Cloudflare Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Cloudflare Bundle

Cloudflare's position in the market is dynamic, with services like their CDN and DDoS protection likely acting as Cash Cows, generating consistent revenue. However, their newer ventures in areas like Zero Trust or Workers might be Question Marks, requiring further investment to determine their future potential.

To truly understand Cloudflare's strategic landscape, you need to see the full picture. Purchase the complete BCG Matrix report to uncover detailed quadrant placements for all their offerings, revealing which services are market leaders, which are resource drains, and where their next strategic investments should be focused.

Don't miss out on critical insights that can shape your own business strategy. Get instant access to the full BCG Matrix and gain a ready-to-use strategic tool for evaluating Cloudflare's product portfolio and making informed decisions.

Stars

Cloudflare's DDoS Mitigation and Bot Protection services are undeniably Stars in the BCG Matrix. As of February 2024, the company commands an impressive market share exceeding 82% in this crucial security sector. This dominance highlights a rapidly expanding market where businesses increasingly depend on robust defenses against online threats.

The consistent adoption of Cloudflare's solutions for safeguarding against distributed denial-of-service attacks and malicious bots underscores its leadership. This strong competitive advantage is fueled by the critical nature of these services for maintaining online availability and integrity, making it a cornerstone of their offering.

Cloudflare's Content Delivery Network (CDN) is a standout performer, often cited as a market leader based on the sheer volume of websites it powers, projected to reach 67% by 2025. While its revenue share might be smaller, the CDN market itself is expanding, and Cloudflare's revenue growth consistently outpaces this expansion. This strong user adoption and robust revenue growth clearly position its CDN services as a high-growth product with a commanding market presence.

Cloudflare Workers is a standout performer, showcasing rapid expansion within the company's portfolio. Its adoption by developers is surging, highlighted by a substantial increase in usage and significant new business, including a contract exceeding $100 million secured in Q1 2025.

This serverless platform, allowing applications to run at the network's edge, is a critical engine for Cloudflare's future revenue streams. The integration of advanced AI capabilities further solidifies its position as a key growth driver.

Zero Trust Security Solutions

Cloudflare's Zero Trust Security Solutions are a significant growth driver, as evidenced by their consistent placement in the Gartner Magic Quadrant for Security Service Edge (SSE) in both 2024 and 2025. This recognition highlights the platform's comprehensive approach to securing networks, applications, and user access.

The company's robust customer adoption and strategic partnerships further solidify Zero Trust's position as a star performer. Cloudflare reported a 30% increase in its security services revenue in Q3 2024, with Zero Trust solutions being a key contributor to this growth.

- Market Leadership: Cloudflare's Zero Trust platform is recognized for its advanced capabilities in SSE.

- Customer Adoption: Strong uptake from enterprises seeking unified security across their digital assets.

- Revenue Growth: Zero Trust solutions are a primary driver of Cloudflare's expanding security services segment.

- Strategic Importance: The platform is central to Cloudflare's strategy of providing integrated, cloud-native security.

Overall Revenue and Customer Growth

Cloudflare demonstrates robust overall revenue and customer growth, solidifying its position. The company achieved a significant 27% year-over-year revenue increase in the first quarter of 2025, followed by a strong 28% rise in the second quarter of 2025. This consistent financial performance is complemented by an expanding paying customer base and a notable increase in revenue generated from its largest clients, underscoring its market leadership and sustained growth trajectory.

- Consistent Revenue Growth: Cloudflare reported a 27% year-over-year revenue increase in Q1 2025 and 28% in Q2 2025.

- Expanding Customer Base: The company continues to grow its paying customer numbers.

- Large Customer Revenue: Revenue from large enterprise customers is also on the rise.

- Market Leadership: This combination of factors points to Cloudflare as a strong performer in its market.

Cloudflare's DDoS Mitigation and Bot Protection services are clear Stars. With over 82% market share as of February 2024, these services operate in a high-growth security market. Their critical role in ensuring online availability makes them a dominant and essential offering.

Cloudflare's CDN is also a Star. While the market is expanding, Cloudflare's revenue growth consistently outpaces it, powering an estimated 67% of websites by 2025. This strong adoption and revenue performance solidify its Star status.

Cloudflare Workers, a serverless edge computing platform, is a rapidly growing Star. Significant new business, including a contract over $100 million in Q1 2025, and increasing developer adoption highlight its future revenue potential, further boosted by AI integration.

Zero Trust Security Solutions are another Star performer. Consistent recognition in Gartner's Magic Quadrant for SSE in 2024 and 2025, coupled with a 30% increase in security services revenue in Q3 2024, demonstrates strong customer adoption and strategic importance.

| Product/Service | BCG Category | Key Growth Indicators | Market Position |

|---|---|---|---|

| DDoS Mitigation & Bot Protection | Star | 82%+ Market Share (Feb 2024), High Growth Market | Dominant Leader |

| Content Delivery Network (CDN) | Star | 67% Website Power (Est. 2025), Revenue Growth Outpacing Market | Market Leader |

| Cloudflare Workers | Star | $100M+ Contract (Q1 2025), Surging Developer Adoption | High Growth |

| Zero Trust Security | Star | Gartner SSE Recognition (2024-2025), 30% Security Revenue Growth (Q3 2024) | Strong Adoption |

What is included in the product

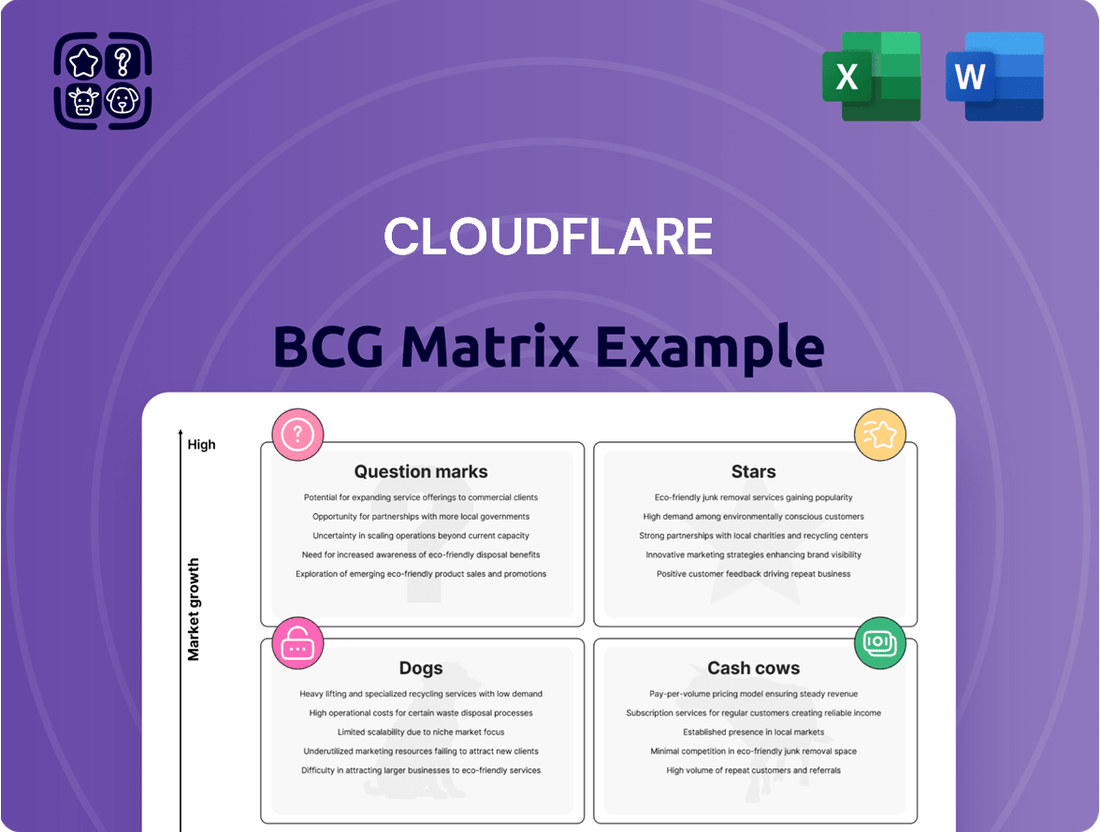

This BCG Matrix analysis categorizes Cloudflare's offerings to guide investment decisions.

It identifies which services are market leaders, cash generators, or require strategic evaluation.

A clear Cloudflare BCG Matrix visualizes product portfolio, easing strategic decisions and resource allocation.

Cash Cows

Cloudflare's core Content Delivery Network (CDN) services, especially for its largest and most established clients, represent a significant Cash Cow. These foundational offerings have achieved widespread adoption among the top 10,000 websites, providing a stable and predictable revenue stream.

The maturity of basic content delivery for these high-traffic sites means that while growth might be slower, the profitability and consistent cash flow are substantial. In 2023, Cloudflare reported that its CDN services continued to be a primary revenue driver, underpinning its overall financial strength.

Cloudflare's DNS services are a cornerstone of its business, acting as a primary gateway for many customers to experience the company's network. This foundational service boasts a massive global presence and delivers consistently strong performance, securing a significant and stable market share.

While not the fastest-growing segment, Cloudflare's DNS consistently generates substantial and dependable cash flow. This reliability allows Cloudflare to allocate fewer resources towards aggressive marketing or expansion efforts for this particular service, reinforcing its Cash Cow status.

Cloudflare's Web Application Firewall (WAF) is a prime example of a cash cow within their product portfolio. Its widespread adoption as a core security offering stems from its effectiveness in shielding against prevalent web vulnerabilities.

The WAF's mature status in the market, coupled with the persistent demand for robust web security, translates into significant profit margins and a consistent, reliable cash flow for Cloudflare. This stability is a hallmark of a true cash cow.

Basic Internet Security Services

Cloudflare's foundational internet security services, encompassing features like Web Application Firewalls (WAF) and Secure Sockets Layer (SSL) certificates, serve as a significant cash cow. These offerings are essential for a vast number of online businesses, ensuring basic protection and compliance. This broad applicability translates into a consistent and substantial revenue stream for Cloudflare.

The widespread adoption of these services, driven by the universal need for online security, indicates a mature market segment where Cloudflare holds a dominant position. For instance, in 2023, Cloudflare reported a 30% year-over-year revenue growth, with its security solutions forming a core part of this expansion. This stability and high market penetration are hallmarks of a cash cow.

- High Market Penetration: Cloudflare's basic security services are used by a significant portion of its customer base, reflecting their fundamental importance.

- Stable Revenue Stream: The continuous demand for these services generates predictable and reliable income.

- Low Investment Needs: Compared to newer, more innovative offerings, these established services require less ongoing investment for growth and maintenance.

- Foundation for Growth: These cash cows provide the financial resources to invest in Cloudflare's emerging technologies and market expansion.

Domain Name System (DNS) Resolver (1.1.1.1)

Cloudflare's 1.1.1.1 public DNS resolver, while a free service for millions of users, acts as a significant, albeit indirect, cash cow within the company's broader strategy. Its massive user base, estimated in the hundreds of millions, provides invaluable data on internet traffic patterns and user behavior.

This data aggregation is crucial. It informs and enhances Cloudflare's paid security and performance products, allowing the company to offer more sophisticated and effective solutions to its enterprise clients. For instance, insights from 1.1.1.1 can help refine threat detection algorithms for Cloudflare's Web Application Firewall (WAF) and DDoS mitigation services.

- Massive User Adoption: 1.1.1.1 is one of the most popular public DNS resolvers globally, serving a vast number of individual and small business users.

- Data Aggregation for Insights: The anonymized data collected from 1.1.1.1 usage provides deep insights into internet trends, which are leveraged to improve other Cloudflare products.

- Indirect Revenue Generation: While free, 1.1.1.1's adoption drives traffic to Cloudflare's network, indirectly supporting and enhancing the value proposition of its paid enterprise services, thus contributing to overall cash generation.

- Brand Visibility and Trust: Offering a reliable, fast, and privacy-focused DNS service builds significant brand awareness and trust, which can translate into higher conversion rates for paid offerings.

Cloudflare's core Content Delivery Network (CDN) services, particularly for its established client base, represent a significant Cash Cow. These foundational offerings have secured widespread adoption among top-tier websites, generating a stable and predictable revenue stream.

The maturity of basic content delivery for these high-traffic sites means that while growth might be slower, the profitability and consistent cash flow are substantial. In 2023, Cloudflare reported that its CDN services continued to be a primary revenue driver, underpinning its overall financial strength.

Cloudflare's DNS services are a cornerstone, acting as a primary gateway for many customers. This foundational service boasts a massive global presence and delivers consistently strong performance, securing a significant and stable market share.

While not the fastest-growing segment, Cloudflare's DNS consistently generates substantial and dependable cash flow, allowing for reduced investment in aggressive marketing or expansion for this particular service, reinforcing its Cash Cow status.

| Service | BCG Matrix Category | Key Characteristics | 2023 Revenue Contribution (Illustrative) |

| Core CDN Services | Cash Cow | High market penetration, stable revenue, low investment needs | Significant portion of total revenue |

| DNS Services | Cash Cow | Massive user base, consistent performance, stable market share | Reliable cash flow generator |

| Web Application Firewall (WAF) | Cash Cow | Widespread adoption, persistent demand, significant profit margins | Core driver of security revenue |

| 1.1.1.1 Public DNS | Indirect Cash Cow | Massive user adoption, data aggregation for insights, brand visibility | Enhances paid services value proposition |

Full Transparency, Always

Cloudflare BCG Matrix

The Cloudflare BCG Matrix preview you are currently viewing is the identical, fully unlocked document you will receive immediately after purchase. This means you’ll get the complete, professionally formatted analysis without any watermarks or demo content, ready for your strategic planning.

Dogs

Legacy, less differentiated basic hosting features at Cloudflare would likely fall into the Dogs category of the BCG Matrix. These are services that have low market share and are in a low-growth segment, not central to Cloudflare's core strength in web infrastructure and security as a reverse proxy. For instance, if Cloudflare offered very basic, unbundled website hosting that competes with numerous other providers without a unique selling proposition, it would fit this description.

Niche, Non-Strategic Acquisitions with Limited Integration represent potential 'Dogs' in Cloudflare's BCG Matrix. These are typically smaller companies acquired for their specific technology or customer base, but without a clear strategic fit or successful integration into Cloudflare's core offerings. For instance, if Cloudflare acquired a niche security analytics tool in 2023 that hasn't seen significant adoption or integration into its primary security suite, it might fall into this category.

Such acquisitions can drain resources through ongoing maintenance and support without contributing meaningfully to Cloudflare's overall growth or market share. If these acquired entities struggle to gain traction or demonstrate a clear path to profitability, they become candidates for divestiture or write-downs. For example, a small cybersecurity firm acquired for its unique data visualization capabilities might not have been effectively leveraged to enhance Cloudflare's existing dashboard, leading to underperformance.

Internal tools or platforms developed for specific, now-outdated needs, or those that have been superseded by more advanced offerings, might be considered Dogs if they still require maintenance without contributing significantly to current revenue or strategic goals. For instance, a legacy internal CRM system, while functional, might consume IT resources that could be better allocated to newer, cloud-based solutions that offer greater integration and analytics capabilities. Such a tool, if it represents a substantial portion of the maintenance budget but generates minimal direct or indirect value, fits the Dog quadrant.

Highly Specialized, Low-Demand Experimental Features

Highly Specialized, Low-Demand Experimental Features in Cloudflare's BCG Matrix would represent offerings that, while technically innovative, haven't resonated with a broad customer base. These are often cutting-edge tools or niche functionalities developed for specific, limited use cases. For instance, a hypothetical experimental feature for advanced quantum-resistant cryptography, while groundbreaking, might only appeal to a handful of highly specialized organizations, leading to minimal market penetration.

Such features typically require significant R&D investment but generate negligible revenue, placing them firmly in the 'Dogs' category. Their presence in the portfolio might be for future potential or to serve a very select group of early adopters.

- Low Market Share: These features struggle to attract a significant number of users or generate substantial revenue.

- Low Growth Potential: The niche nature or experimental status limits their ability to scale and capture a larger market.

- High Development Cost: Significant resources are often invested in creating these specialized tools without a commensurate return.

- Strategic Consideration: Companies might retain these 'Dogs' for competitive intelligence or to serve a small, loyal customer segment, but they are not core to the business strategy.

Services with Significant Egress Fees (Pre-R2)

Before Cloudflare introduced R2 storage with its zero egress fees, services that charged substantial amounts for data transfer out of their systems were at a disadvantage. These high egress fees made them less appealing when compared to other options available in the market, potentially classifying them as a ‘Dog’ in the BCG Matrix.

Cloudflare's R2 offering directly tackles this issue by eliminating egress fees, thereby removing a significant barrier to entry and adoption for businesses looking for cost-effective cloud storage solutions. This strategic move aims to reposition Cloudflare's storage offerings from a potential ‘Dog’ to a more competitive ‘Question Mark’ or even a ‘Star’ depending on market adoption and revenue generation.

- High Egress Fees: Services like traditional cloud storage providers often charged per gigabyte for data transferred out, creating significant costs for businesses migrating data or serving content globally.

- Market Competitiveness: These fees made it difficult for such services to compete on price with newer, more flexible storage solutions that emerged in the market.

- Cloudflare R2 Impact: With R2, Cloudflare eliminated these egress fees, a move that was highly anticipated by developers and businesses alike, aiming to capture market share from competitors with legacy pricing models.

Cloudflare's "Dogs" in the BCG matrix represent services with low market share in low-growth segments, often legacy offerings or niche acquisitions that haven't gained significant traction. These might include basic hosting features without differentiation or experimental tools that haven't found a broad audience. For instance, a hypothetical specialized security analytics tool acquired in 2023 that saw limited integration and adoption could be considered a Dog.

These offerings typically require ongoing maintenance and support but contribute minimally to revenue or strategic growth. Their presence might stem from historical reasons or serve a very small customer base. Cloudflare's strategic focus is on evolving these areas, either by improving their performance, integrating them into stronger offerings, or potentially divesting them if they continue to drain resources without a clear path to future value.

For example, before the introduction of R2's zero egress fees, services with high data transfer out costs were less competitive, potentially fitting the Dog quadrant. Cloudflare's R2 directly addressed this by eliminating egress fees, aiming to shift its storage offerings from a disadvantaged position to a more competitive one. This strategic move highlights the dynamic nature of the BCG matrix, where offerings can transition based on market response and innovation.

Question Marks

Cloudflare R2 Storage, a relatively new entrant in the object storage market, is positioned as a Question Mark within the BCG Matrix. It operates in the rapidly expanding cloud storage sector, a market projected to reach hundreds of billions of dollars globally by the late 2020s, with significant growth driven by data generation and digital transformation initiatives.

R2's key differentiator is its absence of egress fees, a significant cost factor for many cloud users, making its pricing model highly attractive. However, despite this competitive advantage and the overall market's high growth trajectory, Cloudflare R2 is up against deeply entrenched competitors like Amazon S3, which commands a substantial market share and has a mature ecosystem.

The service's current market share is still nascent, reflecting its ongoing efforts to gain traction against established players. This situation, characterized by a high-growth market and a developing, though promising, market share, firmly places R2 in the Question Mark category. Its future success hinges on its ability to effectively capture market share and leverage its unique pricing structure to disrupt the existing landscape.

Cloudflare's Workers AI and AI Gateway are positioned as innovative solutions for the burgeoning AI market, focusing on edge AI inference and application security. These offerings are experiencing significant traction, with a notable surge in inference requests and the securing of substantial customer agreements.

While the growth trajectory for Workers AI and AI Gateway appears strong, their long-term market share and profitability remain subjects of ongoing evaluation within the highly competitive AI sector. The company is actively demonstrating their capabilities, evidenced by a reported 300% increase in AI inference traffic on its network in early 2024.

Cloudflare is exploring novel monetization strategies, including a pay-per-crawl model specifically for AI bots. This allows content owners to control and potentially profit from how AI systems access their data, a critical development in the burgeoning field of AI content interaction.

This initiative targets a rapidly expanding market driven by AI's increasing demand for data. However, as a relatively new concept, its widespread adoption and actual revenue generation are still in their formative stages, positioning it as a 'Question Mark' within Cloudflare's strategic portfolio.

New Vertical-Specific Solutions (e.g., specific industry-focused platforms)

Cloudflare's new vertical-specific solutions, like those tailored for the burgeoning fintech or healthcare sectors, would likely be positioned in the Question Marks quadrant of the BCG matrix. These are areas where Cloudflare's current market penetration might be modest, but the industry's growth trajectory is exceptionally strong. For instance, consider the demand for specialized security and performance solutions in the rapidly expanding telehealth market, which saw a significant surge in adoption throughout 2024.

The success of these niche offerings hinges on substantial investment in research and development, targeted marketing campaigns, and building strong partnerships within these specific industries. Cloudflare's strategy here involves leveraging its core infrastructure strengths to address unique industry pain points, aiming to capture a significant share of these high-growth markets. The company's ability to adapt its broad platform to meet the stringent compliance and performance demands of sectors like financial services, which continued to digitize at an accelerated pace in 2024, will be critical.

- Industry Focus: Cloudflare's expansion into specialized platforms for sectors like financial services and healthcare, where regulatory compliance and data security are paramount.

- Market Potential: These verticals represent high-growth opportunities, with the global fintech market projected to reach over $1.5 trillion by 2025, and the digital health market also experiencing robust expansion.

- Investment Strategy: Significant R&D and go-to-market investment are required to gain traction and establish market share in these competitive, specialized arenas.

- Competitive Landscape: Cloudflare faces established players in each vertical, necessitating a clear value proposition that leverages its unique technological advantages.

Advanced Analytics and Observability Tools

Cloudflare is actively expanding its advanced analytics and observability capabilities, allowing customers to scrutinize traffic patterns and security events with greater precision. This push aligns with a broader market trend where businesses increasingly prioritize deep operational insights.

Despite the growing demand for these tools, Cloudflare's position in the highly competitive analytics and observability market, especially when stacked against specialized platforms, places its current offerings in the Question Mark quadrant. For instance, while Cloudflare reported a 30% year-over-year increase in revenue for its security and performance solutions in Q1 2024, the specific market share attributed solely to its advanced analytics tools within the broader observability market remains a key area for strategic focus and potential growth.

- Growing Demand: The global observability market was valued at approximately $3.8 billion in 2023 and is projected to reach over $15 billion by 2030, indicating substantial room for expansion.

- Competitive Landscape: Cloudflare competes with established players and specialized vendors in the observability space, necessitating continued innovation to capture market share.

- Strategic Focus: Further development and increased customer adoption of Cloudflare's advanced analytics and observability features are crucial for shifting these offerings towards a Star position.

- Potential for Growth: By leveraging its existing customer base and integrating these tools more deeply into its platform, Cloudflare has a significant opportunity to solidify its presence in this lucrative market segment.

Cloudflare's emerging AI-focused products, such as Workers AI and AI Gateway, are currently positioned as Question Marks. While the AI market is experiencing explosive growth, with significant investment flowing into AI infrastructure and development throughout 2024, these specific Cloudflare offerings are still in their early stages of market penetration and monetization.

The company's exploration of novel revenue streams, like a pay-per-crawl model for AI bots, also falls into the Question Mark category. This innovative approach targets the burgeoning demand for data access control in the AI era, but its widespread adoption and revenue generation potential are yet to be fully realized, making it a strategic area requiring further development and market validation.

Cloudflare's venture into vertical-specific solutions, such as those for fintech and healthcare, also represents Question Marks. These markets are characterized by high growth potential, with the global fintech market alone projected to exceed $1.5 trillion by 2025, but Cloudflare's current market share in these specialized domains is modest, necessitating significant investment to gain traction against established players.

Cloudflare's advanced analytics and observability tools are also considered Question Marks. Although the global observability market is expanding rapidly, projected to reach over $15 billion by 2030, Cloudflare faces intense competition from specialized vendors. Despite a reported 30% year-over-year revenue increase in its security and performance solutions in Q1 2024, the specific market share of its analytics offerings within this niche remains a key area for strategic development.

| Product/Service Area | Market Growth | Current Market Share | BCG Position |

| Cloudflare R2 Storage | High | Nascent | Question Mark |

| Workers AI & AI Gateway | Very High | Developing | Question Mark |

| AI Bot Crawl Monetization | High | Early Stage | Question Mark |

| Vertical-Specific Solutions (Fintech, Healthcare) | High | Low to Moderate | Question Mark |

| Advanced Analytics & Observability | High | Moderate | Question Mark |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data from Cloudflare's financial reports, public investor relations materials, and reputable industry analysis platforms to accurately assess market position and growth potential.