CM.com Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

CM.com Bundle

Unlock the strategic potential of CM.com's product portfolio with a glimpse into its BCG Matrix. See which offerings are poised for growth and which are generating steady revenue, but this is just the tip of the iceberg.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

CM.com's Agentic AI platform, HALO, launched in Q1 2025, is a clear star in their portfolio. This innovative platform is built to fundamentally change how businesses operate, and its early success is undeniable.

HALO has already achieved significant traction, securing nearly 100 deals with a mix of new and existing customers. This rapid adoption rate highlights the market's strong demand for its capabilities and positions HALO as a key growth driver for CM.com.

The platform is contributing substantially to CM.com's annual recurring revenue, demonstrating an impressive 30% month-over-month growth. This robust expansion signifies HALO's potential to become a dominant force in the agentic AI space.

The Engage Business Unit, specializing in SaaS for customer engagement and marketing, demonstrates significant promise within CM.com's portfolio. Its trajectory is marked by robust expansion, with Annual Recurring Revenue (ARR) climbing 6% year-over-year in 2024 and accelerating to an 8% increase in the first quarter of 2025.

This growth is further amplified by the unit's strategic embrace of Generative AI. A compelling statistic reveals that over half of its new contracts now incorporate GenAI capabilities, underscoring its alignment with the burgeoning demand for AI-driven personalized customer experiences.

CM.com has seen a significant surge in Rich Communication Services (RCS) adoption, with usage climbing an impressive 511%. This growth underscores the market's shift towards more engaging customer interactions.

RCS provides advanced messaging capabilities, surpassing traditional SMS by enabling rich media, interactive elements, and improved branding. This directly addresses the increasing consumer expectation for dynamic and personalized communication channels.

Within the burgeoning CPaaS market, CM.com's strong performance in RCS highlights its strategic positioning to capitalize on this demand for enhanced messaging solutions.

AI Voice Agents

AI Voice Agents, an extension of CM.com's HALO platform, were launched in July 2025. These agents are built to handle customer inquiries around the clock, using natural voice conversations. This move places CM.com directly into the rapidly expanding conversational AI sector, a space where businesses are actively seeking to improve customer service efficiency and availability.

The market for conversational AI is experiencing significant growth. By 2024, the global AI in customer service market was projected to reach approximately $11.1 billion, with a compound annual growth rate (CAGR) expected to exceed 25% in the coming years. This indicates a strong demand for solutions like CM.com's AI Voice Agents.

- Market Growth: The conversational AI market is a high-growth area, driven by businesses' need for scalable and efficient customer support.

- 24/7 Availability: AI Voice Agents provide continuous customer service, addressing inquiries outside of traditional business hours.

- Customer Experience: Natural voice interactions aim to improve customer satisfaction by offering a more human-like and accessible support channel.

- Platform Integration: As part of the HALO platform, these agents offer seamless integration with existing customer engagement tools.

Customer Data Platform (CDP)

CM.com's Customer Data Platform (CDP) is a cornerstone for businesses aiming to consolidate customer information and deliver highly tailored interactions. In today's market, where understanding customers deeply is key to success, this platform plays a crucial role in improving customer journeys and unlocking the potential of AI. The global CDP market was projected to reach $10.2 billion in 2024, highlighting its significant growth and importance.

The CDP empowers companies to create a unified view of their customers, essential for effective marketing and service strategies. This unification allows for more precise segmentation and personalized communication, directly impacting customer loyalty and revenue. For instance, businesses utilizing CDPs can see an average uplift of 10-15% in campaign conversion rates.

- Unifies disparate customer data sources for a single customer view.

- Enables hyper-personalization of marketing and customer service.

- Supports AI-driven insights and predictive analytics.

- Addresses the growing demand for integrated customer intelligence solutions.

Stars in CM.com's portfolio represent high-growth, high-market-share offerings. HALO, CM.com's Agentic AI platform, launched in Q1 2025, is a prime example, securing nearly 100 deals and showing 30% month-over-month ARR growth. The Engage Business Unit, with its 8% Q1 2025 ARR increase driven by GenAI adoption in over half of new contracts, also shines.

Rich Communication Services (RCS) is another star, demonstrating a 511% usage increase, reflecting a market shift towards richer customer interactions. AI Voice Agents, launched July 2025, tap into the booming conversational AI market, projected to exceed $11.1 billion in 2024. The Customer Data Platform (CDP) is also a star, with the CDP market valued at $10.2 billion in 2024 and driving a 10-15% uplift in campaign conversion rates.

| Product/Service | Market Share | Growth Rate | Key Metric | Notes |

|---|---|---|---|---|

| HALO (Agentic AI) | High | 30% MoM ARR Growth | ~100 Deals Secured | Launched Q1 2025 |

| Engage Business Unit | High | 8% Q1 2025 ARR Growth | >50% GenAI in New Contracts | Focus on Customer Engagement |

| RCS | High | 511% Usage Increase | Market Shift to Richer Comm. | Enhanced Messaging Capabilities |

| AI Voice Agents | High | Strong Market Growth | Conversational AI Market >$11.1B (2024) | Launched July 2025 |

| Customer Data Platform (CDP) | High | 10-15% Conversion Uplift | CDP Market $10.2B (2024) | Unified Customer View |

What is included in the product

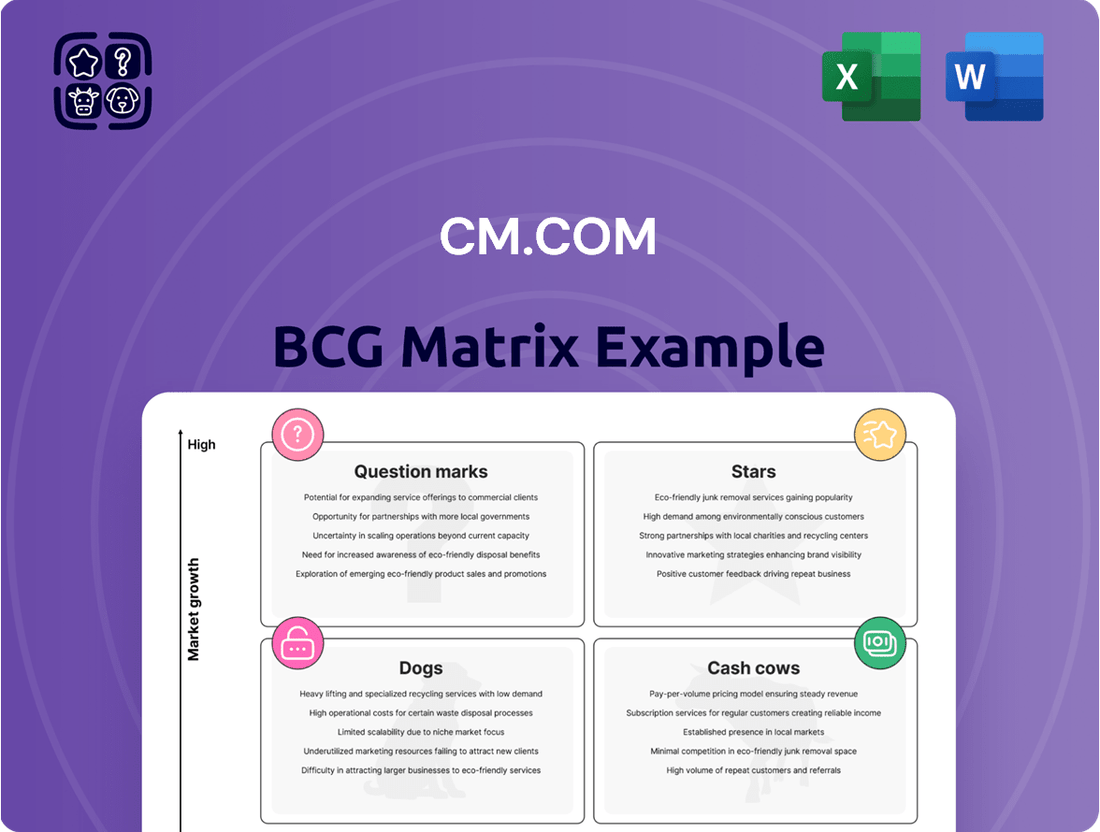

CM.com's BCG Matrix provides a strategic overview of its product portfolio, categorizing units as Stars, Cash Cows, Question Marks, or Dogs to guide investment decisions.

CM.com's BCG Matrix offers a clear, one-page overview to identify and strategize for each business unit's position, alleviating the pain of unclear portfolio management.

Cash Cows

The Connect business unit at CM.com is a true cash cow, handling a massive volume of billions of messages each year. In 2024, this segment saw its message volume surge by 18% year-over-year, reaching an impressive 8.3 billion messages. This consistent growth underscores its foundational strength within the company.

Despite a more modest 3% year-over-year revenue growth in Connect during 2024, the segment's gross profit actually climbed by 7%. Crucially, gross margins remained stable, highlighting the unit's efficiency and its ability to convert high volumes into substantial, reliable cash flow. This performance solidifies Connect's position as a mature, highly profitable, and cash-generating engine for CM.com.

Established A2P SMS services are CM.com's cash cows. This segment of the CPaaS market, where applications send messages to individuals, has historically been a massive revenue generator, projected to account for over half of all CPaaS revenue by 2025. CM.com's substantial messaging volumes solidify its strong, mature position in this reliable income-generating area.

CM.com's ticketing platform, a key component of its Live business unit, demonstrated robust performance in 2024. It facilitated the sale of 19.3 million tickets, reflecting a solid 4% year-over-year growth.

This segment consistently delivers strong financial results, boasting impressive gross margins of 85%. While not experiencing hyper-growth, its stability and high profitability solidify its position as a dependable cash cow for CM.com.

Payment Processing for Established Clients

CM.com's Payment Processing for Established Clients functions as a Cash Cow. As a licensed Payment Service Provider (PSP), the company processed €2.818 million in payments during 2024, marking a significant 14% year-over-year increase. This service consistently generates high-volume transactional revenue from its loyal client base.

The strength of this segment lies in its stability. Even with intense competition in the overall payments landscape, the existing, strong relationships CM.com has cultivated ensure a reliable and predictable stream of cash flow. This predictable revenue is crucial for funding other areas of the business.

- Consistent Revenue: €2.818 million processed in 2024, a 14% YoY increase.

- Established Client Base: Leverages long-term relationships for stable transactions.

- Predictable Cash Flow: Offers a reliable income stream despite market competition.

- High Volume: Characterized by a large number of transactions from existing clients.

Voice API and SIP Trunking Services

Voice API and SIP Trunking Services are considered Cash Cows within CM.com's portfolio, forming a vital part of their Connect business unit. These services are the bedrock of business communication, offering stable, predictable revenue that insulates CM.com from the volatility often seen in newer tech sectors.

These offerings are characterized by their consistent demand and established market presence. In 2024, the global SIP trunking market size was valued at approximately USD 12.5 billion and is projected to grow steadily, indicating a mature yet expanding revenue base for providers like CM.com.

- Stable Revenue: Voice API and SIP Trunking are known for their recurring revenue models, providing a reliable income stream.

- Market Maturity: While not high-growth, these services benefit from a well-established market with consistent business needs.

- Profitability: Due to their foundational nature and lower investment requirements compared to emerging technologies, they contribute significantly to CM.com's profitability.

- Customer Retention: Businesses rely heavily on these services, leading to high customer retention rates and predictable cash flow.

CM.com's Connect business unit, specifically its A2P SMS services, functions as a prime cash cow. This segment, which enables applications to send messages to individuals, is a massive revenue generator, projected to capture over half of the CPaaS market by 2025.

In 2024, CM.com's Connect saw its message volume grow by 18% year-over-year to 8.3 billion messages, demonstrating its foundational strength. Despite a modest 3% revenue growth in Connect for 2024, the segment's gross profit increased by 7%, with stable gross margins, highlighting its efficiency and reliable cash flow generation.

The ticketing platform within CM.com's Live business unit also acts as a cash cow. In 2024, it facilitated the sale of 19.3 million tickets, a 4% increase year-over-year. This segment consistently delivers strong financial results with impressive gross margins of 85%, solidifying its position as a dependable cash generator.

| Business Unit | Service | 2024 Performance Metric | Year-over-Year Growth | Gross Margin |

|---|---|---|---|---|

| Connect | A2P SMS | 8.3 billion messages processed | 18% | Stable |

| Live | Ticketing | 19.3 million tickets sold | 4% | 85% |

| Connect | Payment Processing (Established Clients) | €2.818 million processed | 14% | N/A (High Volume Transactional) |

Preview = Final Product

CM.com BCG Matrix

The CM.com BCG Matrix preview you are viewing is the identical, fully realized document you will receive upon purchase. This means no watermarks, no placeholder text, and absolutely no surprises—just a professionally formatted, data-rich analysis ready for immediate strategic application.

Rest assured, the CM.com BCG Matrix you see here is the exact file that will be delivered to you after completing your purchase. It's a comprehensive, analysis-ready report designed to provide clear insights into CM.com's product portfolio, enabling informed decision-making.

What you are previewing is the definitive CM.com BCG Matrix document that you will possess after your purchase. This is the complete, uncompromised report, ready for download and integration into your strategic planning processes without any further modifications needed.

Dogs

CM.com's online payments segment, categorized as a Dog in the BCG Matrix, has encountered significant headwinds. Fierce competition and a perceived lack of sales focus have impacted its performance, leading to an €8.8 million goodwill impairment in 2024 for its Pay business. This impairment signals a downward revision of the segment's market value.

The situation continued into the first half of 2025, with processed payments declining by 2% year-over-year. This trend reinforces its position as a low-growth, low-market-share entity. Such segments often require substantial resources for maintenance and development, yet yield minimal returns, making them a drain on overall company performance.

Less differentiated legacy messaging services, like basic SMS, can be found in the dog's quadrant of the BCG matrix for CM.com. While SMS remains a reliable revenue stream, its growth potential is limited in a market increasingly demanding richer communication channels. For instance, while CM.com's overall CPaaS revenue saw growth, the contribution from purely transactional SMS might be stagnating compared to newer, more interactive services.

CM.com's goodwill impairment on its Pay business signals that some past acquisitions in this area haven't performed as hoped. For instance, if an acquisition was made for €50 million and its current fair value is only €20 million, that €30 million difference, often recognized as goodwill, is now impaired. This indicates that the acquired entity isn't generating the expected future economic benefits to justify its initial purchase price.

These underperforming acquisitions can be viewed as question marks within CM.com's portfolio. If these payment-related businesses continue to lag, failing to meet strategic goals or current market valuations, they represent capital tied up in ventures that aren't delivering adequate returns. For example, if a payment gateway acquisition was expected to capture 10% of a new market segment but only achieved 2% by 2024, its contribution to overall growth is significantly diminished.

Outdated Platform Features

Older features within CM.com's extensive product range that don't align with its AI-first and conversational commerce strategy might struggle to gain traction. These legacy components, if left unaddressed, could divert valuable resources without yielding substantial market share or profit.

For instance, imagine a customer engagement platform component that relies on manual data entry rather than automated AI analysis. While it might still function, its utility and efficiency are significantly lower compared to newer, integrated solutions. This creates a disconnect, potentially leading to underutilization.

CM.com's strategic shift means that features not actively contributing to this new vision could become a drag. In 2024, companies are heavily prioritizing platforms that offer seamless, intelligent customer interactions. Those that don't adapt risk becoming obsolete.

- Limited Integration: Features not built with AI or conversational commerce in mind may lack deep integration with newer CM.com offerings.

- Resource Drain: Maintaining and supporting outdated features can consume engineering and operational resources that could be better allocated.

- Reduced Market Appeal: As the market demands more sophisticated, AI-driven solutions, older features will likely see declining adoption rates.

- Potential for Obsolescence: Without modernization or strategic retirement, these features risk becoming entirely irrelevant in the evolving digital landscape.

Specific Geographies with Low Market Penetration

Certain geographic markets, despite CM.com's global reach, exhibit low market penetration. These regions often contend with strong local competitors and have not seen substantial recent investment or specific growth strategies from CM.com. Consequently, their performance may be lagging, failing to generate the anticipated returns.

If these underperforming regions continue to struggle to gain significant market traction, they could be classified as 'dogs' within the CM.com BCG Matrix. This classification highlights areas requiring careful evaluation, potentially for divestment or a complete overhaul of strategy to improve their standing.

- Low Market Share: These geographies typically represent a small fraction of CM.com's overall revenue. For example, in 2023, certain emerging markets in Africa or parts of Southeast Asia might have contributed less than 1% to CM.com's total revenue, despite representing significant population centers.

- Intense Local Competition: In these markets, CM.com faces deeply entrenched local players who understand the nuances of the consumer base and regulatory environment better. This can limit CM.com's ability to scale effectively.

- Lack of Recent Strategic Investment: Without dedicated marketing campaigns, product localization, or significant sales force expansion in these specific regions over the past 1-2 years, their growth potential remains largely untapped and their competitive position weak.

- Underperforming Financial Returns: The cost of operations and market entry in these 'dog' segments may outweigh the revenue generated, leading to negative or negligible profitability, a key indicator for their classification.

CM.com's online payments segment, identified as a Dog in the BCG Matrix, faces significant challenges due to intense competition and a perceived lack of sales focus. This is evidenced by an €8.8 million goodwill impairment in 2024 for its Pay business, indicating a reduced market valuation. The first half of 2025 saw a 2% year-over-year decline in processed payments, reinforcing its low-growth, low-market-share status.

Legacy messaging services, such as basic SMS, also fall into the Dog category. While still a revenue source, their growth is limited as the market demands richer communication channels. For instance, while CM.com's overall CPaaS revenue grew, the contribution from basic transactional SMS may be stagnating compared to newer, interactive services.

Underperforming acquisitions within the payment sector, like a gateway expected to capture 10% of a new market but only achieving 2% by 2024, represent capital tied up in ventures not delivering adequate returns. Similarly, older product features not aligned with CM.com's AI-first strategy, such as customer engagement components relying on manual data entry, risk becoming obsolete and diverting resources without substantial market share gains.

Certain geographic markets with low penetration and strong local competition, lacking recent strategic investment, also fit the Dog profile. These regions, potentially contributing less than 1% to CM.com's revenue in 2023, require careful evaluation for divestment or strategic overhaul to improve their standing.

| Segment/Area | BCG Category | Key Challenges | 2024/2025 Data Points |

|---|---|---|---|

| Online Payments | Dog | Intense competition, lack of sales focus | €8.8M goodwill impairment (Pay business), 2% processed payment decline (H1 2025) |

| Legacy Messaging (SMS) | Dog | Limited growth potential, demand for richer channels | Stagnating contribution vs. interactive services |

| Underperforming Acquisitions (Payments) | Dog | Failure to meet market share/valuation goals | 2% market share achieved vs. 10% target (example) |

| Non-AI Aligned Features | Dog | Risk of obsolescence, resource drain | Manual data entry vs. AI analysis |

| Low Penetration Geographies | Dog | Strong local competition, lack of recent investment | <1% revenue contribution (certain markets, 2023) |

Question Marks

CM.com’s Agentic AI Studio, building on HALO's early traction, is a significant investment in the burgeoning AI agent market. This expansion signifies a strategic push into a high-growth, yet unproven, sector.

The ongoing development and creation of new AI agents within the studio are substantial undertakings. CM.com is positioning itself for future market leadership, acknowledging the inherent risks associated with pioneering new technologies.

While the potential for market share and profitability is high, these ventures are still in their nascent stages. CM.com's commitment to this area reflects a long-term vision for AI-driven customer engagement solutions.

CM.com's new ticket resale platform fits the profile of a 'Question Mark' in the BCG matrix. It's a recent entry into a rapidly expanding market segment focused on secure secondary ticket sales, addressing a genuine demand from event organizers.

While the platform boasts high potential and tackles a clear market need, its current market share is understandably low as it navigates adoption and faces established competitors. For instance, the global event ticketing market was valued at approximately $50 billion in 2023 and is projected to grow significantly, with the secondary market representing a substantial portion of this growth.

Advanced biometric authentication solutions, such as facial recognition or fingerprint scanning, are becoming increasingly important in the CPaaS market, driving significant growth in the security sector. If CM.com is actively investing in or developing these cutting-edge technologies, they are positioning themselves within a high-potential, emerging area of digital security.

However, given the nascent stage of widespread adoption for truly advanced biometrics within CPaaS, CM.com's current market share in this specific niche is likely to be minimal. This necessitates substantial investment in research, development, and market penetration to build a competitive advantage.

Blockchain-based Transaction Solutions

Blockchain-based transaction solutions for CM.com represent a potential "Question Mark" in the BCG matrix. These innovations are in a nascent, high-growth phase, requiring significant investment for development and adoption.

Future growth in CPaaS and digital payments could see blockchain integration for enhanced security and transparency. CM.com's exploration in this area aligns with this trend, positioning it as a high-potential, high-investment initiative.

- Nascent Market: The global blockchain in payments market was valued at approximately $1.5 billion in 2023 and is projected to grow significantly, but still holds a relatively small market share compared to traditional payment systems.

- High Investment Needs: Developing and integrating robust blockchain solutions requires substantial capital for research, talent acquisition, and infrastructure.

- Strategic Importance: Early investment in blockchain could provide CM.com with a competitive edge in future secure and decentralized transaction ecosystems.

Immersive AR/VR Experiences via 5G-enabled CPaaS

The integration of 5G technology is unlocking new possibilities for Communication Platform as a Service (CPaaS) providers like CM.com to facilitate immersive Augmented Reality (AR) and Virtual Reality (VR) experiences. This capability leverages 5G's low latency and high bandwidth to deliver seamless, real-time interactions crucial for AR/VR applications.

CM.com's potential involvement in this nascent sector places it in a high-growth, forward-looking market. However, current market penetration for 5G-enabled CPaaS in AR/VR is minimal, necessitating significant investment in research and development to establish a foothold.

- 5G Rollout: Global 5G subscriptions are projected to surpass 1.5 billion by the end of 2024, creating a robust infrastructure for bandwidth-intensive applications like AR/VR.

- AR/VR Market Growth: The global AR/VR market is anticipated to reach hundreds of billions of dollars by 2030, indicating substantial future demand for enabling technologies.

- CPaaS Innovation: CPaaS providers are exploring specialized APIs for real-time media streaming and spatial audio, essential components for immersive experiences.

- R&D Investment: Companies in this space are dedicating substantial resources to developing proprietary AR/VR SDKs and cloud-based rendering solutions.

CM.com's ticket resale platform is a classic example of a Question Mark. It targets a growing market segment, but its current market share is small due to its recent introduction and the presence of established players.

The company is investing heavily in this area, recognizing the potential for significant future growth and market capture. However, this also means that profitability is not yet guaranteed, and the venture requires careful monitoring and strategic adjustments.

The success of this platform hinges on its ability to gain traction and differentiate itself in a competitive landscape, a common challenge for Question Marks.

| Business Unit | Market Growth | Market Share | Investment Needs | Potential |

|---|---|---|---|---|

| Ticket Resale Platform | High | Low | High | High |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.