CM.com Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CM.com Bundle

CM.com operates in a dynamic market, facing significant pressure from rivals and the constant threat of new entrants disrupting the established order. Understanding these forces is crucial for navigating the competitive landscape.

The complete report reveals the real forces shaping CM.com’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

CM.com's reliance on telecommunication carriers and network providers for its messaging and voice services means these suppliers hold considerable sway. Their control over essential infrastructure directly affects CM.com's operational costs and service delivery capabilities.

The significant bargaining power of these network providers stems from their ownership of critical infrastructure. For instance, in 2024, major mobile network operators globally continued to consolidate, potentially increasing their leverage over digital service providers like CM.com by limiting the number of available partners and dictating terms.

CM.com relies on a variety of technology and software suppliers for its platform, from cloud infrastructure providers to specialized API developers. The bargaining power of these suppliers is directly tied to how unique and essential their products are to CM.com's operations. If a supplier offers a solution that is difficult to replicate or has few viable substitutes, their leverage naturally grows.

As CM.com pivots towards becoming an AI-first organization, its dependence on AI and machine learning technology providers is set to increase significantly. This growing reliance could amplify the bargaining power of these specialized vendors, particularly those offering cutting-edge or proprietary AI capabilities. For instance, the global AI market was valued at approximately $200 billion in 2023 and is projected to grow substantially, indicating a robust demand for such technologies.

Payment gateway providers hold significant sway over CM.com's operations. Their market share and the variety of payment methods they facilitate directly impact CM.com's service offerings. For instance, if a few major players dominate the gateway market, they can dictate terms, potentially increasing costs for CM.com.

The security standards and reliability of these providers are also critical. A provider with a strong reputation for security and uptime can command higher fees, as businesses like CM.com depend on seamless and secure transactions. In 2024, the global payment gateway market was valued at approximately $23.5 billion, with a projected compound annual growth rate of over 13% through 2030, indicating a dynamic and competitive, yet consolidating, landscape.

Talent Pool (Skilled Labor)

The availability of skilled professionals in cloud communications, AI, software development, and cybersecurity significantly impacts CM.com's operational costs and innovation capabilities. A tight labor market for these specialized roles can empower the talent pool as a supplier.

For instance, in 2024, the demand for AI and machine learning engineers remained exceptionally high, with reports indicating a global shortage. This scarcity directly translates to higher salary expectations and more competitive benefit packages, increasing the cost of acquiring and retaining essential talent for companies like CM.com. Similarly, the cybersecurity sector continues to face a significant skills gap, with millions of unfilled positions worldwide, further bolstering the bargaining power of qualified professionals in this domain.

- High Demand for AI Specialists: Reports in early 2024 highlighted that the average salary for an AI engineer in major tech hubs could exceed $150,000 annually.

- Cybersecurity Skills Gap: The cybersecurity workforce needed to grow by 65% by 2025 to adequately defend organizations against cyber threats, according to industry analyses.

- Cloud Communications Expertise: Companies require professionals proficient in platforms like CM.com's, leading to increased demand and potential wage inflation for these niche skills.

Data Providers and Analytics Tools

CM.com relies heavily on data providers for customer insights and personalization, a critical component of its business model. Suppliers offering unique, high-quality customer data or sophisticated analytics tools can wield considerable bargaining power.

The influence of these suppliers is directly tied to the exclusivity and depth of the data they provide, or the advanced analytical capabilities they offer, which CM.com needs to maintain its competitive edge.

- Data Aggregators: Companies specializing in aggregating diverse customer datasets are key suppliers.

- Analytics Software Vendors: Providers of AI-driven analytics platforms enhance CM.com's ability to derive actionable insights.

- Data Quality and Uniqueness: The more specialized and accurate the data, the stronger the supplier's position.

CM.com's reliance on telecommunication carriers and specialized technology providers grants these suppliers significant leverage. Their control over essential infrastructure and unique software solutions directly impacts CM.com's operational costs and service capabilities. The consolidation within the mobile network operator sector in 2024, for instance, has amplified the bargaining power of these key infrastructure providers.

The growing dependence on AI and machine learning technology providers, coupled with the high demand for specialized talent in areas like cybersecurity, further strengthens the position of these suppliers. For example, the global AI market's substantial growth underscores the leverage held by leading AI capability providers.

| Supplier Type | Key Dependence | Bargaining Power Factors | 2024/2025 Context |

|---|---|---|---|

| Telecommunication Carriers | Network Infrastructure | Infrastructure Ownership, Consolidation | Increased leverage due to fewer major partners |

| AI/ML Technology Providers | Cutting-edge Capabilities | Proprietary Solutions, Market Growth | High demand, significant market expansion |

| Specialized Talent | Skilled Workforce | Skills Shortage, Demand for Niche Expertise | Elevated wages for AI and cybersecurity professionals |

What is included in the product

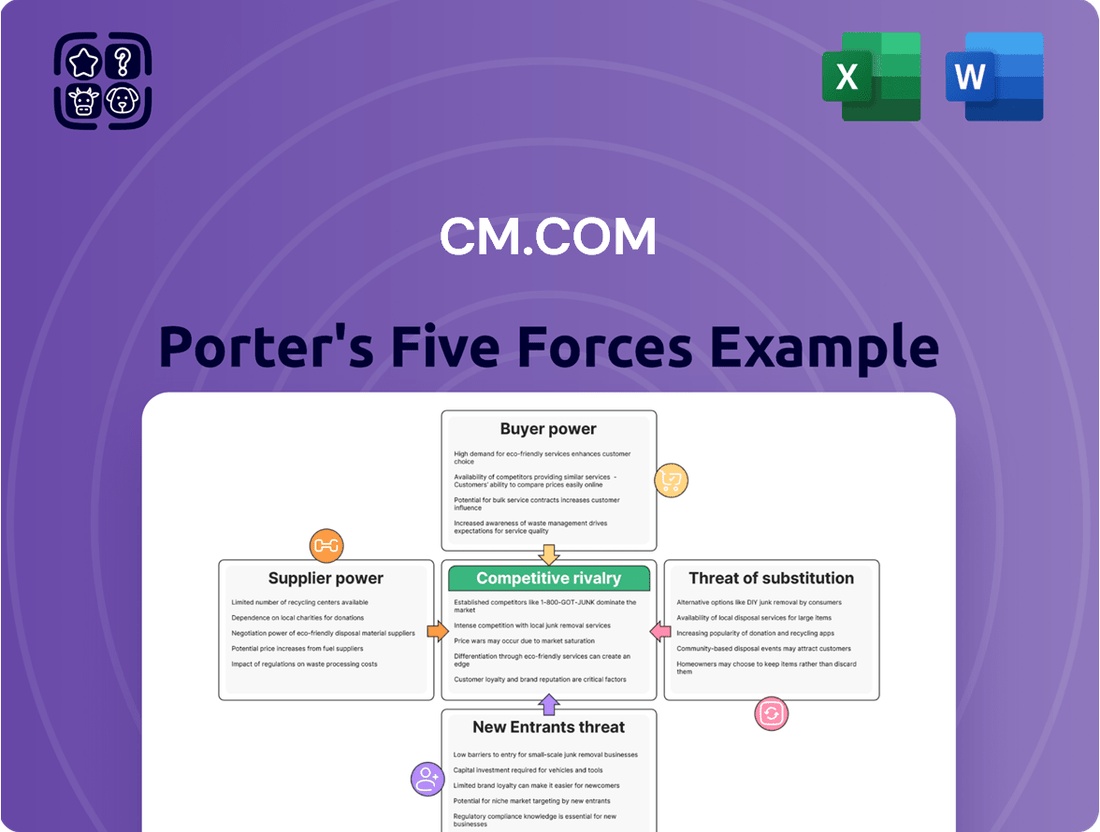

CM.com's Porter's Five Forces Analysis provides a comprehensive evaluation of the competitive landscape, detailing the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, all specific to CM.com's market position.

CM.com's Porter's Five Forces Analysis simplifies complex competitive landscapes, allowing businesses to quickly identify and address strategic threats and opportunities.

Customers Bargaining Power

Large enterprise clients, especially those with substantial usage or critical strategic value, wield considerable influence over CM.com. These clients can negotiate for tailored functionalities, better pricing structures, and specific service level agreements, leveraging the significant revenue they bring to the company.

Small and Medium-sized Enterprises (SMEs) generally possess less individual bargaining power than larger corporations. However, their sheer numbers can create significant collective leverage, particularly in driving down prices or demanding tailored service features. For CM.com, catering to this segment with flexible, cost-effective solutions is key to capturing market share, but the competitive landscape means SMEs can still exert considerable influence.

Customers in specialized sectors such as retail, finance, and healthcare often have stringent compliance, security, and integration needs. Their bargaining power can be amplified if CM.com faces substantial investment costs to cater to these niche requirements or if alternative providers are scarce for these specific demands.

CM.com's significant engagement in the events and ticketing sector highlights a unique set of customer expectations. For instance, in 2024, the global events market is projected to see robust growth, with ticketing platforms playing a crucial role, indicating a concentrated customer base with specific operational needs that CM.com must address.

Customers with Low Switching Costs

When customers face low switching costs in the cloud communications market, their ability to move to a competitor with minimal friction significantly amplifies their bargaining power. This means CM.com must actively cultivate customer loyalty beyond simple pricing. For instance, a business using a Communications Platform as a Service (CPaaS) might find it relatively easy to migrate to another provider if the initial setup was straightforward and data integration is not overly complex. This ease of transition directly translates into greater leverage for the customer during negotiations.

To counter this, CM.com must build substantial "stickiness" into its offerings. This involves developing unique, indispensable features that competitors cannot easily replicate, alongside providing exceptional, responsive customer support that becomes a key differentiator. Seamless integration with a client's existing technology stack is also crucial; the more deeply CM.com's platform is embedded, the higher the switching costs become, thereby reducing customer bargaining power. In 2024, the global CPaaS market was valued at approximately $25 billion, highlighting the intense competition where customer retention is paramount.

- Low Switching Costs: Customers can easily move to competing cloud communications providers without incurring significant financial or operational penalties.

- Increased Bargaining Power: This ease of switching empowers customers to demand better pricing, service levels, or customized solutions.

- CM.com's Strategy: Focus on building platform stickiness through proprietary features, superior customer service, and deep integration to mitigate this threat.

Customers Seeking Omnichannel and AI-Powered Solutions

Customers increasingly expect seamless omnichannel experiences and intelligent, AI-driven interactions. This growing demand grants them greater leverage, as they can choose providers that offer integrated solutions, pushing for advanced features and superior performance from companies like CM.com.

The expectation for AI-powered personalization and efficiency means customers are less likely to settle for basic communication tools. For instance, in 2024, businesses are investing heavily in AI for customer service, with projections indicating significant growth in AI adoption within customer engagement platforms, further empowering informed buyers.

- Demand for Omnichannel Integration: Customers want to interact across multiple channels (web, mobile, social, messaging apps) without losing context.

- Expectation of AI Capabilities: Buyers are looking for AI-driven chatbots, personalized recommendations, and predictive analytics to enhance their experience.

- Increased Switching Costs for Providers: Companies that fail to offer these advanced, integrated solutions may face higher customer churn as clients move to competitors.

- Focus on Value and Performance: Customers with these sophisticated needs are more discerning about the performance and value proposition of communication platforms.

The bargaining power of customers for CM.com is significantly influenced by the ease with which they can switch to alternative providers. Low switching costs mean customers can readily demand better pricing, more features, or improved service levels. This is particularly true in the competitive Communications Platform as a Service (CPaaS) market, valued at approximately $25 billion in 2024, where customer retention is a critical factor for success.

CM.com counters this by focusing on creating "stickiness" through unique, hard-to-replicate features and superior customer support. Deep integration into a client's existing technology stack further raises switching costs, thereby diminishing customer leverage. The growing customer demand for AI-powered personalization and seamless omnichannel experiences also empowers buyers, pushing providers to offer more advanced and integrated solutions.

| Factor | Impact on CM.com | Mitigation Strategy |

|---|---|---|

| Low Switching Costs | Amplifies customer bargaining power, enabling demands for better pricing and terms. | Develop proprietary features, offer excellent customer service, and ensure deep platform integration. |

| Demand for Advanced Features (AI, Omnichannel) | Customers can easily switch to competitors offering superior, integrated solutions. | Continuously innovate and integrate AI and omnichannel capabilities into the platform. |

| Large Enterprise Clients | Significant revenue generators with leverage for tailored solutions and pricing. | Offer customized packages and dedicated support to meet specific enterprise needs. |

| SME Collective Power | While individually weak, their numbers can drive price competition. | Provide flexible, cost-effective solutions to capture market share. |

Preview the Actual Deliverable

CM.com Porter's Five Forces Analysis

This preview offers a comprehensive look at the CM.com Porter's Five Forces Analysis, showcasing the exact document you'll receive immediately after purchase, with no surprises or placeholders. You're viewing the actual, professionally written analysis, meaning the fully formatted and ready-to-use file you see here is precisely what you'll be able to download instantly upon completing your transaction.

Rivalry Among Competitors

The Communication Platform as a Service (CPaaS) market is intensely competitive, featuring dominant players such as Twilio, Infobip, Sinch, and Vonage. These established providers offer a comparable suite of messaging, voice, and payment functionalities, fostering aggressive price competition and a constant push for technological advancement.

In 2024, the global CPaaS market was valued at approximately $28.3 billion, with projections indicating continued growth. This robust market size underscores the significant competition as these major players vie for market share by differentiating through advanced features, global reach, and specialized solutions.

Traditional telecom operators are increasingly moving into the Communications Platform as a Service (CPaaS) market, using their established network infrastructure and direct customer relationships. This trend intensifies competition within the sector.

These telcos can offer aggressive pricing and potentially superior service quality for specific communication channels, directly challenging existing CPaaS providers. For instance, in 2024, many major telecommunication companies announced expanded CPaaS offerings, aiming to capture a larger share of the growing CPaaS market, which was projected to reach over $200 billion globally by 2027.

Unified Communications as a Service (UCaaS) and Contact Center as a Service (CCaaS) providers are increasingly embedding conversational commerce capabilities into their platforms. This trend is intensifying competition by blurring service distinctions and creating more comprehensive offerings that directly challenge established players like CM.com.

For instance, in 2024, many UCaaS and CCaaS vendors announced enhanced AI-powered chatbots and personalized customer engagement tools, directly encroaching on traditional conversational commerce territory. This expansion means customers can now find integrated solutions for both internal communication and external customer interactions, potentially reducing the need for specialized providers.

Specialized Niche Players

The competitive landscape for CM.com is further shaped by specialized niche players. These smaller companies often concentrate on specific industries or unique communication requirements. While they might not compete directly across CM.com's entire service portfolio, they can certainly intensify rivalry in particular segments. For instance, a specialized ticketing platform might present a localized challenge to CM.com's event solutions, or a focused identity verification provider could compete for specific business needs.

These niche competitors, though smaller in scale, can be highly agile and possess deep expertise in their chosen areas. This allows them to offer tailored solutions that resonate strongly with specific customer bases. CM.com must remain aware of these specialized entities, as they can chip away at market share in key service areas. For example, in 2024, the global digital identity solutions market, a segment where niche players are active, was projected to reach over $30 billion, indicating significant opportunity and competition.

- Niche Focus: Specialized players concentrate on specific industries or communication needs, offering tailored solutions.

- Segment Rivalry: While not broad competitors, they can challenge CM.com in particular service areas like ticketing or identity verification.

- Agility and Expertise: Smaller, focused companies often demonstrate high agility and deep domain knowledge.

- Market Impact: The digital identity market, a key area for niche players, is substantial, with projections showing significant growth and competition in 2024.

Rapid Innovation in AI and Automation

The relentless pace of innovation in artificial intelligence and automation significantly intensifies competition within the communications platform as a service (CPaaS) sector. Companies are in a continuous race to deploy advanced AI agents, sophisticated voice AI capabilities, and streamlined automated workflows to capture market share by offering superior customer engagement and operational efficiencies.

CM.com's strategic introduction of its HALO AI platform directly addresses this dynamic competitive landscape. This initiative underscores the company's commitment to staying at the forefront of AI-driven solutions, aiming to provide clients with cutting-edge tools for customer interaction and business process automation.

- AI-driven customer engagement: Companies are investing heavily in AI to personalize customer interactions across various channels.

- Automation of workflows: The drive for efficiency pushes businesses to adopt automated processes for tasks like customer support and marketing.

- CM.com's HALO AI: This platform represents CM.com's strategic response to the need for advanced AI capabilities in the CPaaS market.

- Market differentiation: Innovation in AI and automation is a key differentiator for CPaaS providers seeking to attract and retain customers in 2024.

The CPaaS market is highly competitive, with major players like Twilio and Infobip offering similar services, leading to price wars and a constant need for innovation. In 2024, the global CPaaS market was valued at approximately $28.3 billion, highlighting the intense battle for market share. Traditional telecom operators are also entering the CPaaS space, leveraging their infrastructure to offer competitive pricing and potentially better service quality, further intensifying rivalry.

The competitive landscape is also shaped by specialized niche players who focus on specific industries or unique communication needs, such as ticketing or identity verification. These agile companies, with deep expertise, can challenge established providers like CM.com in particular segments. For example, the digital identity solutions market, a key area for niche players, was projected to exceed $30 billion in 2024. Furthermore, the rapid advancement in AI and automation, exemplified by CM.com's HALO AI platform, is a critical factor driving differentiation and competition as providers race to offer superior customer engagement and efficiency.

| Competitor Type | Key Characteristics | 2024 Market Data/Impact |

|---|---|---|

| Major CPaaS Providers | Broad service offerings, global reach, technological innovation | Global CPaaS market valued at ~$28.3 billion |

| Traditional Telcos | Established infrastructure, direct customer relationships, aggressive pricing | Expanding CPaaS offerings to capture market share |

| Niche Specialists | Deep expertise in specific industries/solutions (e.g., ticketing, identity verification) | Digital identity market projected >$30 billion |

| UCaaS/CCaaS Providers | Embedding conversational commerce, blurring service lines | Increasingly offering AI-powered customer engagement tools |

SSubstitutes Threaten

Businesses can still opt for traditional communication methods like direct email, phone calls, and basic SMS to connect with customers, effectively bypassing more advanced CPaaS solutions. These established channels, while potentially less efficient and personalized, offer a readily available and often lower-cost alternative for companies that aren't focused on building complex conversational commerce experiences.

For large enterprises with substantial IT budgets and dedicated teams, developing and maintaining their own in-house communication systems presents a viable substitute. This approach grants them unparalleled control over their infrastructure and data, allowing for deep customization to meet very specific operational needs. For instance, a major financial institution might opt for an in-house solution to ensure maximum security and compliance, even if it means higher upfront capital expenditure and ongoing operational expenses compared to a service provider.

Businesses might bypass dedicated conversational commerce platforms like CM.com by using readily available consumer social media and messaging apps for customer engagement. This approach presents a cost-effective option, as many of these platforms are free or have minimal charges.

However, relying on consumer-grade apps means forfeiting crucial business functionalities. For instance, while WhatsApp Business offers API access, general consumer versions lack the advanced automation, scalability, and detailed analytics that CM.com provides, hindering efficient customer service and growth.

In 2024, the sheer volume of users on platforms like Facebook Messenger and Instagram Direct, which have billions of active users globally, highlights their potential as substitute channels. For example, Meta reported over 3 billion daily active users across its family of apps in early 2024, indicating a vast potential audience that businesses could theoretically reach without specialized platforms.

Generic Cloud Service Providers with Communication Capabilities

Large cloud providers like Amazon Web Services (AWS) and Microsoft Azure are increasingly offering communication-related APIs and infrastructure. These allow businesses with sufficient technical expertise to develop their own communication solutions, potentially bypassing specialized providers like CM.com for certain functionalities.

While these generic cloud services may not offer the integrated, end-to-end communication suites that CM.com provides, they represent a viable alternative for companies looking to build custom communication tools. For instance, AWS reported a 38% revenue growth in its cloud services for the fiscal year ending March 31, 2024, indicating its expanding infrastructure capabilities that could support such custom builds.

- Alternative Functionality: Generic cloud platforms can provide the foundational building blocks for communication features, such as messaging APIs or voice capabilities.

- Cost-Effectiveness for Customization: Businesses with strong internal development teams might find it more cost-effective to build bespoke solutions on cloud platforms rather than paying for a full-service provider.

- Market Share of Cloud Giants: AWS and Azure combined hold over 60% of the global cloud infrastructure market share as of early 2024, highlighting their significant reach and resource availability.

Unified Communications (UC) and Collaboration Tools

Unified Communications (UC) and collaboration tools, while often internal-facing, are increasingly incorporating external communication capabilities. This evolution presents a potential threat of substitutes for dedicated customer engagement platforms.

For businesses already heavily invested in UC ecosystems like Microsoft Teams or Slack, these platforms can increasingly handle basic customer interactions, such as chat support or appointment scheduling, directly within the existing workflow. This reduces the perceived need for separate, specialized customer communication solutions.

For instance, in 2024, the adoption of integrated collaboration suites continued to rise, with a significant percentage of businesses reporting increased usage of their UC platforms for customer-facing activities. This trend suggests that the barrier to entry for UC platforms to act as substitutes for certain customer communication functions is lowering.

- Increased Feature Parity: UC platforms are adding features like chatbots, CRM integrations, and video conferencing for external use.

- Cost Efficiency: Businesses may opt to leverage existing UC investments rather than incurring additional costs for separate customer engagement tools.

- User Familiarity: Employees are already accustomed to using UC platforms, simplifying adoption for new customer interaction workflows.

- Market Growth: The global UCaaS market was projected to reach over $70 billion in 2024, indicating widespread adoption and potential for feature expansion into customer engagement.

Traditional communication channels like email, phone, and basic SMS remain significant substitutes, especially for businesses prioritizing cost and simplicity over advanced features. These methods are readily available and require minimal integration, making them accessible for a wide range of companies. For example, a small local business might use direct email campaigns and phone calls to reach customers, bypassing the need for complex conversational commerce solutions.

The rise of large social media platforms and messaging apps with billions of users offers a powerful substitute for direct customer engagement. Platforms like Facebook Messenger and WhatsApp, with their extensive user bases and increasing business API offerings, allow companies to connect with customers at scale. In 2024, Meta reported over 3 billion daily active users across its family of apps, underscoring the vast reach these platforms provide as an alternative to specialized CPaaS providers.

Businesses with strong in-house technical capabilities can leverage generic cloud infrastructure from providers like AWS and Azure to build custom communication solutions. This approach offers greater control and flexibility, albeit with higher development overhead. The significant market share of cloud giants, with AWS and Azure holding over 60% of the global cloud infrastructure market as of early 2024, highlights the availability of resources for such custom builds.

Unified Communications (UC) and collaboration tools are increasingly incorporating customer-facing functionalities, presenting a growing threat of substitutes. Platforms like Microsoft Teams and Slack, already integral to many organizations' workflows, are expanding their capabilities to handle customer interactions. This integration allows businesses to leverage existing investments, reducing the need for separate customer engagement solutions. The global UCaaS market’s projected growth to over $70 billion in 2024 indicates a strong trend towards feature expansion into customer communication.

| Substitute Channel | Key Characteristics | Impact on CM.com | 2024 Data Point |

| Traditional Channels (Email, Phone, SMS) | Low cost, high accessibility, basic functionality | Threat for businesses prioritizing simplicity and cost over advanced features | Direct email and phone remain primary communication for many SMEs. |

| Social Media & Messaging Apps (WhatsApp, Messenger) | Massive user base, low integration cost, growing business features | Direct competition for customer engagement, especially for businesses seeking broad reach | Meta's family of apps had over 3 billion daily active users in early 2024. |

| In-house Solutions via Cloud Infrastructure (AWS, Azure) | High customization, control, requires technical expertise | Alternative for enterprises with specific needs and development resources | AWS and Azure hold over 60% of the global cloud infrastructure market share (early 2024). |

| Unified Communications (UC) Platforms | Integration with existing workflows, user familiarity, expanding features | Potential to absorb customer communication needs within existing collaboration tools | Global UCaaS market projected to exceed $70 billion in 2024. |

Entrants Threaten

The threat of new entrants for CM.com is relatively low due to the substantial capital required to establish a competing global cloud communications platform. Building out robust network infrastructure, secure data centers, and sophisticated software development demands millions, if not billions, in upfront investment.

CM.com's strategic advantage lies in its privately owned cloud infrastructure and proprietary, in-house developed software. This integrated approach not only ensures control over its technology stack but also represents a significant sunk cost that new entrants would need to replicate, creating a formidable barrier.

The communications and payments sectors are heavily regulated, with complex rules around data privacy, security, and financial operations. For instance, the General Data Protection Regulation (GDPR) in Europe and similar frameworks globally impose strict requirements that new entrants must meticulously follow. CM.com, having operated for years, has already invested significantly in building robust compliance infrastructure and securing necessary certifications, creating a substantial barrier for newcomers.

Building a comprehensive cloud communications platform requires cultivating extensive relationships with global telecommunication carriers and local operators. This intricate and time-intensive process presents a substantial barrier for new entrants aiming to match CM.com's established reach and reliability.

For instance, in 2024, the global telecommunications market, valued at over $1.6 trillion, is dominated by a few key players with deeply entrenched carrier agreements. New companies must invest heavily in time and resources to forge similar partnerships, a significant hurdle in achieving competitive parity.

Brand Recognition and Customer Trust

Established players like CM.com have cultivated significant brand recognition and customer trust, especially in critical sectors such as payments and identity verification. This makes it challenging for new entrants to quickly establish the same level of credibility, particularly when targeting large enterprise clients who prioritize reliability and security.

CM.com, which has been a publicly traded company since 2020 and boasts a long operational history, benefits from this established reputation. For instance, in 2023, CM.com reported a revenue of €229.1 million, demonstrating its substantial market presence and the trust placed in its services by a broad customer base.

- Brand Loyalty: Years of consistent service delivery have fostered strong brand loyalty, creating a barrier for newcomers.

- Reputational Capital: CM.com's public listing and operational track record provide a strong reputational foundation.

- Enterprise Adoption Hurdles: Large organizations are risk-averse, making it difficult for new, unproven entities to displace incumbent providers.

Technological Complexity and AI Expertise

The rapid integration of AI, machine learning, and advanced analytics into conversational commerce platforms presents a significant barrier for new entrants. Developing and maintaining cutting-edge capabilities in these areas requires substantial investment and specialized talent, a challenge CM.com is addressing by becoming an 'AI-First' company with platforms like HALO.

CM.com's strategic shift towards an 'AI-First' approach, exemplified by its HALO platform, signifies a commitment to leveraging advanced technologies. This focus inherently raises the bar for potential competitors, demanding a high level of technological sophistication and AI expertise from the outset to even consider entering the market.

- AI Integration: Platforms increasingly rely on AI for personalization, automation, and data analysis.

- Machine Learning Expertise: Competitors need to master ML for predictive analytics and customer behavior modeling.

- Data Analytics Prowess: Sophisticated data processing and interpretation are crucial for effective conversational commerce.

- Talent Acquisition: Access to skilled AI and ML engineers is a significant hurdle for newcomers.

The threat of new entrants for CM.com remains low due to significant capital requirements for infrastructure and software development, coupled with stringent regulatory landscapes. CM.com's established carrier relationships and strong brand reputation further deter new players.

The company's investment in advanced technologies like AI, as seen with its HALO platform, creates a high technological barrier. For instance, the global AI market reached approximately $200 billion in 2023, highlighting the substantial investment needed to compete effectively in this space.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Building global cloud infrastructure and proprietary software demands substantial investment. | High barrier, requiring significant upfront funding. |

| Regulatory Compliance | Adhering to data privacy (e.g., GDPR) and financial regulations is complex and costly. | High barrier, necessitating specialized legal and compliance teams. |

| Carrier Relationships | Establishing partnerships with global telecommunication carriers is time-consuming and intricate. | High barrier, requiring extensive networking and negotiation. |

| Technological Sophistication | Developing and integrating advanced AI and ML capabilities is crucial and resource-intensive. | High barrier, demanding specialized talent and R&D investment. |

Porter's Five Forces Analysis Data Sources

Our CM.com Porter's Five Forces analysis is built upon a foundation of robust data, including company financial reports, industry-specific market research from firms like Gartner and IDC, and publicly available trade association data.