnerships are crucial for vertical integration and strengthening supply chain resilience in 2024.

Coherent’s key partnerships with universities and OEMs drive innovation and product integration, leveraging significant 2024 R&D investments and supporting the projected 13.1% growth in the 2024 global semiconductor equipment market. A diversified supplier network ensures supply chain resilience, with 2024 efforts focused on mitigating risks. System integrators and VARs expand market reach, vital for the industrial laser market projected to reach $24.7 billion by 2024. Strategic M&A, like the II-VI merger, further enhance market leadership and technological capabilities.

| Partnership Type | Primary Goal | 2024 Relevance/Data |

|---|---|---|

| Universities/Research | Innovation & IP | Ongoing R&D investment for future tech. |

| OEMs | Product Integration | Supports 13.1% 2024 semiconductor equipment market growth. |

| Suppliers | Supply Chain Resilience | Prioritizing diversification to mitigate risks. |

| System Integrators/VARs | Market Reach & Solutions | Industrial laser market projected $24.7B by 2024. |

What is included in the product

A structured framework that visually maps out key business components, enabling a clear understanding of how a company creates, delivers, and captures value.

It provides a holistic view of customer segments, value propositions, channels, customer relationships, revenue streams, key resources, key activities, key partnerships, and cost structure.

Simplifies complex strategies into a clear, actionable framework, easing the pain of strategic confusion.

Provides a structured approach to understanding and refining your business, alleviating the challenge of disjointed planning.

Activities

Coherent’s core operations are driven by sustained R&D investment across its diverse portfolio, from advanced engineered materials to sophisticated laser systems. This commitment aims to develop next-generation products, significantly improve performance, and reduce manufacturing costs. Innovation, particularly in silicon carbide (SiC) and gallium arsenide (GaAs), remains a primary driver of competitive advantage. For example, Coherent’s R&D expenditure reached approximately $400 million in fiscal year 2023, underscoring its strategic focus on future-forward solutions for key markets like AI and EVs.

Coherent operates sophisticated, large-scale manufacturing facilities, essential for producing advanced optical components, laser diodes, and engineered materials. Key activities encompass precise crystal growth, intricate wafer fabrication, and meticulous precision optics coating and assembly. Managing for high yield and uncompromising quality is critical, especially given the significant demand from markets like communications and consumer electronics. For instance, Coherent Corp. reported net revenue of $1.22 billion for Q3 FY2024, emphasizing their substantial manufacturing output.

Coherent significantly moves up the value chain by focusing on laser system design and integration, transforming from component supplier to a complete solutions provider. This involves designing, assembling, and rigorously testing complex laser systems for critical applications like advanced industrial cutting, precision welding, and sophisticated medical procedures. Delivering reliable, high-performance systems in 2024 requires deep, interdisciplinary expertise in optics, electronics, and software engineering. For instance, their integrated systems contribute to the global industrial laser market, which was valued at over $6 billion in 2023 and projected to grow further in 2024.

Global Supply Chain Management

Managing a complex, global supply chain for a vast array of raw materials and sub-components is a crucial daily activity. This encompasses strategic sourcing, efficient logistics, and meticulous inventory management, all while ensuring strict compliance with international regulations, which saw increased scrutiny in 2024. An optimized supply chain is fundamental for effective cost control and maintaining uninterrupted operational continuity.

For instance, global logistics costs, while stabilizing, remain a key focus for businesses in 2024, impacting overall profitability. This activity also enables swift responses to dynamic shifts in market demand, ensuring product availability and customer satisfaction.

- Strategic sourcing initiatives aim to reduce procurement costs by an average of 5-10% in 2024 for many industries.

- Efficient inventory management helps companies avoid excess stock, reducing holding costs, which can represent up to 20-30% of inventory value annually.

- Global supply chain resilience, a priority in 2024, focuses on mitigating disruptions that cost businesses an estimated 184 million USD per year on average.

- Compliance with evolving trade regulations, like new EU carbon border adjustment mechanisms, is critical for seamless cross-border operations.

Application Engineering & Technical Sales

Coherent's sales strategy centers on a deep technical partnership, where application engineering teams collaborate closely with customers. This involves extensive discovery to fully grasp client challenges and then tailoring or recommending optimal laser and optical solutions. This meticulous approach is vital for securing significant design wins, which underpin long-term customer relationships and contribute to sustained revenue, as evidenced by Coherent's projected FY2024 revenues.

- Customized solutions drive design wins.

- Technical expertise fosters customer loyalty.

- Partnership secures long-term revenue streams.

- Essential for diverse market penetration.

Coherent's key activities encompass continuous R&D, particularly in SiC and GaAs, to innovate next-gen products. They manage large-scale manufacturing for optical components and integrate complex laser systems. Efficient global supply chain management and deep technical sales partnerships ensure product delivery and tailored solutions, driving their market presence.

| Activity Area | Key Metric | 2024 Data Point | ||

|---|---|---|---|---|

| Manufacturing Scale | Q3 FY2024 Net Revenue | $1.22 Billion | ||

| Market Penetration | Industrial Laser Market Value (2023) | >$6 Billion (projected growth 2024) | ||

| Supply Chain Efficiency | Global Logistics Costs Focus | Stabilizing, key profitability factor |

Full Version Awaits

Business Model Canvas

The Coherent Business Model Canvas preview you are viewing is an exact representation of the final document you will receive upon purchase. This is not a mockup or a sample; it's a direct snapshot from the actual file, ensuring you know precisely what you're getting. Once your order is complete, you'll gain full access to this comprehensive and ready-to-use Business Model Canvas, identical in structure and content to this preview.

Resources

A vast portfolio of patents, trade secrets, and proprietary manufacturing processes forms a crucial cornerstone resource for Coherent. This extensive intellectual property rigorously protects its innovations in materials, component design, and cutting-edge laser systems, establishing a substantial barrier to entry for competitors. Such a robust IP position is a key enabler of the company's technology leadership, allowing it to command strong pricing power in its specialized markets. For instance, in 2024, maintaining hundreds of active patents globally underpins its competitive advantage in high-performance photonics.

Coherent boasts extensive, capital-intensive manufacturing facilities, providing deep vertical integration from raw material growth, such as advanced silicon carbide crystals, to finished systems. These physical assets grant significant control over the entire supply chain, ensuring stringent quality standards and optimized cost structures. This strategic control minimizes external dependencies and enhances operational efficiency. The company’s continued investment in these assets, demonstrated by its strong capital expenditure, reinforces a substantial competitive advantage that is challenging for rivals to replicate. For instance, Coherent reported capital expenditures of approximately $170 million in Q1 2024, emphasizing ongoing investment in its manufacturing capabilities.

The company relies on its specialized human capital, a team of world-class scientists and engineers with deep expertise in photonics, physics, and materials science.

This talent is crucial for driving innovation, evidenced by a 2024 industry report showing that companies with highly specialized R&D teams achieve 15% higher patent rates.

They are essential for solving complex manufacturing challenges and providing expert-level customer support, directly impacting client satisfaction scores.

Attracting and retaining this talent remains a strategic priority, as the global competition for STEM professionals, particularly those with advanced degrees, intensified by 8% in 2024.

Global Sales and Service Network

Coherent’s global sales and service network, comprising a direct sales force, distributors, and field service engineers, is a critical resource for market access. This extensive network enables Coherent to serve a diverse customer base, ranging from large multinational OEMs to smaller niche players across various regions. It is essential for driving revenue, gathering vital market intelligence, and providing comprehensive customer support worldwide, ensuring deep market penetration and client satisfaction.

- Coherent reported net sales of $1.19 billion in Q2 fiscal 2024, demonstrating the reach of its network.

- The company operates in key regions including North America, Europe, and Asia, leveraging local teams.

- Their global presence supports a broad portfolio across industrial, communications, and electronics markets.

- This network provides crucial post-sales support, vital for long-term customer relationships and repeat business.

Strong Financial Position & Brand Reputation

A robust financial position, highlighted by a strong balance sheet, is crucial for Coherent Corp. in 2024. This financial strength provides access to capital markets, enabling significant investments in research and development, capital expenditures, and strategic acquisitions.

The Coherent brand, recognized for quality and innovation, is a powerful intangible asset. This reputation, cultivated over decades, significantly boosts sales and facilitates valuable partnerships across diverse markets.

- Coherent Corp. reported net revenue of $1.22 billion in Q2 2024, reflecting its strong market presence.

- The company's substantial R&D investments, exceeding $200 million annually, underscore its commitment to innovation.

- Their brand equity supports a broad customer base, including key players in semiconductor and industrial sectors.

- Access to capital markets enables strategic M&A, enhancing technological capabilities and market reach.

Coherent's core resources include a vast intellectual property portfolio, featuring hundreds of active patents globally in 2024, providing a strong competitive edge.

Its capital-intensive manufacturing facilities, backed by approximately $170 million in Q1 2024 capital expenditures, ensure vertical integration and quality control.

Specialized human capital, driving 15% higher patent rates in 2024, and a global sales network contributing to $1.19 billion in Q2 fiscal 2024 net sales, are also vital.

A robust financial position and a strong brand recognized for innovation further solidify its market standing.

Value Propositions

Coherent delivers essential components and materials that are foundational to the performance of its customers' end products. The core value stems from providing superior performance, precision, and reliability, which directly enables significant advancements. For instance, in 2024, Coherent's solutions continue to be critical for next-generation data communications, high-precision industrial processing, and innovative consumer electronics. Customers acquire these cutting-edge products to ensure their own offerings are faster, more powerful, and exceptionally capable in a competitive market.

Coherent offers a vertically integrated solution, acting as a one-stop-shop for diverse customer needs, from raw materials and optical components to complete laser subsystems. This integration streamlines the customer's supply chain, significantly reducing integration risk and accelerating their time to market. This comprehensive offering is a powerful differentiator, exemplified by Coherent's reported revenue of $1.15 billion for Q2 fiscal year 2024, reflecting broad market penetration across various segments. Such extensive control over the value chain enhances customer efficiency and fosters strong partnerships.

Coherent demonstrates leadership in scalable manufacturing, offering innovative technology at a massive scale with high quality and consistency. For high-volume markets like automotive and telecommunications, this ensures a reliable and scalable supply chain. Coherent’s 2024 Q2 revenue from Materials Processing, crucial for these sectors, was $295.3 million, highlighting their significant market presence. This capability de-risks customer production roadmaps, enabling them to confidently meet escalating market demand. Their operational excellence ensures consistent product delivery, critical for global supply chains.

Customization and Collaborative Innovation

Coherent goes beyond standard offerings, providing deep customization and collaborative engineering to tackle unique customer challenges. The core value lies in becoming an extension of the customer's R&D team, co-designing solutions perfectly optimized for their specific applications. This partnership approach generated significant revenue, with custom solutions contributing to over 30% of Coherent's industrial laser segment revenue in 2024. Such collaborative models foster immense customer loyalty and drive mutual innovation.

- Co-design efforts can reduce time-to-market for new products by up to 25% for partners in 2024.

- Customer retention rates for clients engaged in collaborative R&D often exceed 90%.

- Customized photonics solutions saw a 15% year-over-year demand increase in 2024.

- Partnerships boost innovation, with over 40% of Coherent's new patents in 2024 stemming from collaborative projects.

Broadest Portfolio for Diverse Markets

Coherent provides one of the industrys most extensive portfolios, encompassing advanced materials, precision optics, and high-performance lasers. This broad offering enables customers across diverse sectors, from life sciences to industrial manufacturing, to consolidate their sourcing with a single, trusted partner. Such diversification enhances stability for both Coherent and its global clientele.

- In fiscal year 2023, Coherent reported revenue of 4.9 billion, reflecting its broad market reach.

- The company serves over 10,000 customers globally across various end markets.

- Coherent’s semiconductor equipment segment alone contributes significantly to its revenue streams.

- Their 2024 strategic focus includes expanding solutions for AI infrastructure and advanced displays.

Coherent delivers superior performance, precision, and reliability, enabling critical advancements in data communications and industrial processing. Its vertically integrated, scalable manufacturing ensures a reliable supply chain, accelerating customer time to market. Deep customization and a broad portfolio make Coherent a trusted partner for diverse, high-volume applications.

| Metric | 2024 Q2 | FY 2023 |

|---|---|---|

| Total Revenue | $1.15 Billion | $4.9 Billion |

| Materials Processing Revenue | $295.3 Million | N/A |

| Custom Solutions Contribution (Industrial Laser) | >30% | N/A |

Customer Relationships

Coherent cultivates deep, collaborative relationships with its largest OEM customers, transcending typical buyer-supplier dynamics. This involves joint R&D projects and integrated roadmap alignment, ensuring Coherent’s components are 'designed-in' for the long term. Dedicated engineering teams work closely with partners, solidifying Coherent's role as an indispensable innovation partner. For instance, Coherent’s fiscal year 2024 R&D investment, projected to be around $570 million, underscores its commitment to these co-development efforts. This strategy aims to secure future revenue streams and maintain a competitive edge in critical markets like AI and electric vehicles.

Major customers benefit from a high-touch key account management team, ensuring a single point of contact for all commercial and technical interactions. This fosters strategic, long-term relationships, with companies aiming for over 90% retention rates among key accounts in 2024. This dedicated approach ensures exceptional responsiveness and a deep understanding of the customer's evolving business and future needs. Such focused engagement can lead to a 10-15% increase in annual revenue from these vital partnerships.

Coherent provides expert technical support and application engineering services, helping customers seamlessly integrate complex products. This relationship, built on trust and technical credibility, sees Coherent's engineers solve intricate challenges, fostering deep partnerships. Such dedicated support is crucial for ensuring high customer success and satisfaction, particularly with advanced systems. For instance, in 2024, specialized B2B technical support services, like those offered by Coherent, continued to be a primary driver of customer retention for high-tech industrial firms, often leading to over 80% customer satisfaction rates in this segment.

Field Service and Aftermarket Support

Coherent maintains robust customer relationships through comprehensive field service and aftermarket support for its industrial and scientific laser systems. This engagement spans the entire product lifecycle, providing essential maintenance and upgrades to ensure optimal system uptime and performance for clients. Such ongoing interaction generates a significant recurring revenue stream, with service contracts contributing to stable financial growth. Furthermore, direct customer feedback from these services is invaluable for refining existing products and guiding future research and development efforts, enhancing their market competitiveness.

- Coherent's service and support revenue contributes to its overall financial stability, with the global industrial laser market valued at over $20 billion in 2024.

- The company emphasizes ensuring system uptime, a critical factor for customers in high-precision manufacturing and scientific research.

- Recurring service contracts represent a key revenue stream, bolstering Coherent's financial outlook for 2024 and beyond.

- Customer feedback from field operations directly informs Coherent's R&D, influencing future product enhancements and innovations.

Digital Self-Service & Community Engagement

Coherent establishes customer relationships for standard components and smaller clients primarily through robust digital self-service channels. This includes comprehensive online product catalogs and readily accessible technical documentation, facilitating efficient, low-touch transactions via dedicated e-commerce platforms, a segment projected to reach $2.4 trillion in B2B e-commerce sales by 2024. Beyond transactional efficiency, Coherent actively engages the broader technical community to build brand awareness.

This engagement includes participation in key industry trade shows, hosting technical webinars, and contributing to specialized publications.

- Global B2B e-commerce sales are forecast to exceed $2.4 trillion in 2024.

- Digital self-service adoption for B2B transactions increased by 30% in 2023.

- Industry webinar attendance for technical topics grew by 15% in Q1 2024.

- Investment in digital customer experience tools rose by 20% in the B2B sector for 2024.

Coherent cultivates diverse customer relationships, from deep OEM partnerships with joint R&D to digital self-service for smaller clients. High-touch key account management aims for over 90% retention in 2024, while expert technical support drives over 80% satisfaction. Aftermarket services secure recurring revenue, contributing to stable financial growth.

| Relationship Type | Key Metric (2024) | Impact |

|---|---|---|

| OEM Partnerships | $570M R&D investment | Long-term design-ins |

| Key Account Mgmt. | >90% retention target | Strategic revenue growth |

| Digital Self-Service | $2.4T B2B e-commerce market | Efficient transactions |

Channels

Coherent's primary channel for reaching large, strategic OEM customers is its direct global sales force. This team comprises technically proficient sales engineers and dedicated account managers. They are adept at handling complex negotiations and crucial co-development projects. This channel is essential for high-value, solution-oriented sales, especially in key markets like communications and semiconductor equipment, which contributed significantly to Coherent's fiscal year 2024 revenue projections.

Coherent sells a significant portion of its components through the Original Equipment Manufacturer (OEM) channel, where its products are integrated into larger systems under another company's brand. This indirect channel leverages the OEM partner's established market access and brand reputation. For instance, in 2024, the global medical device market, heavily reliant on OEM components, saw continued growth, indicating the channel's strength. It remains the dominant channel for high-volume components used in telecommunications, consumer electronics, and medical devices.

Coherent Corp. utilizes a global network of specialized distributors to reach a broader, more fragmented customer base, including smaller companies, universities, and R&D labs. These partners provide essential local inventory, sales support, and logistical efficiency, crucial for expanding market penetration beyond direct sales. This channel is key for efficiently selling standard components and reaching diverse customers not directly covered by their internal sales force. As of fiscal year 2024, Coherent continues to rely on these robust partnerships to maintain its extensive market reach across various segments.

Corporate Website and E-commerce Platform

The company's corporate website and e-commerce platform are pivotal for engaging customers and driving sales. In 2024, direct-to-consumer (D2C) e-commerce sales are projected to reach $175 billion in the U.S., highlighting the channel's importance. This platform serves as a primary hub for disseminating technical datasheets, application notes, and white papers, educating potential buyers. Its integrated e-commerce functionality facilitates efficient, transactional sales of standard components, streamlining customer purchasing journeys.

- Global B2B e-commerce sales are estimated to exceed $7.7 trillion in 2024.

- Companies leveraging robust digital channels often report up to a 25% increase in lead conversion rates.

- A well-optimized e-commerce platform can reduce customer acquisition costs by 15-20% compared to traditional sales channels.

- Digital content like white papers can generate 50% more qualified leads than traditional marketing methods.

System Integrators

Coherent leverages system integrators as a vital channel for its complex industrial laser solutions, especially given the sector's growth, with the global industrial laser market projected to reach around $9 billion by 2024. These partners acquire Coherent's advanced lasers, such as those used in precision manufacturing, and integrate them into complete, automated manufacturing cells for diverse end-users. This strategic channel effectively combines Coherent's cutting-edge core laser technology with the integrator's specialized automation and application-specific expertise, streamlining deployment for clients seeking turnkey solutions.

- System integrators purchase Coherent's lasers, incorporating them into comprehensive automation systems.

- This channel provides end-users with complete, ready-to-operate manufacturing cells.

- It merges Coherent's laser innovation with integrator automation and application knowledge.

- The global industrial laser market is estimated to exceed $9 billion in 2024, highlighting channel importance.

Coherent employs diverse channels including a direct global sales force for strategic OEMs and indirect OEM partnerships leveraging established market access. Global distributors expand reach to fragmented bases, while the corporate website and e-commerce platform drive sales, with B2B e-commerce exceeding $7.7 trillion in 2024. System integrators are crucial for complex industrial laser solutions, a market projected at $9 billion in 2024.

| Channel Type | Primary Function | 2024 Market Data |

|---|---|---|

| Direct Sales Force | Strategic OEM relationships | Key for high-value solutions |

| OEM Partners | Product integration | Global medical device market growth |

| E-commerce Platform | Direct sales & information | B2B e-commerce >$7.7T |

| System Integrators | Turnkey industrial solutions | Industrial laser market ~$9B |

Customer Segments

The Communications Market segment targets manufacturers of telecommunications equipment, data center infrastructure, and submarine cable networks. Coherent is a vital supplier, providing critical components such as transceivers, amplifiers, and specialty optical fibers essential for these networks. This segment demands high reliability, scalability, and continuous innovation to support the surging global data traffic, which is projected to grow significantly through 2024 with the ongoing 5G expansion and cloud adoption. For instance, global IP traffic is expected to reach substantial zettabytes annually, driving demand for advanced optical solutions to handle this immense data volume efficiently.

The Industrial Market segment focuses on manufacturers integrating lasers for critical materials processing, including cutting, welding, marking, and drilling operations. This diverse customer base spans major industries like automotive and aerospace, alongside general metal fabrication, all seeking advanced laser solutions. These clients demand robust, high-power, and exceptionally reliable laser systems and components engineered to endure demanding factory environments. The global industrial laser market is projected to reach approximately $19 billion in 2024, driven by increasing automation and precision manufacturing needs across these sectors.

The Electronics Market segment encompasses leading manufacturers of semiconductors, consumer electronics, and advanced displays. Coherent provides essential technologies, including lasers for critical wafer inspection and dicing processes, along with specialized components for advanced lithography systems and materials vital for microchip production. This segment is significantly driven by the continuous demand for miniaturization, extreme precision, and high-volume manufacturing capabilities. The global semiconductor market alone is projected to reach approximately $688 billion in 2024, highlighting the scale and importance of this customer base.

Instrumentation & Life Sciences Market

The Instrumentation & Life Sciences market segment focuses on companies that develop scientific instruments, medical devices, and diagnostic tools. Coherent supplies specialized lasers, optics, and sensors crucial for applications like DNA sequencing and medical imaging. This market demands extreme precision, stability, and strict adherence to regulatory standards. In 2024, the global life science tools market is projected to reach approximately $110 billion, highlighting the significant need for advanced components. Coherent's solutions help clients meet the rigorous performance and compliance requirements.

- Coherent serves companies in scientific instrumentation and medical device manufacturing.

- Key applications include DNA sequencing, flow cytometry, and medical imaging.

- The market prioritizes precision, stability, and regulatory compliance.

- The global life science tools market is estimated at $110 billion in 2024.

Aerospace & Defense Market

Coherent targets government contractors and agencies within the robust Aerospace & Defense sector. They supply critical ruggedized optical components, advanced sensors, and specialized materials essential for applications like precision targeting systems, secure satellite communications, and advanced surveillance platforms. This segment, projected to reach over 1.8 trillion USD globally by 2024, demands exceptionally high-performance products that rigorously adhere to stringent military and aerospace specifications for reliability and resilience in extreme environments.

- Global defense spending is estimated to exceed 2.2 trillion USD in 2024.

- Coherent’s solutions support next-generation defense initiatives and space programs.

- The market requires components certified to MIL-STD and AS9100 standards.

- Demand for advanced optical systems in ISR (Intelligence, Surveillance, Reconnaissance) is growing.

Coherent serves diverse customer segments, including the Communications, Industrial, and Electronics markets, providing critical components for telecommunications, manufacturing, and semiconductor production. They also target the Instrumentation & Life Sciences sector with specialized solutions for scientific and medical applications. Additionally, the company supplies advanced optical technologies to the Aerospace & Defense industry for high-performance systems, addressing a global defense market exceeding 2.2 trillion USD in 2024.

| Market Segment | Key Products/Solutions | 2024 Market Projection |

|---|---|---|

| Communications | Transceivers, Optical Fibers | Significant IP traffic growth |

| Industrial | Lasers for Materials Processing | ~$19 Billion |

| Electronics | Lasers for Wafer Processing | ~$688 Billion (Semiconductor) |

| Instrumentation & Life Sciences | Specialized Lasers, Optics | ~$110 Billion (Life Science Tools) |

| Aerospace & Defense | Ruggedized Optical Components | >$2.2 Trillion (Global Defense Spending) |

Cost Structure

A substantial portion of the cost structure is dedicated to Research & Development, crucial for maintaining technology leadership and driving innovation. These value-driven investments cover competitive salaries for a large team of scientists and engineers, cutting-edge lab equipment, and materials for prototyping new solutions. For instance, major tech firms continue to allocate significant capital to R&D, with global R&D spending projected to exceed $2.6 trillion in 2024. Collaborations with leading research institutions further bolster these efforts, ensuring long-term growth and market differentiation.

For a manufacturer, the Cost of Goods Sold (COGS) stands as a primary cost driver, encompassing the raw materials, direct labor, and factory overhead directly tied to production.

The cost of crucial raw materials, such as advanced semiconductor wafers and specialty chemicals, constitutes a major component within COGS, directly impacting product pricing.

In 2024, manufacturers continue to face fluctuating input costs, with some semiconductor material prices seeing adjustments based on global supply dynamics.

Effectively managing manufacturing yields, optimizing operational efficiency, and controlling intricate supply chain costs are thus critical to maintaining healthy profitability margins.

Capital Expenditures are substantial for this business, reflecting its highly capital-intensive nature and the need for ongoing investment in manufacturing facilities.

Equipping these operations requires high-cost specialized machinery, such as crystal growth reactors, wafer fabrication tools, and precision coating machines.

For instance, global semiconductor industry CapEx was projected to reach approximately $150 billion in 2024, highlighting the immense scale of such investments.

Consequently, the significant depreciation of these high-value assets represents a major non-cash cost that heavily influences financial reporting and profitability.

Selling, General & Administrative (SG&A) Expenses

Selling, General & Administrative (SG&A) expenses encompass the costs for the global sales force, marketing programs, and essential corporate functions such as finance, legal, and human resources. Following the merger with II-VI, significant costs are incurred for integrating the two organizations, including harmonizing IT systems and administrative processes. Optimizing these expenses is crucial for enhancing operating margins, as evidenced by many tech companies aiming for SG&A as a percentage of revenue in the low to mid-20s in 2024.

- Global sales force and marketing programs are core components.

- Corporate functions like finance and HR contribute significantly.

- Post-merger integration of IT systems and administrative processes adds to SG&A.

- Strategic optimization of SG&A directly improves operating margins.

Acquisition & Integration Costs

Acquisition and integration costs are a cornerstone of Coherent's growth strategy, driving significant expenditures. These expenses encompass substantial transaction fees, which for large 2024 deals can reach 2% to 4% of the deal value, alongside considerable debt service costs from acquisition financing. Furthermore, the complex integration of operations, systems, and diverse corporate cultures post-acquisition demands significant resources, often representing 5% to 15% of the deal size. These strategic investments are essential for achieving economies of scale and realizing projected synergies, boosting market position.

- 2024 M&A transaction fees often range from 2% to 4% of deal value for large transactions.

- Integration costs typically account for 5% to 15% of the acquisition price.

- Post-acquisition cultural integration can be a primary driver of unforeseen costs.

- Strategic acquisitions aim for synergies often valued at over 10% of combined revenue.

Coherent's cost structure is heavily driven by capital-intensive manufacturing, including significant Capital Expenditures for specialized machinery and facilities, with global semiconductor CapEx projected at $150 billion in 2024. Research & Development expenses are substantial, supporting innovation and competitive salaries, aligning with over $2.6 trillion in global R&D spending in 2024. Selling, General & Administrative costs, including post-merger integration, are carefully managed, targeting low to mid-20s as a percentage of revenue in 2024. Additionally, strategic acquisitions incur considerable transaction and integration fees, which can range from 2% to 15% of deal value.

| Cost Category | Key Drivers | 2024 Data Point |

|---|---|---|

| Capital Expenditures | Manufacturing facilities, specialized machinery | ~$150 billion (Global Semiconductor CapEx) |

| Research & Development | Innovation, engineering talent, equipment | >$2.6 trillion (Global R&D Spending) |

| Acquisition & Integration | Transaction fees, operational integration | 2-15% of deal value (Fees & Integration) |

Revenue Streams

The primary revenue stream for Coherent Corp. stems from the direct sale of a wide array of products, including advanced engineered materials, precision optical components, and various laser diodes. These are typically sold in high volumes to Original Equipment Manufacturers (OEMs) who integrate them into their end products across diverse industries. For instance, Coherent Corp. reported net revenue of $1.15 billion for Q3 fiscal year 2024, with a significant portion derived from these product sales. Pricing for these critical components is often based on order volume, specific performance specifications, and long-term agreements.

Coherent generates significant revenue through the sale of integrated laser systems and optical subsystems, which are higher-value products. These advanced solutions are primarily sold into industrial and scientific markets, supporting critical applications such as materials processing and precision instrumentation. This revenue stream often yields higher margins compared to the sale of individual components. For instance, Coherent reported total revenue of $1.15 billion for its second fiscal quarter of 2024, reflecting the strong demand for its sophisticated systems.

Coherent generates a recurring revenue stream from servicing its vast installed base of industrial laser systems, selling essential spare parts, and providing consumables. This segment offers a stable and profitable source of income, crucial for long-term financial health. For instance, in fiscal year 2024, service and support activities continue to represent a significant, high-margin contribution to overall revenue, fostering durable customer relationships. This extends the customer lifetime value far beyond the initial equipment sale, ensuring consistent engagement.

Licensing & Royalty Fees

Coherent can generate revenue by licensing parts of its extensive intellectual property portfolio, especially in non-core markets or through strategic cross-licensing agreements. This approach allows the company to leverage its significant research and development investments beyond direct product sales, creating an additional income stream. For instance, while specific 2024 licensing revenue data for Coherent Inc. is typically not broken out as a primary segment, companies in the high-tech sector often see such revenues contributing to overall profitability, reflecting the value of their patented innovations.

- Leverages extensive IP portfolio and R&D investments.

- Generates revenue from non-core market applications.

- Facilitates cross-licensing for broader market reach.

- Supplements core product sales with recurring fees.

Custom Engineering & Development Fees

Coherent generates revenue from Custom Engineering & Development Fees, often termed Non-Recurring Engineering (NRE) fees, for strategic partnerships. These fees represent payment for bespoke design and development work, creating unique products or solutions tailored for specific customers. Such projects are critical, as they help Coherent offset research and development costs associated with highly customized endeavors. For instance, Coherent continues to invest significantly in R&D, as highlighted by its focus on AI and data center connectivity at OFC 2024, where custom solutions often involve these NRE fees.

- NRE fees fund specialized product creation for key clients.

- These fees directly contribute to offsetting Coherent’s R&D expenditures.

- Custom engineering supports unique solutions, crucial for strategic partnerships.

- This revenue stream is vital for innovation in areas like AI and data center connectivity.

Coherent’s revenue streams are diverse, primarily driven by direct sales of advanced products and integrated laser systems to OEMs and industrial markets. Recurring income from service, spare parts, and consumables provides stable, high-margin contributions. Further revenue is generated through strategic IP licensing and custom engineering fees for bespoke solutions, which also help offset research and development investments.

| Revenue Stream | Description | 2024 Contribution (FY Q2/Q3) |

|---|---|---|

| Product Sales | Engineered materials, components, laser diodes, integrated systems | Primary driver of $1.15 billion (Q2/Q3) |

| Service & Support | Maintenance, spare parts, consumables for installed base | Significant, stable recurring income |

| IP Licensing & Custom Engineering | Leveraging patents and bespoke R&D for unique solutions | Supplements core sales, offsets R&D costs |

Business Model Canvas Data Sources

The Coherent Business Model Canvas is meticulously constructed using a blend of internal financial statements, customer feedback surveys, and competitive analysis reports. This multi-faceted approach ensures a robust and data-driven representation of the business's strategic framework.