Clyde Bergemann GmbH SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Clyde Bergemann GmbH Bundle

Clyde Bergemann GmbH's strengths lie in its established reputation and specialized expertise in boiler cleaning technology, while its opportunities stem from growing demand for energy efficiency and emissions reduction. However, potential threats from new market entrants and evolving regulatory landscapes require careful navigation.

Want the full story behind Clyde Bergemann GmbH's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Clyde Bergemann GmbH stands as a distinguished global technology leader, providing highly specialized solutions crucial for the efficient operation of industrial plants worldwide. Their extensive international presence and deep expertise in niche markets grant them a significant competitive edge, built on years of experience serving diverse industrial needs across various continents.

Clyde Bergemann GmbH boasts a broad spectrum of offerings, encompassing essential solutions like boiler cleaning systems, notably their advanced sootblower technology. This extensive product line also includes robust material handling capabilities, such as efficient ash handling systems, and crucial waste heat recovery technologies. This wide array of products positions them to serve a diverse clientele across numerous sectors, including the vital power generation and pulp and paper industries, thereby strengthening their market reach and diversifying their income sources.

Clyde Bergemann GmbH's commitment to optimizing plant performance and reducing emissions directly addresses the escalating global demand for environmental sustainability. This focus is a significant strength, especially as industries worldwide face stricter environmental regulations and a growing imperative to minimize their ecological impact.

Their solutions offer tangible benefits, enabling industries to achieve measurable reductions in their environmental footprint. For instance, their boiler cleaning technologies can improve thermal efficiency by up to 5%, leading to reduced fuel consumption and lower CO2 emissions, a critical factor for companies aiming to meet ESG targets.

Long-Standing Industry Experience and Innovation

Clyde Bergemann GmbH benefits from a deep well of industry knowledge, with its lineage tracing back to the early 1900s through the merger of Clyde Blowers and Bergemann. This heritage fuels a continuous drive for innovation, particularly in enhancing boiler efficiency and advancing sustainable energy recovery solutions. This long-standing expertise positions the company as a reliable and forward-thinking player in the energy sector.

Key strengths stemming from this experience include:

- Decades of Engineering Excellence: A proven track record in developing and implementing advanced boiler cleaning and emissions control technologies.

- Commitment to Innovation: Ongoing investment in research and development to create next-generation solutions for the evolving energy landscape.

- Market Leadership: Established reputation for quality and performance, driving customer loyalty and market share.

- Adaptability: The ability to leverage historical knowledge to address current and future environmental and efficiency challenges in power generation.

Strategic Adaptation and Core Business Focus

Clyde Bergemann GmbH has shown a strong ability to adapt its strategy, exemplified by the divestment of its Pulp & Paper division. This strategic move allows the company to sharpen its focus on its core competency: emission reduction technologies for the power generation sector.

By concentrating on this high-demand area, Clyde Bergemann can dedicate more resources to innovation and market penetration, aiming for enhanced profitability. This specialization aligns with increasing global regulatory pressures for cleaner energy production.

- Strategic Focus: Divestment of Pulp & Paper segment to concentrate on emission reduction for power industry.

- Market Alignment: Addresses growing demand for environmental solutions in energy generation.

- Resource Optimization: Enables concentrated investment in core growth areas and R&D.

- Profitability Potential: Specialization in a key, high-demand market can drive margin improvement.

Clyde Bergemann GmbH possesses a robust portfolio centered on critical industrial solutions, particularly in boiler cleaning and emissions control. Their expertise in sootblower technology, for instance, is a significant asset, directly contributing to improved plant efficiency and reduced environmental impact. This technological prowess is further bolstered by their capabilities in material handling and waste heat recovery, serving key sectors like power generation.

The company's long heritage, dating back to the early 1900s, translates into deep engineering excellence and a strong foundation for innovation. This historical depth allows them to continuously refine their offerings, addressing evolving industry needs for efficiency and sustainability. Their market leadership is built on a reputation for quality and performance, fostering customer loyalty.

Clyde Bergemann's strategic divestment of its Pulp & Paper division in 2023, for example, highlights a sharp focus on the power generation sector and its associated emission reduction technologies. This specialization aligns with the increasing global demand for cleaner energy, positioning the company to capitalize on regulatory drivers and market trends. This strategic alignment is expected to enhance resource allocation for R&D and market penetration in core growth areas.

What is included in the product

Delivers a strategic overview of Clyde Bergemann GmbH’s internal and external business factors, identifying key strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable SWOT analysis that highlights key opportunities and threats for Clyde Bergemann GmbH, enabling proactive strategic adjustments.

Weaknesses

Clyde Bergemann GmbH's specialization in sectors like power generation and pulp and paper, while a strength, also presents a significant weakness. This focus creates a substantial reliance on the economic health and investment cycles within these specific industries. For example, a slowdown in global power plant construction or a downturn in the pulp and paper market could directly and disproportionately affect the company's revenue streams and future growth opportunities.

Clyde Bergemann GmbH's reliance on solutions for industrial plants, particularly those involved in traditional power generation, presents a significant weakness. If the global energy transition accelerates beyond current projections, the demand for their services tied to fossil fuel-based power generation could diminish rapidly. This rapid shift towards renewable energy sources directly threatens their established business models, potentially impacting revenue streams significantly.

The industrial boiler maintenance and air quality control system sectors are quite crowded, featuring many well-established companies. This intense competition, with both global and local rivals, can put pressure on Clyde Bergemann's pricing strategies and its ability to grow market share and maintain profitability.

Supply Chain Vulnerabilities

Clyde Bergemann GmbH, as a global player in providing advanced industrial technologies, faces inherent risks tied to the complexities of international supply chains. Disruptions stemming from geopolitical tensions, trade disputes, or unforeseen logistical hurdles can significantly impact the timely delivery of components and finished products. For instance, the global semiconductor shortage experienced in 2021-2022, which affected numerous manufacturing sectors, highlights the potential for such vulnerabilities to cause production delays and increased costs.

The volatility in raw material prices presents another significant weakness. Fluctuations in the cost of metals, specialized alloys, and other essential inputs directly influence Clyde Bergemann's manufacturing expenses. Reports from early 2024 indicated continued upward pressure on many industrial commodities, a trend that could squeeze profit margins if not effectively managed through strategic sourcing or hedging. This price instability can make long-term cost forecasting challenging and affect the competitiveness of their offerings.

- Global Supply Chain Dependency: Reliance on a network of international suppliers exposes Clyde Bergemann to potential disruptions from geopolitical events, trade policy changes, and logistical bottlenecks.

- Raw Material Price Volatility: Fluctuations in the cost of key industrial inputs, such as specialized metals and components, can directly impact production costs and profitability.

- Lead Time Uncertainty: Extended lead times for critical components, exacerbated by global supply chain pressures, can affect project timelines and customer satisfaction.

- Geopolitical Risks: Trade wars, sanctions, or regional conflicts can disrupt the flow of goods and materials, leading to increased operational costs and delivery delays.

Need for Continuous R&D Investment

Clyde Bergemann GmbH faces a significant challenge in its need for continuous research and development (R&D) investment. To stay ahead in a rapidly evolving industrial landscape, particularly with increasingly stringent environmental regulations, the company must commit substantial resources to innovation. For instance, the global industrial boiler market, a key sector for Clyde Bergemann, is projected to grow, but this growth is heavily dependent on technological advancements in efficiency and emissions control. A failure to innovate at a competitive pace could erode its market position.

This ongoing R&D requirement presents a considerable financial strain. Companies in similar sectors often allocate between 5% to 10% of their annual revenue back into R&D to maintain a competitive edge. For Clyde Bergemann, this means a consistent outflow of capital that must be balanced against other operational and strategic investments. Without this sustained investment, the risk of obsolescence and losing market share to more agile competitors becomes a critical weakness.

The company's ability to adapt to evolving industry demands and stricter environmental regulations is directly tied to its R&D output. For example, upcoming European Union directives on industrial emissions, like the Industrial Emissions Directive (IED), will necessitate new technological solutions. If Clyde Bergemann cannot develop and implement these solutions quickly and cost-effectively, it could face penalties or lose contracts to companies that can.

Key considerations regarding this weakness include:

- Sustained Capital Allocation: The necessity for ongoing, significant R&D spending impacts cash flow and requires careful financial planning.

- Pace of Innovation: Falling behind competitors in developing new, compliant, and efficient technologies is a major risk.

- Regulatory Compliance: Failure to innovate in response to environmental regulations can lead to market exclusion or increased operational costs.

- Competitive Landscape: Competitors are also investing in R&D, making it a continuous race to maintain technological leadership.

Clyde Bergemann GmbH's specialization in niche industrial sectors, while a strategic focus, also represents a weakness due to its inherent reliance on the economic cycles and investment patterns within those specific industries. A downturn in global power generation or pulp and paper sectors, for instance, could disproportionately impact the company's revenue and growth prospects.

The company's business model is closely tied to traditional power generation technologies, which presents a vulnerability as the global energy transition accelerates. A rapid shift towards renewable energy sources could diminish demand for their services, significantly impacting established revenue streams.

The competitive landscape for industrial boiler maintenance and air quality control systems is highly saturated with established global and local players. This intense competition can exert downward pressure on pricing, hinder market share expansion, and challenge profitability.

Clyde Bergemann's global operations expose it to significant supply chain risks. Disruptions from geopolitical events, trade disputes, or logistical challenges, as seen with the 2021-2022 semiconductor shortage, can lead to production delays and increased costs.

Volatility in raw material prices, such as metals and specialized alloys, directly affects manufacturing expenses. In early 2024, many industrial commodities continued to face upward price pressure, potentially squeezing profit margins if not managed effectively through strategic sourcing or hedging.

| Weakness Category | Specific Challenge | Impact | Example/Data Point |

| Market Specialization | Reliance on specific industrial sectors (e.g., power generation) | Vulnerability to sector-specific downturns and investment cycles | A slowdown in global power plant construction directly affects demand. |

| Energy Transition | Dependence on traditional power generation technologies | Risk of declining demand due to rapid shift to renewables | Potential obsolescence of services tied to fossil fuel infrastructure. |

| Competition | Crowded industrial boiler and air quality control markets | Pricing pressure, difficulty in gaining market share, impact on profitability | Numerous well-established global and local rivals. |

| Supply Chain | Global supply chain dependency | Disruptions from geopolitical events, trade disputes, logistics | The 2021-2022 semiconductor shortage demonstrated potential for delays and cost increases. |

| Cost Volatility | Raw material price fluctuations | Impact on manufacturing expenses and profit margins | Early 2024 saw continued upward pressure on industrial commodities. |

What You See Is What You Get

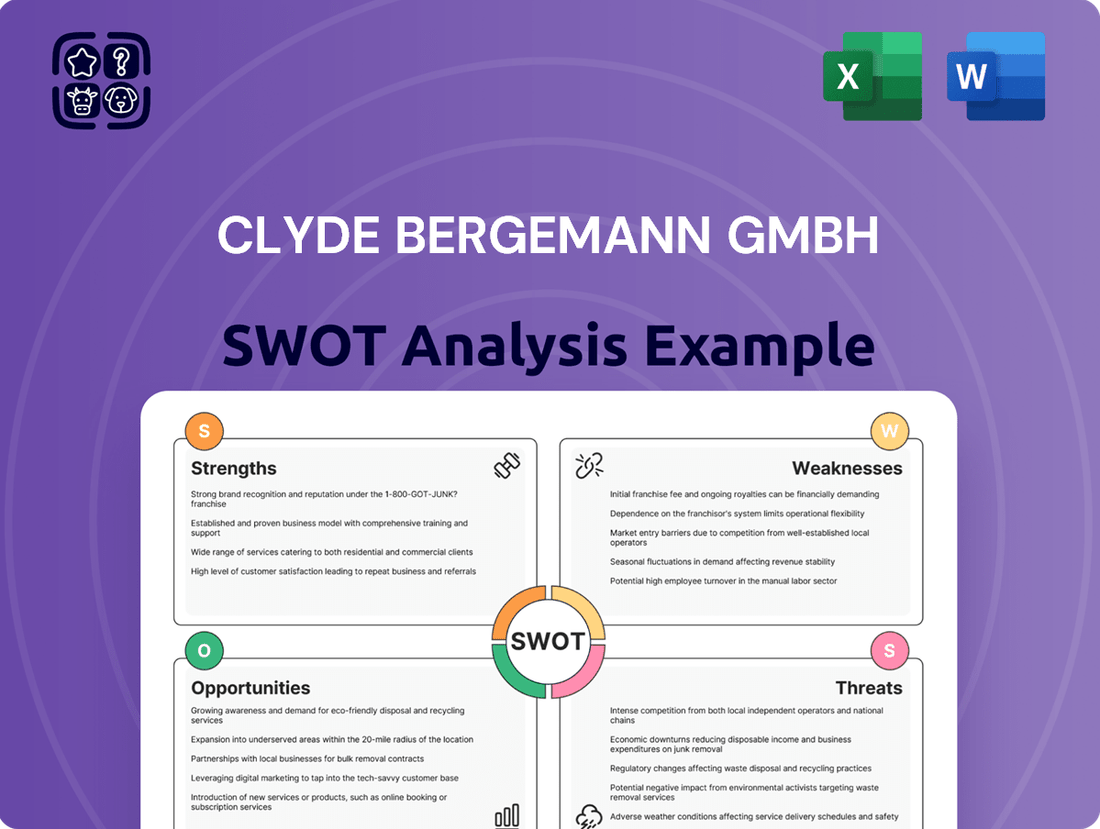

Clyde Bergemann GmbH SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. It offers a concise overview of Clyde Bergemann GmbH's Strengths, Weaknesses, Opportunities, and Threats. The full, detailed analysis, including actionable insights, is unlocked upon purchase.

Opportunities

The global push for industrial efficiency and decarbonization is a major tailwind for Clyde Bergemann. As industries worldwide strive to shrink their carbon footprints, there's a growing need for advanced solutions to optimize processes and reduce emissions. This trend is expected to accelerate in the coming years.

Regulations are playing a crucial role. For instance, the Draft Regulation on the Management of Industrial Emissions, set to become effective in 2025, will mandate stricter controls on air, water, and soil pollution. This creates a direct demand for the technologies and services Clyde Bergemann offers to help companies meet these environmental standards.

Market analysis from 2024 indicates that the global industrial automation market, a key segment for efficiency solutions, is projected to reach over $300 billion by 2027, with a significant portion driven by environmental compliance and energy efficiency initiatives. This growth trajectory directly translates into substantial opportunities for companies like Clyde Bergemann.

The global renewable energy market is experiencing significant growth, with investments projected to reach trillions by 2030. This presents a substantial opportunity for Clyde Bergemann GmbH to expand its offerings into supporting systems for renewable power generation, such as waste heat recovery solutions for biomass or geothermal plants.

By adapting its established energy efficiency technologies, Clyde Bergemann can provide critical infrastructure that optimizes performance and reduces operational costs for renewable energy facilities. For instance, their expertise in flue gas treatment and heat exchangers could be vital for improving the efficiency of concentrated solar power plants or waste-to-energy facilities.

Clyde Bergemann can capitalize on the surging trend of Industry 4.0 by integrating AI, machine learning, and IoT into its offerings. This digital transformation, a key focus for 2025, allows for smarter industrial automation.

By embedding these advanced technologies into solutions like intelligent boiler cleaning systems and real-time operational monitoring, the company can unlock new revenue streams. For instance, a 2024 report indicated that companies adopting predictive maintenance saw an average reduction in downtime of 30% and a 25% decrease in maintenance costs, showcasing the tangible benefits.

This strategic move not only enhances existing product value but also positions Clyde Bergemann as an innovator in a competitive market, meeting the growing demand for efficiency and data-driven insights in industrial processes.

Emerging Markets Growth and Infrastructure Development

Emerging markets, especially in the Asia-Pacific region, are experiencing robust industrialization and a surge in energy needs. This trend offers Clyde Bergemann GmbH a significant chance to grow its global presence and capture a larger market share. These developing economies are actively investing in new industrial infrastructure and modernizing existing plants, creating direct demand for Clyde Bergemann's expertise and solutions.

The infrastructure development push in these regions directly translates into opportunities for Clyde Bergemann. For example, the International Energy Agency reported in 2024 that global energy investment was projected to reach $3 trillion in 2024, with a substantial portion directed towards developing economies and energy infrastructure. This growth trajectory supports the demand for advanced boiler and environmental technology, areas where Clyde Bergemann excels.

- Expanding Global Footprint: Leverage the increasing industrialization in emerging economies, particularly in Asia-Pacific, to broaden market reach.

- Infrastructure Investment: Capitalize on significant investments in new industrial facilities and upgrades to existing plants in these rapidly developing regions.

- Energy Demand Growth: Address the rising energy demands by providing advanced boiler and environmental solutions essential for industrial expansion.

Retrofitting and Modernization of Existing Plants

Many industrial facilities globally are in need of upgrades to comply with evolving environmental regulations and enhance operational efficiency. This presents a significant market opportunity for Clyde Bergemann GmbH to offer retrofitting and modernization solutions for critical systems like boiler cleaning, ash handling, and waste heat recovery. These services can extend the operational life and boost the performance of aging plants.

The global market for industrial plant retrofitting and modernization is substantial. For instance, the energy sector alone saw significant investment in plant upgrades throughout 2024, driven by decarbonization efforts. Clyde Bergemann's expertise in optimizing combustion and emissions control systems positions them well to capitalize on this trend.

- Extended Plant Lifespan: Retrofitting can add years to the operational life of existing industrial assets.

- Environmental Compliance: Upgrades are crucial for meeting stricter emissions standards, a growing focus in 2024 and beyond.

- Efficiency Gains: Modernization leads to reduced energy consumption and lower operating costs for plant owners.

- Market Demand: The ongoing need for plant upgrades creates a consistent demand for specialized services like those offered by Clyde Bergemann.

Clyde Bergemann is well-positioned to benefit from the global drive towards industrial efficiency and decarbonization, with a growing demand for advanced emission control and process optimization solutions. Stricter environmental regulations, such as the anticipated 2025 industrial emissions management directives, directly fuel the need for Clyde Bergemann's technologies, creating a significant market opportunity. The company can also leverage the substantial growth in the renewable energy sector by offering supporting systems for facilities like waste-to-energy plants, enhancing their efficiency and reducing operational costs.

| Opportunity Area | Description | 2024/2025 Data Point |

|---|---|---|

| Industrial Efficiency & Decarbonization | Meeting global demand for reduced emissions and optimized industrial processes. | Global industrial automation market projected to exceed $300 billion by 2027, driven by environmental compliance. |

| Regulatory Compliance | Providing solutions to meet stricter environmental standards. | Draft Regulation on Management of Industrial Emissions effective 2025 mandates tighter pollution controls. |

| Renewable Energy Support | Expanding offerings to support renewable energy infrastructure. | Global renewable energy investments projected to reach trillions by 2030. |

| Digital Transformation (Industry 4.0) | Integrating AI, ML, and IoT for smarter industrial automation. | Companies adopting predictive maintenance saw average 30% downtime reduction in 2024. |

| Emerging Markets Growth | Capitalizing on industrialization and energy needs in regions like Asia-Pacific. | Global energy investment projected at $3 trillion for 2024, with significant allocation to developing economies. |

| Plant Retrofitting & Modernization | Offering upgrades to aging industrial facilities for efficiency and compliance. | Energy sector saw substantial investment in plant upgrades in 2024 due to decarbonization efforts. |

Threats

Globally, environmental regulations are becoming more rigorous, presenting a challenge for Clyde Bergemann GmbH. For instance, the EU's Industrial Emissions Directive and the upcoming F-Gas Regulation, set to be fully implemented by 2025, demand significant technological adaptation. Failure to align with these evolving standards could result in substantial penalties and damage the company's reputation.

The energy sector's rapid shift towards cleaner alternatives, like hydrogen fuel cells and advanced battery storage, presents a significant threat. New technologies could offer more cost-effective or environmentally friendly solutions, potentially undermining Clyde Bergemann's established boiler and emissions control systems. For instance, the global green hydrogen market was valued at approximately $1.5 billion in 2023 and is projected to reach over $70 billion by 2030, indicating a substantial market shift that could bypass traditional combustion technologies.

Global economic slowdowns, particularly in key industrial regions, pose a significant threat. For instance, the International Monetary Fund (IMF) projected a global growth slowdown to 2.9% in 2024, down from 3.5% in 2023, impacting demand for industrial equipment. This can lead to deferred investments in plant upgrades and a general reduction in new project pipelines for companies like Clyde Bergemann.

An industrial slowdown directly translates to lower demand for Clyde Bergemann's core offerings, such as boiler cleaning systems and environmental technology. If major manufacturing sectors experience reduced output or capacity utilization, their need for new or upgraded equipment will diminish, directly affecting Clyde Bergemann's sales volume and revenue streams.

Supply Chain Volatility and Geopolitical Risks

Geopolitical tensions, such as ongoing conflicts and trade disputes, present a significant threat to Clyde Bergemann GmbH. These factors can disrupt global trade flows, leading to increased costs for raw materials, components, and shipping. For instance, the ongoing trade friction between major economic blocs could see tariffs impacting the price of specialized alloys or electrical components crucial for their industrial equipment.

Continued supply chain disruptions, a lingering effect from recent global events, pose a direct risk to project timelines and profitability. A delay in a key component delivery, perhaps from a region experiencing political instability, could push back the commissioning of a large industrial plant, affecting revenue recognition and client satisfaction. The average lead time for critical industrial components saw an increase of up to 20% in early 2024 compared to pre-pandemic levels, impacting manufacturers globally.

- Increased Material Costs: Volatility in commodity prices, driven by geopolitical events, can directly inflate the cost of steel, copper, and other essential materials used in manufacturing.

- Logistics Disruptions: Port congestion and rerouting of shipping lanes due to conflicts can significantly increase transportation expenses and delivery times.

- Component Shortages: Reliance on specific regions for specialized parts makes the company vulnerable to localized disruptions, potentially halting production lines.

- Project Delays: Unforeseen geopolitical events can cascade into project delays, impacting revenue streams and potentially incurring penalties.

Shifting Energy Landscape and Decline of Fossil Fuels

The accelerating global transition away from fossil fuels, particularly coal, poses a significant threat to Clyde Bergemann's established market. As countries increasingly prioritize renewable energy sources and implement stricter emissions regulations, the demand for technologies supporting coal-fired power plants is expected to decline. For instance, the International Energy Agency (IEA) projected in its 2024 outlook that coal consumption in advanced economies would continue its downward trend, with a significant portion of existing coal capacity slated for retirement by 2030.

This fundamental shift in the energy landscape directly impacts Clyde Bergemann's traditional revenue streams. While the company offers solutions for improving the efficiency and environmental performance of existing fossil fuel infrastructure, a sustained and widespread move towards decarbonization could ultimately reduce the overall market size for some of its core products and services. This necessitates a proactive strategy to adapt and diversify its offerings to align with the evolving energy sector.

The decline in fossil fuel reliance presents a strategic challenge:

- Reduced demand for traditional boiler and emissions control technologies

- Increased competition from renewable energy solution providers

- Potential need for significant investment in R&D for new market segments

- Risk of stranded assets if existing infrastructure becomes obsolete faster than anticipated

Heightened environmental regulations globally, such as the EU's updated Industrial Emissions Directive and the forthcoming F-Gas Regulation, necessitate substantial technological upgrades for Clyde Bergemann GmbH. Non-compliance by 2025 could lead to significant penalties and reputational damage.

The rapid global shift towards cleaner energy sources like hydrogen fuel cells and advanced battery storage threatens to marginalize traditional combustion technologies. The global green hydrogen market, valued at around $1.5 billion in 2023 and projected to exceed $70 billion by 2030, highlights this substantial market transition.

Economic slowdowns in key industrial nations, with the IMF projecting global growth to slow to 2.9% in 2024 from 3.5% in 2023, directly impact demand for industrial equipment, potentially leading to deferred investments and reduced project pipelines.

Geopolitical instability and trade disputes create supply chain vulnerabilities, increasing costs for raw materials and components. For example, tariffs on specialized alloys or electrical parts crucial for industrial equipment can inflate manufacturing expenses.

| Threat Category | Specific Impact | Illustrative Data/Trend |

|---|---|---|

| Regulatory Changes | Need for technological adaptation to meet stricter environmental standards | EU F-Gas Regulation implementation by 2025 |

| Energy Transition | Decreased demand for fossil fuel-based technologies | Global green hydrogen market growth projection: $1.5B (2023) to $70B+ (2030) |

| Economic Slowdown | Reduced industrial investment and project pipelines | IMF Global Growth Forecast: 2.9% (2024) vs. 3.5% (2023) |

| Supply Chain Disruptions | Increased costs and delivery delays due to geopolitical factors | Average lead times for critical industrial components up to 20% higher in early 2024 |

SWOT Analysis Data Sources

The data sources for this Clyde Bergemann GmbH SWOT analysis are drawn from verified financial statements, comprehensive market intelligence reports, and expert industry commentary to provide a robust and accurate strategic overview.