Canadian National Railway PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Canadian National Railway Bundle

Navigate the complex external forces shaping Canadian National Railway's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that present both challenges and opportunities for this industry giant. Gain a strategic advantage by leveraging these expert-level insights to refine your own market approach.

Unlock critical intelligence on how regulatory shifts, economic fluctuations, and technological advancements are impacting CN's operations and long-term viability. Perfect for investors, strategists, and industry analysts, this analysis provides the actionable data you need to make informed decisions. Purchase the full PESTLE analysis now for a complete understanding of the external landscape.

Political factors

Government regulations significantly shape Canadian National Railway's (CN) operations, safety, and pricing. The Canadian Transportation Agency (CTA) and the U.S. Surface Transportation Board (STB) are key bodies. For instance, in 2023, the CTA continued its oversight of railway safety and service standards, impacting CN's operational efficiency and compliance costs.

Changes in regulatory frameworks, such as new safety mandates or pricing adjustments, directly influence CN's business model and expenditures. For example, evolving environmental regulations concerning emissions could necessitate investments in cleaner locomotive technologies, adding to operational costs but also potentially creating long-term efficiencies and market advantages.

Canada's trade policies, particularly those with the United States, significantly shape freight volumes for Canadian National Railway (CN). The Canada-United States-Mexico Agreement (CUSMA), which replaced NAFTA, continues to facilitate substantial cross-border trade, impacting the types and quantities of goods CN moves. In 2023, over $700 billion in goods and services flowed between Canada and the U.S., with a significant portion relying on rail transport, directly benefiting CN's extensive network.

Changes in tariffs or non-tariff barriers under CUSMA or future trade agreements could directly alter CN's cross-border freight mix. For instance, shifts in agricultural or automotive trade policies would necessitate adjustments in the types of commodities CN prioritizes. The railway's ability to adapt its services and infrastructure to evolving trade dynamics is crucial for maintaining efficient supply chains for its North American customers.

Government investment in transportation infrastructure significantly impacts Canadian National Railway (CN). For instance, the Canadian government's 2023 budget allocated $1.3 billion over five years to improve grain transportation infrastructure, directly benefiting CN's agricultural commodity shipments. These investments in rail, ports, and intermodal facilities can enhance CN's operational efficiency and support its expansion plans.

Public-private partnerships (PPPs) for major infrastructure projects, such as port expansions or new rail lines, present both opportunities and challenges for CN. These collaborations can accelerate development and share costs, but also introduce complexities in project management and revenue sharing. CN's strategic planning must account for the evolving landscape of national infrastructure plans and their potential to either facilitate or impede its growth and market access.

Geopolitical Stability

Geopolitical stability significantly impacts Canadian National Railway (CN) operations, particularly its extensive cross-border freight movements. Instability in regions where CN sources or delivers goods, or along key international trade routes, can disrupt supply chains and increase operational costs. For instance, ongoing geopolitical tensions in Eastern Europe, while not directly on CN's primary routes, can indirectly affect global commodity prices and demand for certain manufactured goods that CN transports.

Political shifts and changing government priorities can introduce uncertainty for CN's long-term strategic planning and capital investments. For example, a sudden change in trade policy or border regulations in the United States, a major trading partner for Canada, could necessitate rapid adjustments to CN's network and service offerings. In 2024, the ongoing discussions around potential trade agreement reviews and evolving environmental regulations in North America highlight the need for CN to remain agile.

- Trade Policy Shifts: Fluctuations in US trade policies, such as tariffs or import/export restrictions, directly impact the volume and cost of goods transported by CN.

- Border Security and Regulations: Changes in border security measures or customs procedures can lead to delays and increased operational complexity for cross-border shipments.

- International Conflict Impact: Geopolitical events in other parts of the world can indirectly affect commodity markets and demand for raw materials and finished goods that CN transports, as seen with disruptions to global energy and agricultural markets.

- Regulatory Uncertainty: Evolving political landscapes can introduce uncertainty regarding future regulations on transportation, emissions, and labor, influencing CN's investment decisions and operational strategies.

Labor Relations and Policy

Canadian National Railway (CN) operates within a framework of robust Canadian labor laws that significantly influence its workforce management. The company’s relationship with its unions, primarily the Teamsters Canada Rail Conference and Unifor, is a critical factor. For instance, in late 2023, CN successfully negotiated a new collective agreement with the International Brotherhood of Electrical Workers, averting potential disruptions.

Potential policy changes concerning railway workers' rights and conditions could impact CN's operational capacity and financial performance. Government intervention in labor disputes, as seen in past federal back-to-work legislation affecting railway workers, presents a risk. The ongoing dialogue around worker safety, hours of service, and compensation remains a key area for potential legislative or regulatory shifts that could affect CN's cost structure and service reliability.

- Unionized Workforce: CN employs a significant portion of its workforce under collective bargaining agreements, making union relations paramount.

- Past Disruptions: The threat of strikes or lockouts, though often resolved through negotiation, has historically impacted CN's operations.

- Legislative Influence: Federal labor legislation, including amendments to the Canada Labour Code, can directly alter employment standards and dispute resolution processes for federally regulated industries like railways.

- Negotiation Outcomes: The terms of new collective agreements, including wage increases and benefits, directly influence CN's operating expenses and competitive position.

Government regulations, particularly those from the Canadian Transportation Agency (CTA) and U.S. Surface Transportation Board (STB), are pivotal to CN's operations, influencing safety, pricing, and service standards. For example, in 2023, the CTA's continued oversight ensured compliance with safety mandates, impacting CN's operational costs and efficiency.

Trade policies between Canada and the U.S., governed by CUSMA, are crucial for CN's freight volumes. In 2023, over $700 billion in goods flowed between the two nations, with rail transport playing a significant role, directly benefiting CN's extensive network and cross-border operations.

Government investments in infrastructure, like the 2023 allocation of $1.3 billion for grain transportation improvements, directly benefit CN's agricultural commodity shipments by enhancing network efficiency and supporting expansion.

Political shifts and evolving trade dynamics, including potential tariff changes or regulatory reviews, necessitate agility in CN's strategic planning and capital investments to maintain market access and operational efficiency.

What is included in the product

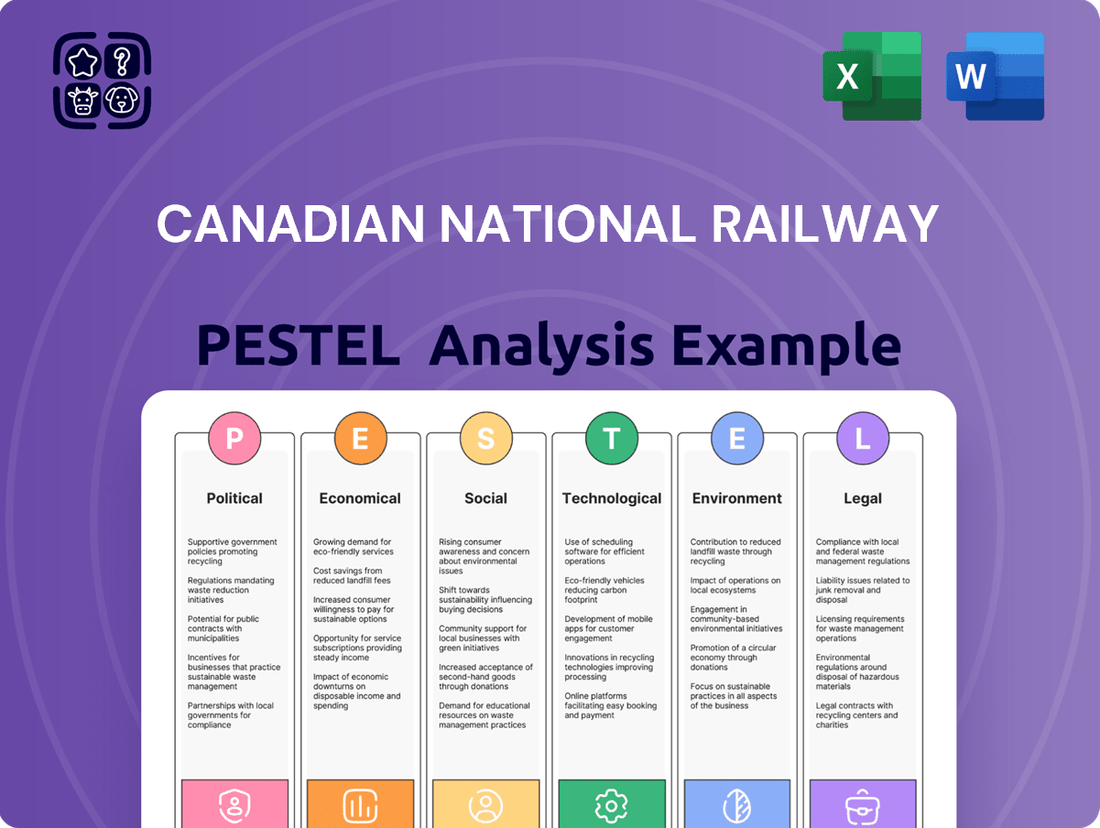

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting the Canadian National Railway, covering Political, Economic, Social, Technological, Environmental, and Legal influences.

It offers actionable insights for strategic decision-making by identifying potential threats and opportunities arising from these dynamic forces.

This PESTLE analysis provides a clean, summarized version of the Canadian National Railway's external environment, making it easy to reference during meetings and presentations to identify and address potential pain points.

Visually segmented by PESTEL categories, this analysis allows for quick interpretation at a glance, helping to pinpoint external factors that could impact operations and require strategic mitigation.

Economic factors

Canadian National Railway's (CN) performance is intrinsically linked to the economic health and industrial output of its primary markets, Canada and the United States. Robust economic growth typically translates into higher demand for freight transportation as manufacturing, mining, and agriculture sectors expand their production and distribution activities.

For instance, Canada experienced a 1.1% increase in real GDP in the first quarter of 2024, signaling continued economic expansion. This growth directly fuels the need for CN to move more raw materials and finished goods, positively impacting its revenue streams.

Conversely, economic downturns or slowdowns in industrial production can significantly reduce freight volumes. During periods of recession, businesses often scale back operations, leading to lower demand for shipping services and consequently impacting CN's profitability and the mix of commodities it transports.

Fuel prices, especially diesel, are a major concern for Canadian National Railway (CN), directly impacting operating expenses. For instance, in 2024, diesel prices saw considerable volatility, influenced by global supply dynamics and geopolitical events. CN's profitability hinges on managing these costs, employing strategies like fuel-efficient locomotives and hedging to mitigate price swings and maintain competitive pricing for its services.

Higher interest rates directly increase Canadian National Railway's (CN) cost of borrowing for essential capital expenditures, like modernizing its locomotive fleet or expanding rail infrastructure. For instance, if the Bank of Canada's key policy rate, which influences broader lending costs, rises, CN's ability to finance new projects through debt becomes more expensive.

This shift in monetary policy significantly impacts CN's financial leverage and investment decisions. A higher cost of capital can make previously viable projects less attractive, potentially slowing down growth initiatives. For example, a project requiring $1 billion in new debt might see its financing costs jump substantially with even a modest rate increase, affecting its overall return on investment and the company's financial health.

Inflation and Cost Management

Inflation significantly impacts Canadian National Railway's (CN) operational expenses, particularly in areas like fuel, labor, and specialized equipment. For instance, in the first quarter of 2024, CN reported that its operating expenses increased by 5% year-over-year, partly driven by higher input costs. The company actively manages these rising costs through efficiency initiatives and strategic sourcing of materials.

CN's ability to pass on increased costs to customers via freight rates is a key factor in maintaining profitability. While the company aims to recover inflationary pressures, the competitive landscape and customer contract terms can influence the speed and extent of rate adjustments. This balancing act is crucial for preserving margins amidst economic uncertainty.

- Rising Input Costs: Fuel, materials, and labor are key cost drivers for CN, directly affected by inflation.

- Cost Management Strategies: CN employs efficiency programs and procurement tactics to mitigate the impact of higher operational expenses.

- Freight Rate Adjustments: The company navigates the challenge of increasing freight rates to offset inflation while remaining competitive.

- Profitability Impact: Inflationary pressures can squeeze profit margins if cost increases cannot be fully passed on to customers.

Exchange Rate Fluctuations

Canadian National Railway's (CN) financial performance is significantly influenced by the fluctuating exchange rate between the Canadian dollar (CAD) and the U.S. dollar (USD). Given its substantial cross-border operations, particularly in the United States, movements in this currency pair directly impact both revenue and expenses.

When the CAD weakens against the USD, CN's U.S.-dollar denominated revenues translate into more Canadian dollars, potentially boosting reported earnings. Conversely, a stronger CAD can reduce the value of those U.S. earnings when converted back. Similarly, expenses incurred in the U.S. become more costly in CAD terms when the Canadian dollar weakens.

These fluctuations can also affect CN's competitiveness. For instance, a stronger CAD might make Canadian exports more expensive for U.S. buyers, potentially impacting freight volumes. Conversely, a weaker CAD could make U.S. exports cheaper, potentially benefiting CN's cross-border traffic.

- Impact on Revenue: In 2023, CN reported that approximately 70% of its revenues were generated in U.S. dollars, highlighting the significant exposure to USD/CAD exchange rate variations.

- Impact on Expenses: A substantial portion of CN's operating costs, including fuel and equipment, are also influenced by currency movements, affecting profitability.

- Competitiveness: Exchange rate shifts can alter the cost of goods transported across the border, influencing demand for rail services.

Canadian National Railway's (CN) financial health is closely tied to the economic cycles of North America. Strong GDP growth in both Canada and the U.S. generally means more goods are being produced and shipped, directly benefiting CN's freight volumes and revenue. For example, Canada's GDP grew by 1.1% in Q1 2024, indicating a positive economic environment for the railway.

However, economic slowdowns or recessions can significantly reduce demand for transportation services as industrial output contracts. This directly impacts CN's profitability and the types of commodities it hauls.

Fuel costs, particularly diesel, are a major operational expense for CN. In 2024, diesel prices experienced significant volatility due to global supply and geopolitical factors, directly affecting CN's cost structure and requiring careful management through efficiency measures and hedging strategies.

Interest rates also play a crucial role, influencing CN's cost of borrowing for capital investments like fleet upgrades and infrastructure expansion. Higher rates can make financing more expensive, potentially impacting investment decisions and growth initiatives.

Inflation impacts CN's operating expenses across fuel, labor, and materials. In Q1 2024, CN's operating expenses rose by 5% year-over-year, partly due to increased input costs, necessitating strategies to pass these costs onto customers through freight rates while remaining competitive.

The exchange rate between the CAD and USD is vital for CN, given its substantial cross-border operations. A weaker CAD can boost reported earnings from U.S. dollar revenues, while a stronger CAD can reduce their value, also influencing cross-border competitiveness.

| Economic Factor | Impact on CN | 2024/2025 Data/Trend |

| GDP Growth | Increases freight volumes and revenue | Canada's GDP grew 1.1% in Q1 2024 |

| Fuel Prices (Diesel) | Major operating expense; volatility impacts profitability | Experienced significant volatility in 2024 |

| Interest Rates | Affects cost of borrowing for capital expenditures | Influenced by Bank of Canada policy rate |

| Inflation | Increases operating expenses (fuel, labor, materials) | CN's Q1 2024 operating expenses up 5% YoY |

| Exchange Rate (USD/CAD) | Impacts revenue and expense translation, competitiveness | Approx. 70% of CN revenues in USD (2023) |

Preview Before You Purchase

Canadian National Railway PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This PESTLE analysis of Canadian National Railway covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategy.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain a comprehensive understanding of the external forces shaping the Canadian National Railway's business landscape.

Sociological factors

Canada's population is increasingly concentrated in urban centers, with over 80% of residents living in cities as of 2023. This trend fuels demand for consumer goods, impacting intermodal freight volumes and the need for efficient last-mile delivery solutions. For Canadian National Railway (CN), this means adapting to shifting freight origins and destinations, potentially requiring adjustments in network capacity and the strategic placement of distribution hubs closer to major metropolitan areas.

Canadian National Railway (CN) faces significant challenges in securing a sufficient and skilled labor force. An aging workforce and a shrinking pool of qualified individuals, particularly for critical roles like locomotive engineers and skilled trades, present a substantial hurdle. For instance, reports from 2023 and early 2024 indicated ongoing efforts by major Canadian employers, including those in transportation, to recruit and train new talent to address these gaps.

These labor shortages can directly impact CN's operational efficiency and safety. A lack of experienced personnel can lead to increased overtime, potential burnout, and a higher risk of operational errors. The railway industry's reliance on specialized knowledge means that even minor skill gaps can have amplified consequences on service reliability and the safe movement of goods across Canada.

Public perception significantly shapes Canadian National Railway's (CN) operational landscape. Concerns about safety, particularly following incidents like the 2019 derailment in Quebec which resulted in fatalities and significant environmental damage, remain a key public focus. CN's proactive engagement through community outreach programs and transparent communication regarding safety protocols is crucial for maintaining trust and a positive reputation.

Effective community relations are vital for CN's social license to operate. Initiatives focused on mitigating noise pollution and addressing environmental impacts, such as spill prevention and response plans, directly influence how local communities view the railway. For instance, CN invested $30 million in 2024 for community benefit programs across its network, aiming to foster goodwill and address local concerns.

Health and Safety Standards

Societal expectations for worker and public safety within the Canadian railway sector are increasingly stringent. Canadian National Railway (CN) invests heavily in health and safety, recognizing its critical role in operational integrity. For instance, in 2023, CN reported a significant reduction in reportable injuries, with a Total Recordable Injury Frequency Rate (TRIFR) of 0.56, down from 0.62 in 2022, reflecting ongoing safety initiatives.

Adherence to robust safety protocols helps CN mitigate the risk of accidents, which can lead to substantial liabilities and operational disruptions. The company's commitment is evident in its continuous improvement programs and technological investments aimed at enhancing track integrity and train operations. These efforts are crucial for maintaining public trust and ensuring regulatory compliance.

- Worker Safety Investment: CN's 2024 capital program includes substantial allocations towards track maintenance and infrastructure upgrades, directly impacting worker safety.

- Public Safety Initiatives: The company actively engages in public safety awareness campaigns, particularly concerning railway crossing safety, a key societal concern.

- Regulatory Compliance: CN operates under strict Transport Canada regulations, with ongoing audits and adherence to safety standards being paramount.

- Risk Mitigation: Proactive safety measures, such as advanced train control systems and regular equipment inspections, significantly reduce the likelihood of accidents and associated financial risks.

Consumer Behavior and Supply Chain Demands

Shifting consumer preferences, particularly the surge in e-commerce, are fundamentally reshaping supply chain demands. This trend necessitates faster, more reliable delivery, pushing logistics providers like Canadian National Railway (CN) to enhance their intermodal capabilities. CN's investment in terminal upgrades and fleet modernization directly addresses this need for agility.

CN is adapting its logistics by focusing on integrated solutions that streamline the movement of goods from origin to final destination. This includes leveraging technology for real-time tracking and optimizing routes to meet the growing expectation for expedited shipping. For instance, CN's 2024 capital investment plan includes significant allocations towards improving terminal efficiency and expanding its intermodal network to better serve the e-commerce boom.

- E-commerce Growth: Online retail sales in Canada are projected to continue their upward trajectory, with e-commerce penetration expected to reach over 20% by 2025, driving demand for rapid fulfillment.

- Intermodal Efficiency: CN's focus on intermodal services allows for seamless transitions between rail and truck, crucial for meeting the speed requirements of modern supply chains.

- Customer Expectations: Consumers increasingly expect faster delivery times and greater transparency in the shipping process, compelling CN to invest in technology and infrastructure that supports these demands.

Societal expectations for worker and public safety within the Canadian railway sector are increasingly stringent, with Canadian National Railway (CN) investing heavily in health and safety. For instance, in 2023, CN reported a Total Recordable Injury Frequency Rate (TRIFR) of 0.56, a decrease from 0.62 in 2022, highlighting ongoing safety initiatives.

Public perception significantly shapes CN's operational landscape, with safety concerns remaining a key focus. CN's community outreach and transparent communication on safety protocols are vital for maintaining trust. For example, CN invested $30 million in 2024 for community benefit programs to foster goodwill and address local concerns.

The growing concentration of Canada's population in urban centers, with over 80% residing in cities as of 2023, fuels demand for consumer goods and impacts freight volumes. This trend necessitates that CN adapts to shifting freight origins and destinations, potentially requiring adjustments in network capacity and strategic placement of distribution hubs.

Technological factors

Canadian National Railway (CN) is increasingly integrating automation and artificial intelligence into its operations. This includes advancements like AI-powered predictive maintenance, which analyzes vast datasets to anticipate equipment failures, thereby minimizing downtime. For instance, CN has invested in technologies to monitor track conditions and rolling stock health more effectively, aiming to prevent costly breakdowns and enhance safety across its extensive network.

These technological shifts are designed to significantly boost efficiency and reduce operational expenses. Autonomous train technologies, while still in development for widespread commercial use, represent a future where operations could be streamlined further. Automated inspection systems are already being deployed to speed up the assessment of infrastructure, leading to quicker repairs and less disruption.

The adoption of AI-driven solutions is projected to yield substantial cost savings. By optimizing train speeds, fuel consumption, and crew scheduling, CN can achieve greater operational leverage. In 2024, the railway sector, including CN, continued to explore and implement AI for route optimization and load balancing, contributing to a more sustainable and cost-effective supply chain.

Canadian National Railway (CN) heavily relies on data analytics to refine its operations. By leveraging big data, CN optimizes train routing and scheduling, leading to significant improvements in asset utilization. For instance, in 2024, CN reported a 5% increase in locomotive utilization through advanced analytics, directly impacting efficiency and cost savings.

The digitalization of CN's supply chain management enhances visibility and customer service. This digital transformation allows for real-time tracking of shipments and proactive communication with clients. CN's investment in digital platforms in 2024 was over $150 million, aiming to provide seamless integration and improved experience for its diverse customer base.

CN uses data-driven insights to inform critical operational and strategic decisions. This includes predictive maintenance for its vast fleet of locomotives and railcars, minimizing downtime and ensuring safety. The company's commitment to digitalization is a key factor in its competitive edge, enabling agile responses to market demands and operational challenges throughout 2024 and into 2025.

Canadian National Railway (CN) benefits from ongoing advancements in rail infrastructure. Innovations like smart tracks, which monitor track conditions in real-time, and sophisticated advanced signaling systems are being implemented. These technologies aim to boost efficiency and safety across the network.

Investments in modernized infrastructure are crucial for CN. For instance, upgrading bridges and tunnels not only ensures structural integrity but also allows for heavier and faster trains, thereby increasing overall capacity. This focus on modernization by CN is projected to enhance the reliability of its services and significantly extend the operational lifespan of its critical assets.

Cybersecurity and Data Protection

Cybersecurity is a paramount concern for Canadian National Railway (CN), given its reliance on sophisticated operational technology (OT) systems for everything from train control to logistics management. Protecting these critical assets and the vast amounts of sensitive data generated daily from evolving cyber threats is essential to prevent disruptions and maintain operational continuity.

CN is actively investing in robust cybersecurity strategies to safeguard its infrastructure. These measures aim to ensure data integrity, prevent unauthorized access, and maintain the seamless flow of operations, which is crucial for the Canadian economy. The company's commitment to cybersecurity is underscored by its continuous efforts to adapt to new threats and implement advanced protective technologies.

- Increased Investment: CN's cybersecurity spending is expected to rise, mirroring industry trends where critical infrastructure operators are enhancing their defenses against sophisticated cyberattacks.

- Data Protection: Protecting sensitive customer information, operational data, and intellectual property is a key focus, with advanced encryption and access control measures in place.

- Operational Resilience: Strategies are in place to ensure that even in the event of a cyber incident, essential railway operations can continue with minimal disruption, safeguarding supply chains.

- Regulatory Compliance: CN must adhere to stringent data protection and cybersecurity regulations, which are continually being updated to address emerging threats.

Alternative Fuels and Propulsion Systems

Canadian National Railway (CN) is actively investing in alternative fuels and propulsion systems to enhance sustainability. This includes significant research into hydrogen fuel cell technology for locomotives. For instance, CN is a participant in a project aiming to demonstrate a hydrogen-powered freight locomotive, a key step in reducing reliance on diesel.

Beyond hydrogen, CN is exploring battery-electric and biofuel options. These initiatives are crucial for meeting environmental targets and improving operational efficiency. The company's commitment to reducing its carbon footprint is evident in its ongoing trials and pilot programs for these advanced propulsion technologies.

- Hydrogen Fuel Cells: CN is involved in developing and testing hydrogen-powered locomotives, aiming for zero-emission freight transport.

- Battery-Electric Technology: The railway is evaluating battery-electric systems for specific yard and short-haul operations.

- Biofuels: CN continues to assess the viability and scalability of biofuels as a lower-carbon alternative to conventional diesel.

Technological advancements are reshaping Canadian National Railway's (CN) operational landscape, driving efficiency and sustainability. CN's integration of AI for predictive maintenance is a prime example, aiming to preemptively address equipment issues and minimize service disruptions. The company's 2024 investments in digital transformation, exceeding $150 million, underscore its commitment to leveraging technology for enhanced visibility and customer experience.

CN is actively embracing data analytics, with 2024 seeing a reported 5% increase in locomotive utilization thanks to advanced analytics. This focus on data-driven decision-making extends to optimizing train routing and load balancing, contributing to a more cost-effective and environmentally conscious supply chain. The ongoing exploration of technologies like automated inspection systems further streamlines operations.

Looking ahead, CN is investing in alternative fuels and propulsion systems, with a notable focus on hydrogen fuel cell technology for locomotives. These initiatives are critical for meeting evolving environmental regulations and reducing the company's carbon footprint, positioning CN for a more sustainable future in freight transport.

Legal factors

Canadian National Railway (CN) operates under a robust legal framework in both Canada and the United States. In Canada, the primary legislation includes the Canada Transportation Act, which governs the economic aspects of transportation, and the Railway Safety Act, focusing on operational safety. For instance, the Transportation Appeal Tribunal of Canada handles disputes related to these acts, ensuring fair play. CN's compliance with these regulations, which cover everything from track maintenance standards to crew hours, directly influences its operational costs and efficiency.

In the U.S., CN is subject to regulations by the Surface Transportation Board (STB) for economic matters and the Federal Railroad Administration (FRA) for safety. The STB's oversight includes approving mergers and acquisitions and resolving rate disputes, impacting CN's market access and pricing strategies. The FRA's stringent safety standards, such as those for track integrity and equipment, necessitate significant investment in maintenance and technology. For example, in 2023, the FRA reported over 1,000 track-related defects nationwide, highlighting the continuous need for compliance and investment by all railways, including CN.

Competition laws also play a crucial role. In Canada, the Competition Bureau monitors market practices to prevent anti-competitive behavior. Similarly, U.S. antitrust laws, enforced by the Department of Justice and the Federal Trade Commission, ensure a level playing field. CN's market conduct, including pricing and service agreements, must adhere to these laws to avoid penalties and maintain market access. Navigating these complex legal landscapes requires dedicated legal and compliance teams, adding to CN's overhead but ensuring its license to operate and market integrity.

Canadian National Railway (CN) operates under a stringent legal framework governing environmental protection. This includes federal and provincial laws like the Canadian Environmental Protection Act, which sets standards for air emissions, water pollution, and hazardous waste management. CN must comply with regulations concerning the prevention and cleanup of spills, particularly given its extensive network transporting various goods, including hazardous materials.

Adherence to these environmental laws is crucial for CN's operational continuity and reputation. For instance, in 2023, CN reported investing approximately $361 million in sustainability initiatives, including efforts to reduce greenhouse gas emissions and manage waste responsibly. Non-compliance can lead to significant fines, operational disruptions, and damage to public trust, impacting its social license to operate.

Canadian National Railway (CN) operates within a robust legal framework for labor and employment. This includes federal and provincial laws governing collective bargaining, with CN having significant unionized workforces, notably the Teamsters Canada Rail Conference. These agreements dictate wages, benefits, and working conditions, directly impacting CN's human resources strategy and operational costs. For instance, in 2023, CN reported that approximately 73% of its employees were represented by unions, highlighting the substantial influence of collective bargaining on its labor relations and flexibility.

Workplace safety regulations are paramount in the railway industry. CN must adhere to stringent standards set by Transport Canada and provincial occupational health and safety bodies to prevent accidents and ensure employee well-being. Non-compliance can lead to significant fines and operational disruptions. Furthermore, anti-discrimination laws prohibit unfair treatment based on protected characteristics, influencing CN's hiring, promotion, and disciplinary practices to foster an inclusive workplace.

Land Use and Property Rights

Canadian National Railway (CN) operates within a stringent legal framework governing land use and property rights across Canada. The acquisition of land for new lines or expansion projects, as well as securing rights-of-way for existing operations, involves navigating complex federal, provincial, and municipal regulations. These legal intricacies can significantly influence project timelines and costs, as demonstrated by past disputes over land access and compensation. For instance, in 2024, CN continued to engage in land negotiations for various infrastructure upgrades, facing potential delays due to differing interpretations of easement rights and environmental protection laws.

The legal complexities surrounding property development along CN's extensive rail network also present challenges. Zoning laws, environmental impact assessments, and community consultation requirements are all critical legal considerations that can impact the feasibility and scope of development projects adjacent to or on CN property. These factors necessitate careful legal due diligence and proactive engagement with stakeholders to ensure compliance and mitigate risks. In 2025, CN's strategic planning for intermodal hub expansions will heavily rely on successfully navigating these land-use legalities.

- Land Acquisition: Legal frameworks dictate the process for acquiring land, including expropriation powers and compensation standards, impacting CN's ability to expand its network.

- Rights-of-Way: Securing and maintaining legal rights-of-way for rail operations is crucial for operational continuity, with ongoing legal scrutiny of easement agreements.

- Property Development: Zoning regulations and environmental laws govern any development on or near CN property, requiring adherence to diverse legal requirements.

- Legal Disputes: Past and potential legal challenges related to land use can lead to project delays and increased operational costs for CN.

International Trade and Customs Laws

International trade and customs laws significantly impact Canadian National Railway's (CN) cross-border operations, particularly with the United States. Navigating complex customs procedures, tariffs, and import/export regulations directly influences the speed and cost of freight movement. Changes in these legal frameworks can create substantial operational hurdles or opportunities.

For instance, the Canada-United States-Mexico Agreement (CUSMA), which replaced NAFTA, continues to shape trade dynamics. While CUSMA generally facilitates trade, specific provisions related to customs valuation, rules of origin, and product standards require diligent compliance. In 2023, the total value of goods traded between Canada and the U.S. exceeded $800 billion, underscoring the sheer volume of cross-border shipments CN handles.

CN must remain agile in adapting to evolving customs legislation and trade agreements. Key areas of focus include:

- Customs Clearance Efficiency: Streamlining the process for faster border crossings, reducing dwell times for rail cars.

- Tariff Rate Changes: Monitoring and adjusting pricing strategies in response to any modifications in import/export duties between Canada and the U.S.

- Regulatory Compliance: Ensuring adherence to all legal requirements for transporting various goods, including hazardous materials, across the border.

- Trade Dispute Resolution: Understanding the legal mechanisms for addressing trade-related issues that could disrupt cross-border rail traffic.

Legal factors significantly shape CN's operations, from safety mandates to labor relations. The Canada Transportation Act and Railway Safety Act in Canada, alongside U.S. STB and FRA regulations, dictate operational standards and necessitate substantial compliance investments. For example, CN's 2023 sustainability investments, including emissions reduction, highlight the intersection of environmental law and operational strategy.

Environmental factors

Climate change presents significant physical risks to Canadian National Railway (CN). The increasing frequency of extreme weather events like floods, wildfires, and severe storms directly impacts CN's extensive infrastructure, from tracks to bridges. For instance, the 2021 British Columbia floods caused widespread disruptions and significant repair costs, highlighting the vulnerability of rail lines to such events.

These disruptions lead to service interruptions, affecting supply chains and customer deliveries. CN's operational efficiency can be hampered by weather-related delays, impacting revenue. Furthermore, the need for more robust infrastructure and emergency response capabilities translates into increased maintenance and capital expenditure, as seen in ongoing investments to mitigate future weather impacts.

Canadian National Railway (CN) faces increasing pressure to reduce greenhouse gas emissions from its operations, driven by ambitious federal and provincial climate targets and growing stakeholder expectations for decarbonization. These environmental factors significantly influence CN's strategic planning and investment decisions as it navigates the transition to a lower-carbon economy.

CN is actively investing in cleaner technologies and operational efficiencies to lower its carbon footprint. For instance, in 2024, the company continued its focus on modernizing its locomotive fleet and exploring alternative fuels. CN's 2024 sustainability report highlighted a commitment to reducing Scope 1 and Scope 2 emissions by 45% by 2035 compared to a 2019 baseline, with specific investments in battery-electric and hydrogen fuel cell locomotives planned for pilot programs.

Canadian National Railway (CN) faces ongoing scrutiny regarding the environmental impact of its extensive rail infrastructure on Canada's diverse ecosystems. This includes concerns about habitat fragmentation, which can isolate wildlife populations, and the risk of wildlife collisions with trains. CN's commitment to minimizing its ecological footprint is demonstrated through various initiatives and adherence to stringent environmental regulations.

In 2023, CN reported investing $10 million in biodiversity initiatives, including habitat restoration projects along its operating corridors. The company actively works to comply with federal and provincial environmental protection laws, such as the Species at Risk Act, to mitigate its impact on sensitive habitats and species. These efforts reflect a growing industry trend towards integrating conservation principles into large-scale infrastructure operations.

Resource Scarcity and Waste Management

Canadian National Railway (CN) faces environmental challenges related to resource consumption, including water for operations and materials for track maintenance, alongside the generation of waste. The company is actively engaged in initiatives to mitigate these impacts. For instance, CN reported a 10% reduction in water consumption per million revenue ton-miles in 2023 compared to 2022, demonstrating progress in sustainable resource management.

CN's commitment to recycling and responsible waste disposal is evident in its operations. In 2024, the railway aims to divert 75% of its operational waste from landfills through various recycling programs, focusing on materials like scrap metal, wood, and plastics.

- Water Conservation: CN is implementing water-efficient technologies and practices across its network, aiming for a further 5% reduction in water usage by the end of 2025.

- Waste Diversion: The company's comprehensive waste management strategy includes partnerships with specialized recycling facilities to process diverse waste streams.

- Material Sourcing: CN prioritizes the use of recycled and sustainable materials in infrastructure projects where feasible, contributing to a circular economy.

- Emissions Reduction: Beyond waste, CN continues to invest in cleaner locomotive technologies to reduce overall environmental footprint.

Stakeholder Expectations for Sustainability

Canadian National Railway (CN) faces increasing pressure from investors, customers, and the general public to showcase robust environmental stewardship and transparent sustainability practices. Stakeholders are actively seeking evidence of a company's commitment to reducing its ecological footprint and operating responsibly.

Meeting these heightened expectations can significantly boost CN's brand reputation. For instance, in 2023, CN reported a 10% reduction in Scope 1 and 2 greenhouse gas (GHG) emissions intensity compared to their 2019 baseline, a metric closely watched by environmentally conscious investors. This commitment to sustainability can also attract vital capital, as a growing number of investment funds prioritize companies with strong Environmental, Social, and Governance (ESG) profiles.

- Investor Demand: A significant portion of institutional capital is now allocated based on ESG criteria, with many funds actively divesting from companies with poor environmental records.

- Customer Preferences: Shippers are increasingly choosing logistics partners that align with their own sustainability goals, making environmental performance a competitive differentiator for CN.

- Public Scrutiny: Public awareness of climate change and corporate responsibility means that companies like CN are under constant observation regarding their environmental impact and reporting.

Canadian National Railway (CN) faces direct operational risks from climate change, with extreme weather events like the 2021 British Columbia floods causing significant infrastructure damage and service disruptions. These events necessitate increased capital expenditure for resilience and impact revenue through delays. CN is actively investing in decarbonization, aiming for a 45% reduction in Scope 1 and 2 emissions by 2035 from a 2019 baseline, with pilot programs for battery-electric and hydrogen locomotives underway in 2024.

CN also manages ecological impacts, investing $10 million in biodiversity initiatives in 2023, including habitat restoration, and adhering to regulations like the Species at Risk Act. Resource management is another focus, with CN reporting a 10% reduction in water consumption intensity in 2023 and targeting 75% waste diversion from landfills in 2024.

Stakeholder pressure for environmental stewardship is high, with investors increasingly prioritizing ESG performance. CN's commitment, evidenced by a 10% reduction in GHG emissions intensity in 2023, can enhance brand reputation and attract capital, as shippers also favor sustainable logistics partners.

| Environmental Factor | CN's Action/Impact | Key Data/Target |

|---|---|---|

| Climate Change & Extreme Weather | Infrastructure vulnerability, service disruptions, investment in resilience | 2021 BC floods caused significant disruption; Continued investment in weather mitigation |

| Greenhouse Gas Emissions | Decarbonization efforts, cleaner technologies | Target: 45% reduction in Scope 1 & 2 emissions by 2035 (vs. 2019); Pilot programs for electric/hydrogen locomotives in 2024 |

| Ecological Impact & Biodiversity | Habitat concerns, wildlife collisions, conservation initiatives | $10M invested in biodiversity in 2023; Compliance with Species at Risk Act |

| Resource Consumption & Waste | Water usage, material sourcing, waste diversion | 10% reduction in water consumption intensity (2023); Target: 75% waste diversion (2024) |

| Stakeholder Expectations & ESG | Demand for transparency, brand reputation, capital attraction | 10% reduction in GHG emissions intensity (2023); Growing investor focus on ESG |

PESTLE Analysis Data Sources

Our Canadian National Railway PESTLE Analysis is built on a robust foundation of data from official government agencies like Transport Canada and Statistics Canada, as well as reports from industry associations and reputable financial institutions. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the railway sector.