Clyde Bergemann GmbH PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Clyde Bergemann GmbH Bundle

Navigate the intricate external landscape affecting Clyde Bergemann GmbH with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, and evolving social trends directly impact their operational efficiency and strategic direction. Gain a crucial competitive advantage by leveraging these insights to anticipate market shifts and opportunities.

Unlock the full potential of your strategic planning with our in-depth PESTLE analysis of Clyde Bergemann GmbH. Discover how technological advancements and environmental regulations are reshaping the industry, providing you with actionable intelligence to fortify your market position. Download the complete report now for unparalleled foresight.

Political factors

Governments globally are tightening rules on industrial emissions, especially for power plants and heavy manufacturing. This push, fueled by climate change worries, creates a strong market for companies providing emission reduction technologies and environmental compliance services. For instance, in 2024, the EU's Emissions Trading System (ETS) saw carbon prices averaging around €65 per tonne, encouraging investment in cleaner operations.

Clyde Bergemann's expertise in areas like flue gas cleaning and energy efficiency directly aligns with these evolving regulatory landscapes. As nations commit to net-zero targets, such as the UK's goal of reducing emissions by 78% by 2035 compared to 1990 levels, the demand for their solutions is set to grow significantly.

Global decarbonization efforts, driven by political mandates like the European Union's Green Deal and the US Inflation Reduction Act, are fundamentally reshaping the energy landscape. This shift directly affects Clyde Bergemann's traditional markets, as new coal power plant construction is declining. For instance, global coal power capacity additions slowed significantly in 2023 compared to previous years, with a notable decrease in new projects announced.

However, these initiatives also present new avenues for Clyde Bergemann. The focus on optimizing existing fossil fuel plants for greater efficiency and lower emissions, or their conversion to cleaner fuels like natural gas or biomass, leverages the company's core expertise. Furthermore, the growing investment in waste-to-energy and biomass power generation facilities, supported by government incentives and targets, opens up substantial market opportunities for their specialized equipment and services.

International trade policies significantly influence Clyde Bergemann GmbH's global operations. For instance, the ongoing trade tensions between major economic blocs, including potential adjustments to tariffs on industrial equipment, could increase the cost of imported components vital for their boiler and environmental technology manufacturing. Conversely, new free trade agreements, such as those being negotiated or revised in 2024 and 2025, could reduce barriers for exporting their advanced solutions to key markets in Asia and the Americas, potentially boosting sales by an estimated 3-5% in those regions if favorable terms are secured.

Political Stability in Key Markets

The political stability of countries where Clyde Bergemann operates or plans to expand is a critical consideration. Unstable political environments can introduce significant risks, including project delays, the potential for contract cancellations, and unpredictable currency fluctuations, all of which can complicate long-term investment strategies.

Assessing geopolitical risks is therefore vital for sustained business growth and operational continuity. For instance, in 2024, regions experiencing heightened political tensions, such as parts of Eastern Europe and the Middle East, present increased operational challenges for companies with international supply chains or manufacturing facilities.

- Geopolitical Risk Index: Monitoring global geopolitical risk indices, which often see fluctuations based on regional conflicts and political shifts, directly impacts investment decisions and operational planning for companies like Clyde Bergemann.

- Trade Policy Impact: Changes in trade policies and tariffs, often driven by political decisions, can affect the cost of raw materials and the competitiveness of exported goods, influencing Clyde Bergemann's global market strategy.

- Regulatory Environment: Political stability underpins a predictable regulatory environment. In 2024, countries with stable governance structures tend to offer more consistent and favorable conditions for industrial equipment suppliers regarding permits, environmental standards, and labor laws.

Subsidies and Incentives for Green Technologies

Governments worldwide are increasingly providing financial support for green technologies. For instance, the European Union's Green Deal initiatives and national programs in countries like Germany and the United States offer substantial subsidies and tax credits for companies investing in energy efficiency and emissions reduction. Clyde Bergemann's waste heat recovery and emission control systems are prime candidates to benefit from these programs, making their adoption more financially viable for industrial clients.

These incentives can significantly reduce the upfront capital expenditure for businesses looking to implement cleaner technologies. For example, the Inflation Reduction Act in the US offers tax credits for clean energy investments, which can directly apply to projects utilizing Clyde Bergemann's solutions. This makes their offerings more competitive and accelerates the adoption of sustainable industrial practices.

- Governmental Support: Many nations, including Germany and the US, offer tax credits and grants for green technology adoption.

- Cost Reduction for Clients: Subsidies lower the financial barrier for industrial clients to invest in Clyde Bergemann's waste heat recovery and emission reduction systems.

- Market Competitiveness: Financial incentives enhance the attractiveness and market competitiveness of Clyde Bergemann's sustainable solutions.

Governmental policies are a major driver for Clyde Bergemann GmbH. Stricter environmental regulations, like the EU's push for lower industrial emissions, create a direct demand for their emission control technologies. For example, the EU's Emissions Trading System saw carbon prices averaging around €65 per tonne in 2024, incentivizing investments in cleaner operations.

Political stability in operating regions is crucial, as instability can lead to project delays and contract risks. Global trade policies and potential tariffs also impact component costs and export competitiveness. For instance, new free trade agreements being negotiated in 2024-2025 could boost Clyde Bergemann's exports to Asia and the Americas by an estimated 3-5%.

Government incentives, such as tax credits for green technologies offered under initiatives like the US Inflation Reduction Act, significantly enhance the financial viability of Clyde Bergemann's solutions for industrial clients. This support is vital for accelerating the adoption of energy efficiency and emission reduction systems.

What is included in the product

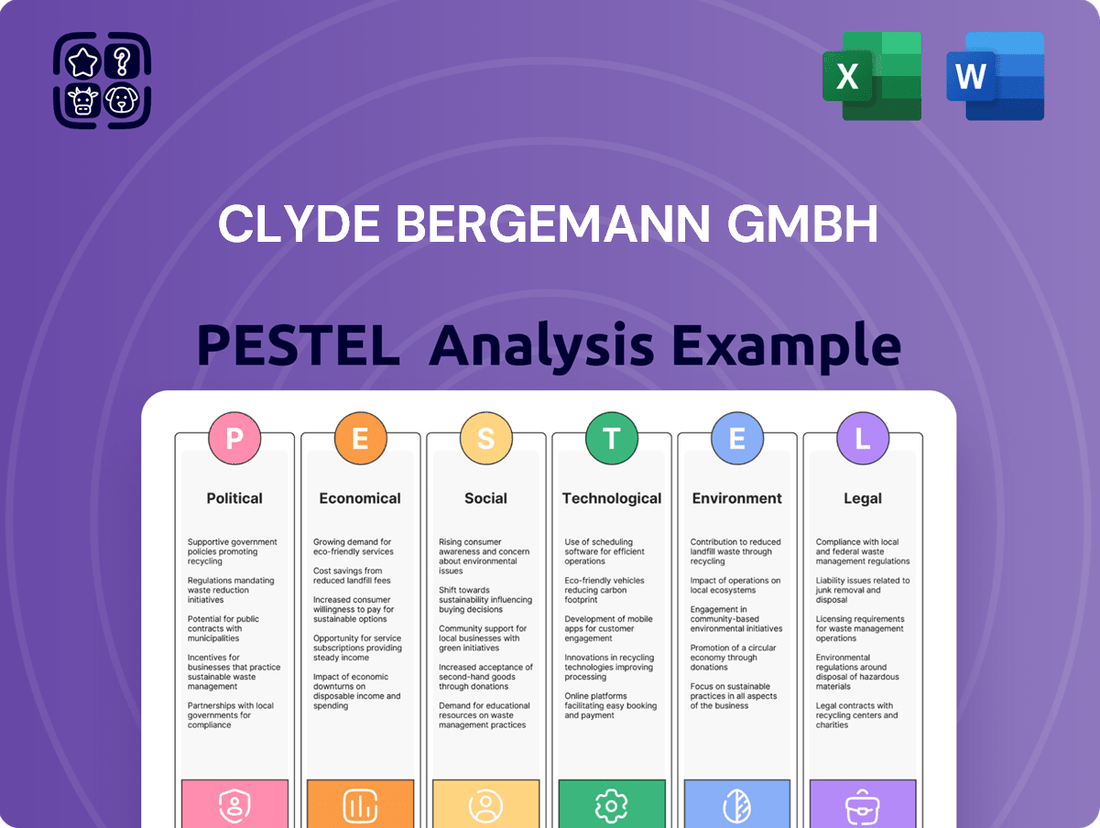

This PESTLE analysis for Clyde Bergemann GmbH examines the influence of political, economic, social, technological, environmental, and legal factors on its operations and strategic positioning.

It provides a comprehensive overview of the macro-environmental landscape, identifying key external forces that present both challenges and opportunities for the company.

This PESTLE analysis for Clyde Bergemann GmbH acts as a pain point reliever by providing a structured framework to anticipate and mitigate external challenges, ensuring strategic agility and market resilience.

Economic factors

Global economic growth is a significant driver for Clyde Bergemann, as robust expansion fuels investment in industrial infrastructure. For instance, the International Monetary Fund projected global growth at 3.1% for 2024, a slight uptick from 3.0% in 2023, indicating a generally positive environment for industrial capital expenditure.

When economies are performing well, industries tend to increase production, leading to greater demand for Clyde Bergemann's solutions like boiler cleaning and material handling systems. This increased industrial activity directly translates into opportunities for upgrades and new installations.

Conversely, a slowdown in global industrial output, perhaps due to geopolitical instability or supply chain disruptions, can dampen demand. For example, if major manufacturing hubs experience reduced output, as seen in some sectors during 2023, it can lead to delayed or canceled projects for companies like Clyde Bergemann.

Fluctuations in global energy prices, especially for fossil fuels, directly affect the operational costs for Clyde Bergemann's clients in power generation and heavy industry. For instance, Brent crude oil prices averaged around $82.50 per barrel in early 2024, a significant increase from previous years, impacting fuel expenses for many. This volatility influences how much clients are willing to invest in energy efficiency and waste heat recovery systems.

When energy prices surge, like the 2023 average of $82.38 per barrel for WTI crude, clients are more motivated to adopt solutions that reduce fuel consumption. This creates a stronger business case for Clyde Bergemann's offerings, as the payback period for efficiency investments shortens. Conversely, periods of sustained low energy prices, though less common recently, can diminish the immediate financial incentive for clients to upgrade their systems.

The availability and cost of capital are paramount for large industrial projects that Clyde Bergemann serves. For instance, in 2024, global interest rates remained a significant factor, with central banks like the European Central Bank adjusting policy rates to manage inflation, impacting the borrowing costs for Clyde Bergemann's clients undertaking new plant constructions or major upgrades.

Banking liquidity and the appetite of financial institutions to fund industrial ventures directly affect project feasibility. In 2024, while some sectors saw robust lending, others faced tighter credit conditions, meaning Clyde Bergemann's clients needed to carefully assess financing options and the willingness of banks to support capital-intensive industrial investments.

The timing of these investments is intrinsically linked to financing accessibility. For example, a client planning a significant emissions control system upgrade in 2025 might accelerate or delay the project based on prevailing interest rates and the ease of securing project finance, directly influencing demand for Clyde Bergemann's services.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations present a significant challenge for Clyde Bergemann GmbH, a global technology provider. Volatile currency movements can directly affect the profitability of its international sales and the cost of sourcing components from abroad. For instance, a strengthening Euro in 2024 could make German-manufactured equipment more expensive for international buyers, potentially reducing demand.

The impact extends to the company's balance sheet, where overseas assets and liabilities are revalued with every shift in exchange rates. Managing these currency risks is therefore crucial for maintaining financial stability and ensuring competitive pricing in diverse global markets. Companies like Clyde Bergemann often employ hedging strategies to mitigate these effects.

- Impact on International Sales: A stronger Euro can make Clyde Bergemann's exports more expensive, potentially dampening international demand.

- Cost of Imported Components: Conversely, a weaker Euro could increase the cost of raw materials or specialized parts imported for manufacturing.

- Valuation of Overseas Assets: Fluctuations affect the reported value of subsidiaries or investments held in foreign currencies.

- Competitive Pricing: Unmanaged currency volatility can erode profit margins, forcing price adjustments that might impact market competitiveness.

Competitive Landscape and Pricing Pressure

The industrial plant optimization sector is highly competitive, featuring a mix of long-standing companies and emerging innovators. This crowded market often translates into significant pricing pressure, directly impacting the profitability of firms like Clyde Bergemann GmbH.

To navigate this, Clyde Bergemann must prioritize continuous innovation and clearly articulate the unique value proposition of its solutions. Failing to differentiate risks commoditization, where its offerings are seen as interchangeable, further exacerbating pricing challenges.

- Market Share Dynamics: Global industrial automation market expected to reach $300 billion by 2027, with significant competition in specialized optimization segments.

- Pricing Trends: Average project margins for plant optimization services can range from 10-25%, but intense competition can drive these towards the lower end.

- Innovation Imperative: Companies investing 5-10% of revenue in R&D are more likely to maintain competitive pricing power.

- Customer Acquisition Costs: High competition can inflate customer acquisition costs by up to 30% as companies vie for market attention.

Global economic growth significantly influences Clyde Bergemann's prospects, as robust expansion encourages investment in industrial infrastructure. The IMF projected global growth at 3.1% for 2024, a slight increase from 3.0% in 2023, signaling a generally favorable environment for capital expenditure in the industrial sector.

When economies are performing well, industries tend to boost production, leading to increased demand for Clyde Bergemann's solutions like boiler cleaning and material handling systems. This heightened industrial activity directly translates into opportunities for upgrades and new installations.

Conversely, a global economic slowdown, perhaps due to geopolitical instability or supply chain disruptions, can reduce demand. For instance, if major manufacturing hubs experience reduced output, as observed in some sectors during 2023, it can lead to project delays or cancellations for companies like Clyde Bergemann.

Fluctuations in global energy prices, particularly for fossil fuels, directly impact the operational costs for Clyde Bergemann's clients in power generation and heavy industry. For example, Brent crude oil prices averaged around $82.50 per barrel in early 2024, a notable increase from previous years, affecting fuel expenses for many clients. This volatility influences their willingness to invest in energy efficiency and waste heat recovery systems.

When energy prices surge, like the 2023 average of $82.38 per barrel for WTI crude, clients become more motivated to adopt solutions that reduce fuel consumption. This strengthens the business case for Clyde Bergemann's offerings, as the payback period for efficiency investments shortens. Conversely, periods of sustained low energy prices, though less common recently, can diminish the immediate financial incentive for clients to upgrade their systems.

The availability and cost of capital are crucial for the large industrial projects that Clyde Bergemann serves. In 2024, global interest rates remained a significant factor, with central banks like the European Central Bank adjusting policy rates to manage inflation, impacting borrowing costs for Clyde Bergemann's clients undertaking new plant constructions or major upgrades.

Banking liquidity and financial institutions' willingness to fund industrial ventures directly affect project feasibility. In 2024, while some sectors saw robust lending, others faced tighter credit conditions, meaning Clyde Bergemann's clients needed to carefully assess financing options and the willingness of banks to support capital-intensive industrial investments.

The timing of these investments is intrinsically linked to financing accessibility. For example, a client planning a significant emissions control system upgrade in 2025 might accelerate or delay the project based on prevailing interest rates and the ease of securing project finance, directly influencing demand for Clyde Bergemann's services.

Currency exchange rate fluctuations present a significant challenge for Clyde Bergemann GmbH, a global technology provider. Volatile currency movements can directly affect the profitability of its international sales and the cost of sourcing components from abroad. For instance, a strengthening Euro in 2024 could make German-manufactured equipment more expensive for international buyers, potentially reducing demand.

The impact extends to the company's balance sheet, where overseas assets and liabilities are revalued with every shift in exchange rates. Managing these currency risks is therefore crucial for maintaining financial stability and ensuring competitive pricing in diverse global markets. Companies like Clyde Bergemann often employ hedging strategies to mitigate these effects.

| Economic Factor | Impact on Clyde Bergemann | Data/Example (2024/2025) |

|---|---|---|

| Global Economic Growth | Drives demand for industrial infrastructure investment. | IMF projected 3.1% global growth for 2024. |

| Industrial Output | Higher output increases demand for Clyde Bergemann's solutions. | Slowdowns in manufacturing hubs in 2023 impacted industrial activity. |

| Energy Prices | Affects clients' operational costs and investment in efficiency. | Brent crude averaged ~$82.50/barrel in early 2024; WTI averaged $82.38 in 2023. |

| Cost of Capital | Influences client's ability to finance projects. | ECB adjusting policy rates in 2024 to manage inflation. |

| Currency Exchange Rates | Impacts international sales profitability and component costs. | A strengthening Euro in 2024 could make German exports pricier. |

Preview Before You Purchase

Clyde Bergemann GmbH PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis of Clyde Bergemann GmbH.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, detailing the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Clyde Bergemann GmbH.

The content and structure shown in the preview is the same document you’ll download after payment, providing actionable insights into the external environment for Clyde Bergemann GmbH.

Sociological factors

Growing public concern over climate change, air pollution, and resource scarcity is a significant sociological driver influencing industrial operations. This heightened awareness translates into increased demand for environmentally sound practices and technologies, aligning perfectly with Clyde Bergemann's core business of emission reduction and efficiency enhancement.

For instance, in 2024, the global renewable energy market saw substantial growth, with investments reaching record highs, reflecting this societal shift. Companies like Clyde Bergemann, which provide solutions that help industries meet stricter environmental regulations and improve their ecological footprint, are therefore well-positioned to capitalize on this trend.

Furthermore, a company's perceived environmental responsibility significantly impacts its public image and stakeholder relations. In 2025, a significant majority of consumers indicated they would favor brands demonstrating strong environmental commitment, making sustainability a key differentiator in the market.

Clyde Bergemann GmbH's operational success hinges on the availability of a skilled workforce. This includes engineers for design and R&D, technicians for manufacturing and maintenance, and specialized labor for on-site installations and services. For instance, the global demand for mechanical engineers, a core discipline for Clyde Bergemann, was projected to grow steadily, with an estimated 300,000 job openings in the US alone between 2022 and 2032, indicating a competitive landscape for talent.

Demographic shifts significantly influence workforce availability. Aging populations in some key European markets, where Clyde Bergemann has a strong presence, can lead to a shrinking pool of experienced workers, necessitating robust knowledge transfer programs. Conversely, regions with younger, growing populations may offer a larger talent pool, but educational standards and vocational training quality become critical factors in ensuring the necessary skill sets are developed, impacting the company's ability to recruit and retain expertise for projects and innovation.

Stakeholders, from investors to customers and employees, are increasingly scrutinizing corporate behavior, demanding tangible commitments to Corporate Social Responsibility (CSR). This trend is amplified by growing awareness of climate change and social equity issues, pushing companies to integrate sustainability into their core operations.

Clyde Bergemann's focus on developing and delivering environmentally friendly solutions, such as advanced emissions control technologies, directly addresses these evolving stakeholder expectations. Their contribution to sustainable industrial operations resonates with a market segment prioritizing ethical and eco-conscious business practices.

By highlighting their role in fostering cleaner industrial processes, Clyde Bergemann can bolster its brand image and appeal to socially responsible investors and a workforce that values environmental stewardship. For instance, a significant portion of global investors, estimated at over 70% in some surveys from 2024, now consider ESG (Environmental, Social, and Governance) factors when making investment decisions.

Health and Safety Standards

Societal expectations for robust health and safety in industrial settings are escalating globally. Clyde Bergemann must align its product design, service delivery, and internal operations with these evolving standards to ensure regulatory compliance, safeguard its workforce, and uphold its corporate reputation. This is especially critical given the inherent risks associated with the heavy industries it serves.

In 2024, the global industrial safety market was valued at approximately USD 55 billion, with a projected compound annual growth rate (CAGR) of 6.5% through 2030, indicating a strong market emphasis on safety advancements. This trend underscores the necessity for companies like Clyde Bergemann to invest in and demonstrate adherence to best-in-class safety protocols.

- Increasing Regulatory Scrutiny: Governments worldwide are enhancing occupational safety regulations, impacting manufacturing and operational processes.

- Employee Well-being as a Priority: Companies are increasingly recognizing that a safe working environment is crucial for employee morale, productivity, and talent retention.

- Public Perception and Brand Image: A strong safety record positively influences public perception and can be a significant differentiator in a competitive market.

- Technological Advancements in Safety: Innovations in automation, AI-driven monitoring, and advanced personal protective equipment are setting new benchmarks for safety performance.

Consumer and Industrial Demand for Sustainable Products

Even though Clyde Bergemann supplies directly to industrial sectors, the end-user preference for sustainable goods significantly shapes the demand for the products these industries create. This growing consumer consciousness translates into a push for cleaner manufacturing practices, creating a market for Clyde Bergemann's solutions that improve efficiency and cut emissions.

For example, in 2024, global consumer spending on sustainable products saw a notable increase, with reports indicating that over 70% of consumers consider sustainability when making purchasing decisions. This trend directly impacts industrial clients, prompting them to seek technologies that align with environmental, social, and governance (ESG) goals.

- Growing Consumer Preference: A significant portion of consumers now prioritize eco-friendly products, influencing B2B purchasing decisions.

- Indirect Demand Driver: Consumer demand for sustainability indirectly fuels industrial investment in greener technologies.

- Market Opportunity: Clyde Bergemann's emission-reducing and efficiency-enhancing solutions are well-positioned to meet this evolving industrial need.

Societal expectations around environmental stewardship and corporate responsibility are paramount. Public concern over climate change is driving demand for cleaner industrial processes, directly benefiting companies like Clyde Bergemann that offer emission reduction technologies. For instance, in 2024, global investment in renewable energy reached unprecedented levels, signaling a strong societal shift towards sustainability.

The availability of a skilled workforce is a critical sociological factor. Clyde Bergemann relies on engineers and technicians, and the demand for mechanical engineers, for example, remains robust, with the US alone projecting hundreds of thousands of job openings in this field between 2022 and 2032.

Stakeholder scrutiny of corporate social responsibility (CSR) is intensifying, with a significant majority of investors in 2024 considering ESG factors. Clyde Bergemann's focus on eco-friendly solutions aligns with these expectations, enhancing its brand image and appeal to socially conscious investors and employees.

Safety standards in industrial settings are continually rising, influencing product design and operational practices. The global industrial safety market, valued at approximately USD 55 billion in 2024, is projected to grow, highlighting the importance of robust safety protocols for companies like Clyde Bergemann.

| Sociological Factor | Relevance to Clyde Bergemann | Supporting Data/Trend (2024/2025) |

|---|---|---|

| Environmental Awareness | Drives demand for emission reduction solutions | Global renewable energy investment hit record highs in 2024. |

| Skilled Workforce Availability | Crucial for R&D, manufacturing, and services | Strong demand for mechanical engineers, with significant projected job openings in the US. |

| Corporate Social Responsibility (CSR) | Enhances brand image and investor appeal | Over 70% of investors considered ESG factors in 2024. |

| Health and Safety Standards | Impacts product design and operational compliance | Global industrial safety market valued at ~USD 55 billion in 2024, showing market emphasis on safety. |

Technological factors

The accelerating integration of Industry 4.0, the Internet of Things (IoT), Artificial Intelligence (AI), and advanced automation presents substantial growth avenues for Clyde Bergemann. These technologies allow for the development of intelligent boiler cleaning systems and predictive maintenance solutions for ash handling, directly improving client operational efficiency.

By leveraging data analytics, Clyde Bergemann can optimize waste heat recovery systems, leading to reduced operational costs for their customers. This digital transformation is crucial for maintaining a competitive edge in the evolving industrial landscape, with global industrial automation market expected to reach $310.6 billion by 2027, growing at a CAGR of 7.5%.

Breakthroughs in material science are directly impacting Clyde Bergemann's product development. For instance, advancements in ceramic composites and advanced alloys offer enhanced resistance to extreme temperatures and corrosive elements, crucial for their boiler cleaning systems. These materials can extend the operational life of components by up to 30% in high-wear environments.

The energy sector is rapidly evolving with advancements in new generation technologies. Innovations like next-generation solar photovoltaic (PV) cells, which in 2024 are seeing module efficiencies pushing past 25%, and small modular nuclear reactors (SMRs) are gaining traction. Hydrogen-based power, particularly green hydrogen produced via electrolysis powered by renewables, is also a significant development, with global investment in hydrogen projects expected to reach hundreds of billions by 2030.

These shifts present a dual-edged sword for Clyde Bergemann. While the decline in traditional fossil fuel reliance might impact demand for certain existing equipment, the need for efficient heat recovery and material handling in these new energy processes creates substantial opportunities. For example, adapting boiler cleaning technologies for biomass or waste-to-energy plants, which are seeing renewed interest as alternatives to fossil fuels, could be a key growth area.

Furthermore, the development of advanced materials for high-temperature applications in fusion energy or specialized hydrogen storage solutions could open entirely new product lines. The global clean energy investment reached a record $1.8 trillion in 2023, indicating a strong market appetite for solutions supporting the transition, a trend projected to continue through 2025 and beyond.

Research and Development in Emission Control Technologies

Clyde Bergemann GmbH's commitment to continuous research and development in emission control technologies is paramount for navigating increasingly stringent environmental regulations and client expectations. This proactive approach ensures they remain at the forefront of the industry by exploring innovative solutions for reducing NOx, SOx, and particulate matter, alongside advancements in carbon capture. For instance, the global market for emissions control systems is projected to reach over $110 billion by 2028, highlighting the significant growth potential and the need for technological leadership.

Investment in R&D is not merely an operational cost but a strategic imperative for Clyde Bergemann's long-term viability and competitive edge. By developing novel methods and expanding their portfolio beyond current offerings, they can provide more comprehensive environmental solutions to their diverse industrial clientele.

- Focus on Novel Reduction Methods: Exploring advanced catalytic converters and selective catalytic reduction (SCR) systems for NOx abatement.

- Particulate Matter Control Innovation: Developing next-generation filters and electrostatic precipitators for enhanced PM removal.

- Carbon Capture Technology Exploration: Investigating and integrating emerging carbon capture, utilization, and storage (CCUS) solutions.

- Regulatory Foresight: Aligning R&D efforts with anticipated future environmental legislation and industry standards.

Improvement in Waste Heat Recovery Efficiency

Technological progress is significantly boosting the efficiency of waste heat recovery (WHR) systems, making them viable for more industrial applications. Innovations in heat exchanger design and the development of advanced heat transfer fluids are key drivers. For instance, advancements in materials science are enabling the creation of more robust and efficient heat exchangers capable of operating under extreme conditions, as seen in projects targeting high-temperature industrial exhaust streams.

Smarter control systems, often incorporating AI and machine learning, are further optimizing WHR performance. These systems can dynamically adjust operations based on real-time process data, maximizing energy capture and economic returns. This enhanced applicability and efficiency directly translates to a larger market potential for companies like Clyde Bergemann, as clients increasingly see the tangible financial and environmental benefits.

The economic advantages are substantial; improved WHR efficiency can lead to significant reductions in operational energy costs for industrial clients. For example, a 10% increase in WHR efficiency could translate to millions in annual savings for a large manufacturing plant. This growing economic incentive, coupled with environmental regulations, is driving demand for sophisticated WHR solutions.

- Enhanced Heat Exchanger Performance: New designs and materials improve heat transfer rates by up to 15% in advanced systems.

- Novel Heat Transfer Fluids: Development of fluids with higher thermal conductivity and stability expands operational temperature ranges.

- Smart Control Integration: AI-driven systems optimize energy recovery, potentially increasing overall system efficiency by 5-10%.

- Broader Industrial Applicability: WHR is becoming cost-effective for a wider range of processes, including those with intermittent heat sources.

Technological advancements are reshaping the industrial landscape, directly benefiting Clyde Bergemann's core business. The integration of Industry 4.0, IoT, and AI enables the development of smarter boiler cleaning and predictive maintenance solutions, enhancing client operational efficiency. These digital transformations are critical for competitiveness, with the global industrial automation market projected to reach $310.6 billion by 2027.

Breakthroughs in material science are also key, with advanced alloys and ceramic composites offering enhanced resistance to extreme conditions, extending component life by up to 30% in demanding environments. Furthermore, innovations in waste heat recovery (WHR) systems, driven by improved heat exchanger designs and AI-powered controls, are making WHR more viable across a broader range of industries, potentially increasing efficiency by 5-10%.

The energy sector's evolution, with advancements in solar PV efficiency (exceeding 25% in 2024) and the rise of green hydrogen, presents both challenges and opportunities. While traditional fossil fuel reliance may decrease, the need for efficient heat recovery in new energy processes, such as biomass or waste-to-energy plants, offers significant growth potential. Global clean energy investment hit a record $1.8 trillion in 2023, underscoring this trend.

Legal factors

Clyde Bergemann GmbH operates within sectors subject to stringent environmental regulations, particularly concerning air emissions and waste management. Compliance with directives like the EU Industrial Emissions Directive, which sets limits for pollutants from industrial activities, is paramount for their clients. For instance, in 2024, the EU continued to refine its emissions trading system, impacting industries that Clyde Bergemann serves.

Clyde Bergemann GmbH operates under stringent health and safety legislation, a critical factor in the industrial equipment sector. These laws, such as those enforced by OSHA in the US and equivalent national bodies elsewhere, mandate rigorous standards for the design, manufacturing, installation, and ongoing maintenance of industrial machinery. For instance, in 2023, industrial accidents in Germany's manufacturing sector resulted in approximately 300,000 reportable injuries, highlighting the importance of compliance. Failure to adhere to these regulations can lead to severe legal penalties, operational shutdowns, and significant reputational damage.

Ensuring full compliance with occupational health and safety laws is not merely a legal obligation but a fundamental aspect of Clyde Bergemann's operational integrity and market standing. The company must proactively integrate safety protocols into every stage of its product lifecycle, from initial concept to after-sales service. This commitment protects not only their employees and clients' workforce but also safeguards the company from costly litigation and insurance premium increases, which can impact profitability. For example, companies demonstrating strong safety records often see lower insurance premiums, a tangible financial benefit.

Clyde Bergemann GmbH's global operations necessitate strict adherence to international trade laws and sanctions. For instance, in 2024, the European Union continued to update its sanctions regimes, impacting trade with specific nations and entities, requiring meticulous due diligence for all cross-border dealings. Failure to comply can result in significant fines and reputational damage, underscoring the critical need for expert legal counsel in navigating these evolving regulations.

Intellectual Property Rights and Patents

Protecting Clyde Bergemann's innovative technologies through patents, trademarks, and trade secrets is fundamental to securing their market position. For instance, as of early 2024, the global patent application rate for industrial machinery continues to grow, underscoring the importance of robust IP protection in this sector. They must also diligently ensure their processes and products do not infringe upon existing intellectual property rights of competitors, a growing concern with increased cross-border collaboration. The legal landscape governing intellectual property directly fuels innovation by providing incentives for research and development, and safeguards against the unauthorized replication of their specialized solutions.

Key considerations regarding intellectual property for Clyde Bergemann include:

- Patent Strategy: Securing patents for novel boiler cleaning systems and related technologies to prevent imitation.

- Trademark Protection: Safeguarding the Clyde Bergemann brand name and logo to maintain brand recognition and trust.

- Freedom to Operate: Conducting thorough IP due diligence to avoid infringing on existing patents held by other companies.

- Trade Secret Management: Implementing strict internal controls to protect proprietary manufacturing processes and know-how.

Contract Law and Product Liability

Clyde Bergemann GmbH operates within a complex web of international contract law. For instance, in 2024, the International Chamber of Commerce (ICC) reported a significant increase in cross-border commercial disputes, highlighting the critical need for robust contractual frameworks and efficient dispute resolution mechanisms. Adherence to these diverse legal stipulations is paramount for ensuring project success and managing potential conflicts across its global operations.

Product liability is another significant legal consideration for Clyde Bergemann. In 2025, regulatory bodies worldwide continue to emphasize stringent product safety standards. Companies face increasing scrutiny and potential litigation for product defects, making rigorous quality assurance and compliance with international safety regulations, such as ISO 9001, indispensable for mitigating legal exposure and maintaining market trust.

- Global Contractual Complexity: Clyde Bergemann's international business necessitates navigating varying contract laws, impacting project execution and dispute resolution.

- Product Liability Risks: The company must manage product liability laws, which hold manufacturers accountable for product defects, requiring strict quality control.

- Mitigating Legal Exposure: Adherence to international safety standards and robust quality management systems are crucial for reducing legal risks in 2024-2025.

Clyde Bergemann GmbH must navigate a complex landscape of international trade laws and sanctions, which were actively updated by bodies like the EU in 2024. Strict adherence to these regulations is vital to avoid significant fines and reputational harm, necessitating thorough due diligence for all cross-border transactions.

Intellectual property laws are critical for protecting Clyde Bergemann's innovations, with global patent applications in industrial machinery showing continued growth as of early 2024. The company must secure its own patents while ensuring it does not infringe on existing IP rights, a growing challenge with increased international collaboration.

Product liability remains a key legal factor, with global regulators emphasizing stringent safety standards in 2025. Companies like Clyde Bergemann face heightened scrutiny and potential litigation for defects, making robust quality assurance and compliance with standards such as ISO 9001 essential for mitigating legal risks.

Contract law complexity is inherent in Clyde Bergemann's global operations, as highlighted by the ICC's report of increased cross-border disputes in 2024. Effective management of contractual obligations and dispute resolution mechanisms is paramount for successful project execution worldwide.

Environmental factors

The intensifying global commitment to combating climate change is a significant tailwind for companies like Clyde Bergemann. This push translates directly into a heightened demand for technologies that slash carbon emissions and boost energy efficiency within industrial operations. For instance, the International Energy Agency reported in early 2024 that global energy-related CO2 emissions saw a slight increase in 2023, underscoring the ongoing need for effective mitigation strategies.

Clyde Bergemann's core offerings, such as their advanced waste heat recovery systems and plant performance optimization solutions, are perfectly aligned with these environmental imperatives. These technologies enable industries to recapture and reuse energy that would otherwise be lost, thereby reducing their reliance on primary energy sources and lowering their overall carbon footprint. This strategic positioning is crucial in a market increasingly influenced by stringent environmental regulations and corporate sustainability goals, with many nations setting ambitious net-zero targets for 2050.

Growing concerns about the scarcity of vital natural resources, like water and fossil fuels, are compelling industries worldwide to prioritize operational efficiency and sustainable practices. For instance, by 2025, global freshwater demand is projected to outstrip supply by 40% in many regions, according to UN Water reports, highlighting the urgency for water conservation across all sectors.

Clyde Bergemann's innovative solutions, such as advanced ash handling systems and sophisticated boiler cleaning technologies, directly address these efficiency demands. These offerings enable industries to significantly reduce their energy consumption and material waste, leading to lower operational expenditures and a more responsible environmental footprint. This aligns perfectly with global resource management objectives, helping clients navigate increasing regulatory pressures and market expectations for sustainability.

Deteriorating air quality in many industrial regions is a significant concern, driving demand for advanced pollution control measures. Clyde Bergemann's technologies, designed to boost combustion efficiency and cut down on particulate matter and harmful gaseous emissions from industrial boilers, directly tackle these environmental challenges. This allows their clients to comply with increasingly strict air quality regulations, a key market driver.

Waste Management and Circular Economy Principles

The global push towards a circular economy, aiming to minimize waste and maximize resource recovery, presents both challenges and opportunities. For instance, by 2025, projections suggest the global waste management market could reach over $600 billion, highlighting the scale of this sector.

Clyde Bergemann's expertise in material handling, especially for industrial by-products like ash, directly supports these circular economy goals. Their systems can be crucial in efficiently managing these materials, potentially enabling their repurposing in construction or other industries, thereby diverting them from landfills.

Furthermore, the company's involvement in waste-to-energy solutions aligns with the principle of transforming waste into a valuable resource. In 2024, the waste-to-energy sector is seeing significant investment, with Europe leading in installed capacity, demonstrating the growing economic viability of these technologies.

- Circular Economy Growth: The global waste management market is projected to exceed $600 billion by 2025.

- Resource Recovery: Clyde Bergemann's ash handling systems can facilitate the reuse of industrial by-products.

- Waste-to-Energy Potential: Solutions for waste-to-energy processes are gaining traction, with Europe a key market.

Water Usage and Conservation

Water usage is a critical environmental consideration for industrial operations. As global water stress intensifies, conservation efforts become increasingly important. For instance, in 2023, the World Resources Institute reported that 25% of the global population faces extremely high water stress, a figure projected to rise. Companies are therefore under pressure to manage their water footprints more effectively.

While Clyde Bergemann GmbH's core business is not directly water supply, their technologies can indirectly influence water consumption. Efficient plant operations and waste heat recovery systems, key areas for Clyde Bergemann, can lead to reduced water usage. This is often achieved by optimizing cooling processes or improving the efficiency of steam cycles, thereby contributing to better water stewardship within industrial facilities.

Consider these points regarding water usage and conservation:

- Industrial water consumption is a growing concern due to increasing global water scarcity.

- Clyde Bergemann's energy efficiency solutions can indirectly lower water demand in industrial cooling and steam systems.

- Optimizing plant operations through their technologies supports broader corporate sustainability goals related to water conservation.

The increasing global focus on environmental protection and sustainability directly benefits Clyde Bergemann's business. As industries worldwide strive to reduce their carbon footprint and improve energy efficiency, the demand for advanced solutions like waste heat recovery and emission control technologies is on the rise. For example, in 2024, the global market for industrial energy efficiency solutions was valued at over $200 billion, with significant growth projected due to stringent environmental regulations and corporate net-zero commitments.

Clyde Bergemann's expertise in optimizing combustion processes and managing industrial by-products like ash positions them well to capitalize on these trends. Their technologies help clients meet stricter air quality standards and manage waste more effectively, aligning with the principles of a circular economy. This is particularly relevant as many regions are implementing policies to promote resource recovery and reduce landfill waste, with projections indicating continued expansion in the waste management sector through 2025.

The growing pressure on industries to conserve resources, especially water, also presents opportunities. While not directly a water provider, Clyde Bergemann's efficiency-enhancing solutions can indirectly reduce industrial water consumption by optimizing cooling and steam systems. This indirect benefit supports broader corporate sustainability objectives and helps clients navigate increasing water scarcity challenges, a critical issue with projections showing significant global water stress by 2025.

| Environmental Factor | Impact on Clyde Bergemann | Supporting Data/Trend |

| Climate Change & Emissions Reduction | Increased demand for efficiency and emission control technologies. | Global energy efficiency solutions market projected to grow significantly through 2025. |

| Resource Scarcity (Water, Materials) | Demand for solutions that improve operational efficiency and reduce waste. | Global water stress impacting 25% of the population in 2023, driving conservation efforts. |

| Circular Economy & Waste Management | Opportunity in managing industrial by-products and waste-to-energy solutions. | Global waste management market expected to exceed $600 billion by 2025. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Clyde Bergemann GmbH is informed by a comprehensive review of official government publications, reputable economic databases, and leading industry analysis reports. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.