Cloudflare Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cloudflare Bundle

Cloudflare operates in a dynamic tech landscape where the threat of new entrants is moderate due to high switching costs and network effects, while the bargaining power of buyers is also somewhat limited by the essential nature of its services. The intensity of rivalry among existing players, however, is a significant force, demanding constant innovation and competitive pricing.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Cloudflare’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Cloudflare's reliance on a vast global network of data centers and internet service providers (ISPs) for its infrastructure is significant. These providers are essential for hosting Cloudflare's services and ensuring efficient delivery to users worldwide. While Cloudflare operates a substantial network of its own, the fundamental physical infrastructure and connectivity offered by these external entities remain critical to its operations.

The bargaining power of these core infrastructure providers can be considered moderate. This is particularly true concerning essential peering agreements and in regions with high demand for bandwidth and connectivity. However, Cloudflare's immense scale and its continuous investment in expanding its own network infrastructure serve as a significant mitigating factor against any excessive leverage these providers might otherwise exert.

Cloudflare's strategic use of commodity hardware significantly dilutes the bargaining power of individual suppliers. By sourcing standard servers and networking gear from a wide array of vendors, the company fosters a competitive environment among its hardware providers.

This approach allows Cloudflare to maintain cost-effectiveness and avoid becoming dependent on any single supplier. For instance, in 2024, the widespread availability of x86 servers and standard networking components meant that no single hardware manufacturer held substantial leverage over Cloudflare's procurement decisions.

While Cloudflare builds much of its own technology, it probably uses some third-party software licenses, open-source elements, or specialized tech vendors for specific features. The bargaining strength of these software and technology providers hinges on how unique and essential their products are. For instance, if a critical component is only available from a single provider, that provider gains significant leverage.

The bargaining power of these software and technology suppliers is generally moderated by Cloudflare's likely strategy of diversifying its technology stack. By not relying too heavily on any single supplier for essential functions, Cloudflare can reduce the risk of facing exorbitant pricing or unfavorable terms. This diversification is a key strategy to maintain flexibility and control costs in a rapidly evolving tech landscape.

Talent Pool for Specialized Skills

The availability of highly skilled engineers, cybersecurity experts, and cloud infrastructure specialists is a critical input for Cloudflare's operations and innovation. A shortage of such talent can increase the bargaining power of these individuals or specialized recruitment agencies. In 2024, the demand for cloud computing professionals continued to outstrip supply, with reports indicating a global deficit of millions of skilled workers in the sector.

Cloudflare's reputation as an innovative company in the tech space, particularly in areas like Zero Trust security and edge computing, helps it attract top talent. However, competition for these highly sought-after skills remains intense across the industry. For instance, in early 2025, major tech companies were observed offering significantly enhanced compensation packages and remote work flexibility to secure specialized cloud talent.

- High Demand for Cloud Expertise: The global cloud market is projected to reach over $1.3 trillion by 2025, driving an insatiable need for skilled professionals.

- Talent Shortage Impact: A 2024 survey found that 70% of IT leaders reported difficulty in finding qualified cybersecurity talent, directly impacting companies like Cloudflare.

- Competitive Compensation: To attract and retain top engineers, Cloudflare, like its peers, must contend with escalating salary and benefits packages, increasing input costs.

- Reputation as an Attractor: Cloudflare's strong brand in cutting-edge technology is a key factor in its ability to draw in specialized talent, mitigating some supplier power.

Energy and Utility Providers

Energy and utility providers hold considerable bargaining power over Cloudflare due to the immense energy consumption of its global network. Reliable and substantial power is non-negotiable for Cloudflare's data centers, making these suppliers critical. In 2024, the global average price of electricity for industrial users saw fluctuations, with some regions experiencing increases due to supply chain issues and demand, directly impacting Cloudflare's operational expenses.

The bargaining power of these suppliers is often amplified by regional factors. Local monopolies or stringent regulatory environments can limit Cloudflare's options for sourcing power, potentially leading to higher costs. For instance, in areas where utility providers operate as sole suppliers, they can dictate terms more forcefully, impacting Cloudflare's cost structure and profitability.

- High Energy Demand: Cloudflare's extensive global network necessitates significant and consistent energy input.

- Essential Infrastructure: Reliable power is a fundamental requirement for Cloudflare's data center operations.

- Regional Power Dynamics: Bargaining power varies by region due to local monopolies and regulatory frameworks affecting electricity costs.

Suppliers of commodity hardware, like servers and networking equipment, generally have low bargaining power over Cloudflare. This is because Cloudflare sources these components from a wide range of vendors, creating a competitive market. In 2024, the availability of standardized, off-the-shelf hardware meant Cloudflare could easily switch suppliers if prices or terms became unfavorable, thus limiting individual supplier leverage.

Specialized technology or software providers might possess moderate bargaining power, especially if their offerings are unique and critical to Cloudflare's operations. However, Cloudflare's strategy of diversifying its technology stack and utilizing open-source solutions helps to mitigate this. The bargaining power of these suppliers is thus constrained by Cloudflare's ability to find alternative solutions or develop in-house capabilities.

The bargaining power of energy and utility providers is significant for Cloudflare, given the company's massive energy consumption for its global network. Reliable power is a non-negotiable necessity, and in 2024, regional variations in electricity costs and supply chain issues meant that some providers could exert considerable influence over pricing, directly impacting Cloudflare's operational expenses.

What is included in the product

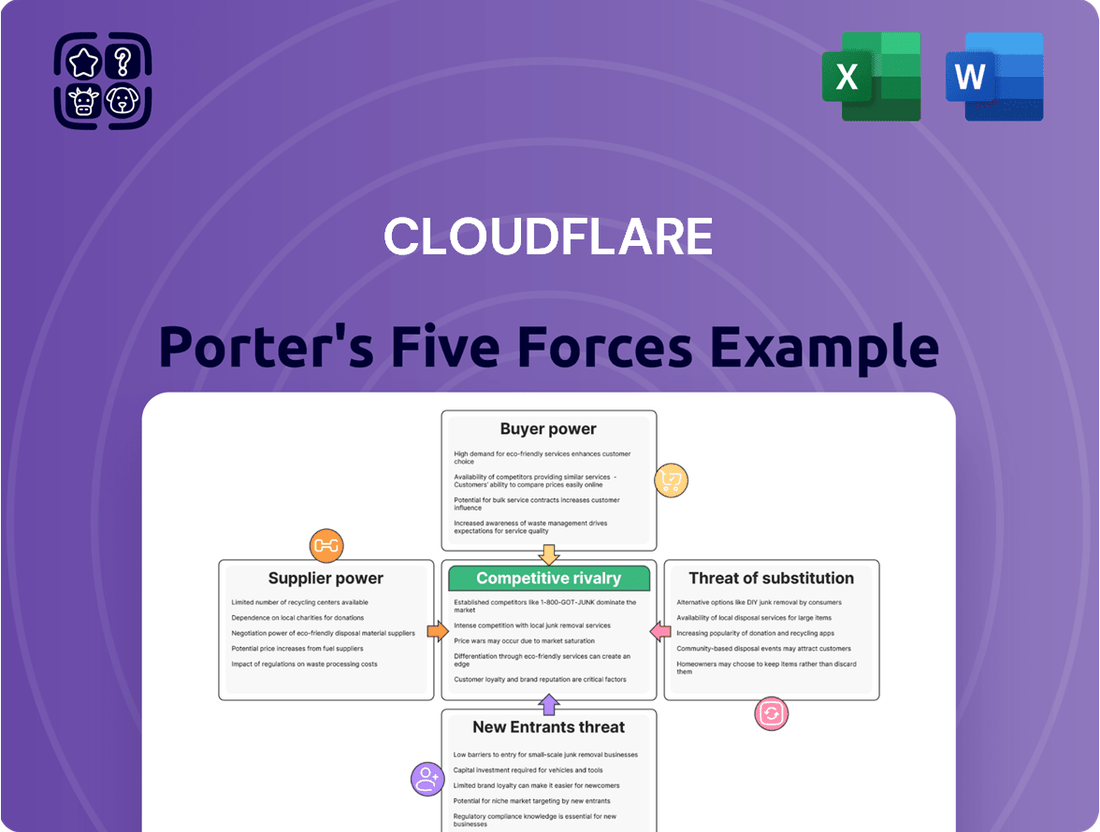

This Porter's Five Forces analysis for Cloudflare meticulously examines the competitive intensity, buyer and supplier power, threat of new entrants, and the risk of substitutes within the web infrastructure and security market.

Instantly visualize competitive intensity and identify strategic vulnerabilities with a dynamic, interactive Porter's Five Forces model.

Customers Bargaining Power

Cloudflare’s vast and varied customer base significantly tempers the bargaining power of individual customers. With hundreds of thousands of paying clients, ranging from solo developers to major corporations and government bodies, the company isn’t overly reliant on any single entity.

This broad reach is a key strength. As of the second quarter of 2025, Cloudflare reported approximately 266,000 paying customers. This sheer volume means that the loss of any one or even a small group of customers would have a minimal impact on overall revenue, thereby reducing their leverage.

For large enterprise clients, Cloudflare's comprehensive suite of security, performance, and reliability solutions often becomes deeply integrated into their core web operations. The sheer complexity and the significant risk of disruption associated with migrating these critical services to another provider create substantial barriers to switching.

This deep integration is a key reason for Cloudflare's strong customer loyalty. Evidence of this stickiness can be seen in their impressive dollar-based net retention rate, which reached 114% in the second quarter of 2025, demonstrating that existing customers are spending more over time, even after accounting for churn.

Cloudflare's value proposition for SMBs is a significant factor in understanding customer bargaining power. By offering free and low-cost tiers, Cloudflare makes advanced security and performance accessible to a vast number of smaller businesses that would otherwise struggle to afford such services. This accessibility is a key driver of their market penetration.

While individual SMBs possess limited bargaining power due to their smaller size, their sheer volume represents a substantial collective force. This widespread adoption, facilitated by the ease of integration, allows Cloudflare to capture a large market share. The tiered service model also plays a role, encouraging customer loyalty and making it more difficult for businesses to switch as they scale.

Importance of Services to Customer Operations

Cloudflare's offerings, including robust DDoS mitigation and Content Delivery Network (CDN) services, are frequently indispensable to their clients' online functionalities. These services directly influence customer revenue streams and brand standing, making their reliability paramount. This inherent criticality diminishes a customer's inclination to negotiate service terms or easily switch providers, thereby constraining their bargaining leverage.

The essential nature of Cloudflare's security and performance solutions is underscored by their operational impact. For instance, in the second quarter of 2025, Cloudflare successfully intercepted an average of 190 billion cyber threats each day. This demonstrates the vital role these services play in maintaining business continuity and protecting digital assets.

- Mission-Critical Services: Cloudflare’s DDoS mitigation and CDN are vital for customer online operations.

- Revenue and Reputation Impact: Service disruptions directly affect customer earnings and public image.

- Reduced Switching Incentive: High criticality makes customers hesitant to change providers, limiting their bargaining power.

- Cyber Threat Defense: Cloudflare blocked an average of 190 billion cyber threats daily in Q2 2025, highlighting service necessity.

Pricing Pressure from Competitive Landscape

While Cloudflare enjoys strong customer loyalty, the diverse competitive landscape across its service areas, including Content Delivery Networks (CDN), security solutions, and Domain Name System (DNS) services, can still lead to some pricing pressure. Larger clients, in particular, have the leverage to solicit competitive bids, which can influence negotiation outcomes for services that are perceived as less unique.

However, Cloudflare's management has observed a shift in market dynamics, noting a stabilization in their customers' business operations. This stabilization, as reported in Q1 2025, has coincided with a reduction in the pricing pressure stemming from intense competition, suggesting a more balanced market environment.

- Competitive Landscape: Cloudflare operates in markets with numerous players, impacting pricing power.

- Customer Leverage: Larger customers can use competitive offers to negotiate better pricing.

- Q1 2025 Observation: Management noted stabilization in customer businesses and reduced competitive pricing pressure.

Cloudflare's extensive customer base significantly dilutes the bargaining power of individual customers. With over 266,000 paying customers as of Q2 2025, the company's revenue is not dependent on any single client, minimizing their leverage.

The essential nature of Cloudflare's services, such as DDoS mitigation which blocked 190 billion threats daily in Q2 2025, makes switching costly and disruptive for clients, further reducing their bargaining power.

While competition exists, leading some larger clients to seek competitive bids, Cloudflare observed reduced pricing pressure in Q1 2025 due to customer business stabilization, indicating a more balanced market.

| Metric | Value (Q2 2025) | Implication for Customer Bargaining Power |

| Paying Customers | ~266,000 | Low reliance on any single customer |

| Dollar-Based Net Retention Rate | 114% | High customer stickiness and increasing spend |

| Daily Cyber Threats Blocked | ~190 billion | Indispensable service, high switching cost |

Full Version Awaits

Cloudflare Porter's Five Forces Analysis

This preview showcases the complete Cloudflare Porter's Five Forces Analysis, offering a deep dive into the competitive landscape of its industry. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact file, providing a comprehensive understanding of the forces shaping Cloudflare's market position.

Rivalry Among Competitors

Cloudflare navigates a fiercely competitive landscape across its core service areas, including Content Delivery Networks (CDN), DDoS mitigation, web application firewalls (WAF), and Zero Trust security. This intense rivalry stems from a diverse set of players, from hyperscale cloud providers to niche cybersecurity specialists.

Major cloud giants like Amazon Web Services (AWS) with CloudFront, Google Cloud CDN, and Microsoft Azure CDN present formidable competition, offering integrated solutions within their broader cloud ecosystems. These providers leverage their vast infrastructure and existing customer bases to compete aggressively on price and feature sets.

Beyond the cloud behemoths, established CDN and security firms such as Akamai and Fastly also vie for market share. Akamai, a long-standing leader in CDN services, continues to innovate in edge computing and security, while Fastly focuses on developer-centric solutions and edge cloud platforms. The market also includes numerous other specialized providers, creating a fragmented yet highly dynamic environment.

Cloudflare's competitive strategy centers on its extensive and integrated service portfolio, a 'connectivity cloud,' which sets it apart from competitors offering single-point solutions. This broad platform, encompassing networking, security, and developer tools, is designed to simplify operations and lower costs for businesses.

By offering a holistic value proposition, Cloudflare competes not just on individual features but on the overall efficiency and cost-effectiveness of its integrated suite. This approach allows them to capture a wider market share and foster deeper customer relationships. For instance, in 2024, Cloudflare continued to expand its offerings, integrating AI-powered security and performance enhancements across its network, further solidifying its position as a comprehensive provider.

The pace of innovation in web infrastructure and security is incredibly fast, demanding constant updates to keep up with evolving threats and user needs. Cloudflare highlights its commitment to innovation, especially with advancements in AI and its developer platform, Workers, as a significant differentiator.

In 2024, Cloudflare continued to heavily invest in R&D, with a notable portion of its revenue dedicated to developing new security and performance solutions. This focus on rapid product development, including AI-powered threat detection and enhanced developer tools, is crucial for maintaining market leadership against competitors who are also pushing boundaries.

Market Share Dynamics

Cloudflare's competitive rivalry is intense, particularly as it navigates different segments of the web infrastructure market. While it commands a substantial portion of the market in areas like DDoS and bot protection, with an impressive 82.16% share as of February 2024, and leads as the largest CDN by website count, the landscape shifts for high-traffic clients.

The competition intensifies when looking at the top 10,000 most trafficked websites. In this arena, Cloudflare's market share is more modest, highlighting the strong presence of major cloud providers and established CDN players who are formidable rivals for these larger, more demanding customers.

- Dominant in Niche Markets: Cloudflare holds a commanding 82.16% market share in DDoS and bot protection as of February 2024, and is the leading CDN by the sheer number of websites it serves.

- Challenged by Giants: For the top 10,000 highest-traffic websites, Cloudflare faces more significant competition from major cloud providers and established CDN vendors.

- Market Segmentation: This disparity underscores that while Cloudflare is a leader for a broad base of users, its competitive standing is more contested among enterprise-level, high-volume clients.

Pricing Strategies and Free Tier Offerings

Cloudflare's aggressive free tier strategy, a cornerstone of its growth, significantly influences competitive rivalry. This approach, which saw its free tier users grow substantially, acts as a powerful lead generation tool, funneling individuals and smaller businesses towards paid enterprise solutions. For instance, by Q1 2024, Cloudflare reported a significant increase in its customer base, many of whom likely started with the free offerings, demonstrating the model's effectiveness in market penetration.

This widespread adoption through a generous free tier inevitably creates pricing pressure across the industry. Competitors often find themselves needing to match or offer comparable free services to remain relevant, potentially eroding profit margins for all players. The challenge lies in balancing this accessibility with the need to monetize advanced, mission-critical features that enterprise clients demand.

- Free Tier as a Competitive Differentiator: Cloudflare's extensive free tier attracts a vast user base, acting as a significant market entry barrier for competitors and a potent customer acquisition channel.

- Pricing Pressure Impact: The accessibility of Cloudflare's free services compels rivals to either offer similar free plans or risk losing market share, thereby intensifying price competition.

- Monetization Strategy: The company's success hinges on its ability to upsell users from the free tier to paid plans, particularly its enterprise-grade security and performance solutions, maintaining revenue growth.

- Customer Acquisition Cost: While the free tier lowers initial customer acquisition costs, the ongoing investment in infrastructure to support these users requires careful financial management to ensure long-term sustainability and profitability.

Cloudflare faces intense competition across its product suite, from hyperscale cloud providers like AWS and Google Cloud to specialized security firms such as Akamai and Fastly. While Cloudflare dominates in areas like DDoS protection, holding an 82.16% market share as of February 2024 and leading by website count, its position is more contested among the highest-traffic websites where cloud giants and established CDNs are strong rivals.

The company's aggressive free tier strategy is a key competitive lever, driving user acquisition and market penetration. This approach creates pricing pressure across the industry, as competitors often need to offer comparable free services to remain competitive. Cloudflare's success relies on effectively upselling these users to its paid enterprise solutions.

The rapid pace of innovation in web infrastructure and security necessitates continuous investment in R&D. Cloudflare's commitment to developing AI-powered security and performance enhancements, alongside its developer platform Workers, serves as a critical differentiator in this dynamic market.

| Metric | Cloudflare (Feb 2024) | Key Competitors | Implication |

|---|---|---|---|

| DDoS & Bot Protection Market Share | 82.16% | Major Cloud Providers, Security Specialists | Dominant position, but high-end clients see more competition. |

| CDN Market Share (by Website Count) | Leading | Akamai, Fastly, Cloud Providers | Broad reach, but competition intensifies for high-traffic sites. |

| Free Tier User Base | Substantial Growth | Various | Drives market penetration and creates pricing pressure. |

| R&D Investment | Significant % of Revenue | High | Essential for staying ahead in a rapidly evolving market. |

SSubstitutes Threaten

Large enterprises with substantial capital and unique requirements might choose to develop their web infrastructure, security, and content delivery networks internally. This path demands significant upfront investment and specialized technical talent.

For instance, a major financial institution might invest hundreds of millions in custom-built data centers and security protocols to meet stringent regulatory and performance demands. However, the sheer complexity and ongoing operational costs often make Cloudflare's integrated solutions a more cost-effective and efficient choice for many.

Many businesses opt to host their applications directly on major cloud platforms like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud. These providers offer their own integrated CDN, security, and DNS services, which can directly substitute for Cloudflare's offerings, particularly for companies already heavily committed to a specific cloud ecosystem. For instance, AWS CloudFront, Azure CDN, and Google Cloud CDN provide content delivery capabilities that compete with Cloudflare's edge network.

For smaller businesses or developers, open-source software and do-it-yourself (DIY) solutions for basic web security, performance optimization, or DNS management can serve as substitutes. These options, while often lacking the scalability and advanced features of Cloudflare, present a low-cost alternative for fundamental requirements. For instance, projects like Let's Encrypt offer free SSL certificates, directly competing with Cloudflare's basic security offerings.

Traditional Network Hardware and Appliances

Before the widespread adoption of cloud-native security and performance services, businesses heavily relied on physical network hardware. These included dedicated firewalls, load balancers, and VPN appliances. While Cloudflare's cloud-based platform offers superior flexibility and scalability, some organizations with specific compliance needs or deeply entrenched legacy systems might still consider these traditional hardware solutions as viable substitutes.

While the market for traditional network hardware is mature, it still represents a segment of IT spending. For instance, in 2023, the global network security appliance market was valued at approximately $25 billion, indicating a persistent demand for these physical solutions, even as cloud adoption accelerates.

- Legacy System Dependence: Some businesses have significant investments in existing hardware infrastructure that are difficult or costly to replace.

- Specific Compliance Requirements: Certain industries or regulatory mandates may necessitate on-premises hardware solutions for data control and security.

- Perceived Control and Security: A segment of IT decision-makers still prefers the tangible control offered by physical appliances, believing them to be inherently more secure.

- Cost Considerations for Small Deployments: For very small-scale or niche applications, the upfront cost of a physical appliance might appear more manageable than a subscription-based cloud service.

Alternative Security or Performance Vendors

While Cloudflare provides a broad range of services, specialized vendors offering deep expertise in a single area, such as advanced bot mitigation or highly specific Web Application Firewall (WAF) rules, can act as substitutes. For instance, a company with a unique cybersecurity challenge might opt for a niche provider for that particular function.

Customers may also choose to assemble a solution from multiple specialized vendors, potentially creating a fragmented but highly tailored security or performance stack. This approach, while increasing complexity, could appeal to organizations with very distinct requirements not fully met by an all-in-one platform. In 2024, the cybersecurity market continued to see significant investment in specialized solutions, with some reports indicating growth in niche segments outpacing broader platform plays.

Cloudflare's integrated platform is designed to combat this by offering a unified experience, thereby reducing the need for customers to manage multiple vendor relationships and disparate systems. However, the allure of best-in-class performance from specialized providers remains a persistent competitive pressure.

- Niche Vendors: Specialized providers focus on specific security or performance functions, offering deep expertise.

- Customer Strategy: Some clients may opt to combine multiple specialized vendors for tailored solutions.

- Cloudflare's Approach: Cloudflare aims to mitigate this by offering an integrated, all-in-one platform.

- Market Trend: Investment in specialized cybersecurity solutions saw continued growth in 2024.

The threat of substitutes for Cloudflare comes from several angles, including in-house development, major cloud providers' integrated services, and open-source solutions. While building custom infrastructure is costly, companies like AWS, Azure, and Google Cloud offer competing content delivery, security, and DNS services. For instance, AWS CloudFront directly competes with Cloudflare's CDN capabilities.

Open-source DIY options provide a low-cost alternative for basic needs, with projects like Let's Encrypt offering free SSL certificates, a direct substitute for Cloudflare's entry-level security. Furthermore, traditional hardware solutions like physical firewalls and load balancers, though less flexible, still represent a market segment. In 2023, the global network security appliance market was valued at approximately $25 billion, highlighting the continued demand for these alternatives.

Specialized vendors focusing on specific functions like advanced bot mitigation or niche WAF rules also pose a threat, as some customers prefer to assemble tailored solutions from multiple providers. This trend persisted in 2024, with continued investment in specialized cybersecurity segments.

| Substitute Category | Examples | Key Characteristics | Market Relevance (2023/2024) |

|---|---|---|---|

| In-house Development | Custom data centers, proprietary security protocols | High upfront cost, specialized talent required | Significant for very large enterprises with unique needs |

| Cloud Provider Services | AWS CloudFront, Azure CDN, Google Cloud CDN | Integrated with cloud ecosystems, scalable | Major competitive force for existing cloud users |

| Open-Source/DIY | Let's Encrypt, self-managed DNS | Low cost, basic functionality, requires technical expertise | Viable for small businesses and basic requirements |

| Traditional Hardware | Physical firewalls, VPN appliances | Tangible control, specific compliance needs | Network security appliance market valued at ~$25 billion (2023) |

| Specialized Vendors | Niche bot mitigation, advanced WAF providers | Deep expertise in single function, tailored solutions | Growing investment in specialized cybersecurity segments (2024) |

Entrants Threaten

Building a global network comparable to Cloudflare's, spanning hundreds of cities and involving extensive peering, demands enormous capital and considerable time. This substantial initial investment in physical infrastructure acts as a significant deterrent for potential new competitors.

Cloudflare's commitment to its network is evident, with capital expenditures representing 11% of its revenue in the second quarter of 2025. This highlights the continuous and significant financial resources needed to maintain and expand such a critical infrastructure.

The intricate technology underpinning Cloudflare's offerings, from its global content delivery network to advanced security solutions like DDoS mitigation and Zero Trust, presents a significant hurdle for potential new entrants. Building and sustaining this complex software stack requires specialized knowledge in distributed systems, cybersecurity, and network architecture. Cloudflare's CEO has repeatedly emphasized that innovation is a key differentiator, underscoring the continuous investment in R&D needed to compete.

In cybersecurity, brand recognition and trust are incredibly important, acting as significant barriers to new entrants. Cloudflare has cultivated a robust reputation as a dependable guardian of online assets, a trust that takes considerable time and consistent performance to build. New competitors would struggle to replicate this established confidence, especially when dealing with the critical need for security. For context, Cloudflare reports blocking an average of 87 billion threats daily, a testament to its scale and the trust users place in its services.

Economies of Scale and Network Effects

Cloudflare's significant advantage stems from its massive scale, which creates substantial barriers for potential new entrants. As Cloudflare's network grows and its customer base expands, it achieves greater economies of scale. This allows the company to operate more efficiently and offer its services at highly competitive price points, making it difficult for newcomers to match these cost structures.

Furthermore, the sheer volume of data processed by Cloudflare fuels a powerful network effect. With 5.8 trillion internet requests handled daily, this vast data flow provides continuous insights for enhancing security protocols and network performance. This positive feedback loop, where more users lead to better service and thus attract even more users, strongly favors incumbents like Cloudflare.

- Economies of Scale: Cloudflare's extensive infrastructure and operational efficiency allow for cost reductions per unit of service as its scale increases, deterring new entrants unable to achieve similar cost advantages.

- Network Effects: The more users and traffic Cloudflare processes, the more data it gains to improve its services, creating a superior offering that is hard for competitors to replicate.

- Data Advantage: The 5.8 trillion daily internet requests processed by Cloudflare are a critical asset, enabling continuous learning and optimization that strengthens its competitive position.

Regulatory and Compliance Hurdles

Operating globally in web infrastructure and security means grappling with a complex maze of international data privacy rules like GDPR and CCPA, alongside cybersecurity standards and various national internet policies. New players would need substantial investment in legal and compliance teams to satisfy these varied demands, making market entry significantly tougher.

These regulatory and compliance hurdles represent a substantial barrier to entry. For instance, Cloudflare's 2024 Impact Report highlights their ongoing commitment to compliance, underscoring the resources required to navigate this landscape effectively.

- Global Data Privacy Regulations: Adherence to frameworks such as GDPR and CCPA necessitates significant legal and operational infrastructure.

- Cybersecurity Standards: Meeting diverse international cybersecurity mandates requires continuous investment in security protocols and certifications.

- National Internet Policies: Navigating country-specific internet regulations adds another layer of complexity and cost for new entrants.

- Compliance Investment: Cloudflare's stated focus on compliance in its 2024 Impact Report indicates the substantial financial and human capital required to manage these obligations.

The threat of new entrants into Cloudflare's market is considerably low due to the immense capital required for global network infrastructure and the complex technological expertise needed. Cloudflare's substantial investment, with capital expenditures at 11% of revenue in Q2 2025, underscores this barrier. Furthermore, the company's established brand trust and the network effects derived from processing 5.8 trillion internet requests daily create a formidable competitive moat.

| Barrier | Description | Cloudflare's Advantage |

|---|---|---|

| Capital Requirements | Building a global network requires massive investment. | Cloudflare's extensive infrastructure is a significant deterrent. |

| Technology & Expertise | Complex software stack and specialized knowledge are essential. | Cloudflare's continuous R&D and innovation are key differentiators. |

| Brand & Trust | Reputation for security and reliability takes time to build. | Cloudflare's established trust is hard for newcomers to replicate. |

| Economies of Scale | Larger scale leads to lower per-unit costs. | Cloudflare's size allows for competitive pricing. |

| Network Effects | More users improve service, attracting more users. | Cloudflare's vast data processing enhances its offerings. |

| Regulatory Compliance | Navigating global data privacy and cybersecurity rules is complex. | Cloudflare's commitment to compliance, as noted in its 2024 Impact Report, demonstrates the resources needed. |

Porter's Five Forces Analysis Data Sources

Our Cloudflare Porter's Five Forces analysis is built upon a robust foundation of data, including Cloudflare's own investor relations materials, financial filings, and public statements. We supplement this with industry-specific market research reports and analyses from reputable technology publications to capture the broader competitive landscape.