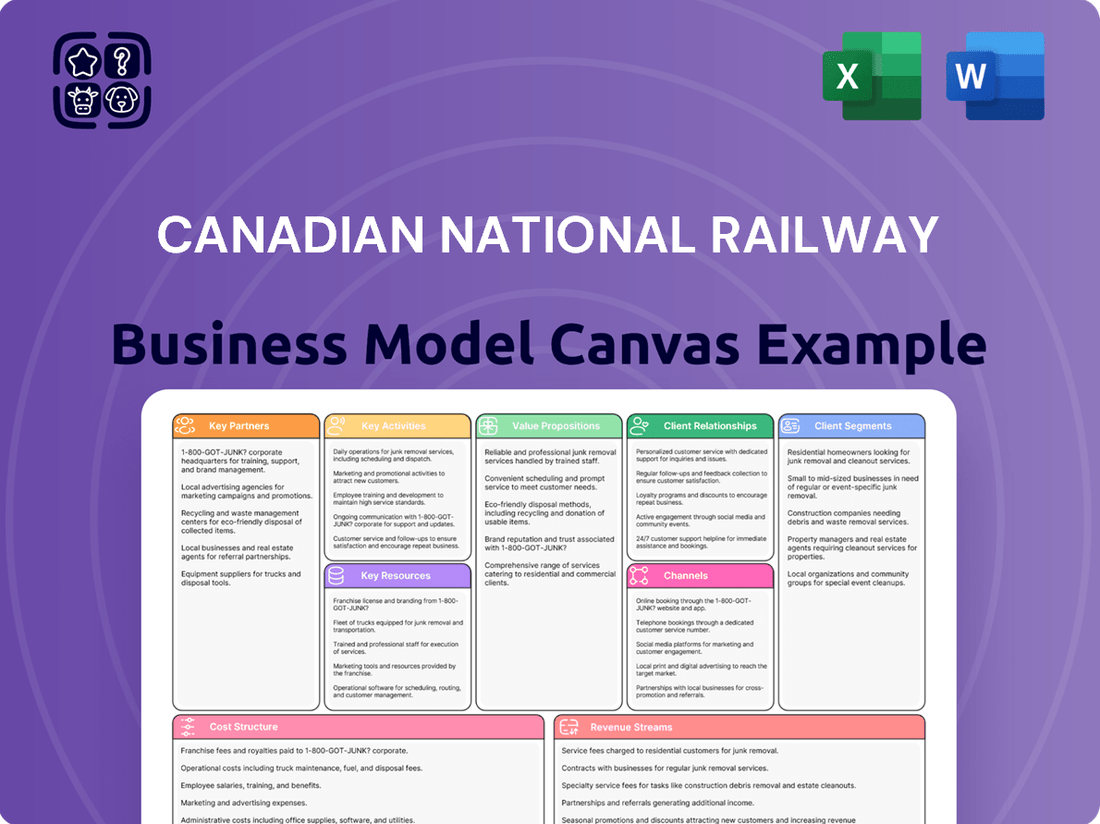

Canadian National Railway Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Canadian National Railway Bundle

Curious about how Canadian National Railway (CN) masterfully connects North America's economy? This Business Model Canvas unpacks CN's core customer segments, unique value propositions, and key revenue streams that fuel its extensive network. Discover the strategic partnerships and cost structures that empower CN's operational excellence.

Partnerships

Canadian National Railway (CN) relies on strong relationships with port authorities and intermodal terminal operators. These collaborations are vital for smoothly moving goods between ships, trains, and trucks, enhancing overall supply chain efficiency and broadening market access for global trade.

CN actively partners with key ports across Canada's three coasts and manages 23 intermodal terminals. This extensive network allows for efficient handling and transfer of freight, a critical component of their business model for connecting producers to global markets.

Canadian National Railway (CN) collaborates with trucking and logistics companies to offer integrated door-to-door services, extending its reach beyond its rail network. These partnerships are crucial for managing the first and last-mile segments of shipments, ensuring a seamless flow of goods for customers. For instance, CN's intermodal services rely heavily on these trucking partners to move containers efficiently between rail yards and final destinations.

In 2024, CN continued to leverage these relationships to enhance its supply chain solutions, aiming to shift freight from long-haul trucks to intermodal rail transport. This strategy not only optimizes logistics but also contributes to reduced carbon emissions, aligning with sustainability goals. The efficiency gains from these partnerships are vital for CN's competitive positioning in the North American freight market.

Canadian National Railway (CN) actively partners with technology and innovation providers to drive operational improvements. These collaborations focus on enhancing efficiency, bolstering safety protocols, and advancing sustainability initiatives across its network.

Key partnerships involve the integration of advanced tracking systems, the deployment of AI-driven wayside detection technologies, and the exploration of alternative fuels. A notable example is Duos Technologies Group's five-year strategic agreement with CN, initiated in October 2024, for Machine Vision/AI Wayside Detection Safety Data subscriptions, underscoring CN's commitment to leveraging cutting-edge technology for safety enhancements.

Suppliers and Equipment Manufacturers

Canadian National Railway (CN) relies heavily on strategic alliances with suppliers and equipment manufacturers to keep its vast network running efficiently and to invest in future technologies. These partnerships are crucial for acquiring and maintaining the company's extensive fleet of locomotives and specialized freight cars. For instance, CN has historically partnered with major locomotive manufacturers like General Electric and EMD (Electro-Motive Diesel) for its rolling stock. These collaborations are not just about purchasing equipment; they often involve joint development and testing of new technologies, such as advanced diesel-electric locomotives designed for improved fuel efficiency and reduced emissions.

These vital relationships ensure CN has access to cutting-edge rail technology. This includes not only the latest locomotive models but also specialized freight cars tailored for specific commodities, enhancing operational flexibility and capacity. Furthermore, these partnerships are increasingly focused on sustainability. CN actively collaborates with suppliers to test and validate renewable fuel blends, such as biofuels and hydrogen-powered systems, which are critical for meeting the company's environmental targets. In 2023, CN continued its investment in fleet modernization, with a significant portion of its capital expenditures directed towards new locomotives and advanced freight car technologies.

- Locomotive Manufacturers: Essential for acquiring and maintaining the core power units of CN's operations, ensuring access to the latest fuel-efficient and emissions-reducing technologies.

- Freight Car Builders: Provide specialized rolling stock necessary for transporting diverse commodities, from bulk goods to intermodal containers, optimizing cargo capacity and efficiency.

- Technology and Fuel Suppliers: Partnering for the development and implementation of new technologies, including renewable fuels and advanced monitoring systems, supporting sustainability initiatives and operational improvements.

Government Agencies and Regulatory Bodies

Canadian National Railway (CN) maintains critical relationships with government agencies and regulatory bodies across Canada and the United States. These collaborations are fundamental for ensuring strict adherence to safety standards and navigating the intricate web of transportation regulations. For instance, CN's comprehensive winter operating plan, a crucial element for maintaining service reliability during harsh weather, incorporates vital feedback and requirements from these regulatory authorities, underscoring their influence on operational planning.

These partnerships are not merely about compliance; they are instrumental in facilitating CN's ongoing infrastructure development and expansion projects. By working closely with bodies like Transport Canada and the U.S. Department of Transportation, CN can effectively manage the permitting processes and environmental assessments necessary for growth. In 2024, significant investments in track upgrades and terminal expansions are directly influenced by these regulatory frameworks.

- Regulatory Compliance: CN works with Transport Canada and the Surface Transportation Board (U.S.) to meet all operational and safety mandates.

- Infrastructure Development: Partnerships facilitate approvals for new lines, terminal expansions, and track modernization projects, crucial for 2024 growth initiatives.

- Safety Standards: Collaboration ensures adherence to stringent safety protocols, including those related to hazardous materials transport, with ongoing audits and reviews.

- Winter Operations: Regulatory input shapes CN's winter contingency plans, a critical factor given the operational impact of Canadian winters on freight movement.

CN's key partnerships extend to technology providers, fostering innovation in safety and efficiency. For example, a 2024 agreement with Duos Technologies Group for Machine Vision/AI Wayside Detection subscriptions highlights this focus.

What is included in the product

This Business Model Canvas for Canadian National Railway details its core operations, focusing on efficient freight transportation across North America. It outlines key customer segments like agriculture and manufacturing, their needs, and how CN's extensive network and intermodal services deliver value.

The Canadian National Railway's Business Model Canvas acts as a pain point reliever by providing a clear, actionable roadmap for operational efficiency and cost reduction, enabling swift identification of areas for improvement.

It offers a structured approach to understanding and optimizing complex logistics, alleviating the pain of inefficient supply chains and resource allocation.

Activities

Canadian National Railway's primary function revolves around its freight transportation services, leveraging a vast rail network that spans across Canada and the United States. This core activity ensures the secure and timely movement of a wide array of goods for numerous industries.

CN's operations are critical for the economy, with the company transporting over 300 million tons of commodities annually. These include vital natural resources, manufactured goods, and finished products, underscoring its role as a backbone for supply chains.

Canadian National Railway's network management and operations involve overseeing its extensive 20,000-mile rail network, a critical activity for efficient logistics. This includes sophisticated dispatching and traffic control systems to optimize train movements across its North American routes.

CN's commitment to service excellence is deeply tied to its network operations, focusing on minimizing delays and maximizing asset utilization. In 2023, CN reported a substantial capital expenditure program, with a significant portion allocated to maintaining and enhancing the safety and fluidity of its rail network, underscoring the importance of this key activity.

Canadian National Railway's key activity involves the rigorous maintenance of its vast network, including tracks, bridges, signals, and rolling stock. This ensures operational safety and consistent service reliability for its customers.

CN actively invests in its infrastructure, undertaking substantial capital programs. These investments focus on crucial upgrades, expanding capacity to meet growing demand, and installing new rail lines to enhance efficiency and reach.

In 2024, CN's commitment to infrastructure was evident with approximately $3.5 billion in capital investments. A significant portion, $1.7 billion, was specifically earmarked for track infrastructure improvements, highlighting its strategic importance.

Logistics and Supply Chain Solutions

Canadian National Railway (CN) goes beyond simply moving goods by rail. They provide a suite of value-added logistics and supply chain solutions designed to streamline operations for their clients. This encompasses intermodal services, which combine rail and truck transportation, as well as transload and distribution facilities, and even customs brokerage to facilitate cross-border movements.

These integrated offerings allow CN to manage more of a customer's supply chain, offering a one-stop shop for complex logistical needs. For instance, in 2024, CN continued to invest in its intermodal network, enhancing capacity and efficiency to meet growing demand for seamless door-to-door service. Their commitment to innovation in this area directly supports businesses looking to optimize their inventory management and reduce transit times.

- Intermodal Services: Combining rail and truck for efficient long-haul and last-mile delivery.

- Transload and Distribution: Facilities for transferring goods between modes and managing inventory.

- Customs Brokerage: Expertise in navigating international trade regulations and customs clearance.

- Integrated Supply Chain Solutions: Offering a comprehensive approach to logistics management.

Technology Development and Implementation

Canadian National Railway (CN) heavily invests in and deploys advanced technologies to boost operational efficiency, safety, and customer service. This focus on technological advancement is a core activity for the company.

CN utilizes data analytics, automation, and machine vision for critical tasks like track inspection, ensuring the integrity and safety of its vast network. Real-time tracking systems are also a significant component, providing transparency and predictability for customers.

The company's commitment to modernizing its fleet and enhancing service reliability is directly tied to its technology development and implementation efforts. For instance, in 2024, CN continued its strategic investments in advanced train control systems and digital tools aimed at optimizing train movements and reducing transit times.

- Data Analytics: Employing sophisticated analytics to optimize train scheduling, fuel consumption, and predictive maintenance.

- Automation: Implementing automated systems for yard operations and track maintenance to improve throughput and safety.

- Machine Vision: Using advanced cameras and sensors for automated track and equipment inspection, identifying potential issues before they escalate.

- Real-time Tracking: Providing customers with live updates on their shipments, enhancing visibility and service quality.

Canadian National Railway's core operational activities are centered around the efficient and safe movement of freight across its extensive North American network. This includes managing over 20,000 miles of track, optimizing train schedules, and ensuring the integrity of its infrastructure through rigorous maintenance. In 2024, CN allocated approximately $3.5 billion to capital investments, with a significant portion dedicated to track infrastructure, underscoring the critical nature of maintaining and enhancing its network for reliable service delivery.

Full Version Awaits

Business Model Canvas

The Business Model Canvas for Canadian National Railway that you are previewing is the actual document you will receive upon purchase. This means you're seeing a direct representation of the comprehensive analysis, including all key components and strategic insights, that will be delivered to you. Once your order is complete, you'll gain full access to this exact, ready-to-use document, ensuring no surprises and immediate utility for your business planning.

Resources

Canadian National Railway's (CN) most critical asset is its extensive rail network, covering roughly 20,000 route miles across Canada and the United States. This vast physical infrastructure, from tracks to yards, is fundamental to its business and a key differentiator.

This network is a significant competitive advantage, enabling CN to efficiently transport goods across North America, connecting three coasts. The sheer scale of this infrastructure is a testament to its operational reach and capacity.

Canadian National Railway’s locomotive fleet and rolling stock are the backbone of its operations, enabling the transport of a vast array of goods across its extensive network. This includes a diverse mix of modern locomotives and specialized freight cars designed for everything from intermodal containers and automotive parts to bulk commodities like grain.

CN’s commitment to maintaining and enhancing this critical asset is evident in its ongoing investment strategy. For 2025, the company is allocating more than C$500 million towards upgrading and expanding its rolling stock, a move aimed at bolstering efficiency and meeting evolving customer demands.

Canadian National Railway (CN) depends heavily on its approximately 25,000 employees across North America for safe and efficient operations. This skilled workforce includes critical roles like engineers, conductors, and maintenance crews, all essential for managing its extensive rail network.

The expertise of CN's logistics professionals is also a key resource, ensuring the seamless movement of goods. In 2024, the company continued to invest in training and development to maintain and enhance this vital human capital, recognizing its direct impact on service reliability and operational excellence.

Information Technology and Data Systems

Canadian National Railway (CN) relies heavily on advanced information technology and data systems to power its operations. These sophisticated systems, including real-time tracking, robust data analytics platforms, and comprehensive operational control systems, are fundamental to optimizing logistics, managing the complex movement of trains, and improving overall decision-making. CN is actively integrating cutting-edge tracking technologies that leverage real-time data streams to enhance visibility and efficiency across its network.

These IT assets are instrumental in ensuring efficient service delivery and enabling proactive identification and resolution of operational challenges. For instance, CN's investment in technology allows for precise monitoring of its vast network, contributing to improved asset utilization and service reliability.

- Real-time Tracking: CN utilizes advanced GPS and sensor technology for live tracking of locomotives and freight cars, providing immediate visibility into asset location and status.

- Data Analytics: Sophisticated platforms analyze vast datasets to optimize train scheduling, predict maintenance needs, and identify efficiency gains in operations.

- Operational Control: Integrated systems manage train movements, yard operations, and crew assignments, ensuring safe and efficient network flow.

- Customer Visibility: Technology provides customers with real-time shipment tracking and status updates, enhancing transparency and service experience.

Strategic Land Holdings and Facilities

Canadian National Railway's strategic land holdings and facilities are a cornerstone of its operational efficiency and growth potential. CN owns and operates a vast network of real estate, including essential intermodal terminals, distribution centers, and maintenance facilities strategically located across North America. This extensive infrastructure allows for seamless logistics and offers significant opportunities for future development, such as expanding capacity or creating new service offerings.

CN's commitment to its physical network is evident in its substantial asset base. As of its most recent reporting, the company manages over 40 distribution centers and operates 23 intermodal terminals. These facilities are critical for facilitating the efficient movement of goods, connecting various modes of transportation, and supporting the diverse needs of its customer base. The ownership of these assets provides CN with a competitive advantage, ensuring operational control and flexibility.

- Extensive Network: CN operates over 40 distribution centers and 23 intermodal terminals across North America.

- Operational Flexibility: Ownership of these facilities allows for adaptable logistics and service provision.

- Growth Opportunities: Strategic land holdings provide a platform for future expansion and development projects.

- Competitive Advantage: Control over key infrastructure enhances operational efficiency and customer service.

Canadian National Railway’s intellectual property, including its proprietary logistics software and operational methodologies, represents a significant intangible asset. These systems are crucial for optimizing train performance, managing complex supply chains, and maintaining a competitive edge in the transportation industry.

CN's brand reputation and strong customer relationships are also key resources. The company's commitment to reliability and service excellence has fostered trust among its diverse clientele, from major industrial producers to agricultural businesses. This established brand equity is vital for attracting and retaining business.

CN's financial strength and access to capital are fundamental. The company's ability to secure funding for infrastructure upgrades and strategic investments is a critical enabler of its long-term growth and operational efficiency. This financial capacity underpins its ability to execute its business strategy effectively.

| Key Resource | Description | Significance | 2024/2025 Data Point |

|---|---|---|---|

| Rail Network | ~20,000 route miles across Canada and the US | Core operational asset, competitive differentiator | Continued investment in network upgrades |

| Rolling Stock | Locomotives and freight cars | Enables diverse cargo transport | Over C$500 million allocated for 2025 upgrades |

| Employees | ~25,000 skilled workforce | Ensures safe and efficient operations | Ongoing investment in training and development in 2024 |

| IT Systems | Real-time tracking, data analytics, operational control | Optimizes logistics and decision-making | Integration of cutting-edge tracking technologies |

| Facilities | Intermodal terminals, distribution centers | Facilitates efficient goods movement | Operates 23 intermodal terminals and over 40 distribution centers |

Value Propositions

Canadian National Railway (CN) boasts an extensive North American network, a cornerstone of its business model. This reach provides customers with unparalleled access to key markets across Canada and the United States, effectively connecting the Atlantic, Pacific, and Gulf coasts. This vital link in North American supply chains is a significant value proposition for shippers.

CN's expansive network, spanning from coast to coast in Canada and extending deep into the Midwestern and Southern United States, facilitates efficient transportation. In 2024, CN reported operating over 19,800 route miles, a testament to this broad geographic coverage. This allows customers to reach diverse origins and destinations with greater ease and efficiency.

Canadian National Railway (CN) offers dependable and timely freight transportation, a vital service for businesses needing consistent goods delivery. In 2023, CN moved over 2.6 million carloads of diverse freight, highlighting its role in the supply chain.

CN consistently works to enhance operational efficiency and service quality, aiming to surpass customer expectations. This focus is crucial for maintaining their competitive edge in the market.

By leveraging its robust customer service and operational efficiency, CN targets profitable business growth. The company's commitment to reliability underpins its strategy for expanding its market presence.

Canadian National Railway (CN) boasts extensive capabilities for handling a diverse range of commodities, a key element of its business model. This includes everything from intermodal containers and automotive parts to essential resources like coal, metals, minerals, and fertilizers, as well as everyday consumer products.

This broad handling capacity allows CN to serve a wide spectrum of industries, meeting their unique and often complex transportation requirements. The company's revenue generation is directly tied to this versatility, with freight revenues segmented across seven distinct commodity groups, showcasing the breadth of its operational scope.

Integrated Logistics and Supply Chain Solutions

Canadian National Railway (CN) extends its value proposition beyond basic rail transport by offering a suite of integrated logistics and supply chain solutions. These services include intermodal transport, transload facilities, and customs brokerage, creating a seamless, end-to-end experience for customers. This approach simplifies the complexities of modern supply chain management for businesses.

CN's unique offering combines its robust rail network with warehousing and distribution capabilities. This synergy allows for efficient movement and storage of goods, providing a comprehensive solution that streamlines operations. For example, in 2024, CN continued to invest in its intermodal network, enhancing its capacity to handle diverse cargo types and volumes across North America, a critical component of its integrated service offering.

- End-to-End Supply Chain Management: CN provides a single point of contact for complex logistics needs, from origin to destination.

- Intermodal Expertise: Leveraging its rail network, CN offers efficient intermodal solutions, combining rail, truck, and ocean transport.

- Value-Added Services: Services like transloading and warehousing add significant value by optimizing inventory and distribution processes.

- Customs Brokerage: CN facilitates smoother cross-border movements by managing customs clearance, reducing delays and complexities for international shipments.

Commitment to Safety and Sustainability

Canadian National Railway (CN) places a strong emphasis on safety and sustainability throughout its operations. This dedication resonates with customers who increasingly seek partners demonstrating environmental responsibility and ethical practices in their supply chains.

CN’s commitment to sustainability is evident in its efforts to reduce greenhouse gas emissions and explore renewable fuel technologies. This focus on environmental stewardship is a key value proposition for a growing segment of the market.

In 2024, CN reported a significant achievement by reducing its total absolute Scope 1, 2, and 3 greenhouse gas (GHG) emissions by approximately 4% compared to 2023 levels. This tangible progress highlights their ongoing investment in cleaner operations and fuels.

- Safety First: CN’s operational philosophy is built around ensuring the highest safety standards for its employees, communities, and customers.

- Environmental Responsibility: The company actively pursues strategies to minimize its environmental footprint, including emission reduction targets.

- Renewable Fuel Investment: CN is investing in and exploring the use of renewable fuels to power its locomotive fleet, aiming for a greener future.

- Customer Appeal: This dual commitment to safety and sustainability attracts and retains customers who prioritize ethical and environmentally conscious logistics partners.

CN's value proposition centers on its extensive North American network, connecting key markets and facilitating efficient, reliable freight transportation across diverse commodities. They offer integrated logistics solutions, including intermodal and value-added services, simplifying supply chains for customers. Furthermore, CN's commitment to safety and sustainability appeals to environmentally conscious businesses.

| Value Proposition | Description | 2024 Data/Impact |

|---|---|---|

| Extensive Network & Market Access | Unparalleled reach across Canada and the US, connecting Atlantic, Pacific, and Gulf coasts. | Operated over 19,800 route miles, enabling access to diverse origins and destinations. |

| Reliable & Timely Freight Transport | Consistent delivery of goods, vital for businesses dependent on supply chains. | Moved over 2.6 million carloads in 2023, demonstrating operational capacity. |

| Diverse Commodity Handling | Capabilities to transport a wide array of goods, from intermodal containers to bulk resources. | Serves multiple industries, with revenue segmented across seven distinct commodity groups. |

| Integrated Logistics Solutions | End-to-end supply chain services including intermodal, transloading, and customs brokerage. | Continued investment in intermodal network enhances capacity for diverse cargo handling. |

| Safety & Sustainability Commitment | Emphasis on operational safety and environmental responsibility, reducing emissions. | Achieved ~4% reduction in absolute GHG emissions in 2024 compared to 2023. |

Customer Relationships

Canadian National Railway (CN) cultivates robust customer relationships by assigning dedicated account managers. These professionals deeply understand each client's unique operational requirements and business objectives, enabling them to craft and deliver highly customized solutions. This personalized engagement is key to building enduring partnerships and ensuring prompt, effective service delivery.

This focus on tailored service is crucial for CN's success. For instance, in 2024, CN reported that approximately 85% of its revenue comes from repeat business, a testament to the strength of these dedicated relationships and the consistent quality of service provided to its diverse customer base, which includes major players in agriculture, automotive, and energy sectors.

Canadian National Railway (CN) fosters deep customer relationships through active collaboration in supply chain optimization. By partnering with clients and logistics providers, CN co-creates innovative solutions that enhance freight movement efficiency and promote sustainable growth.

In 2024, CN's commitment to these partnerships is evident in its ongoing efforts to streamline operations. For instance, their investments in intermodal capacity and digital tools directly benefit customers by reducing transit times and improving visibility, a key aspect of optimizing the entire supply chain.

Canadian National Railway (CN) significantly enhances customer relationships through its robust suite of online tools and digital platforms. These digital resources, including advanced shipping tools for both carload and intermodal services, along with Application Programming Interface (API) and Electronic Data Interchange (EDI) solutions, offer unparalleled convenience and transparency. In 2024, CN continued to invest in these platforms, aiming to streamline the customer journey from booking to delivery.

Proactive Communication and Issue Resolution

Canadian National Railway (CN) places a strong emphasis on proactive customer communication, particularly concerning service updates and potential operational disruptions. This approach aims to build trust and ensure customers are well-informed. For instance, CN’s comprehensive winter plan involves sharing detailed information and forecasts to mitigate the impact of severe weather on operations and customer shipments.

A core element of CN's customer relationship strategy is its commitment to promptly addressing and resolving issues. By maintaining a robust system for issue management, CN strives to foster customer satisfaction and loyalty. This responsiveness is crucial in the logistics sector where timely delivery and reliable service are paramount.

- Proactive Information Sharing: CN actively communicates service updates, potential disruptions, and operational changes to its customers.

- Issue Resolution: A strong focus on promptly addressing and resolving customer concerns helps maintain trust and satisfaction.

- Winter Operations: CN's winter plan includes proactive information sharing and customer forecasts to manage the impact of severe weather.

Industry-Specific Expertise

Canadian National Railway (CN) cultivates deep industry-specific expertise to cater to the distinct needs of sectors like agriculture, automotive, and energy. This specialized knowledge is crucial for delivering efficient and tailored services across its diverse operations.

CN's freight revenues are segmented into seven key commodity groups, highlighting its broad engagement with various industries and the specialized knowledge required for each. For instance, in 2024, CN reported significant revenue contributions from sectors like Automotive & Equipment and Energy & Mining, underscoring the importance of their sector-specific operational capabilities.

- Agricultural Expertise: CN's understanding of grain logistics, including seasonal demands and storage requirements, ensures timely delivery of essential crops.

- Automotive Solutions: The company provides specialized railcar services and route optimization for the automotive sector, facilitating efficient vehicle transport.

- Energy Sector Support: CN leverages expertise in handling bulk commodities like coal, petroleum, and chemicals, adhering to stringent safety and environmental standards.

- Diverse Commodity Handling: CN's ability to manage a wide array of goods, from lumber to intermodal containers, demonstrates its adaptable industry-specific knowledge base.

Canadian National Railway (CN) prioritizes customer relationships through dedicated account management and collaborative supply chain optimization. These efforts are supported by significant investments in digital platforms and proactive communication strategies, reinforcing customer loyalty and operational efficiency.

CN's customer-centric approach is validated by its strong repeat business, with approximately 85% of its revenue in 2024 derived from returning clients. This highlights the effectiveness of tailored solutions and consistent service quality across diverse sectors.

| Relationship Aspect | CN's Approach | Impact/Evidence (2024 Data) |

|---|---|---|

| Dedicated Account Management | Personalized service, understanding client needs | Drives customized solutions and enduring partnerships |

| Supply Chain Collaboration | Co-creating solutions with clients and logistics providers | Enhances freight movement efficiency and visibility |

| Digital Platforms & Tools | Online shipping tools, API, EDI solutions | Offers convenience, transparency, and streamlined customer journey |

| Proactive Communication | Sharing service updates and disruption forecasts | Builds trust, especially during events like winter operations |

| Issue Resolution | Prompt and effective problem-solving | Fosters customer satisfaction and loyalty |

Channels

Canadian National Railway (CN) leverages a direct sales force and specialized account teams as its primary channels for engaging with large enterprise customers. These teams are crucial for understanding the unique freight transportation and logistics requirements of businesses, enabling CN to propose tailored solutions. The company's commercial officers, integral to its leadership structure, oversee these client relationships.

Canadian National Railway (CN) leverages its official website and dedicated customer portals as primary channels for communication and service delivery. These digital platforms are crucial for sharing company information, offering self-service options for clients, and providing access to essential shipping tools and resources.

The company's website prominently features an 'Investors' section, which serves as a vital hub for stakeholders seeking detailed financial reports and operational performance data. In 2023, CN reported total revenues of CAD 17.4 billion, with a significant portion of this information made accessible through its online investor relations portal, facilitating transparency for shareholders and analysts.

CN's network of 23 intermodal terminals and over 40 distribution centers across North America are the physical conduits for its business. These facilities are crucial for seamlessly transferring and consolidating freight, linking rail operations with trucking and other transport methods.

These strategically positioned hubs facilitate efficient cargo movement, acting as vital nodes where goods transition between different transportation legs. This extensive infrastructure underpins CN's ability to offer integrated logistics solutions to its diverse customer base.

Ports and Global Shipping Lines

Canadian National Railway (CN) actively partners with major global ports and international shipping lines, acting as a critical conduit for overseas traffic. These strategic alliances are fundamental to CN's ability to offer seamless transcontinental freight solutions, effectively bridging ocean and land transportation networks.

These collaborations are vital for extending CN's operational reach and ensuring efficient cargo movement. In 2024, approximately 35% of CN's total revenues were directly attributable to this overseas traffic, highlighting the significant economic impact of these port and shipping line relationships.

- Port Partnerships: CN collaborates with key North American ports like Vancouver, Prince Rupert, and Montreal to manage inbound and outbound international freight.

- Shipping Line Alliances: Agreements with major global carriers ensure consistent cargo volumes and integrated logistics services for overseas customers.

- Revenue Contribution: Overseas traffic accounted for a substantial 35% of CN's revenue in 2024, underscoring the importance of these international shipping channels.

- Supply Chain Integration: These relationships enable CN to offer end-to-end supply chain solutions, managing goods from international waters to final destinations across North America.

Industry Conferences and Trade Shows

Canadian National Railway (CN) actively participates in industry conferences and trade shows to highlight its comprehensive logistics solutions and connect with a broad range of stakeholders. These events are crucial for showcasing new service offerings, fostering relationships with potential clients, and identifying emerging industry trends. For instance, CN's presence at events like the Railway Interchange show provides a platform to demonstrate its capabilities and engage directly with the rail industry's key players.

These professional gatherings are vital for business development and strategic partnerships. They allow CN to gauge market sentiment and adapt its service portfolio accordingly. In 2024, for example, CN's executives attended numerous investor conferences, providing updates on financial performance and strategic initiatives, such as their network expansion plans and sustainability efforts, reinforcing their commitment to transparent communication with the financial community.

CN leverages these channels for more than just visibility; they are instrumental in building and maintaining key relationships. By engaging with potential customers, suppliers, and industry influencers, CN strengthens its market position. This direct interaction helps them understand evolving customer needs and competitive landscapes, ensuring their business model remains agile and responsive.

Key benefits derived from these engagements include:

- Business Development: Generating leads and securing new business opportunities.

- Networking: Building and strengthening relationships with customers, partners, and industry peers.

- Market Intelligence: Gaining insights into emerging trends, technologies, and competitive strategies.

- Brand Visibility: Enhancing CN's profile as a leading logistics provider and employer.

CN's channels encompass direct sales, digital platforms, and physical infrastructure. Direct sales teams engage enterprise clients, while websites and portals offer information and self-service options. Intermodal terminals and distribution centers are key physical conduits for freight movement.

Strategic partnerships with global ports and shipping lines are vital for international traffic, acting as critical conduits for overseas business. These alliances facilitate seamless transcontinental freight, bridging ocean and land networks. In 2024, overseas traffic contributed approximately 35% to CN's revenue.

Industry conferences and trade shows serve as platforms for showcasing solutions and building relationships. These events are crucial for business development, networking, and gathering market intelligence, allowing CN to adapt its services to evolving customer needs and competitive landscapes.

| Channel Type | Description | Key Function | 2024 Relevance |

|---|---|---|---|

| Direct Sales Force | Specialized account teams | Tailored solutions for enterprise clients | Facilitates high-value B2B relationships |

| Digital Platforms | Website, customer portals | Information sharing, self-service, shipping tools | Enhances customer experience and accessibility |

| Physical Infrastructure | Intermodal terminals, distribution centers | Freight transfer and consolidation | Enables efficient logistics and network reach |

| Port & Shipping Partnerships | Alliances with global ports and carriers | Seamless transcontinental freight, overseas traffic | 35% of 2024 revenue from overseas traffic |

| Industry Events | Conferences, trade shows | Business development, networking, market intelligence | Supports strategic partnerships and brand visibility |

Customer Segments

Large industrial and manufacturing companies, including those in automotive, metals, minerals, forest products, and petroleum and chemicals, represent a crucial customer segment for Canadian National Railway (CN). These businesses rely on CN for high-volume, consistent freight movement across North America, essential for their supply chains. For example, in 2024, CN continued to be a primary transporter of automotive parts, contributing significantly to the North American automotive industry's logistics.

These clients often present intricate logistics challenges, making CN's expansive network and specialized handling expertise particularly valuable. CN's ability to move bulk commodities like coal, metals, and minerals, alongside finished goods and raw materials for the forest product and chemical sectors, underscores its importance to these foundational industries. The railway's infrastructure is critical for ensuring these sectors can efficiently access markets and raw materials.

Agricultural and fertilizer producers represent a cornerstone customer segment for Canadian National Railway (CN). Their core need is the dependable and cost-effective transport of bulk commodities like grain and fertilizer, crucial for both domestic consumption and global export markets. This reliance on efficient logistics makes CN an indispensable partner.

The importance of this segment is underscored by recent performance data. In the second quarter of 2025, CN observed a notable 12% increase in grain and fertilizer shipments, highlighting the robust demand and the critical role CN plays in supporting these industries.

Retail and consumer goods companies are a vital customer segment for Canadian National Railway (CN). These businesses depend on CN to transport their finished products and intermodal containers efficiently across vast distances. The need for speed and dependability in transit is paramount to satisfy ever-present consumer demand.

In 2024, intermodal services, which are crucial for many retail and consumer goods shipments, represented a significant 22% of CN's total revenues. This highlights the substantial reliance of this sector on CN's network for getting goods to market quickly.

Intermodal Shipping Companies and Logistics Providers

Intermodal shipping companies and logistics providers are crucial customers for CN, relying on its extensive rail network to offer seamless door-to-door transportation. These businesses integrate CN's rail services with trucking and ocean freight to create comprehensive supply chain solutions, particularly valuing the efficiency and sustainability of rail for long-haul segments.

CN's intermodal offerings are vital for these partners, enabling them to optimize their operations. For instance, in 2024, intermodal traffic represented a significant portion of CN's overall freight volume, demonstrating the sector's importance. These companies benefit from CN's investments in terminal infrastructure and equipment, which enhance transit times and reliability.

- Key Value Proposition: CN provides a critical link in their integrated logistics chains, offering cost-effective and environmentally friendly long-haul rail transport that complements their trucking and ocean operations.

- Customer Needs: These partners require reliable, high-frequency intermodal services with competitive transit times and terminal efficiency to meet their end customers' demands.

- CN's Contribution: CN facilitates these services through its extensive rail network, intermodal terminals, and strategic partnerships, enabling door-to-door solutions.

- Market Context: The demand for intermodal solutions continues to grow, driven by a need for supply chain resilience and reduced carbon footprints, with CN playing a pivotal role in facilitating this shift.

Energy and Resource Companies

Canadian National Railway (CN) plays a critical role in transporting essential commodities for energy and resource companies across North America. This segment is vital for the movement of coal, crude oil, and various other energy-related products, underpinning significant portions of the economy. For instance, in 2023, CN reported moving over 175 million metric tons of coal, a substantial portion of which serves energy generation and metallurgical purposes. Petroleum and chemical products also represent a significant freight category for CN, highlighting the sector's reliance on efficient rail transport.

The energy and resource sector’s performance is intrinsically linked to global commodity prices and evolving energy policies. CN's operations within this segment are therefore subject to market fluctuations and regulatory shifts. The company must maintain specialized equipment and adhere to stringent handling protocols to safely and effectively transport these often hazardous materials. This includes dedicated tank cars for petroleum products and specialized hoppers for coal, ensuring compliance with safety standards and environmental regulations.

- Key Commodities Transported: Coal, crude oil, petroleum products, chemicals, and other energy-related materials.

- Market Influences: Global commodity prices, energy policies, and demand for fossil fuels.

- Operational Requirements: Specialized railcars (tank cars, hoppers), strict safety protocols, and efficient logistics for bulk transport.

- Economic Significance: Facilitates the movement of essential resources that power industries and economies.

Government and municipal entities represent a distinct customer segment for Canadian National Railway (CN). These organizations utilize CN's services for infrastructure projects, disaster relief, and the transport of public goods. For example, in 2024, CN supported several provincial initiatives involving the movement of construction materials for public works. Their needs often involve large-scale, scheduled movements requiring significant logistical coordination and adherence to public safety standards.

This segment also includes the transport of waste and recycled materials, a growing area of focus for municipalities aiming for sustainability. CN's ability to move these materials efficiently over long distances contributes to environmental goals and cost savings for local governments. The railway's role in national infrastructure development further solidifies its relationship with governmental bodies.

Cost Structure

The largest components of CN's cost structure are operational expenses, primarily fuel for locomotives, employee wages and benefits, and the ongoing maintenance of its extensive infrastructure and rolling stock. These costs are directly influenced by the volume of freight transported and the operational scope of the network.

In the fourth quarter of 2024, Canadian National Railway reported an increase in operating expenses. This rise was attributed to factors such as higher fuel prices and increased labor costs, impacting the overall cost of service delivery.

Canadian National Railway (CN) requires substantial capital expenditures to maintain and enhance its vast rail network, including acquiring new locomotives and modernizing its fleet of rolling stock. These significant, long-term investments are fundamental to ensuring operational capacity, upholding safety standards, and boosting overall efficiency across its operations. In 2024, CN allocated approximately $3.5 billion towards these critical capital investments.

Depreciation and amortization are significant non-cash expenses for Canadian National Railway (CN) due to its extensive investments in long-lived assets like tracks, rolling stock, and signal systems. This accounts for the gradual decrease in the value of these assets over their useful lives. In 2023, CN reported depreciation and amortization expenses of approximately $2.5 billion.

Administrative and General Expenses

Administrative and General Expenses are crucial for Canadian National Railway's (CN) operations, covering essential corporate functions. These include executive and administrative staff salaries, IT infrastructure and support, legal services, marketing efforts, and other overhead costs vital for managing a complex enterprise like CN.

These expenses are an integral part of CN's total operating costs, directly impacting its profitability. For instance, in 2023, CN reported total operating expenses of $10,980 million. While specific breakdowns for administrative and general expenses are not always separately itemized in high-level reports, they represent a significant portion of the SG&A (Selling, General & Administrative) expenses, which were $2,093 million in 2023.

- Executive and Staff Compensation: Costs associated with leadership and support personnel.

- Information Technology: Investment in and maintenance of IT systems for operations and administration.

- Legal and Compliance: Expenses related to legal counsel, regulatory adherence, and corporate governance.

- Marketing and Communications: Costs for promoting services and maintaining corporate brand image.

Regulatory Compliance and Safety Costs

Canadian National Railway (CN) faces substantial expenses to adhere to rigorous safety and environmental regulations across Canada and the United States. These costs are essential for maintaining operational integrity and public trust.

Investments in advanced safety technologies, comprehensive employee training programs, and proactive environmental protection measures are key components of CN's regulatory compliance strategy. These expenditures are critical for mitigating risks and ensuring sustainable operations.

CN's commitment to safety is further detailed in its 2024 Sustainability Data Supplement, which highlights important performance indicators in this area. For instance, the supplement may detail investments in track maintenance or the adoption of new safety protocols.

- Safety Technology Investment: CN allocates significant capital to technologies like positive train control (PTC) and advanced track inspection systems to enhance safety.

- Training and Development: Costs associated with continuous training for engineers, conductors, and maintenance crews on safety procedures and emergency response are substantial.

- Environmental Stewardship: Expenses related to emissions reduction, spill prevention, and habitat protection, as mandated by environmental regulations, form another significant cost category.

- Regulatory Reporting: The administrative burden and associated costs of preparing and submitting detailed compliance reports to various regulatory bodies in both countries are ongoing.

The primary cost drivers for Canadian National Railway (CN) are its extensive operational expenses, including fuel, labor, and infrastructure maintenance. These are directly tied to the volume of goods moved and the network's utilization.

Capital expenditures are also a significant cost, with CN investing heavily in maintaining and upgrading its rail network and rolling stock. In 2024, these critical investments amounted to approximately $3.5 billion.

Depreciation and amortization represent substantial non-cash expenses, reflecting the wear and tear on CN's vast, long-lived assets. In 2023, these expenses were around $2.5 billion.

| Cost Category | 2023 Expense (Millions CAD) | Key Drivers |

| Operating Expenses (Fuel, Labor, Maintenance) | ~10,980 | Freight volume, fuel prices, wage agreements |

| Capital Expenditures | 3,500 (2024 est.) | Network upgrades, fleet modernization, safety improvements |

| Depreciation & Amortization | ~2,500 | Asset base (tracks, locomotives, rolling stock) |

| Selling, General & Administrative (SG&A) | ~2,093 | Corporate functions, IT, legal, marketing |

Revenue Streams

Canadian National Railway's core revenue comes from moving goods via its extensive rail network. This freight transportation service is the backbone of its business, generating the vast majority of its income.

CN's freight revenue is impressively diverse, covering a wide array of commodities. This includes everything from shipping cars and auto parts to hauling coal, metals, minerals, and agricultural products. The intermodal segment, which involves transporting goods in standardized containers or trailers, is also a significant contributor.

For the fiscal year ending December 31, 2024, CN reported total revenues of $17,046 million. Of this substantial amount, freight revenues accounted for $16,395 million, highlighting its critical importance to the company's financial performance.

Intermodal services are a cornerstone of Canadian National Railway's (CN) revenue generation. This segment focuses on moving freight in standardized containers, allowing for smooth transitions between different modes of transport like rail, trucks, and ships. This flexibility is key to its appeal for shippers.

In 2024, intermodal operations proved to be CN's most significant revenue driver. It represented a substantial 22% of the company's total revenues, highlighting its critical role in CN's overall financial performance and business strategy.

Canadian National Railway (CN) generates revenue beyond core rail transport by offering specialized logistics and supply chain services. These include value-added offerings like transloading, distribution, and customs brokerage, creating integrated solutions for customers.

These services represent a significant revenue stream, allowing CN to capture more value from the movement of goods. For instance, in 2024, CN continued to expand its intermodal and logistics capabilities, contributing to its overall financial performance by providing end-to-end supply chain management.

Accessorial Charges and Surcharges

Canadian National Railway (CN) generates significant additional revenue through accessorial charges and surcharges. These fees are applied for specific services or to offset fluctuating operational costs, common practices within the railway sector.

These charges can include demurrage, which is levied when railcars are held beyond the free time allowance, and storage fees for goods kept on CN property. Fuel surcharges are also a crucial component, directly reflecting the volatile costs of diesel fuel, a major operating expense for CN.

- Demurrage Fees: Charges for exceeding allotted railcar dwell times, encouraging efficient cargo movement.

- Storage Fees: Revenue from holding freight on CN's network beyond standard periods.

- Fuel Surcharges: Variable charges passed on to customers to cover fluctuations in diesel fuel prices.

- Other Accessorials: Including fees for switching, weighing, and other specialized rail services.

In 2023, CN reported that its operating expenses included significant fuel costs, highlighting the importance of fuel surcharges in maintaining profitability amidst price volatility. While specific figures for accessorial charges are often embedded within broader revenue categories, their contribution is substantial, particularly during periods of high demand and supply chain congestion.

Leasing and Sales of Assets

Canadian National Railway (CN) generates revenue through the leasing and sale of its assets. This includes surplus rolling stock, equipment, and other railroad materials that are no longer essential for core operations. This strategy not only recovers value but also optimizes the utilization of its extensive asset base.

In 2024, CN continued to leverage this revenue stream by actively engaging in the sale and leasing of its surplus equipment. This practice allows CN to maintain a lean and efficient operational footprint while capitalizing on the market demand for railway assets. For instance, the company might lease out specialized rail cars or sell older locomotives that have been replaced by newer, more efficient models.

- Asset Monetization: CN actively sells and leases surplus rolling stock, equipment, and railroad materials to generate additional income and optimize asset utilization.

- Value Recovery: This revenue stream allows CN to recover capital from assets that are no longer part of its primary operational needs, enhancing financial flexibility.

- Market Responsiveness: By leasing or selling assets, CN can adapt to changing market demands and operational requirements, ensuring its fleet remains optimized.

Canadian National Railway's revenue streams are multifaceted, extending beyond basic freight hauling. The company generates income from intermodal services, specialized logistics, accessorial charges, and asset leasing. These diverse revenue sources contribute significantly to CN's overall financial health and operational flexibility.

In 2024, CN's total revenues reached $17,046 million, with freight revenue comprising $16,395 million. Intermodal services alone accounted for a substantial 22% of total revenues, underscoring its importance. Accessorial charges, including demurrage and fuel surcharges, also play a vital role in offsetting operational costs and generating additional income.

| Revenue Stream | Description | 2024 Contribution (Approximate) |

|---|---|---|

| Freight Transportation | Core business of moving various commodities via rail. | $16,395 million |

| Intermodal Services | Transporting goods in standardized containers. | 22% of total revenue |

| Logistics & Supply Chain Services | Value-added services like transloading and distribution. | Significant contributor, integrated with freight. |

| Accessorial Charges | Fees for services like demurrage, storage, and fuel surcharges. | Substantial, especially during high demand. |

| Asset Leasing & Sales | Monetizing surplus rolling stock and equipment. | Ongoing activity to optimize asset utilization. |

Business Model Canvas Data Sources

The Canadian National Railway Business Model Canvas is informed by a blend of internal financial reports, operational data, and external market intelligence. This comprehensive approach ensures a robust and accurate representation of the company's strategic framework.